MISTRAS Group, Inc. (MG: NYSE), a leading "one source"

multinational provider of integrated technology-enabled asset

protection solutions, reported financial results for its third

quarter and nine months ended September 30, 2023.

Highlights of the Third Quarter 2023*

- Revenue of $179.4 million, a 0.5%

increase

- Gross profit of $54.4 million, with gross profit margin

of 30.3%, a 20 basis points increase

- Non-cash goodwill impairment charge of $13.8 million in

International segment triggered by macroeconomic factors in

Europe

- Net loss of $10.3 million, reflecting the goodwill

impairment charge and reorganization and other related costs,

including the associated tax impacts, incurred in the

quarter

- Adjusted EBITDA (non-GAAP) up 12.5% to $20.9

million

Highlights of the Year-to-Date 2023*

- Revenue of $523.4 million, a 0.8%

increase

- Gross profit of $150.2 million, with gross profit

margin of 28.7%, a 30 basis point increase

- Net loss of $15.0 million, reflecting the goodwill

impairment charge and reorganization and other related costs,

including the associated tax impacts, incurred in the

year

- Adjusted EBITDA up 9.9% to $46.6

million

* All comparisons are consolidated and

versus the equivalent prior year period, unless otherwise

noted.

For the third quarter of 2023, consolidated revenue was $179.4

million, a 0.5% increase. Third quarter revenue reflects growth in

all sub-categories of Oil & Gas, in addition to continued

strength in the Company’s key growth areas, particularly Commercial

Aerospace and Data Analytical Solutions markets offset by softness

in the Power Generation & Transmission and Other Process

Industries due to project timing.

Third quarter 2023 gross profit increased 1.1% with gross profit

margin expanding 20 basis points, as compared to the prior year

period. The improvement in gross margin to 30.3% was primarily due

to a favorable sales mix and lower healthcare expenses. Gross

profit margin was up 210 basis points sequentially from the second

quarter of 2023, driven by an improved revenue mix.

Selling, general and administrative expenses (“SG&A”) in the

third quarter of 2023 were $39.5 million, down 3.0% compared to

$40.8 million in the third quarter of 2022 and were also down 4.7%

sequentially from the second quarter of 2023, as a result of the

ongoing implementation of Project Phoenix. Year to date SG&A is

essentially flat with the prior year period and the Company expects

further SG&A reduction in the fourth quarter of 2023 due to

Project Phoenix related cost actions which have been incorporated

into the Company’s updated 2023 guidance ranges discussed

below.

The Company reported a GAAP net loss of $10.3 million, or

$(0.34) per diluted share in the third quarter of 2023, which was

primarily due to a non-cash impairment charge of $13.8 million

recorded within the Company’s International Segment and

reorganization charges of $2.7 million incurred in the quarter. Net

income excluding special items (non-GAAP) was $5.6 million or $0.18

per diluted share.

Adjusted EBITDA was $20.9 million in the third quarter of 2023

compared to $18.6 million in the prior year period, an increase of

12.5%. Year to date Adjusted EBITDA was $46.6 million compared to

$42.4 million in the prior year period, an increase of 9.9%

primarily attributable to a favorable change in sales mix and

overhead cost containment. Manny N. Stamatakis, Chairman of the

Board and Interim President & CEO, stated, “I am pleased to be

presenting the Company’s results and outlook to you for this

quarter. I sincerely appreciate the support and patience that our

long-term shareholders have shown to MISTRAS. Our results for the

third quarter of 2023 were largely in line with our expectations

for revenue and Adjusted EBITDA.”

Mr. Stamatakis continued, “With respect to Project Phoenix, we

have completed the validation of a majority of the initial Project

Phoenix opportunities. As previously disclosed, we completed our

transformation of the Products and Systems Segment in September. We

subsequently implemented additional initiatives in the month of

October related to streamlining our North American operations and

improvements related to pricing actions. The implementation of

these transformations to our organization structure are expected to

yield a projected annualized proforma cost savings of $24 million

in 2024, of which an approximate $9 million overhead reduction is

expected to be achieved in 2023 with an incremental $15 million

expected be realized in 2024. These initiatives also provide a

benefit to the bottom line and provide additional cash flow to

invest into our higher growth sectors, such as Data Analytical

Solutions.”

Edward Prajzner, Senior Executive Vice President and Chief

Financial Officer commented “I also share Manny’s optimism for the

future of MISTRAS. Our target related to Project Phoenix is to

achieve a 15% reduction in global non-billable headcount, without

any impact on our ability to manage our operations and service

customers. With the ongoing implementation of our Project Phoenix

initiatives, and our focus on lowering SG&A, improving free

cash flow, and reinvigorating and refining our Go-to-Market plans

and revenue strategies, we believe this will lead to improved

overall performance enabling us to achieve meaningful profitable

growth in 2024.”

Mr. Stamatakis concluded, “I am pleased to be leading the

Company at this crucial juncture, supported by an invigorated

senior leadership team. Our Board of Directors and I are optimistic

for the future of the Company and believe that the implementation

of these initiatives will lead to an increase in shareholder

value.”

Refer to the Company’s press release associated with Project

Phoenix released on November 2, 2023 for additional details

associated with this important initiative.

Performance by certain segments during the third quarter was as

follows:

North America segment (Referred to as

“Services” in prior filings) third quarter 2023 revenue was $148.8

million, down 2.6% from $152.8 million in the prior year quarter.

The revenue decline was primarily due to a decrease in workload

under a defense contract and decreases in Power Generation and

Other Process Industries due to project timing, which offset the

strong growth achieved in our West Penn Aerospace lab, OnStream

Pipeline InLine Inspection (“ILI”) business, and other Data

Analytical Solutions related offerings. For the third quarter of

2023, gross profit was $44.8 million, compared to $44.9 million in

the prior year period. Gross profit margin was 30.1% for the third

quarter of 2023, a 70 basis point increase from 29.4% in the third

quarter of the prior year. This increase was primarily due to

improved sales mix in the current year period and lower healthcare

expenses.

International segment third quarter 2023

revenue was $31.0 million, up 20.6% from $25.7 million in the prior

year quarter inclusive of favorable foreign currency exchange. This

revenue growth was primarily due to increased turnaround projects

and higher activity levels than in the prior year comparable

quarter in addition to strong commercial aerospace growth.

International segment third quarter 2023 gross profit grew by 10.2%

with gross margin of 27.4%, compared to 29.9% in the prior year

period, a 250-basis point decrease, primarily attributable to

inflationary pressures including rising energy costs and

incremental subcontractor costs.

During the third quarter of 2023, a triggering event was

identified within the Company's reporting units within the

International segment due to decreased gross margin in the current

period as a result of inflationary pressures and rising energy

costs impacting the International reporting units' operations. As a

result, the Company performed an interim quantitative goodwill

impairment test. The decreased gross margins, in addition to

increased interest rates in the current period, contributed to an

unfavorable decrease in the reporting unit’s value. Based upon the

results of the test, the Company recorded an impairment charge of

$13.8 million within the International Segment reporting units.

Cash Flow and Balance Sheet

The Company’s net cash provided by operating activities was

$10.7 million for the first nine months of 2023, compared to $10.5

million in the prior year period. Free cash flow, a non-GAAP

financial measure, was negative $5.6 million for the first nine

months of 2023, compared to a positive $0.9 million in the prior

year period. This decrease was primarily attributable to an

increase in capital expenditures during the current year and higher

than normal accounts receivable balances as of September 30, 2023

due to the timing of projects in the third quarter of 2023. Capital

expenditures increased by $6.6 million in the first nine months of

2023 compared to the prior year period, reflecting the Company’s

increasing investments in its shop laboratories and Data Analytical

Solutions offerings to foster revenue growth.

The Company’s gross debt was $193.9 million as of September 30,

2023, compared to $191.3 million as of December 31, 2022 and $183.7

million as of June 30, 2023. The increase in gross debt during the

period was attributable to the cash flow dynamics described above.

The Company’s net debt, a non-GAAP financial measure, was $181.1

million as of September 30, 2023.

Reorganization and Other

For the third quarter of 2023, the Company recorded $2.7 million

of reorganization costs related to on-going efficiency and

productivity initiatives, primarily related to overhead cost

savings achieved via Project Phoenix. For the quarter, these

charges included professional fees and certain restructuring

charges associated with changes made in the Company’s

organizational structure. For the nine months ended September 30,

2023, the Company recorded $6.0 million of total reorganization

costs.

Outlook 2023 The Company is lowering its

guidance ranges for the full year 2023. Revenue is now expected to

be between $695 and $705 million (from $700-$720 million

previously) and Adjusted EBITDA is now expected to be between $65

and $68 million (from $68 million to $71 million previously). These

reductions in Revenue and Adjusted EBITDA are due to lower than

previously forecasted fourth quarter results.

Free Cash Flow guidance is being lowered to be between $7 and

$10 million (from $23-$25 million previously, excluding certain

cash expenses to achieve cost savings). The reduction in Free Cash

Flow guidance was due to an increase in accounts receivable, due to

timing of projects in the third quarter and the incurrence of

certain cash expenses to achieve Project Phoenix cost savings.

Preliminary 2024 Outlook The Company

anticipates a modest single digit revenue growth in 2024, yet a

significant expansion in Adjusted EBITDA, attributable to operating

leverage and the ongoing benefits of Project Phoenix. We believe

this will result in an all-time high in Adjusted EBITDA in fiscal

2024 of greater than $88 million. This outlook includes

approximately $20 million in incremental benefit from Project

Phoenix in 2024.

Conference Call In connection with this

release, MISTRAS will hold a conference call on November 3, 2023,

at 9:00 a.m. (Eastern).

To listen to the live webcast of the conference call, visit the

Investor Relations section of MISTRAS Group’s website at

www.mistrasgroup.com

Note there is a new process to participate in the live question

and answer session. Individuals wishing to participate may

preregister at:

https://register.vevent.com/register/BI1d9e10d7ee7d412d8d7ff829b244567f

Upon registering, a dial-in number and unique PIN will be

provided to join the conference call. Following the conference

call, an archived webcast of the event will be available for one

year by visiting the Investor Relations section of MISTRAS Group’s

website.

About MISTRAS Group, Inc. - One Source for Asset

Protection Solutions®MISTRAS Group, Inc. (NYSE: MG) is a

leading "one source" multinational provider of integrated

technology-enabled asset protection solutions, helping to maximize

the safety and operational uptime for civilization’s most critical

industrial and civil assets.

Backed by an innovative, data-driven asset protection portfolio,

proprietary technologies, strong commitment to Environmental,

Social, and Governance (ESG) initiatives, and a decades-long legacy

of industry leadership, MISTRAS leads clients in the oil and gas,

aerospace and defense, renewable and nonrenewable power, civil

infrastructure, and manufacturing industries towards achieving

operational and environmental excellence. By supporting these

organizations that help fuel our vehicles and power our society,

inspecting components that are trusted for commercial, defense, and

space craft; building real-time monitoring equipment to enable safe

travel across bridges; and helping to propel sustainability,

MISTRAS helps the world at large.

MISTRAS enhances value for its clients by integrating asset

protection throughout supply chains and centralizing integrity data

through a suite of Industrial IoT-connected digital software and

monitoring solutions. The company’s core capabilities also include

non-destructive testing (“NDT”) field inspections enhanced by

advanced robotics, laboratory quality control and assurance

testing, sensing technologies and NDT equipment, asset and

mechanical integrity engineering services, and light mechanical

maintenance and access services.

For more information about how MISTRAS helps protect

civilization’s critical infrastructure, visit www.mistrasgroup.com

or contact Nestor S. Makarigakis, Group Vice President of Marketing

& Communications at marcom@mistrasgroup.com.

Forward-Looking and Cautionary StatementsThis

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Such forward-looking statements include, but are not limited to,

our earnings guidance, cost savings and other benefits we expect to

realize from Project Phoenix and actions that we expect or seek to

take in furtherance of our strategies and activities to enhance our

financial results and future growth. These forward-looking

statements generally use words such as "future," "possible,"

"potential," "targeted," "anticipate," "believe," "estimate,"

"expect," "intend," "plan," "predict," "project," "will," "may,"

"should," "could," "would" and other similar words and phrases.

Such statements are not guarantees of future performance or results

and will not necessarily be accurate indications of the times at,

or by which, such performance or results will be achieved, if at

all. These statements are subject to risks and uncertainties that

could cause actual performance or results to differ materially from

those expressed in these statements. A list, description and

discussion of these and other risks and uncertainties can be found

in the "Risk Factors" section of the Company's 2022 Annual Report

on Form 10-K dated March 15, 2023, as updated by our reports on

Form 10-Q and Form 8-K. The forward-looking statements are made as

of the date hereof, and MISTRAS undertakes no obligation to update

such statements as a result of new information, future events or

otherwise.

Use of Non-GAAP Financial MeasuresIn addition

to financial information prepared in accordance with generally

accepted accounting principles in the U.S. (GAAP), this press

release also contains adjusted financial measures that are not

prepared in accordance with GAAP and that we believe provide

investors and management with supplemental information relating to

operating performance and trends that facilitate comparisons

between periods and with respect to trends and forward-looking

information. The term "Adjusted EBITDA" used in this release is a

financial measurement not calculated in accordance with GAAP and is

defined by the Company as net income attributable to MISTRAS Group,

Inc. plus: interest expense, provision for income taxes,

depreciation and amortization, share-based compensation expense,

certain acquisition related costs (including transaction due

diligence costs and adjustments to the fair value of contingent

consideration), foreign exchange (gain) loss, non-cash impairment

charges, reorganization and related charges and, if applicable,

certain additional special items which are noted. A reconciliation

of Adjusted EBITDA to Net Income (loss) as computed under GAAP is

set forth in a table attached to this press release. The Company

also uses the term “net debt”, a non-GAAP financial measure defined

as the sum of the current and long-term portions of long-term debt,

less cash and cash equivalents and the term “free cash flow”, a

non-GAAP measure the Company defines as cash provided by operating

activities less capital expenditures (which is classified as an

investing activity). A reconciliation of these non-GAAP financial

measures to GAAP are also set forth in tables attached to this

press release. In the tables attached is also a table reconciling

“Segment and Total Company Income (Loss) from Operations (GAAP) to

Income (Loss) from Operations before Special Items (non-GAAP)",

“Net Loss (GAAP) and Diluted EPS (GAAP) to Net Loss Excluding

Special Items (non-GAAP) and Diluted EPS Excluding Special Items

(non-GAAP)” which reconciles the non-GAAP amounts to GAAP measures.

Each of these non-GAAP financial measures has material limitations

as a performance or liquidity measure and should not be considered

alternatives to net income (loss) or any other measures derived in

accordance with GAAP. Because Income (loss) from operations before

special items and other non-GAAP financial measures used in this

press release may not be calculated in the same manner by all

companies, these measures may not be comparable to other similarly

titled measures used by other companies.

| |

|

MISTRAS Group, Inc. and

SubsidiariesCondensed Consolidated Balance

Sheets(in thousands, except share and per share data) |

| |

| |

|

September 30, 2023 |

|

December 31, 2022 |

| ASSETS |

|

(unaudited) |

|

|

| Current Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

12,752 |

|

|

$ |

20,488 |

|

|

Accounts receivable, net |

|

|

136,363 |

|

|

|

123,657 |

|

|

Inventories |

|

|

15,780 |

|

|

|

13,556 |

|

|

Prepaid expenses and other current assets |

|

|

18,259 |

|

|

|

10,181 |

|

|

Total current assets |

|

|

183,154 |

|

|

|

167,882 |

|

| Property, plant and equipment,

net |

|

|

79,762 |

|

|

|

77,561 |

|

| Intangible assets, net |

|

|

44,468 |

|

|

|

49,015 |

|

| Goodwill |

|

|

185,519 |

|

|

|

199,635 |

|

| Deferred income taxes |

|

|

2,229 |

|

|

|

779 |

|

| Other assets |

|

|

41,558 |

|

|

|

40,032 |

|

|

Total assets |

|

$ |

536,690 |

|

|

$ |

534,904 |

|

| LIABILITIES AND

EQUITY |

|

|

|

|

| Current Liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

14,628 |

|

|

$ |

12,532 |

|

|

Accrued expenses and other current liabilities |

|

|

81,853 |

|

|

|

77,844 |

|

|

Current portion of long-term debt |

|

|

8,402 |

|

|

|

7,425 |

|

|

Current portion of finance lease obligations |

|

|

5,253 |

|

|

|

4,201 |

|

|

Income taxes payable |

|

|

1,025 |

|

|

|

1,726 |

|

|

Total current liabilities |

|

|

111,161 |

|

|

|

103,728 |

|

| Long-term debt, net of current

portion |

|

|

185,466 |

|

|

|

183,826 |

|

| Obligations under finance

leases, net of current portion |

|

|

12,375 |

|

|

|

10,045 |

|

| Deferred income taxes |

|

|

8,542 |

|

|

|

6,283 |

|

| Other long-term

liabilities |

|

|

33,362 |

|

|

|

32,273 |

|

|

Total liabilities |

|

|

350,906 |

|

|

|

336,155 |

|

| Equity |

|

|

|

|

|

Preferred stock, 10,000,000 shares authorized |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value, 200,000,000 shares authorized,

30,353,100 and 29,895,487 shares issued and outstanding |

|

|

302 |

|

|

|

298 |

|

|

Additional paid-in capital |

|

|

246,075 |

|

|

|

243,031 |

|

|

Accumulated deficit |

|

|

(26,436 |

) |

|

|

(11,489 |

) |

|

Accumulated other comprehensive loss |

|

|

(34,463 |

) |

|

|

(33,390 |

) |

|

Total MISTRAS Group, Inc. stockholders’ equity |

|

|

185,478 |

|

|

|

198,450 |

|

|

Non-controlling interests |

|

|

306 |

|

|

|

299 |

|

|

Total equity |

|

|

185,784 |

|

|

|

198,749 |

|

|

Total liabilities and equity |

|

$ |

536,690 |

|

|

$ |

534,904 |

|

| |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Condensed Consolidated

Statements of Income (Loss)(in thousands, except per share

data) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| Revenue |

$ |

179,354 |

|

|

$ |

178,462 |

|

|

$ |

523,399 |

|

|

$ |

519,155 |

|

|

Cost of revenue |

|

118,812 |

|

|

|

119,110 |

|

|

|

355,304 |

|

|

|

354,848 |

|

|

Depreciation |

|

6,160 |

|

|

|

5,568 |

|

|

|

17,914 |

|

|

|

17,074 |

|

| Gross

profit |

|

54,382 |

|

|

|

53,784 |

|

|

|

150,181 |

|

|

|

147,233 |

|

|

Selling, general and administrative expenses |

|

39,537 |

|

|

|

40,767 |

|

|

|

123,844 |

|

|

|

123,545 |

|

|

Bad debt provision for troubled customers, net of recoveries |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

289 |

|

|

Reorganization and other costs |

|

2,702 |

|

|

|

130 |

|

|

|

6,017 |

|

|

|

65 |

|

|

Goodwill Impairment Charges |

|

13,799 |

|

|

|

— |

|

|

|

13,799 |

|

|

|

— |

|

|

Loss on Debt Modification |

|

— |

|

|

|

693 |

|

|

|

— |

|

|

|

693 |

|

|

Legal settlement and insurance recoveries, net |

|

— |

|

|

|

— |

|

|

|

150 |

|

|

|

(994 |

) |

|

Research and engineering |

|

438 |

|

|

|

450 |

|

|

|

1,428 |

|

|

|

1,523 |

|

|

Depreciation and amortization |

|

2,588 |

|

|

|

2,629 |

|

|

|

7,556 |

|

|

|

8,058 |

|

|

Acquisition-related expense, net |

|

— |

|

|

|

1 |

|

|

|

5 |

|

|

|

63 |

|

| Income (loss) from

operations |

|

(4,682 |

) |

|

|

9,114 |

|

|

|

(2,618 |

) |

|

|

13,991 |

|

|

Interest expense |

|

4,167 |

|

|

|

2,735 |

|

|

|

12,093 |

|

|

|

6,790 |

|

| Income (loss) before

provision (benefit) for income taxes |

|

(8,849 |

) |

|

|

6,379 |

|

|

|

(14,711 |

) |

|

|

7,201 |

|

|

Provision for income taxes |

|

1,489 |

|

|

|

1,985 |

|

|

|

229 |

|

|

|

3,494 |

|

| Net Income

(Loss) |

|

(10,338 |

) |

|

|

4,394 |

|

|

|

(14,940 |

) |

|

|

3,707 |

|

|

Less: net income (loss) attributable to noncontrolling interests,

net of taxes |

|

(40 |

) |

|

|

21 |

|

|

|

7 |

|

|

|

54 |

|

| Net Income (Loss)

attributable to MISTRAS Group, Inc. |

$ |

(10,298 |

) |

|

$ |

4,373 |

|

|

$ |

(14,947 |

) |

|

$ |

3,653 |

|

| |

|

|

|

|

|

|

|

| Earnings (loss) per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.34 |

) |

|

$ |

0.15 |

|

|

$ |

(0.49 |

) |

|

$ |

0.12 |

|

|

Diluted |

$ |

(0.34 |

) |

|

$ |

0.14 |

|

|

$ |

(0.49 |

) |

|

$ |

0.12 |

|

| Weighted-average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

30,402 |

|

|

|

29,965 |

|

|

|

30,277 |

|

|

|

29,879 |

|

|

Diluted |

|

30,402 |

|

|

|

30,245 |

|

|

|

30,277 |

|

|

|

30,209 |

|

| |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Operating Data by

Segment(in thousands) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenues |

|

|

|

|

|

|

|

|

North America |

$ |

148,814 |

|

|

$ |

152,778 |

|

|

$ |

431,295 |

|

|

$ |

435,251 |

|

|

International |

|

30,980 |

|

|

|

25,693 |

|

|

|

90,664 |

|

|

|

83,441 |

|

|

Products and Systems |

|

2,829 |

|

|

|

3,078 |

|

|

|

9,897 |

|

|

|

8,666 |

|

|

Corporate and eliminations |

|

(3,269 |

) |

|

|

(3,087 |

) |

|

|

(8,457 |

) |

|

|

(8,203 |

) |

| |

$ |

179,354 |

|

|

$ |

178,462 |

|

|

$ |

523,399 |

|

|

$ |

519,155 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Gross

profit |

|

|

|

|

|

|

|

|

North America |

$ |

44,773 |

|

|

$ |

44,869 |

|

|

$ |

121,088 |

|

|

$ |

118,348 |

|

|

International |

|

8,481 |

|

|

|

7,694 |

|

|

|

24,247 |

|

|

|

25,324 |

|

|

Products and Systems |

|

1,096 |

|

|

|

1,189 |

|

|

|

4,773 |

|

|

|

3,514 |

|

|

Corporate and eliminations |

|

32 |

|

|

|

32 |

|

|

|

73 |

|

|

|

47 |

|

| |

$ |

54,382 |

|

|

$ |

53,784 |

|

|

$ |

150,181 |

|

|

$ |

147,233 |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Revenues by

Category(in thousands)

Revenue by industry was as follows:

| Three Months Ended

September 30, 2023 |

North America |

|

International |

|

Products |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

94,390 |

|

|

$ |

8,827 |

|

|

$ |

35 |

|

|

$ |

— |

|

|

$ |

103,252 |

|

| Aerospace & Defense |

|

14,240 |

|

|

|

5,778 |

|

|

|

47 |

|

|

|

— |

|

|

|

20,065 |

|

| Industrials |

|

10,325 |

|

|

|

6,018 |

|

|

|

310 |

|

|

|

— |

|

|

|

16,653 |

|

| Power Generation &

Transmission |

|

7,388 |

|

|

|

1,653 |

|

|

|

696 |

|

|

|

— |

|

|

|

9,737 |

|

| Other Process Industries |

|

6,933 |

|

|

|

2,864 |

|

|

|

(5 |

) |

|

|

— |

|

|

|

9,792 |

|

| Infrastructure, Research &

Engineering |

|

6,042 |

|

|

|

2,383 |

|

|

|

1,070 |

|

|

|

— |

|

|

|

9,495 |

|

| Petrochemical |

|

3,313 |

|

|

|

586 |

|

|

|

— |

|

|

|

— |

|

|

|

3,899 |

|

| Other |

|

6,183 |

|

|

|

2,871 |

|

|

|

676 |

|

|

|

(3,269 |

) |

|

|

6,461 |

|

|

Total |

$ |

148,814 |

|

|

$ |

30,980 |

|

|

$ |

2,829 |

|

|

$ |

(3,269 |

) |

|

$ |

179,354 |

|

| Three Months Ended

September 30, 2022 |

North America |

|

International |

|

Products |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

90,578 |

|

|

$ |

6,418 |

|

|

$ |

35 |

|

|

$ |

— |

|

|

$ |

97,031 |

|

| Aerospace & Defense |

|

16,784 |

|

|

|

4,397 |

|

|

|

112 |

|

|

|

— |

|

|

|

21,293 |

|

| Industrials |

|

9,728 |

|

|

|

5,834 |

|

|

|

436 |

|

|

|

— |

|

|

|

15,998 |

|

| Power Generation &

Transmission |

|

10,378 |

|

|

|

1,946 |

|

|

|

456 |

|

|

|

— |

|

|

|

12,780 |

|

| Other Process Industries |

|

10,283 |

|

|

|

3,033 |

|

|

|

8 |

|

|

|

— |

|

|

|

13,324 |

|

| Infrastructure, Research &

Engineering |

|

4,936 |

|

|

|

1,784 |

|

|

|

1,150 |

|

|

|

— |

|

|

|

7,870 |

|

| Petrochemical |

|

3,427 |

|

|

|

280 |

|

|

|

— |

|

|

|

— |

|

|

|

3,707 |

|

| Other |

|

6,664 |

|

|

|

2,001 |

|

|

|

881 |

|

|

|

(3,087 |

) |

|

|

6,459 |

|

|

Total |

$ |

152,778 |

|

|

$ |

25,693 |

|

|

$ |

3,078 |

|

|

$ |

(3,087 |

) |

|

$ |

178,462 |

|

| Nine Months Ended

September 30, 2023 |

North America |

|

International |

|

Products |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

281,663 |

|

|

$ |

26,291 |

|

|

$ |

87 |

|

|

$ |

— |

|

|

$ |

308,041 |

|

| Aerospace & Defense |

|

41,516 |

|

|

|

15,894 |

|

|

|

275 |

|

|

|

— |

|

|

|

57,685 |

|

| Industrials |

|

30,693 |

|

|

|

18,274 |

|

|

|

1,336 |

|

|

|

— |

|

|

|

50,303 |

|

| Power Generation &

Transmission |

|

17,834 |

|

|

|

4,840 |

|

|

|

3,189 |

|

|

|

— |

|

|

|

25,863 |

|

| Other Process Industries |

|

24,906 |

|

|

|

10,567 |

|

|

|

73 |

|

|

|

— |

|

|

|

35,546 |

|

| Infrastructure, Research &

Engineering |

|

12,696 |

|

|

|

6,547 |

|

|

|

2,759 |

|

|

|

— |

|

|

|

22,002 |

|

| Petrochemical |

|

10,027 |

|

|

|

887 |

|

|

|

— |

|

|

|

— |

|

|

|

10,914 |

|

| Other |

|

11,960 |

|

|

|

7,364 |

|

|

|

2,178 |

|

|

|

(8,457 |

) |

|

|

13,045 |

|

|

Total |

$ |

431,295 |

|

|

$ |

90,664 |

|

|

$ |

9,897 |

|

|

$ |

(8,457 |

) |

|

$ |

523,399 |

|

| |

|

|

|

|

|

|

|

|

|

| Nine Months Ended

September 30, 2022 |

North America |

|

International |

|

Products |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

270,289 |

|

|

$ |

22,018 |

|

|

$ |

212 |

|

|

$ |

— |

|

|

$ |

292,519 |

|

| Aerospace & Defense |

|

49,106 |

|

|

|

14,455 |

|

|

|

246 |

|

|

|

— |

|

|

|

63,807 |

|

| Industrials |

|

28,529 |

|

|

|

17,868 |

|

|

|

1,271 |

|

|

|

— |

|

|

|

47,668 |

|

| Power Generation &

Transmission |

|

22,578 |

|

|

|

6,505 |

|

|

|

1,979 |

|

|

|

— |

|

|

|

31,062 |

|

| Other Process Industries |

|

32,217 |

|

|

|

10,305 |

|

|

|

23 |

|

|

|

— |

|

|

|

42,545 |

|

| Infrastructure, Research &

Engineering |

|

10,625 |

|

|

|

6,016 |

|

|

|

2,489 |

|

|

|

— |

|

|

|

19,130 |

|

| Petrochemical |

|

10,056 |

|

|

|

413 |

|

|

|

— |

|

|

|

— |

|

|

|

10,469 |

|

| Other |

|

11,851 |

|

|

|

5,861 |

|

|

|

2,446 |

|

|

|

(8,203 |

) |

|

|

11,955 |

|

|

Total |

$ |

435,251 |

|

|

$ |

83,441 |

|

|

$ |

8,666 |

|

|

$ |

(8,203 |

) |

|

$ |

519,155 |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Revenues by Category

(continued)(in thousands)

The Company has retrospectively reclassified certain Oil and Gas

sub-category revenues for each quarterly period in 2022 in order to

conform the classification with the current year presentation.

Total Oil and Gas sub-category revenues were unchanged in total in

each quarterly period and for the full year ended December 31,

2022. The table below presents the reclassified balances for each

quarterly period in the prior year.

| |

2022 Quarterly Revenues |

| |

Three months endedMarch 31, |

|

Three months endedJune 30, |

|

Three months endedSeptember 30, |

|

Three months endedDecember 31, |

| Oil and Gas Revenue by

sub-category |

|

|

|

|

|

|

|

|

Upstream |

$ |

36,397 |

|

|

$ |

38,051 |

|

|

$ |

35,173 |

|

|

$ |

36,435 |

|

|

Midstream |

|

20,427 |

|

|

|

27,153 |

|

|

|

25,885 |

|

|

|

23,540 |

|

|

Downstream |

|

37,399 |

|

|

|

36,061 |

|

|

|

35,973 |

|

|

|

35,258 |

|

| Total |

$ |

94,223 |

|

|

$ |

101,265 |

|

|

$ |

97,031 |

|

|

$ |

95,233 |

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Oil and Gas Revenue by

sub-category |

|

|

|

|

|

|

|

|

Upstream |

$ |

38,041 |

|

|

$ |

35,173 |

|

|

$ |

116,941 |

|

|

$ |

109,621 |

|

|

Midstream |

|

26,215 |

|

|

|

25,885 |

|

|

|

74,739 |

|

|

|

73,465 |

|

|

Downstream |

|

38,996 |

|

|

|

35,973 |

|

|

|

116,361 |

|

|

|

109,433 |

|

| Total |

$ |

103,252 |

|

|

$ |

97,031 |

|

|

$ |

308,041 |

|

|

$ |

292,519 |

|

Consolidated Revenue by type was as follows:

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| Field Services |

$ |

122,717 |

|

|

$ |

118,526 |

|

|

$ |

348,501 |

|

|

$ |

345,385 |

|

| Shop Laboratories |

|

14,840 |

|

|

|

12,528 |

|

|

|

42,216 |

|

|

|

35,533 |

|

| Data Analytical Solutions |

|

17,997 |

|

|

|

17,151 |

|

|

|

52,916 |

|

|

|

45,786 |

|

| Other |

|

23,800 |

|

|

|

30,257 |

|

|

|

79,766 |

|

|

|

92,451 |

|

|

Total |

$ |

179,354 |

|

|

$ |

178,462 |

|

|

$ |

523,399 |

|

|

$ |

519,155 |

|

| |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Reconciliation

ofSegment and Total Company Income (Loss) from

Operations (GAAP) to Income before Special Items

(non-GAAP)(in thousands) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| North

America: |

|

|

|

|

|

|

|

|

Income from operations (GAAP) |

$ |

18,004 |

|

|

$ |

16,700 |

|

|

$ |

39,719 |

|

|

$ |

35,315 |

|

|

Bad debt provision for troubled customers, net of recoveries |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

289 |

|

|

Reorganization and other costs |

|

35 |

|

|

|

12 |

|

|

|

574 |

|

|

|

40 |

|

|

Legal settlement and insurance recoveries, net |

|

— |

|

|

|

— |

|

|

|

150 |

|

|

|

(841 |

) |

|

Acquisition-related expense, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

45 |

|

|

Income from operations before special items (non-GAAP) |

$ |

18,039 |

|

|

$ |

16,712 |

|

|

$ |

40,443 |

|

|

$ |

34,848 |

|

|

International: |

|

|

|

|

|

|

|

|

Income (loss) from operations (GAAP) |

$ |

(12,970 |

) |

|

$ |

814 |

|

|

$ |

(13,031 |

) |

|

$ |

2,678 |

|

|

Goodwill Impairment charges |

|

13,799 |

|

|

|

— |

|

|

|

13,799 |

|

|

|

— |

|

|

Reorganization and other costs, net |

|

33 |

|

|

|

(15 |

) |

|

|

228 |

|

|

|

(114 |

) |

|

Income from operations before special items (non-GAAP) |

$ |

862 |

|

|

$ |

799 |

|

|

$ |

996 |

|

|

$ |

2,564 |

|

| Products and

Systems: |

|

|

|

|

|

|

|

|

Loss from operations (GAAP) |

$ |

(557 |

) |

|

$ |

(333 |

) |

|

$ |

(78 |

) |

|

$ |

(1,334 |

) |

|

Reorganization and other costs |

|

189 |

|

|

|

— |

|

|

|

189 |

|

|

|

— |

|

|

Income (loss) from operations before special items (non-GAAP) |

$ |

(368 |

) |

|

$ |

(333 |

) |

|

$ |

111 |

|

|

$ |

(1,334 |

) |

| Corporate and

Eliminations: |

|

|

|

|

|

|

|

|

Loss from operations (GAAP) |

$ |

(9,159 |

) |

|

$ |

(8,067 |

) |

|

$ |

(29,228 |

) |

|

$ |

(22,668 |

) |

|

Loss on debt modification |

|

— |

|

|

|

693 |

|

|

|

— |

|

|

|

693 |

|

|

Legal settlement and insurance recoveries, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(153 |

) |

|

Reorganization and other costs |

|

2,445 |

|

|

|

133 |

|

|

|

5,026 |

|

|

|

139 |

|

|

Acquisition-related expense, net |

|

— |

|

|

|

1 |

|

|

|

5 |

|

|

|

19 |

|

|

Loss from operations before special items (non-GAAP) |

$ |

(6,714 |

) |

|

$ |

(7,240 |

) |

|

$ |

(24,197 |

) |

|

$ |

(21,970 |

) |

| Total

Company: |

|

|

|

|

|

|

|

|

Income (loss) from operations (GAAP) |

$ |

(4,682 |

) |

|

$ |

9,114 |

|

|

$ |

(2,618 |

) |

|

$ |

13,991 |

|

|

Bad debt provision for troubled customers, net of recoveries |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

289 |

|

|

Goodwill Impairment charges |

|

13,799 |

|

|

|

— |

|

|

|

13,799 |

|

|

|

— |

|

|

Reorganization and other costs |

|

2,702 |

|

|

|

130 |

|

|

|

6,017 |

|

|

|

65 |

|

|

Loss on debt modification |

|

— |

|

|

|

693 |

|

|

|

— |

|

|

|

693 |

|

|

Legal settlement and insurance recoveries, net |

|

— |

|

|

|

— |

|

|

|

150 |

|

|

|

(994 |

) |

|

Acquisition-related expense, net |

|

— |

|

|

|

1 |

|

|

|

5 |

|

|

|

64 |

|

|

Income from operations before special items (non-GAAP) |

$ |

11,819 |

|

|

$ |

9,938 |

|

|

$ |

17,353 |

|

|

$ |

14,108 |

|

| |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Reconciliation of

Gross Debt (GAAP) to Net Debt (non-GAAP)(in

thousands) |

| |

| |

|

September 30, 2023 |

|

December 31, 2022 |

| |

|

|

|

|

|

Current portion of long-term debt |

|

$ |

8,402 |

|

|

$ |

7,425 |

|

| Long-term debt, net of current

portion |

|

|

185,466 |

|

|

|

183,826 |

|

| Total Gross Debt (GAAP) |

|

|

193,868 |

|

|

|

191,251 |

|

| Less: Cash and cash

equivalents |

|

|

(12,752 |

) |

|

|

(20,488 |

) |

| Total Net Debt (non-GAAP) |

|

$ |

181,116 |

|

|

$ |

170,763 |

|

| |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Summary Cash Flow

Information(in thousands) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net cash provided by (used

in): |

|

|

|

|

|

|

|

|

Operating activities |

$ |

(7,637 |

) |

|

$ |

2,722 |

|

|

$ |

10,684 |

|

|

$ |

10,531 |

|

|

Investing activities |

|

(5,359 |

) |

|

|

(2,378 |

) |

|

|

(15,170 |

) |

|

|

(8,877 |

) |

|

Financing activities |

|

9,348 |

|

|

|

303 |

|

|

|

(1,839 |

) |

|

|

(4,753 |

) |

|

Effect of exchange rate changes on cash |

|

(1,599 |

) |

|

|

(1,172 |

) |

|

|

(1,411 |

) |

|

|

(2,927 |

) |

| Net change in cash and cash

equivalents |

$ |

(5,247 |

) |

|

$ |

(525 |

) |

|

$ |

(7,736 |

) |

|

$ |

(6,026 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Reconciliation of

Net Cash Provided by Operating Activities (GAAP) to Free

Cash Flow (non-GAAP)(in thousands) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| Net cash provided by

operating activities (GAAP) |

$ |

(7,637 |

) |

|

$ |

2,722 |

|

|

$ |

10,684 |

|

|

$ |

10,531 |

|

| Less: |

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

(4,602 |

) |

|

|

(2,358 |

) |

|

|

(14,403 |

) |

|

|

(9,050 |

) |

|

Purchases of intangible assets |

|

(1,046 |

) |

|

|

(181 |

) |

|

|

(1,868 |

) |

|

|

(580 |

) |

| Free cash flow

(non-GAAP) |

$ |

(13,285 |

) |

|

$ |

183 |

|

|

$ |

(5,587 |

) |

|

$ |

901 |

|

| |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Reconciliation of

Net Income (Loss) (GAAP) to Adjusted EBITDA

(non-GAAP)(in thousands) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

| Net Income (loss)

(GAAP) |

$ |

(10,338 |

) |

|

$ |

4,394 |

|

|

$ |

(14,940 |

) |

|

$ |

3,707 |

|

|

Less: Net income attributable to non-controlling interests, net of

taxes |

|

(40 |

) |

|

|

21 |

|

|

|

7 |

|

|

|

54 |

|

| Net Income (loss)

attributable to MISTRAS Group, Inc. |

$ |

(10,298 |

) |

|

$ |

4,373 |

|

|

$ |

(14,947 |

) |

|

$ |

3,653 |

|

|

Interest expense |

|

4,167 |

|

|

|

2,735 |

|

|

|

12,093 |

|

|

|

6,790 |

|

|

Provision for income taxes |

|

1,489 |

|

|

|

1,985 |

|

|

|

229 |

|

|

|

3,494 |

|

|

Depreciation and amortization |

|

8,748 |

|

|

|

8,197 |

|

|

|

25,470 |

|

|

|

25,132 |

|

|

Share-based compensation expense |

|

1,010 |

|

|

|

1,396 |

|

|

|

3,649 |

|

|

|

4,166 |

|

|

Acquisition-related expense |

|

— |

|

|

|

1 |

|

|

|

5 |

|

|

|

63 |

|

|

Reorganization and other related costs, net |

|

2,702 |

|

|

|

130 |

|

|

|

6,017 |

|

|

|

65 |

|

|

Goodwill Impairment charges |

|

13,799 |

|

|

|

— |

|

|

|

13,799 |

|

|

|

— |

|

|

Legal settlement and insurance recoveries, net |

|

— |

|

|

|

— |

|

|

|

150 |

|

|

|

(994 |

) |

|

Loss on debt modification |

|

— |

|

|

|

693 |

|

|

|

— |

|

|

|

693 |

|

|

Bad debt provision for troubled customers, net of recoveries |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

289 |

|

|

Foreign exchange (gain) loss |

|

(721 |

) |

|

|

(928 |

) |

|

|

149 |

|

|

|

(924 |

) |

| Adjusted EBITDA

(non-GAAP) |

$ |

20,896 |

|

|

$ |

18,582 |

|

|

$ |

46,614 |

|

|

$ |

42,427 |

|

| |

|

MISTRAS Group, Inc. and

SubsidiariesUnaudited Reconciliation

ofNet Income (Loss) (GAAP) and Diluted EPS (GAAP)

to Net Income (Loss) Excluding Special Items (non-GAAP)

and Diluted EPS Excluding Special Items

(non-GAAP)(dollars in thousands, except per share

data) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net income (loss)

attributable to MISTRAS Group, Inc. (GAAP) |

$ |

(10,298 |

) |

|

$ |

4,373 |

|

|

$ |

(14,947 |

) |

|

$ |

3,653 |

|

|

Bad debt provision for troubled customers, net of recoveries |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

289 |

|

|

Goodwill Impairment charges |

|

13,799 |

|

|

|

— |

|

|

|

13,799 |

|

|

|

— |

|

|

Reorganization and other costs |

|

2,702 |

|

|

|

130 |

|

|

|

6,017 |

|

|

|

65 |

|

|

Loss on debt modification |

|

— |

|

|

|

693 |

|

|

|

— |

|

|

|

693 |

|

|

Legal settlement and insurance recoveries, net |

|

— |

|

|

|

— |

|

|

|

150 |

|

|

|

(994 |

) |

|

Acquisition-related expense, net |

|

— |

|

|

|

1 |

|

|

|

5 |

|

|

|

64 |

|

|

Special Items Total |

$ |

16,501 |

|

|

$ |

824 |

|

|

$ |

19,971 |

|

|

$ |

117 |

|

|

Tax impact on special items |

|

(653 |

) |

|

|

(188 |

) |

|

|

(1,468 |

) |

|

|

(8 |

) |

|

Special items, net of tax |

$ |

15,848 |

|

|

$ |

636 |

|

|

$ |

18,503 |

|

|

$ |

109 |

|

| Net income (loss)

attributable to MISTRAS Group, Inc. Excluding Special Items

(non-GAAP) |

$ |

5,550 |

|

|

$ |

5,009 |

|

|

$ |

3,556 |

|

|

$ |

3,762 |

|

| |

|

|

|

|

|

|

|

| Diluted EPS

(GAAP)(1) |

$ |

(0.34 |

) |

|

$ |

0.14 |

|

|

$ |

(0.49 |

) |

|

$ |

0.12 |

|

|

Special items, net of tax |

|

0.52 |

|

|

|

0.02 |

|

|

|

0.61 |

|

|

|

— |

|

| Diluted EPS Excluding

Special Items (non-GAAP) |

$ |

0.18 |

|

|

$ |

0.16 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

_______________(1) For the three and nine months ended September

30, 2023, 1,508,255 and 926,224 shares related to restricted stock

were excluded from the calculation of diluted EPS due to the net

loss for the period.

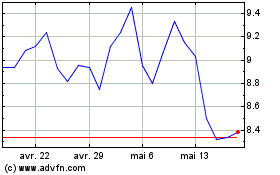

Mistras (NYSE:MG)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Mistras (NYSE:MG)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025