Atlas Salt (the “Company” or “Atlas”

– TSXV: SALT) is pleased to announce the results of a

Feasibility Study (FS) and updated Mineral Resource estimate

prepared by SLR Consulting (Canada) Ltd. (SLR) on its 100%-owned

Great Atlantic Salt Project (“Great Atlantic”, or the “Project”)

located in western Newfoundland, Canada. The FS represents a

significant economic improvement over the Preliminary Economic

Assessment (PEA), also completed by SLR, released by Atlas January

30, 2023 (all figures in Canadian dollars).

In addition, SLR has also provided an expansion

case to 4.0 million tonnes per year (Mtpa) of road deicing salt

over a 47.5-year mine life presented at a Preliminary Economic

Assessment (PEA) level analysis. This demonstrates a robust upside

production scenario with a pre-tax net present value (NPV) at 8% of

$2.015 billion (CDN) and a pre-tax IRR of 28%. The

expansion case is based on Probable Mineral Reserves, with the

remainder being Inferred Mineral Resources. Inferred Mineral

Resources are considered too geologically speculative to have

economic considerations applied to them that would enable them to

be categorized as Mineral Reserves. There is no certainty that the

production forecasts on which the expansion case is based will be

realized.

FS Highlights

Robust economics based on 2.5 million tonnes-per-year production

over a 34-year mine life:

Pre-Tax Economics

-

Internal Rate of Return (IRR) of 23%.

-

Net Present Value (NPV) at 8% of $1.017 billion

(CDN).

-

Payback in 4.2 years after commencement of operations.

-

Low-cost production – utilizing a Q3 2023 cost basis of $22.70 per

tonne FOB originating port.

Expansion of Indicated Mineral Resources, and

first-time declaration of Mineral Reserves:

Updated Mineral Resource

Estimate

-

Indicated Mineral Resources totaling 383 Mt at 96.0 % NaCl.

-

Inferred Mineral Resources totaling 868 Mt at 95.2 % NaCl.

-

Probable Mineral Reserves totaling 88.1 Mt at 96% NaCl.Note: The

conversion of Inferred to Indicated Mineral Resources (and

subsequent conversion to Probable Mineral Reserves) has been

limited by the target of an initial 34-year mine life. It is

anticipated that further upgrading of Mineral Resources to Mineral

Reserves will be carried out from underground during the production

phase.

-

Key elements of the Project are designed to accommodate mine and

processing expansion of up to 4.0 Mtpa and to extend the mine life

beyond 34 years.

-

Great Atlantic would stand out as a low-cost producer and the first

major underground salt mine in North America designed to be

accessible by declines as opposed to shafts.

-

Designed to minimize environmental impact by utilizing electrified

equipment.

Mr. Rick LaBelle, Atlas CEO, commented: “I am

thrilled to be joining the Company at this pivotal point in its

history. The Independent Feasibility Study is a major milestone on

the path to the development of the massive high-grade Great

Atlantic deposit which will stand out as the salt mine of the 21st

century in North America, strategically located in the heart of a

robust salt market serving Eastern Canada and the U.S. East

Coast.”

Mr. LaBelle added, “I’m excited to be working

with President Rowland Howe, who played such an important role in

the development of the world’s largest underground salt mine at

Goderich, and we’re in the midst of assembling a top-notch team to

get the job done at Great Atlantic. The expansion scenario

underscores how there is substantial additional room to optimize an

already strong Feasibility Study. We have de-risked this project

and we will maximize the value of this unique, transformative asset

for shareholders in an investor-friendly way.”

Mr. LaBelle concluded, “I look forward to a very

busy Q4 as we build momentum and accordingly I expect Atlas Salt

will have much more to announce.”

PRMediaNow Interview with CEO Rick LaBelle:

“I think until today, this project was a

trailblazer. After today, it’s a game-changer.” - Atlas Salt CEO

Rick LaBelle discusses this news release

with PRmediaNow’s Cyndi Edwards

- click on the link below to view.

https://www.youtube.com/watch?v=SNOdVL4d-Nc

FS Technical Summary

Overview

The FS considers developing Great Atlantic into

an underground operating mine capable of producing 2.5 Mtpa of rock

salt with key mine access and plant infrastructure designed for 4.0

Mtpa. Construction of the mine would occur over three years, with

access to the deposit via twin declines. Extraction of rock salt

would occur using the room and pillar method, with continuous

mining equipment. Salt would be processed to a specific size and

grade using a crushing and screening plant located within the

underground mine, and then brought to surface via conveyor belts.

An overland conveyor would transport the rock salt from the mine

area to the existing Turf Point port for loading onto ships

destined for Canadian and American markets. The FS builds upon the

January 30, 2023 PEA and will form the basis for environmental

licensing and permitting and the next phase of engineering

design.

Mineral Resources

Canadian Institute of Mining, Metallurgy and

Petroleum (CIM) Definition Standards for Mineral Resources and

Mineral Reserves (CIM (2014) definitions) were used for Mineral

Resource classification. The updated Mineral Resource currently

includes 383 Mt of Indicated Mineral Resources plus 868 Mt of

Inferred Resources. Table 1 provides a summary of the Great

Atlantic Mineral Resource estimate prepared by SLR, with an

effective date of May 11, 2023. The results from the January 30 PEA

are shown for comparison.

Table 1: Summary of Great Atlantic

Mineral Resources

|

Category |

Tonnage(Mt) |

Grade(% NaCl) |

Contained NaCl(Mt) |

Jan 30 PEAResource

Tonnage(Mt) |

Jan 30 PEAResource

Grade(%NACL) |

|

Indicated |

383 |

96.0 |

368 |

187.2 |

96.4 |

|

Inferred |

868 |

95.2 |

827 |

999.4 |

95.6 |

Notes:

- CIM (2014) definitions were

followed for Mineral Resources.

- Mineral Resources are estimated

without a reporting cut-off grade. Reasonable Prospects for

Eventual Economic Extraction were instead demonstrated by reporting

within Mineable “Stope” Optimised (MSO) shapes, with a minimum

height of 5 m, minimum width of 20 m, length of

40 m, and minimum grade of 90% NaCl, with a 5 m minimum

pillar width between shapes.

- Bulk density is

2.16 t/m3.

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are inclusive of

Mineral Reserves.

- Salt prices are not directly

incorporated into the Mineral Resource MSO minimum target grades,

however, the mean Mineral Resource grades exceed the 95.0% NaCl (±

0.5%) specification outlined in ASTM Designation D632-12

(2012).

- Numbers may not add due to rounding.

The QP is not aware of any environmental,

permitting, legal, title, taxation, socio-economic, marketing,

political, or other relevant factors that could materially affect

the Mineral Reserve estimate.

Mining and Mineral Reserves

Mining designs, development plans, and schedules

have been prepared for a fully electric, mechanized room and pillar

mining operation. It is envisaged that salt will be mined using

continuous miners and hauled by truck to a lump breaker and

conveyor system to move material to a crushing and screening plant

located underground. The FS is based upon the initial production of

2.5 Mtpa of rock salt product with key mine infrastructure capacity

to expand to 4.0 Mtpa. A summary of Mineral Reserves, effective

July 31, 2023, is shown in Table 2.

Table 2: Summary of Great Atlantic

Mineral Reserves

|

Category |

Tonnage(Mt) |

Grade(% NaCl) |

Contained NaCl(Mt) |

|

Probable |

88.1 |

96.0% |

84.5 |

Notes:

- CIM (2014)

definitions were followed for Mineral Reserves.

- All Mineral Reserves

are classified as Probable Mineral Reserves, with extents limited

to the Indicated Mineral Resource wireframe.

- Salt prices are not

directly correlated into the Mineral Reserve estimate, however the

mean Reserve grades exceed the 95.0% NaCl (± 0.5%) specification

outlined in ASTM Designation D632-12 (2012) and based on a detailed

salt market review to determine economic viability.

- A minimum mining

height of 5.0 m and width of 16.0 m were used for production

rooms.

- Sterilization zones

8.0 m below top of salt and 5.0 m above bottom of salt have been

applied.

- A mining extraction

factor of 100% was applied to all excavations.

- Bulk density is 2.16

t/m3.

- Planned process

recovery is 95%.

- Numbers may not add

due to rounding.

The QP is not aware of any environmental,

permitting, legal, title, taxation, socio-economic, marketing,

political, or other relevant factors that could materially affect

the Mineral Reserve estimate.

The mine will be accessed through two declines

driven to 240 Level (nominally 240 m below surface) where the

process plant and related infrastructure will be located. One

decline will provide fresh air into the mine and be used for

vehicle access, while the other will exhaust air and contain an

overhead conveyor to transport finished rock salt product to

surface. Twin declines will be extended from the 240 Level to the

first production level at 320 Level, continuing deeper into the

mine as each new production level gets established. The primary

mine-related infrastructure including maintenance shops, vehicle

charging bays, and gear storages will be located on the 320

Level.

Internal declines will be developed as necessary

to sustain the initial production rate of 2.5 Mtpa over an initial

34-year mine life. A total of seven production levels supported

with internal declines and level-specific infrastructure will be

constructed to support mining activities on each level. Room and

pillar production mining will be executed in four cuts of five

meters height, resulting in a maximum room height of 20 m. Rooms

will be 16 m wide, separated by 25 m square pillars.

All major equipment used in the mine will be

battery electric or plugged electric, with minimal diesel-powered

equipment in the mine.

Processing

Processing of the salt will take place at a

crushing and screening plant located within the underground mine.

The rock salt produced will be suitable for use as a deicing

product, conforming to specification ASTM-D632, with a minimum NaCl

grade of 95% and certain grading sizes. Excess fines produced

during the crushing and screening process will be used within the

mine for haulage way surfacing. There are no chemical processes or

reagents involved in the production of rock salt, other than an

anti-caking agent that is added to the product immediately before

shipping. After rock salt has been processed, it will be

transported to the surface via conveyor belts. On surface, a series

of conveyor belts will transport the rock salt from the mine site

to the port.

Infrastructure

The Great Atlantic operation will include both

on and off-site infrastructure. On-site infrastructure has been

configured to minimize the mine site surface footprint. Components

of the on-site infrastructure include:

-

Site terrace

-

Lined and covered temporary salt storage area used during initial

excavations

-

Boxcut and decline access area

-

Surface buildings such as administration, warehouse, fuel bay, dry

facility, maintenance shop

-

Salt storage building and associated material handling system

-

Electrical substation and distribution

-

Surface water management system

-

Gatehouse and fencing

Notably, a tailings management facility is not

required for the Project, as all material that is processed will be

sold as rock salt or remain in the mine as fines.

Off-site infrastructure has been designed to

take advantage of some of the existing facilities available in the

immediate area, including the port, historical haul road, and a NL

Power electrical substation. From PEA to FS, the design of elements

for the off-site infrastructure have been improved based on

discussions with stakeholders.

Planned off-site infrastructure includes the

following:

-

Improved site access road alignment overland conveyor connecting

the mine to the port

-

Retrofitting of the existing port facilities to handle rock

salt

-

Addition of a new building and material handling system at the port

to expand the capacity of covered material storage

-

High voltage transmission line connection to NL Power’s substation

located in the town

-

Sewer and water connection to town utilities

Environment and Community Engagement

Environmental base line studies of the project

area have been completed by GEMTEC Consulting Engineers and

Scientists Limited (GEMTEC) throughout 2022 in preparation for the

registration of the project under the environmental review process.

Consultations with local community and affected groups are ongoing.

Atlas has retained the services of an experienced communications

consultant to assist and facilitate informed community input into

the project development. With the FS now concluded, Atlas intends

to launch into the formal environmental assessment process.

Marketing and Logistics

As part of the FS, Atlas and SLR have

commissioned multiple independent assessments of marketing and

logistics. These independent assessments have formed the basis of

the assumptions used in the FS.

Rock salt produced from Great Atlantic will

initially target the regional deicing markets in eastern Canada and

the US East Coast. It is estimated that this market requires

between 11.0 Mtpa and 16.0 Mtpa of rock salt in any given year,

sourced from domestic and international suppliers, with the demand

highly correlated to weather conditions. The primary customers of

rock salt are government entities which use a tender system for the

annual supply of deicing salt. Secondary customers include

commercial deicing operators.

Government entities include municipalities,

Departments of Transportation (DoT), counties, and other provincial

or state entities, while commercial operators may vary from

distribution companies for retail purchase, or contractors who

purchase rock salt for de-icing commercial and private

properties.

Cash Flow Model Basis

SLR has prepared a cash flow model that is based

on a 34-year mine plan with a production rate of 2.5 Mtpa. It is

noted that the Mineral Resource base will allow for a much longer

mine life. The mine schedule includes a three year ramp up period,

with year one production of 1.5 Mtpa, year two production of 2.0

Mtpa, and year three reaching steady-state production of 2.5

Mtpa.

The cash flow model comprises estimates of

capital costs, operating costs, an assessment of revenue, and

estimate of project economic metrics such as net present value,

internal rate of return, and payback period. Economic metrics were

assessed both on a pre- and post-tax basis.

SLR has assumed that pre-construction activities

commence in 2024, construction of the mine would commence in 2025,

with salt production commencing in 2028. To bring salt prices to a

2028 base date, SLR has applied a 4.0% annual increase to the price

of salt, which is consistent with other publicly available

technical reports on existing salt operations in North America.

Beyond 2028, SLR has applied a 2.0% annual increase to the price of

salt. In terms of costs, SLR has applied 2.0% annual inflation to

capital and operating costs. SLR has also applied a 2% premium to

prices every fifth year, to account for volatility in the rock salt

markets due to weather events.

Capital Costs

Capital costs for the Project have been

estimated based on first principles build ups, factored estimates,

and quotes for major equipment and supplies. The capital cost

estimate conforms to an AACE Class 3 estimate, as of the third

quarter (Q3) of 2023. Capital costs are divided between

pre-production capital (representing years leading up to salt

production) and sustaining capital. Costs are divided into areas

including mining, processing, infrastructure, off-site

infrastructure, indirect costs, owner’s costs, and contingency. The

capital cost estimate is presented in Table 3.

Table 3: Capital Cost Estimate – Initial

34 Year Production Plan

|

Direct Cost |

Amount (C$ '000) |

|

Mining |

151,646 |

|

Processing |

39,352 |

|

On-Site Infrastructure |

46,437 |

|

Off-Site Infrastructure |

64,522 |

|

Total Direct Cost |

301,958 |

|

|

|

Other Costs |

|

Indirect Cost |

71,121 |

|

Owners Costs |

34,154 |

|

Subtotal Costs |

407,232 |

|

|

|

Contingency |

72,898 |

|

Initial Capital Cost |

480,130 |

|

|

|

Sustaining |

599,930 |

|

Reclamation and closure |

30,246 |

|

Total Capital Cost |

1,107,222 |

Notes:

- Capital costs include escalation.

Operating Costs

Operating costs for the Project have been

estimated based on first principles build ups, estimations of

labour quantities and remuneration, productivity, and consumption

assumptions. The operating cost estimate is as of Q3 2023.

Operating costs are divided into disciplines including mining,

processing, general and administration, and port operations. SLR

has assumed that the port would be owned and operated by a

third-party and accessible based on commercial terms. The operating

cost estimate is presented in Table 4.

Table 4: Operating Cost

Estimate

|

Area |

LOM – Initial 34Year Plan (C$

‘000) |

Unit Costs with Q32023 Basis (C$/mt

shipped) |

LOM Unit Costs(C$/mt

shipped) |

|

Mining |

1,532,637 |

11.71 |

18.32 |

|

Processing and Material Handling |

1,087,987 |

8.34 |

13.01 |

|

General and Administration |

345,763 |

2.65 |

4.13 |

|

Total |

2,966,386 |

22.70 |

35.46 |

Notes:

2. The columns LOM (life of

mine) – Initial 34 Year Plan, and LOM Unit Costs include

escalation.

Pricing and Revenue Assumptions

SLR has assumed a weighted average price of rock

salt based on a market analysis review completed by a third-party,

as well as taking into consideration the shipping and logistics

costs of getting the salt to destination ports. SLR’s revenue

analysis is based on pricing FOB Turf Point and is based on Q3

2023. The Project is subject to a royalty payable to Vulcan

Minerals Inc., in the amount of 3% of net production revenue. A

summary of revenue assumptions is presented in Table 5.

Table 5: Summary of Revenue

Assumptions

|

Price Forecast (FOB Turf Point) |

Value |

Units |

|

Q3 2023 Base Price |

72.24 |

C$/mt |

|

Year 1 Sales Price |

87.90 |

C$/mt |

|

LOM Sales Price |

124.86 |

C$/mt |

Economic Outcomes

The resulting economics of the Project including

net present value (NPV) and internal rate of return (IRR) are

presented in Table 6. Results from the January 30 PEA are shown for

comparison purposes.

Table 6: Summary of Economic Outcomes –

Initial 34 Year Production Plan at 2.5 Mtpa

|

Metric |

Units |

Value |

January 30 PEA |

|

Pre-Tax Payback Period |

yrs |

4.2 |

4.2 |

|

Pre-Tax IRR |

% |

23% |

22.1% |

|

Pre-tax NPV at 5% discounting |

C$ '000 |

1,900,081 |

1,627,736 |

|

Pre-tax NPV at 8% discounting |

C$ '000 |

1,017,038 |

909,338 |

|

Pre-tax NPV at 10% discounting |

C$ '000 |

681,292 |

620,247 |

|

|

|

|

|

|

Post-Tax Payback Period |

yrs |

4.8 |

5.0 |

|

Post-tax IRR |

% |

19% |

17.3 |

|

Post-tax NPV at 5% discounting |

C$ '000 |

1,145,765 |

920,320 |

|

Post-tax NPV at 8% discounting |

C$ '000 |

599,926 |

481,900 |

|

Post-tax NPV at 10% discounting |

C$ '000 |

386,682 |

304,935 |

It is noted that all calculations of NPV and IRR

assume an initial capital spending period of four years. The

payback period calculations have a base date of the commencement of

operations.

Expansion Case To 4 Million Tonnes Per Year

Production

In addition to the FS Case of 2.5 Mtpa, SLR has

prepared a Preliminary Economic Assessment for a scenario

comprising expanded production at a rate of 4 Mtpa. The mine plan

for the PEA is based upon extraction of 193 million tonnes,

consisting of the Mineral Reserves defined in the FS plus Indicated

and Inferred Mineral Resources from 320 level to 530 level. The

mine life is 47.5 years, with significant unmined Inferred

Resources remaining.

The mining designs contained in the PEA are

based, in part, on Inferred Mineral Resources. Approximately 46% of

the mine plan is based on Probable Mineral Reserves, with the

remainder being Inferred Mineral Resources. Inferred Mineral

Resources are considered too geologically speculative to have

economic considerations applied to them that would enable them to

be categorized as Mineral Reserves. There is no certainty that the

production forecasts on which the PEA is based will be

realized.

The major difference from the FS case is the

addition of three more continuous miners (total of five plus a

roadheader) and up to seven additional haul trucks. In the

pre-production and early years of production, development is

accelerated in order to access more workplaces.

The results of the PEA economic analysis are

shown in Table 7.

Table 7: Expansion Case Results

Summary

|

Item |

Units |

Expansion Case |

|

Reserve Tonnes Mined |

Mt |

88 |

|

Inferred Tonnes Mined |

Mt |

105 |

|

Total Tonnes Mined |

Mt |

193 |

|

NaCl Grade |

% |

95.5 |

|

Mine Life |

Years |

47.5 |

|

Total Net Revenue1 |

C$ millions |

24,754 |

|

Total LOM Operating Cost1 |

C$ millions |

4,885 |

|

LOM Unit Operating Cost |

C$/tonne |

34.45 |

|

Initial Capital Cost |

C$ millions |

480 |

|

Expansion Capital Cost |

C$ millions |

101 |

|

Sustaining Capital |

C$ millions |

1,446 |

|

Reclamation and Closure |

C$ millions |

39 |

|

Total Capital |

C$ millions |

2,063 |

|

Pre-Tax Cashflow |

C$ millions |

17,803 |

|

Payback |

Years |

4.2 |

|

Pre-Tax IRR |

% |

28 |

|

Pre-tax NPV at 5% |

C$ millions |

4,095 |

|

Pretax NPV at 8% |

C$ millions |

2,015 |

|

Pretax NPV at 10% |

C$ millions |

1,320 |

- All costs and

revenue are escalated from Q3/2023. Revenue is escalated at 4% per

year to 2028 and 2% per year thereafter. Operating costs are

escalated at 2% per year.

Next Steps

Upon completion of the FS, Atlas intends to

release a supporting NI 43-101 Technical Report filed on SEDAR

within 45 days of this news release. Other ongoing work towards

advancing the Project includes the following:

- Ramp up of owner’s team to advance

the next phases of engineering

- Initiation of formal environmental

approvals process

- Review of recommended field programs

that could further de-risk the project

- Continued engagement with

stakeholders and First Nations groups

- Ongoing discussions with potential

vendors and suppliers

Qualified Persons

This News Release describes an updated Mineral

Resource estimate, a feasibility study and cash flow, and an

expansion case at a PEA level based upon geological, engineering,

technical and cost inputs developed by SLR Consulting (Canada) Ltd.

A National Instrument 43-101 Technical Report (NI 43-101) will be

filed on SEDAR within 45 days. The technical

information in this news release has been prepared in accordance

with the Canadian regulatory requirements set out in NI 43-101 and

reviewed and approved by EurGeol Dr. John G. Kelly, P.Geo., FIMMM,

MIQ, David M. Robson, P.Eng., MBA, Lance Engelbrecht, P.Eng., Derek

J. Riehm, M.A.Sc., P.Eng., and Graham G. Clow, P.Eng. each of whom

is a “qualified person” under National Instrument 43-101

– Standards of Disclosure for Mineral Projects ("NI

43-101").

The technical information in this news release

has been prepared in accordance with the Canadian regulatory

requirements set out in National Instrument 43-101 and reviewed on

behalf of the company by Patrick J. Laracy, P. Geo, Chairman

of Atlas Salt, a qualified person.

About Atlas Salt

Bringing the Power of SALT to

Investors: Atlas Salt owns 100% of the Great Atlantic

salt deposit strategically located in western Newfoundland in the

middle of the robust eastern North America road salt market. The

project features a large homogeneous high-grade resource located

immediately next to a deep-water port. Atlas is also the largest

shareholder in Triple Point Resources as it pursues development of

the Fischell’s Brook Salt Dome approximately 15 kilometers south of

Great Atlantic in the heart of an emerging Clean Energy

Hub.

We seek Safe Harbor.

For information, please

contact:

Richard LaBelle, CEO(709)

754-3186investors@atlassalt.ca

MarketSmart Communications

Inc.Adrian SydenhamToll-free:

1-877-261-4466info@marketsmart.ca

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider, (as the term is defined in the

Policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release. This press release

includes certain “forward-looking information” and “forward-looking

statements” (collectively “forward-looking statements”) within the

meaning of applicable Canadian securities legislation. All

statements, other than statements of historical fact, included

herein, without limitation, statements relating to the future

operating or financial performance of the Company, are

forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “potential”,

“possible”, and similar expressions, or statements that events,

conditions, or results “will”, “may”, “could”, or “should” occur or

be achieved. Forward-looking statements in this press release

relate to, among other things: completion, delivery and timing of

the referenced assessments and analysis and assumptions related

thereto. Actual future results may differ materially. There can be

no assurance that such statements will prove to be accurate, and

actual results and future events could differ materially from those

anticipated in such statements. Forward-looking statements reflect

the beliefs, opinions and projections on the date the statements

are made and are based upon a number of assumptions and estimates

that, while considered reasonable by the respective parties, are

inherently subject to significant business, technical, economic,

and competitive uncertainties and contingencies. Many factors, both

known and unknown, could cause actual results, performance or

achievements to be materially different from the results,

performance or achievements that are or may be expressed or implied

by such forward-looking statements and the parties have made

assumptions and estimates based on or related to many of these

factors. Such factors include, without limitation: the timing,

completion and delivery of the referenced assessments and analysis.

Readers should not place undue reliance on the forward-looking

statements and information contained in this news release

concerning these times. Except as required by law, the Company does

not assume any obligation to update the forward-looking statements

of beliefs, opinions, projections, or other factors, should they

change, except as required by law.

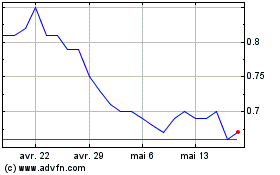

Atlas Salt (TSXV:SALT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Atlas Salt (TSXV:SALT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025