Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”)

("

Verde” or the “

Company”) is

pleased to announce that it has received net proceeds of $1,410,057

from the exercise of 1,410,057 Warrants issued pursuant to the

private placement completed on March 12, 2019 (the

“

Warrants”) from a total of sixteen investors. Of

these, three were Company insiders.

The Warrants were part of a fundraising exercise

that raised $1,692,068. On that occasion, Mr Cristiano Veloso,

Verde's President & CEO, was the lead investor, which gave

greater comfort to many of the subscribers. That offering was made

available to any accredited investor who wished to participate and

was completed without broker involvement or fees, despite the

market challenges of that period.

The Warrants' expiry was on March 12, 2021 and

its exercise price was $1.00 per share.

The insider investors who exercised their

Warrants were Mr Cristiano Veloso ($456,208), Mr Felipe Paolucci

($83,333) and Mr Michael St Aldwyn ($41,666).

“The Warrants exercise by all investors

demonstrates the continued support of the Company’s shareholders,

recognizing the vision and long-term value that Verde is creating.

Recent sales results, disclosed on March 01, 2021, showing a 103%

growth for the year ended December 31, 2020 (“FY

2020”) compared to the year ended December 31, 2019, are

an indication of this positive and accelerating market success”,

said Mr Cristiano Veloso, Verde's founder, President & CEO.

The Company intends to use proceeds from the

Warrants exercised to advance its growth strategy, including CAPEX

for the development of its mining and processing facilities and

general working cashflow purposes.

Audited financial results for the fourth quarter

(“Q4 2020”) and FY 2020 will be reported and filed

on SEDAR on March 30, 2021.

CORPORATE UPDATE

Verde’s Board of Directors has developed a

long-term incentive plan in order to ensure that the Company

continues to attract and retain professional talent. This has been

particularly relevant in view of the fast-growing pace of the

Company, which means that the new employees are more efficiently

onboarded thanks to the experience and vision shared by their

senior peers. This strategy has abundant parallels in technology

companies and other sectors where fast scaling of operations is

essential for market success.

Seeing that Verde has only two C-level

executives and no vice president, Mr Veloso and Mr Paolucci assume

different tasks and responsibilities, therefore their continued

engagement plays a vital role in its management and growth.

Mr Veloso has been issued with 750,000 Stock

Options with an exercise price of $1.22 that, in compliance with

the Company's stock option plan, was based on the 5-day average

market closing price to March 5th, 2021, date when the options were

granted by the Board. He has voluntarily committed to the Board

that if the options are exercised when the share price is trading

under C$6.45 (the highest price ever achieved in a private

placement made by Verde), the shares will be held in escrow until

such value is reached.

Mr Paolucci and Mr Veloso were issued with

100,000 and 399,000 shares respectively. Those shares will be held

in escrow and can only be released under the following conditions:

50% to be released when the shares of the Company trade above $6.45

for 10 consecutive days; 50% to be released when the Company’s

sales grow approximately 10 times the 2020 total, reaching

R$300,000,000 with a minimum of annual audited EBITDA of

R$50,000,000.

No future compensation will be settled by the

issuance of shares and the Board of Directors has no intention to

request such permission from shareholders as had to be the case in

the last 4 years.

For 2020, Mr Veloso was paid a bonus of $550,990

for hitting the Company’s targets of growth and sales for the

period. He reinvested all his bonus in the Company through the

exercise of stock options and warrants. For 2021, Mr Veloso’s bonus

will be a sliding scale with a maximum of $420,000 if the Company

achieves a 115% growth in its EBITDA (before non-cash events) and a

minimum of $210,000 if the Company achieves a 45% growth. The

EBITDA will be calculated considering the cost of the bonus.

The golden age of potash prices saw the

company’s share price reach $10 in 2011. In the dark days when

potash prices traded as low as a fifth of previous prices, Mr

Veloso remained committed to the Company. Over this period, in

order to preserve the Company’s dwindling cash reserves, Mr Veloso

agreed to forego any cash payment and to be compensated exclusively

in shares. Since the Company's incorporation in 2005, Mr Veloso has

never sold a single Company share and since 2017 has reinvested all

the money paid as salaries and bonus into the Company, as well as

investing over $1 million in new financing.

As importantly, in 2014, it was thanks to Mr

Veloso's vision that the Company decided to focus on developing a

novel fertilizer that could be produced with a low capex and in a

scalable fashion. This strategy has allowed the company to become

profitable with minimal shareholder dilution since the Company was

incorporated, a policy that still underpins its strategy.

“I thank our loyal shareholders who trusted we

could turn the Company around in a time of great uncertainty.

Without their support we wouldn’t have succeeded when other

development potash companies were struggling. Thanks to them we

have become the only new entrant to succeed in bringing a new

potash mine into production. I also welcome all new shareholders

who are joining us in fulfilling our purpose to improve the health

of the planet and humanity. We will continue to do our utmost to

grow the sales and profitability of the Company”, declared Mr

Veloso.

INVESTORS NEWSLETTER

Subscribe to receive the Company’s monthly

updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

http://bit.ly/InvestorsNL-February2021

Q4 AND FY 2020 RESULTS CONFERENCE CALL

The Company will host a conference call on

Wednesday, April 7, 2021 at 11:00 pm Eastern Time (4:00 pm

Greenwich Mean Time), to discuss Q4 and FY 2020 results and provide

an update. Subscribe using the link below and receive the

conference details by email.

|

Date: |

Wednesday, April 7, 2021 |

|

Time: |

11:00 am Eastern Time (4:00 pm Greenwich Mean Time) |

|

Subscription link: |

http://bit.ly/VerdeAgriTech-Q4-FY-2020 |

The Company’s third quarter financial statements

and related notes for the period ended on September 30, 2020 are

available to the public on SEDAR at www.sedar.com and the Company’s

website at www.investor.verde.ag/.

About Verde AgriTech

Verde AgriTech promotes sustainable and

profitable agriculture through the development of its Cerrado Verde

Project. Cerrado Verde, located in the heart of Brazil’s largest

agricultural market, is the source of a potassium-rich deposit from

which the Company intends to produce solutions for crop nutrition,

crop protection, soil improvement and increased sustainability.

For additional information please

contact:

Cristiano Veloso, President

& Chief Executive

Officer Tel: +55

(31) 3245 0205; Email: cv@verde.ag

www.verde.ag | www.supergreensand.com

Cautionary Language and Forward Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

- the estimated amount and grade of Mineral Resources and Mineral

Reserves;

- the PFS representing a viable development option for the

Project;

- estimates of the capital costs of constructing mine facilities

and bringing a mine into production, of sustaining capital and the

duration of financing payback periods;

- the estimated amount of future production, both produced and

sold; and,

- estimates of operating costs and total costs, net cash flow,

net present value and economic returns from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include:

- the presence of and continuity of resources and reserves at the

Project at estimated grades;

- the geotechnical and metallurgical characteristics of rock

conforming to sampled results; including the quantities of water

and the quality of the water that must be diverted or treated

during mining operations;

- the capacities and durability of various machinery and

equipment;

- the availability of personnel, machinery and equipment at

estimated prices and within the estimated delivery times;

- currency exchange rates;

- Super Greensand® and K Forte® sales prices, market size and

exchange rate assumed;

- appropriate discount rates applied to the cash flows in the

economic analysis;

- tax rates and royalty rates applicable to the proposed mining

operation;

- the availability of acceptable financing under assumed

structure and costs;

- anticipated mining losses and dilution;

- reasonable contingency requirements;

- success in realizing proposed operations;

- receipt of permits and other regulatory approvals on acceptable

terms; and

- the fulfilment of environmental assessment commitments and

arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com ) for the year ended December

31, 2019. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

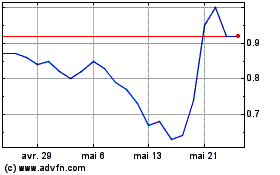

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025