Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

18 Novembre 2024 - 11:05PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-272237

Sempra

Final Term Sheet

November 18, 2024

6.625% Fixed-to-Fixed Reset Rate Junior Subordinated Notes due

2055 (Non-Call 5 2055 Notes)

6.550%

Fixed-to-Fixed Reset Rate Junior Subordinated Notes due 2055 (Non-Call 10 2055 Notes)

This issuer free writing prospectus relates only to the securities described below and should be read together with Sempra’s preliminary

prospectus supplement dated November 18, 2024 (the “Preliminary Prospectus Supplement”), the accompanying prospectus dated May 26, 2023 and the documents incorporated and deemed to be incorporated by reference therein.

|

|

|

| Issuer: |

|

Sempra (the “Company”) |

|

|

| Anticipated Ratings:1 |

|

Baa3 (stable) by Moody’s Investors Service, Inc.

BBB- (stable) by S&P Global Ratings

BBB- (stable) by Fitch Ratings, Inc. |

|

|

| Trade Date: |

|

November 18, 2024 |

|

|

| Settlement Date: |

|

November 21, 2024 (T+3) |

|

|

| Non-Call 5 2055 Notes |

|

|

|

|

| Securities Offered: |

|

6.625% Fixed-to-Fixed Reset Rate Junior Subordinated Notes due 2055 (the “Non-Call 5 2055

notes”) |

|

|

| Aggregate Principal Amount Offered: |

|

$400,000,000 |

|

|

| Maturity: |

|

April 1, 2055 |

|

|

| Price to Public: |

|

100.000% of the principal amount, plus accrued interest, if any. |

|

|

| CUSIP: |

|

816851 BU2 |

|

|

| ISIN: |

|

US816851BU28 |

|

|

| Non-Call 10 2055 Notes |

|

|

|

|

| Securities Offered: |

|

6.550% Fixed-to-Fixed Reset Rate Junior Subordinated Notes due 2055 (the “Non-Call 10 2055 notes” and,

collectively with the Non-Call 5 2055 notes, the “notes”) |

|

|

| Aggregate Principal Amount Offered: |

|

$600,000,000 |

| 1 |

Note: A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or

withdrawal at any time. |

|

|

|

| Maturity: |

|

April 1, 2055 |

|

|

| Price to Public: |

|

100.000% of the principal amount, plus accrued interest, if any. |

|

|

| CUSIP: |

|

816851 BV0 |

|

|

| ISIN: |

|

US816851BV01 |

|

|

| All Notes Offered Hereby |

|

|

|

|

| Interest Rate: |

|

The Non-Call 5 2055 notes will bear interest (i) from and including November 21, 2024 to,

but excluding, April 1, 2030 (the “Non-Call 5 2055 notes First Reset Date”) at the rate of 6.625% per annum and (ii) from and including the

Non-Call 5 2055 notes First Reset Date, during each Reset Period (as defined in the Preliminary Prospectus Supplement) at a rate per annum equal to the Five-year U.S. Treasury Rate (as defined in the

Preliminary Prospectus Supplement) as of the most recent Reset Interest Determination Date (as defined in the Preliminary Prospectus Supplement) plus a spread of 2.354%, to be reset on each Reset Date (as defined in the Preliminary Prospectus

Supplement). The Non-Call 10 2055 notes will

bear interest (i) from and including November 21, 2024 to, but excluding, April 1, 2035 (the “Non-Call 10 2055 notes First Reset Date” and, together with the Non-Call 5 2055 notes First Reset Date, each a “First Reset Date”) at the rate of 6.550% per annum and (ii) from and including the Non-Call 10 2055 notes First

Reset Date, during each Reset Period at a rate per annum equal to the Five-year U.S. Treasury Rate as of the most recent Reset Interest Determination Date plus a spread of 2.138%, to be reset on each Reset Date.

For additional information and the definitions of the terms Reset Period, Five-year U.S.

Treasury Rate, Reset Interest Determination Date and Reset Date, see “Description of the Notes—Interest Rate and Maturity” in the Preliminary Prospectus Supplement. |

|

|

| Interest Payment Dates: |

|

April 1 and October 1 of each year, beginning on April 1, 2025 (each, an “interest payment date”) (subject to the Company’s right to defer interest payments as described under

“Optional Interest Deferral” below). |

|

|

|

| Optional Interest Deferral: |

|

So long as no event of default (as defined in the Preliminary Prospectus Supplement) with respect to the notes of any series has occurred and is continuing, the Company may, at its option, defer interest payments on either or both

series of notes, from time to time, for one or more Optional Deferral Periods (as defined in the Preliminary Prospectus Supplement) of up to 20 consecutive semi-annual Interest Payment Periods (as defined in the Preliminary Prospectus Supplement)

each, except that no such Optional Deferral Period may extend beyond the final maturity date of the applicable series of notes or end on a day other than the day immediately preceding an interest payment date. No interest will be due or payable on

the applicable series of notes during an Optional Deferral Period, except upon a redemption of any such notes on any redemption date during such Optional Deferral Period (in which case all accrued and unpaid interest (including, to the extent

permitted by applicable law, any compound interest) on the notes to be redeemed to, but excluding, such redemption date will be due and payable on such redemption date), or unless the principal of and interest on such notes shall have been declared

due and payable as the result of an event of default with respect to such notes (in which case all accrued and unpaid interest, including, to the extent permitted by applicable law, any compound interest, on such notes shall become due and payable).

The Company may elect, at its option, to extend such Optional Deferral Period, so long as the entire Optional Deferral Period does not exceed 20 consecutive Interest Payment Periods or extend beyond the final maturity date of the applicable series

of notes. The Company may also elect, at its option, to shorten the length of any Optional Deferral Period. The Company cannot begin a new Optional Deferral Period until the Company has paid all accrued and unpaid interest on the applicable series

of notes from any previous Optional Deferral Period. During any Optional Deferral Period, interest on the applicable series of notes will continue to accrue at the then-applicable interest rate on such notes (as reset from time to time on any Reset

Date occurring during such Optional Deferral Period in accordance with the terms of such notes). In addition, during any Optional Deferral Period, interest on the deferred interest will accrue at the then-applicable interest rate on the applicable

series of notes (as reset from time to time on any Reset Date occurring during such Optional Deferral Period in accordance with the terms of such notes), compounded semi-annually, to the extent permitted by applicable

law. |

|

|

|

|

|

For additional information and the definitions of the terms event of default, Optional Deferral Period and Interest Payment Period, see “Description of the Notes—Events of Default” and “Description of the

Notes—Option to Defer Interest Payments” in the Preliminary Prospectus Supplement. |

|

|

| Optional Redemption Provisions: |

|

The Company may redeem some or all of the notes of each series, as applicable, at its option, in whole or in part (i) on any day in the

period commencing on the date falling 90 days prior to the First Reset Date for the applicable series of notes and ending on and including such First Reset Date and (ii) after such First Reset Date, on any interest payment date, at a redemption

price in cash equal to 100% of the principal amount of the applicable series of notes being redeemed, plus, subject to the terms described in the first paragraph under “Description of the Notes—Redemption—Redemption Procedures;

Cancellation of Redemption” in the Preliminary Prospectus Supplement, accrued and unpaid interest on the applicable series of notes to be redeemed to, but excluding, the redemption date.

The Company may at its option redeem the notes of each series, as applicable, in whole

but not in part, at any time following the occurrence and during the continuance of a Tax Event (as defined in the Preliminary Prospectus Supplement) at a redemption price in cash equal to 100% of the principal amount of the applicable series of

notes, plus, subject to the terms described in the first paragraph under “Description of the Notes—Redemption—Redemption Procedures; Cancellation of Redemption” in the Preliminary Prospectus Supplement, accrued and unpaid

interest on the applicable series of notes to, but excluding, the redemption date.

The Company may at its option redeem the notes of each series, as applicable, in whole but not in part, at any time following the occurrence and during the

continuance of a Rating Agency Event (as defined in the Preliminary Prospectus Supplement) at a redemption price in cash equal to 102% of the principal amount of the applicable series of notes, plus, subject to the terms described in the first

paragraph under “Description of the Notes—Redemption—Redemption Procedures; Cancellation of Redemption” in the Preliminary Prospectus Supplement, accrued and unpaid interest on the applicable series of notes to, but excluding,

the redemption date. |

|

|

|

|

|

For additional information and the definitions of the terms Tax Event and Rating Agency Event, see “Description of the Notes—Redemption” in the Preliminary Prospectus Supplement. |

|

|

| Total Proceeds to the Company: |

|

Approximately $990.0 million, after deducting the underwriting discount but before deducting the estimated offering expenses payable by the Company. |

|

|

| Joint Book-Running Managers: |

|

BofA Securities, Inc. Goldman Sachs &

Co. LLC J.P. Morgan Securities LLC Mizuho Securities USA

LLC Morgan Stanley & Co. LLC PNC Capital Markets

LLC |

|

|

| Senior Co-Manager: |

|

U.S. Bancorp Investments, Inc. |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling

BofA Securities, Inc. toll-free at (800) 294-1322, by calling Goldman Sachs & Co. LLC toll-free at (866) 520-4056, by calling J.P. Morgan Securities LLC collect

at (212) 834-4533, by calling Mizuho Securities USA LLC toll-free at (866) 271-7403, by calling Morgan Stanley & Co. LLC toll-free at (866) 718-1649 or by calling PNC Capital Markets LLC toll-free at (855) 881-0697.

Any legends, disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such legends,

disclaimers or other notices have been automatically generated as a result of this communication having been sent via Bloomberg or another system.

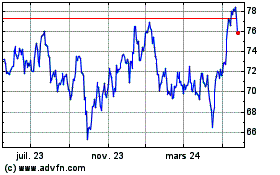

Sempra (NYSE:SRE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

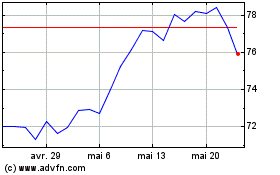

Sempra (NYSE:SRE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024