D-BOX Technologies Inc. (“D-BOX” or the “Company”) (TSX: DBO) a

world leader in haptic and immersive experiences, today reported

financial results for the third quarter ended

December 31, 2024.

“Since taking on the role of CEO at D-BOX, I

have been privileged to work alongside the talented team that has

come together over the past five years to execute a strategy that

is driving strong topline and bottom-line results. We are now

focusing on our best-performing commercial markets, those that

align with our unique IP and platform, while optimizing operations

for cost efficiency,” said Sebastien Mailhot, President and Chief

Executive Officer of D-BOX.

Q3 2025 Operating Results

In the third quarter, total revenues reached a

record $13.3 million, up $5.2 million, or 65%, over the

prior year. This included a record $10.1 million from system

sales, up 52%, and $3.2 million in royalties, more than double

the prior-year period.

Our system sales in the Entertainment markets

totalled $8.2 million–covering theatrical and sim racing

markets, two key commercial markets—saw a $3.7 million

increase, or 82% over the prior year. Revenue growth was primarily

driven by the continued large-scale rollout of systems to major

theatrical customers, including 51 net new screen installations,

compared to 19 last year and 27 two years ago—nearly doubling on a

two-year basis. Results underscore the successful execution of our

strategy, with the theatrical industry recovery also contributing

to growth in the quarter, as system sales in the prior year were

impacted by the Hollywood labour stoppage and delayed capital

spending. Entertainment system sales were further supported by the

expansion of sim racing centers, highlighted by the opening of a

new location of the F1 Arcade rollout in Washington. Our third key

commercial market, Simulation and training, closed the quarter with

$1.9 million in system sales, down $0.2 million or 9%

from the prior year, reflecting the timing of certain industrial

customers transitioning to the next generation of D-BOX products.

Favourable movements in currency exchange rates also contributed

positively to the quarter's results.

Additionally, having surpassed the milestone of

1,000 screens as of December 31, 2024, and with the

combined success of multiple blockbusters, royalties in the quarter

totalled $3.2 million, also benefiting from favourable

movements in currency exchange rates. Box office hits for the

quarter included Moana 2, Venom: The Last Dance, Sonic the Hedgehog

3, and Mufasa: The Lion King, reflecting a broader blockbuster

offering compared to the previous year. Overall, we are pleased

with two consecutive quarters of record total revenues,

highlighting our expanding footprint and the improving industry

backdrop. While we highlight this outperformance, it is important

to consider the variability and seasonality in quarterly sales and

the importance of assessing D-BOX's performance over a trailing

twelve-month period. It is also important to note that we are

closely monitoring the evolving U.S.-Canada tariffs situation and

actively evaluating potential measures to minimize any impact on

our operations in the fourth quarter and beyond.

|

(Amounts are in thousands of Canadian dollars) |

Q3 2025 |

Q3 2024 |

Var. ($) |

Var. (%) |

YTD 2025 |

YTD 2024 |

Var. ($) |

Var. (%) |

| Revenues |

|

|

|

|

|

|

|

|

| System sales |

|

|

|

|

|

|

|

|

|

Entertainment 2 |

8,180 |

4,496 |

3,684 |

82% |

19,194 |

15,665 |

3,529 |

23% |

|

Simulation and training |

1,956 |

2,161 |

(205) |

(9%) |

6,197 |

7,180 |

(983) |

(14%) |

|

Total System Sales |

10,136 |

6,657 |

3,479 |

52% |

25,391 |

22,845 |

2,546 |

11% |

| Rights

for use, rental and maintenance (“royalties”) |

3,163 |

1,418 |

1,745 |

123% |

8,787 |

6,573 |

2,214 |

34% |

|

Total Revenues |

13,299 |

8,075 |

5,224 |

65% |

34,178 |

29,418 |

4,760 |

16% |

2) Entertainment system sales include theatrical

and sim racing commercial markets as well as direct-to-consumer

hardware markets which D-BOX exited as of February 2024.

D-BOX generated gross profit of

$6.7 million, up $3.0 million versus the prior year,

driven by higher revenues and improved margin performance. Gross

margin1 of 50%, increased by 4 percentage points from 46% last

year, primarily due to a higher proportion of revenues from

royalties and the favourable impact from currency exchange rates in

the quarter. We emphasize the significant positive impact that a

higher proportion of royalties, as part of our total revenues, has

on our profitability. However, we caution that this revenue stream

can fluctuate due to the seasonality of new theatrical releases and

varying consumer responses.

Operating expenses of $5.0 million in the

third quarter were up $1.0 million or 26% over the prior year,

mainly reflecting a foreign exchange loss as well as increased

R&D expenses driven by the development of the next generation

of products and software. As a percentage of sales, operating

expenses of 38% improved by 12 percentage points, reflecting

sales leverage. The Company generated operating income of

$1.6 million, or 12% of total revenues, compared to a

$0.3 million operating loss, in the same quarter last year.

Adjusted EBITDA1 was $2.6 million, or 19% of total revenues,

up from approximately nil a year ago. As a result, the Company

achieved a net profit this quarter of $1.5 million compared to

a net loss of $0.4 million a year earlier.

Through strong free cash flow generation in the

quarter, D-BOX reduced long-term debt by $0.9 million, further

strengthening its balance sheet and providing increased financial

flexibility. Additionally, with a solid cash position and undrawn

credit facilities totalling $14.3 million of liquidity at the

end of the quarter, the Company is well positioned to support its

strategic initiatives and navigate potential risks and

uncertainties.

Year-to-date Operating

Results

Total revenues for the nine months ended

December 31, 2024 were $34.2 million, up

$4.8 million, or 16%. This growth was driven by the successful

execution of the D-BOX strategy combined with an improved industry

backdrop, compared to a weaker performance last year, which was

impacted by the Hollywood labour stoppage. Total revenues for the

nine-month period consisted of $25.4 million in system sales

and $8.8 million in royalties. Sales growth was primarily

driven by a $3.5 million increase, or 23%, in Entertainment

system sales, despite a $1 million headwind from exiting the

direct-to-consumer market as part of our strategy to focus on our

best-performing commercial markets. Additionally, revenue from

royalties rose by $2.2 million, or 34%, compared to the prior

year, partially offset by $1 million, or 14%, decline in

Simulation & Training system sales. Gross margin of 52%

increased 5 percentage points compared to last year reflecting a

higher proportion of revenues from royalties, and the impact of

exiting the lower-margin direct-to-consumer hardware market.

Operating margin of 11% and adjusted EBITDA margin1 of 17%

increased by 8 and 9 percentage points, respectively, compared to

the prior year, driven by higher gross margin and the benefit of

operating sales leverage. Reflecting significantly lower financial

expenses compared to last year, net profit totalled

$3.3 million, up seven-fold from the same period last year.

Cash flows from operating activities totalled $5.4 million

compared to $2.6 million in the prior year, mainly due to

higher net profit.

1 Please refer to "Non-IFRS and other financial performance

measures" in this press release

NOTICE OF VIDEO INVESTOR

PRESENTATION

D-BOX will be publishing a video presentation to

investors on the Company’s website at

https://www.d-box.com/en/investor-relations on

Friday, February 14, 2025, at 9:00 a.m. ET.

During the presentation, management will discuss the Company’s

second quarter results. Investors are invited to submit relevant

questions in advance by email to investors@d-box.com.

This release should be read in conjunction with

the Company’s audited consolidated financial statements and the

Management’s Discussion and Analysis dated

February 12, 2025. These documents are available at

www.sedarplus.ca.

Supplemental Financial Data -

unaudited

|

(Amounts are in thousands of Canadian dollars) |

Q3 2025 |

Q3 2024 |

Var. (%) |

YTD 2025 |

YTD 2024 |

Var. (%) |

| Total Revenues |

13,299 |

8,075 |

65% |

34,178 |

29,418 |

16% |

| Gross profit |

6,687 |

3,737 |

79% |

17,666 |

13,926 |

27% |

| Operating expenses |

5,041 |

4,012 |

26% |

14,033 |

12,953 |

8% |

| Operating income (loss) |

1,646 |

(275) |

n.m. |

3,633 |

973 |

273% |

| Adjusted EBITDA1 |

2,565 |

90 |

n.m. |

5,733 |

2,439 |

135% |

| Financial expenses |

104 |

152 |

(32%) |

272 |

493 |

(45%) |

| Net

profit (loss) |

1,531 |

(425) |

n.m. |

3,340 |

473 |

606% |

|

Gross margin1 |

50% |

46% |

4 p.p. |

52% |

47% |

5 p.p. |

| Operating expenses as % of

total revenues1 |

38% |

50% |

(12 p.p.) |

41% |

44% |

(3 p.p.) |

| Operating margin1 |

12% |

(3%) |

n.m. |

11% |

3% |

8 p.p. |

| Adjusted EBITDA margin1 |

19% |

1% |

18 p.p. |

17% |

8% |

9 p.p. |

| Cash

flows provided by operating activities |

|

|

|

5,430 |

2,624 |

|

|

|

|

|

|

|

| As at (in thousands of

Canadian dollars) |

|

|

Dec. 31, 2024 |

Mar. 31, 2024 |

| Total

debt1 |

|

|

1,292 |

2,468 |

| Cash

and cash equivalents |

|

|

6,333 |

2,916 |

| Net

cash (net debt) 1 |

|

|

5,041 |

448 |

|

Adjusted EBITDA (LTM) 1 |

|

|

6,352 |

3,056 |

| Total

debt to adjusted EBITDA (LTM) 1 |

|

|

|

0.2x |

|

0.8x |

1) Please refer to "Non-IFRS and other financial

performance measures" in this press releasen.m.= not meaningful

NON-IFRS AND OTHER FINANCIAL PERFORMANCE

MEASURES

D-BOX uses the following non-IFRS financial

performance measures in its MD&A and other communications. The

non-IFRS measures do not have any standardized meaning prescribed

by IFRS and are unlikely to be comparable to similarly titled

measures reported by other companies. Investors are cautioned that

the disclosure of these metrics is meant to add to, and not to

replace, the discussion of financial results determined in

accordance with IFRS. Management uses both IFRS and non-IFRS

measures when planning, monitoring and evaluating the Company’s

performance. The non-IFRS performance measures are described as

follows:

EBITDA

EBITDA represents earnings before interest and

financing, income taxes and depreciation and amortization.

Adjustments to EBITDA are for items that are not necessarily

reflective of the Company’s underlying operating performance. As

there is no generally accepted method of calculating EBITDA, this

measure is not necessarily comparable to similarly titled measures

reported by other issuers. Adjusted EBITDA provides useful and

complementary information, which can be used, in particular, to

assess profitability and cash flow from operations. Adjusted EBITDA

margin is defined as adjusted EBITDA divided by total revenues. A

reconciliation of net profit to adjusted EBITDA margin is included

below.

Total Debt, Net Debt and Total Debt to

Adjusted EBITDA

Total debt is defined as the total bank

indebtedness, long-term debt (including any current portion), and

net debt is calculated as total debt net of cash and cash

equivalents. The Company considers total debt and net debt to be

important indicators for management and investors to assess the

financial position and liquidity of the Company and measure its

financial leverage. These measures do not have any standardized

meanings prescribed by IFRS and are therefore unlikely to be

comparable to similar measures presented by other companies. Total

debt to adjusted EBITDA ratio is calculated as total net debt

divided by the last four quarters adjusted EBITDA. We believe that

total debt to adjusted EBITDA is a useful metric to assess the

Company’s ability to manage debt and liquidity.

Supplementary Financial

Measures

Gross margin is defined as gross profit divided by total

revenues.

Operating expenses as a percentage of sales are defined as

operating expenses divided by total revenues.

Operating margin is defined as operating income divided by net

sales.

The following table reconciles adjusted

EBITDA to net profit:

|

(Amounts are in thousands of Canadian dollars) |

Q3 2025 |

Q3 2024 |

YTD 2025 |

YTD 2024 |

|

Net profit |

1,531 |

(425) |

3,340 |

473 |

|

Amortization of property and equipment |

296 |

286 |

813 |

848 |

|

Amortization of intangible assets |

134 |

187 |

416 |

574 |

|

Financial expenses |

104 |

152 |

272 |

493 |

|

Income taxes |

11 |

(2) |

21 |

7 |

|

Share-based payments |

19 |

2 |

57 |

35 |

|

Foreign exchange loss (gain) |

470 |

(110) |

409 |

12 |

|

Restructuring costs |

― |

― |

405 |

― |

|

Adjusted EBITDA |

2,565 |

90 |

5,733 |

2,439 |

ABOUT D-BOX

D-BOX creates and redefines realistic, immersive

experiences by moving the body and sparking the imagination through

effects: motion, vibration and texture. D-BOX has collaborated with

some of the best companies in the world to deliver new ways to

enhance great stories. Whether it’s films, video games, music,

relaxation, virtual reality applications, metaverse experience,

themed entertainment or professional simulation, D-BOX creates a

feeling of presence that makes life resonate like never before.

D-BOX Technologies Inc. (TSX: DBO) is headquartered in Montreal

with presence in Los Angeles and China. Visit D-BOX.com.

DISCLAIMER REGARDING FORWARD-LOOKING

STATEMENTS

Certain information included in this press

release may constitute “forward-looking information” within the

meaning of applicable Canadian securities legislation.

Forward-looking information may include, among others, statements

regarding the future plans, activities, objectives, operations,

strategy, business outlook, and financial performance and condition

of the Company, or the assumptions underlying any of the foregoing.

In this document, words such as “may”, “would”, “could”, “will”,

“likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”,

“estimate” and similar words and the negative form thereof are used

to identify forward-looking statements. Forward-looking statements

should not be read as guarantees of future performance or results,

and will not necessarily be accurate indications of whether, or the

times at or by which, such future performance will be achieved.

Forward-looking information, by its very nature, is subject to

numerous risks and uncertainties and is based on several

assumptions which give rise to the possibility that actual results

could differ materially from the Company’s expectations expressed

in or implied by such forward-looking information and no assurance

can be given that any events anticipated by the forward-looking

information will transpire or occur, including but not limited to

the future plans, activities, objectives, operations, strategy,

business outlook and financial performance and condition of the

Company.

Forward-looking information is provided in this

press release for the purpose of giving information about

Management’s current expectations and plans and allowing investors

and others to get a better understanding of the Company’s operating

environment. However, readers are cautioned that it may not be

appropriate to use such forward-looking information for any other

purpose.

Forward-looking information provided in this

document is based on information available at the date hereof

and/or management’s good-faith belief with respect to future events

and are subject to known or unknown risks, uncertainties,

assumptions and other unpredictable factors, many of which are

beyond the Company’s control.

The risks, uncertainties and assumptions that

could cause actual results to differ materially from the Company’s

expectations expressed in or implied by the forward-looking

information include, but are not limited to, the ability to

increase royalty-based revenue and generate profitable growth.

These and other risk factors that could cause actual results to

differ materially from expectations expressed in or implied by the

forward-looking information are outlined under “Risk Factors” in

the Company’s management's discussion and analysis for the period

ended December 31, 2024, and discussed in greater detail

in the most recently filed Annual Information Form dated

May 30, 2024, a copy of which is available on SEDAR+ at

www.sedarplus.ca.

Except as may be required by Canadian securities

laws, the Company does not intend nor does it undertake any

obligation to update or revise any forward-looking information

contained in this press release to reflect subsequent information,

events, circumstances or otherwise.

The Company cautions readers that the risks

described above are not the only ones that could have an impact on

it. Additional risks and uncertainties not currently known to the

Company or that the Company currently deems to be immaterial may

also have a material adverse effect on the Company’s business,

financial condition or results of operations.

CONTACT INFORMATION

| Josh Chandler Chief Financial

OfficerD-BOX Technologies Inc.514-928-8043jchandler@d-box.com |

Elisabeth Hamaoui IR &

Strategic Communications ConsultantElisabeth Hamaoui Conseils

investors@d-box.com |

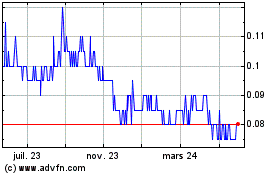

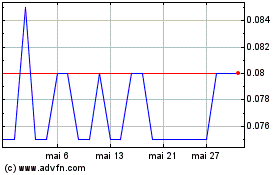

D Box Technologies (TSX:DBO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

D Box Technologies (TSX:DBO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025