UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number: 001-40210

Tuya Inc.

10/F, Building A,

Huace Center

Xihu District, Hangzhou

City

Zhejiang, 310012

People’s Republic

of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXPLANATORY NOTE

We made an announcement dated March 11, 2024 with The Stock Exchange of Hong Kong Limited in relation to the preliminary unaudited annual

results for the year ended December 31, 2023. For details, please refer to Exhibit 99.1 to this current report on Form 6-K.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Tuya Inc. |

| |

|

| |

By |

: |

/s/ Yao (Jessie) Liu |

| |

Name |

: |

Yao (Jessie) Liu |

| |

Title |

: |

Chief Financial Officer |

Date: March 11, 2024

Exhibit 99.1

Hong Kong Exchanges

and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this preliminary results

announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss

howsoever arising from or in reliance upon the whole or any part of the contents of this preliminary results announcement.

Tuya Inc.

塗鴉智能*

(A company controlled

through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(HKEX Stock Code:

2391)

(NYSE Stock Ticker:

TUYA)

PRELIMINARY UNAUDITED

ANNUAL RESULTS ANNOUNCEMENT

FOR THE YEAR

ENDED DECEMBER 31, 2023

Tuya Inc. (“Tuya”

or the “Company”, HKEX: 2391; NYSE: TUYA), a global leading internet-of-things (“IoT”) cloud development

platform, today announced the preliminary unaudited financial results of the Company, its subsidiaries and consolidated affiliated entities

(the “Group”) for the year ended December 31, 2023 (the “Reporting Period”), together with

comparative figures for the year ended December 31, 2022.

FINANCIAL

HIGHLIGHTS FOR THE YEAR ENDED DECEMBER 31, 2023

·

Total revenue was US$230.0 million, up approximately

10.5% year-over-year (for the year ended December 31, 2022: US$208.2 million).

·

IoT platform-as-a-service (“PaaS”) revenue was

US$167.7 million, up approximately 9.7% year-over-year (for the year ended December 31, 2022: US$152.9 million).

·

Software-as-a-service (“SaaS”) and others revenue

was US$35.8 million, up approximately 20.0% year-over-year (for the year ended December 31, 2022: US$29.8 million).

·

Overall gross margin increased to 46.4%, up 3.4 percentage

points year-over-year (for the year ended December 31, 2022: 43.0%). Gross margin of IoT PaaS increased to 43.7%, up 2.6 percentage

points year-over-year (for the year ended December 31, 2022: 41.1%).

·

Operating margin was negative 46.0%, improved by 34.8

percentage points year-over-year (for the year ended December 31, 2022: negative 80.8%). Non-GAAP operating margin was

negative 10.9%, improved by 36.7 percentage points year-over-year (for the year ended December 31, 2022: negative 47.6%).

· Net

margin was negative 26.2%, improved by 44.0 percentage points year-over-year (for the year ended December 31, 2022: negative

70.2%). Non-GAAP net margin was 8.9%, improved by 46.0 percentage points year-over-year (for the year ended December 31,

2022: negative 37.1%), achieving the annual break-even for the first time. |

* For

identification purposes only.

·

Net cash generated

from operating activities was US$36.4 million, compared to net cash used in operating

activities of US$70.7 million for the year ended December 31, 2022.

·

Total cash, cash equivalents, time deposits and U.S. treasury

securities recorded as short-term and long-term investments were US$984.3 million as of December 31, 2023, compared to US$952.0

million as of December 31, 2022.

OPERATING

HIGHLIGHTS FOR THE YEAR ENDED DECEMBER 31, 2023

·

IoT PaaS customers1 for the year ended December 31,

2023 were approximately 4,000 (for the year ended December 31, 2022: 5,100). Total customers for the year ended December 31,

2023 were approximately 6,100 (for the year ended December 31, 2022: 7,600).

·

Premium IoT PaaS customers2 for the trailing

12 months ended December 31, 2023 were 265 (the trailing 12 months ended December 31, 2022: 263). In the year ended December 31,

2023, the Group’s premium IoT PaaS customers contributed approximately 83.4% (for the year ended December 31, 2022: 81.7%)

of IoT PaaS revenue.

·

Dollar-based net expansion rate (“DBNER”)3

of IoT PaaS for the trailing 12 months ended December 31, 2023 was 103% (the trailing 12 months ended December 31,

2022: 51%).

·

Registered IoT device and software developers (“registered

developers”) were approximately 993,000 as of December 31, 2023, up 40.3% from approximately 708,000 developers as

of December 31, 2022.

1. The

Group defines an IoT PaaS customer for a given period as a customer who has directly placed orders for IoT PaaS with the Group during

that period.

2. The

Group defines a premium IoT PaaS customer as a customer as of a given date that contributed more than US$100,000 of IoT PaaS revenue

during the immediately preceding 12-month period.

3. The

Group calculates DBNER of IoT PaaS for a trailing 12-month period by first identifying all customers in the prior 12-month period

(i.e., those have placed at least one order for IoT PaaS during that period), and then calculating the quotient from dividing the

IoT PaaS revenue generated from such customers in the current trailing 12-month period by the IoT PaaS revenue generated from the

same group of customers in the prior 12-month period. The Group’s DBNER may change from period to period, due to a combination

of various factors, including changes in the customers’ purchase cycles and amounts and the Group’s customer mix, among

other things, DBNER indicates the Group’s ability to expand customer use of its platform over time and generate revenue growth

from existing customers. |

UNAUDITED FINANCIAL

RESULTS FOR THE YEAR ENDED DECEMBER 31, 2023

Revenue

Total revenue increased

by 10.5% to US$230.0 million in 2023 from US$208.2 million in 2022, mainly due to increase in IoT PaaS revenue, SaaS and others revenue

and smart device distribution revenue.

| · | IoT

PaaS revenue increased by 9.7% to US$167.7 million in the year ended December 31, 2023

from US$152.9 million in 2022. This recovered year-over-year growth was due to the relief

of downstream inventory backlog and a global economic improvement compared with 2022, along

with the effective customer-focus and product-enhancement strategies the Company adopted

to navigate through the macroeconomic headwinds. As a result of these factors, the Group’s

DBNER of IoT PaaS for the trailing 12 months ended December 31, 2023 increased to 103%

from 51% for the trailing 12 months ended December 31, 2022. |

| · | SaaS

and others revenue increased by 20.0% to US$35.8 million in the year ended December 31,

2023 from US$29.8 million in 2022, primarily due to an increase in revenue from cloud software

products. The Group remained committed to offering value-added services and a diverse range

of software products with compelling value propositions to its customers. |

| · | Smart

device distribution revenue increased by 4.2% to US$26.5 million in the year ended December 31,

2023 from US$25.4 million in 2022, primarily attributable to the increase in revenue from

smart device solutions, partially offset by the decrease in revenue from smart device sourcing

which saves its customers from dealing with multiple OEMs, and the variations in the timing

and volume of customer demands and purchases. |

Cost of revenue

Cost of revenue

increased by 3.9% to US$123.3 million in the year ended December 31, 2023 from US$118.7 million in 2022, in line with the increase

in total revenue.

Gross profit

and gross margin

Total gross profit

increased by 19.3% to US$106.7 million in the year ended December 31, 2023 from US$89.4 million in 2022 and gross margin increased

to 46.4% in the year ended December 31, 2023 from 43.0% in 2022.

| · | IoT

PaaS gross margin was 43.7% in the year ended December 31, 2023, up 2.6 percentage points

compared to 41.1% in 2022, primarily due to the changes in product mix, enhancement in product

value, and the decrease in provision recorded for certain slow-moving IoT chips and raw materials

compared with 2022. |

| · | SaaS

and others gross margin was 74.2% in the year ended December 31, 2023, fluctuating due

to product and service mix, but generally remaining at a consistent level compared to 79.0%

in 2022. |

| · | Smart

device distribution gross margin was 25.5% in the year ended December 31, 2023, compared

to 11.6% in 2022, primarily due to higher-value product solutions we provided to our customers

during the year. |

Operating

expenses

Operating expenses

decreased by 17.5% to US$212.5 million in the year ended December 31, 2023 from US$257.6 million in 2022.

Non-GAAP operating

expenses, defined as operating expenses excluding share-based compensation expenses and credit loss of long-term investments, decreased

by 30.2% to US$131.7 million in the year ended December 31, 2023 from US$188.6 million in 2022. Share-based compensation expenses

were US$65.2 million in the year ended December 31, 2023, compared to US$69.0 million in 2022. Credit loss of long-term investments

was US$15.5 million in the year ended December 31, 2023, compared to nil in 2022.

| · | Research

and development expenses were US$102.3 million in the year ended December 31, 2023,

down 29.4% from US$144.9 million in 2022, primarily because of the Group’s strategic

streamlining of its research and development team and operations. The Group’s total

salaried research and development headcount as of December 31, 2023 was 1,047, down

20.3% compared to that as of December 31, 2022. Non-GAAP adjusted research and development

expenses in the year ended December 31, 2023 were US$87.5 million, compared to US$130.3

million in 2022. |

| · | Sales

and marketing expenses were US$40.4 million in the year ended December 31, 2023, down

27.3% from US$55.7 million in 2022, primarily because of (i) the Group’s strategic

streamlining of its sales and marketing team, and (ii) the Group’s efforts to

control expenditures and improve sales and marketing efficiency. Non-GAAP adjusted sales

and marketing expenses in the year ended December 31, 2023 were US$35.0 million, compared

to US$48.8 million in 2022. |

| · | General

and administrative expenses were US$80.7 million in the year ended December 31, 2023,

up 19.5% from US$67.5 million in 2022, primarily because of the credit loss of US$15.5 million

of long-term investments (nil in 2022), partially offset by the decrease in salary related

expenses due to the Group’s strategic streamlining of its general and administrative

team. Non-GAAP adjusted general and administrative expenses in the year ended December 31,

2023 were US$20.1 million, compared to US$20.0 million in 2022. |

| · | Other

operating incomes, net were US$10.9 million in the year ended December 31, 2023, primarily

due to receipts of software value-added tax refund and various general subsidies for enterprises. |

Loss from

operations and operating margin

Loss from operations

was US$105.8 million in the year ended December 31, 2023, narrowed by 37.1% compared to US$168.2 million in 2022. Non-GAAP loss

from operations was US$25.1 million in the year ended December 31, 2023, narrowed by 74.7% compared to US$99.2 million in 2022.

Operating margin

was negative 46.0% in the year ended December 31, 2023, improved by 34.8 percentage points from negative 80.8% in 2022. Non-GAAP

operating margin was negative 10.9% in the year ended December 31, 2023, improved by 36.7 percentage points from negative 47.6%

in 2022.

Net loss/profit

and net margin

Net loss was US$60.3

million in the year ended December 31, 2023, narrowed by 58.7% compared to US$146.2 million in 2022. The differences between loss

from operation and net loss in the year ended December 31, 2023 was primarily because of a US$49.7 million interest income achieved

mainly due to well implemented treasury strategies on the Group’s cash and bank time deposits recorded as short-term and long-term

investments.

The Group had a

non-GAAP net profit of US$20.4 million in the year ended December 31, 2023, significantly improved compared to a non-GAAP net loss

of US$77.2 million in 2022, marking it the first fiscal year that the Group has achieved break-even profitability on a non-GAAP basis.

Net margin was

negative 26.2% in the year ended December 31, 2023, improved by 44.0 percentage points from negative 70.2% in 2022, and non-GAAP

net margin was 8.9% in the year ended December 31, 2023, improved by 46.0 percentage points from negative 37.1% in 2022.

Basic and

diluted net loss/profit per ADS

Basic and diluted

net loss per ADS were US$0.11 in the year ended December 31, 2023, compared to US$0.26 in 2022. Each ADS represents one Class A

ordinary share of the Company.

Non-GAAP basic

and diluted net profit per ADS in the year ended December 31, 2023 were approximately US$0.04 and US$0.03, respectively, compared

to net loss per ADS of US$0.14 in 2022.

Cash and

cash equivalents, time deposits and U.S. treasury securities recorded as short-term and long-term investments

Cash and cash equivalents,

time deposits and U.S. treasury securities recorded as short-term and long-term investments were US$984.3 million as of December 31,

2023, compared to US$952.0 million as of December 31, 2022, which the Group believes is sufficient to meet its current liquidity

and working capital needs.

Net cash

generated from operating activities

Net cash generated

from operating activities was US$36.4 million in the year ended December 31, 2023, significantly improved compared to US$70.7 million

of net cash used in operating activities in 2022. The net cash generated in operating activities in the year ended December 31,

2023 improved mainly due to the increase in the Group’s total revenue, and the decrease in operating expenses, particularly employee

related costs, and working capital changes in the ordinary course of business.

For further information

on non-GAAP financial measures discussed above, see the section headed “Use of Non-GAAP Financial Measures” on page 13

of this preliminary results announcement.

BUSINESS REVIEW

AND OUTLOOK

Business

review

IoT PaaS customers

for the year ended December 31, 2023 were approximately 4,000. Total customers for the year ended December 31, 2023 were approximately

6,100. The Group defines an IoT PaaS customer for a given period as a customer who has directly placed orders for IoT PaaS with the Group

during that period.

Premium IoT PaaS

customers for the trailing 12 months ended December 31, 2023 were 265. In the year ended December 31, 2023, the Group’s

premium IoT PaaS customers contributed approximately 83.4% of IoT PaaS revenue. The Group defines a premium IoT PaaS customer as a customer

as of a given date that contributed more than US$100,000 of IoT PaaS revenue during the immediately preceding 12-month period.

DBNER of IoT PaaS

for the trailing 12 months ended December 31, 2023 was 103%. The Group calculates DBNER of IoT PaaS for a trailing 12-month period

by first identifying all customers in the prior 12-month period (i.e., those have placed at least one order for IoT PaaS during that

period), and then calculating the quotient from dividing the IoT PaaS revenue generated from such customers in the current trailing 12-month

period by the IoT PaaS revenue generated from the same group of customers in the prior 12-month period. The Group’s DBNER may change

from period to period, due to a combination of various factors, including changes in the customers’ purchase cycles and amounts

and the Group’s customer mix, among other things. DBNER indicates the Group’s ability to expand customer use of its platform

over time and generate revenue growth from existing customers.

Registered IoT

device and software developers, or registered developers, were approximately 993,000 as of December 31, 2023, up 40.3% from over

708,000 developers as of December 31, 2022.

Outlook

In the fiscal year

2023, we continued to observe a moderately declining yet persisting overall inflation, which is expected to continually influence the

discretionary consumer electronics spending. On the supply chain front, we expect downstream inventory levels to be normalizing ongoingly,

providing downstream smart device manufacturers, brands, and retail channels with greater flexibility and resilience to adapt their operational

and procurement plans as necessary. This, in turn, will revitalize their investment in smart business. Overall, discretionary consumer

electronic spending alongside enterprise procurement are expected to prioritize cost-effectiveness, reflecting a balanced approach widely

adopted in the current economic climate.

In response to

this evolving market environment, the Group will remain committed to continuously iterating and improving its products and services,

further enhancing software and hardware capabilities, expanding key customer base, investing in innovations and new opportunities, diversifying

revenue streams, and further optimizing operating efficiency. At the same time, the Group understands that future trajectories may encounter

challenges, including shifting consumer spending patterns, regional economic disparities, inventory management, foreign exchange rate

volatility, and broader geopolitical uncertainties.

MANAGEMENT DISCUSSION

AND ANALYSIS

| 1. | Liquidity

and capital resources |

The Group

has been incurring losses from operations since inception. The Group incurred net losses of US$60.3 million and US$146.2 million year

ended December 31, 2023 and 2022, respectively. Accumulated deficit amounted to US$574.8 million as of December 31, 2023. However,

due to well implementation of the Group’s initiatives to navigate the headwinds and strategies for its long-term development, the

Group achieved a net cash generated from operating activities of US$36.4 million for the year ended December 31, 2023, compared

to a net cash used of US$70.7 million for the year ended December 31, 2022.

The Group’s

liquidity is based on its ability to enhance its operating cash flow position, obtain capital financing from equity interest investors

to fund its general operations, research and development activities and capital expenditures. The Group’s ability to continue as

a going concern is dependent on management’s ability to execute its business plan successfully, which includes increasing market

acceptance of its products to boost sales volume to achieve economies of scale or strengthen its technology capabilities to provide advanced

products with higher value proposition while applying more effective marketing strategies and cost control measures to better manage

operating cash flow position and obtaining funds from outside sources of financing to generate positive financing cash flows. In March and

April 2021, with the completion of its initial public offering on the New York Stock Exchange and the exercise of the over-allotment

option by underwriters, the Company received net proceeds, after deducting the underwriting discounts and commissions, fees and offering

expenses, of US$904.7 million. On July 5, 2022, the Class A ordinary shares of the Company were listed on the Main Board of

the Stock Exchange of Hong Kong Limited (the “Stock Exchange”). In connection with the Listing, 7,300,000 new Class A

ordinary shares of the Company were issued and allotted at the offer price of HK$19.3 per Class A ordinary share. Net proceeds from

the global offering, after deducting the underwriting fees and commissions, were approximately HK$70.0 million (the “Global

Offering Net Proceeds”), and no over-allotment option was exercised.

As of

December 31, 2023, the balance of cash and cash equivalents, time deposits and U.S. treasury securities recorded as short-term and

long-term investments were US$984.3 million as of December 31, 2023, compared to US$952.0 million as of December 31, 2022.

| 2. | Interest-bearing

bank and other borrowings |

As of

December 31, 2023, the Group did not have any interest-bearing bank and other borrowings.

As of

December 31, 2023, the Group did not have any pledge of assets.

Gearing

ratio equals total debt divided by total equity as of the end of the period. Total debt is defined to include short-term borrowings,

current portion of long-term borrowings and long-term borrowings which are all interest-bearing borrowings. As of December 31, 2023,

the gearing ratio of the Group was nil as the Group had no borrowings (as of December 31, 2022: nil).

For the

year ended December 31, 2023, the Group did not have any significant investments (including any investment in an investee company

with a value of 5% or more of the Group’s total assets as of December 31, 2023) except for time deposits of US$475.5 million

presented as short-term and long-term investments according to the applicable accounting standards. As of December 31, 2023, the

Group did not have other plans for material investments and capital assets.

| 6. | Capital

expenditure commitments |

As of

December 31, 2023, the Group did not have any capital expenditure commitments.

As of

December 31, 2023, the Group did not have any material contingent liabilities.

| 8. | Material

acquisitions and disposals |

The Group

did not conduct any material acquisitions and disposals during the year ended December 31, 2023.

Foreign

exchange risk

The revenue

of the Group is predominantly denominated in Renminbi (“RMB”) and a substantial portion of the Group’s expenses

is also denominated in RMB. The Group uses United States dollar as its reporting currency. The functional currency of the Company and

its subsidiaries incorporated in Cayman Islands and Hong Kong is the United States dollar, while the functional currency of the Group’s

other subsidiaries and consolidated affiliated entities is their respective local currency as determined based on the criteria of ASC

830, Foreign Currency Matters. The financial statements of its subsidiaries and consolidated affiliated entities using functional currencies

other than U.S. dollar, such as RMB, are translated to the U.S. dollar. As a result, as RMB depreciates or appreciates against the U.S.

dollar, the Group’s revenue presented in U.S. dollar will be negatively or positively affected. The Group does not believe that

it currently has any significant direct foreign exchange risk arising from its operating activities. As of December 31, 2023, the

Group did not hold any financial instruments for hedging purposes.

Interest

rate risk

The Group’s

exposure to interest rate risk primarily relates to the interest income generated by excess cash, which is mostly held in interest-bearing

bank deposits. The Group has not used any derivative financial instruments to manage its interest risk exposure. Interest-earning instruments

carry a degree of interest rate risk. The Group has not been exposed, nor does the Group anticipate being exposed, to material risks

due to changes in interest rates. However, the Group’s future interest income may be lower than expected due to changes in market

interest rates.

| 10. | Employees

and remuneration policies |

The following

table sets forth the breakdown of the Group’s salaried employees by function as of December 31, 2023:

| Function | |

Number of

Employees | |

| Research and development | |

| 1,047 | |

| Sales and marketing | |

| 310 | |

| General and administrative, and others | |

| 108 | |

| | |

| | |

| Total | |

| 1,465 | |

The Group

primarily recruits the employees by its recruitment specialists at human resources department through referrals and online channels,

including the Company’s corporate website and social networking platforms. The Group has adopted a series of training policies

and tailor-made lessons, pursuant to which technology, corporate culture, leadership, and other trainings are regularly provided to the

Group’s employees by internal speakers and third-party consultants. The Group offers its employees competitive compensation packages

and a dynamic work environment that encourages initiative. The Group participates in various government statutory employee benefit plans,

including social insurance, namely pension insurance, medical insurance, unemployment insurance, work-related injury insurance and maternity

insurance, and housing funds. In addition, the Group participates in a supplemental employee commercial healthcare insurance program

effective on December 23, 2022, aiming to promote healthy work and healthy life of employees.

CORPORATE GOVERNANCE

The board (the

“Board”) of directors (the “Directors” and each, a “Director”) of the Company

is committed to achieving high corporate governance standards. The Board believes that high corporate governance standards are essential

in providing a framework for the Company to safeguard the interests of shareholders and to enhance corporate value and accountability.

Compliance

with the Corporate Governance Code

For the year ended

December 31, 2023, the Company has complied with all the code provisions of the Corporate Governance Code set forth in Appendix

C1 to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”),

save and except for the following.

Pursuant to code

provision C.2.1 of the Corporate Governance Code, companies listed on the Hong Kong Stock Exchange are expected to comply with, but may

choose to deviate from the requirement that the responsibilities between the chairman and the chief executive officer should be separate

and should not be performed by the same individual. The Company deviates from this code provision because Mr. WANG Xueji (“Mr. Wang”)

performs both the roles of a co-chairman of the Board and the chief executive officer of the Company. Mr. Wang is a founder of the

Group and has extensive experience in the business operations and management of the Group. The Board believes that, in view of Mr. Wang’s

experience, personal profile and his roles in the Company as mentioned above, Mr. Wang is the Director best suited to identify strategic

opportunities, ensure the consistent leadership within the Company, and focus on the Board due to his extensive understanding of the

Company’s business as the chief executive officer of the Company. The Board also believes that the combined roles of both chairman

and chief executive officer can promote the effective execution of strategic initiatives and facilitate the flow of information between

management and the Board.

The Board considers

that the balance of power and authority will not be impaired due to this arrangement. The reasons are: (i) all major decisions are

made in consultation with members of the Board, including the relevant Board committees, and four independent non-executive Directors;

(ii) Mr. Wang and the other Directors acknowledge and undertake to fulfil their fiduciary duties as directors, which require

them, among other things, to act in the interests of the Company in a manner that is in the best interests of the Company and to make

decisions for the Group accordingly; and (iii) the Board is made up of experienced and talented people who meet regularly to discuss

matters affecting the operations of the Company to ensure a balance of power and authority. In addition, the Group’s overall strategic

and other major businesses, financial and operational policies have been formulated jointly by the Board and senior management after

detailed discussion.

The Board will

continue to review and may recommend separating the roles of chairman of the Board and the chief executive officer of the Company in

the future if and when it is appropriate, taking into account the circumstances of the Group as a whole.

Compliance

with the Model Code for Securities Transactions by Directors of Listed Issuers (the “Model Code”)

The Company has

adopted the Model Code set out in Appendix C3 to the Listing Rules as its code of conduct regarding directors’ securities

transactions. Specific enquiry has been made of all the Directors and the relevant employees and they have confirmed that they have complied

with the Model Code for the year ended December 31, 2023.

Audit Committee

The audit committee

of the Company (the “Audit Committee”) comprises three independent non-executive Directors, being Mr. HUANG Sidney

Xuande, Mr. KUOK Meng Xiong (alias GUO Mengxiong) and Mr. YIP Pak Tung Jason, with Mr. HUANG Sidney Xuande (being the

independent non-executive Director with the appropriate professional qualifications) as the chairman of the Audit Committee.

The Audit Committee

has reviewed the unaudited condensed consolidated financial statements and annual results of the Group for the Reporting Period, and

there is no disagreement between the Board and the Audit Committee regarding the accounting treatment adopted by the Company.

The Audit Committee

has met with the independent auditor of the Company (the “Auditor”), PricewaterhouseCoopers, and has also discussed

matters with respect to the accounting policies and practices adopted by the Company and internal control and financial reporting matters.

Auditor’s

Procedures Performed on this Preliminary Results Announcement

The figures in

respect of the preliminary results announcement of the Group’s unaudited condensed consolidated balance sheets, unaudited condensed

consolidated statements of comprehensive loss, unaudited condensed consolidated statements of cash flows and the related notes thereto

for the year ended December 31, 2023 have been agreed by the Auditor to the amounts included in the Group’s most current set

of unaudited consolidated financial statements for the year. The work performed by the Auditor in this respect did not constitute an

audit, review or other assurance engagement, and consequently no assurance has been expressed by the Auditor on this preliminary results

announcement.

OTHER INFORMATION

Purchase,

Sale and Redemption of the Company’s Listed Securities

During the Reporting

Period, the Company repurchased approximately 1.2 million ADSs representing the same number of Class A ordinary shares of the Company

from the open market for a total consideration of approximately US$2.0 million.

Save as disclosed

above, neither the Company nor any of its subsidiaries purchased, sold, or redeemed any of the Company’s securities listed on the

Hong Kong Stock Exchange during the Reporting Period.

Use of Proceeds

from the Global Offering

On July 5,

2022, the Class A ordinary shares of the Company were listed on the Main Board of the Hong Kong Stock Exchange and the Company successfully

raised the Global Offering Net Proceeds (as defined above) of approximately HK$70.0 million. As of the date of this preliminary results

announcement, there was no change in the intended use of net proceeds as previously disclosed in the section headed “Future

Plans and Use of Proceeds” in the prospectus of the Company dated June 22, 2022.

As at December 31,

2023, the Company had utilized the net proceeds as set out in the table below:

| | |

Percentage of

the total

net

proceeds raised

from the

Listing

Approximate | | |

Planned use of

proceeds in

the

same manner

and proportion

as stated in

the Prospectus

Approximate | | |

Net proceeds

unused as at

December

31, 2022

Approximate | | |

Actual

use of

proceeds

during the

Reporting

Period

Approximate | | |

Net proceeds

unutilized as

at December

31, 2023

Approximate | | |

Expected timeframe

for utilizing the

remaining unutilized

net proceeds |

| | |

(%) | | |

(HK$ million) | | |

(HK$ million) | | |

(HK$ million) | | |

(HK$ million) | | |

|

| To enhance our IoT technologies and infrastructure. | |

| 30 | % | |

| 21.0 | | |

| 21.0 | | |

| 6.3 | | |

| 14.7 | | |

Over the course of the next four years |

| To expand and enhance our product offerings. | |

| 30 | % | |

| 21.0 | | |

| 21.0 | | |

| 6.3 | | |

| 14.7 | | |

Over the course of the next four years |

| For marketing and branding activities. | |

| 15 | % | |

| 10.5 | | |

| 10.5 | | |

| 3.2 | | |

| 7.3 | | |

Over the course of the next four years |

| To pursue strategic partnerships, investments and acquisitions to implement our long-term growth strategies. | |

| 15 | % | |

| 10.5 | | |

| 10.5 | | |

| 3.2 | | |

| 7.3 | | |

Over the course of the next four years |

| For general corporate purposes and working capital needs. | |

| 10 | % | |

| 7.0 | | |

| 7.0 | | |

| 2.1 | | |

| 4.9 | | |

Over the course of the next four years |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| Total | |

| 100 | % | |

| 70.0 | | |

| 70.0 | | |

| 21.1 | | |

| 48.9 | | |

|

Dividend

The Board did not

recommend the distribution of a final dividend for the year ended December 31, 2023.

Important

Events after the Reporting Period

No important events

affecting the Group occurred since December 31, 2023 and up to the date of this preliminary results announcement.

Contingencies

As disclosed in

the announcement of the Company dated July 26, 2023 and in the Form 20-F of the Company for the fiscal year 2022 which was

published on April 26, 2023, the Company was named as a defendant in a putative securities class action lawsuit initiated in August 2022.

The Company filed a motion to dismiss the action in May 2023. On March 5, 2024 (U.S. Eastern Time), the court entered an order

granting the Company’s motion to dismiss in part and denying it in part. As of the date of this announcement, the lawsuit is still

ongoing.

Publication

of Preliminary Annual Results Announcement and Annual Report

This preliminary

results announcement is published on the website of the Hong Kong Stock Exchange at http://www.hkexnews.hk and on the website

of the Company at https://ir.tuya.com. The annual report of the Company for the Reporting Period containing all the information

required by the Listing Rules will be dispatched to the shareholders and will be made available on the websites of the Company and

the Hong Kong Stock Exchange in due course.

About Tuya

Inc.

Tuya Inc. is a

global leading IoT cloud development platform with a mission to build an IoT developer ecosystem and enable everything to be smart. Tuya

has pioneered a purpose-built IoT cloud development platform that delivers a full suite of offerings, including Platform-as-a-Service,

or PaaS, and Software-as-a-Service, or SaaS, to businesses and developers. Through its IoT cloud development platform, Tuya has enabled

developers to activate a vibrant IoT ecosystem of brands, OEMs, partners and end users to engage and communicate through a broad range

of smart devices.

Use of Non-GAAP

Financial Measures

In evaluating the

business, the Company considers and uses non-GAAP financial measures, such as non-GAAP operating expenses, non-GAAP loss from operations

(including non-GAAP operating margin), non-GAAP net (loss)/profit (including non-GAAP net margin), and non-GAAP basic and diluted net

(loss)/profit per ADS, as supplemental measures to review and assess its operating performance. The presentation of non-GAAP financial

measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance

with generally accepted accounting principles in the United States of America (“U.S. GAAP”). The Company defines non-GAAP

financial measures by excluding the impact of share-based compensation expenses and credit-related impairment of long-term investments

from the respective GAAP financial measures. The Company presents the non-GAAP financial measures because they are used by the management

to evaluate its operating performance and formulate business plans. The Company also believes that the use of the non-GAAP financial

measures facilitates investors’ assessment of its operating performance.

Non-GAAP financial

measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. Non-GAAP financial measures have limitations

as analytical tools. One of the key limitations of using the aforementioned non-GAAP financial measures is that they do not reflect all

items of expenses that affect the Group’s operations. Share-based compensation expenses and credit-related impairment of long-term

investments have been and may continue to be incurred in the business and are not reflected in the presentation of non-GAAP measures.

Further, the non-GAAP financial measures may differ from the non-GAAP information used by other companies, including peer companies,

and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP measures

to the most directly comparable U.S. GAAP measures, all of which should be considered when evaluating the Group’s performance.

The Company encourages you to review its financial information in its entirety and not rely on a single financial measure.

The unaudited reconciliations

of Tuya’s non-GAAP measures to the most comparable U.S. GAAP measures are included at the end of this preliminary results announcement.

Safe Harbor

Statement

This preliminary

results announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of

the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the Company’s

beliefs, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a

number of factors could cause actual results to differ materially from those contained in any forward-looking statement. In some cases,

forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”,

“anticipate”, “target”, “aim”, “estimate”, “intend”, “plan”,

“believe”, “potential”, “continue”, “is/are likely to” or other similar expressions.

Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the United

States Securities and Exchange Commission. The forward-looking statements included in this preliminary results announcement are only

made as of the date hereof, and the Company disclaims any obligation to publicly update any forward-looking statement to reflect subsequent

events or circumstances, except as required by law. All forward-looking statements should be evaluated with the understanding of their

inherent uncertainty.

| |

By order of the

Board |

| |

Tuya Inc. |

| |

WANG Xueji |

| |

Chairman |

Hong Kong, March 11,

2024

As at the date

of this preliminary results announcement, the Board comprises Mr. WANG Xueji, Mr. CHEN Liaohan, Mr. YANG Yi and Ms. LIU

Yao as executive Directors; and Mr. HUANG Sidney Xuande, Mr. QIU Changheng, Mr. KUOK Meng Xiong (alias GUO Mengxiong)

and Mr. YIP Pak Tung Jason as independent non-executive Directors.

TUYA INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF DECEMBER 31, 2022 AND 2023

(All amounts in US$ thousands (“US$”),

except for share and per share data, unless

otherwise noted)

| | |

Note | |

As of

December 31,

2022 | | |

As of

December 31,

2023 | |

| ASSETS | |

| |

| | | |

| | |

| Current assets | |

| |

| | | |

| | |

| Cash and cash equivalents | |

| |

| 133,161 | | |

| 498,688 | |

| Short-term investments | |

| |

| 821,134 | | |

| 291,023 | |

| Accounts receivable, net | |

7 | |

| 12,172 | | |

| 9,214 | |

| Notes receivable, net | |

| |

| 2,767 | | |

| 4,955 | |

| Inventories, net | |

| |

| 45,380 | | |

| 32,865 | |

| Prepayments and other current assets, net | |

| |

| 8,752 | | |

| 11,053 | |

| | |

| |

| | | |

| | |

| Total current assets | |

| |

| 1,023,366 | | |

| 847,798 | |

| | |

| |

| | | |

| | |

| Non-current assets | |

| |

| | | |

| | |

| Property, equipment and software, net | |

| |

| 3,827 | | |

| 2,589 | |

| Operating lease right-of-use assets, net | |

| |

| 9,736 | | |

| 7,647 | |

| Long-term investments | |

| |

| 18,031 | | |

| 207,489 | |

| Other non-current assets, net | |

| |

| 1,179 | | |

| 877 | |

| | |

| |

| | | |

| | |

| Total non-current assets | |

| |

| 32,773 | | |

| 218,602 | |

| | |

| |

| | | |

| | |

| Total assets | |

| |

| 1,056,139 | | |

| 1,066,400 | |

| | |

| |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| |

| | | |

| | |

| Current liabilities | |

| |

| | | |

| | |

| Accounts payable | |

8 | |

| 9,595 | | |

| 11,577 | |

| Advance from customers | |

| |

| 27,633 | | |

| 31,776 | |

| Deferred revenue, current | |

| |

| 6,821 | | |

| 6,802 | |

| Accruals and other current liabilities | |

| |

| 33,383 | | |

| 32,807 | |

| Incomes tax payables | |

| |

| – | | |

| 689 | |

| Lease liabilities, current | |

| |

| 3,850 | | |

| 3,883 | |

| | |

| |

| | | |

| | |

| Total current liabilities | |

| |

| 81,282 | | |

| 87,534 | |

TUYA INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(CONTINUED)

AS OF DECEMBER 31, 2022 AND 2023

(All amounts in US$ thousands (“US$”),

except for share and per share data, unless

otherwise noted)

| | |

Note | |

As of

December 31,

2022 | | |

As of

December 31,

2023 | |

| Non-current liabilities | |

| |

| | | |

| | |

| Lease liabilities, non-current | |

| |

| 5,292 | | |

| 3,904 | |

| Deferred revenue, non-current | |

| |

| 394 | | |

| 506 | |

| Other non-current liability | |

| |

| 7,004 | | |

| 3,891 | |

| | |

| |

| | | |

| | |

| Total non-current liabilities | |

| |

| 12,690 | | |

| 8,301 | |

| | |

| |

| | | |

| | |

| Total liabilities | |

| |

| 93,972 | | |

| 95,835 | |

| | |

| |

| | | |

| | |

| Shareholders’ equity | |

| |

| | | |

| | |

| Ordinary shares | |

| |

| – | | |

| – | |

| Class A ordinary shares | |

| |

| 25 | | |

| 25 | |

| Class B ordinary shares | |

| |

| 4 | | |

| 4 | |

| Treasury stock | |

| |

| (86,438 | ) | |

| (53,630 | ) |

| Additional paid-in capital | |

| |

| 1,584,764 | | |

| 1,616,105 | |

| Accumulated other comprehensive loss | |

| |

| (22,115 | ) | |

| (17,091 | ) |

| Accumulated deficit | |

| |

| (514,073 | ) | |

| (574,848 | ) |

| | |

| |

| | | |

| | |

| Total shareholders’ equity | |

| |

| 962,167 | | |

| 970,565 | |

| | |

| |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

| |

| 1,056,139 | | |

| 1,066,400 | |

TUYA INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE LOSS

(All amounts in US$ thousands (“US$”),

except for share and per share data, unless

otherwise noted)

| | |

| |

For the Year Ended

December 31, | |

| | |

Note | |

2022 | | |

2023 | |

| Revenue | |

3 | |

| 208,172 | | |

| 229,990 | |

| Cost of revenue | |

| |

| (118,749 | ) | |

| (123,335 | ) |

| | |

| |

| | | |

| | |

| Gross profit | |

| |

| 89,423 | | |

| 106,655 | |

| | |

| |

| | | |

| | |

| Operating expenses: | |

| |

| | | |

| | |

| Research and development expenses | |

| |

| (144,942 | ) | |

| (102,277 | ) |

| Sales and marketing expenses | |

| |

| (55,662 | ) | |

| (40,440 | ) |

| General and administrative expenses | |

| |

| (67,513 | ) | |

| (80,663 | ) |

| Other operating incomes, net | |

| |

| 10,508 | | |

| 10,901 | |

| | |

| |

| | | |

| | |

| Total operating expenses | |

| |

| (257,609 | ) | |

| (212,479 | ) |

| | |

| |

| | | |

| | |

| Loss from operations | |

| |

| (168,186 | ) | |

| (105,824 | ) |

| | |

| |

| | | |

| | |

| Other income | |

| |

| | | |

| | |

| Other non-operating incomes, net | |

| |

| 2,904 | | |

| 3,113 | |

| Financial income, net | |

| |

| 18,546 | | |

| 44,976 | |

| Foreign exchange gain, net | |

| |

| 2,441 | | |

| 669 | |

| | |

| |

| | | |

| | |

| Loss before income tax expense | |

| |

| (144,295 | ) | |

| (57,066 | ) |

| Income tax expense | |

4 | |

| (1,880 | ) | |

| (3,249 | ) |

| | |

| |

| | | |

| | |

| Net loss | |

| |

| (146,175 | ) | |

| (60,315 | ) |

| | |

| |

| | | |

| | |

| Net loss attributable to Tuya Inc. | |

| |

| (146,175 | ) | |

| (60,315 | ) |

| | |

| |

| | | |

| | |

| Net loss attributable to ordinary shareholders | |

| |

| (146,175 | ) | |

| (60,315 | ) |

TUYA INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE LOSS (CONTINUED)

(All amounts in US$ thousands (“US$”),

except for share and per share data, unless

otherwise noted)

| | |

| |

For the Year Ended

December 31, | |

| | |

Note | |

2022 | | |

2023 | |

| Net loss | |

| |

| (146,175 | ) | |

| (60,315 | ) |

| | |

| |

| | | |

| | |

| Other comprehensive (loss)/income | |

| |

| | | |

| | |

| Changes in fair value of long-term investments | |

| |

| (9,493 | ) | |

| (7,791 | ) |

| Transfer out of

fair value changes of long-term investments | |

| |

| – | | |

| 15,537 | |

| Foreign currency translation | |

| |

| (14,942 | ) | |

| (2,722 | ) |

| | |

| |

| | | |

| | |

| Total comprehensive loss attributable to Tuya Inc. | |

| |

| (170,610 | ) | |

| (55,291 | ) |

| | |

| |

| | | |

| | |

| Net loss attributable to Tuya Inc. | |

| |

| (146,175 | ) | |

| (60,315 | ) |

| | |

| |

| | | |

| | |

| Net loss attributable to ordinary shareholders | |

| |

| (146,175 | ) | |

| (60,315 | ) |

| | |

| |

| | | |

| | |

| Weighted average number of ordinary shares used in computing net loss per share, basic and diluted | |

6 | |

| 553,527,529 | | |

| 555,466,061 | |

| | |

| |

| | | |

| | |

| Net loss per share attributable to ordinary shareholders, basic and diluted | |

6 | |

| (0.26 | ) | |

| (0.11 | ) |

| | |

| |

| | | |

| | |

| Share-based compensation expenses were included in: | |

| |

| | | |

| | |

| Research and development expenses | |

| |

| 14,692 | | |

| 14,734 | |

| Sales and marketing expenses | |

| |

| 6,825 | | |

| 5,446 | |

| General and administrative expenses | |

| |

| 47,502 | | |

| 45,036 | |

TUYA INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(All amounts in US$ thousands (“US$”),

except for share and per share data, unless

otherwise noted)

| | |

| |

For the Year Ended

December 31, | |

| | |

Note | |

2022 | | |

2023 | |

| Net cash (used in)/generated from operating activities | |

| |

| (70,654 | ) | |

| 36,443 | |

| Net cash (used in)/generated from investing activities | |

| |

| (714,225 | ) | |

| 332,455 | |

| Net cash used in financing activities | |

| |

| (38,582 | ) | |

| (2,223 | ) |

| Effect of exchange rate changes on cash and cash equivalents, restricted cash | |

| |

| (7,954 | ) | |

| (1,148 | ) |

| | |

| |

| | | |

| | |

| Net (decrease)/increase in cash and cash equivalents, restricted cash | |

| |

| (831,415 | ) | |

| 365,527 | |

| | |

| |

| | | |

| | |

| Cash and cash equivalents, restricted cash at the beginning of year | |

| |

| 964,576 | | |

| 133,161 | |

| | |

| |

| | | |

| | |

| Cash and cash equivalents, restricted cash at the end of year | |

| |

| 133,161 | | |

| 498,688 | |

NOTES TO THE UNAUDITED FINANCIAL INFORMATION:

Tuya Inc. (the “Company”)

was incorporated under the laws of the Cayman Islands on August 28, 2014, as an exempted company with limited liability. The Company

and its subsidiaries and consolidated variable interest entity (“VIE”) (collectively referred to as the “Group”)

are principally engaged in offering PaaS (Platform-as-a-Service) to business customers developing IoT (Internet of Things) devices, including

brands and their OEMs (original equipment manufacturer). Also, the Group offers Industry SaaS (Software-as-a-Service) and cloud-based

value-added services to its customers. The Group also sells finished smart devices powered by Tuya purchased from qualified OEMs (the

“Smart device distribution”).

Prior to the incorporation of Tuya Inc.

in August 2014, the Group commenced its initial operations through Hangzhou Tuya Technology Co., Ltd. (“Hangzhou Tuya

Technology”), which was established on June 16, 2014 by Wang Xueji and another individual. After a series of agreements,

Hangzhou Tuya Technology was owned by Wang Xueji and other four individuals (collectively, the “Registered Shareholders”)

together with two unrelated investors of Series Angel financing (the “Non-Registered Shareholders VIE Investors”)

by August 2014. In December 2014, Hangzhou Tuya Information Technology Co., Ltd. (“the WFOE”) was established

after the incorporation of Tuya Inc. The Group then entered into a series of contractual arrangements among the WFOE, Hangzhou Tuya Technology

and Hangzhou Tuya Technology’s shareholders in December 2014, and thereafter Hangzhou Tuya Technology (the “VIE”)

became the variable interest entity of the Group. The VIE was controlled by Wang Xueji before and after this transaction. After the completion

of this transaction, the Group’s consolidated financial statements include the financial statements of the Company, its subsidiaries

and the consolidated VIE. In 2019, the VIE agreements were amended and restated, which amended the VIE’s shareholders list and equity

interest of each shareholder as a result of the change in registered share capital of the VIE and exit of Non-Registered Shareholders

VIE Investors as the VIE’s shareholders. The contractual arrangements were further amended and restated in January 2022.

The VIE operated de minimis business

activities and had no material impact on the Company’s financial position, results of operations or cash flows for the years ended

December 31, 2022 and 2023.

The consolidated financial statements

of the Group have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S.

GAAP”) to reflect the financial position, results of operations and cash flows of the Group. The accounting policies applied

are consistent with those of the unaudited consolidated financial statements for the preceding fiscal year.

The Group’s revenue was disaggregated

by its major revenue streams in the years presented as follows:

| | |

Year Ended December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| IoT PaaS | |

| 152,914 | | |

| 167,694 | |

| Smart device distribution | |

| 25,446 | | |

| 26,517 | |

| SaaS and others | |

| 29,812 | | |

| 35,779 | |

| | |

| | | |

| | |

| Total revenue | |

| 208,172 | | |

| 229,990 | |

Cayman Islands

Under the current tax laws of Cayman

Islands, the Company is not subject to income, corporation or capital gains tax, and no withholding tax is imposed upon the payment of

dividends.

British Virgin

Islands

Under the current laws of the British

Virgin Islands, entities incorporated in the British Virgin Islands are not subject to tax on their income or capital gains.

Hong Kong

Under the current Hong Kong Inland Revenue

Ordinance, the Group’s subsidiaries in Hong Kong are subject to 16.5% Hong Kong profit tax on its taxable income generated from

operations in Hong Kong.

PRC

PRC Enterprise

Income Tax (“EIT”)

On March 16, 2007, the National

People’s Congress of PRC enacted the Enterprise Income Tax Law (the “new CIT Law”), under which foreign invested

enterprises (“FIEs”) and domestic companies would be subject to enterprise income tax (“EIT”) at

a uniform rate of 25%. The new CIT law became effective on January 1, 2008. In accordance with the implementation rules of EIT

Law, a qualified “High and New Technology Enterprise” (“HNTE”) is eligible for a preferential tax rate

of 15%. The HNTE certificate is effective for a period of three years. An entity could re-apply for the HNTE certificate when the prior

certificate expires.

The WFOE (Hangzhou Tuya Information

Technology Co., Ltd.) obtained its HNTE certificate with a valid period of six years from years ended December 31, 2018 to 2024,

and renewed in 2022 with a valid period of three years from years ended December 31, 2022 to 2024. Therefore, the WFOE is eligible

to enjoy a preferential tax rate of 15% during each of the years the certificate is valid, to the extent it has taxable income under the

EIT Law, and as long as it maintains the HNTE qualification and duly conducts relevant EIT filing procedures with the relevant tax authority.

PRC Withholding

Income Tax on Dividends

The EIT Law also provides that an enterprise

established under the laws of a foreign country or region but whose “de facto management body” is located in the PRC be treated

as a resident enterprise for PRC tax purposes and consequently be subject to the PRC income tax at the rate of 25% for its global income.

The implementing Rules of the EIT Law merely define the location of the “de facto management body” as “the place

where the exercising, in substance, of the overall management and control of the production and business operation, personnel, accounting,

properties, etc., of a non-PRC company is located.”

The EIT Law also imposes a withholding

income tax of 10% on dividends distributed by a FIE to its immediate holding company outside of China, if such immediate holding company

is considered as a non-resident enterprise without any establishment or place within China or if the received dividends have no connection

with the establishment or place of such immediate holding company within China, unless such immediate holding company’s jurisdiction

of incorporation has a tax treaty with China that provides for a different withholding arrangement. According to the arrangement between

Mainland China and Hong Kong Special Administrative Region on the Avoidance of Double Taxation and Prevention of Fiscal Evasion in August 2006,

dividends paid by a FIE in China to its immediate holding company in Hong Kong can be subject to withholding tax at a rate of no more

than 5% if the immediate holding company in Hong Kong owns directly at least 25% of the shares of the FIE, and could be recognized as

a Beneficial Owner of the dividend from PRC tax perspective.

As of December 31, 2022 and 2023,

the Company did not record any withholding tax on the retained earnings of its subsidiaries in the PRC as the Group does not have any

plan to require its PRC subsidiaries to distribute their retained earnings and intends to retain them to operate and expand its business

in the PRC.

United States

The Company’s subsidiary in California,

United States is subject to U.S. federal corporate tax and California corporate franchise tax on its taxable income as reported in its

statutory financial statements adjusted in accordance with relevant U.S. tax laws. The applicable U.S. federal corporate tax rate is 21%

and the California corporate franchise tax rate is 8.84% or minimum of $0.8, whatever is larger in 2022 and 2023.

On December 22, 2017, the U.S.

government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”).

The Tax Act makes broad and complex changes to the U.S. tax code including, but not limited to: (1) reducing the U.S. federal corporate

tax rate from 35% to 21%; (2) requiring companies to pay a one-time transition tax on certain unrepatriated earnings of foreign subsidiaries;

(3) generally eliminating U.S. federal income taxes on dividends from foreign subsidiaries; (4) requiring a current inclusion

in U.S. federal taxable income of certain earnings of controlled foreign corporations; (5) eliminating the corporate alternative

minimum tax (“AMT”) and changing how existing AMT credits can be realized; (6) creating the base erosion anti-abuse

tax (“BEAT”), a new minimum tax; (7) creating a new limitation on deductible interest expense; and (8) changing

rules related to uses and limitations of net operating loss carry-forwards created in tax years beginning after December 31,

2017. In addition, the California corporate franchise tax remained the same after the enactment of the Tax Act. The Company assessed the

impact of Tax Act and concluded that it was not material to the Company.

As the Group incurred income tax expense

mainly from PRC tax jurisdictions, the following information is based mainly on PRC income taxes.

Composition of

income tax expense

The components of loss before tax are

as follow:

| | |

Year Ended December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| Loss before tax | |

| | | |

| | |

| Loss from PRC entities | |

| (143,951 | ) | |

| (71,249 | ) |

| (Loss)/profit from overseas entities | |

| (344 | ) | |

| 14,183 | |

| | |

| | | |

| | |

| Total loss before tax | |

| (144,295 | ) | |

| (57,066 | ) |

| | |

Year Ended December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| Current income tax expense | |

| 1,880 | | |

| 3,249 | |

| Deferred income tax | |

| – | | |

| – | |

| | |

| | | |

| | |

| Total income tax expense | |

| 1,880 | | |

| 3,249 | |

Reconciliation of the differences between

statutory tax rate and the effective tax rate.

Reconciliation of the differences between

the statutory EIT rate applicable to losses of the consolidated entities and the income tax expenses of the Group:

| | |

Year Ended December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| PRC Statutory income tax rate | |

| 25.0 | % | |

| 25.0 | % |

| Effect of tax rates in different tax jurisdiction | |

| (0.3 | )% | |

| (2.5 | )% |

| Effect of preferential tax rate for qualified HNTE entities (1) | |

| (6.0 | )% | |

| (5.4 | )% |

| Additional deduction for research and development expenditures | |

| 8.5 | % | |

| 17.7 | % |

| Share-based compensation expenses | |

| (10.5 | )% | |

| (19.7 | )% |

| Permanent book-tax differences | |

| (1.4 | )% | |

| 1.6 | % |

| Change in valuation allowance (2) | |

| (16.6 | )% | |

| (22.4 | )% |

| | |

| | | |

| | |

| Effective tax rates | |

| (1.3 | )% | |

| (5.7 | )% |

| (1) | The effect of the preferential income tax rate that the WFOE is entitled to enjoy as a qualified HNTE

is 15%. |

| (2) | Valuation allowance for the years ended December 31, 2022 and 2023 are related to the deferred tax

assets of certain group entities which reported losses. The Group believes that it is more likely than not that the deferred tax assets

of these entities will not be utilized. Therefore, valuation allowance has been provided. |

Deferred tax

assets and deferred tax liabilities

The following table sets forth the significant

components of the deferred tax assets:

| | |

As of December 31, | |

| | |

2021 | | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | | |

US$ | |

| Deferred tax assets | |

| | | |

| | | |

| | |

| Net accumulated losses-carry forward | |

| 76,944 | | |

| 103,231 | | |

| 114,958 | |

| Payroll liabilities | |

| 5,438 | | |

| 2,915 | | |

| 2,451 | |

| Credit-related impairment of long-term investments | |

| – | | |

| – | | |

| 1,421 | |

| Inventory write-downs | |

| 402 | | |

| 691 | | |

| 531 | |

| Receivables allowances | |

| 171 | | |

| 42 | | |

| 279 | |

| Other deductible temporary difference | |

| 9 | | |

| 88 | | |

| 106 | |

| Less: valuation allowance | |

| (82,964 | ) | |

| (106,967 | ) | |

| (119,746 | ) |

| | |

| | | |

| | | |

| | |

| Total deferred tax assets | |

| – | | |

| – | | |

| – | |

As of December 31, 2023, the Group

had tax losses carry forwards of approximately US$608,109, which mainly arose from its subsidiaries established in the PRC. These tax

losses carry forwards from PRC entities will expire during the period from 2024 to 2033 as follows:

| At December 31, 2023 | |

US$ | |

| 2024 | |

| 227 | |

| 2025 | |

| 59,719 | |

| 2026 | |

| 106,030 | |

| 2027 | |

| 50,463 | |

| 2028 | |

| 59,405 | |

| 2029 | |

| 68,687 | |

| 2030 | |

| 37,607 | |

| 2031 | |

| 34,690 | |

| 2032 | |

| 98,215 | |

| 2033 | |

| 36,502 | |

| | |

| | |

| Total tax losses carry forwards | |

| 551,545 | |

Movement of valuation allowance

| | |

As of December 31, | |

| | |

2021 | | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | | |

US$ | |

| Balance at beginning of the year | |

| 37,405 | | |

| 82,964 | | |

| 106,967 | |

| Changes of valuation allowance (1) | |

| 45,559 | | |

| 24,003 | | |

| 12,779 | |

| | |

| | | |

| | | |

| | |

| Balance at end of the year | |

| 82,964 | | |

| 106,967 | | |

| 119,746 | |

| (1) | Valuation allowances have been provided against deferred tax assets when the Group determines that it

is more likely than not that the deferred tax assets will not be utilized in the future. In making such determination, the Group evaluates

a variety of factors including the Group’s entities’ operating history, accumulated deficit, existence of taxable temporary

differences and reversal periods. As of December 31, 2022 and 2023, full valuation allowances on deferred tax assets were provided

because it was more likely than not that the Group will not be able to utilize tax loss carry forwards and other temporary tax difference

generated by its unprofitable subsidiaries and the VIE. |

The board of directors of the Company

did not recommend the distribution of any annual dividend for the years ended December 31, 2022 and 2023. No dividend was paid for

the years ended December 31, 2022 and 2023.

| 6. | BASIC AND DILUTED NET LOSS PER SHARE |

Basic and diluted loss per share have

been calculated in accordance with ASC 260 on computation of earnings (loss) per share for each of the years ended December 31, 2022

and 2023 are calculated as follows:

| | |

Year Ended December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| Basic and diluted net loss per share calculation Numerator: | |

| | | |

| | |

| Net loss attributable to Tuya Inc.’s ordinary shareholders, basic and diluted | |

| (146,175 | ) | |

| (60,315 | ) |

| | |

| | | |

| | |

| Denominator: | |

| | | |

| | |

| Weighted-average ordinary shares outstanding, basic and diluted | |

| 553,527,529 | | |

| 555,466,061 | |

| | |

| | | |

| | |

| Net loss per share attributable to ordinary shareholders: | |

| | | |

| | |

| – Basic and Diluted | |

| (0.26 | ) | |

| (0.11 | ) |

| 7. | ACCOUNTS RECEIVABLE, NET |

| | |

As of December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| Accounts receivable, gross | |

| 13,955 | | |

| 12,581 | |

| Less: allowance for doubtful accounts | |

| (1,783 | ) | |

| (3,367 | ) |

| | |

| | | |

| | |

| Total accounts receivable, net | |

| 12,172 | | |

| 9,214 | |

The Group recorded the allowance for

doubtful accounts of US$288 for the year ended December 31, 2022.

The Group recorded the allowance for

credit losses of US$1,530 and write off the allowance for credit losses of US$304 under ASU 2016-13 Financial instruments – credit

losses for the year ended December 31, 2023.

An aging analysis based on relevant

invoice dates is as follows:

| | |

As of December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| 0-3 months | |

| 7,033 | | |

| 5,518 | |

| 3-6 months | |

| 1,754 | | |

| 1,002 | |

| 6-12 months | |

| 3,031 | | |

| 2,238 | |

| Over 1 year | |

| 2,137 | | |

| 3,823 | |

| | |

| | | |

| | |

| Total accounts receivable, gross | |

| 13,955 | | |

| 12,581 | |

| | |

As of December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| Total accounts payable | |

| 9,595 | | |

| 11,577 | |

An aging analysis based on relevant

invoice dates as follows:

| | |

As of December 31, | |

| | |

2022 | | |

2023 | |

| | |

US$ | | |

US$ | |

| 0-3 months | |

| 8,594 | | |

| 11,153 | |

| 3-6 months | |

| 206 | | |

| 44 | |

| 6-12 months | |

| 615 | | |

| 58 | |

| Over 1 year | |

| 180 | | |

| 322 | |

| | |

| | | |

| | |

| Total accounts payable | |

| 9,595 | | |

| 11,577 | |

END OF NOTES TO UNAUDITED FINANCIAL

INFORMATION.

TUYA INC.

UNAUDITED RECONCILIATION OF NON-GAAP MEASURES

TO THE MOST DIRECTLY COMPARABLE U.S. GAAP MEASURES

(All amounts in US$ thousands (“US$”),

except for share and per share data, unless

otherwise noted)

| | |

For the Year Ended December 31, | |

| | |

2022 | | |

2023 | |

| Reconciliation of operating expenses to non-GAAP operating expenses | |

| | | |

| | |

| Research and development expenses | |

| (144,942 | ) | |

| (102,277 | ) |

| Add: Share-based compensation expenses | |

| 14,692 | | |

| 14,734 | |

| Adjusted Research and development expenses | |

| (130,250 | ) | |

| (87,543 | ) |

| | |

| | | |

| | |

| Sales and marketing expenses | |

| (55,662 | ) | |

| (40,440 | ) |

| Add: Share-based compensation expenses | |

| 6,825 | | |

| 5,446 | |

| Adjusted Sales and marketing expenses | |

| (48,837 | ) | |

| (34,994 | ) |

| | |

| | | |

| | |

| General and administrative expenses | |

| (67,513 | ) | |

| (80,663 | ) |

| Add: Share-based compensation expenses | |

| 47,502 | | |

| 45,036 | |

| Add: Credit-related impairment of long-term investments | |

| – | | |

| 15,537 | |

| Adjusted General and administrative expenses | |

| (20,011 | ) | |

| (20,090 | ) |

| | |

| | | |

| | |

| Reconciliation of loss from operations to non-GAAP loss from operations | |

| | | |

| | |

| Loss from operations | |

| (168,186 | ) | |

| (105,824 | ) |

| Add: Share-based compensation expenses | |

| 69,019 | | |

| 65,216 | |

| Add: Credit-related impairment of long-term investments | |

| – | | |

| 15,537 | |

| Non-GAAP Loss from operations | |

| (99,167 | ) | |

| (25,071 | ) |

| | |

| | | |

| | |

| Non-GAAP Operating margin | |

| (47.6 | )% | |

| (10.9 | )% |

| | |

| | | |

| | |

| Reconciliation of net loss to non-GAAP net (loss)/profit | |

| | | |

| | |

| Net loss | |

| (146,175 | ) | |

| (60,315 | ) |

| Add: Share-based compensation expenses | |

| 69,019 | | |

| 65,216 | |

| Add: Credit-related impairment of long-term investments | |

| – | | |

| 15,537 | |

| Non-GAAP Net (loss)/profit | |

| (77,156 | ) | |

| 20,438 | |

| | |

| | | |

| | |

| Non-GAAP Net margin | |

| (37.1 | )% | |

| 8.9 | % |

| | |

| | | |

| | |

| Weighted average number of ordinary shares used in computing non-GAAP net loss per share | |

| | | |

| | |

| – Basic | |

| 553,527,529 | | |

| 555,466,061 | |

| | |

| | | |

| | |

| – Diluted | |

| 553,527,529 | | |

| 586,431,849 | |

| | |

| | | |

| | |

| Non-GAAP net (loss)/profit per share attributable to ordinary shareholders | |

| | | |

| | |

| – Basic | |

| (0.14 | ) | |

| 0.04 | |

| | |

| | | |

| | |

| – Diluted | |

| (0.14 | ) | |

| 0.03 | |

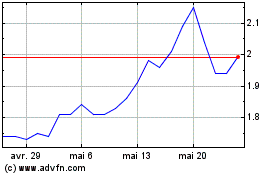

Tuya (NYSE:TUYA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Tuya (NYSE:TUYA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024