Invitation Homes Inc. (NYSE: INVH) (“Invitation Homes” or the

“Company”) announced today that its operating partnership,

Invitation Homes Operating Partnership LP (the “Operating

Partnership”), has priced a public offering of $500 million

aggregate principal amount of 4.875% Senior Notes due 2035 (the

“Notes”). The Notes were priced at 98.855% of the principal amount

and will mature on February 1, 2035. The offering is expected to

close on September 26, 2024, subject to the satisfaction of

customary closing conditions. The Notes will be fully and

unconditionally guaranteed, jointly and severally, by the Company,

Invitation Homes OP GP LLC, and IH Merger Sub, LLC.

The Operating Partnership intends to use the net proceeds from

the offering for general corporate purposes, which may include,

without limitation, repayment of indebtedness, working capital,

acquisitions and renovations of single-family properties, and for

related activities in accordance with the Company’s business

strategy.

PNC Capital Markets LLC, Deutsche Bank Securities, Mizuho, Wells

Fargo Securities, BNP PARIBAS, BofA Securities, Capital One

Securities, Goldman Sachs & Co. LLC, J.P. Morgan, and US

Bancorp are acting as the joint book-running managers of the

offering. BMO Capital Markets, BNY Capital Markets, Huntington

Capital Markets, KeyBanc Capital Markets, M&T Securities,

Morgan Stanley, RBC Capital Markets, Regions Securities LLC, Truist

Securities, Citigroup, Raymond James, Scotiabank, and Siebert

Williams Shank are acting as the co-managers of the offering.

The offering is being made pursuant to an effective shelf

registration statement filed by the Company, the Operating

Partnership, Invitation Homes OP GP LLC, and IH Merger Sub, LLC

with the Securities and Exchange Commission (the “SEC”). A

prospectus supplement and accompanying prospectus relating to the

offering will be filed with the SEC. When available, a copy of the

prospectus supplement and accompanying prospectus relating to the

offering may be obtained from: PNC Capital Markets LLC, toll-free:

855-881-0697; Deutsche Bank Securities Inc., toll-free:

1-800-503-4611; Mizuho Securities USA LLC, toll-free:

1-866-271-7403; Wells Fargo Securities, LLC by telephone (toll

free) at 1-800-645-3751; or by visiting the EDGAR database on the

SEC’s website at www.sec.gov.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy nor will there be any sale of these

securities in any state or other jurisdiction in which such an

offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Invitation Homes

Invitation Homes, an S&P 500 company, is the nation’s

premier single-family home leasing and management company, meeting

changing lifestyle demands by providing access to high-quality,

updated homes with valued features such as close proximity to jobs

and access to good schools. The Company’s mission, “Together with

you, we make a house a home,” reflects its commitment to providing

homes where individuals and families can thrive and high-touch

service that continuously enhances residents’ living

experiences.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which include, but are not limited to, statements related

to the Company’s expectations regarding the performance of the

Company’s business, its financial results, its liquidity and

capital resources and the use of the net proceeds from the

offering, and other non-historical statements. In some cases, you

can identify these forward-looking statements by the use of words

such as “outlook,” “guidance,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates” or the

negative version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties including, among others, risks inherent to the

single-family rental industry and the Company’s business model,

macroeconomic factors beyond the Company’s control, competition in

identifying and acquiring properties, competition in the leasing

market for quality residents, increasing property taxes,

homeowners’ association and insurance costs, poor resident

selection and defaults and non-renewals by the Company’s residents,

the Company’s dependence on third parties for key services, risks

related to the evaluation of properties, performance of the

Company’s information technology systems, development and use of

artificial intelligence, risks related to the Company’s

indebtedness, and risks related to the potential negative impact of

unfavorable global and United States economic conditions,

uncertainty in financial markets (including as a result of events

affecting financial institutions), geopolitical tensions, natural

disasters, climate change, and public health crises, on the

Company’s financial condition, results of operations, cash flows,

business, associates, and residents. Accordingly, there are or will

be important factors that could cause actual outcomes or results to

differ materially from those indicated in these statements. The

Company believes these factors include, but are not limited to,

those described under Part I. Item 1A. “Risk Factors” of the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 (the “Annual Report”), as such factors may be updated from

time to time in the Company’s periodic filings with the SEC, which

are accessible on the SEC’s website at www.sec.gov. These factors

should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in this release, in the Annual Report, and in the Company’s other

periodic filings. The forward-looking statements speak only as of

the date of this press release, and the Company expressly disclaims

any obligation or undertaking to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except to the extent otherwise

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240923821665/en/

Investor Relations Contact: Scott McLaughlin 844.456.INVH

(4684) IR@InvitationHomes.com

Media Relations Contact: Kristi DesJarlais 972.421.3587

Media@InvitationHomes.com

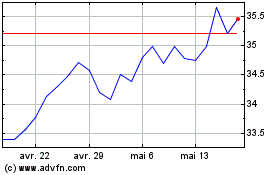

Invitation Homes (NYSE:INVH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

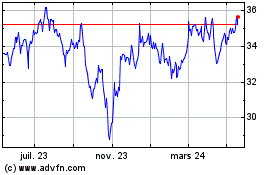

Invitation Homes (NYSE:INVH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024