Computer Modelling Group Ltd. (“CMG” or the “Company”) announces

its financial results for the three and six months ended September

30, 2021.

Quarterly Performance

| |

Fiscal 2020 |

Fiscal 2021 |

Fiscal 2022 |

| $

thousands, unless otherwise stated) |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

| Annuity/maintenance license

revenue |

16,612 |

15,233 |

14,523 |

14,144 |

13,477 |

13,790 |

12,286 |

13,239 |

| Perpetual license revenue |

964 |

1,403 |

- |

1,775 |

660 |

1,184 |

125 |

846 |

|

Software license revenue |

17,576 |

16,636 |

14,523 |

15,919 |

14,137 |

14,974 |

12,411 |

14,085 |

|

Professional services |

1,699 |

1,879 |

2,149 |

1,933 |

1,901 |

1,827 |

2,003 |

1,864 |

| Total revenue |

19,275 |

18,515 |

16,672 |

17,852 |

16,038 |

16,801 |

14,414 |

15,949 |

| Operating profit |

7,538 |

7,802 |

5,711 |

9,861 |

8,437 |

6,556 |

5,573 |

5,440 |

| Operating profit (%) |

39 |

42 |

34 |

55 |

53 |

39 |

39 |

34 |

| Profit before income and other

taxes |

7,054 |

9,613 |

4,405 |

9,360 |

7,410 |

5,747 |

4,827 |

5,321 |

| Income and other taxes |

1,942 |

2,550 |

1,143 |

2,600 |

1,535 |

1,454 |

1,094 |

1,175 |

| Net income for the period |

5,112 |

7,063 |

3,262 |

6,760 |

5,875 |

4,293 |

3,733 |

4,146 |

| EBITDA(1) |

8,644 |

8,923 |

6,767 |

10,933 |

9,509 |

7,627 |

6,596 |

6,473 |

| Cash dividends declared and

paid |

8,025 |

8,024 |

4,013 |

4,013 |

4,015 |

4,014 |

4,015 |

4,016 |

| Funds flow from

operations |

7,366 |

7,515 |

4,703 |

7,991 |

7,322 |

6,267 |

4,811 |

4,904 |

| Free

cash flow(1) |

6,726 |

6,840 |

4,239 |

7,474 |

7,005 |

5,755 |

4,478 |

4,494 |

| Per share amounts –

($/share) |

|

|

|

|

|

|

|

|

| Earnings per share (EPS) –

basic and diluted |

0.06 |

0.09 |

0.04 |

0.08 |

0.07 |

0.05 |

0.05 |

0.05 |

| Cash dividends declared and

paid |

0.10 |

0.10 |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

| Funds flow from operations per

share - basic |

0.09 |

0.09 |

0.06 |

0.10 |

0.09 |

0.08 |

0.06 |

0.06 |

| Free

cash flow per share – basic(1) |

0.08 |

0.09 |

0.05 |

0.09 |

0.09 |

0.07 |

0.06 |

0.06 |

(1) Non-IFRS financial measures are defined in the “Non-IFRS

Financial Measures” section.

Commentary on Quarterly

Performance

|

For the Three Months Ended |

For the Six Months Ended |

|

September 30, 2021 and compared to the same period of the previous

fiscal year, when appropriate: |

|

|

| • Annuity/maintenance license

revenue decreased by 6%; |

• Annuity/maintenance license

revenue decreased by 11%; |

| • Total revenue decreased by

11%; |

• Total revenue decreased by

12%; |

| • CMG signed a multi-year

agreement for CoFlow annuity licensing, the largest agreement for

CoFlow commercial use to date; |

|

| • Total operating expenses

increased by 32%. Adjusted for a one-time restructuring charge in

the current quarter and a CEWS benefit included in the prior year

quarter, operating expenses decreased by 6%, mainly due to lower

stock-based compensation expense as a result of the share price

decrease during the current quarter; |

• Total operating expenses

increased by 2%. Adjusted for the one-time restructuring charge and

CEWS/CERS benefits, operating expenses decreased by 12%, due to

lower stock-based compensation expense, salary reductions and lower

headcount; |

| • Quarterly operating profit

margin was 34%, down from the comparative quarter’s figure of 55%.

Adjusted for the one-time restructuring charge in the current

quarter and a CEWS benefit included in the prior year quarter,

operating profit margin was 39% and 41%, respectively, in line with

the pre-COVID average for fiscal 2019 and fiscal 2020 of 40%; |

• Year-to-date operating profit

margin was 36%, down from the comparative period’s figure of 45%.

Adjusted for the restructuring charge and the CEWS/CERS benefits,

operating profit was 38% in the current year-to-date period and the

prior year period; |

| • Basic EPS of $0.05 was lower

than the comparative quarter’s EPS of $0.08; |

• Basic EPS of $0.10 was lower

than the comparative period’s EPS of $0.12; |

| • Achieved free cash flow per

share of $0.06; |

• Achieved free cash flow per

share of $0.11; |

| • Declared and paid a dividend of

$0.05 per share. |

• Declared and paid dividends of

$0.10 per share. |

Revenue

| Three months ended September

30, |

2021 |

|

2020 |

|

$ change |

% change |

| ($

thousands) |

|

|

|

|

| |

|

|

|

|

|

Software license revenue |

14,085 |

|

15,919 |

|

(1,834 |

) |

-12 |

% |

| Professional services |

1,864 |

|

1,933 |

|

(69 |

) |

-4 |

% |

|

Total revenue |

15,949 |

|

17,852 |

|

(1,903 |

) |

-11 |

% |

| |

|

|

|

|

| Software license revenue as a

% of total revenue |

88 |

% |

89 |

% |

|

|

|

Professional services as a % of total revenue |

12 |

% |

11 |

% |

|

|

| Six months ended September

30, |

2021 |

|

2020 |

|

$ change |

% change |

| ($

thousands) |

|

|

|

|

| |

|

|

|

|

|

Software license revenue |

26,496 |

|

30,442 |

|

(3,946 |

) |

-13 |

% |

| Professional services |

3,867 |

|

4,082 |

|

(215 |

) |

-5 |

% |

|

Total revenue |

30,363 |

|

34,524 |

|

(4,161 |

) |

-12 |

% |

| |

|

|

|

|

| Software license revenue as a

% of total revenue |

87 |

% |

88 |

% |

|

|

|

Professional services as a % of total revenue |

13 |

% |

12 |

% |

|

|

CMG’s revenue is comprised of software license sales, which

provide the majority of the Company’s revenue, and fees for

professional services.

Total revenue for the three and six months ended September 30,

2021 decreased by 11% and 12%, due to decreases in both software

license revenue and professional services revenue.

Software License Revenue

| Three months ended September

30, |

2021 |

|

2020 |

|

$ change |

% change |

| ($

thousands) |

|

|

|

|

| |

|

|

|

|

|

Annuity/maintenance license revenue |

13,239 |

|

14,144 |

|

(905 |

) |

-6 |

% |

| Perpetual license revenue |

846 |

|

1,775 |

|

(929 |

) |

-52 |

% |

|

Total software license revenue |

14,085 |

|

15,919 |

|

(1,834 |

) |

-12 |

% |

| |

|

|

|

|

| Annuity/maintenance as a % of

total software license revenue |

94 |

% |

89 |

% |

|

|

|

Perpetual as a % of total software license revenue |

6 |

% |

11 |

% |

|

|

| Six months ended September

30, |

2021 |

|

2020 |

|

$ change |

% change |

| ($

thousands) |

|

|

|

|

| |

|

|

|

|

| Annuity/maintenance license

revenue |

25,525 |

|

28,667 |

|

(3,142 |

) |

-11 |

% |

| Perpetual license revenue |

971 |

|

1,775 |

|

(804 |

) |

-45 |

% |

|

Total software license revenue |

26,496 |

|

30,442 |

|

(3,946 |

) |

-13 |

% |

| |

|

|

|

|

| Annuity/maintenance as a % of

total software license revenue |

96 |

% |

94 |

% |

|

|

|

Perpetual as a % of total software license revenue |

4 |

% |

6 |

% |

|

|

Total software license revenue for the three and six months

ended September 30, 2021 decreased by 12% and 13%, respectively,

compared to the same periods of the previous fiscal year, due to

decreases in both annuity/maintenance license revenue and perpetual

license revenue.

During the three and six months ended September 30, 2021, CMG’s

annuity/maintenance license revenue decreased by 6% and 11%,

respectively, compared to the same periods of the previous fiscal

year. Canada, the US and the Eastern Hemisphere saw decreases in

licensing, while South America increased primarily due to a

multi-year agreement that includes CoFlow annuity licensing.

Perpetual license revenue decreased 52% and 45% during the three

and six months ended September 30, 2021, respectively.

Software Revenue by Geographic Region

| Three months ended September

30, |

2021 |

2020 |

$ change |

% change |

| ($

thousands) |

|

|

|

|

| Annuity/maintenance

license revenue |

|

|

|

|

|

Canada |

3,088 |

3,143 |

(55 |

) |

-2 |

% |

| United States |

3,089 |

3,649 |

(560 |

) |

-15 |

% |

| South America |

1,817 |

1,702 |

115 |

|

7 |

% |

| Eastern

Hemisphere(1) |

5,245 |

5,650 |

(405 |

) |

-7 |

% |

|

|

13,239 |

14,144 |

(905 |

) |

-6 |

% |

| Perpetual license

revenue |

|

|

|

|

| Canada |

- |

- |

- |

|

0 |

% |

| United States |

96 |

- |

96 |

|

100 |

% |

| South America |

- |

979 |

(979 |

) |

-100 |

% |

| Eastern Hemisphere |

750 |

796 |

(46 |

) |

-6 |

% |

|

|

846 |

1,775 |

(929 |

) |

-52 |

% |

| Total software license

revenue |

|

|

|

|

| Canada |

3,088 |

3,143 |

(55 |

) |

-2 |

% |

| United States |

3,185 |

3,649 |

(464 |

) |

-13 |

% |

| South America |

1,817 |

2,681 |

(864 |

) |

-32 |

% |

| Eastern Hemisphere |

5,995 |

6,446 |

(451 |

) |

-7 |

% |

|

|

14,085 |

15,919 |

(1,834 |

) |

-12 |

% |

| Six months ended September

30, |

2021 |

2020 |

$ change |

% change |

| ($

thousands) |

|

|

|

|

| Annuity/maintenance

license revenue |

|

|

|

|

|

Canada |

6,122 |

6,355 |

(233 |

) |

-4 |

% |

| United States |

6,073 |

7,884 |

(1,811 |

) |

-23 |

% |

| South America |

3,311 |

3,092 |

219 |

|

7 |

% |

| Eastern

Hemisphere(1) |

10,019 |

11,336 |

(1,317 |

) |

-12 |

% |

|

|

25,525 |

28,667 |

(3,142 |

) |

-11 |

% |

| Perpetual license

revenue |

|

|

|

|

| Canada |

- |

- |

- |

|

0 |

% |

| United States |

221 |

- |

221 |

|

100 |

% |

| South America |

- |

979 |

(979 |

) |

-100 |

% |

| Eastern Hemisphere |

750 |

796 |

(46 |

) |

-6 |

% |

|

|

971 |

1,775 |

(804 |

) |

-45 |

% |

| Total software license

revenue |

|

|

|

|

| Canada |

6,122 |

6,355 |

(233 |

) |

-4 |

% |

| United States |

6,294 |

7,884 |

(1,590 |

) |

-20 |

% |

| South America |

3,311 |

4,071 |

(760 |

) |

-19 |

% |

| Eastern Hemisphere |

10,769 |

12,132 |

(1,363 |

) |

-11 |

% |

|

|

26,496 |

30,442 |

(3,946 |

) |

-13 |

% |

(1) Includes Europe, Africa, Asia and Australia.

During the three months ended September 30, 2021, compared to

the same period of the previous fiscal year, total software license

revenue decreased in all geographic regions.

The Canadian region (representing 23% of year-to-date total

software license revenue) experienced slight decreases of 2% and 4%

in annuity/maintenance license revenue during the three and six

months ended September 30, 2021, due to the combined effect of a

couple of non-renewals and reduced licensing by existing customers,

partially offset by increases in licensing by some other

customers.

The United States (representing 24% of year-to-date total

software license revenue) experienced decreases of 15% and 23% in

annuity/maintenance license revenue during the three and six months

ended September 30, 2021, compared to the same periods of the

previous fiscal year. The decrease was largely due to the same

factors that affected the region’s revenue in the previous fiscal

year: consolidation in the industry and reduced licensing due to

ongoing challenges experienced by US unconventional shale plays.

Perpetual sales were up compared to the previous fiscal year.

South America (representing 12% of year-to-date total software

license revenue) experienced an increase of 7% in

annuity/maintenance license revenue during the three and six months

ended September 30, 2021, primarily due to a new multi-year lease

that includes CoFlow.

The Eastern Hemisphere (representing 41% of year-to-date total

software license revenue) experienced decreases of 7% and 12% in

annuity/maintenance license revenue during the three and six months

ended September 30, 2021, due to reduced licensing by some

customers. Perpetual revenue during the three and six months ended

September 30, 2021 was comparable to the same periods of the

previous fiscal year.

Deferred Revenue

| ($

thousands) |

Fiscal 2022 |

|

Fiscal 2021 |

|

Fiscal 2020 |

$ change |

% change |

| Deferred revenue at: |

|

|

|

|

|

|

|

|

Q1 (June 30) |

23,451 |

|

25,492 |

|

|

(2,041 |

) |

-8 |

% |

| Q2 (September 30) |

21,242 |

|

19,549 |

|

|

1,693 |

|

9 |

% |

| Q3 (December 31) |

|

|

15,347 |

|

15,679 |

(332 |

) |

-2 |

% |

| Q4

(March 31) |

|

|

30,461 |

|

33,838 |

(3,377 |

) |

-10 |

% |

CMG’s deferred revenue consists primarily of amounts for prepaid

licenses. Our annuity/maintenance revenue is deferred and

recognized ratably over the license period, which is generally one

year or less. Amounts are deferred for licenses that have been

provided and revenue recognition reflects the passage of time.

The above table illustrates the normal trend in the deferred

revenue balance from the beginning of the calendar year (which

corresponds with Q4 of our fiscal year), when most renewals occur,

to the end of the calendar year (which corresponds with Q3 of our

fiscal year). Our fourth quarter corresponds with the beginning of

the fiscal year for most oil and gas companies, representing a time

when they enter a new budget year and sign/renew their

contracts.

The deferred revenue balance at the end of Q2 of fiscal 2022

increased by 9% compared to Q2 of fiscal 2021 and was positively

affected by early renewals.

Expenses

| Three months ended September

30, |

|

|

2021 |

2020 |

$ change |

% change |

| ($

thousands) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Sales, marketing and professional services |

|

|

3,840 |

3,590 |

250 |

|

7 |

% |

|

Research and development |

|

|

4,656 |

3,107 |

1,549 |

|

50 |

% |

|

General and administrative |

|

|

2,013 |

1,294 |

719 |

|

56 |

% |

|

Total operating expenses |

|

|

10,509 |

7,991 |

2,518 |

|

32 |

% |

|

|

|

|

|

|

|

|

|

Direct employee costs(1) |

|

|

8,579 |

5,714 |

2,865 |

|

50 |

% |

| Other

corporate costs |

|

|

1,930 |

2,277 |

(347 |

) |

-15 |

% |

|

|

|

|

10,509 |

7,991 |

2,518 |

|

32 |

% |

| Six months ended September

30, |

|

|

2021 |

2020 |

$ change |

% change |

| ($

thousands) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Sales, marketing and professional services |

|

|

7,252 |

7,874 |

(622 |

) |

-8 |

% |

|

Research and development |

|

|

8,673 |

8,066 |

607 |

|

8 |

% |

|

General and administrative |

|

|

3,425 |

3,012 |

413 |

|

14 |

% |

|

Total operating expenses |

|

|

19,350 |

18,952 |

398 |

|

2 |

% |

|

|

|

|

|

|

|

|

|

Direct employee costs(1) |

|

|

15,649 |

14,667 |

982 |

|

7 |

% |

| Other

corporate costs |

|

|

3,701 |

4,285 |

(584 |

) |

-14 |

% |

|

|

|

|

19,350 |

18,952 |

398 |

|

2 |

% |

(1) Includes salaries, bonuses, stock-based compensation,

benefits, commissions, and professional development. See “Non-IFRS

Financial Measures”.

Effective July 1, 2021, CMG revised staff compensation,

resulting in partial reinstatements of staff salaries that had been

reduced since July 1, 2020. At the end of the second quarter, CMG

restructured its Calgary office, incurring a one-time restructuring

cost of $0.9 million before tax. The restructuring, net of salary

reinstatements, is expected to result in annual savings of

approximately $0.2 million before tax.

Direct employee costs for the three months ended September 30,

2021 increased by $2.9 million, compared to the same period of the

previous fiscal year. The increase was due mainly to the fact that

the comparative quarter included CEWS benefits of $2.5 million (no

CEWS benefits in the current quarter) and the current quarter

included the aforementioned $0.9 million one-time restructuring

cost, partially offset by lower stock-based compensation expense as

a result of the share price decrease during the current quarter.

Adjusted for the CEWS and the restructuring charge, direct employee

expenses decreased by $0.5 million, or 6%.

Direct employee costs for the six months ended September 30,

2021 increased by $1.0 million, compared to the same period of the

previous fiscal year. The increase was due mainly to the lower CEWS

benefits, the $0.9 million one-time restructuring cost, partially

offset by lower stock-based compensation expense, salary reductions

implemented on July 1, 2020 and lower headcount. Adjusted for the

CEWS and the restructuring charge, direct employee expenses

decreased by $2.1 million, or 12%.

Other corporate costs for the three months ended September 30,

2021 decreased by 15%, compared to the same period of the previous

fiscal year, mainly due to higher SR&ED credits, as explained

in the next section. Other corporate costs for the six months ended

September 30, 2021 decreased by 14%, compared to the same period of

the previous fiscal year, due to a refund of office operating

costs, the CERS benefit received during the first quarter of the

current year and higher SR&ED credits.

Outlook

During the three and six months ended September 30, 2021, CMG’s

annuity/maintenance license revenue decreased by 6% and 11%,

compared to the same periods of the previous fiscal year. While

commodity prices have improved in calendar 2021, annual spending

budgets were set by our customers at the end of calendar 2020, in

the midst of COVID-related cautions and uncertainties, so any

positive effects on CMG’s revenue may be lagged because of the

annual nature of our customers’ budgets.

Geographically, Canada, the US and the Eastern Hemisphere

experienced decreases during the quarter and year to date, compared

to the same periods of the previous fiscal year, as license

reductions that occurred at the beginning of calendar 2021 continue

to negatively affect revenue comparison with the prior year.

South American annuity/maintenance revenue increased by 7%

during the quarter and year to date, the main contributor to the

increase being a multi-year agreement with Petroleo Brasileiro S.A

that includes commercial use of CoFlow. We are excited to focus on

commercial deployments with now both of the original partners of

the CoFlow project. Subsequent to quarter-end, we closed another

deal with a South American customer for commercial licensing of

CoFlow.

In September 2021, CMG and Shell agreed that CMG will add and/or

allocate up to six additional full-time employees in order to

accelerate CoFlow development and support targeted CoFlow

deployments. Shell’s contribution will increase accordingly.

At the end of the second quarter, CMG restructured its Calgary

office, incurring a one-time restructuring cost of $0.9 million

before tax. Effective July 1, 2021, CMG revised staff compensation,

resulting in partial reinstatements of staff salaries that had been

reduced since July 1, 2020. The restructuring, net of salary

reinstatements, is expected to result in annual savings of

approximately $0.2 million before tax. Directors’ cash compensation

reductions and officers’ salary reductions implemented on July 1,

2020 will remain unchanged for the current fiscal year. Our goal is

to continue to defend our margins, while making sure we deliver

reliable and accurate reservoir simulation solutions to our

customers.

Adjusted for the restructuring charge in the current quarter and

the CEWS benefit included in the prior year quarter, total

operating expenses decreased by 6%, compared to the prior year

quarter, mainly due to lower stock-based compensation expense.

Adjusted for the restructuring charge and the CEWS/CERS benefits,

year-to-date total operating expenses decreased by 12%, due to

lower stock-based compensation expense, salary reductions and lower

headcount. For more than one fiscal year now, discretionary

expenses like travel, tradeshows and customer engagement have been

reduced due to pandemic-related restrictions.

Adjusted for the restructuring charge and the CEWS/CERS

benefits, operating profit margin was 39% and 38%, in line with the

pre-COVID fiscal 2019 and fiscal 2020 historic average of 40% and

reflective of our effective cost management.

We continue to maintain a strong financial position. We closed

the quarter with $48.0 million of cash, no debt and no significant

accounts receivable collectability concerns. Basic earnings per

share were $0.05 for the quarter and $0.10 for the year to date.

During the quarter and year to date, we generated free cash flow of

$0.06 and $0.11 per share, respectively. During the three months

ended September 30, 2021, we declared and paid dividends totaling

$0.05 per share.

Energy transition-related modelling (carbon

capture/sequestration and EOR, hydrogen, geothermal and other

processes/mechanisms) has been a bright spot for CMG for the past

year and a half. The current macro focus on energy transition has

generated increased interest in our related training courses and

has also created a number of opportunities that CMG has been able

to capture or pursue. CMG’s existing software has had the technical

capabilities to support energy transition-related modelling for, in

some instances, decades, and we believe that CMG is the

experienced, go-to partner for all of our existing customers, as

well as new entrants that are focused on this area. During the

current quarter, we continued to add new software and consulting

contracts for energy transition and CO2-related work.

Although our results are impacted by the ongoing headwinds

associated with the COVID-19 pandemic, we are seeing recovery in

both oil and gas demand and commodity prices. As market sentiment

improves and our customers adapt to operating in volatile market

conditions, we are focused on returning to growth by working with

our customers in their upcoming annual budget cycles to provide

them with needed solutions. As the market focuses on energy

transition, capital discipline, operational efficiencies and debt

reduction, CMG will be responsive and proactive to our customers’

needs and will support them in improving the value of their assets

by optimizing production and realizing operational cost

efficiencies.

For further details on the results, please refer to CMG's

Management Discussion and Analysis and Consolidated Financial

Statements, which are available on SEDAR at www.sedar.com or on

CMG's website at www.cmgl.ca.

Additional IFRS Measure

Funds flow from operations is an additional IFRS measure that

the Company presents in its consolidated statements of cash flows.

Funds flow from operations is calculated as cash flows provided by

operating activities adjusted for changes in non-cash working

capital. Management believes that this measure provides useful

supplemental information about operating performance and liquidity,

as it represents cash generated during the period, regardless of

the timing of collection of receivables and payment of payables,

which may reduce comparability between periods.

Non-IFRS Financial Measures

Certain financial measures in this press release – namely,

direct employee costs, other corporate costs, EBITDA and free cash

flow – do not have a standard meaning prescribed by IFRS and,

accordingly, may not be comparable to measures used by other

companies. Management believes that these indicators nevertheless

provide useful measures in evaluating the Company’s

performance.

Direct employee costs include salaries, bonuses, stock-based

compensation, benefits, commission expenses, and professional

development. Other corporate costs include facility-related

expenses, corporate reporting, professional services, marketing and

promotion, computer expenses, travel, and other office-related

expenses. Direct employee costs and other corporate costs should

not be considered an alternative to total operating expenses as

determined in accordance with IFRS. People-related costs represent

the Company’s largest area of expenditure; hence, management

considers highlighting separately corporate and direct employee

costs to be important in evaluating the quantitative impact of cost

management of these two major expenditure pools. See “Expenses”

heading for a reconciliation of direct employee costs and other

corporate costs to total operating expenses.

EBITDA refers to net income before adjusting for depreciation

expense, finance income, finance costs, and income and other taxes.

EBITDA should not be construed as an alternative to net income as

determined by IFRS. The Company believes that EBITDA is useful

supplemental information as it provides an indication of the

results generated by the Company’s main business activities prior

to consideration of how those activities are amortized, financed or

taxed.

Free cash flow is a non-IFRS financial measure that is

calculated as funds flow from operations less capital expenditures

and repayment of lease liabilities. Free cash flow per share is

calculated by dividing free cash flow by the number of weighted

average outstanding shares during the period. Management uses free

cash flow and free cash flow per share to help measure the capacity

of the Company to pay dividends and invest in business growth

opportunities.

Forward-Looking Information

Certain information included in this press release is

forward-looking. Forward-looking information includes statements

that are not statements of historical fact and which address

activities, events or developments that the Company expects or

anticipates will or may occur in the future, including such things

as investment objectives and strategy, the development plans and

status of the Company’s software development projects, the

Company’s intentions, results of operations, levels of activity,

future capital and other expenditures (including the amount, nature

and sources of funding thereof), business prospects and

opportunities, research and development timetable, and future

growth and performance. When used in this press release, statements

to the effect that the Company or its management “believes”,

“expects”, “expected”, “plans”, “may”, “will”, “projects”,

“anticipates”, “estimates”, “would”, “could”, “should”,

“endeavours”, “seeks”, “predicts” or “intends” or similar

statements, including “potential”, “opportunity”, “target” or other

variations thereof that are not statements of historical fact

should be construed as forward-looking information. These

statements reflect management’s current beliefs with respect to

future events and are based on information currently available to

management of the Company. The Company believes that the

expectations reflected in such forward-looking information are

reasonable, but no assurance can be given that these expectations

will prove to be correct and such forward-looking information

should not be unduly relied upon.

Corporate Profile

CMG is a computer software technology company serving the energy

industry. The Company is a leading supplier of advanced process

reservoir modelling software, with a diverse customer base of

international oil companies and technology centers in approximately

60 countries. CMG’s existing technology has differentiating

capabilities built into its software products that can also be

directly applied to the energy transition needs of its customers.

The Company also provides professional services consisting of

highly specialized support, consulting, training, and contract

research activities. CMG has sales and technical support services

based in Calgary, Houston, London, Dubai, Bogota and Kuala Lumpur.

CMG’s Common Shares are listed on the Toronto Stock Exchange

(“TSX”) and trade under the symbol “CMG”.

Condensed Consolidated Statements of Financial

Position

|

UNAUDITED (thousands of Canadian $) |

September 30, 2021 |

|

March 31, 2021 |

|

| |

|

|

| Assets |

|

|

| Current assets: |

|

|

|

Cash |

48,012 |

|

49,068 |

|

|

Trade and other receivables |

14,081 |

|

23,239 |

|

|

Prepaid expenses |

1,020 |

|

820 |

|

|

Prepaid income taxes |

1,522 |

|

8 |

|

|

|

64,635 |

|

73,135 |

|

| Property and equipment |

11,318 |

|

12,025 |

|

| Right-of-use assets |

34,292 |

|

35,509 |

|

|

Deferred tax asset |

1,878 |

|

1,822 |

|

|

Total assets |

112,123 |

|

122,491 |

|

| |

|

|

| Liabilities and

shareholders’ equity |

|

|

| Current liabilities: |

|

|

|

Trade payables and accrued liabilities |

5,597 |

|

6,316 |

|

|

Income taxes payable |

36 |

|

49 |

|

|

Deferred revenue |

21,242 |

|

30,461 |

|

|

Lease liability |

1,436 |

|

1,356 |

|

|

|

28,311 |

|

38,182 |

|

| Long-term stock-based

compensation liability |

1,052 |

|

1,281 |

|

|

Long-term lease liability |

38,914 |

|

39,606 |

|

| Total

liabilities |

68,277 |

|

79,069 |

|

| |

|

|

| Shareholders’ equity: |

|

|

|

Share capital |

80,248 |

|

80,051 |

|

|

Contributed surplus |

14,630 |

|

14,251 |

|

|

Deficit |

(51,032 |

) |

(50,880 |

) |

|

Total shareholders' equity |

43,846 |

|

43,422 |

|

|

Total liabilities and shareholders' equity |

112,123 |

|

122,491 |

|

Condensed Consolidated Statements of Operations and

Comprehensive Income

| |

Three months ended September 30 |

|

Six months ended September 30 |

|

|

UNAUDITED (thousands of Canadian $ except per share amounts) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

| |

|

|

|

|

|

Revenue |

15,949 |

|

17,852 |

|

30,363 |

|

34,524 |

|

| |

|

|

|

|

| Operating

expenses |

|

|

|

|

| Sales, marketing and

professional services |

3,840 |

|

3,590 |

|

7,252 |

|

7,874 |

|

| Research and

development |

4,656 |

|

3,107 |

|

8,673 |

|

8,066 |

|

| General and

administrative |

2,013 |

|

1,294 |

|

3,425 |

|

3,012 |

|

|

|

10,509 |

|

7,991 |

|

19,350 |

|

18,952 |

|

| Operating

profit |

5,440 |

|

9,861 |

|

11,013 |

|

15,572 |

|

| |

|

|

|

|

| Finance income |

384 |

|

97 |

|

224 |

|

196 |

|

| Finance costs |

(503 |

) |

(598 |

) |

(1,089 |

) |

(2,003 |

) |

|

Profit before income and other taxes |

5,321 |

|

9,360 |

|

10,148 |

|

13,765 |

|

| Income

and other taxes |

1,175 |

|

2,600 |

|

2,269 |

|

3,743 |

|

| |

|

|

|

|

|

Net and total comprehensive income |

4,146 |

|

6,760 |

|

7,879 |

|

10,022 |

|

| |

|

|

|

|

| Earnings per

share |

|

|

|

|

| Basic

and diluted |

0.05 |

|

0.08 |

|

0.10 |

|

0.12 |

|

Condensed Consolidated Statements of Cash

Flows

| |

Three months ended September 30 |

|

Six months ended September 30 |

|

|

UNAUDITED (thousands of Canadian $) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

| |

|

|

|

|

| Operating

activities |

|

|

|

|

| Net income |

4,146 |

|

6,760 |

|

7,879 |

|

10,022 |

|

| Adjustments for: |

|

|

|

|

|

Depreciation |

1,033 |

|

1,072 |

|

2,056 |

|

2,128 |

|

|

Deferred income tax expense (recovery) |

157 |

|

(7 |

) |

(55 |

) |

(434 |

) |

|

Stock-based compensation |

(432 |

) |

166 |

|

(165 |

) |

978 |

|

|

Funds flow from operations |

4,904 |

|

7,991 |

|

9,715 |

|

12,694 |

|

| Movement in non-cash working

capital: |

|

|

|

|

|

Trade and other receivables |

(5,264 |

) |

(3,383 |

) |

9,158 |

|

15,202 |

|

|

Trade payables and accrued liabilities |

1,582 |

|

(1,282 |

) |

(209 |

) |

(2,047 |

) |

|

Prepaid expenses |

(153 |

) |

(128 |

) |

(200 |

) |

(168 |

) |

|

Income taxes payable |

(867 |

) |

62 |

|

(1,527 |

) |

1,092 |

|

|

Deferred revenue |

(2,209 |

) |

(5,943 |

) |

(9,219 |

) |

(14,289 |

) |

| Increase in non-cash working

capital |

(6,911 |

) |

(10,674 |

) |

(1,997 |

) |

(210 |

) |

|

Net cash (used in) provided by operating

activities |

(2,007 |

) |

(2,683 |

) |

7,718 |

|

12,484 |

|

| |

|

|

|

|

| Financing

activities |

|

|

|

|

| Repayment of lease

liability |

(277 |

) |

(317 |

) |

(583 |

) |

(632 |

) |

| Dividends paid |

(4,016 |

) |

(4,013 |

) |

(8,031 |

) |

(8,026 |

) |

|

Net cash used in financing activities |

(4,293 |

) |

(4,330 |

) |

(8,614 |

) |

(8,658 |

) |

| |

|

|

|

|

| Investing

activities |

|

|

|

|

| Property and equipment

additions |

(133 |

) |

(200 |

) |

(160 |

) |

(349 |

) |

|

(Decrease) Increase in cash |

(6,433 |

) |

(7,213 |

) |

(1,056 |

) |

3,477 |

|

| Cash,

beginning of period |

54,445 |

|

51,195 |

|

49,068 |

|

40,505 |

|

|

Cash, end of period |

48,012 |

|

43,982 |

|

48,012 |

|

43,982 |

|

| |

|

|

|

|

| Supplementary cash

flow information |

|

|

|

|

| Interest received |

126 |

|

99 |

|

224 |

|

198 |

|

| Interest paid |

503 |

|

521 |

|

1,010 |

|

1,046 |

|

| Income

taxes paid |

1,782 |

|

3,294 |

|

3,510 |

|

3,478 |

|

See accompanying notes to consolidated financial statements,

which are available on SEDAR at www.sedar.com or on CMG's website

at www.cmgl.ca.

For further information, contact:

| Ryan N. SchneiderPresident &

CEO(403) 531-1300ryan.schneider@cmgl.cawww.cmgl.ca |

or |

Sandra BalicVice President,

Finance & CFO(403) 531-1300sandra.balic@cmgl.ca |

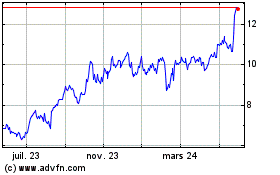

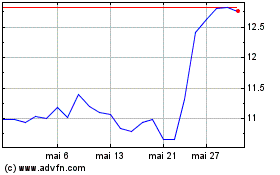

Computer Modelling (TSX:CMG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Computer Modelling (TSX:CMG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024