KKR Provides Bespoke Financing Solution to Australian GP Group Family Doctor

02 Mars 2025 - 11:02PM

Business Wire

KKR, a leading global investment firm, and Family Doctor Pty

Ltd. (“Family Doctor”), a leading group of general practitioner

(“GP”) clinics in Australia, today announced a bespoke financing

solution by KKR (through funds managed by KKR) to Family Doctor.

KKR’s bespoke financing solution positions the Family Doctor to

accelerate its growth and expansion, including through

acquisitions.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250302805504/en/

Founded in 2008, Family Doctor provides comprehensive medical

care services through its network of more than 110 GP-run clinics

located in key metropolitan and regional areas across Australia,

including Victoria, Queensland, Western Australia, New South Wales,

the Australian Capital Territory, and South Australia.

KKR’s Asia Pacific Credit platform seeks to provide, among other

private credit strategies, bespoke solutions to high-quality

companies, entrepreneurs and sponsors that harness the strength of

KKR’s private markets investment capabilities and its expertise as

one of the largest alternative credit managers globally. These

bespoke structures allow entrepreneurs to retain equity ownership

and control in their businesses whilst accessing deep capital pools

that allow them to meet their objectives to invest in growth or

return capital to shareholders.

Diane Raposio, Partner and Head of Asia Credit and Markets,

KKR, said, “We are pleased to provide a bespoke financing

solution to Family Doctor and Dr. Aziz, who has established one of

Australia’s leading networks of GP clinics. Our investment builds

on our experience and ability to work with homegrown champions and

entrepreneurs in Australia, a key market for KKR across multiple

private credit strategies. We look forward to sharing our global

network and expertise to support the Company on their mission to

extend high-quality patient care and their expansion plans.”

Dr. Rodney Aziz, Founder, CEO and Principal GP at Family

Doctor, said, “Over the last more than 17 years, we have grown

from a single clinic to one of Australia’s largest medical centre

groups. The bespoke financing solution provided by KKR allows

Family Doctor to stay true to our mission of being 100%

doctor-owned and providing quality care and services. As we look

forward to scaling our impact and our next phase of growth, we are

delighted to collaborate with KKR on a flexible finance solution

that not only is tailored to our stage of growth but also brings

KKR’s global knowledge and know-how to our platform.”

KKR is making its investment from its Asia Pacific Credit

strategy. In Australia, KKR has provided bespoke solutions to DBG

Health (a leading pharmaceutical company) and Lendi (a leading

fintech), and financings to companies and sponsors across a range

of industries and private credit strategies. Since 2019, KKR has

closed more than 50 credit investments in Asia Pacific, accounting

for a total transaction value of close to US$21 billion.

***

About Family Doctor

Family Doctor is a 100% GP owned group of 110 medical and dental

practices across Australia enabling delivery of 3.2 million high

quality medical consultations to Australians in metro and regional

areas each year. Family Doctor is the fastest growing medical group

in Australia, and is keen to support like-minded practice owners

with their succession planning.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250302805504/en/

Media Inquiries

For more information, please contact:

For Family Doctor Dr Rodney Aziz, CEO and Principal GP

+61 03 8592 9855 rod@familydoctor.com.au

For KKR Wei Jun Ong +65 6922 5813 WeiJun.Ong@kkr.com

KKR (NYSE:KKR)

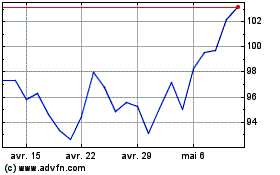

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

KKR (NYSE:KKR)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025