Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX:

PPL; NYSE: PBA) announced today that it has agreed to issue $950

million aggregate principal amount of senior unsecured medium-term

notes (the "Offering"). The Offering will be conducted in three

tranches consisting of: (i) $650 million principal amount of senior

unsecured medium-term notes, series 23 (the "Series 23 Notes")

having a fixed coupon of 5.22% per annum, paid semi-annually, and

maturing on June 28, 2033; (ii) $150 million principal amount to be

issued through a re-opening of the Company's senior unsecured

medium-term notes, series 20 (the "Series 20 Notes") having a fixed

coupon of 5.02% per annum, paid semi-annually, and maturing on

January 12, 2032; and (iii) $150 million principal amount to be

issued through a re-opening of the Company's senior unsecured

medium-term notes, series 22 (the "Series 22 Notes") having a fixed

coupon of 5.67% per annum, paid semi-annually, and maturing on

January 12, 2054.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240626224564/en/

Closing of the Offering is expected to occur on June 28, 2024.

Pembina intends to use the net proceeds of the Offering: (i) to

repay indebtedness of the Company under its unsecured $1.5 billion

revolving credit facility maturing in June 2029; (ii) to fund the

previously announced redemption by the Company of $150 million

aggregate principal amount of its $300 million aggregate principal

amount of 5.72% Medium Term Notes, Series 19 (the "Series 19

Notes") due June 22, 2026; and (iii) for general corporate

purposes.

The Series 23 Notes and the re-opened Series 20 Notes and Series

22 Notes are being offered through a syndicate of dealers under

Pembina's short form base shelf prospectus dated December 20, 2023,

as supplemented by related pricing supplements dated June 26,

2024.

This news release does not constitute an offer to sell or the

solicitation of an offer to buy the notes in any jurisdiction. The

notes being offered have not been approved or disapproved by any

regulatory authority. The notes have not been and will not be

registered under the United States Securities Act of 1933, as

amended, or any state securities law, and may not be offered or

sold within the United States.

About Pembina

Pembina Pipeline Corporation is a leading energy transportation

and midstream service provider that has served North America's

energy industry for 70 years. Pembina owns an integrated network of

hydrocarbon liquids and natural gas pipelines, gas gathering and

processing facilities, oil and natural gas liquids infrastructure

and logistics services, and an export terminals business. Through

our integrated value chain, we seek to provide safe and reliable

energy solutions that connect producers and consumers across the

world, support a more sustainable future and benefit our customers,

investors, employees and communities. For more information, please

visit www.pembina.com.

Purpose of Pembina: We deliver extraordinary energy solutions so

the world can thrive.

Pembina is structured into three Divisions: Pipelines Division,

Facilities Division and Marketing & New Ventures Division.

Pembina's common shares trade on the Toronto and New York stock

exchanges under PPL and PBA, respectively. For more information,

visit www.pembina.com.

Forward-Looking Statements and Information

This news release contains certain forward-looking statements

and forward-looking information (collectively, "forward-looking

statements"), including forward-looking statements within the

meaning of the "safe harbor" provisions of applicable securities

legislation that are based on Pembina's current expectations,

estimates, projections and assumptions in light of its experience

and its perception of historical trends. In some cases,

forward-looking statements can be identified by terminology such as

"expect", "intend", "will", "shall", and similar expressions

suggesting future events or future performance.

In particular, this news release contains forward-looking

statements relating to: the Offering, including the anticipated

closing date of the Offering and the intended use of the net

proceeds of the Offering; and the partial redemption of the Series

19 Notes, including the occurrence thereof. These forward-looking

statements are based on certain assumptions that Pembina has made

in respect thereof as at the date of this news release, including:

oil and gas industry exploration and development activity levels

and the geographic region of such activity; that favourable market

conditions exist; the success of Pembina's operations; prevailing

commodity prices, interest rates, carbon prices, tax rates and

exchange rates; the ability of Pembina to maintain current credit

ratings; the availability of capital to fund future capital

requirements relating to existing assets and projects; future

operating costs; geotechnical and integrity costs; that all

required regulatory and environmental approvals can be obtained on

the necessary terms in a timely manner; prevailing regulatory, tax

and environmental laws and regulations; maintenance of operating

margins; and certain other assumptions in respect of Pembina's

forward-looking statements detailed in Pembina's Annual Information

Form for the year ended December 31, 2023 (the "AIF") and

Management's Discussion and Analysis for the year ended December

31, 2023 (the "Annual MD&A"), which were each filed on SEDAR+

on February 22, 2024, in Pembina's Management's Discussion and

Analysis for the three months ended March 31, 2024 (the "Interim

MD&A"), which was filed on SEDAR+ on May 9, 2024, and from time

to time in Pembina's public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at

www.pembina.com.

These forward-looking statements are not guarantees of future

performance and are subject to a number of known and unknown risks

and uncertainties, including, but not limited to: the regulatory

environment and decisions and Indigenous and landowner consultation

requirements; the impact of competitive entities and pricing;

reliance on third parties to successfully operate and maintain

certain assets; the strength and operations of the oil and natural

gas production industry and related commodity prices;

non-performance or default by counterparties to agreements with

Pembina or one or more of its affiliates; actions taken by

governmental or regulatory authorities; the ability of Pembina to

acquire or develop the necessary infrastructure in respect of

future development projects; fluctuations in operating results;

adverse general economic and market conditions in Canada, North

America and worldwide; the ability to access various sources of

debt and equity capital; changes in credit ratings; counterparty

credit risk; and certain other risks and uncertainties detailed in

the AIF, Annual MD&A, Interim MD&A and from time to time in

Pembina's public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at

www.pembina.com. In addition, the closing of the Offering and the

partial redemption of the Series 19 Notes may not be completed, or

may be delayed, if the conditions to the completion thereof are not

satisfied on the anticipated timeline or at all. Accordingly, there

is a risk that the Offering will not be completed and the Series 19

Notes may not be redeemed within the anticipated time, on the terms

currently proposed, or at all. The intended use of the net proceeds

of the Offering by Pembina may change if the board of directors of

Pembina determines that it would be in the best interests of

Pembina to deploy the proceeds for some other purpose and there can

be no guarantee as to how or when such proceeds may be used.

Accordingly, readers are cautioned that events or circumstances

could cause results to differ materially from those predicted,

forecasted or projected. The forward-looking statements contained

in this news release are expressly qualified by the above

statements. Pembina does not undertake any obligation to publicly

update or revise any forward-looking statements or information

contained herein, except as required by applicable laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240626224564/en/

For further information: Investor Relations (403) 231-3156

1-855-880-7404 e-mail: investor-relations@pembina.com

www.pembina.com

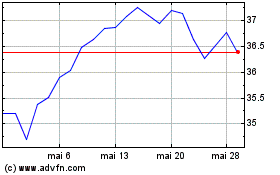

Pembina Pipeline (NYSE:PBA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Pembina Pipeline (NYSE:PBA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025