Verde AgriTech Ltd (TSX: “NPK”)

(“

Verde” or the “

Company”) is

pleased to announce that its potassium multinutrient specialty

fertilizer, K Forte® (the “

Product”), has a

significantly lower carbon footprint than traditional potassium

chloride (“

KCl”) fertilizer, according to the

calculation tool developed by the Brazilian government, RenovaCalc.

The emission factor in Renovacalc applied to Potassium Chloride,

with 60% K2O mass content, is set at 0.455 tons of carbon dioxide

equivalent per ton of K2O (“t CO2e/t K2O”), sourced from the

Ecoinvent database.1 Following Renovacalc’s criteria and based on K

Forte®’s Life Cycle Assessment (“

LCA”), the

emission factor of the Product is set at 0.0655 t CO2e/t K2O.2,3

Therefore, the substitution of KCl fertilizer with Verde's Product

results in a reduction in emissions of 0.39 t CO2e/t K2O, which

represents an 85.6% reduction of the carbon footprint for K2O

within sugarcane and corn ethanol production in Brazil.

Brazil has approximately 3.3 million hectares of

sugarcane crops and 1.1 million hectares of corn dedicated to

biofuels.4 It takes 20 kg of the Product per ton of sugarcane and

10 kg of the Product per ton of corn, to replace KCl in K2O

supply.

"Brazil's dependence on potash imports,

primarily from Canada, Russia, and Belarus, which account for over

95% of its total consumption, has significant environmental

impacts. Given that agriculture contributes about 10-12% of the

world's greenhouse gas emissions, the need for mitigation

initiatives within corporate value chains is critical.5 Our Product

not only provides a high-quality source of potash and other

nutrients but also enhances soil biodiversity due to its salinity

and chloride-free properties. In addition, the replacement of KCl

with K Forte® in biofuel agricultural production could

significantly contribute to a more environmentally responsible

supply chain”, stated Cristiano Veloso, Verde’s Founder and

CEO.

The substitution of KCl fertilizer with Verde's

Product results in immediate carbon reductions and thus bolsters

Verde's sales value proposition, potentially strengthening Product

sales among farmers who track their emissions to meet

decarbonization goals.

BRAZILIAN NATIONAL BIOFUELS POLICY AND

RENOVACALC PARAMETERS

The Brazilian National Biofuels Policy

(“RenovaBio”) is a federal government initiative

formally established by Law 13.576/2017.6 RenovaBio aims to support

Brazil's commitments under the Paris Agreement within the United

Nations Framework Convention on Climate Change. The program focuses

on enhancing energy efficiency and reducing greenhouse gas

emissions across the production, marketing, and use of biofuels

through lifecycle assessment mechanisms. Additionally, it seeks to

promote the expansion of biofuel production and use within Brazil’s

energy matrix, ensuring a consistent fuel supply.

RenovaBio's guiding principle for achieving its

objectives is to incentivize fuels that have a lesser impact on

global warming, specifically those that result in lower lifecycle

greenhouse gas (“GHG”) emissions, such as

biofuels.

The policy operates through the following

steps:7

- Establishing of long-term national

goals (over 10 years) for reducing GHG emissions in the Brazilian

fuel matrix,

- Breaking down of these national

targets into individual mandatory targets for fuel producers,

- Assessing the performance of fuel

producers through RenovaCalc. The tool employs an attributional

approach for the lifecycle assessment (LCA) of biofuels,

encapsulating the "well-to-wheel" scope which assesses the

environmental impact from fuel extraction to its end use in vehicle

propulsion. The tool utilizes inventory data from the Ecoinvent

v.3.1 database for upstream agricultural processes, prioritizing

inventories specific to Brazil (BR), global averages (GLO), and,

when unavailable, data from the 'Rest of the World' (RoW), which is

an exact copy of the GLO dataset with adjusted uncertainty. For

biofuel distribution and usage, RenovaCalc relies on official and

sectoral statistics and a tool for estimating greenhouse gases for

intersectoral sources. With these inputs, RenovaCalc calculates the

carbon intensity (CI) of produced biofuels using standardized

lifecycle emission factors.

- Translating biofuels’s carbon

intensity into an Environmental Efficiency Score

(“EES”).

- Certifying fuel production based on

each producer's EES, leading to the generation of Biofuel

Decarbonization Credit Certificates (“CBIOs” from the Portuguese

“Créditos de Descarbonização de Biocombustíveis”), awarded to

producers of renewable biofuels based on the volume of production

and the sustainability of their processes. CBIOs are digital

financial securities held by financial institutions authorized by

the Brazilian National Agency of Petroleum, Natural Gas and

Biofuels (“ANP”), representing the reduction of

one ton of carbon dioxide emissions, verified by RenovaCalc through

each fuel's lifecycle analysis.

- These certificates can then be sold

in the financial market, primarily to fossil fuel distributors who

are mandated under Brazilian law to offset a portion of their

carbon emissions by purchasing CBIOs.8 This certification is

conducted by auditors accredited by the ANP.

Based on Brazil’s potash consumption for

sugarcane and corn for ethanol production, the use of K Forte® as a

potash source could potentially avoid the emission of up to 300,429

tons of CO2 per year,9 due to the reduction in emissions associated

with KCl production from 350,912 tons of CO2 to 50,483 tons

associated with K Forte® production. Given the average price of

CBIOs in the last 6 months, at C$28.20,10 this substitution could

generate the equivalent to C$8.5 million in CBIOs annually.11

Replacing KCl with the Product in a standard

biofuel production plant12 would result in an approximate 0.8%

increase in the Environmental Efficiency Score of the production

chain.

“The potential annual avoidance of CO2 emissions

is equivalent to taking approximately 65,000 cars off the road for

an entire year,13 or the amount of CO2 absorbed by approximately 5

million tree seedlings grown over ten years. This represents a

tremendous impact,” commented Mr Veloso.

BRAZILIAN AGRIBUSINESS DECARBONIZATION

Decarbonization in agriculture is becoming an

ever more relevant topic. Brazil is advancing its agenda for

reducing GHG from agriculture through the "Adaptation and Low

Carbon Emission Plan in Agriculture - ABC+" (2020-2030). This

initiative is designed to support Brazil's commitment to the Paris

Agreement by facilitating climate change adaptation and promoting

sustainable landscape management.14

Energy agriculture presents a pivotal

opportunity to transform Brazilian agribusiness as global economic

growth fuels increased energy demand. Ethanol and biodiesel, as

alternatives to fossil fuel energy, are gaining traction. Produced

from renewable resources such as sugarcane and forest biomass,

these biofuels are a step towards sustainability. Sugarcane

ethanol, noted for its exceptionally low carbon footprint,

contributes significantly to Brazil's renewable energy

matrix—accounting for 15.4% of the national energy matrix or 32% of

all domestically offered renewable energy. This places Brazil

(47.4%) well above the global average (14.1%) and the OECD

developed countries (11.5%) in the adoption of clean and renewable

energy. The sugarcane energy chain alone generates over US$100

billion in gross value, contributing roughly US$40 billion to

Brazil's GDP, equivalent to about 2% of the national GDP.15

In Brazil, a 27% ethanol blend in gasoline has

been legally mandated since 2015, making the country the world's

second-largest ethanol producer. Ethanol, derived from both

sugarcane and corn, can be used either in its hydrated form or

mixed with gasoline (anhydrous ethanol), significantly aiding

environmental preservation and air quality improvement by reducing

GHG emissions by up to 90% compared to gasoline.16

RenovaBio sets annual decarbonization targets

for the fuel sector to boost biofuel production and use in the

nation's transport energy matrix. By 2030, RenovaBio aims to

achieve more than a 10% reduction in GHG emissions within the

Brazilian transport sector, significantly contributing to the

national commitment of a 43% total GHG emission reduction.17

Internationally, similar initiatives to

RenovaBio, such as the Low Carbon Fuel Standard (LCFS) of the

California government and the Renewable Energy Directive (RED) of

the European Union, have demonstrated success and longevity, with

over a decade of implementation.

ABOUT VERDE AGRITECH

Verde Agritech is dedicated to advancing

sustainable agriculture through the innovation of specialty

multi-nutrient potassium fertilizers. Our mission is to increase

agricultural productivity, enhance soil health, and significantly

contribute to environmental sustainability. Utilizing our unique

position in Brazil, we harness proprietary technologies to develop

solutions that not only meet the immediate needs of farmers but

also address global challenges such as food security and climate

change. Our commitment to carbon capture and the production of

eco-friendly fertilizers underscores our vision for a future where

agriculture contributes positively to the health of our planet.

For more information on how we are leading the

way towards sustainable agriculture and climate change mitigation

in Brazil, visit our website at https://verde.ag/en/home/.

COMPANY UPDATES

Verde invites you to subscribe for updates. By

signing up, you'll receive the latest news about the Company's

projects, achievements, and future plans.

Subscribe at the following link:

http://cloud.marketing.verde.ag/InvestorsSubscription

CAUTIONARY LANGUAGE AND FORWARD-LOOKING

STATEMENTS

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

- the estimated amount and grade of

Mineral Resources and Mineral Reserves;

- the estimated amount of CO2 removal

per ton of rock;

- the PFS representing a viable

development option for the Project;

- estimates of the capital costs of

constructing mine facilities and bringing a mine into production,

of sustaining capital and the duration of financing payback

periods;

- the estimated amount of future

production, both produced and sold;

- timing of disclosure for the PFS

and recommendations from the Special Committee;

- the Company’s competitive position

in Brazil and demand for potash; and,

- estimates of operating costs and

total costs, net cash flow, net present value and economic returns

from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

- the presence of and continuity of

resources and reserves at the Project at estimated grades;

- the estimation of CO2 removal based

on the chemical and mineralogical composition of assumed resources

and reserves;

- the geotechnical and metallurgical

characteristics of rock conforming to sampled results; including

the quantities of water and the quality of the water that must be

diverted or treated during mining operations;

- the capacities and durability of

various machinery and equipment;

- the availability of personnel,

machinery and equipment at estimated prices and within the

estimated delivery times;

- currency exchange rates;

- Super Greensand® and K Forte® sales

prices, market size and exchange rate assumed;

- appropriate discount rates applied

to the cash flows in the economic analysis;

- tax rates and royalty rates

applicable to the proposed mining operation;

- the availability of acceptable

financing under assumed structure and costs;

- anticipated mining losses and

dilution;

- reasonable contingency

requirements;

- success in realizing proposed

operations;

- receipt of permits and other

regulatory approvals on acceptable terms; and

- the fulfilment of environmental

assessment commitments and arrangements with local

communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Cristiano Veloso, Chief

Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.verde.ag | www.investor.verde.ag

__________________________________1 Please see the

“RenovaCalc” section for further information on the calculation

assumptions.2 Considers K Forte®’s “cradle-to-gate” emissions, in

accordance with RenovaCalc’s parameters. RenovaCalc’s standardized

lifecycle emission factors encompass all emissions from the

extraction of raw materials through to the completion of

production, not including shipping emissions. For biofuel

distribution and usage, RenovaCalc relies on official and sectoral

statistics and a tool for estimating greenhouse gases for

intersectoral sources. With these inputs, RenovaCalc calculates the

Environmental Efficiency Score (“EES”) of produced biofuels. Please

see the “RenovaCalc” section for further information on the

calculation assumptions.3 For K Forte®, containing 10% K2O, a

tenfold increase in application is considered to match the mass

equivalent of K2O used in KCl, achieving equivalence to 1 kg of

K2O.4 Assumptions: 31.193 million liters of ethanol produced per

year (Source: Sugarcane and Bioenergy Observatory –

UNICAdata). Dosages of 100 and 200 kg of K2O per hectare,

respectively, for corn and sugarcane. Assuming the average yield of

4,025 liters per hectare for corn and 8,100 liters per hectare for

sugarcane. K Forte (10% K2O) and KCl (60% K2O).5 BRENTRUP, F.;

HOXHA, A.; CHRISTENSEN, B. Carbon footprint analysis of mineral

fertilizer production in Europe and other world regions. [s.l:

s.n.].6 To meet the obligations assumed by Brazil at the United

Nations Conference on Climate Change 2015 (COP 21), the Brazilian

National Biofuels Policy (RenovaBio) was implemented in 2017

by Law No. 13,576/2017, with additional regulations

established by Decree No. 9,888/2019 and Ordinance No. 56 of

December 21, 2022 issued by the Brazilian Ministry of Mines and

Energy. For further information, please see:

https://www.gov.br/mme/pt-br/assuntos/secretarias/petroleo-gas-natural-e-biocombustiveis/renovabio-1/renovabio-ingles7

Sources: a) ANP (2018). RenovaBio – Strategic

Guidelines – Proposal submitted for public consultation.b) ANP

(2018). RenovaBio – Next Steps in Regulation. 40th Ordinary Meeting

of the Sugar and Alcohol Production Chain Sectoral Chamber.c)

Official Gazette of the Union, National Energy Policy Council –

Resolutions No. 5, June 5, 2018 and Resolution No. 758, November

23, 2018.d) Embrapa (2018). Technical Note – RenovaCalcMD: Method

and Tool for Accounting the Carbon Intensity of Biofuels in the

RenovaBio Program.8 Although there is no restriction on the type of

buyer eligible to purchase CBIOs, it should be noted that,

according to Brazilian Law No. 13,576, it is mandatory for fossil

fuel distribution companies to buy CBIOs to meet their

decarbonization targets.9 Assumptions: 31.193 million liters of

ethanol produced per year (Source: Data from the Sugarcane and

Bioenergy Observatory - UNICAdata - which provides historical data

on ethanol production by raw materials, sugarcane and corn for the

2022/2023 harvest). Dosages of 100 and 200 kg of K2O per hectare,

respectively, for corn and sugarcane. Assuming the average yield of

4,025 liters per hectare for corn and 8,100 liters per hectare for

sugarcane. Demand for 7.71 million tons for K Forte (10% K2O) and

1.28 million tons for KCl (60% K2O).10 CBIOs average price from

December 01, 2023 to May 31, 2024 was 102.92 Brazilian Reais

("R$”). Source: B3. Currency Exchange Rate: C$1.00

= R$3.65.11 R$30.9 million. Currrency Exchange Rate: C$1.00 =

R$3.65.12 Standard profile for biofuel production: an option in

RenovaCalc for biofuel producers or importers, which includes the

technical parameters related to the production of energy biomass,

pre-filled with data that reflects the average production profile

in Brazil, with added penalties. Source: Official Gazette of the

Union, ANP – Resolution No. 758, November 23, 2018.13 Based on the

average car emitting about 4.6 tons of CO2 annually.14 Sources:

https://www.gov.br/agricultura/pt-br/assuntos/sustentabilidade/planoabc-abcmais

and

https://www.gov.br/agricultura/pt-br/assuntos/sustentabilidade/planoabc-abcmais/abc/programas-e-estrategias15

Source: https://unicadata.com.br/listagem.php?idMn=15816 Source:

Data report on the sugar energy sector in Brazil and its economic,

environmental and social impacts (from Portuguese “Fotografia do

setor açúcar energético no Brasil e os benefícios econômicos,

ambientais e sociais gerados”), Brazilian Sugarcane Industry and

Bioenergy Association (Unica).17 Source: Brazilian Sugarcane

Industry and Bioenergy Association (Unica)

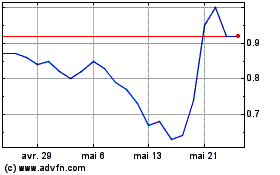

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024