CN (TSX: CNR) (NYSE: CNI) today reported its financial and

operating results for the third quarter ended September 30, 2024.

“Our scheduled operating plan demonstrated its

resilience in the third quarter, allowing us to adapt our

operations to challenges posed by wildfires and prolonged labor

issues. Our operations recovered quickly and the railroad is

running well. As we close 2024, we will continue to focus on

recovering volumes, growth, and ensuring our resources are aligned

to demand.”

– Tracy Robinson, President and Chief

Executive Officer, CN

Quarterly highlights

- Revenue ton miles (RTMs) of 56,548

(millions), an increase of 2%.

- Revenues of C$4,110 million, an

increase of C$123 million, or 3%.

- Operating income of C$1,515 million

was in line with prior year.

- Operating ratio, defined as

operating expenses as a percentage of revenues, of 63.1%, an

increase of 1.1-points.

- Diluted earnings per share (EPS) of

C$1.72, an increase of 2%.

2024 guidance and

long-term financial outlook (1)(2) CN continues to

expect to deliver adjusted diluted EPS growth in the low

single-digit range and continues to expect to invest approximately

C$3.5 billion in its capital program, net of amounts reimbursed by

customers. The Company also continues to expect adjusted return on

invested capital (ROIC) to be in the 13%-15% range.

Over the 2024-2026 period, CN continues to

target compounded annual adjusted diluted EPS growth in the high

single-digit range.

CONFERENCE CALL DETAILS CN's

senior officers will review the results and the railway's outlook

in a conference call starting at 4:30 p.m. Eastern Time on October

22. Tracy Robinson, CN President and Chief Executive Officer, will

lead the call. Parties wishing to participate via telephone may

dial 1-800-715-9871 (Canada/U.S.), or 1-647-932-3411

(International), using 5497429 as the passcode. Participants are

advised to dial in 10 minutes prior to the call.

(1) Non-GAAP Measures CN's

full-year and long-term adjusted diluted EPS outlook and full-year

adjusted ROIC outlook (2) exclude certain adjustments, which are

expected to be comparable to adjustments made in prior years.

However, management cannot individually quantify on a

forward-looking basis the impact of these adjustments on its

adjusted diluted EPS or its adjusted ROIC because these items,

which could be significant, are difficult to predict and may be

highly variable. As a result, CN does not provide a corresponding

GAAP measure for, or reconciliation to, its adjusted diluted EPS

outlook or its adjusted ROIC outlook.

(2) Forward-Looking Statements

Certain statements included in this news release constitute

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and under

Canadian securities laws, including statements based on

management’s assessment and assumptions and publicly available

information with respect to CN. By their nature, forward-looking

statements involve risks, uncertainties and assumptions. CN

cautions that its assumptions may not materialize and that current

economic conditions render such assumptions, although reasonable at

the time they were made, subject to greater uncertainty.

Forward-looking statements may be identified by the use of

terminology such as "believes," "expects," "anticipates,"

"assumes," "outlook," "plans," "targets", or other similar

words.

2024 key

assumptions CN has made a number of economic and market

assumptions in preparing its 2024 outlook. The Company continues to

assume slightly positive North American industrial production in

2024. For the 2023/2024 crop year, the grain crop in Canada was

below its three-year average (excluding the significantly lower

2021/2022 crop year) and the U.S. grain crop was above its

three-year average. The Company continues to assume that the

2024/2025 grain crop in Canada will be in line with its three-year

average (excluding the significantly lower 2021/2022 crop year) and

that the U.S. grain crop will be above its three-year average. CN

continues to assume RTM growth will be at the low end of the 3%-5%

range assumed previously. CN assumes continued pricing above rail

inflation. CN also continues to assume that in 2024, the value of

the Canadian dollar in U.S. currency will be approximately $0.75,

and that in 2024 the average price of crude oil (West Texas

Intermediate) will be in the range of US$80 - US$90 per barrel.

Additionally, CN assumes that there will be no further rail or port

labor disruptions in 2024.

2024-2026 key assumptions CN

has made a number of economic and market assumptions in preparing

its three-year financial perspective. CN continues to assume that

the North American industrial production will increase by

approximately 1% CAGR over the 2024 to 2026 period. CN assumes

continued pricing above rail inflation. CN assumes that the value

of the Canadian dollar in U.S. currency will be approximately $0.75

and that the average price of crude oil (West Texas Intermediate)

will be approximately US$80 per barrel during this period.

Forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and other

factors which may cause actual results, performance or achievements

of CN to be materially different from the outlook or any future

results, performance or achievements implied by such statements.

Accordingly, readers are advised not to place undue reliance on

forward-looking statements. Important risk factors that could

affect the forward-looking statements in this news release include,

but are not limited to, general economic and business conditions,

including factors impacting global supply chains such as pandemics

and geopolitical conflicts and tensions; industry competition;

inflation, currency and interest rate fluctuations; changes in fuel

prices; legislative and/or regulatory developments; compliance with

environmental laws and regulations; actions by regulators;

increases in maintenance and operating costs; security threats;

reliance on technology and related cybersecurity risk; trade

restrictions or other changes to international trade arrangements;

transportation of hazardous materials; various events which could

disrupt operations, including illegal blockades of rail networks,

and natural events such as severe weather, droughts, fires, floods

and earthquakes; climate change; labor negotiations and

disruptions; environmental claims; uncertainties of investigations,

proceedings and other types of claims and litigation; risks and

liabilities arising from derailments; timing and completion of

capital programs; the availability of and cost competitiveness of

renewable fuels and the development of new locomotive propulsion

technology; reputational risks; supplier concentration; pension

funding requirements and volatility; and other risks detailed from

time to time in reports filed by CN with securities regulators in

Canada and the United States. Reference should also be made to

Management’s Discussion and Analysis (MD&A) in CN’s annual and

interim reports, Annual Information Form and Form 40-F, filed with

Canadian and U.S. securities regulators and available on CN’s

website, for a description of major risk factors relating to

CN.

Forward-looking statements reflect information

as of the date on which they are made. CN assumes no obligation to

update or revise forward-looking statements to reflect future

events, changes in circumstances, or changes in beliefs, unless

required by applicable securities laws. In the event CN does update

any forward-looking statement, no inference should be made that CN

will make additional updates with respect to that statement,

related matters, or any other forward-looking statement.

Information contained on, or accessible through, our website is not

incorporated by reference into this news release.

This earnings news release, as well as

additional information, including the Financial Statements, Notes

thereto and MD&A, is contained in CN’s Quarterly Review

available on the Company's website at

www.cn.ca/financial-results and on SEDAR+ at

www.sedarplus.ca as well as on the U.S. Securities and

Exchange Commission's website at www.sec.gov through

EDGAR.

About CN CN powers the economy

by safely transporting more than 300 million tons of natural

resources, manufactured products, and finished goods throughout

North America every year for its customers. With its nearly

20,000-mile rail network and related transportation services, CN

connects Canada’s Eastern and Western coasts with the U.S. Midwest

and the Gulf of Mexico, contributing to sustainable trade and the

prosperity of the communities in which it operates since 1919.

|

Contacts: |

|

|

Media |

Investment Community |

|

Jonathan Abecassis |

Stacy Alderson |

|

Director |

Assistant Vice-President |

|

Public Affairs and Media Relations |

Investor Relations |

|

(438) 455-3692 |

(514) 399-0052 |

|

media@cn.ca |

investor.relations@cn.ca |

|

|

|

|

|

|

|

|

|

SELECTED RAILROAD STATISTICS – UNAUDITED

| |

Three months ended September 30 |

Nine months ended September 30 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Financial measures |

|

|

|

|

| Key

financial performance indicators (1) |

|

|

|

|

| Total

revenues ($ millions) |

4,110 |

3,987 |

12,688 |

12,357 |

| Freight

revenues ($ millions) |

3,922 |

3,820 |

12,212 |

11,933 |

| Operating

income ($ millions) |

1,515 |

1,517 |

4,619 |

4,779 |

| Adjusted

operating income ($ millions) (2)(3) |

1,515 |

1,517 |

4,697 |

4,779 |

| Net income

($ millions) |

1,085 |

1,108 |

3,302 |

3,495 |

| Adjusted net

income ($ millions) (2)(3) |

1,085 |

1,108 |

3,360 |

3,495 |

| Diluted

earnings per share ($) |

1.72 |

1.69 |

5.19 |

5.27 |

| Adjusted

diluted earnings per share ($) (2)(3) |

1.72 |

1.69 |

5.28 |

5.27 |

| Free cash

flow ($ millions) (2)(4) |

584 |

581 |

2,060 |

2,274 |

| Gross

property additions ($ millions) |

1,176 |

934 |

2,605 |

2,270 |

| Share

repurchases ($ millions) |

427 |

1,196 |

2,498 |

3,438 |

| Dividends

per share ($) |

0.8450 |

0.7900 |

2.5350 |

2.3700 |

|

Financial ratio |

|

|

|

|

| Operating

ratio (%) (5) |

63.1 |

62.0 |

63.6 |

61.3 |

|

Adjusted operating ratio (%) (2)(3) |

63.1 |

62.0 |

63.0 |

61.3 |

|

Operational measures (6) |

|

|

|

|

|

Statistical operating data |

|

|

|

|

| Gross ton

miles (GTMs) (millions) |

110,555 |

108,221 |

344,034 |

333,356 |

| Revenue ton

miles (RTMs) (millions) |

56,548 |

55,640 |

176,233 |

171,478 |

| Carloads

(thousands) |

1,304 |

1,326 |

4,066 |

4,048 |

| Route miles

(includes Canada and the U.S.) |

18,800 |

18,600 |

18,800 |

18,600 |

| Employees

(end of period) |

25,428 |

25,101 |

25,428 |

25,101 |

|

Employees (average for the period) |

25,593 |

25,168 |

25,451 |

24,859 |

|

Key operating measures |

|

|

|

|

| Freight

revenue per RTM (cents) |

6.94 |

6.87 |

6.93 |

6.96 |

| Freight

revenue per carload ($) |

3,008 |

2,881 |

3,003 |

2,948 |

| GTMs per

average number of employees (thousands) |

4,320 |

4,300 |

13,518 |

13,410 |

| Operating

expenses per GTM (cents) |

2.35 |

2.28 |

2.35 |

2.27 |

| Labor and

fringe benefits expense per GTM (cents) |

0.72 |

0.71 |

0.74 |

0.70 |

| Diesel fuel

consumed (US gallons in millions) |

94.4 |

90.0 |

301.0 |

291.5 |

| Average fuel

price ($ per US gallon) |

4.43 |

4.66 |

4.50 |

4.56 |

| Fuel

efficiency (US gallons of locomotive fuel consumed per 1,000

GTMs) |

0.854 |

0.832 |

0.875 |

0.874 |

| Train weight

(tons) |

9,130 |

9,246 |

9,104 |

9,146 |

| Train length

(feet) |

7,849 |

7,927 |

7,885 |

7,870 |

| Car velocity

(car miles per day) |

208 |

209 |

208 |

212 |

| Through

dwell (entire railroad, hours) |

7.1 |

7.1 |

7.0 |

7.0 |

| Through

network train speed (miles per hour) |

19.2 |

19.7 |

18.7 |

19.9 |

|

Locomotive utilization (trailing GTMs per total horsepower) |

182 |

189 |

186 |

191 |

|

Safety indicators (7) |

|

|

|

|

| Injury

frequency rate (per 200,000 person hours) |

1.04 |

1.08 |

1.08 |

1.03 |

|

Accident rate (per million train miles) |

1.46 |

2.10 |

1.62 |

1.86 |

|

(1) |

|

Amounts expressed in Canadian dollars and prepared in accordance

with United States generally accepted accounting principles (GAAP),

unless otherwise noted. |

| (2) |

|

These non-GAAP measures do not have any standardized meaning

prescribed by GAAP and therefore, may not be comparable to similar

measures presented by other companies. |

| (3) |

|

See the supplementary schedule entitled Non-GAAP Measures –

Adjusted performance measures for an explanation of these non-GAAP

measures. |

| (4) |

|

See the supplementary schedule entitled Non-GAAP Measures – Free

cash flow for an explanation of this non-GAAP measure. |

| (5) |

|

Operating ratio is defined as operating expenses as a percentage of

revenues. |

| (6) |

|

Statistical operating data, key operating measures and safety

indicators are unaudited and based on estimated data available at

such time and are subject to change as more complete information

becomes available. Definitions of gross ton miles, revenue ton

miles, freight revenue per RTM, fuel efficiency, train weight,

train length, car velocity, through dwell and through network train

speed are included within the Company’s Management’s Discussion and

Analysis. Definitions of all other indicators are provided on CN's

website, www.cn.ca/glossary. |

| (7) |

|

Based on Federal Railroad Administration (FRA) reporting

criteria. |

SUPPLEMENTARY INFORMATION – UNAUDITED

| |

Three months ended September 30 |

|

Nine months

ended September 30 |

|

|

2024 |

2023 |

% Change Fav (Unfav) |

|

% Change at constant currency (1) Fav (Unfav) |

|

|

2024 |

2023 |

% Change Fav (Unfav) |

|

% Change at constant currency (1) Fav (Unfav) |

|

|

Revenues ($ millions) (2) |

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

839 |

758 |

11 |

% |

9 |

% |

|

2,546 |

2,334 |

9 |

% |

8 |

% |

|

Metals and minerals |

502 |

515 |

(3 |

%) |

(4 |

%) |

|

1,560 |

1,541 |

1 |

% |

— |

% |

|

Forest products |

467 |

466 |

— |

% |

(1 |

%) |

|

1,462 |

1,457 |

— |

% |

— |

% |

|

Coal |

229 |

242 |

(5 |

%) |

(6 |

%) |

|

691 |

768 |

(10 |

%) |

(10 |

%) |

|

Grain and fertilizers |

786 |

722 |

9 |

% |

8 |

% |

|

2,384 |

2,271 |

5 |

% |

4 |

% |

|

Intermodal |

882 |

880 |

— |

% |

— |

% |

|

2,881 |

2,875 |

— |

% |

— |

% |

|

Automotive |

217 |

237 |

(8 |

%) |

(9 |

%) |

|

688 |

687 |

— |

% |

(1 |

%) |

|

Total freight revenues |

3,922 |

3,820 |

3 |

% |

2 |

% |

|

12,212 |

11,933 |

2 |

% |

2 |

% |

|

Other revenues |

188 |

167 |

13 |

% |

11 |

% |

|

476 |

424 |

12 |

% |

11 |

% |

|

Total revenues |

4,110 |

3,987 |

3 |

% |

2 |

% |

|

12,688 |

12,357 |

3 |

% |

2 |

% |

|

Revenue ton miles (RTMs) (millions) (3) |

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

11,398 |

10,470 |

9 |

% |

9 |

% |

|

34,763 |

31,915 |

9 |

% |

9 |

% |

|

Metals and minerals |

7,275 |

7,630 |

(5 |

%) |

(5 |

%) |

|

22,183 |

21,458 |

3 |

% |

3 |

% |

|

Forest products |

5,323 |

5,719 |

(7 |

%) |

(7 |

%) |

|

16,843 |

17,529 |

(4 |

%) |

(4 |

%) |

|

Coal |

4,908 |

5,421 |

(9 |

%) |

(9 |

%) |

|

14,839 |

17,234 |

(14 |

%) |

(14 |

%) |

|

Grain and fertilizers |

15,072 |

14,528 |

4 |

% |

4 |

% |

|

46,690 |

45,138 |

3 |

% |

3 |

% |

|

Intermodal |

11,793 |

11,048 |

7 |

% |

7 |

% |

|

38,538 |

35,918 |

7 |

% |

7 |

% |

|

Automotive |

779 |

824 |

(5 |

%) |

(5 |

%) |

|

2,377 |

2,286 |

4 |

% |

4 |

% |

|

Total RTMs |

56,548 |

55,640 |

2 |

% |

2 |

% |

|

176,233 |

171,478 |

3 |

% |

3 |

% |

|

Freight revenue / RTM (cents) (2)(3) |

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

7.36 |

7.24 |

2 |

% |

1 |

% |

|

7.32 |

7.31 |

— |

% |

— |

% |

|

Metals and minerals |

6.90 |

6.75 |

2 |

% |

1 |

% |

|

7.03 |

7.18 |

(2 |

%) |

(3 |

%) |

|

Forest products |

8.77 |

8.15 |

8 |

% |

6 |

% |

|

8.68 |

8.31 |

4 |

% |

4 |

% |

|

Coal |

4.67 |

4.46 |

5 |

% |

4 |

% |

|

4.66 |

4.46 |

4 |

% |

4 |

% |

|

Grain and fertilizers |

5.21 |

4.97 |

5 |

% |

4 |

% |

|

5.11 |

5.03 |

2 |

% |

1 |

% |

|

Intermodal |

7.48 |

7.97 |

(6 |

%) |

(7 |

%) |

|

7.48 |

8.00 |

(6 |

%) |

(7 |

%) |

|

Automotive |

27.86 |

28.76 |

(3 |

%) |

(4 |

%) |

|

28.94 |

30.05 |

(4 |

%) |

(4 |

%) |

|

Total freight revenue / RTM |

6.94 |

6.87 |

1 |

% |

— |

% |

|

6.93 |

6.96 |

— |

% |

(1 |

%) |

|

Carloads (thousands) (3) |

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

158 |

156 |

1 |

% |

1 |

% |

|

485 |

468 |

4 |

% |

4 |

% |

|

Metals and minerals |

243 |

264 |

(8 |

%) |

(8 |

%) |

|

730 |

749 |

(3 |

%) |

(3 |

%) |

|

Forest products |

73 |

76 |

(4 |

%) |

(4 |

%) |

|

228 |

234 |

(3 |

%) |

(3 |

%) |

|

Coal |

116 |

124 |

(6 |

%) |

(6 |

%) |

|

343 |

386 |

(11 |

%) |

(11 |

%) |

|

Grain and fertilizers |

163 |

153 |

7 |

% |

7 |

% |

|

496 |

483 |

3 |

% |

3 |

% |

|

Intermodal |

501 |

494 |

1 |

% |

1 |

% |

|

1,625 |

1,556 |

4 |

% |

4 |

% |

|

Automotive |

50 |

59 |

(15 |

%) |

(15 |

%) |

|

159 |

172 |

(8 |

%) |

(8 |

%) |

|

Total carloads |

1,304 |

1,326 |

(2 |

%) |

(2 |

%) |

|

4,066 |

4,048 |

— |

% |

— |

% |

|

Freight revenue / carload ($) (2)(3) |

|

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

5,310 |

4,859 |

9 |

% |

8 |

% |

|

5,249 |

4,987 |

5 |

% |

5 |

% |

|

Metals and minerals |

2,066 |

1,951 |

6 |

% |

4 |

% |

|

2,137 |

2,057 |

4 |

% |

3 |

% |

|

Forest products |

6,397 |

6,132 |

4 |

% |

3 |

% |

|

6,412 |

6,226 |

3 |

% |

2 |

% |

|

Coal |

1,974 |

1,952 |

1 |

% |

— |

% |

|

2,015 |

1,990 |

1 |

% |

1 |

% |

|

Grain and fertilizers |

4,822 |

4,719 |

2 |

% |

1 |

% |

|

4,806 |

4,702 |

2 |

% |

2 |

% |

|

Intermodal |

1,760 |

1,781 |

(1 |

%) |

(2 |

%) |

|

1,773 |

1,848 |

(4 |

%) |

(4 |

%) |

|

Automotive |

4,340 |

4,017 |

8 |

% |

7 |

% |

|

4,327 |

3,994 |

8 |

% |

8 |

% |

|

Total freight revenue / carload |

3,008 |

2,881 |

4 |

% |

3 |

% |

|

3,003 |

2,948 |

2 |

% |

1 |

% |

|

(1) |

|

This non-GAAP measure does not have any standardized meaning

prescribed by GAAP and therefore, may not be comparable to similar

measures presented by other companies. See the supplementary

schedule entitled Non-GAAP Measures – Constant currency for an

explanation of this non-GAAP measure. |

| (2) |

|

Amounts expressed in Canadian dollars. |

| (3) |

|

Statistical operating data and related key operating measures are

unaudited and based on estimated data available at such time and

are subject to change as more complete information becomes

available. |

NON-GAAP MEASURES –

UNAUDITED

In this supplementary schedule, the "Company" or

"CN" refers to Canadian National Railway Company, together with its

wholly-owned subsidiaries. Financial information included in this

schedule is expressed in Canadian dollars, unless otherwise

noted.

CN reports its financial results in accordance

with United States generally accepted accounting principles (GAAP).

The Company also uses non-GAAP measures that do not have any

standardized meaning prescribed by GAAP, including adjusted

performance measures, free cash flow, constant currency and

adjusted debt-to-adjusted EBITDA multiple. These non-GAAP measures

may not be comparable to similar measures presented by other

companies. From management's perspective, these non-GAAP measures

are useful measures of performance and provide investors with

supplementary information to assess the Company's results of

operations and liquidity. These non-GAAP measures should not be

considered in isolation or as a substitute for financial measures

prepared in accordance with GAAP.

Adjusted performance

measures

Adjusted net income, adjusted diluted earnings

per share, adjusted operating income, adjusted operating expenses

and adjusted operating ratio are non-GAAP measures that are used to

set performance goals and to measure CN's performance. Management

believes that these adjusted performance measures provide

additional insight to management and investors into the Company's

operations and underlying business trends as well as facilitate

period-to-period comparisons, as they exclude certain significant

items that are not reflective of CN's underlying business

operations and could distort the analysis of trends in business

performance. These items may include:

- operating expense adjustments:

workforce reduction program, depreciation expense on the deployment

of replacement system, advisory fees related to shareholder

matters, losses and recoveries from assets held for sale, business

acquisition-related costs;

- non-operating expense adjustments:

business acquisition-related financing fees, merger termination

income, gains and losses on disposal of property; and

- the effect of changes in tax laws

including rate enactments, and changes in tax positions affecting

prior years.

These non-GAAP measures do not have any

standardized meaning prescribed by GAAP and therefore, may not be

comparable to similar measures presented by other companies.

For the three and nine months ended September

30, 2024, the Company's adjusted net income was $1,085 million, or

$1.72 per diluted share, and $3,360 million, or $5.28 per diluted

share, respectively. The adjusted figures for the nine months ended

September 30, 2024 exclude a loss on assets held for sale of $78

million, or $58 million after-tax ($0.09 per diluted share),

recorded in the second quarter, resulting from an agreement to

transfer the ownership and related risks and obligations of the

Quebec Bridge located in Quebec, Canada, to the Government of

Canada. See Note 4 – Assets held for sale to the Company's

unaudited Interim Consolidated Financial Statements for additional

information.

For the three and nine months ended September

30, 2023, the Company's net income was $1,108 million, or $1.69 per

diluted share, and $3,495 million, or $5.27 per diluted share,

respectively. There were no adjustments in the third quarter and

the first nine months of 2023.

Adjusted net income is defined as Net income in

accordance with GAAP adjusted for certain significant items.

Adjusted diluted earnings per share is defined as adjusted net

income divided by the weighted-average diluted shares outstanding.

The following table provides a reconciliation of Net income and

Earnings per share in accordance with GAAP, as reported for the

three and nine months ended September 30, 2024 and 2023, to the

non-GAAP adjusted performance measures presented herein:

| |

Three months ended September 30 |

Nine months ended September 30 |

|

In millions, except per share data |

|

2024 |

|

2023 |

|

2024 |

|

|

2023 |

|

Net income |

$ |

1,085 |

$ |

1,108 |

$ |

3,302 |

|

$ |

3,495 |

|

Adjustments: |

|

|

|

|

|

Loss on assets held for sale |

|

— |

|

— |

|

78 |

|

|

— |

|

Tax effect of adjustments (1) |

|

— |

|

— |

|

(20 |

) |

|

— |

|

Total adjustments |

|

— |

|

— |

|

58 |

|

|

— |

|

Adjusted net income |

$ |

1,085 |

$ |

1,108 |

$ |

3,360 |

|

$ |

3,495 |

|

Diluted earnings per share |

$ |

1.72 |

$ |

1.69 |

$ |

5.19 |

|

$ |

5.27 |

|

Impact of adjustments, per share |

|

— |

|

— |

|

0.09 |

|

|

— |

|

Adjusted diluted earnings per share |

$ |

1.72 |

$ |

1.69 |

$ |

5.28 |

|

$ |

5.27 |

|

(1) |

|

The tax impact of adjustments is based on the nature of the item

for tax purposes and related tax rates in the applicable

jurisdiction. |

Adjusted operating income is defined as

Operating income in accordance with GAAP adjusted for certain

significant operating expense items that are not reflective of CN's

underlying business operations. Adjusted operating expenses is

defined as Operating expenses in accordance with GAAP adjusted for

certain significant operating expense items that are not reflective

of CN's underlying business operations. Adjusted operating ratio is

defined as adjusted operating expenses as a percentage of revenues.

The following table provides a reconciliation of Operating income,

Operating expenses and operating ratio, as reported for the three

and nine months ended September 30, 2024 and 2023, to the non-GAAP

adjusted performance measures presented herein:

| |

Three months ended September 30 |

Nine months ended September 30 |

|

In millions, except percentages |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Operating income |

$ |

1,515 |

|

$ |

1,517 |

|

$ |

4,619 |

|

$ |

4,779 |

|

|

Adjustment: |

|

|

|

|

|

Loss on assets held for sale |

|

— |

|

|

— |

|

|

78 |

|

|

— |

|

|

Total adjustment |

|

— |

|

|

— |

|

|

78 |

|

|

— |

|

|

Adjusted operating income |

$ |

1,515 |

|

$ |

1,517 |

|

$ |

4,697 |

|

$ |

4,779 |

|

|

|

|

|

|

|

| Operating

expenses |

$ |

2,595 |

|

$ |

2,470 |

|

$ |

8,069 |

|

$ |

7,578 |

|

|

Total adjustment |

|

— |

|

|

— |

|

|

(78 |

) |

|

— |

|

|

Adjusted operating expenses |

$ |

2,595 |

|

$ |

2,470 |

|

$ |

7,991 |

|

$ |

7,578 |

|

|

|

|

|

|

|

| Operating

ratio |

|

63.1 |

% |

|

62.0 |

% |

|

63.6 |

% |

|

61.3 |

% |

|

Impact of adjustment |

|

— |

% |

|

— |

% |

|

(0.6 |

)% |

|

— |

% |

|

Adjusted operating ratio |

|

63.1 |

% |

|

62.0 |

% |

|

63.0 |

% |

|

61.3 |

% |

Free cash flow

Free cash flow is a useful measure of liquidity

as it demonstrates the Company's ability to generate cash for debt

obligations and for discretionary uses such as payment of

dividends, share repurchases, and strategic opportunities. The

Company defines its free cash flow measure as the difference

between net cash provided by operating activities and net cash used

in investing activities, adjusted for the impact of (i) business

acquisitions and (ii) merger transaction-related payments, cash

receipts and cash income taxes, which are items that are not

indicative of operating trends. Free cash flow does not have any

standardized meaning prescribed by GAAP and therefore, may not be

comparable to similar measures presented by other companies.

The following table provides a reconciliation of

Net cash provided by operating activities in accordance with GAAP,

as reported for the three and nine months ended September 30, 2024

and 2023, to the non-GAAP free cash flow presented herein:

| |

Three months ended September 30 |

Nine months ended September 30 |

|

In millions |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net cash provided by operating activities |

$ |

1,774 |

|

$ |

1,512 |

|

$ |

4,704 |

|

$ |

4,552 |

|

| Net cash

used in investing activities |

|

(1,190 |

) |

|

(931 |

) |

|

(2,644 |

) |

|

(2,278 |

) |

|

Free cash flow |

$ |

584 |

|

$ |

581 |

|

$ |

2,060 |

|

$ |

2,274 |

|

Constant currency

Financial results at constant currency allow

results to be viewed without the impact of fluctuations in foreign

currency exchange rates, thereby facilitating period-to-period

comparisons in the analysis of trends in business performance.

Measures at constant currency are considered non-GAAP measures and

do not have any standardized meaning prescribed by GAAP and

therefore, may not be comparable to similar measures presented by

other companies. Financial results at constant currency are

obtained by translating the current period results denominated in

US dollars at the weighted average foreign exchange rates used to

translate transactions denominated in US dollars of the comparable

period of the prior year.

The average foreign exchange rates were $1.364

and $1.360 per US$1.00 for the three and nine months ended

September 30, 2024, respectively, and $1.341 and $1.345 per US$1.00

for the three and nine months ended September 30, 2023,

respectively. On a constant currency basis, the Company's net

income for the three and nine months ended September 30, 2024 would

have been lower by $12 million ($0.02 per diluted share) and

lower by $17 million ($0.03 per diluted share),

respectively.

The following table provides a reconciliation of

the impact of constant currency and related percentage change at

constant currency on the financial results, as reported for the

three and nine months ended September 30, 2024:

| |

Three months

ended September 30 |

Nine months ended September 30 |

|

In millions, except per share data |

|

2024 |

|

Constant currency impact |

|

|

2023 |

|

% Change at constant currency Fav (Unfav) |

|

|

2024 |

|

Constant currency impact |

|

|

2023 |

|

% Change at constant currency Fav (Unfav) |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

Petroleum and chemicals |

$ |

839 |

|

$ |

(9 |

) |

$ |

758 |

|

9 |

% |

$ |

2,546 |

|

$ |

(16 |

) |

$ |

2,334 |

|

8 |

% |

|

Metals and minerals |

|

502 |

|

|

(7 |

) |

|

515 |

|

(4 |

%) |

|

1,560 |

|

|

(13 |

) |

|

1,541 |

|

— |

% |

|

Forest products |

|

467 |

|

|

(6 |

) |

|

466 |

|

(1 |

%) |

|

1,462 |

|

|

(11 |

) |

|

1,457 |

|

— |

% |

|

Coal |

|

229 |

|

|

(2 |

) |

|

242 |

|

(6 |

%) |

|

691 |

|

|

(3 |

) |

|

768 |

|

(10 |

%) |

|

Grain and fertilizers |

|

786 |

|

|

(7 |

) |

|

722 |

|

8 |

% |

|

2,384 |

|

|

(11 |

) |

|

2,271 |

|

4 |

% |

|

Intermodal |

|

882 |

|

|

(4 |

) |

|

880 |

|

— |

% |

|

2,881 |

|

|

(8 |

) |

|

2,875 |

|

— |

% |

|

Automotive |

|

217 |

|

|

(2 |

) |

|

237 |

|

(9 |

%) |

|

688 |

|

|

(5 |

) |

|

687 |

|

(1 |

%) |

|

Total freight revenues |

|

3,922 |

|

|

(37 |

) |

|

3,820 |

|

2 |

% |

|

12,212 |

|

|

(67 |

) |

|

11,933 |

|

2 |

% |

|

Other revenues |

|

188 |

|

|

(2 |

) |

|

167 |

|

11 |

% |

|

476 |

|

|

(4 |

) |

|

424 |

|

11 |

% |

|

Total revenues |

|

4,110 |

|

|

(39 |

) |

|

3,987 |

|

2 |

% |

|

12,688 |

|

|

(71 |

) |

|

12,357 |

|

2 |

% |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

Labor and fringe benefits |

|

795 |

|

|

(6 |

) |

|

773 |

|

(2 |

%) |

|

2,539 |

|

|

(10 |

) |

|

2,332 |

|

(8 |

%) |

|

Purchased services and material |

|

566 |

|

|

(3 |

) |

|

534 |

|

(5 |

%) |

|

1,715 |

|

|

(8 |

) |

|

1,698 |

|

(1 |

%) |

|

Fuel |

|

519 |

|

|

(7 |

) |

|

486 |

|

(5 |

%) |

|

1,579 |

|

|

(14 |

) |

|

1,528 |

|

(2 |

%) |

|

Depreciation and amortization |

|

475 |

|

|

(3 |

) |

|

457 |

|

(3 |

%) |

|

1,403 |

|

|

(6 |

) |

|

1,354 |

|

(3 |

%) |

|

Equipment rents |

|

93 |

|

|

(1 |

) |

|

89 |

|

(3 |

%) |

|

294 |

|

|

(3 |

) |

|

262 |

|

(11 |

%) |

|

Other |

|

147 |

|

|

(1 |

) |

|

131 |

|

(11 |

%) |

|

461 |

|

|

(3 |

) |

|

404 |

|

(13 |

%) |

|

Loss on assets held for sale |

|

— |

|

|

— |

|

|

— |

|

— |

% |

|

78 |

|

|

— |

|

|

— |

|

— |

% |

|

Total operating expenses |

|

2,595 |

|

|

(21 |

) |

|

2,470 |

|

(4 |

%) |

|

8,069 |

|

|

(44 |

) |

|

7,578 |

|

(6 |

%) |

|

Operating income |

|

1,515 |

|

|

(18 |

) |

|

1,517 |

|

(1 |

%) |

|

4,619 |

|

|

(27 |

) |

|

4,779 |

|

(4 |

%) |

| Interest

expense |

|

(230 |

) |

|

3 |

|

|

(185 |

) |

(23 |

%) |

|

(660 |

) |

|

5 |

|

|

(523 |

) |

(25 |

%) |

| Other

components of net periodic benefit income |

|

114 |

|

|

— |

|

|

121 |

|

(6 |

%) |

|

341 |

|

|

— |

|

|

360 |

|

(5 |

%) |

|

Other income (loss) |

|

10 |

|

|

— |

|

|

(2 |

) |

600 |

% |

|

44 |

|

|

— |

|

|

— |

|

— |

% |

|

Income before income taxes |

|

1,409 |

|

|

(15 |

) |

|

1,451 |

|

(4 |

%) |

|

4,344 |

|

|

(22 |

) |

|

4,616 |

|

(6 |

%) |

|

Income tax expense |

|

(324 |

) |

|

3 |

|

|

(343 |

) |

6 |

% |

|

(1,042 |

) |

|

5 |

|

|

(1,121 |

) |

7 |

% |

|

Net income |

$ |

1,085 |

|

$ |

(12 |

) |

$ |

1,108 |

|

(3 |

%) |

$ |

3,302 |

|

$ |

(17 |

) |

$ |

3,495 |

|

(6 |

%) |

|

Diluted earnings per share |

$ |

1.72 |

|

$ |

(0.02 |

) |

$ |

1.69 |

|

1 |

% |

$ |

5.19 |

|

$ |

(0.03 |

) |

$ |

5.27 |

|

(2 |

%) |

Adjusted debt-to-adjusted EBITDA multiple

Management believes that the adjusted

debt-to-adjusted EBITDA multiple is a useful credit measure because

it reflects the Company's ability to service its debt and other

long-term obligations. The Company calculates the adjusted

debt-to-adjusted EBITDA multiple as adjusted debt divided by the

last twelve months of adjusted EBITDA. Adjusted debt is defined as

the sum of Long-term debt and Current portion of long-term debt as

reported on the Company’s Consolidated Balance Sheets as well as

Operating lease liabilities, including current portion and pension

plans in deficiency recognized on the Company's Consolidated

Balance Sheets due to the debt-like nature of their contractual and

financial obligations. Adjusted EBITDA is calculated as Net income

excluding Interest expense, Income tax expense, Depreciation and

amortization, operating lease cost, Other components of net

periodic benefit income, Other income (loss), and other significant

items that are not reflective of CN's underlying business

operations and which could distort the analysis of trends in

business performance. Adjusted debt and adjusted EBITDA are

non-GAAP measures used to compute the adjusted debt-to-adjusted

EBITDA multiple. These measures do not have any standardized

meaning prescribed by GAAP and therefore, may not be comparable to

similar measures presented by other companies.

The following table provides a reconciliation of

debt and Net income in accordance with GAAP, reported as at and for

the twelve months ended September 30, 2024 and 2023, to the

adjusted measures presented herein, which have been used to

calculate the non-GAAP adjusted debt-to-adjusted EBITDA

multiple:

|

In millions, unless otherwise indicated |

As at and for the twelve months ended September 30, |

|

2024 |

|

|

2023 |

|

|

Debt |

$ |

20,698 |

|

$ |

18,382 |

|

|

Adjustments: |

|

|

|

Operating lease liabilities, including current portion (1) |

|

363 |

|

|

429 |

|

|

Pension plans in deficiency (2) |

|

356 |

|

|

351 |

|

|

Adjusted debt |

$ |

21,417 |

|

$ |

19,162 |

|

|

Net income |

$ |

5,432 |

|

$ |

4,915 |

|

|

Interest expense |

|

859 |

|

|

676 |

|

|

Income tax expense |

|

784 |

|

|

1,582 |

|

|

Depreciation and amortization |

|

1,866 |

|

|

1,805 |

|

|

Operating lease cost (3) |

|

153 |

|

|

147 |

|

|

Other components of net periodic benefit income |

|

(460 |

) |

|

(484 |

) |

|

Other loss (income) |

|

(178 |

) |

|

2 |

|

|

Adjustment: |

|

|

|

Loss on assets held for sale (4) |

|

78 |

|

|

— |

|

|

Adjusted EBITDA |

$ |

8,534 |

|

$ |

8,643 |

|

|

Adjusted debt-to-adjusted EBITDA multiple

(times) |

|

2.51 |

|

|

2.22 |

|

|

(1) |

|

Represents the present value of operating lease payments. |

|

(2) |

|

Represents the total funded deficit of all defined benefit pension

plans with a projected benefit obligation in excess of plan

assets. |

|

(3) |

|

Represents the operating lease costs recorded in Purchased services

and material and Equipment rents within the Consolidated Statements

of Income. |

|

(4) |

|

Relates to a loss of $78 million on assets held for sale recorded

in the second quarter of 2024, resulting from an agreement to

transfer the ownership and related risks and obligations of the

Quebec Bridge located in Quebec, Canada, to the Government of

Canada. See Note 4 – Assets held for sale to the Company's

unaudited Interim Consolidated Financial Statements for additional

information. |

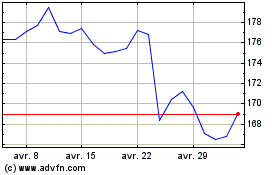

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024