Scorpio Tankers Inc. Announces Update on the Repurchase of Its Securities and a New $250 Million Securities Repurchase Progra...

08 Septembre 2020 - 12:28PM

Scorpio Tankers Inc. (NYSE:STNG) (“Scorpio Tankers,” or the

“Company”) announced an update on the repurchase of the Company’s

securities and a new $250 Million Securities Repurchase Program.

Repurchase of Securities

Between July 1, 2020 and today, the Company

repurchased $52.3 million face value of its Convertible Notes due

2022 at an average price of $894.12 per $1,000 principal amount, or

$46.7 million. The current outstanding face value of the

Convertible Notes due 2022 is $151.2 million.

So far in September 2020, the Company has

acquired an aggregate of 1,170,000 of its common shares at an

average price of $11.18 per share for a total of $13.1 million; the

repurchased shares are being held as treasury shares.

New $250 Million Securities Repurchase

Program

In September 2020, the Company's Board of

Directors authorized a new Securities Repurchase Program to

purchase up to an aggregate of $250 million of the Company's

securities which, in addition to its common shares, currently

consist of its Convertible Notes due 2022 and Senior Unsecured

Notes due 2025 (NYSE: SBBA). As of today, there is $250

Million available under the new $250 Million Securities Repurchase

Program, and all future purchases of the Company’s securities will

be made under this program.

About Scorpio Tankers Inc.

Scorpio Tankers is a provider of marine

transportation of petroleum products worldwide. The Company’s fleet

consists of 134 owned, finance leased, or bareboat chartered-in

product tankers (42 LR2 tankers, 12 LR1 tankers, 62 MR tankers and

18 Handymax tankers) with an average age of 4.8 years. The Company

also has a leasehold interest in an MR product tanker that is

currently under construction. Additional information about the

Company is available at the Company’s

website www.scorpiotankers.com, which is not a part of this

press release.

Forward-Looking Statements

Matters discussed in this press release may

constitute forward‐looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward‐looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The Company desires to take

advantage of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and is including this cautionary

statement in connection with this safe harbor legislation. The

words "believe," "expect," "anticipate," "estimate," "intend,"

"plan," "target," "project," "likely," "may," "will," "would,"

"could" and similar expressions identify forward‐looking

statements.

The forward‐looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, management’s examination of historical operating

trends, data contained in the Company’s records and other data

available from third parties. Although management believes that

these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond the Company’s control, there can be no assurance that the

Company will achieve or accomplish these expectations, beliefs or

projections. The Company undertakes no obligation, and specifically

declines any obligation, except as required by law, to publicly

update or revise any forward‐looking statements, whether as a

result of new information, future events or otherwise.

In addition to these important factors, other

important factors that, in the Company’s view, could cause actual

results to differ materially from those discussed in the

forward‐looking statements include unforeseen liabilities, future

capital expenditures, revenues, expenses, earnings, synergies,

economic performance, indebtedness, financial condition, losses,

future prospects, business and management strategies for the

management, length and severity of the ongoing novel coronavirus

(COVID-19) outbreak, including its effect on demand for petroleum

products and the transportation thereof, expansion and growth of

the Company’s operations, risks relating to the integration of

assets or operations of entities that it has or may in the future

acquire and the possibility that the anticipated synergies and

other benefits of such acquisitions may not be realized within

expected timeframes or at all, the failure of counterparties to

fully perform their contracts with the Company, the strength of

world economies and currencies, general market conditions,

including fluctuations in charter rates and vessel values, changes

in demand for tanker vessel capacity, changes in the Company’s

operating expenses, including bunker prices, drydocking and

insurance costs, the market for the Company’s vessels, availability

of financing and refinancing, charter counterparty performance,

ability to obtain financing and comply with covenants in such

financing arrangements, changes in governmental rules and

regulations or actions taken by regulatory authorities, potential

liability from pending or future litigation, general domestic and

international political conditions, potential disruption of

shipping routes due to accidents or political events, vessels

breakdowns and instances of off‐hires, and other factors. Please

see the Company's filings with the SEC for a more complete

discussion of certain of these and other risks and

uncertainties.

Contact Information

Scorpio Tankers Inc. (212) 542-1616

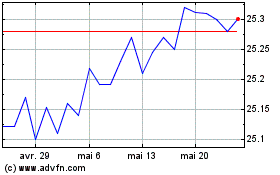

Scorpio Tankers (NYSE:SBBA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Scorpio Tankers (NYSE:SBBA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024