RenaissanceRe Holdings Ltd. Advances Strategy with $2.985 Billion Acquisition of Validus Re

22 Mai 2023 - 10:27PM

Business Wire

Accelerates Growth in a Favorable Reinsurance Market

Enhances Three Drivers of Profit – Underwriting, Fee and

Investment Income

Creates Top 5 Global Property and Casualty Reinsurer

RenaissanceRe Holdings Ltd. (NYSE: RNR) (“RenaissanceRe”) today

announced it has entered into a definitive agreement with American

International Group, Inc. (“AIG”), whereby RenaissanceRe will

acquire AIG’s treaty reinsurance business, which includes Validus

Reinsurance Ltd. and its consolidated subsidiaries, AlphaCat

Managers Ltd. and its managed funds, and all renewal rights to the

Assumed Reinsurance Treaty Unit of Talbot (collectively, “Validus

Re”).

AIG has committed to deliver at closing $2.1 billion in

unlevered shareholder’s equity to RenaissanceRe with any excess to

be retained by AIG. RenaissanceRe will pay approximately $2.985

billion in total consideration, including $2.735 billion of cash

and $250 million of RenaissanceRe common shares. The cash

consideration is expected to be funded through RenaissanceRe

available funds and proceeds from the issuance of common equity and

debt. The shares received by AIG will be valued at the lower of the

public offer price for an expected underwritten public offering by

RenaissanceRe or the closing price on May 22, 2023.

The agreement has been approved by RenaissanceRe’s Board of

Directors. The transaction is expected to close in the fourth

quarter of 2023 and is subject to customary closing conditions and

regulatory approvals. No shareholder approval is required.

As part of the transaction, AIG will retain 95% of the

development on net reserves at closing. In addition, following the

closing of the transaction, AIG expects to make substantial

investments in RenaissanceRe’s Capital Partners business.

Kevin O’Donnell, President and Chief Executive Officer of

RenaissanceRe, commented: “This acquisition advances our strategy

as a leading global property and casualty reinsurer, providing

additional scale, and increasing our importance to customers.

Furthermore, by gaining access to a large, attractive book of

reinsurance business in a favorable market environment, we expect

to accelerate our three drivers of profit – underwriting, fee, and

investment income. Additionally, we are enhancing our relationship

with AIG and demonstrating how our consistent, highly

differentiated strategy provides us with unique access to large,

one-of-a-kind opportunities that create shareholder value. I have

deep respect for Peter and AIG and look forward to extending our

partnership.”

Sidley Austin LLP and Morgan Stanley acted as legal counsel and

financial advisor, respectively, for RenaissanceRe.

Conference Call Information

RenaissanceRe will host an investment community conference call

discussing the transaction on Monday, May 22, 2023 at 4:45 p.m. ET.

The teleconference can be accessed by dialing 800-245-3047 (U.S.

callers), or 203-518-9765 (international callers), and providing

the passcode RNR0522 approximately fifteen minutes in advance of

the call. A live broadcast of the conference call will also be

available through the “Investors – Webcasts Presentations” section

of the Company’s website at www.renre.com.

Cautionary Statement Regarding Forward-Looking

Statements

Any forward-looking statements made in this Press Release,

including statements about our expectations, forecasts, projections

and estimates regarding the impact of the transactions described

herein, reflect RenaissanceRe’s current views with respect to

future events and financial performance and are made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. We may also make forward-looking statements

with respect to our business and industry, such as those relating

to our strategy and management objectives, plans and expectations

regarding our response and ability to adapt to changing economic

conditions, market standing and product volumes, and insured losses

from loss events, among other things. These statements are subject

to numerous factors that could cause actual results to differ

materially from those addressed by such forward-looking statements,

including those disclosed in RenaissanceRe’s filings with the SEC,

including its Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q and the following: the risk that the Validus Re

acquisition may not be completed within the expected timeframe or

at all; the risk that regulatory agencies in certain jurisdictions

may impose onerous conditions following the Validus Re acquisition;

difficulties in integrating Validus Re; risk that the due diligence

process that we undertook in connection with the Validus Re

acquisition may not have revealed all facts that may be relevant in

connection with the Validus Re acquisition; our ability to manage

the growth of the Validus Re operations successfully following the

acquisition of Validus Re; that historical financial statements of

Validus Re are not representative of the future financial position,

future results of operations or future cash flows of Validus Re

following the acquisition of Validus Re; our exposure to natural

and non-natural catastrophic events and circumstances and the

variance they may cause in our financial results; the effect of

climate change on our business, including the trend towards

increasingly frequent and severe climate events; the effectiveness

of our claims and claim expense reserving process; the effect of

emerging claims and coverage issues; the performance of our

investment portfolio and financial market volatility; the effects

of inflation; the ability of our ceding companies and delegated

authority counterparties to accurately assess the risks they

underwrite; our ability to maintain our financial strength ratings;

the highly competitive nature of our industry; our reliance on a

small number of brokers; collection on claimed retrocessional

coverage, and new retrocessional reinsurance being available on

acceptable terms or at all; the historically cyclical nature of the

(re)insurance industries; our ability to attract and retain key

executives and employees; our ability to successfully implement our

business, strategies and initiatives; our exposure to credit loss

from counterparties; our need to make many estimates and judgments

in the preparation of our financial statements; our ability to

effectively manage capital on behalf of investors in joint ventures

or other entities we manage; changes to the accounting rules and

regulatory systems applicable to our business, including changes in

Bermuda and U.S. laws or regulations; other political, regulatory

or industry initiatives adversely impacting us; our ability to

comply with covenants in our debt agreements; the effect of adverse

economic factors, including changes in the prevailing interest

rates and recession or the perception that recession may occur; the

effect of cybersecurity risks, including technology breaches or

failure; a contention by the IRS that any of our Bermuda

subsidiaries are subject to taxation in the U.S.; the effects of

possible future tax reform legislation and regulations in the

jurisdictions in which we operate; our ability to determine any

impairments taken on our investments; our ability to raise capital

on acceptable terms, including through debt instruments, the

capital markets, and third party investments in our joint ventures

and managed fund partners; our ability to comply with applicable

sanctions and foreign corrupt practices laws; and our dependence on

the ability of our operating subsidiaries to declare and pay

dividends.

About RenaissanceRe

RenaissanceRe is a global provider of reinsurance and insurance

that specializes in matching well-structured risks with efficient

sources of capital. The Company provides property, casualty and

specialty reinsurance and certain insurance solutions to customers,

principally through intermediaries. Established in 1993, the

Company has offices in Bermuda, Australia, Ireland, Singapore,

Switzerland, the United Kingdom and the United States.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230522005628/en/

Investor Contact: RenaissanceRe Holdings Ltd. Keith McCue Senior

Vice President, Finance & Investor Relations 441-239-4830

Media Contacts: RenaissanceRe Holdings Ltd. Hayden Kenny Vice

President, Investor Relations & Communications 441-239-4946

Kekst CNC Nicolas Capuano 917-842-7859

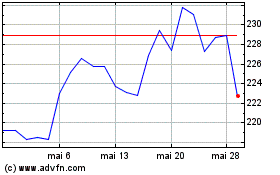

RenaissanceRe (NYSE:RNR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

RenaissanceRe (NYSE:RNR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025