American Hotel Income Properties REIT LP Announces Completion of Refinancing and Full Repayment of Senior Credit Facility

10 Mars 2025 - 1:00PM

American Hotel Income Properties REIT LP (“

AHIP”)

(TSX: HOT.UN, TSX: HOT.U, TSX: HOT.DB.V), today announced the

completion of a non-recourse debt refinancing and repayment in full

of its Senior Credit Facility (defined below). The initial gross

loan proceeds are $85.0 million secured against eleven hotel

properties, with additional advances of up to $41.0 million

available, comprised of $16.3 million upon the addition of a

further hotel property and up to $24.7 million for renovations and

improvements to these twelve hotel properties (the

“

Portfolio Loan”).

“This refinancing improves our ability to drive

long-term value for our unitholders,” said Jonathan Korol,

CEO. “It was achieved in two steps: through the previously

announced CMBS refinancing completed in early 2025 and this

non-recourse Portfolio Loan. This loan includes attractive

proceeds, a delayed draw structure on capital expenditures, longer

duration, an extension option, flexibility for asset sales and no

parent company financial covenants.”

AHIP used the net proceeds from the Portfolio

Loan to fully repay the outstanding balance under the credit

facility revolver and credit facility term loan governed by the

Sixth Amendment (the “Senior Credit Facility”) and

this facility is now terminated. The eleven hotel properties

secured by the Portfolio Loan were previously secured under the

Senior Credit Facility. The Portfolio Loan has an initial principal

amount of $85.0 million, a two-year term with the option to extend

the term for another one-year period subject to the satisfaction of

certain conditions, and bears interest at SOFR plus 4.65% per

annum.

All amounts presented in this news release are

in United States dollars (“U.S. dollars”).

For further details, see a copy of the agreement

governing the Portfolio Loan, which will be filed under AHIP’s

profile on SEDAR+ at www.sedarplus.com.

ABOUT AMERICAN HOTEL INCOME PROPERTIES REIT

LP

American Hotel Income Properties REIT LP (TSX:

HOT.UN, TSX: HOT.U, TSX: HOT.DB.V), or AHIP, is a limited

partnership formed to invest in hotel real estate properties across

the United States. AHIP’s portfolio of premium branded,

select-service hotels are located in secondary metropolitan markets

that benefit from diverse and stable demand. AHIP hotels operate

under brands affiliated with Marriott, Hilton, and IHG through

license agreements. AHIP’s long-term objectives are to build on its

proven track record of successful investment, deliver monthly U.S.

dollar denominated distributions to unitholders, and generate value

through the continued growth of its diversified hotel portfolio.

More information is available at www.ahipreit.com.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may

constitute “forward-looking information” within the meaning of

applicable securities laws. Forward-looking information generally

can be identified by words such as “anticipate”, “believe”,

“continue”, “expect”, “estimates”, “intend”, “may”, “outlook”,

“objective”, “plans”, “should”, “will” and similar expressions

suggesting future outcomes or events. Forward-looking information

includes, but is not limited to, statements made or implied

relating to the objectives of AHIP, AHIP’s strategies to achieve

those objectives and AHIP’s beliefs, plans, estimates, projections

and intentions and similar statements concerning anticipated future

events, results, circumstances, performance, or expectations that

are not historical facts. Forward-looking information in this news

release includes, but is not limited to, statements with respect

to: the potential to increase the size of the Portfolio Loan and

extend the term of the Portfolio Loan; the terms of the Portfolio

Loan improving AHIP’s ability to create long-term value for

unitholders; and AHIP’s stated long-term objectives.

Although the forward-looking information

contained in this news release is based on what AHIP’s management

believes to be reasonable assumptions, AHIP cannot assure investors

that actual results will be consistent with such information.

Forward-looking information is based on a number of key

expectations and assumptions made by AHIP, including, without

limitation: AHIP will satisfy the conditions to increase the size

of the Portfolio Loan if desired by AHIP; AHIP will satisfy the

conditions to extend the term of the Portfolio Loan if desired by

AHIP; inflation, labor shortages, and supply chain disruptions will

negatively impact the U.S. economy, U.S. hotel industry and AHIP’s

business; AHIP will continue to have sufficient funds to meet its

financial obligations, including under the Portfolio Loan; AHIP’s

strategies with respect to completion of capital projects,

liquidity, addressing near-term debt maturities, and divestiture of

assets will be successful and achieve their intended effects; AHIP

will continue to have good relationships with its hotel brand

partners; capital markets will provide AHIP with readily available

access to equity and/or debt financing on terms acceptable to AHIP,

including the ability to refinance maturing debt as it becomes due

on terms acceptable to AHIP; AHIP’s future level of indebtedness

and its future growth potential will remain consistent with AHIP’s

current expectations; and AHIP will achieve its long term

objectives.

Forward-looking information involves significant

risks and uncertainties and should not be read as a guarantee of

future performance or results as actual results may differ

materially from those expressed or implied in such forward-looking

information, accordingly undue reliance should not be placed on

such forward-looking information. Those risks and uncertainties

include, among other things, risks related to: AHIP may not be able

to satisfy the conditions to increase the size of the Portfolio

Loan; AHIP may not be able to satisfy the conditions to extend the

term of the Portfolio Loan; AHIP may not achieve its expected

performance levels in 2025 and beyond; inflation, labor shortages,

supply chain disruptions; AHIP’s brand partners may impose revised

service standards and capital requirements which are adverse to

AHIP; AHIP may not be successful in reducing its leverage; AHIP may

not be able to refinance debt obligations as they become due or may

do so on terms less favorable to AHIP than under AHIP’s existing

loan agreements; general economic conditions, including the impact

of tariffs and consumer confidence; the growth in the U.S. hotel

and lodging industry; prices for AHIP’s units and its debentures;

liquidity; tax risks; ability to access debt and capital markets;

financing risks; changes in interest rates; the financial condition

of, and AHIP’s relationships with, its external hotel manager and

franchisors; real property risks, including environmental risks;

the degree and nature of competition; ability to acquire accretive

hotel investments; ability to integrate new hotels; environmental

matters; increased geopolitical instability; and changes in

legislation and AHIP may not achieve its long term objectives.

Management believes that the expectations reflected in the

forward-looking information are based upon reasonable assumptions

and information currently available; however, management can give

no assurance that actual results will be consistent with the

forward-looking information contained herein. Additional

information about risks and uncertainties is contained in AHIP’s

management’s discussion and analysis for the three and nine months

ended September 30, 2024 and 2023, and AHIP’s annual information

form for the year ended December 31, 2023, copies of which are

available on SEDAR+ at www.sedarplus.com.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. Forward-looking information reflects management's

current beliefs and is based on information currently available to

AHIP. The forward-looking information contained herein is made as

of the date of this news release and AHIP assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For additional information, please

contact:

Investor Relationsir@ahipreit.com

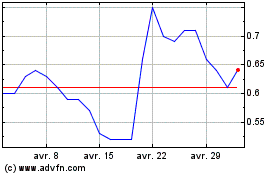

American Hotel Income Pr... (TSX:HOT.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

American Hotel Income Pr... (TSX:HOT.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025