Capital Power Corporation (“Capital Power”) (TSX:CPX) announced

today that it has priced a public offering in Canada of unsecured

medium term notes (the “Notes”) in the aggregate principal amount

of C$600 million (the “Offering”). The Notes have a coupon rate of

4.831% and mature on September 16, 2031.

The Offering is expected to close on or about

September 16, 2024.

Capital Power intends to use the net proceeds of

the Offering to repay, redeem or refinance existing indebtedness,

including indebtedness under outstanding debt securities or Capital

Power’s credit facilities, or for general corporate purposes.

The Notes have been assigned a provisional

rating of BBB- by S&P Global Ratings and BBB (low) by DBRS

Limited.

The Notes are being offered in Canada through a

syndicate of investment dealers co-led by BMO Nesbitt Burns Inc.

and National Bank Financial Inc. under Capital Power’s short form

base shelf prospectus dated June 12, 2024 as supplemented by a

prospectus supplement dated June 17, 2024 and a pricing supplement

to be dated August 26, 2024. The short form base shelf prospectus,

the prospectus supplement and the pricing supplement contain

important detailed information about the Notes. Copies of these

documents are, and in the case of the pricing supplement will be,

available electronically on the System for Electronic Data Analysis

and Retrieval + (“SEDAR+”) at www.sedarplus.ca.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the Notes in any

jurisdiction. The Notes have not been approved or disapproved by

any regulatory authority. The Notes have not been and will not be

registered under the United States Securities Act of 1933, as

amended, or any state securities law, and may not be offered or

sold within the United States, or to or for the account of, United

States persons.

Forward-looking Information

Forward-looking information or statements

included in this press release are provided to inform Capital

Power’s shareholders and potential investors about management’s

assessment of Capital Power’s future plans and operations. This

information may not be appropriate for other purposes. The

forward-looking information in this press release is generally

identified by words such as will, anticipate, plan, intend, and

expect or similar words that suggest future outcomes.

Material forward-looking information in this

press release includes expectations regarding the Offering,

including: (i) the timing of closing, and (ii) the expected use of

the net proceeds.

These statements are based on certain

assumptions and analyses made by Capital Power considering its

experience and perception of historical trends, current conditions,

expected future developments and other factors it believes are

appropriate including its review of purchased businesses and

assets. The material factors and assumptions used to develop these

forward-looking statements relate to: (i) electricity natural gas,

other energy and carbon prices, (ii) performance, (iii) business

prospects (including potential re-contracting of facilities) and

opportunities including expected growth and capital projects, (iv)

the status of and impact of policy, legislation and regulations and

(v) effective tax rates.

Whether actual results, performance or

achievements will conform to Capital Power’s expectations and

predictions is subject to a number of known and unknown risks and

uncertainties which could cause actual results and experience to

differ materially from Capital Power’s expectations. Such material

risks and uncertainties are: (i) changes in electricity, natural

gas and carbon prices in markets in which Capital Power operates

and the use of derivatives, (ii) regulatory and political

environments including changes to environmental, climate, financial

reporting, market structure and tax legislation, (iii) disruptions,

or price volatility within Capital Power’s supply chains, (iv)

generation facility availability, wind capacity factor and

performance including maintenance expenditures, (v) ability to fund

current and future capital and working capital needs, (vi)

acquisitions and developments including timing and costs of

regulatory approvals and construction, (vii) changes in the

availability of fuel, (viii) the ability to realize the anticipated

benefits of acquisitions, (ix) limitations inherent in Capital

Power’s review of acquired assets, (x) changes in general economic

and competitive conditions, including inflation and recession and

(xi) changes in the performance and cost of technologies and the

development of new technologies, new energy efficient products,

services and programs. See Risks and Risk Management in Capital

Power’s Integrated Annual Report for the year ended December 31,

2023, prepared as of February 27, 2024, and Capital Power’s interim

Management’s Discussion and Analysis for the three and six months

ended June 30, 2024, under Capital Power’s profile on SEDAR+

(www.sedarplus.ca), and other reports filed by Capital Power with

Canadian securities regulators.

Readers are cautioned not to place undue

reliance on any such forward-looking statements, which speak only

as of the specified approval date. Capital Power does not undertake

or accept any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements to reflect

any change in Capital Power’s expectations or any change in events,

conditions or circumstances on which any such statement is based,

except as required by law.

Territorial AcknowledgementIn

the spirit of reconciliation, Capital Power respectfully

acknowledges that we operate within the ancestral homelands,

traditional and treaty territories of the Indigenous Peoples of

Turtle Island, or North America. Capital Power’s head office is

located within the traditional and contemporary home of many

Indigenous Peoples of the Treaty 6 Territory and Métis Nation of

Alberta Region 4. We acknowledge the diverse Indigenous communities

that are located in these areas and whose presence continues to

enrich the community.

About Capital PowerCapital

Power (TSX: CPX) is a growth-oriented power producer with

approximately 9,300 MW of power generation at 32 facilities across

North America. We prioritize safely delivering reliable and

affordable power communities can depend on today, building clean

power systems needed for tomorrow, and creating balanced solutions

for our energy future. We are Powering Change by Changing

Power™.

For more information, please

contact:

Investor and Media

Relations:

Media Relations Katherine Perron (780) 392-5335

kperron@capitalpower.com

Investor Relations Roy Arthur (403) 736-3315

investor@capitalpower.com

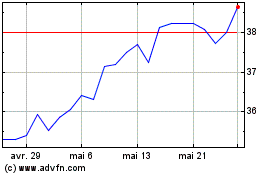

Capital Power (TSX:CPX)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Capital Power (TSX:CPX)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025