Vicky Schiff, Dream Unlimited Corp. and PaulsCorp, LLC Launch Avrio Real Estate Credit

14 Mars 2023 - 4:00PM

Dream Unlimited Corp. (TSX: DRM) (“Dream”), PaulsCorp, LLC

(“Pauls”) and Vicky Schiff have launched

Avrio Real Estate Credit (“Avrio”).

Avrio will offer short-term, first mortgage debt and other

structured finance products including B notes, mezzanine debt and

preferred equity for the acquisition, refinancing and

recapitalization of commercial real estate assets, with loans

ranging from $25 million to $150 million.

“We believe with the current real estate capital markets

experiencing some dislocation, now is an opportune

time,” according to Schiff, who assumes the role

as Avrio’s Chief Executive Officer. “In addition to

financing new development and value-add projects

that utilize energy-efficient and green construction materials,

methods, or systems, we want to work with borrowers who create

jobs, encourage education and employee engagement and who are

dedicated to building projects that help expand the inventory of

workforce, affordable and transitional housing,” adds Schiff.

For Dream, a Canadian public company and one of that country’s

leading real estate firms with 600 employees, 12 offices across

Canada, the U.S., and Europe with over C$23 billion in assets

throughout North America and Europe under

management, Avrio represents Dream’s entry into the U.S.

credit market.

“Given the current supply gap of available debt to meet the

needs of real estate operators and developers in the

U.S, Avrio will play a critical role in bringing flexible

and creative debt funding to developers searching for this type of

instrument,” said Co-Founder and Chief Responsible Officer

Michael Cooper. “Dream places a strong emphasis on

sustainability across all of our strategies and Avrio fits well

within our goals of building better communities in our markets,”

said Cooper.

The new venture will use a specialized process, developed with

Dream’s sustainability and ESG team, to collect, analyze and report

on ESG data in a streamlined manner, intended to help external

partners and borrowers improve their assets ESG scores, attributes

and their overall impacts on their communities and the

environment.

Avrio also provides a compelling opportunity to utilize Pauls’

expertise in development, asset management, property management,

construction management and underwriting across multiple markets

and asset classes, with demonstrated results in industrial, rental

multifamily, for-sale residential, land entitlement and office,

including ground-up development, value-add development, and general

contracting.

Avrio also announces that Kyle Geoghegan has joined

as U.S. Head of Originations. Geoghegan brings

to Avrio 30 years of experience in the real estate

capital markets, having originated more than $11 billion in CRE

debt product encompassing a range of offerings from construction

and bridge to permanent loans at various leverage points in the

capital stack. Most recently, he was Managing Director

for Trez Capital, where he helped create a new

national lending platform resulting in the production of $800

million in its first year. He previously spent 14 years with C-III

Capital/Resource America as a Managing Director and had prior

stints at Bear Stearns and PNC Bank.

Headquartered in Denver, Avrio also has offices in New

York, Toronto, and Los Angeles.

About Dream Unlimited Corp.:Dream is a leading

developer of exceptional office and residential assets in Toronto,

owns stabilized income generating assets in both Canada and the

U.S., and has an established and successful asset management

business, inclusive of over C$23 billion of assets under management

across four Toronto Stock Exchange listed trusts, a private asset

management business and numerous partnerships as of February 17,

2023. Dream also develops land and residential assets in Western

Canada. Dream expects to generate more recurring income in the

future as its urban development properties are completed and held

for the long term. Dream has a proven track record for being

innovative and for its ability to source, structure and execute on

compelling investment opportunities. For more information please

visit: www.dream.ca.

About PaulsCorp LLC:Founded in 1993 and

headquartered in Denver, Pauls is a leading real estate investment,

development, and management company with an established track

record in both the U.S. and Canada. Pauls is a family-based

corporation with a longstanding reputation for high-quality work

and excellent working relationships. The extensive experience of

Pauls’ management team with its blend of entrepreneurial energy and

institutional discipline has resulted in numerous successful

investments over many years and through several economic and real

estate cycles.

Pauls has developed or managed over $6.5 billion in real estate

assets including approximately 15,000 single family homes,

multi-residential units, townhomes, and condominiums. Pauls

currently has over $2 billion in assets under management and $825

million under development. Pauls has a deep real estate platform,

consisting of over 230 employees, with expertise across the entire

real estate cycle.

About Avrio Real Estate Credit

(http://www.avriore.com):Avrio’s team brings multi-decade

real estate credit, ownership and development experience, in both

public and private U.S., Canadian and European markets, and aims to

be an industry leading, real estate private credit franchise with a

reputation as a dependable and entrepreneurial financier while

focusing on projects and borrowers who positively impact their

communities.

Media Contact: Bruce Beck/DB&R Marketing Communications,

Inc. (805) 777-7971 (office) (818) 540-8077 (mobile)

bruce@dbrpr.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1b0ac166-62fc-4e81-b3dc-f95b2a665b9a

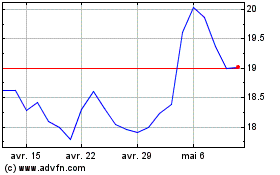

DREAM Unlimited (TSX:DRM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

DREAM Unlimited (TSX:DRM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025