Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

16 Novembre 2023 - 4:41PM

Edgar (US Regulatory)

| | |

MCN | Madison Covered Call & Equity Strategy Fund | September 30, 2023 |

|

| Madison Covered Call & Equity Strategy Fund Portfolio of Investments (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares | Value (Note 1,2) | |

| COMMON STOCKS - 77.0% | | | |

| Communication Services - 1.1% | | | |

| Comcast Corp., Class A (A) | 31,500 | $1,396,710 | |

| Lumen Technologies, Inc. * (B) | 124,000 | 176,080 | |

| | 1,572,790 | |

| Consumer Discretionary - 7.1% | | | |

| Las Vegas Sands Corp. (A) | 123,900 | 5,679,576 | |

| Lowe's Cos., Inc. (A) | 11,000 | 2,286,240 | |

| Nordstrom, Inc. (A) | 156,000 | 2,330,640 | |

| | 10,296,456 | |

| Consumer Staples - 9.6% | | | |

| Archer-Daniels-Midland Co. (A) | 28,000 | 2,111,760 | |

| Colgate-Palmolive Co. (A) | 41,000 | 2,915,510 | |

| Constellation Brands, Inc., Class A (A) | 9,000 | 2,261,970 | |

| Keurig Dr Pepper, Inc. (A) | 74,000 | 2,336,180 | |

| PepsiCo, Inc. (A) | 10,000 | 1,694,400 | |

| Target Corp. (A) | 23,500 | 2,598,395 | |

| | 13,918,215 | |

| Energy - 13.3% | | | |

| APA Corp. (A) | 102,700 | 4,220,970 | |

| Baker Hughes Co. (A) | 45,500 | 1,607,060 | |

| Diamondback Energy, Inc. (A) | 20,500 | 3,175,040 | |

| EOG Resources, Inc. (A) | 21,000 | 2,661,960 | |

| Transocean Ltd. * (A) | 940,000 | 7,717,400 | |

| | 19,382,430 | |

| Equity Real Estate Investment Trusts (REITs) - 2.8% | | | |

| American Tower Corp., REIT (A) | 24,500 | 4,029,025 | |

| Financials - 7.9% | | | |

| BlackRock, Inc. (A) | 5,700 | 3,684,993 | |

| CME Group, Inc. (A) | 8,000 | 1,601,760 | |

| JPMorgan Chase & Co. (A) | 11,000 | 1,595,220 | |

| Morgan Stanley (A) | 18,000 | 1,470,060 | |

| PayPal Holdings, Inc. * (A) | 53,800 | 3,145,148 | |

| | 11,497,181 | |

| Health Care - 16.3% | | | |

| Abbott Laboratories (A) | 29,000 | 2,808,650 | |

| Agilent Technologies, Inc. (A) | 14,000 | 1,565,480 | |

| Cencora, Inc. (A) | 10,000 | 1,799,700 | |

| CVS Health Corp. (A) | 48,500 | 3,386,270 | |

| Danaher Corp. (A) | 16,000 | 3,969,600 | |

| Elevance Health, Inc. (A) | 8,200 | 3,570,444 | |

| Medtronic PLC (A) | 53,300 | 4,176,588 | |

| Pfizer, Inc. (A) | 74,000 | 2,454,580 | |

| | 23,731,312 | |

| Industrials - 3.8% | | | |

| | |

| See accompanying Notes to Portfolios of Investments. |

1

| | |

MCN | Madison Covered Call & Equity Strategy Fund | September 30, 2023 |

|

Madison Covered Call & Equity Strategy Fund Portfolio of Investments (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3M Co. | 12,500 | 1,170,250 | |

| Fastenal Co. (A) | 42,000 | 2,294,880 | |

| United Parcel Service, Inc., Class B (A) | 13,300 | 2,073,071 | |

| | 5,538,201 | |

| Information Technology - 3.8% | | | |

| Ciena Corp. * (A) | 37,500 | 1,772,250 | |

| Microsoft Corp. (A) | 5,000 | 1,578,750 | |

| Texas Instruments, Inc. (A) | 14,000 | 2,226,140 | |

| | 5,577,140 | |

| Materials - 6.6% | | | |

| Air Products & Chemicals, Inc. (A) | 10,600 | 3,004,040 | |

| Barrick Gold Corp. (A) | 244,500 | 3,557,475 | |

| Newmont Corp. (A) | 80,000 | 2,956,000 | |

| | 9,517,515 | |

| Utilities - 4.7% | | | |

| AES Corp. (A) | 234,000 | 3,556,800 | |

| NextEra Energy, Inc. (A) | 57,000 | 3,265,530 | |

| | 6,822,330 | |

| Total Common Stocks

( Cost $135,954,841 ) | 111,882,595 | |

| EXCHANGE TRADED FUNDS - 1.9% | | | |

| VanEck Gold Miners ETF (A) | 104,000 | 2,798,640 | |

| Total Exchange Traded Funds

( Cost $3,417,868 ) | 2,798,640 | |

| SHORT-TERM INVESTMENTS - 22.5% | | | |

| State Street Institutional U.S. Government Money Market Fund, Premier Class (C), 5.29% | 32,594,088 | 32,594,088 | |

| State Street Navigator Securities Lending Government Money Market Portfolio (C) (D), 5.36% | 151,139 | 151,139 | |

| Total Short-Term Investments

( Cost $32,745,227 ) | 32,745,227 | |

TOTAL INVESTMENTS - 101.4% ( Cost $172,117,936 ) | 147,426,462 | |

TOTAL CALL & PUT OPTIONS WRITTEN - (1.0%) | (1,436,535) | |

NET OTHER ASSETS AND LIABILITIES - (0.4%) | (562,381) | |

TOTAL NET ASSETS - 100.0% | $145,427,546 | |

| * | | Non-income producing. | |

| (A) | | All or a portion of these securities' positions, with a value of $113,334,905, represent covers (directly or through conversion rights) for outstanding options written. | |

| (B) | | All or a portion of these securities, with an aggregate fair value of $143,078, are on loan as part of a securities lending program. | |

| (C) | | 7-day yield. | |

| (D) | | Represents investments of cash collateral received in connection with securities lending. | |

| |

| ETF | | Exchange Traded Fund. | |

| PLC | | Public Limited Company. | |

| REIT | | Real Estate Investment Trust. | |

|

|

|

| | |

| See accompanying Notes to Portfolios of Investments. |

2

| | |

MCN | Madison Covered Call & Equity Strategy Fund | September 30, 2023 |

|

Madison Covered Call & Equity Strategy Fund Portfolio of Investments (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Written Option Contracts Outstanding at September 30, 2023 | |

| Description | | Exercise Price | Expiration Date | Number of Contracts | Notional Amount | Market Value | Premiums Paid (Received) | Unrealized Appreciation (Depreciation) | |

|

| Call Options Written | | | |

| Abbott Laboratories | | $ | 110 | 11/17/23 | (290) | $ (3,190,000) | $ | (6,670) | | $ | (54,172) | | $ | 47,502 | | |

| AES Corp. | | | 20.00 | 1/19/24 | (471) | (942,000) | | (4,710) | | (16,000) | | 11,290 | |

| Agilent Technologies, Inc. | | | 120.00 | 1/19/24 | (140) | (1,680,000) | | (53,200) | | (53,425) | | 225 | |

| Air Products & Chemicals, Inc. | | | 300.00 | 10/20/23 | (106) | (3,180,000) | | (9,010) | | (40,940) | | 31,931 | |

| American Tower Corp., REIT | | | 185.00 | 10/20/23 | (170) | (3,145,000) | | (2,550) | | (59,324) | | 56,774 | |

| American Tower Corp., REIT | | | 195.00 | 1/19/24 | (40) | (780,000) | | (5,400) | | (17,159) | | 11,759 | |

| APA Corp. | | | 47.50 | 10/20/23 | (707) | (3,358,250) | | (6,009) | | (81,096) | | 75,087 | |

| APA Corp. | | | 47.50 | 11/17/23 | (320) | (1,520,000) | | (16,000) | | (28,470) | | 12,470 | |

| Archer-Daniels-Midland Co. | | | 82.50 | 10/20/23 | (280) | (2,310,000) | | (2,100) | | (55,711) | | 53,611 | |

| Baker Hughes Co. | | | 34.00 | 10/20/23 | (455) | (1,547,000) | | (85,313) | | (42,761) | | (42,552) | |

| Barrick Gold Corp. | | | 19.00 | 1/19/24 | (1,225) | (2,327,500) | | (17,763) | | (40,388) | | 22,625 | |

| Written Option Contracts Outstanding at September 30, 2023 (continued) | |

| Description | | Exercise Price | Expiration Date | Number of Contracts | Notional Amount | Market Value | Premiums Paid (Received) | Unrealized Appreciation (Depreciation) | |

|

| BlackRock, Inc. | | $ | 780 | 10/20/23 | (57) | $ (4,446,000) | $ | (3,135) | | $ | (102,541) | | $ | 99,406 | | |

| Cencora, Inc. | | | 180.00 | 10/20/23 | (100) | (1,800,000) | | (37,500) | | (45,897) | | 8,397 | |

| Ciena Corp. | | | 45.00 | 10/20/23 | (375) | (1,687,500) | | (103,125) | | (64,526) | | (38,599) | |

| CME Group, Inc. | | | 210.00 | 12/15/23 | (80) | (1,680,000) | | (27,200) | | (25,873) | | (1,327) | |

| Colgate-Palmolive Co. | | | 77.50 | 10/20/23 | (410) | (3,177,500) | | — | | (36,477) | | 36,477 | |

| Comcast Corp., Class A | | | 47.50 | 10/20/23 | (315) | (1,496,250) | | (3,150) | | (36,950) | | 33,800 | |

| Constellation Brands, Inc., Class A | | | 270.00 | 1/19/24 | (90) | (2,430,000) | | (49,050) | | (78,209) | | 29,159 | |

| CVS Health Corp. | | | 72.50 | 11/17/23 | (485) | (3,516,250) | | (79,298) | | (65,596) | | (13,702) | |

| Danaher Corp. | | | 260.00 | 10/20/23 | (160) | (4,160,000) | | (28,000) | | (104,794) | | 76,794 | |

| Diamondback Energy, Inc. | | | 160.00 | 10/20/23 | (205) | (3,280,000) | | (34,338) | | (50,253) | | 15,916 | |

| Elevance Health, Inc. | | | 480.00 | 10/20/23 | (40) | (1,920,000) | | (5,200) | | (51,958) | | 46,758 | |

| Elevance Health, Inc. | | | 470.00 | 1/19/24 | (42) | (1,974,000) | | (50,610) | | (58,266) | | 7,656 | |

| EOG Resources, Inc. | | | 135.00 | 10/20/23 | (210) | (2,835,000) | | (15,225) | | (56,418) | | 41,193 | |

| Fastenal Co. | | | 60.00 | 11/17/23 | (420) | (2,520,000) | | (10,500) | | (66,767) | | 56,267 | |

| JPMorgan Chase & Co. | | | 150.00 | 12/15/23 | (110) | (1,650,000) | | (42,900) | | (42,786) | | (114) | |

| Keurig Dr Pepper, Inc. | | | 34.00 | 10/20/23 | (370) | (1,258,000) | | (2,775) | | (27,369) | | 24,594 | |

| Keurig Dr Pepper, Inc. | | | 35.00 | 10/20/23 | (123) | (430,500) | | (922) | | (9,919) | | 8,996 | |

| Keurig Dr Pepper, Inc. | | | 35.00 | 11/17/23 | (134) | (469,000) | | (1,340) | | (9,242) | | 7,902 | |

| Keurig Dr Pepper, Inc. | | | 35.00 | 1/19/24 | (113) | (395,500) | | (3,107) | | (6,664) | | 3,556 | |

| Las Vegas Sands Corp. | | | 65.00 | 10/20/23 | (52) | (338,000) | | — | | (6,186) | | 6,186 | |

| Las Vegas Sands Corp. | | | 50.00 | 11/17/23 | (1,187) | (5,935,000) | | (107,424) | | (118,661) | | 11,238 | |

| Lowe's Cos., Inc. | | | 230.00 | 10/20/23 | (110) | (2,530,000) | | (1,815) | | (57,636) | | 55,821 | |

| Medtronic PLC | | | 87.50 | 1/19/24 | (533) | (4,663,750) | | (46,904) | | (96,100) | | 49,196 | |

| Microsoft Corp. | | | 325.00 | 11/17/23 | (50) | (1,625,000) | | (44,000) | | (40,448) | | (3,552) | |

| Morgan Stanley | | | 92.50 | 1/19/24 | (180) | (1,665,000) | | (19,800) | | (36,648) | | 16,848 | |

| Newmont Corp. | | | 45.00 | 1/19/24 | (800) | (3,600,000) | | (42,000) | | (79,423) | | 37,423 | |

| NextEra Energy, Inc. | | | 72.50 | 12/15/23 | (570) | (4,132,500) | | (4,275) | | (77,425) | | 73,150 | |

| Nordstrom, Inc. | | | 25.00 | 10/20/23 | (1,560) | (3,900,000) | | (3,120) | | (84,334) | | 81,214 | |

| PayPal Holdings, Inc. | | | 70.00 | 11/17/23 | (538) | (3,766,000) | | (35,508) | | (109,875) | | 74,367 | |

| | |

| See accompanying Notes to Portfolios of Investments. |

3

| | |

MCN | Madison Covered Call & Equity Strategy Fund | September 30, 2023 |

|

Madison Covered Call & Equity Strategy Fund Portfolio of Investments (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PepsiCo, Inc. | | | 180.00 | 1/19/24 | (100) | (1,800,000) | | (26,250) | | (47,538) | | 21,288 | |

| Pfizer, Inc. | | | 37.50 | 11/17/23 | (188) | (705,000) | | (2,444) | | (14,094) | | 11,650 | |

| Pfizer, Inc. | | | 38.00 | 1/19/24 | (552) | (2,097,600) | | (21,528) | | (35,311) | | 13,783 | |

| Target Corp. | | | 140.00 | 11/17/23 | (235) | (3,290,000) | | (6,932) | | (57,840) | | 50,908 | |

| Texas Instruments, Inc. | | | 170.00 | 12/15/23 | (140) | (2,380,000) | | (45,150) | | (58,788) | | 13,638 | |

| Transocean Ltd. | | | 9.00 | 11/17/23 | (8,200) | (7,380,000) | | (291,100) | | (409,749) | | 118,649 | |

| United Parcel Service, Inc., Class B | | | 180.00 | 10/20/23 | (133) | (2,394,000) | | (465) | | (42,423) | | 41,957 | |

| VanEck Gold Miners ETF | | | 33.00 | 1/19/24 | (1,040) | (3,432,000) | | (31,720) | | (76,928) | | 45,208 | |

| Total Call Options Written | | $ | (1,436,535) | | $ | (2,879,358) | | $ | 1,442,823 | | |

| Total Options Written, at Value | | $ | (1,436,535) | | $ | (2,879,358) | | $ | 1,442,823 | | |

| | |

| See accompanying Notes to Portfolios of Investments. |

4

| | |

MCN | Madison Covered Call & Equity Strategy Fund | September 30, 2023 |

|

| Notes to Portfolio of Investments (unaudited) |

1. Portfolio Valuation: Madison Covered Call & Equity Strategy Fund (the "Fund") values securities traded on a national securities exchange are valued at their closing sale price, except for securities traded on the National Association of Securities Dealers Automated Quotation System ("NASDAQ"), which are valued at the NASDAQ official closing price ("NOCP"). If no sale occurs, equities traded on a U.S. exchange or on NASDAQ are valued at the bid price. Options are valued at the mean between the best bid and best ask price across all option exchanges. Debt securities having maturities of 60 days or less are valued at amortized cost, which approximates market value. Debt securities having longer maturities are valued on the basis of the last available bid prices or current market quotations provided by dealers or pricing services approved by the Fund. Mutual funds are valued at their net asset value ("NAV"). Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures approved by the Board of Trustees.

At times, the Fund maintains cash balances at financial institutions in excess of federally insured limits. The Fund monitors this credit risk and has not experienced any losses related to this risk.

2. Fair Value Measurements: The Fund has adopted Financial Accounting Standards Board (the "FASB") applicable guidance on fair value measurements. Fair value is defined as the price that each fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data "inputs" and minimize the use of unobservable "inputs" and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

·Level 1 - unadjusted quoted prices in active markets for identical investments

·Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rate volatilities, prepayment speeds, credit risk, benchmark yields, transactions, bids, offers, new issues, spreads and other relationships observed in the markets among comparable securities, underlying equity of the issuer; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data, etc.)

·Level 3 - significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The valuation techniques used by the Fund to measure fair value for the period ended September 30, 2023, maximized the use of observable inputs and minimized the use of unobservable inputs.

There were no transfers between classification levels during the period ended September 30, 2023. As of and during the period ended September 30, 2023, the Fund did not hold securities deemed as Level 3 securities.

The following is a summary of the inputs used as of September 30, 2023, in valuing the Fund's investments carried at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Level 1 | | Level 2 | | Level 3 | | Value at 9/30/23 |

Assets:1 | | | | | | | | |

| Common Stocks | $ | 111,882,595 | $ | - | $ | - | $ | 111,882,595 |

| Exchange Traded Funds | | 2,798,640 |

| - | | - | | 2,798,640 |

| Short-Term Investments | | 32,745,227 |

| - | | - | | 32,745,227 |

| $ | 147,426,462 | $ | - | $ | - | $ | 147,426,462 |

Liabilities:1 | | | | | | | | |

| Options Written | $ | (1,436,535) | $ | - | $ | - | $ | (1,436,535) |

1 Please see the Portfolio of Investments for a listing of all securities within each category. |

Derivatives: The FASB issued guidance intended to enhance financial statement disclosure for derivative instruments and enable investors to understand: a) how and why a fund uses derivative investments, b) how derivative instruments are accounted for, and c) how derivative instruments affect a fund's financial position, and results of operations.

The following table presents the types of derivatives in the Fund and their effect:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Statement of Asset & Liability Presentation of Fair Values of Derivative Instruments |

| | Asset Derivatives | | | | Liability Derivatives | | | |

|

Derivatives accounted for as hedging instruments | Statement of Assets and Liabilities Location | Fair Value | | | Statement Assets and Liabilities Location | Fair Value |

| Equity | | | Options purchased | | | $ - | | | Options written | | | $ (1,436,535) |

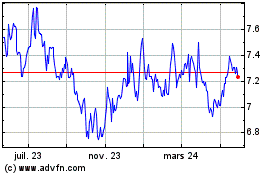

Madison Covered Call and... (NYSE:MCN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Madison Covered Call and... (NYSE:MCN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024