Surge Energy Inc. Announces Upsizing of Previously Announced Equity Financing

03 Novembre 2022 - 1:20PM

Surge Energy Inc. (“Surge”, “SGY”, or the “Company”) (TSX: SGY) is

pleased to announce that, as a result of excess demand, it has

agreed with the syndicate of underwriters led by National Bank

Financial Inc. and Peters & Co. Limited to increase the size of

its previously announced bought-deal financing (the "Offering").

Surge will now issue 7,568,000 common shares (the "Common Shares")

at a price of $9.25 per Common Share to raise aggregate gross

proceeds of $70,004,000 pursuant to the Offering.

The underwriters will have an option to purchase

up to an additional 15% of the Common Shares issued under the

Offering at a price of $9.25 per Common Share to cover over

allotments exercisable in whole or in part at any time until 30

days after the closing of the Offering. The maximum gross proceeds

that could be raised under the Offering is $80,504,600 should the

over-allotment option be exercised in full.

In all other respects, the terms of the Offering

and use of proceeds therefrom will remain as previously disclosed

in the November 2, 2022 press release.

For more information about Surge, visit our website at

www.surgeenergy.ca

| Paul

Colborne, President & CEO |

Jared

Ducs, CFO |

| Surge Energy Inc. |

Surge Energy Inc. |

| Phone: (403) 930-1507 |

Phone: (403) 930-1046 |

| Fax: (403) 930-1011 |

Fax: (403) 930-1011 |

| Email: pcolborne@surgeenergy.ca |

Email: jducs@surgeenergy.ca |

Neither the

TSX nor its

Regulation Services

Provider (as

that term is

defined in the

policies of the

TSX) accepts

responsibility for

the adequacy or

accuracy of this

release.

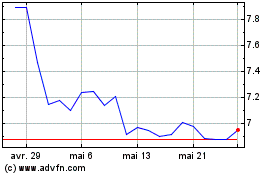

Surge Energy (TSX:SGY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Surge Energy (TSX:SGY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024