Canacol Energy Ltd. Announces New Gas Discovery at Lulo 1, Provides Test Results for the Saxofon 1 and Dividivi 1 Gas Discoveries, and Provides a Gas Sales Update

04 Mai 2023 - 12:00AM

Canacol Energy Ltd. (“Canacol” or the “Corporation”) (TSX:CNE;

OTCQX:CNNEF; BVC:CNEC) is pleased to provide the following

information concerning the new Lulo 1 gas discovery, production

test results for the previously announced Saxofon 1 and Dividivi 1

gas discoveries, and the April 2023 natural gas sales.

April Gas Sales of 180

MMscfpd

Realized contractual natural gas sales (which

are gas produced, delivered, and paid for were 180 million standard

cubic feet per day (“MMscfpd”) for April 2023.

Lulo 1 encounters 207 feet of net gas

pay

The Lulo 1 exploration well, located on the 100

percent operated VIM21 Exploration and Production (“E&P”)

contract, was spud on April 17 and reached a total depth of 8,434

feet measured depth (“ft MD”) on April 26, 2023. The well

encountered 207 feet true vertical depth (“ft TVD”) of net gas pay

with average porosity of 21 percent within the primary Cienage de

Oro (“CDO”) sandstone reservoir.

The well has been cased and various zones will

be production tested prior to tying the well into permanent

production directly into the Jobo gas treatment facility located

only fifty meters from the drilling platform. The success at Lulo

has opened an area of deeper potential within the CDO in and around

the main producing area that the Corporation intends to pursue

aggressively. Upon completion of the well the Corporation plans to

immediately drill the Lulo 2 well to appraise the extent of the

discovery.

Saxofon 1 tests combined rate of 16

MMscfpd

The Corporation commenced the drilling of the

Saxofon 1 exploration well on December 2, 2022 on its 100% operated

VIM5 E&P contract located in the Lower Magdalena Basin. As

previously reported, the well encountered gas within the Porquero

and CDO sandstone reservoirs.

The CDO reservoir was perforated over a 22-foot

Interval and flowed at an average rate of 6.1 MMscfpd over 12

hours. The peak rate was 8.4 MMscfpd at a choke of 32/128" and a

THP of 2449 psig with no water production observed. The well is

currently shut in undergoing the build up phase. The pressure

transient data will be interpreted when the gauges are

retrieved.

The Porquero reservoir was perforated over a

57-foot Interval and flowed at an average rate of 5.9 MMscfpd over

15 hours. The peak flow rate was 7.2 MMscfpd at a choke of 35/128"

and a THP of 1044 psig with 8 barrels of water during the test was

produced. The salinity of the produced water indicates that it is

completion fluid related to the drilling process. The well is

currently shut in undergoing the build up phase. The pressure

transient data will be interpreted when the gauges are

retrieved.

The Corporation is currently in the process of

tying the well into permanent production. A large 3D seismic

program will be executed in late 2023 over this part of the VIM 5

block plan for the drilling multiple appraisal and development

wells.

Dividivi 1 tests 5 MMscfpd

The Corporation commenced the drilling of the

Dividivi 1 exploration well on December 20, 2022 on its 100%

operated VIM33 E&P contract located in the Lower Magdalena

Basin. As previously reported, the well encountered gas within the

primary CDO sandstone and Cicuco limestone reservoirs.

The Cicuco reservoir was perforated over a

12-foot Interval and flowed at an average rate of 3.84 MMscfpd over

9 hours. The peak flow rate was 5 MMscfpd at a choke of 28/128” and

a THP of 731 psig. No water production was observed.

The Corporation is currently preparing to

execute a long-term flow test of the well in order to formulate a

commercial development plan for the discovery. The discovery is

located approximately 35 kilometers to the west of the TGI gas

pipeline which currently has approximately 260 MMscfpd of spare

transportation capacity into the interior of Colombia.

About Canacol

Canacol is a natural gas exploration and

production company with operations focused in Colombia. The

Corporation’s common stock trades on the Toronto Stock Exchange,

the OTCQX in the United States of America, and the Colombia Stock

Exchange under ticker symbol CNE, CNNEF, and CNEC,

respectively.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of applicable

securities law. Forward-looking statements are frequently

characterized by words such as “plan”, “expect”, “project”,

“intend”, “believe”, “anticipate”, “estimate” and other similar

words, or statements that certain events or conditions “may” or

“will” occur, including without limitation statements relating to

estimated production rates from the Corporation’s properties and

intended work programs and associated timelines. Forward-looking

statements are based on the opinions and estimates of management at

the date the statements are made and are subject to a variety of

risks and uncertainties and other factors that could cause actual

events or results to differ materially from those projected in the

forward-looking statements. The Corporation cannot assure that

actual results will be consistent with these forward-looking

statements. They are made as of the date hereof and are subject to

change and the Corporation assumes no obligation to revise or

update them to reflect new circumstances, except as required by

law. Prospective investors should not place undue reliance on

forward looking statements. These factors include the inherent

risks involved in the exploration for and development of crude oil

and natural gas properties, the uncertainties involved in

interpreting drilling results and other geological and geophysical

data, fluctuating energy prices, the possibility of cost overruns

or unanticipated costs or delays and other uncertainties associated

with the oil and gas industry. Other risk factors could include

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities, and other factors, many of which are beyond the control

of the Corporation.

Realized contractual gas sales is defined as gas

produced and sold plus gas revenues received from nominated take or

pay contracts.

For more information please contact:

Investor Relations

South America: +571.621.1747 IR-SA@canacolenergy.com

Global: +1.403.561.1648 IR-GLOBAL@canacolenergy.com

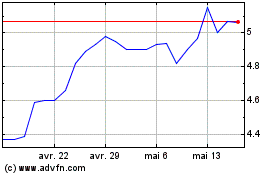

Canacol Energy (TSX:CNE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Canacol Energy (TSX:CNE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024