- Net income from continuing operations available to common

shareholders in second quarter 2023 was $123 million, or $1.15 per

diluted share

- Adjusted diluted earnings per share from continuing

operations1 was $1.44 in second quarter 2023

- Consolidated Adjusted EBITDA1 in second quarter 2023 was

$843 million, including $8 million of grant income

- Second quarter 2023 Ambulatory Care Adjusted EBITDA of $369

million increased 16.4% over second quarter 2022 excluding grant

income

- Same-facility system-wide ambulatory surgical cases

increased 6.6% versus second quarter 2022; Same-hospital admissions

increased 3.0% versus second quarter 2022, with non-Covid

admissions up 5%

- FY 2023 Adjusted EBITDA Outlook increased, now expected to

be in the range of $3.310 billion to $3.460 billion

Tenet Healthcare Corporation (Tenet) (NYSE: THC) today announced

its results for the quarter ended June 30, 2023.

"We have continued positive momentum through the second quarter

with robust same facility volume and revenue growth in our

ambulatory care segment as well as continued strength in our

hospital segment," said Saum Sutaria, M.D., Chief Executive of

Tenet. "Our strategic growth initiatives and operating discipline

helped drive these results as we expand our patient-centered care

capabilities in the communities we serve."

Tenet’s results for second quarter 2023 versus second quarter

2022 are as follows:

Three Months Ended June

30,

Six Months Ended June

30,

($ in millions, except per share

results)

2023

2022

2023

2022

Net operating revenues

$5,082

$4,638

$10,103

$9,383

Net income available to Tenet common

shareholders from continuing operations

$123

$38

$266

$177

Net income available to Tenet common

shareholders from continuing operations per diluted share

$1.15

$0.35

$2.47

$1.63

Adjusted EBITDA1 excluding grant

income

$835

$749

$1,664

$1,631

Adjusted EBITDA1

$843

$843

$1,675

$1,731

Adjusted diluted earnings per share from

continuing operations1

$1.44

$1.48

$2.87

$3.33

- Net income from continuing operations available to the

Company’s common shareholders in the second quarter 2023 was $123

million, or $1.15 per diluted share, versus $38 million, or $0.35

per diluted share, in second quarter 2022.

- Second quarter 2023 included COVID-related stimulus grant

income of $8 million pre-tax ($6 million after-tax, or $0.06 per

diluted share) versus $94 million pre-tax ($71 million after-tax,

or $0.65 per diluted share) in second quarter 2022.

- The Company recognized additional income tax expense for the

three months ended June 30, 2023 of approximately $23 million, or

$0.22 per diluted share, and $45 million, or $0.41 per diluted

share for the three months ended June 30, 2022, as a result of

interest expense limitation tax regulations.

- Adjusted EBITDA1 excluding grant income in second quarter 2023

was $835 million compared to $749 million in second quarter 2022,

reflecting strong volume growth in our Ambulatory Care and Hospital

Operations segments, and improved contract labor costs. The Company

believes this strong volume growth is due in part to patient care

deferred as a result of the pandemic. Second quarter 2022 results

included the adverse impacts associated with a cybersecurity

incident.

Balance Sheet and Cash Flows

- Cash flows provided by operating activities for the six months

ended June 30, 2023 were $1.047 billion versus $347 million for the

six months ended June 30, 2022 (or $822 million excluding $475

million of repayments associated with Medicare advances).

- The Company produced free cash flow1 of $680 million for the

six months ended June 30, 2023 versus $40 million for the six

months ended June 30, 2022 (or $515 million excluding the repayment

of Medicare advances).

- In the three months ended June 30, 2023, the Company

repurchased 579,637 shares of common stock for $40 million. In the

six months ended June 30, 2023, the Company repurchased 1,485,983

shares of common stock for $90 million.

- In June 2023, the Company completed a private placement of

$1.350 billion in aggregate principal amount of newly issued 6.750%

senior secured first lien notes maturing in 2031. The Company used

the net proceeds from the sale of the notes, after payment of fees

and expenses, to finance, together with cash on hand, the

redemption of all $1.345 billion aggregate principal amount then

outstanding of its 4.625% senior secured notes due 2024. The

Company now has no significant debt maturities until 2026.

- The Company’s ratio of net debt to Adjusted EBITDA1 was 4.14x

at June 30, 2023 compared to 4.19x at March 31, 2023 and 4.10x at

December 31, 2022.

- The Company had no outstanding borrowings on its $1.5 billion

line of credit as of June 30, 2023.

Ambulatory Care (Ambulatory)

Segment

Tenet’s Ambulatory business segment is comprised of the

operations of United Surgical Partners International (USPI). As of

June 30, 2023, USPI had interests in 455 ambulatory surgery centers

(312 consolidated) and 24 surgical hospitals (eight consolidated)

in 35 states. For all periods prior to June 30, 2022, the Company

owned 95% of the voting stock of USPI and now owns 100%.

Three Months Ended June

30,

Six Months Ended June

30,

Ambulatory segment results ($ in

millions)

2023

2022

2023

2022

Revenues

Net operating revenues

$942

$771

$1,847

$1,509

Same-facility system-wide net patient

service revenues2

$1,721

$1,568

$3,358

$3,065

Volume Changes versus the Prior-Year

Period

Same-facility system-wide surgical

cases2

6.6%

(0.9)%

7.2%

3.3%

Same-facility system-wide surgical cases

on same-business day basis2

6.6%

(0.9)%

7.2%

2.4%

Adjusted EBITDA, Margins and

Noncontrolling Interest (NCI)

Adjusted EBITDA excluding grant income

$369

$317

$709

$597

Adjusted EBITDA

$370

$319

$710

$601

Adjusted EBITDA margin excluding grant

income

39.2%

41.1%

38.4%

39.6%

Adjusted EBITDA margin

39.3%

41.4%

38.4%

39.8%

Adjusted EBITDA less facility-level NCI

excluding grant income

$231

$209

$445

$395

Adjusted EBITDA less facility-level

NCI

$231

$210

$445

$397

Adjusted EBITDA less total NCI excluding

grant income

$231

$204

$445

$386

Adjusted EBITDA less total NCI

$231

$205

$445

$388

- Second quarter 2023 net operating revenues increased 22.2%

compared to second quarter 2022 driven by strong same-facility net

surgical case growth, acquisitions and opening of new facilities,

service line growth and improved pricing yield.

- Surgical business same-facility system-wide net patient service

revenues increased 9.8% in second quarter 2023 compared to second

quarter 2022, with cases up 6.6% and net revenue per case up

2.9%.

- Second quarter 2023 Adjusted EBITDA excluding grant income

increased 16.4% relative to second quarter 2022, due to strong

same-facility system-wide surgical case growth, contributions from

acquisitions and de novo facilities, improved pricing yield, and

effective expense management.

- Adjusted EBITDA margin excluding grant income in the second

quarter 2023 declined relative to second quarter 2022 primarily due

to higher other operating expenses partially offset by improved

salaries, wages and benefits.

Hospital Operations and Other

(Hospital) Segment

Tenet’s Hospital business segment is primarily comprised of

acute care and specialty hospitals, imaging centers, ancillary

outpatient facilities, micro-hospitals and physician practices.

Three Months Ended June

30,

Six Months Ended June

30,

Hospital segment results ($ in

millions)

2023

2022

2023

2022

Revenues

Net operating revenues (prior to

inter-segment eliminations)

$3,922

$3,645

$7,821

$7,443

Grant income

$7

$92

$10

$96

Same-hospital net patient service

revenues3

$3,590

$3,344

$7,137

$6,851

Same-Hospital Volume Changes versus the

Prior-Year Period

Admissions

3.0%

(8.1)%

3.6%

(6.4)%

Adjusted admissions4

3.2%

(5.3)%

4.9%

(3.5)%

Outpatient visits (including outpatient ER

visits)

(1.3)%

(10.0)%

(0.6)%

(4.7)%

Emergency Room visits (inpatient and

outpatient)

0.4%

3.8%

2.5%

8.5%

Hospital surgeries

(0.1)%

(8.0)%

1.1%

(4.3)%

Adjusted EBITDA

Adjusted EBITDA excluding grant income

$381

$339

$783

$849

Adjusted EBITDA

$388

$431

$793

$945

Adjusted EBITDA margin excluding grant

income

9.7%

9.3%

10.0%

11.4%

Adjusted EBITDA margin

9.9%

11.8%

10.1%

12.7%

- Second quarter 2023 net operating revenues increased 7.6% from

second quarter 2022 primarily due to increased adjusted admissions,

improved pricing yield, and the adverse impacts associated with a

cybersecurity incident in the second quarter of 2022.

- Same-hospital net patient service revenue per adjusted

admission increased 4.0% year-over-year for second quarter 2023

primarily due to improved pricing yield and our focus on growing

higher acuity services. COVID admissions were 2% of total

admissions in the second quarter 2023 versus 3% in the second

quarter 2022. Second quarter non-COVID inpatient admissions

increased 5% over second quarter 2022.

- Adjusted EBITDA excluding grant income in second quarter 2023

was $381 million compared to $339 million in second quarter 2022,

reflecting strong adjusted admissions growth and improved contract

labor costs, partially offset by higher other operating expenses.

Second quarter 2022 results included the adverse impacts associated

with a cybersecurity incident.

Conifer Segment

Tenet’s Conifer business segment provides comprehensive

end-to-end and focused-point business process services, including

hospital and physician revenue cycle management, patient

communications and engagement support and value-based care

solutions to hospitals, health systems, physician practices,

employers, and other clients.

Three Months Ended June

30,

Six Months Ended June

30,

Conifer segment results ($ in

millions)

2023

2022

2023

2022

Net operating revenues

$323

$333

$647

$657

Adjusted EBITDA

$85

$93

$172

$185

Adjusted EBITDA margin

26.3%

27.9%

26.6%

28.2%

- Second quarter 2023 net operating revenues declined 3.0%

compared to second quarter 2022 reflecting previously announced

contract changes with Tenet hospitals.

- Second quarter 2023 Adjusted EBITDA and Adjusted EBITDA margin

declined compared to second quarter 2022 reflecting the

aforementioned contract changes.

2023 Outlook1

Tenet’s Outlook for full year 2023 (consolidated and by segment)

and third quarter 2023 follows:

CONSOLIDATED ($ in millions, except

per share amounts)

FY 2023 Outlook

Third Quarter 2023

Outlook

Net operating revenues

$20,100 to $20,500

$4,900 to $5,100

Income from continuing operations

available to Tenet common stockholders

$447 to $582

$75 to $120

Adjusted EBITDA

$3,310 to $3,460

$775 to $825

Adjusted EBITDA margin

16.5% to 16.9%

15.8% to 16.2%

Diluted income per common share from

continuing operations

$4.19 to $5.48

$0.71 to $1.13

Adjusted net income from continuing

operations

$550 to $640

$100 to $135

Adjusted diluted earnings per share from

continuing operations

$5.18 to $6.03

$0.94 to $1.28

Equity in earnings of unconsolidated

affiliates

$200 to $220

$45 to $55

Depreciation and amortization

$850 to $875

$210 to $220

Interest expense

$895 to $905

$220 to $230

Income tax expense5

$315 to $335

$65 to $75

Net income available to NCI

$660 to $700

$160 to $170

Weighted average diluted common shares

~105 million

~105 million

NCI cash distributions

$565 to $605

Net cash provided by operating

activities

$1,775 to $2,075

Adjusted net cash provided by operating

activities

$1,925 to $2,175

Capital expenditures

$675 to $725

Free cash flow

$1,100 to $1,350

Adjusted free cash flow – continuing

operations

$1,250 to $1,450

Ambulatory Segment ($ in

millions)

FY 2023 Outlook

Net operating revenues

$3,725 to $3,825

Adjusted EBITDA

$1,490 to $1,530

Total NCI (Facility level)

$545 to $565

Adjusted EBITDA less total NCI

$945 to $965

Changes versus prior year6:

Surgical cases volumes

Up 5.0% to 6.0%

Net revenues per surgical case

Up 2.0% to 3.0%

Hospital Segment ($ in

millions)

FY 2023 Outlook

Net operating revenues (prior to

inter-segment eliminations)

$15,540 to $15,790

Adjusted EBITDA

$1,490 to $1,590

NCI

$25 to $40

Changes versus prior year6:

Inpatient admissions

Up 2.0% to 4.0%

Adjusted admissions

Up 2.5% to 4.5%

Conifer Segment ($ in millions)

FY 2023 Outlook

Net operating revenues

$1,285 to $1,335

Adjusted EBITDA

$330 to $340

NCI

$90 to $95

Management’s Webcast Discussion of

Results

Tenet management will discuss the Company’s second quarter 2023

results in a webcast scheduled for 5:00 p.m. Eastern Time (4:00

p.m. Central Time) on July 31, 2023. Investors can access the

webcast through the Company’s website at

www.tenethealth.com/investors.

The slide presentation associated with the webcast referenced

above, a copy of this earnings press release, and a related

supplemental financial disclosures document will be available on

the Company’s Investor Relations website on July 31, 2023.

Cautionary Statement

This release contains “forward-looking statements” - that is,

statements that relate to future, not past, events. In this

context, forward-looking statements often address the Company’s

expected future business and financial performance and financial

condition, and often contain words such as “expect,” “anticipate,”

“assume,” “believe,” “budget,” “estimate,” “forecast,” “intend,”

“plan,” “predict,” “project,” “seek,” “see,” “target,” or “will.”

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain, especially with regards to

developments related to COVID-19. Particular uncertainties that

could cause the Company’s actual results to be materially different

than those expressed in the Company’s forward-looking statements

include, but are not limited to the impact of the COVID-19

pandemic, and other factors disclosed under “Forward-Looking

Statements” and “Risk Factors” in our Form 10-K for the year ended

December 31, 2022 and other filings with the Securities and

Exchange Commission.

Footnotes

- Tables and discussions throughout this earnings release include

certain financial measures, including those related to our second

quarter and full year 2023 Outlook, that are not in accordance with

accounting principles generally accepted in the United States of

America (GAAP). Reconciliations of GAAP measures to the Adjusted

(non-GAAP) measures used are detailed in Tables #1-6 included at

the end of this earnings release. Management’s reasoning for the

use of these non-GAAP measures and descriptions of the various

non-GAAP measures are included in the Non-GAAP Financial Measures

section of this earnings release.

- Same-facility system-wide revenues and statistical information

include the results of the facilities in which the Ambulatory

segment has an investment that are not consolidated by Tenet. To

help analyze the segment’s results of operations, management uses

system-wide measures, which include revenues and cases of both

consolidated and unconsolidated facilities.

- For 2023, same-hospital revenues and statistical data include

those for hospitals and hospital-affiliated outpatient centers

operated by the Company’s Hospital segment continuously from

January 1, 2022 through June 30, 2023. Amounts associated with

physician practices are excluded.

- Adjusted admissions represent actual patient admissions

adjusted to include outpatient services provided by facilities in

our Hospital segment by multiplying actual patient admissions by

the sum of gross inpatient revenues and outpatient revenues, then

dividing that result by gross inpatient revenues.

- Income tax expense is calculated by multiplying 24% (the

federal corporate tax rate of 21% plus an estimate of state taxes)

by the sum of: pretax income less GAAP facility level NCI expense

plus permanent differences, and non-deductible interest

expense.

- Change versus prior year is presented on a same-facility

system-wide basis for USPI Ambulatory surgical cases and on a

same-hospital basis for hospital statistics.

About Tenet Healthcare

Tenet Healthcare Corporation (NYSE: THC) is a diversified

healthcare services company headquartered in Dallas. Our care

delivery network includes United Surgical Partners International,

the largest ambulatory platform in the country, which operates or

has ownership interests in more than 475 ambulatory surgery centers

and surgical hospitals. We also operate 61 acute care and specialty

hospitals, approximately 110 other outpatient facilities, a network

of leading employed physicians and a global business center in

Manila, Philippines. Our Conifer Health Solutions subsidiary

provides revenue cycle management and value-based care services to

hospitals, health systems, physician practices, employers and other

clients. Across the Tenet enterprise, we are united by our mission

to deliver quality, compassionate care in the communities we serve.

For more information, please visit www.tenethealth.com.

Non-GAAP Financial

Measures

The Company believes the non-GAAP measures described below are

useful to investors and analysts because they present additional

information on the Company’s financial performance. Investors,

analysts, Company management and the Company’s Board of Directors

utilize these non-GAAP measures, in addition to GAAP measures, to

track the Company’s financial and operating performance and compare

the Company’s performance to its peer companies, which use similar

non-GAAP financial measures in their presentations and earnings

releases. The Human Resources Committee of the Company’s Board of

Directors also uses certain of these measures to evaluate

management’s performance for the purpose of determining incentive

compensation. Additional information regarding the purpose and

utility of specific non-GAAP measures used in this release is set

forth below.

- Adjusted EBITDA is defined by the Company as net income

available (loss attributable) to Tenet common shareholders before

(1) the cumulative effect of changes in accounting principles, (2)

net loss attributable (income available) to noncontrolling

interests, (3) income (loss) from discontinued operations, net of

tax, (4) income tax benefit (expense), (5) gain (loss) from early

extinguishment of debt, (6) other non-operating income (expense),

net, (7) interest expense, (8) litigation and investigation benefit

(costs), net of insurance recoveries, (9) net gains (losses) on

sales, consolidation and deconsolidation of facilities, (10)

impairment and restructuring charges and acquisition-related costs,

(11) depreciation and amortization and (12) income (loss) from

divested and closed businesses (i.e., health plan businesses).

Litigation and investigation costs excluded do not include ordinary

course of business malpractice and other litigation and related

expenses.

- Adjusted diluted earnings (loss) per share from continuing

operations is defined by the Company as Adjusted net income

available (loss attributable) from continuing operations to Tenet

common shareholders, divided by the weighted average diluted shares

outstanding in the reporting period.

- Adjusted net income available (loss attributable) from

continuing operations to Tenet common shareholders is defined by

the Company as net income available (loss attributable) to Tenet

common shareholders before (1) income (loss) from discontinued

operations, net of tax, (2) gain (loss) from early extinguishment

of debt, (3) litigation and investigation benefit (costs), net of

insurance recoveries, (4) net gains (losses) on sales,

consolidation and deconsolidation of facilities, (5) impairment and

restructuring charges and acquisition-related costs, (6) income

(loss) from divested and closed businesses (i.e., health plan

businesses) and (7) the associated impact of these items on taxes

and noncontrolling interests. Litigation and investigation costs

excluded do not include ordinary course of business malpractice and

other litigation and related expenses.

- Free Cash Flow is defined by the Company as (1) net cash

provided by (used in) operating activities, less (2) purchases of

property and equipment for continuing operations.

- Adjusted Free Cash Flow is defined by the Company as (1)

Adjusted net cash provided by (used in) operating activities from

continuing operations, less (2) purchases of property and equipment

from continuing operations.

- Adjusted net cash provided by (used in) operating activities is

defined by the Company as cash provided by (used in) operating

activities prior to (1) payments for restructuring charges,

acquisition-related costs and litigation costs and settlements, and

(2) net cash provided by (used in) operating activities from

discontinued operations.

The Company believes that Adjusted EBITDA is a useful measure,

in part, because certain investors and analysts use both historical

and projected Adjusted EBITDA, in addition to other GAAP and

non-GAAP measures, as factors in determining the estimated fair

value of shares of the Company’s common stock. Company management

also regularly reviews the Adjusted EBITDA performance for each

operating segment. The Company does not use Adjusted EBITDA to

measure liquidity, but instead to measure operating

performance.

The Company uses, and believes investors use, Free Cash Flow and

Adjusted Free Cash Flow as supplemental non-GAAP measures to

analyze cash flows generated from the Company’s operations. The

Company believes these measures are useful to investors in

evaluating its ability to fund distributions paid to noncontrolling

interests or for acquisitions, purchasing equity interests in joint

ventures or repaying debt.

These non-GAAP measures may not be comparable to similarly

titled measures reported by other companies. Because these measures

exclude many items that are included in the Company’s financial

statements, they do not provide a complete measure of the Company’s

operating performance. For example, the Company’s definitions of

Free Cash Flow and Adjusted Free Cash Flow do not include other

important uses of cash including (1) cash used to purchase

businesses or joint venture interests, or (2) any items that are

classified as Cash Flows from Financing Activities on the Company’s

Consolidated Statement of Cash Flows, including items such as (i)

cash used to repay borrowings, or (ii) distributions paid to

noncontrolling interests. Accordingly, investors are encouraged to

use GAAP measures when evaluating the Company’s financial

performance.

See corresponding reconciliations of the non-GAAP financial

measures referred to above to the most comparable GAAP financial

measures in Tables #1 - 6 below.

Tenet Healthcare

Corporation

Financial Statements and

Reconciliations

Second Quarter Earnings

Release

Table of Contents

Description

Page

Consolidated Statements of Operations

13

Consolidated Balance Sheets

15

Consolidated Statements of Cash Flows

16

Segment Reporting

17

Table #1 – Reconciliations of Net Income

to Adjusted Net Income

18

Table #2 – Reconciliations of Net Income

to Adjusted EBITDA

19

Table #3 – Reconciliations of Net Cash

Provided by Operating Activities to Free Cash Flow and Adjusted

Free Cash Flow

20

Table #4 – Reconciliations of Outlook Net

Income to Outlook Adjusted Net Income

21

Table #5 – Reconciliations of Outlook Net

Income to Outlook Adjusted EBITDA

22

Table #6 – Reconciliations of Outlook Net

Cash Provided by Operating Activities to Outlook Free Cash Flow and

Outlook Adjusted Free Cash Flow

23

TENET HEALTHCARE

CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(Dollars in millions, except per share

amounts)

Three Months Ended June

30,

2023

%

2022

%

Change

Net operating revenues

$

5,082

100.0

%

$

4,638

100.0

%

9.6

%

Grant income

8

0.2

%

94

2.0

%

(91.5

)%

Equity in earnings of unconsolidated

affiliates

54

1.1

%

54

1.2

%

—

%

Operating expenses:

Salaries, wages and benefits

2,285

45.0

%

2,126

45.8

%

7.5

%

Supplies

891

17.5

%

811

17.5

%

9.9

%

Other operating expenses, net

1,125

22.1

%

1,006

21.7

%

11.8

%

Depreciation and amortization

213

4.3

%

216

4.7

%

Impairment and restructuring charges, and

acquisition-related costs

16

0.3

%

57

1.2

%

Litigation and investigation costs

10

0.2

%

18

0.4

%

Net gains on sales, consolidation and

deconsolidation of facilities

—

—

%

(1

)

—

%

Operating income

604

11.9

%

553

11.9

%

Interest expense

(226

)

(222

)

Other non-operating income, net

6

—

Loss from early extinguishment of debt

(11

)

(66

)

Income from continuing operations,

before income taxes

373

265

Income tax expense

(80

)

(86

)

Net income

293

179

Less: Net income available to

noncontrolling interests

170

141

Net income available to Tenet

Healthcare Corporation common shareholders

$

123

$

38

Earnings per share available to Tenet

Healthcare Corporation common shareholders:

Basic

Continuing operations

$

1.21

$

0.35

Diluted

Continuing operations

$

1.15

$

0.35

Weighted average shares and dilutive

securities outstanding

(in thousands):

Basic

101,766

107,790

Diluted

104,778

108,750

TENET HEALTHCARE

CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(Dollars in millions, except per share

amounts)

Six Months Ended June

30,

2023

%

2022

%

Change

Net operating revenues

$

10,103

100.0

%

$

9,383

100.0

%

7.7

%

Grant income

11

0.1

%

100

1.1

%

(89.0

)%

Equity in earnings of unconsolidated

affiliates

104

1.0

%

100

1.1

%

4.0

%

Operating expenses:

Salaries, wages and benefits

4,543

45.0

%

4,308

45.9

%

5.5

%

Supplies

1,782

17.6

%

1,596

17.0

%

11.7

%

Other operating expenses, net

2,218

22.0

%

1,948

20.8

%

13.9

%

Depreciation and amortization

430

4.2

%

419

4.5

%

Impairment and restructuring charges, and

acquisition-related costs

37

0.4

%

73

0.8

%

Litigation and investigation costs

14

0.1

%

38

0.4

%

Net gains on sales, consolidation and

deconsolidation of facilities

(13

)

(0.1

)%

—

—

%

Operating income

1,207

11.9

%

1,201

12.8

%

Interest expense

(447

)

(449

)

Other non-operating income, net

4

—

Loss from early extinguishment of debt

(11

)

(109

)

Income from continuing operations,

before income taxes

753

643

Income tax expense

(164

)

(185

)

Income from continuing operations,

before discontinued operations

589

458

Income from discontinued

operations

—

1

Net income

589

459

Less: Net income available to

noncontrolling interests

323

281

Net income available to Tenet

Healthcare Corporation common shareholders

$

266

$

178

Amounts available to Tenet Healthcare

Corporation common shareholders

Income from continuing operations, net of

tax

$

266

$

177

Income from discontinued operations, net

of tax

—

1

Net income available to Tenet

Healthcare Corporation common shareholders

$

266

$

178

Earnings per share available to Tenet

Healthcare Corporation common shareholders:

Basic

Continuing operations

$

2.61

$

1.64

Discontinued operations

—

0.01

$

2.61

$

1.65

Diluted

Continuing operations

$

2.47

$

1.63

Discontinued operations

—

0.01

$

2.47

$

1.64

Weighted average shares and dilutive

securities outstanding

(in thousands):

Basic

102,028

107,636

Diluted

105,354

114,054

TENET HEALTHCARE

CORPORATION

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(Dollars in millions)

June 30,

December 31,

2023

2022

ASSETS

Current assets:

Cash and cash equivalents

$

934

$

858

Accounts receivable

2,914

2,943

Inventories of supplies, at cost

404

405

Assets held for sale

141

—

Other current assets

1,602

1,775

Total current assets

5,995

5,981

Investments and other assets

3,130

3,147

Deferred income taxes

8

19

Property and equipment, at cost, less

accumulated depreciation and amortization

6,268

6,462

Goodwill

10,350

10,123

Other intangible assets, at cost, less

accumulated amortization

1,406

1,424

Total assets

$

27,157

$

27,156

LIABILITIES AND EQUITY

Current liabilities:

Current portion of long-term debt

$

141

$

145

Accounts payable

1,246

1,504

Accrued compensation and benefits

718

778

Professional and general liability

reserves

257

255

Accrued interest payable

199

213

Liabilities held for sale

17

—

Contract liabilities

76

110

Other current liabilities

1,498

1,471

Total current liabilities

4,152

4,476

Long-term debt, net of current portion

14,907

14,934

Professional and general liability

reserves

793

790

Defined benefit plan obligations

329

331

Deferred income taxes

243

217

Other long-term liabilities

1,732

1,800

Total liabilities

22,156

22,548

Commitments and contingencies

Redeemable noncontrolling interests in

equity of consolidated subsidiaries

2,277

2,149

Equity:

Shareholders’ equity:

Common stock

8

8

Additional paid-in capital

4,800

4,778

Accumulated other comprehensive loss

(178

)

(181

)

Accumulated deficit

(537

)

(803

)

Common stock in treasury, at cost

(2,750

)

(2,660

)

Total shareholders’ equity

1,343

1,142

Noncontrolling interests

1,381

1,317

Total equity

2,724

2,459

Total liabilities and equity

$

27,157

$

27,156

TENET HEALTHCARE

CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

(Dollars in millions)

Six Months Ended

June 30,

2023

2022

Net income

$

589

$

459

Adjustments to reconcile net income to

net cash provided by operating activities:

Depreciation and amortization

430

419

Deferred income tax expense

37

132

Stock-based compensation expense

33

34

Impairment and restructuring charges, and

acquisition-related costs

37

73

Litigation and investigation costs

14

38

Net gains on sales, consolidation and

deconsolidation of facilities

(13

)

—

Loss from early extinguishment of debt

11

109

Equity in earnings of unconsolidated

affiliates, net of distributions received

7

18

Amortization of debt discount and debt

issuance costs

18

15

Pre-tax income from discontinued

operations

—

(1

)

Net gains from the sale of investments and

long-lived assets

(15

)

(71

)

Other items, net

(3

)

12

Changes in cash from operating assets

and liabilities:

Accounts receivable

7

(74

)

Inventories and other current assets

160

173

Income taxes

(31

)

(86

)

Accounts payable, accrued expenses,

contract liabilities and other current liabilities

(168

)

(764

)

Other long-term liabilities

12

(41

)

Payments for restructuring charges,

acquisition-related costs, and litigation costs and

settlements

(78

)

(98

)

Net cash provided by operating

activities

1,047

347

Cash flows from investing

activities:

Purchases of property and equipment

(367

)

(307

)

Purchases of businesses or joint venture

interests, net of cash acquired

(96

)

(66

)

Proceeds from sales of facilities and

other assets

16

209

Proceeds from sales of marketable

securities, long-term investments and other assets

26

9

Purchases of marketable securities and

equity investments

(37

)

(41

)

Other items, net

(9

)

(4

)

Net cash used in investing

activities

(467

)

(200

)

Cash flows from financing

activities:

Repayments of borrowings

(1,437

)

(2,744

)

Proceeds from borrowings

1,362

2,013

Repurchases of common stock

(90

)

—

Debt issuance costs

(15

)

(24

)

Distributions paid to noncontrolling

interests

(270

)

(310

)

Proceeds from the sale of noncontrolling

interests

30

9

Purchases of noncontrolling interests

(79

)

(29

)

Other items, net

(5

)

(75

)

Net cash used in financing

activities

(504

)

(1,160

)

Net increase (decrease) in cash and cash

equivalents

76

(1,013

)

Cash and cash equivalents at beginning of

period

858

2,364

Cash and cash equivalents at end of

period

$

934

$

1,351

Supplemental disclosures:

Interest paid, net of capitalized

interest

$

(445

)

$

(416

)

Income tax payments, net

$

(158

)

$

(140

)

TENET HEALTHCARE

CORPORATION

SEGMENT REPORTING

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

(Dollars in millions)

2023

2022

2023

2022

Net operating revenues:

Ambulatory Care

$

942

$

771

$

1,847

$

1,509

Hospital Operations and other (prior to

inter-segment eliminations)

3,922

3,645

7,821

7,443

Conifer

Tenet

105

111

212

226

Other clients

218

222

435

431

Total Conifer revenues

323

333

647

657

Inter-segment eliminations

(105

)

(111

)

(212

)

(226

)

Total

$

5,082

$

4,638

$

10,103

$

9,383

Equity in earnings of unconsolidated

affiliates:

Ambulatory Care

$

52

$

52

$

99

$

94

Hospital Operations and other

2

2

5

6

Total

$

54

$

54

$

104

$

100

Adjusted EBITDA (including grant

income):

Ambulatory Care

$

370

$

319

$

710

$

601

Hospital Operations and other

388

431

793

945

Conifer

85

93

172

185

Total

$

843

$

843

$

1,675

$

1,731

Adjusted EBITDA margins (including

grant income):

Ambulatory Care

39.3

%

41.4

%

38.4

%

39.8

%

Hospital Operations and other

9.9

%

11.8

%

10.1

%

12.7

%

Conifer

26.3

%

27.9

%

26.6

%

28.2

%

Total

16.6

%

18.2

%

16.6

%

18.4

%

Adjusted EBITDA margins (excluding

grant income):

Ambulatory Care

39.2

%

41.1

%

38.4

%

39.6

%

Hospital Operations and other

9.7

%

9.3

%

10.0

%

11.4

%

Conifer

26.3

%

27.9

%

26.6

%

28.2

%

Total

16.4

%

16.1

%

16.5

%

17.4

%

Capital expenditures:

Ambulatory Care

$

20

$

19

$

38

$

40

Hospital Operations and other

109

130

324

262

Conifer

3

3

5

5

Total

$

132

$

152

$

367

$

307

TENET HEALTHCARE

CORPORATION

Additional Supplemental

Non-GAAP disclosures

Table #1 – Reconciliations of

Net Income Available to Tenet Healthcare Corporation Common

Shareholders to Adjusted Net Income Available from Continuing

Operations to Common Shareholders

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

(Dollars in millions, except per share

amounts)

2023

2022

2023

2022

Net income available to Tenet

Healthcare Corporation common shareholders

$

123

$

38

$

266

$

178

Net income from discontinued

operations

—

—

—

1

Net income from continuing

operations

123

38

266

177

Less: Impairment and restructuring

charges, and acquisition-related costs

(16

)

(57

)

(37

)

(73

)

Litigation and investigation costs

(10

)

(18

)

(14

)

(38

)

Net gains on sales, consolidation and

deconsolidation of facilities

—

1

13

—

Loss from early extinguishment of debt

(11

)

(66

)

(11

)

(109

)

Tax and noncontrolling interests impact of

above items

6

17

7

26

Adjusted net income available from

continuing operations to common shareholders

$

154

$

161

$

308

$

371

Diluted earnings per share from

continuing operations

$

1.15

$

0.35

$

2.47

$

1.63

Less: Impairment and restructuring

charges, and acquisition-related costs

(0.15

)

(0.52

)

(0.35

)

(0.64

)

Litigation and investigation costs

(0.10

)

(0.17

)

(0.13

)

(0.33

)

Net gains on sales, consolidation and

deconsolidation of facilities

—

0.01

0.12

—

Loss from early extinguishment of debt

(0.10

)

(0.61

)

(0.10

)

(0.96

)

Tax and noncontrolling interests impact of

above items

0.06

0.16

0.06

0.23

Adjusted diluted earnings per share

from continuing operations

$

1.44

$

1.48

$

2.87

$

3.33

Weighted average basic shares

outstanding (in thousands)

101,766

107,790

102,028

107,636

Weighted average dilutive shares

outstanding (in thousands)

104,778

108,750

105,354

114,054

TENET HEALTHCARE

CORPORATION

Additional Supplemental

Non-GAAP disclosures

Table #2 – Reconciliations of

Net Income Available to Tenet Healthcare Corporation Common

Shareholders to Adjusted EBITDA

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

(Dollars in millions)

2023

2022

2023

2022

Net income available to Tenet

Healthcare Corporation common shareholders

$

123

$

38

$

266

$

178

Less: Net income available to

noncontrolling interests

(170

)

(141

)

(323

)

(281

)

Income from discontinued operations, net

of tax

—

—

—

1

Income from continuing operations

293

179

589

458

Income tax expense

(80

)

(86

)

(164

)

(185

)

Loss from early extinguishment of debt

(11

)

(66

)

(11

)

(109

)

Other non-operating income, net

6

—

4

—

Interest expense

(226

)

(222

)

(447

)

(449

)

Operating income

604

553

1,207

1,201

Litigation and investigation costs

(10

)

(18

)

(14

)

(38

)

Net gains on sales, consolidation and

deconsolidation of facilities

—

1

13

—

Impairment and restructuring charges, and

acquisition-related costs

(16

)

(57

)

(37

)

(73

)

Depreciation and amortization

(213

)

(216

)

(430

)

(419

)

Adjusted EBITDA

$

843

$

843

$

1,675

$

1,731

Net operating revenues

$

5,082

$

4,638

$

10,103

$

9,383

Net income available to Tenet

Healthcare Corporation common shareholders as a % of net operating

revenues

2.4

%

0.8

%

2.6

%

1.9

%

Adjusted EBITDA as a % of net operating

revenues (Adjusted EBITDA margin)

16.6

%

18.2

%

16.6

%

18.4

%

TENET HEALTHCARE

CORPORATION

Additional Supplemental

Non-GAAP disclosures

Table #3 – Reconciliations of

Net Cash Provided by Operating Activities to Free Cash Flow and

Adjusted Free Cash Flow from Continuing Operations

(Unaudited)

(Dollars in millions)

2023

Q2

YTD

Net cash provided by operating

activities

$

598

$

1,047

Purchases of property and equipment

(132

)

(367

)

Free cash flow – continuing

operations

$

466

$

680

Net cash used in investing

activities

$

(181

)

$

(467

)

Net cash used in financing

activities

$

(249

)

$

(504

)

Net cash provided by operating

activities

$

598

$

1,047

Less: Payments for restructuring charges,

acquisition-related costs, and litigation costs and settlements

(54

)

(78

)

Adjusted net cash provided by operating

activities from continuing operations

652

1,125

Purchases of property and equipment

(132

)

(367

)

Adjusted free cash flow – continuing

operations

$

520

$

758

(Dollars in millions)

2022

Q2

YTD

Net cash provided by operating

activities

$

119

$

347

Purchases of property and equipment

(152

)

(307

)

Free cash flow

(33

)

40

Add back: Medicare Advance Repayments

281

475

Free cash flow – continuing operations,

excluding repayments of Medicare Advances

$

248

$

515

Net cash used in investing

activities

$

(140

)

$

(200

)

Net cash used in financing

activities

$

(33

)

$

(1,160

)

Net cash provided by operating

activities

$

119

$

347

Less: Payments for restructuring charges,

acquisition-related costs, and litigation costs and settlements

(42

)

(98

)

Adjusted net cash provided by operating

activities from continuing operations

161

445

Purchases of property and equipment

(152

)

(307

)

Adjusted free cash flow – continuing

operations

9

138

Add back: Medicare Advance Repayments

281

475

Adjusted free cash flow – continuing

operations, excluding repayments of Medicare Advances

$

290

$

613

TENET HEALTHCARE

CORPORATION

Additional Supplemental

Non-GAAP disclosures

Table #4 – Reconciliations of

Outlook Net Income Available to Tenet Healthcare Corporation Common

Shareholders to Outlook Adjusted Net Income Available from

Continuing Operations to Common Shareholders

(Unaudited)

Third Quarter 2023

FY 2023

(Dollars in millions, except per share

amounts)

Low

High

Low

High

Net income available to Tenet

Healthcare Corporation common shareholders

$

75

$

120

$

447

$

582

Less: Impairment and restructuring

charges, acquisition-related costs, and litigation costs and

settlements(1)

(30

)

(20

)

(125

)

(75

)

Net gains on sales, consolidation and

deconsolidation of facilities

—

—

13

13

Loss from early extinguishment of

debt(2)

—

—

(11

)

(11

)

Tax and noncontrolling interests impact of

above items

5

5

20

15

Adjusted net income available from

continuing operations to common shareholders

$

100

$

135

$

550

$

640

Diluted earnings per share from

continuing operations

$

0.71

$

1.13

$

4.19

$

5.48

Less: Impairment and restructuring

charges, acquisition-related costs, and litigation costs and

settlements

(0.28

)

(0.20

)

(1.20

)

(0.71

)

Net gains on sales, consolidation and

deconsolidation of facilities

—

—

0.12

0.12

Loss from early extinguishment of debt

—

—

(0.10

)

(0.10

)

Tax and noncontrolling interests impact of

above items

0.05

0.05

0.19

0.14

Adjusted diluted earnings per share

from continuing operations

$

0.94

$

1.28

$

5.18

$

6.03

Weighted average basic shares

outstanding (in thousands)

102,000

102,000

102,000

102,000

Weighted average dilutive shares

outstanding (in thousands)

105,000

105,000

105,000

105,000

(1)

The figures shown represent the Company's

estimate for restructuring charges plus the actual year-to-date

results for impairment and restructuring charges,

acquisition-related costs, and litigation costs and settlements.

The Company does not generally forecast impairment charges,

acquisition-related costs, and litigation costs and settlements

because it does not believe that it can forecast these items with

sufficient accuracy since some of these items are indeterminable at

the time the Company provides its financial Outlook.

(2)

The Company does not generally forecast

losses from the early extinguishment of debt because the Company

does not believe that it can forecast this item with sufficient

accuracy since it is indeterminable at the time the Company

provides its financial Outlook. The figures shown relate to the

debt repurchased or refinanced by the Company in 2023.

TENET HEALTHCARE

CORPORATION

Additional Supplemental

Non-GAAP disclosures

Table #5 – Reconciliations of

Outlook Net Income Available to Tenet Healthcare Corporation Common

Shareholders to Outlook Adjusted EBITDA

(Unaudited)

Third Quarter 2023

FY 2023

(Dollars in millions)

Low

High

Low

High

Net income available to Tenet

Healthcare Corporation common shareholders

$

75

$

120

$

447

$

582

Less: Net income available to

noncontrolling interests

(160

)

(170

)

(660

)

(700

)

Income tax expense

(65

)

(75

)

(315

)

(335

)

Interest expense

(230

)

(220

)

(905

)

(895

)

Loss from early extinguishment of

debt(2)

—

—

(11

)

(11

)

Other non-operating income (expense),

net

(5

)

—

(10

)

—

Net gains on sales, consolidation and

deconsolidation of facilities

—

—

13

13

Impairment and restructuring charges,

acquisition-related costs, and litigation costs and

settlements(1)

(30

)

(20

)

(125

)

(75

)

Depreciation and amortization

(210

)

(220

)

(850

)

(875

)

Adjusted EBITDA

$

775

$

825

$

3,310

$

3,460

Income from continuing

operations

$

75

$

120

$

447

$

582

Net operating revenues

$

4,900

$

5,100

$

20,100

$

20,500

Net income available to Tenet

Healthcare Corporation common shareholders as a % of net operating

revenues

1.5

%

2.4

%

2.2

%

2.8

%

Adjusted EBITDA as a % of net operating

revenues (Adjusted EBITDA margin)

15.8

%

16.2

%

16.5

%

16.9

%

(1)

The figures shown represent the Company's

estimate for restructuring charges plus the actual year-to-date

results for impairment and restructuring charges,

acquisition-related costs, and litigation costs and settlements.

The Company does not generally forecast impairment charges,

acquisition-related costs, and litigation costs and settlements

because it does not believe that it can forecast these items with

sufficient accuracy since some of these items are indeterminable at

the time the Company provides its financial Outlook.

(2)

The Company does not generally forecast

losses from the early extinguishment of debt because the Company

does not believe that it can forecast this item with sufficient

accuracy since it is indeterminable at the time the Company

provides its financial Outlook. The figures shown relate to the

debt repurchased or refinanced by the Company in 2023.

TENET HEALTHCARE

CORPORATION

Additional Supplemental

Non-GAAP disclosures

Table #6 – Reconciliations of

Outlook Net Cash Provided by Operating Activities

to Outlook Free Cash Flow

– Continuing Operations and Outlook Adjusted Free Cash

Flow – Continuing

Operations

(Unaudited)

(Dollars in millions)

FY 2023

Low

High

Net cash provided by operating

activities

$

1,775

$

2,075

Purchases of property and equipment

(675

)

(725

)

Free cash flow – continuing

operations

$

1,100

$

1,350

Net cash provided by operating

activities

$

1,775

$

2,075

Less: Payments for restructuring charges,

acquisition-related costs and litigation costs and

settlements(1)

(150

)

(100

)

Adjusted net cash provided by operating

activities – continuing operations

1,925

2,175

Purchases of property and equipment

(675

)

(725

)

Adjusted free cash flow – continuing

operations(2)

$

1,250

$

1,450

(1)

The figures shown represent the Company's

estimate for restructuring payments plus the actual year-to-date

payments for restructuring charges, acquisition-related costs, and

litigation costs and settlements. The Company does not generally

forecast payments for acquisition-related costs, and litigation

costs and settlements because it does not believe that it can

forecast these items with sufficient accuracy since some of these

items are indeterminable at the time the Company provides its

financial Outlook.

(2)

The Company’s definition of Adjusted Free

Cash Flow does not include other important uses of cash including

(1) cash used to purchase businesses or joint venture interests, or

(2) any items that are classified as Cash Flows From Financing

Activities on the Company’s Consolidated Statement of Cash Flows,

including items such as (i) cash used to repay borrowings, and (ii)

distributions paid to noncontrolling interests.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230730228072/en/

Investor Contact Will McDowell 469-893-2387

william.mcdowell@tenethealth.com

Media Contact Robert Dyer 469-893-2640

mediarelations@tenethealth.com

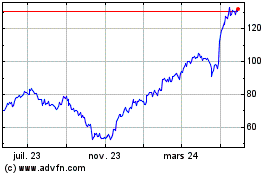

Tenet Healthcare (NYSE:THC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

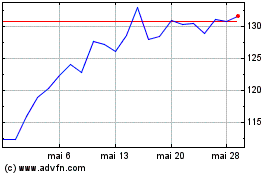

Tenet Healthcare (NYSE:THC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024