- Annualized return on average common equity of 16.4% and

annualized operating return on average common equity of 28.7%.

- Gross premiums written grew by $1.2 billion, or 43.0%. Property

grew by $585.7 million, or 44.9%, and Casualty and Specialty grew

by $614.7 million, or 41.4%.

- Combined ratio of 77.9% and adjusted combined ratio of

75.4%.

- Fee income of $83.6 million; up 86.6% from Q1 2023.

- Net investment income of $390.8 million; up 53.6% from Q1

2023.

RenaissanceRe Holdings Ltd. (NYSE: RNR) (“RenaissanceRe” or the

“Company”) today announced its financial results for the first

quarter of 2024.

Net Income Available to Common

Shareholders per Diluted Common Share: $6.94 Operating

Income Available to Common Shareholders per Diluted Common Share:

$12.18

Underwriting Income

$540.7M

Fee Income

$83.6M

Net Investment Income

$390.8M

Change in Book Value per

Common Share: 3.5% Change in Tangible Book Value per Common

Share Plus Change in Accum. Dividends: 5.3%

Operating Return on Average Common Equity, Operating Income

(Loss) Available (Attributable) to Common Shareholders, Operating

Income (Loss) Available (Attributable) to Common Shareholders per

Diluted Common Share, Change in Tangible Book Value per Common

Share Plus Change in Accumulated Dividends, Adjusted Combined

Ratio, Property Adjusted Combined Ratio and Casualty and Specialty

Adjusted Combined Ratio are non-GAAP financial measures; see

“Comments on Non-GAAP Financial Measures” for a reconciliation of

non-GAAP financial measures.

Kevin J. O’Donnell, President and

Chief Executive Officer, said, “We are pleased to deliver another

exceptional quarter, characterized by strong profitability,

substantial growth and persistent tailwinds behind our Three

Drivers of Profit. The successful renewal of the RenaissanceRe and

Validus portfolio is deepening our partnerships with our customers

while broadening our access to attractive risk. This combined

underwriting portfolio, along with growing fee and net investment

income, should continue to drive significant value for our

shareholders.”

Consolidated Financial

Results

Consolidated Highlights

Three months ended March

31,

(in thousands, except per share amounts

and percentages)

2024

2023

Gross premiums written

$

3,990,684

$

2,790,261

Net premiums written

3,199,573

2,263,703

Net premiums earned

2,443,910

1,680,550

Underwriting income (loss)

540,682

369,619

Combined ratio

77.9

%

78.0

%

Adjusted combined ratio (1)

75.4

%

77.8

%

Net Income (Loss)

Available (attributable) to common

shareholders

364,798

564,062

Available (attributable) to common

shareholders per diluted common share

$

6.94

$

12.91

Return on average common equity -

annualized

16.4

%

46.6

%

Operating Income (Loss) (1)

Available (attributable) to common

shareholders

636,379

364,027

Available (attributable) to common

shareholders per diluted common share

$

12.18

$

8.25

Operating return on average common equity

- annualized (1)

28.7

%

30.0

%

Book Value per Share

Book value per common share

$

170.92

$

116.44

Quarterly change in book value per share

(2)

3.5

%

11.3

%

Quarterly change in book value per common

share plus change in accumulated dividends (2)

3.7

%

11.6

%

Tangible Book Value per Share

(1)

Tangible book value per common share plus

accumulated dividends (1)

$

175.92

$

134.46

Quarterly change in tangible book value

per common share plus change in accumulated dividends (1) (2)

5.3

%

12.7

%

(1)

See “Comments on Non-GAAP Financial

Measures” for a reconciliation of non-GAAP financial measures.

(2)

Represents the percentage change in value

during the periods presented.

Acquisition of Validus

On November 1, 2023, the Company completed its acquisition (the

“Validus Acquisition”) of Validus Holdings, Ltd. (“Validus

Holdings”), Validus Specialty, LLC (“Validus Specialty”) and the

renewal rights, records and customer relationships of the assumed

treaty reinsurance business of Talbot Underwriting Limited from

subsidiaries of American International Group, Inc. Validus

Holdings, Validus Specialty, and their respective subsidiaries

collectively are referred to herein as “Validus.”

The first quarter of 2024 was the first full quarter that

reflected the results of Validus. As such, the results of

operations for the three months ended March 31, 2024 compared to

the three months ended March 31, 2023, should be viewed in that

context. In addition, the results of operations for three months

ended March 31, 2024 may not be reflective of the ongoing business

of the combined entities.

Three Drivers of Profit:

Underwriting, Fee and Investment Income

Underwriting Results - Property Segment: Combined ratio of

42.9%; increase in gross premiums written of 44.9%

Property Segment

Three months ended March

31,

Q/Q Change

(in thousands, except percentages)

2024

2023

Gross premiums written

$

1,889,881

$

1,304,199

44.9

%

Net premiums written

1,397,618

1,019,829

37.0

%

Net premiums earned

936,083

687,420

36.2

%

Underwriting income (loss)

534,428

298,679

Underwriting Ratios

Net claims and claim expense ratio -

current accident year

26.6

%

39.2

%

(12.6) pts

Net claims and claim expense ratio - prior

accident years

(10.1

)%

(11.9

)%

1.8 pts

Net claims and claim expense ratio -

calendar year

16.5

%

27.3

%

(10.8) pts

Underwriting expense ratio

26.4

%

29.3

%

(2.9) pts

Combined ratio

42.9

%

56.6

%

(13.7) pts

Adjusted combined ratio (1)

40.5

%

56.3

%

(15.8) pts

(1)

See “Comments on Non-GAAP Financial

Measures” for a reconciliation of non-GAAP financial measures.

- Gross premiums written increased by $585.7 million, or

44.9%, driven by:

– a $412.5 million increase in catastrophe,

driven by the renewal of business acquired in the Validus

Acquisition, in conjunction with the retention of legacy lines, at

the January 1, 2024 renewal.

– a $173.1 million increase in other

property, reflecting the renewal of business acquired in the

Validus Acquisition and organic growth, in both catastrophe and

non-catastrophe exposed business.

- Net premiums written increased by $377.8 million, or

37.0%, driven by the increase in gross premiums written discussed

above, partially offset by an increase in ceded premiums written as

part of the Company’s gross-to-net strategy.

- Combined ratio improved by 13.7 percentage points, and

adjusted combined ratio, which removes the impact of

acquisition related purchase accounting adjustments, improved by

15.8 percentage points, each primarily due to growth in net

premiums earned and the lower level of current accident year net

losses.

- Net claims and claim expense ratio - current accident

year improved by 12.6 percentage points due to a lower impact

from large loss events in the first quarter of 2024 compared to the

impact from the large loss events in the first quarter of

2023.

- Net claims and claim expense ratio - prior accident

years reflects net favorable development in the first quarter

of 2024, primarily from weather-related large losses across the

2017 to 2022 accident years, driven by better than expected loss

emergence.

- Underwriting expense ratio decreased 2.9 percentage

points, primarily due to:

– a 1.6 percentage point decrease in the

operating expense ratio due, in part, to higher net premiums

earned.

– a 1.3 percentage point decrease in the

acquisition expense ratio, driven by changes in the mix of business

as a result of continued relative growth in catastrophe, which has

a lower acquisition expense ratio than other property, partially

offset by the increase in acquisition expenses from purchase

accounting adjustments related to the Validus Acquisition.

Underwriting Results - Casualty and Specialty Segment:

Combined ratio of 99.6% and adjusted combined ratio of 97.1%;

increase in gross premiums written of 41.4%

Casualty and Specialty Segment

Three months ended March

31,

Q/Q Change

(in thousands, except percentages)

2024

2023

Gross premiums written

$

2,100,803

$

1,486,062

41.4

%

Net premiums written

1,801,955

1,243,874

44.9

%

Net premiums earned

1,507,827

993,130

51.8

%

Underwriting income (loss)

6,254

70,940

Underwriting Ratios

Net claims and claim expense ratio -

current accident year

67.3

%

64.1

%

3.2 pts

Net claims and claim expense ratio - prior

accident years

(0.2

)%

(2.3

)%

2.1 pts

Net claims and claim expense ratio -

calendar year

67.1

%

61.8

%

5.3 pts

Underwriting expense ratio

32.5

%

31.1

%

1.4 pts

Combined ratio

99.6

%

92.9

%

6.7 pts

Adjusted combined ratio (1)

97.1

%

92.6

%

4.5 pts

(1)

See “Comments on Non-GAAP Financial

Measures” for a reconciliation of non-GAAP financial measures.

- Gross premiums written increased by $614.7 million, or

41.4%, primarily driven by the renewal of business acquired in the

Validus Acquisition, in conjunction with the retention of legacy

lines. In particular, the other specialty line of business grew by

$392.4 million as compared to the first quarter of 2023.

- Net premiums written increased 44.9%, consistent with

the drivers discussed for gross premiums written above.

- Combined ratio increased by 6.7 percentage points, and

adjusted combined ratio, which removes the impact of

acquisition related purchase accounting adjustments, increased by

4.5 percentage points, each primarily due to the increase in the

net claims and claim expense ratio.

- Net claims and claim expense ratio - current accident

year increased by 3.2 percentage points. The Baltimore Bridge

Collapse in the first quarter of 2024 added 4.2 points to the net

claims and claim expense ratio - current accident year.

- Net claims and claim expense ratio - prior accident

years reflects net favorable development driven by reported

losses generally coming in lower than expected on attritional net

claims and claim expenses from the other specialty and credit lines

of business, partially offset by the impact of purchase accounting

adjustments relating to the Validus Acquisition.

- Underwriting expense ratio increased 1.4 percentage

points, which consisted of:

– a 0.8 percentage point increase in the

operating expense ratio as compared to the first quarter of 2023,

due to a reduction in the benefit from override fees from a

decrease in retrocessional reinsurance coverage purchased; and

– a 0.6 percentage point increase in the

acquisition expense ratio primarily due to the impact of the

purchase accounting adjustments relating to the Validus

Acquisition.

Fee Income: $83.6 million of fee income, up 86.6% from Q1

2023; increase in both management and performance fees

Fee Income

Three months ended March

31,

Q/Q Change

(in thousands)

2024

2023

Total management fee income

$

56,053

$

40,905

$

15,148

Total performance fee income (loss)

(1)

27,497

3,867

23,630

Total fee income

$

83,550

$

44,772

$

38,778

(1)

Performance fees are based on the

performance of the individual vehicles or products, and may be

negative in a particular period if, for example, large losses

occur, which can potentially result in no performance fees or the

reversal of previously accrued performance fees.

- Management fee income increased $15.1 million,

reflecting growth in the Company’s joint ventures and managed

funds, specifically DaVinciRe Holdings Ltd. (“DaVinci”), Fontana

Holdings L.P. (“Fontana”) and RenaissanceRe Medici Fund Ltd.

(“Medici”), as well as the addition of fees earned by AlphaCat

Managers Ltd., which was acquired as part of the Validus

Acquisition.

- Performance fee income increased $23.6 million, driven

by improved underwriting results and prior year favorable

development, primarily in DaVinci.

Investment Results: Total investment result of $177.1

million; net investment income growth of 53.6%

Investment Results

Three months ended March

31,

Q/Q Change

(in thousands, except percentages)

2024

2023

Net investment income

$

390,775

$

254,378

$

136,397

Net realized and unrealized gains (losses)

on investments

(213,654

)

279,451

(493,105

)

Total investment result

$

177,121

$

533,829

$

(356,708

)

Net investment income return -

annualized

5.7

%

4.9

%

0.8 pts

Total investment return - annualized

2.8

%

10.0

%

(7.2) pts

- Net investment income increased $136.4 million, due to a

combination of higher average invested assets, primarily resulting

from the Validus Acquisition, and higher yielding assets in the

fixed maturity and short term portfolios.

- Net realized and unrealized gains (losses) on

investments decreased by $493.1 million, principally driven

by:

– Net realized and unrealized losses on fixed

maturity investments trading of $202.2 million, primarily driven by

increases in interest rates in the current quarter, compared to net

realized and unrealized gains of $207.3 million in the first

quarter of 2023, due to decreases in interest rates during the

comparative period; and

– Net realized and unrealized losses on

investment-related derivatives of $57.8 million in the current

quarter, compared to net realized and unrealized gains of $12.2

million in the first quarter of 2023. The current and comparative

quarter results were primarily driven by the interest rate trends

during the periods, as described above.

- Total investments were $29.6 billion at March 31, 2024

(December 31, 2023 - $29.2 billion). Weighted average yield to

maturity and duration on the Company’s investment portfolio

(excluding investments that have no final maturity, yield to

maturity or duration) was 5.8% and 2.6 years, respectively

(December 31, 2023 - 5.8% and 2.6 years, respectively).

Other Items of Note

- Net income attributable to redeemable noncontrolling

interests of $244.8 million was primarily driven by:

– strong underwriting results in DaVinci and

Vermeer; and

– strong net investment income driven by

higher interest rates and higher yielding assets within the

investment portfolios of the Company’s joint ventures and managed

funds.

- Raised partner capital of $565.7 million in the first

quarter of 2024, primarily in DaVinci ($300.0 million), Medici

($145.7 million) and Fontana ($100.0 million).

- Returned partner capital of $701.2 million during the

first quarter of 2024, including $390.7 million of distributions

from DaVinci, Vermeer, Medici and Top Layer following strong

earnings across these vehicles in 2023.

- Corporate expenses increased by $26.4 million, primarily

driven by expenses incurred in support of the Validus

Acquisition.

- Income tax expense of $15.4 million in the current

quarter, compared to $28.9 million in the first quarter of 2023.

The decrease in income tax expense was primarily driven by

investment losses in the first quarter of 2024, compared to

investment gains in the first quarter of 2023, partially offset by

an increase in operating income in the first quarter of 2024.

Net Negative Impact

Net negative impact on underwriting result includes the sum of

(1) net claims and claim expenses incurred, (2) assumed and ceded

reinstatement premiums earned and (3) earned and lost profit

commissions. Net negative impact on net income (loss) available

(attributable) to RenaissanceRe common shareholders is the sum of

(1) net negative impact on underwriting result and (2) redeemable

noncontrolling interest, both before consideration of any related

income tax benefit (expense).

The Company’s estimates of net negative impact are based on a

review of the Company’s potential exposures, preliminary

discussions with certain counterparties and actuarial modeling

techniques. The Company’s actual net negative impact, both

individually and in the aggregate, may vary from these estimates,

perhaps materially. Changes in these estimates will be recorded in

the period in which they occur.

Meaningful uncertainty remains regarding the estimates and the

nature and extent of the losses from this catastrophe event, driven

by the magnitude and recent nature of the event, the relatively

limited claims data received to date, the contingent nature of

business interruption and other exposures, potential uncertainties

relating to reinsurance recoveries and other factors inherent in

loss estimation, among other things.

Net negative impact on the consolidated financial

statements

Three months

ended March 31, 2024

2024 Large Loss Events

(1)

(in thousands)

Net claims and claims expenses

incurred

$

(84,650

)

Assumed reinstatement premiums earned

14,027

Ceded reinstatement premiums earned

(9,310

)

Earned (lost) profit commissions

—

Net negative impact on underwriting

result

(79,933

)

Redeemable noncontrolling interest

25,420

Net negative impact on net income (loss)

available (attributable) to RenaissanceRe common shareholders

$

(54,513

)

Net negative impact on the segment underwriting results and

consolidated combined ratio

Three months

ended March 31, 2024

2024 Large Loss Events

(1)

(in thousands, except percentages)

Net negative impact on Property segment

underwriting result

$

(19,058

)

Net negative impact on Casualty and

Specialty segment underwriting result

(60,875

)

Net negative impact on underwriting

result

$

(79,933

)

Percentage point impact on consolidated

combined ratio

3.3

(1)

“2024 Large Loss Events” represents the

collapse of the Francis Scott Key Bridge in Baltimore following a

collision with a cargo ship in March 2024 (the “Baltimore Bridge

Collapse”).

Conference Call Details and

Additional Information

Non-GAAP Financial Measures and Additional Financial

Information

This Press Release includes certain financial measures that are

not calculated in accordance with generally accepted accounting

principles in the U.S. (“GAAP”) including “operating income (loss)

available (attributable) to RenaissanceRe common shareholders,”

“operating income (loss) available (attributable) to RenaissanceRe

common shareholders per common share - diluted,” “operating return

on average common equity - annualized,” “tangible book value per

common share,” “tangible book value per common share plus

accumulated dividends,” “adjusted combined ratio,” “property

adjusted combined ratio” and “casualty and specialty adjusted

combined ratio.” A reconciliation of such measures to the most

comparable GAAP figures in accordance with Regulation G is

presented in the attached supplemental financial data.

Please refer to the “Investors - Financial Reports - Financial

Supplements” section of the Company’s website at www.renre.com for

a copy of the Financial Supplement which includes additional

information on the Company’s financial performance.

Conference Call Information

RenaissanceRe will host a conference call on Wednesday, May 1,

2024 at 10:00 a.m. ET to discuss this release. Live broadcast of

the conference call will be available through the “Investors -

Webcasts & Presentations” section of the Company’s website at

www.renre.com.

About RenaissanceRe

RenaissanceRe is a global provider of reinsurance and insurance

that specializes in matching desirable risk with efficient capital.

The Company provides property, casualty and specialty reinsurance

and certain insurance solutions to customers, principally through

intermediaries. Established in 1993, RenaissanceRe has offices in

Bermuda, Australia, Canada, Ireland, Singapore, Switzerland, the

United Kingdom and the United States.

Cautionary Statement Regarding Forward-Looking

Statements

Any forward-looking statements made in this Press Release

reflect RenaissanceRe’s current views with respect to future events

and financial performance and are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

The Company may also make forward-looking statements with respect

to its business and industry, such as those relating to its

strategy and management objectives, plans and expectations

regarding its response and ability to adapt to changing economic

conditions, market standing and product volumes, estimates of net

negative impact and insured losses from loss events, and the

Validus Acquisition and its impact on the Company’s business, among

other things. These statements are subject to numerous factors that

could cause actual results to differ materially from those

addressed by such forward-looking statements, including the

following: the Company’s exposure to natural and non-natural

catastrophic events and circumstances and the variance it may cause

in the Company’s financial results; the effect of climate change on

the Company’s business, including the trend towards increasingly

frequent and severe climate events; the effectiveness of the

Company’s claims and claim expense reserving process; the effect of

emerging claims and coverage issues; the performance of the

Company’s investment portfolio and financial market volatility; the

effects of inflation; the ability of the Company’s ceding companies

and delegated authority counterparties to accurately assess the

risks they underwrite; the Company’s ability to maintain its

financial strength ratings; the Company’s reliance on a small

number of brokers; the highly competitive nature of the Company’s

industry; the historically cyclical nature of the (re)insurance

industries; collection on claimed retrocessional coverage, and new

retrocessional reinsurance being available on acceptable terms or

at all; the Company’s ability to attract and retain key executives

and employees; the Company’s ability to successfully implement its

business strategies and initiatives; difficulties in integrating

Validus; the Company’s exposure to credit loss from counterparties;

the Company’s need to make many estimates and judgments in the

preparation of its financial statements; the Company’s exposure to

risks associated with its management of capital on behalf of

investors in joint ventures or other entities it manages; changes

to the accounting rules and regulatory systems applicable to the

Company’s business, including changes in Bermuda and U.S. laws and

regulations; the effect of current or future macroeconomic or

geopolitical events or trends, including the ongoing conflicts

between Russia and Ukraine, and Israel and Hamas; other political,

regulatory or industry initiatives adversely impacting the Company;

the Company’s ability to comply with covenants in its debt

agreements; the effect of adverse economic factors, including

changes in prevailing interest rates; the impact of cybersecurity

risks, including technology breaches or failure; a contention by

the U.S. Internal Revenue Service that any of the Company’s Bermuda

subsidiaries are subject to taxation in the U.S.; the effects of

new or possible future tax reform legislation and regulations in

the jurisdictions in which the Company operates, including recent

changes in Bermuda tax law; the Company’s ability to determine any

impairments taken on its investments; the Company’s ability to

raise capital on acceptable terms, including through debt

instruments, the capital markets, and third party investments in

the Company’s joint ventures and managed fund partners; the

Company’s ability to comply with applicable sanctions and foreign

corrupt practices laws; the Company’s dependence on capital

distributions from its subsidiaries; and other factors affecting

future results disclosed in RenaissanceRe’s filings with the SEC,

including its Annual Reports on Form 10-K and Quarterly Reports on

Form 10-Q.

RenaissanceRe Holdings

Ltd.

Summary Consolidated

Statements of Operations

(in thousands of United States

Dollars, except per share amounts and percentages)

(Unaudited)

Three months ended

March 31, 2024

March 31, 2023

Revenues

Gross premiums written

$

3,990,684

$

2,790,261

Net premiums written

$

3,199,573

$

2,263,703

Decrease (increase) in unearned

premiums

(755,663

)

(583,153

)

Net premiums earned

2,443,910

1,680,550

Net investment income

390,775

254,378

Net foreign exchange gains (losses)

(35,683

)

(14,503

)

Equity in earnings (losses) of other

ventures

14,127

9,530

Other income (loss)

(50

)

(4,306

)

Net realized and unrealized gains (losses)

on investments

(213,654

)

279,451

Total revenues

2,599,425

2,205,100

Expenses

Net claims and claim expenses incurred

1,166,123

801,200

Acquisition expenses

630,921

432,257

Operational expenses

106,184

77,474

Corporate expenses

39,252

12,843

Interest expense

23,104

12,134

Total expenses

1,965,584

1,335,908

Income (loss) before taxes

633,841

869,192

Income tax benefit (expense)

(15,372

)

(28,902

)

Net income (loss)

618,469

840,290

Net (income) loss attributable to

redeemable noncontrolling interests

(244,827

)

(267,384

)

Net income (loss) attributable to

RenaissanceRe

373,642

572,906

Dividends on preference shares

(8,844

)

(8,844

)

Net income (loss) available

(attributable) to RenaissanceRe common shareholders

$

364,798

$

564,062

Net income (loss) available (attributable)

to RenaissanceRe common shareholders per common share – basic

$

6.96

$

12.95

Net income (loss) available (attributable)

to RenaissanceRe common shareholders per common share – diluted

$

6.94

$

12.91

Operating (loss) income (attributable)

available to RenaissanceRe common shareholders per common share -

diluted (1)

$

12.18

$

8.25

Average shares outstanding - basic

51,678

42,876

Average shares outstanding - diluted

51,828

43,006

Net claims and claim expense ratio

47.7

%

47.7

%

Underwriting expense ratio

30.2

%

30.3

%

Combined ratio

77.9

%

78.0

%

Return on average common equity -

annualized

16.4

%

46.6

%

Operating return on average common equity

- annualized (1)

28.7

%

30.0

%

(1)

See Comments on Non-GAAP Financial

Measures for a reconciliation of non-GAAP financial measures.

RenaissanceRe Holdings

Ltd.

Summary Consolidated Balance

Sheets

(in thousands of United States

Dollars, except per share amounts)

March 31, 2024

December 31,

2023

Assets

Fixed maturity investments trading, at

fair value

$

21,309,460

$

20,877,108

Short term investments, at fair value

4,639,165

4,604,079

Equity investments, at fair value

119,992

106,766

Other investments, at fair value

3,468,281

3,515,566

Investments in other ventures, under

equity method

99,684

112,624

Total investments

29,636,582

29,216,143

Cash and cash equivalents

1,606,739

1,877,518

Premiums receivable

8,431,335

7,280,682

Prepaid reinsurance premiums

1,282,860

924,777

Reinsurance recoverable

4,993,680

5,344,286

Accrued investment income

196,893

205,713

Deferred acquisition costs and value of

business acquired

1,822,163

1,751,437

Deferred tax asset

669,635

685,040

Receivable for investments sold

1,168,305

622,197

Other assets

377,268

323,960

Goodwill and other intangible assets

758,874

775,352

Total assets

$

50,944,334

$

49,007,105

Liabilities, Noncontrolling Interests

and Shareholders’ Equity

Liabilities

Reserve for claims and claim expenses

$

20,369,610

$

20,486,869

Unearned premiums

7,247,615

6,136,135

Debt

1,884,411

1,958,655

Reinsurance balances payable

3,353,834

3,186,174

Payable for investments purchased

1,427,932

661,611

Other liabilities

570,164

1,021,872

Total liabilities

34,853,566

33,451,316

Redeemable noncontrolling interests

6,297,983

6,100,831

Shareholders’ Equity

Preference shares

750,000

750,000

Common shares

52,908

52,694

Additional paid-in capital

2,137,343

2,144,459

Accumulated other comprehensive income

(loss)

(13,778

)

(14,211

)

Retained earnings

6,866,312

6,522,016

Total shareholders’ equity attributable

to RenaissanceRe

9,792,785

9,454,958

Total liabilities, noncontrolling

interests and shareholders’ equity

$

50,944,334

$

49,007,105

Book value per common share

$

170.92

$

165.20

RenaissanceRe Holdings

Ltd.

Supplemental Financial Data -

Segment Information

(in thousands of United States

Dollars, except percentages)

(Unaudited)

Three months ended March 31,

2024

Property

Casualty and Specialty

Other

Total

Gross premiums written

$

1,889,881

$

2,100,803

$

—

$

3,990,684

Net premiums written

$

1,397,618

$

1,801,955

$

—

$

3,199,573

Net premiums earned

$

936,083

$

1,507,827

$

—

$

2,443,910

Net claims and claim expenses incurred

154,249

1,011,874

—

1,166,123

Acquisition expenses

185,782

445,139

—

630,921

Operational expenses

61,624

44,560

—

106,184

Underwriting income (loss)

$

534,428

$

6,254

$

—

540,682

Net investment income

390,775

390,775

Net foreign exchange gains (losses)

(35,683

)

(35,683

)

Equity in earnings of other ventures

14,127

14,127

Other income (loss)

(50

)

(50

)

Net realized and unrealized gains (losses)

on investments

(213,654

)

(213,654

)

Corporate expenses

(39,252

)

(39,252

)

Interest expense

(23,104

)

(23,104

)

Income (loss) before taxes and redeemable

noncontrolling interests

633,841

Income tax benefit (expense)

(15,372

)

(15,372

)

Net (income) loss attributable to

redeemable noncontrolling interests

(244,827

)

(244,827

)

Dividends on preference shares

(8,844

)

(8,844

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders

$

364,798

Net claims and claim expenses incurred –

current accident year

$

248,916

$

1,014,288

$

—

$

1,263,204

Net claims and claim expenses incurred –

prior accident years

(94,667

)

(2,414

)

—

(97,081

)

Net claims and claim expenses incurred –

total

$

154,249

$

1,011,874

$

—

$

1,166,123

Net claims and claim expense ratio –

current accident year

26.6

%

67.3

%

51.7

%

Net claims and claim expense ratio – prior

accident years

(10.1

)%

(0.2

)%

(4.0

)%

Net claims and claim expense ratio –

calendar year

16.5

%

67.1

%

47.7

%

Underwriting expense ratio

26.4

%

32.5

%

30.2

%

Combined ratio

42.9

%

99.6

%

77.9

%

Three months ended March 31,

2023

Property

Casualty and Specialty

Other

Total

Gross premiums written

$

1,304,199

$

1,486,062

$

—

$

2,790,261

Net premiums written

$

1,019,829

$

1,243,874

$

—

$

2,263,703

Net premiums earned

$

687,420

$

993,130

$

—

$

1,680,550

Net claims and claim expenses incurred

187,609

613,591

—

801,200

Acquisition expenses

145,319

286,938

—

432,257

Operational expenses

55,813

21,661

—

77,474

Underwriting income (loss)

$

298,679

$

70,940

$

—

369,619

Net investment income

254,378

254,378

Net foreign exchange gains (losses)

(14,503

)

(14,503

)

Equity in earnings of other ventures

9,530

9,530

Other income (loss)

(4,306

)

(4,306

)

Net realized and unrealized gains (losses)

on investments

279,451

279,451

Corporate expenses

(12,843

)

(12,843

)

Interest expense

(12,134

)

(12,134

)

Income (loss) before taxes and redeemable

noncontrolling interests

869,192

Income tax benefit (expense)

(28,902

)

(28,902

)

Net (income) loss attributable to

redeemable noncontrolling interests

(267,384

)

(267,384

)

Dividends on preference shares

(8,844

)

(8,844

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders

$

564,062

Net claims and claim expenses incurred –

current accident year

$

269,302

$

636,650

$

—

$

905,952

Net claims and claim expenses incurred –

prior accident years

(81,693

)

(23,059

)

—

(104,752

)

Net claims and claim expenses incurred –

total

$

187,609

$

613,591

$

—

$

801,200

Net claims and claim expense ratio –

current accident year

39.2

%

64.1

%

53.9

%

Net claims and claim expense ratio – prior

accident years

(11.9

)%

(2.3

)%

(6.2

)%

Net claims and claim expense ratio –

calendar year

27.3

%

61.8

%

47.7

%

Underwriting expense ratio

29.3

%

31.1

%

30.3

%

Combined ratio

56.6

%

92.9

%

78.0

%

RenaissanceRe Holdings

Ltd.

Supplemental Financial Data -

Gross Premiums Written

(in thousands of United States

Dollars)

(Unaudited)

Three months ended

March 31, 2024

March 31, 2023

Property

Segment

Catastrophe

$

1,341,137

$

928,595

Other property

548,744

375,604

Property segment gross premiums

written

$

1,889,881

$

1,304,199

Casualty and

Specialty Segment

General casualty (1)

$

588,566

$

467,892

Professional liability (2)

370,481

382,253

Credit (3)

345,132

231,676

Other specialty (4)

796,624

404,241

Casualty and Specialty segment gross

premiums written

$

2,100,803

$

1,486,062

(1)

Includes automobile liability, casualty

clash, employer’s liability, umbrella or excess casualty, workers’

compensation and general liability.

(2)

Includes directors and officers, medical

malpractice, professional indemnity and transactional

liability.

(3)

Includes financial guaranty, mortgage

guaranty, political risk, surety and trade credit.

(4)

Includes accident and health, agriculture,

aviation, construction, cyber, energy, marine, satellite and

terrorism. Lines of business such as regional multi-line and whole

account may have characteristics of various other classes of

business, and are allocated accordingly.

RenaissanceRe Holdings

Ltd.

Supplemental Financial Data -

Total Investment Result

(in thousands of United States

Dollars, except percentages)

(Unaudited)

Three months ended

March 31, 2024

March 31, 2023

Fixed maturity investments trading

$

257,289

$

155,500

Short term investments

46,791

32,950

Equity investments

560

3,399

Other investments

Catastrophe bonds

58,249

38,831

Other

17,925

24,571

Cash and cash equivalents

14,722

4,264

395,536

259,515

Investment expenses

(4,761

)

(5,137

)

Net investment income

$

390,775

$

254,378

Net investment income return -

annualized

5.7

%

4.9

%

Net realized gains (losses) on fixed

maturity investments trading

$

9,796

$

(104,765

)

Net unrealized gains (losses) on fixed

maturity investments trading

(211,996

)

312,026

Net realized and unrealized gains (losses)

on fixed maturity investments trading

(202,200

)

207,261

Net realized and unrealized gains (losses)

on investment-related derivatives

(57,806

)

12,162

Net realized gains (losses) on equity

investments

—

(8,738

)

Net unrealized gains (losses) on equity

investments

13,097

39,151

Net realized and unrealized gains (losses)

on equity investments

13,097

30,413

Net realized and unrealized gains (losses)

on other investments - catastrophe bonds

18,907

24,126

Net realized and unrealized gains (losses)

on other investments - other

14,348

5,489

Net realized and unrealized gains

(losses) on investments

(213,654

)

279,451

Total investment result

$

177,121

$

533,829

Total investment return -

annualized

2.8

%

10.0

%

Comments on Non-GAAP Financial

Measures

In addition to the GAAP financial measures set forth in this

Press Release, the Company has included certain non-GAAP financial

measures within the meaning of Regulation G. The Company has

provided certain of these financial measures in previous investor

communications and the Company’s management believes that such

measures are important to investors and other interested persons,

and that investors and such other persons benefit from having a

consistent basis for comparison between quarters and for comparison

with other companies within or outside the industry. These measures

may not, however, be comparable to similarly titled measures used

by companies within or outside of the insurance industry. Investors

are cautioned not to place undue reliance on these non-GAAP

measures in assessing the Company’s overall financial

performance.

Operating Income (Loss) Available (Attributable) to

RenaissanceRe Common Shareholders and Operating Return on Average

Common Equity - Annualized

The Company uses “operating income (loss) available

(attributable) to RenaissanceRe common shareholders” as a measure

to evaluate the underlying fundamentals of its operations and

believes it to be a useful measure of its corporate performance.

“Operating income (loss) available (attributable) to RenaissanceRe

common shareholders” as used herein differs from “net income (loss)

available (attributable) to RenaissanceRe common shareholders,”

which the Company believes is the most directly comparable GAAP

measure, by the exclusion of (1) net realized and unrealized gains

and losses on investments, excluding other investments -

catastrophe bonds, (2) net foreign exchange gains and losses, (3)

corporate expenses associated with acquisitions and dispositions,

(4) acquisition related purchase accounting adjustments, (5) the

Bermuda net deferred tax asset, (6) the income tax expense or

benefit associated with these adjustments, and (7) the portion of

these adjustments attributable to the Company’s redeemable

noncontrolling interests. The Company also uses “operating income

(loss) available (attributable) to RenaissanceRe common

shareholders” to calculate “operating income (loss) available

(attributable) to RenaissanceRe common shareholders per common

share - diluted” and “operating return on average common equity -

annualized.”

The Company’s management believes that “operating income (loss)

available (attributable) to RenaissanceRe common shareholders,”

“operating income (loss) available (attributable) to RenaissanceRe

common shareholders per common share - diluted” and “operating

return on average common equity - annualized” are useful to

management and investors because they provide for better

comparability and more accurately measure the Company’s results of

operations and remove variability.

The following table is a reconciliation of: (1) net income

(loss) available (attributable) to RenaissanceRe common

shareholders to “operating income (loss) available (attributable)

to RenaissanceRe common shareholders”; (2) net income (loss)

available (attributable) to RenaissanceRe common shareholders per

common share - diluted to “operating income (loss) available

(attributable) to RenaissanceRe common shareholders per common

share - diluted”; and (3) return on average common equity -

annualized to “operating return on average common equity -

annualized.” Comparative information for the prior periods

presented have been updated to conform to the current methodology

and presentation.

Three months ended

(in thousands of United States Dollars,

except per share amounts and percentages)

March 31, 2024

March 31, 2023

Net income (loss) available (attributable)

to RenaissanceRe common shareholders

$

364,798

$

564,062

Adjustment for:

Net realized and unrealized losses (gains)

on investments, excluding other investments - catastrophe bonds

232,561

(255,325

)

Net foreign exchange losses (gains)

35,683

14,503

Corporate expenses associated with

acquisitions and dispositions

20,266

—

Acquisition related purchase accounting

adjustments (1)

60,560

4,019

Bermuda net deferred tax asset (2)

(7,890

)

—

Income tax expense (benefit) (3)

(12,772

)

11,322

Net income (loss) attributable to

redeemable noncontrolling interests (4)

(56,827

)

25,446

Operating income (loss) available

(attributable) to RenaissanceRe common shareholders

$

636,379

$

364,027

Net income (loss) available (attributable)

to RenaissanceRe common shareholders per common share - diluted

$

6.94

$

12.91

Adjustment for:

Net realized and unrealized losses (gains)

on investments, excluding other investments - catastrophe bonds

4.49

(5.94

)

Net foreign exchange losses (gains)

0.69

0.34

Corporate expenses associated with

acquisitions and dispositions

0.39

—

Acquisition related purchase accounting

adjustments (1)

1.17

0.09

Bermuda net deferred tax asset (2)

(0.15

)

—

Income tax expense (benefit) (3)

(0.25

)

0.26

Net income (loss) attributable to

redeemable noncontrolling interests (4)

(1.10

)

0.59

Operating income (loss) available

(attributable) to RenaissanceRe common shareholders per common

share - diluted

$

12.18

$

8.25

Return on average common equity -

annualized

16.4

%

46.6

%

Adjustment for:

Net realized and unrealized losses (gains)

on investments, excluding other investments - catastrophe bonds

10.7

%

(21.1

)%

Net foreign exchange losses (gains)

1.6

%

1.2

%

Corporate expenses associated with

acquisitions and dispositions

0.9

%

—

%

Acquisition related purchase accounting

adjustments (1)

2.7

%

0.3

%

Bermuda net deferred tax asset (2)

(0.4

)%

—

%

Income tax expense (benefit) (3)

(0.6

)%

0.9

%

Net income (loss) attributable to

redeemable noncontrolling interests (4)

(2.6

)%

2.1

%

Operating return on average common equity

- annualized

28.7

%

30.0

%

(1)

Represents the purchase accounting

adjustments related to the amortization of acquisition related

intangible assets, amortization (accretion) of VOBA and acquisition

costs, and the fair value adjustments to the net reserves for

claims and claim expenses for the three months ended March 31, 2024

for the acquisitions of Validus $56.9 million (2023 - $Nil); and

TMR and Platinum $3.7 million (2023 - $4.0 million).

(2)

Represents a net deferred tax benefit

recorded during the period in connection with the enactment of the

15% Bermuda corporate income tax on December 27, 2023.

(3)

Represents the income tax (expense)

benefit associated with the adjustments to net income (loss)

available (attributable) to RenaissanceRe common shareholders. The

income tax impact is estimated by applying the statutory rates of

applicable jurisdictions, after consideration of other relevant

factors.

(4)

Represents the portion of the adjustments

above that are attributable to the Company’s redeemable

noncontrolling interests, including the income tax impact of those

adjustments.

Tangible Book Value Per Common Share and Tangible Book Value

Per Common Share Plus Accumulated Dividends

The Company has included in this Press Release “tangible book

value per common share” and “tangible book value per common share

plus accumulated dividends.” “Tangible book value per common share”

is defined as book value per common share excluding per share

amounts for (1) acquisition related goodwill and other intangible

assets, (2) acquisition related purchase accounting adjustments,

and (3) other goodwill and intangible assets. “Tangible book value

per common share plus accumulated dividends” is defined as book

value per common share excluding per share amounts for (1)

acquisition related goodwill and other intangible assets, (2)

acquisition related purchase accounting adjustments, and (3) other

goodwill and intangible assets, plus accumulated dividends.

The Company’s management believes “tangible book value per

common share” and “tangible book value per common share plus

accumulated dividends” are useful to investors because they provide

a more accurate measure of the realizable value of shareholder

returns, excluding the impact of goodwill and intangible assets and

acquisition related purchase accounting adjustments. The following

table is a reconciliation of book value per common share to

“tangible book value per common share” and “tangible book value per

common share plus accumulated dividends.” Comparative information

for the prior periods presented have been updated to conform to the

current methodology and presentation.

March 31, 2024

March 31, 2023

Book value per common share

$

170.92

$

116.44

Adjustment for:

Acquisition related goodwill and other

intangible assets (1)

(14.35

)

(5.38

)

Other goodwill and intangible assets

(2)

(0.34

)

(0.40

)

Acquisition related purchase accounting

adjustments (3)

(7.22

)

(1.58

)

Tangible book value per common share

149.01

109.08

Adjustment for accumulated dividends

26.91

25.38

Tangible book value per common share plus

accumulated dividends

$

175.92

$

134.46

Quarterly change in book value per common

share

3.5

%

11.3

%

Quarterly change in book value per common

share plus change in accumulated dividends

3.7

%

11.6

%

Quarterly change in tangible book value

per common share plus change in accumulated dividends

5.3

%

12.7

%

(1)

Represents the acquired goodwill and other

intangible assets at March 31, 2024 for the acquisitions of Validus

$527.4 million (March 31, 2023 - $Nil), TMR $26.9 million (March

31, 2023 - $28.0 million) and Platinum $204.6 million (March 31,

2023 - $208.5 million).

(2)

At March 31, 2024, the adjustment for

other goodwill and intangible assets included $18.0 million (March

31, 2023 - $17.5 million) of goodwill and other intangibles

included in investments in other ventures, under equity method.

Previously reported “adjustment for goodwill and other intangibles”

has been bifurcated into “acquisition related goodwill and other

intangible assets” and “other goodwill and intangible assets.”

(3)

Represents the purchase accounting

adjustments related to the unamortized VOBA and acquisition costs,

and the fair value adjustments to reserves at March 31, 2024 for

the acquisitions of Validus $323.3 million (March 31, 2023 - $Nil),

TMR $59.6 million (March 31, 2023 - $70.6 million) and Platinum

$(0.8) million (March 31, 2023 - $(0.8) million).

Adjusted Combined Ratio

The Company has included in this Press Release “adjusted

combined ratio” for the company, its segments and certain classes

of business. “Adjusted combined ratio” is defined as the combined

ratio adjusted for the impact of acquisition related purchase

accounting, which includes the amortization of acquisition related

intangible assets, purchase accounting adjustments related to the

amortization (accretion) of VOBA and acquisition costs, and the

fair value adjustments to the net reserve for claims and claim

expenses for the acquisitions of Validus, TMR and Platinum. The

combined ratio is calculated as the sum of (1) net claims and claim

expenses incurred, (2) acquisition expenses, and (3) operational

expenses; divided by net premiums earned. The acquisition related

purchase accounting adjustments impact net claims and claim

expenses incurred and acquisition expenses. The Company’s

management believes “adjusted combined ratio” is useful to

management and investors because it provides for better

comparability and more accurately measures the Company’s underlying

underwriting performance. The following table is a reconciliation

of combined ratio to “adjusted combined ratio.”

Three months ended March 31,

2024

Catastrophe

Other Property

Property

Casualty and Specialty

Total

Combined ratio

19.8

%

75.3

%

42.9

%

99.6

%

77.9

%

Adjustment for acquisition related

purchase accounting adjustments (1)

(3.6

)%

(0.7

)%

(2.4

)%

(2.5

)%

(2.5

)%

Adjusted combined ratio

16.2

%

74.6

%

40.5

%

97.1

%

75.4

%

Three months ended March 31,

2023

Catastrophe

Other Property

Property

Casualty and Specialty

Total

Combined ratio

21.3

%

93.7

%

56.6

%

92.9

%

78.0

%

Adjustment for acquisition related

purchase accounting adjustments (1)

(0.3

)%

(0.1

)%

(0.3

)%

(0.3

)%

(0.2

)%

Adjusted combined ratio

21.0

%

93.6

%

56.3

%

92.6

%

77.8

%

(1)

Adjustment for acquisition related

purchase accounting includes the amortization of the acquisition

related intangible assets and purchase accounting adjustments

related to the net amortization (accretion) of VOBA and acquisition

costs, and the fair value adjustments to the net reserve for claims

and claim expenses for the acquisitions of Validus, TMR and

Platinum.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430977849/en/

INVESTOR CONTACT: RenaissanceRe Holdings Ltd. Keith McCue

Senior Vice President, Finance & Investor Relations (441)

239-4830

MEDIA CONTACT: RenaissanceRe Holdings Ltd. Hayden Kenny

Senior Vice President, Investor Relations & Communications

(441) 239-4946 or Kekst CNC Nicholas Capuano (917) 842-7859

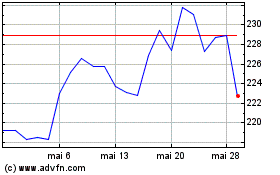

RenaissanceRe (NYSE:RNR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

RenaissanceRe (NYSE:RNR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024