MetLife Expands Customer Experience Capability

11 Avril 2024 - 2:00PM

Business Wire

MetLife Connected Benefits to further

accelerate voluntary benefits linkage, driving comprehension and

utilization, maximizing value of employer offerings for today’s

workforce

Today MetLife announced a significant customer experience

enhancement with an expanded connected benefits capability –

creating more value for both employers and employees when benefits

are packaged and designed to work together. The upgraded

functionality utilizes technology to screen certain

permission-based medical and pharmacy claims and user activity to

deliver personalized benefit education and streamlined claims

processes across MetLife’s robust portfolio of products.

As benefit plans expand to meet the rising expectations of

today’s workforce, employers are faced with increasing challenges

around lack of benefit education – MetLife’s 2024 U.S. Employee

Benefit Trends Study found 62% of employees are not completely

confident they know about all of the benefits offered to them,

which can result in lower benefit utilization and satisfaction.

MetLife's data also finds 73% of employees say benefits integration

is important to them, underscoring increased expectations for

streamlined and cohesive experiences.

“Our expanded MetLife Connected Benefits capability addresses

the awareness and education gaps that today’s employees face while

enhancing the customer experience,” said Bradd Chignoli, executive

vice president of National Accounts and Financial Wellness at

MetLife. “We’re setting a new bar in helping employers and their

employees understand how benefits can work together to meet their

specific needs. This expansion underscores our commitment to

empowering employees to make the most of their benefit choices as

well as help employers sustain a productive and healthy

workforce.”

As a market leader with one of the industry’s largest voluntary

benefit portfolios, MetLife brings deep expertise in offering

solutions that meet the needs and goals of today’s workforce.

MetLife Connected Benefits taps into the strength of these robust

benefit solutions, linking seamless experiences and providing

comprehensive education that drives utilization. MetLife’s data

finds employees who choose and successfully use benefits are

holistically healthier, leading to better business outcomes

including employees who are 1.3x more likely to feel loyal and

engaged at work.

MetLife Connected Benefits is enhancing holistic experiences

across the product portfolio, for example:

- Nayya Claims is now the primary technology solution to analyze

medical claims data which enables MetLife Connected Benefits for

accident & health (A&H) and dental products. Nayya Claims’

sophisticated technology intakes permissioned medical and pharmacy

claims data to proactively identify claims opportunities and

scenarios where additional services may be available, such as

offering more frequent dental cleanings for employees diagnosed

with diabetes or who are currently pregnant.

- This is an enhancement of MetLife’s current capabilities that

leverage data across MetLife’s accident and health (A&H),

disability, and dental insurance to link and identify additional

benefit opportunities.

- MetLife Legal Plans and MetLife and Aura Identity & Fraud

Protection also links employee experiences. For example, Identity

& Fraud Protection can detect a new loan inquiry on an

employee’s credit file and proactively serve up access to legal

services to support loan-related activities such as the home buying

process. And once an employee completes their digital estate plan,

they are reminded that they can securely store and share copies of

their estate plan documents using the Aura vault.

As part of MetLife’s business strategy, MetLife Connected

Benefits now works with its Upwise benefit engagement platform to

deliver a seamless experience with decision support at enrollment

and on-going communications on when and how to leverage benefits

throughout the year. MetLife is committed to building a more

confident future for all, and MetLife Connected Benefits is not

only solving the comprehension and utilization challenges of today,

but will continue to evolve across the portfolio to meet the

growing benefit experience needs of the future.

For more information about MetLife products & services,

please visit

https://www.metlife.com/business-and-brokers/employee-benefits/

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Japan, Latin America, Asia, Europe,

and the Middle East. For more information, visit

www.metlife.com.

About Nayya

Nayya is a leading innovator in employee benefits uniting data

and technology to deliver a trusted benefits adviser to every

employee. Nayya unites health, wealth, and wellness to drive value

across the entire employee benefits journey, reducing friction,

increasing understanding, and driving action. Our technology

empowers benefits carriers and broker intermediaries to

differentiate through employee experiences that enhance the value

of their offerings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240411028327/en/

MetLife Liz Harish 929-343-7473 elizabeth.harish@metlife.com

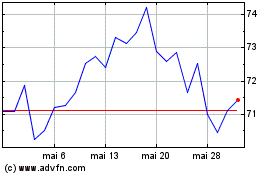

MetLife (NYSE:MET)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

MetLife (NYSE:MET)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025