true

Amend Original Filing

0001527702

0001527702

2024-01-19

2024-01-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM

8-K/A

Amendment No. 1

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January

19, 2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Explanatory Note

On January 25, 2024, we filed a

Current Report on Form 8-K to disclose the closing of a Share Purchase Agreement (the “Agreement”) with Yukon River

Holdings, Ltd., described in Item 1.01 to that report, which agreement provides for the purchase of 51% of the equity of QXTEL

LIMITED, a company incorporated in England and Wales. This Amendment to the Current Report on Form 8-K is filed to provide the

required financial statements of the business to be acquired and pro forma financial information.

SECTION 1 - REGISTRANT'S BUSINESS AND OPERATIONS

ITEM 1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Share Purchase Agreement

On January 19, 2024, we entered into a Share Purchase

Agreement (“Purchase Agreement”) with Yukon River

Holdings, Ltd. (“Yukon River”), a

corporation formed under the laws of the British Virgin Islands (“Seller”) concerning the contemplated sale by Seller and

the purchase by us of 51% of the ordinary shares Seller holds in QXTEL LIMITED, a company incorporated in England and Wales (the “Company”).

The Company is one of the

most advanced & diversified telecommunications and technology services provider focused on platform services for wholesale, retail

and cloud communications service providers, wholesale carrier voice, wholesale carrier messaging (A2P SMS) and carrier technology services

with over 20 years in the telecom industry switching more than 5 billion voice & A2P SMS transactions over 200 interconnections worldwide.

Headquartered in London (UK) with regional offices in Florida (USA), Buenos Aires (Argentina), Dubai (UAE), Belgrade (Serbia) and Istanbul

(Turkey).

The purchase price (the “Purchase Price”)

payable to the Seller for the shares is US $5,000,000. Upon the execution of the Purchase Agreement, we agreed to deposit US $1,500,000

of the Purchase Price into the trust account of a law firm acting as escrow agent (the “Escrow Agent”) as a nonrefundable

deposit to evidence our good faith intention to purchase the shares. If the Purchase Agreement does not close before April 30, 2024, the

deposit is non-refundable. If the Purchase Agreement closes, the deposit will be credited against the Purchase Price.

At closing, in addition to the US $1,500,000 with

the Escrow Agent that will form part of the Purchase Price, we are required to pay US $1,500,000 in cash and US $2,000,000.00 to the Seller,

either (A) in the form of a promissory note (the “Promissory Note”), or (B) by the delivery of iQSTEL shares to Seller. Seller

may decide the form of payment between the Promissory Note or the share of iQSTEL, and if a Promissory Note is chosen, we have agreed

to allow Seller the option to exchange the Promissory Note for shares of iQSTEL.

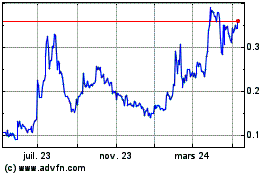

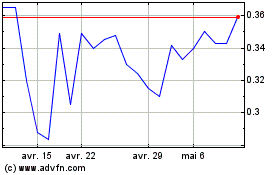

We are required to reserve a sufficient number

of shares for the iQSTEL shares payable to the Seller under a formula discounted by 20% of the average closing sales price for 5 consecutive

days on the trading market.

Also, in the event Seller chooses the Promissory

Note, Seller shall also have a security interest, or pledge, in 40% of the ordinary shares that are being sold to us. In the event Seller

chooses the Promissory Note, the $2,000,000 will be paid with no interests in 7 monthly payments of $200,000 each and an eighth payment

of $600,000.

For the period commencing on January 1, 2024 and

ending December 31, 2024 (the “Determination Period”), Seller may receive an earn-out payment (“Earnout Payment”),

as additional consideration. If we have positive Net Income of greater than US $1,000,000 during the Determination Period, then we shall

pay to Seller an Earnout Payment equal to the Earnout Amount. If we have positive Net Income equal to or greater than $750,000, but less

than US $1,000,000, during the Determination Period, then we shall pay to Seller an Earnout Payment equal to the amount of the Net Income.

If we have positive Net Income of less than $750,000 during the Determination Period, then Seller shall not be entitled to any Earnout

Payment.

At closing, which must occur before April 30,

2024, we have agreed to enter into a shareholder’s agreement with Seller that, among other things, establishes a first of first

refusal for us to repurchase the shares from Seller.

Our obligation to close the transactions contemplated

by the Purchase Agreement is contingent upon the closing of debt and/or equity financing of up to an additional US $1,500,000 on terms

reasonably satisfactory to us.

The closing of the Purchase Agreement is subject

to, among other things, the Company having prepared all accounting information in accordance with SEC standards in such manner that any

audit of the Company, if required, may be performed.

The Purchase Agreement contains customary representations

and warranties of the parties, including, among others, with respect to corporate organization, capitalization, corporate authority, financial

statements and compliance with applicable laws. The representations and warranties of each party set forth in the Purchase Agreement were

made solely for the benefit of the other parties to the Purchase Agreement, and investors are not third-party beneficiaries of the Purchase

Agreement. In addition, such representations and warranties (a) are subject to materiality and other qualifications contained in the Purchase

Agreement, which may differ from what may be viewed as material by investors, (b) were made only as of the date of the Purchase Agreement

or such other date as is specified in the Purchase Agreement and (c) may have been included in the Purchase Agreement for the purpose

of allocating risk between the parties rather than establishing matters as facts. Accordingly, the Purchase Agreement is included with

this filing only to provide investors with information regarding the terms of the Purchase Agreement, and not to provide investors with

any other factual information regarding any of the parties or their respective businesses.

The foregoing description of the Purchase Agreement

is not complete and is qualified in its entirety by reference to the text of such document, which is filed as Exhibit 2.1 hereto and which

is incorporated herein by reference.

Securities Purchase Agreement and Secured Convertible

Promissory Note

On January 24, 2024, we entered into a securities

purchase agreement (the “SPA”) with M2B Funding Corp., a Florida

corporation, for it to purchase up to the principal

amount of US $3,888,888.89 in secured convertible promissory notes (the “Notes”) for an aggregate purchase price of US $3,500,000.00

(the “Purchase Price”), which Notes are convertible into shares (“Conversion Shares”) of our common stock with

an initial conversion price of $0.11 per share. Each noteholder shall receive shares of common stock (“Kicker Shares”) in

an amount equal to ten percent of the

principal amount of any Note issued divided by

$0.11. The Notes are secured by all of our assets under a Security Agreement signed with the SPA.

The initial tranche will be for US $2,222,222.22

in face value of Notes and Kicker Shares, with an original issue discount of US $222,222.22, and the second tranche will be for US $1,666,666.67

in face value of Notes and Kicker Shares, with an original issue discount of US $166,666.67. Each one-year note bears interest at 18%

per annum.

Provided no default has occurred, we may prepay

the Notes at 110% of the outstanding principal amounts plus all other sums due and owing.

We have agreed with certain covenants in connection

with the financing, including a prohibition on us entering any variable rate transactions, restrictions on future offerings or incurring

indebtedness, and a most favored nation clause, among other provisions.

We have also agreed, pursuant to a Registration

Rights Agreement, to register the Conversion Shares and the Kicker Shares with the Securities and Exchange Commission in a registration

statement.

The foregoing description of the SPA, the Registration

Rights Agreement, the Security Agreement and form of Note is not complete and is qualified in its entirety by reference to the text of

such documents, which are filed as Exhibit 10.1, 10.2, 10.3 and 4.1 hereto and which are incorporated herein by reference.

SECTION 2 - FINANCIAL INFORMATION

Item 2.01 Completion of

Acquisition or Disposition of Assets.

The information set forth

in Items 1.01 is incorporated into this Item 2.01 by reference.

ITEM

2.03 – CREATION OF A DIRECT FINANCIAL OBLIGATION

The information set forth

in Items 1.01 is incorporated into this Item 2.03 by reference.

SECTION 9 – FINANCIAL

STATEMENTS AND EXHIBITS

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS.

| Exhibit No. |

Description |

| 2.1 |

Purchase Agreement, dated January 19, 2024 |

| 4.1 |

Secured Convertible Promissory Note, dated January 1, 2024 |

| 10.1 |

Securities Purchase Agreement, dated January 1, 2024 |

| 10.2 |

Registration Rights Agreement, dated January 24, 2024 |

| 10.3 |

Security Agreement, dated January 24, 2024 |

| 99.1 |

Audited financial statements as of and for the years ended December 31, 2022 and 2021 |

| 99.2 |

Unaudited financial statements as of and for the three and nine-month periods ended September 30, 2023 and 2022 |

| 99.3 |

Unaudited pro forma financial statements |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date: February 8, 2024

| |

|

Financial Statements |

| |

|

As of and For the Years Ended |

| |

|

December 31, 2022 and 2021 |

| Independent Auditor’s Report |

1-2 |

| |

|

| |

|

| Financial Statements |

|

| |

|

| Balance Sheets |

| 3 | |

| |

| | |

| Statements of Income |

| 4 | |

| |

| | |

| Statements of Changes in Shareholders’ Equity |

| 5 | |

| |

| | |

| Statements of Cash Flows |

| 6 | |

| |

| | |

| Notes to Financial Statements |

| 7-11 | |

Independent Auditor’s Report

To the Members of

Qxtel Limited

Opinion

We have audited the financial

statements of Qxtel Limited (the Company), which comprise the balance sheets as of December 31, 2022 and 2021, and the related statements

of income, changes in shareholders’ equity, and cash flows for the years then ended, and the related notes to the financial statements.

In our opinion, the accompanying

financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021,

and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted

in the United States of America.

Basis for Opinion

We conducted our audits in

accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards

are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are

required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements

relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit

opinion.

Responsibilities of Management for the Financial

Statements

Management is responsible for the

preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United

States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation

of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements,

management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about

the Company’s ability to continue as a going concern within one year after the date that the financial statements are available

to be issued.

Auditor’s Responsibilities for the Audits

of the Financial Statements

Our objectives are to obtain

reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error,

and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute

assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement

when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as

fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are

considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made

by a reasonable user based on the financial statements.

In performing an audit in accordance

with GAAS, we:

| · | Exercise professional judgment and maintain professional skepticism throughout

the audit. |

|

| · | Identify and assess the risks of material misstatement

of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures

include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. |

|

| · | Obtain an understanding of internal control relevant

to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion

on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. |

|

| · | Evaluate the appropriateness of accounting policies

used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the

financial statements. |

|

| · | Conclude whether, in our judgment, there are conditions

or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern

for a reasonable period of time. |

|

We are required to communicate

with those charged with governance regarding, among other matters, the planned scope and timing of the audits, significant audit findings,

and certain internal control-related matters that we identified during the audits.

Pittsburgh, Pennsylvania February 5, 2024

Qxtel Limited

Balance Sheets

| December 31, |

2022 |

2021 |

|

Assets |

|

|

| Current assets |

|

|

| Cash and cash equivalents |

$ 1,841,237 |

$ 1,228,674 |

| Accounts receivable - trade, net |

5,558,471 |

4,746,529 |

|

Total current assets |

7,399,708 |

5,975,203 |

|

Property and equipment |

|

|

| Fixtures and fittings |

14,281 |

14,281 |

| Computer equipment |

36,100 |

22,508 |

| |

50,381 |

36,789 |

| Less accumulated depreciation |

(26,500) |

(21,418) |

|

Total property

and equipment |

23,881 |

15,371 |

|

Other assets |

|

|

| Intangible assets |

73,798 |

- |

| Other asset |

150,000 |

150,000 |

|

Total other

assets |

223,798 |

150,000 |

|

Total

assets |

$ 7,647,387 |

$ 6,140,574 |

| Liabilities and shareholders' equity |

|

|

| Current liabilities |

|

|

| Accounts payable |

3,809,526 |

2,856,075 |

| Accrued expenses |

1,535,963 |

1,410,382 |

|

Total current liabilities |

5,345,489 |

4,266,457 |

|

Shareholders' equity |

|

|

| Share capital |

152 |

152 |

| Retained earnings |

2,301,746 |

1,873,965 |

| Total shareholders' equity |

2,301,898 |

1,874,117 |

|

Total liabilities and shareholders' equity |

$ 7,647,387 |

$ 6,140,574 |

The accompanying notes are

an integral part of these financial statements.

Qxtel

Limited

Statements

of Income

| Years

Ended December 31, |

2022 |

2021 |

Sales |

$

81,506,401 |

$

82,514,250 |

| Cost

of sales |

77,623,467 |

78,644,593 |

Gross

profit |

3,882,934 |

3,869,657 |

| Selling,

general, and administrative expenses |

2,569,589 |

2,484,817 |

Net

income before provision for income taxes |

1,313,345 |

1,384,840 |

| Income

tax expense |

235,564 |

283,144 |

Net

income |

$

1,077,781 |

$ 1,101,696 |

The accompanying notes are an

integral part of these financial statements.

Qxtel Limited

Statements

of Changes in Shareholders’ Equity

| |

Share capital | | |

Retained earnings | | |

Total Shareholders' Equity | |

Balance

- December 31, 2020 |

$ | 152 | | |

$ | 1,772,269 | | |

$ | 1,772,421 | |

| |

| | | |

| | | |

| | |

| Net income |

| — | | |

| 1,101,696 | | |

| 1,101,696 | |

| |

| | | |

| | | |

| | |

| Distributions |

| — | | |

| (1,000,000 | ) | |

| (1,000,000 | ) |

Balance

- December 31, 2021 |

$ | 152 | | |

$ | 1,873,965 | | |

$ | 1,874,117 | |

| |

| | | |

| | | |

| | |

| Net income |

| — | | |

| 1,077,781 | | |

| 1,077,781 | |

| |

| | | |

| | | |

| | |

| Distributions |

| — | | |

| (650,000 | ) | |

| (650,000 | ) |

Balance

- December 31, 2022 |

$ | 152 | | |

$ | 2,301,746 | | |

$ | 2,301,898 | |

The accompanying notes are an integral

part of these financial statements.

Qxtel Limited

Statements

of Cash Flows

| Years

Ended December 31, |

2022 |

2021 |

Cash

flows from operating activities:

Net

income |

$ 1,077,781 |

$ 1,101,696 |

Adjustment

to reconcile net income to net cash provided by operating activities:

Depreciation

expense |

5,082 |

3,820 |

| Changes

in operating assets and liabilities: Accounts receivable

- trade |

(811,942) |

527,677 |

| Accounts

payable |

953,451 |

(217,053) |

| Accrued

expenses |

125,581 |

(512,060) |

| Net

cash provided by operating activities |

1,349,953 |

904,080 |

Cash

flows from investing activities:

Purchase

of property and equipment |

(13,592) |

(7,825) |

| Purchase

of intangible assets |

(73,798) |

- |

| Net

cash used in investing activities |

(87,390) |

(7,825) |

Cash

flows from financing activities:

Distributions

paid |

(650,000) |

(1,000,000) |

| Net

increase (decrease) in cash and cash equivalents |

612,563 |

(103,745) |

| Cash

and cash equivalents, beginning of year |

1,228,674 |

1,332,419 |

| Cash

and cash equivalents, end of year |

$ 1,841,237 |

$ 1,228,674 |

Supplemental

disclosure of cash flow information:

Cash

paid for taxes |

$ 235,564 |

$ 283,144 |

The

accompanying notes are an integral part of these financial statements.

Qxtel Limited

Notes to

Financial Statements

For

the Years Ended December 31, 2022 and 2021

Qxtel Limited (the “Company”) is a private company, domiciled and incorporated in England and Wales. The registered office address is No. 1 Poultry, London, EC2R 8EJ.

The principal activity of the Company is the provision of international telecommunications traffic, offering both wholesale voice and retail services. In 2022, the Company also began to offer retail and wholesale A2P SMS services.

| 2. Accounting Policies |

| |

| Basis of Preparation of Financial Statements |

| |

| The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, which, in the opinion of management, have been consistently applied. |

| |

| The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates. |

| |

| The following principal accounting policies have been applied: |

| |

| Foreign Currency Translation and re-measurement |

| |

| The Company's functional and presentational currency is USD. |

| |

| Foreign currency transactions are translated into the functional currency using the spot exchange rates at the dates of the transactions. |

| |

| At each period end foreign currency items are translated using the closing rate. Non monetary items measured at historical cost are translated using the exchange rate at the date of the transaction and non monetary items measured at fair value are measured using the exchange rate when fair value was determined. No material foreign currency translation amounts are included in the accompanying financial statements. |

| |

| Revenue |

| |

The

Company recognizes revenue related to monthly usage charges and other recurring charges during the period in which the telecommunication

services are rendered in accordance with FASB ASC 606, “Revenue from Contracts with Customers, provided that persuasive

evidence of a sales arrangement existed and collection was reasonably assured. Persuasive evidence of a sales arrangement exists

upon execution of a written interconnection agreement. Revenue is measured at the fair value of the consideration receivable,

excluding discounts, rebates, value added tax and other sales taxes or duty. The Company’s payment terms vary by clients. |

Qxtel Limited

Notes to

Financial Statements

For

the Years Ended December 31, 2022 and 2021

| 2. Accounting Policies (cont.) |

|

| |

|

| Cost of Sales |

|

| |

|

| Cost of sales represent direct charges from vendors that the Company incurs to deliver services to its customers. These costs primarily consist of usage charges for calls terminated in the Company’s vendor networks. |

| |

| Cash and Cash Equivalents |

|

| |

|

| Cash and cash equivalents include cash in banks, money market funds, and certificates of term deposits with maturities of less than three months from inception, which are readily convertible to known amounts of cash. The Company maintains certain of its cash and cash equivalents in non-interest bearing accounts that are insured by the Federal Deposit Insurance Company up to $250,000. The Company’s deposits may, from time to time, exceed the $250,000 limit; however, management believes that there is no unusual risk present, as the Company places its cash and cash equivalents with financial institutions which management considers being of high quality. |

| |

| Accounts Receivable and Allowance for Uncollectible Accounts |

| |

| Substantially all of the Company’s accounts receivable balance is related to trade receivables. Trade accounts receivable are recorded at the invoiced amount and do not bear interest. The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in its existing accounts receivable. The Company reviews its allowance for doubtful accounts daily and past due balances over 60 days and a specified amount are reviewed individually for collectability. Account balances are charged off after all means of collection have been exhausted and the potential for recovery is considered remote. |

| |

| Intangible Assets |

|

| |

|

| Intangible assets are initially recognized at cost. After recognition intangible assets are measured at cost less any accumulated amortization and any accumulated impairment losses. |

| |

| The assets relate to software which is still in development as of December 31, 2022 and 2021. No amortization expense was recorded for the years ending December 31, 2022 or 2021. |

| |

| Property and Equipment |

|

| |

|

| Property and equipment are stated at historical cost less accumulated depreciation and any accumulated impairment losses. Historical cost includes all expenditures that are directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. |

| |

| Depreciation is charged so as to allocate the cost of assets less their residual value over their estimated useful lives. Depreciation expense was $5,082 and $3,820 for the years ended December 31, 2022 and 2021, respectively. |

| |

| The recovery periods of the asset classes are as follows: |

| |

Fixtures and fittings |

4 years |

| |

Computer equipment |

4 years |

Gains and losses on disposals are determined by comparing the proceeds with the carrying amount and are recognized in the statements of income.

Qxtel Limited

Notes to

Financial Statements

For

the Years Ended December 31, 2022 and 2021

| 2. Accounting

Policies (cont.) |

| |

| Impairment

of Long-Lived Assets |

| |

In

accordance with FASB ASC 360-10-45, Accounting for the Impairment or Disposal of Long-Lived Assets, long-lived assets,

such as property and equipment, are evaluated for impairment whenever events or changes in circumstances indicate that the carrying

value of an asset may not be recoverable. An impairment loss is recognized when the estimated future cash flows expected to result

from the use of the asset plus net proceeds expected from disposition of the asset (if any) are less than the carrying value

of the asset. When impairment is identified, the carrying amount of the asset is reduced to its fair value. No impairments were

recorded in the accompanying financial statements. |

| |

| Defined

Contribution Pension Plan |

| |

| The

Company operates a defined contribution plan for its employees. A defined contribution plan is a pension plan under which the Company

pays fixed contributions into a separate entity in accordance with the terms of the People’s Pension Scheme of the United Kingdom.

Once the contributions have been paid the Company has no further payment obligations. Contributions totaled $3,908 and $4,669 during

the years ended December 31, 2022 and 2021, respectively. |

| |

| Income

Taxes |

| |

| The

Company accounts for income taxes in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification

(ASC) 740, Accounting for Income Taxes, which requires, among other things, the recognition of deferred income tax assets and

liabilities based on the temporary differences between the financial statement carrying amounts and the tax basis of assets and liabilities

using the current applicable income tax rates. A valuation allowance is established when necessary to reduce deferred income tax

assets to the amount that will more-likely-than-not be realized. |

| |

The

Company accounts for uncertainty in income taxes pursuant to FASB ASC 740-10, Accounting for Uncertainties in Income Taxes, which

prescribes a minimum recognition threshold and measurement methodology that a tax position taken or expected to be taken in a

tax return is required to meet before being recognized in the financial statements. See Note 4 for additional details. Management

has reviewed the tax positions that have been taken and has concluded that no liability or disclosure is necessary.

|

| |

Qxtel Limited

Notes to

Financial Statements

For

the Years Ended December 31, 2022 and 2021

| 2. Accounting Policies (cont.) |

| |

| Dividends |

| |

| Equity

dividends are recognized when they become legally payable when approved by the shareholders at an annual general meeting. |

| |

| Advertising |

| |

| The

Company expenses advertising costs as incurred. Advertising expense was $9,584 and $1,143 for the years ended December 31, 2022 and

2021, respectively. |

| |

| 3. Revenue |

| |

| An

analysis of revenue by class of business is as follows: |

| December

31, |

2022 |

2021 |

Voice

Services |

$

80,097,727 |

$

82,514,250 |

| SMS

Services |

1,408,674 |

- |

| Total |

$

81,506,401 |

$

82,514,250 |

Analysis

of revenue by country of destination:

| December

31, |

2022 |

2021 |

United

Kingdom |

$

14,474,905 |

$

19,640,261 |

| Rest

of the world |

67,031,496 |

62,873,989 |

| Total |

$

81,506,401 |

$

82,514,250 |

| 4. Income Taxes |

| |

| The Company provides for income taxes under ASC 740, “Income Taxes.” Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recorded based on the differences between the financial statement and tax basis of assets and liabilities and the tax rates in effect when these differences are expected to reverse. There were no material differences between the financial statement and tax basis of assets and liabilities as of December 31, 2022 and 2021. |

| |

| The income tax provision attributable to the net income before income taxes for the years ended December 31, 2022 and 2021 differed from the amounts computed by applying the standard 19% corporate tax rate in the UK primarily due to differences in the method of calculating depreciation and certain expenses that are reflected in the accompanying financial statements that are not deductible for tax purposes. Such differences are not material to the financial statements taken as a whole. |

| |

| Finance Act 2021 includes legislation to increase the UK corporate tax from 19% to 25%, effective April 1, 2023. |

| |

Qxtel Limited

Notes to

Financial Statements

For

the Years Ended December 31, 2022 and 2021

| 5. Share

Capital |

| |

| Share

capital consistent of the following: |

| December

31, | | |

2022 | | |

2021 |

| | | |

| | |

|

Ordinary

A shares | | |

$ | 27 | | |

$ | 27 |

| Ordinary B shares | | |

| 125 | | |

| 125 |

| | | |

| | | |

| |

| Total | | |

$ | 152 | | |

$ | 152 |

There are no differences

in rights between Ordinary A and Ordinary B shares. There were 100 shares authorized and 18 and 82 shares of Ordinary A and Ordinary

B shares, respectively, issued and outstanding at December 31, 2022 and 2021. The par value of the shares is $1.00.

| 6. Related

Party Transactions |

| |

During

the years ended December 31, 2022 and 2021 the Company entered into transactions totaling $360,000 with Topax Consulting Corp,

an entity in which one of the directors of the Company is also a director. Such amounts are included in Selling, general, and

administrative expenses in the accompanying Statements of Income. No amounts are payable to Topax Cosulting Corp. as of December

31, 2022 or 2021.

During

the years ended December 31, 2022 and 2021 the Company entered into transactions totaling $27,118 and $0 with Valorex Holdings Inc.,

an entity with a majority interest in the Company. Such amounts are included in Selling, general, and administrative expenses in

the accompanying Statements of Income. Payables of $25,618 and $0 are included in Accounts payable in the accompany Balance sheets

as of December 31, 2022 and 2021. |

| |

| 7. Major

Customer and Supplier |

| |

The

Company had one major customer representing approximately 11% of revenues during the year ended December 31, 2022, and accounts

receivable from the customer totaled $372,542 at December 31, 2022. There were no major customers for the year ended December

31, 2021.

The

Company had one major supplier who accounted for 11% of purchases during the year ended December 31, 2022. There were no amounts

payable to the supplier at December 31, 2022. There were no major suppliers for the year ended December 31, 2021. The products and

services provided by the suppliers are available from other sources. |

| |

| 8. Subsequent

Events |

| |

Management

has evaluated events and transactions subsequent to the balance sheet date through the date of the independent auditor’s

report (the date the financial statements were available to be issued) for potential recognition or disclosure in the financial

statements. On January 19, 2024, iQSTEL, Inc. entered into a share purchase agreement with Yukon River Holdings, Ltd. (“Seller”)

concerning the contemplated sale by Seller and the purchase by iQSTEL, Inc. of 51% of the ordinary shares Seller holds in the

Company. The accompanying financial statements have not been adjusted to reflect the transaction.

Management

has not identified any other items requiring recognition or disclosure. |

| |

Financial Statements |

| |

As of September 30, 2023 and December 31, 2022 |

| |

And the Three and Nine Month Periods

Ended |

| |

September 30, 2023 and September 30,

2022 |

| |

|

| Financial Statements |

|

| |

|

| Balance Sheets as of September 30,

2023 and December 31, 2022 (unaudited) |

| 3 | |

| |

| | |

| Statements of Income for the Three and Nine Months Ended September 30, 2023 and 2022 (unaudited) |

| 4 | |

| |

| | |

| Statements of Changes in Shareholders’ Equity for the Nine Months Ended September 30, 2023 and 2022 (unaudited) |

| 5 | |

| |

| | |

| Statements of Cash Flows for the Nine Months Ended

September 30, 2023 and 2022 (unaudited) |

| 6 | |

| |

| | |

| Notes to Financial Statements (unaudited) |

| 7-11 | |

Qxtel Limited

Balance Sheets

(unaudited)

| |

September 30, 2023 |

December 31, 2022 |

|

Assets |

|

|

| Current assets |

|

|

| Cash and cash equivalents |

$ 1,238,633 |

$ 1,841,237 |

| Accounts receivable - trade, net |

6,434,280 |

5,558,471 |

| Related party receivable |

120,000 |

- |

| Total current assets |

7,792,913 |

7,399,708 |

| Property and equipment |

|

|

| Fixtures and fittings |

14,281 |

14,281 |

| Computer equipment |

41,525 |

36,100 |

| |

55,806 |

50,381 |

| Less accumulated depreciation |

(26,500) |

(26,500) |

| Total property and equipment |

29,306 |

23,881 |

| Other assets |

|

|

| Intangible assets |

147,430 |

73,798 |

| Other asset |

150,000 |

150,000 |

| Total other assets |

297,430 |

223,798 |

| Total assets |

$ 8,119,649 |

$ 7,647,387 |

| Liabilities and shareholders' equity |

|

|

| Current liabilities |

|

|

| Accounts payable |

4,827,775 |

3,809,526 |

| Accrued expenses |

673,739 |

1,535,963 |

| Total current liabilities |

5,501,514 |

5,345,489 |

| Shareholders' equity |

|

|

| Share capital |

152 |

152 |

| Retained earnings |

2,617,983 |

2,301,746 |

| Total shareholders' equity |

2,618,135 |

2,301,898 |

|

Total liabilities and shareholders' equity |

$ 8,119,649 |

$ 7,647,387 |

The accompanying notes are

an integral part of these financial statements.

Qxtel

Limited

Statements

of Income

(unaudited)

| |

Three

Months Ended

September

30, |

Nine Months Ended

September 30, |

| |

2023 |

2022 |

2023 |

2022 |

Sales |

$ 19,198,370 |

$ 19,574,379 |

$ 59,702,308 |

$ 60,766,675 |

| Cost

of Sales |

(17,825,223) |

(18,745,592) |

(56,533,224) |

(58,709,106) |

| Gross

Profit |

1,373,147 |

828,787 |

3,169,084 |

2,057,569 |

| Selling,

general, and administrative expenses |

(778,687) |

(617,396) |

(2,184,222) |

(1,662,796) |

Net

income before provision for income taxes |

594,460 |

211,391 |

984,862 |

394,773 |

| Income

tax expense |

(109,750) |

(42,278) |

(203,975) |

(78,954) |

Net

income |

$ 484,710 |

$ 169,113 |

$ 780,887 |

$ 315,819 |

The accompanying notes are an

integral part of these financial statements.

Qxtel Limited

Statements

of Changes in Shareholders’ Equity

(unaudited)

| |

Share capital |

Retained earnings |

Total Shareholders' Equity |

Balance

- December 31, 2021 |

$ 152 |

$

1,873,965 |

$

1,874,117 |

| Net

income |

- |

315,819 |

315,819 |

| Distributions |

- |

(139,216) |

(139,216) |

Balance

- September 30, 2022 |

$ 152 |

$

2,050,568 |

$

2,050,720 |

| |

|

Retained |

Total

Shareholders' |

| |

Share

capital |

earnings |

Equity |

Balance

- December 31, 2022 |

$ 152 |

$

2,301,746 |

$

2,301,898 |

| Net

income |

- |

780,887 |

780,887 |

| Distributions |

- |

(464,650) |

(464,650) |

Balance

- September 30, 2023 |

$ 152 |

$

2,617,983 |

$

2,618,135 |

The accompanying notes are an integral

part of these financial statements.

Qxtel Limited

Statements

of Cash Flows

(unaudited)

| Nine

Months Ended September 30, |

2023 |

2022 |

Cash

flows from operating activities:

Net

income |

$ 780,887 |

$ 315,819 |

Changes

in operating assets and liabilities:

Accounts

receivable - trade |

(875,809) |

(6,299,962) |

| Accounts

payable |

1,018,249 |

6,404,562 |

| Accrued

expenses |

(862,224) |

(374,963) |

Net

cash provided by operating activities |

61,103 |

45,456 |

Cash

flows from investing activities:

Purchase

of property and equipment |

(5,425) |

(8,531) |

| Advances

of amounts due from related party |

(120,000) |

- |

| Purchase

of intangible assets |

(73,632) |

- |

Net

cash used in investing activities |

(199,057) |

(8,531) |

Cash

flows from financing activities:

Distributions

paid |

(464,650) |

(139,216) |

Net

cash used in financing activities |

(464,650) |

(139,216) |

Net

decrease in cash and cash equivalents |

(602,604) |

(102,291) |

| Cash

and cash equivalents, beginning of period |

1,841,237 |

1,228,674 |

Cash

and cash equivalents, end of period |

$ 1,238,633 |

$ 1,126,383 |

Supplemental

disclosure of cash flow information:

Cash

paid for taxes |

$ 203,975 |

$ 78,954 |

The

accompanying notes are an integral part of these financial statements.

Qxtel Limited

Notes to

Financial Statements

For

the Three and Nine Month Periods

Ended September 30, 2023 and 2022

(unaudited)

Qxtel Limited (the “Company”) is a private company, domiciled and incorporated in England and Wales. The registered office address is No. 1 Poultry, London, EC2R 8EJ.

The principal activity of the Company is the provision of international telecommunications traffic, offering both wholesale voice and retail services. In 2022, the Company also began to offer retail and wholesale A2P SMS services.

| 2. Accounting Policies |

| |

| Basis of Preparation of Financial Statements |

| |

| The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, which, in the opinion of management, have been consistently applied. |

| |

| The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates. |

| |

| The following principal accounting policies have been applied: |

| |

| Foreign Currency Translation and re-measurement |

| |

| The Company's functional and presentational currency is USD. |

| |

| Foreign currency transactions are translated into the functional currency using the spot exchange rates at the dates of the transactions. |

| |

| At each period end foreign currency items are translated using the closing rate. Non monetary items measured at historical cost are translated using the exchange rate at the date of the transaction and non monetary items measured at fair value are measured using the exchange rate when fair value was determined. No material foreign currency translation amounts are included in the accompanying financial statements. |

| |

| Revenue |

| |

The

Company recognizes revenue related to monthly usage charges and other recurring charges during the period in which the telecommunication

services are rendered in accordance with FASB ASC 606, “Revenue from Contracts with Customers, provided that persuasive

evidence of a sales arrangement existed and collection was reasonably assured. Persuasive evidence of a sales arrangement exists

upon execution of a written interconnection agreement. Revenue is measured at the fair value of the consideration receivable,

excluding discounts, rebates, value added tax and other sales taxes or duty. The Company’s payment terms vary by clients. |

Qxtel Limited

Notes to

Financial Statements

For

the Three and Nine Month Periods

Ended September 30, 2023 and 2022

(unaudited)

| 2. Accounting Policies (cont.) |

|

| |

|

| Cost of Sales |

|

| |

|

| Cost of sales represent direct charges from vendors that the Company incurs to deliver services to its customers. These costs primarily consist of usage charges for calls terminated in the Company’s vendor networks. |

| |

| Cash and Cash Equivalents |

|

| |

|

| Cash and cash equivalents include cash in banks, money market funds, and certificates of term deposits with maturities of less than three months from inception, which are readily convertible to known amounts of cash. The Company maintains certain of its cash and cash equivalents in non-interest bearing accounts that are insured by the Federal Deposit Insurance Company up to $250,000. The Company’s deposits may, from time to time, exceed the $250,000 limit; however, management believes that there is no unusual risk present, as the Company places its cash and cash equivalents with financial institutions which management considers being of high quality. |

| |

| Accounts Receivable and Allowance for Uncollectible Accounts |

| |

| Substantially all of the Company’s accounts receivable balance is related to trade receivables. Trade accounts receivable are recorded at the invoiced amount and do not bear interest. The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in its existing accounts receivable. The Company reviews its allowance for doubtful accounts daily and past due balances over 60 days and a specified amount are reviewed individually for collectability. Account balances are charged off after all means of collection have been exhausted and the potential for recovery is considered remote. |

| |

| Intangible Assets |

|

| |

|

| Intangible assets are initially recognized at cost. After recognition intangible assets are measured at cost less any accumulated amortization and any accumulated impairment losses. |

| |

| The assets relate to software which is still in development as of September

30, 2023 and December 31, 2022. No amortization expense was recorded for the three and nine month periods ended September 30, 2023 and

2022. |

| |

| Property and Equipment |

|

| |

|

| Property and equipment are stated at historical cost less accumulated depreciation and any accumulated impairment losses. Historical cost includes all expenditures that are directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. |

| |

| Depreciation is charged so as to allocate the cost of assets less their residual value

over their estimated useful lives. No material amounts of depreciation expense were recorded for the three and nine month periods ended

September 30, 2023 or 2022. |

| |

| The recovery periods of the asset classes are as follows: |

| |

Fixtures and fittings |

4 years |

| |

Computer equipment |

4 years |

Gains and losses on disposals are determined by comparing the proceeds with the carrying amount and are recognized in the statements of income.

Qxtel Limited

Notes to

Financial Statements

For

the Three and Nine Month Periods

Ended September 30, 2023 and 2022

(unaudited)

| 2. Accounting

Policies (cont.) |

| |

| Impairment

of Long-Lived Assets |

| |

In

accordance with FASB ASC 360-10-45, Accounting for the Impairment or

Disposal of Long-Lived Assets, long-lived assets, such as property and equipment, are evaluated for impairment whenever events or

changes in circumstances indicate that the carrying value of an asset may not be recoverable. An impairment loss is recognized when the

estimated future cash flows expected to result from the use of the asset plus net proceeds expected from disposition of the asset (if

any) are less than the carrying value of the asset. When impairment is identified, the carrying amount of the asset is reduced to its

fair value. No impairments were recorded in the accompanying financial statements. |

| |

| Defined

Contribution Pension Plan |

| |

| The Company operates a defined contribution

plan for its employees. A defined contribution plan is a pension plan under which the Company pays fixed contributions into a separate

entity in accordance with the terms of the People’s Pension Scheme of the United Kingdom. Once the contributions have been paid

the Company has no further payment obligations. Contributions totaled $3,120 and $2,973 during the nine-months ended September 30, 2023

and 2022, respectively, $1,022 and $945 during the three-months ended September 30, 2023 and 2022,

respectively |

| |

| Income

Taxes |

| |

| The

Company accounts for income taxes in accordance with Financial Accounting

Standards Board (FASB) Accounting Standards Codification (ASC) 740, Accounting for Income Taxes, which requires, among other things,

the recognition of deferred income tax assets and liabilities based on the temporary differences between the financial statement carrying

amounts and the tax basis of assets and liabilities using the current applicable income tax rates. A valuation allowance is established

when necessary to reduce deferred income tax assets to the amount that will more-likely-than-not be realized. |

| |

The

Company accounts for uncertainty in income taxes pursuant to FASB ASC 740-10, Accounting for Uncertainties in Income Taxes, which

prescribes a minimum recognition threshold and measurement methodology that a tax position taken or expected to be taken in a

tax return is required to meet before being recognized in the financial statements. See Note 4 for additional details. Management

has reviewed the tax positions that have been taken and has concluded that no liability or disclosure is necessary.

|

| |

Qxtel Limited

Notes to

Financial Statements

For

the Three and Nine Month Periods

Ended September 30, 2023 and 2022

(unaudited)

| 2. Accounting Policies (cont.) |

| |

| Dividends |

| |

| Equity

dividends are recognized when they become legally payable when approved by the shareholders at an annual general meeting. |

| |

| Advertising |

| |

| The

Company expenses advertising costs as incurred. Advertising expense was

$23,248 and $9,361 for the nine month periods ended September 30, 2023 and 2022, respectively. Advertising expense was $486 and $0 for

the three month periods ended September 30, 2023 and 2022, respectively. |

| |

| 3. Revenue |

| |

| An

analysis of revenue by class of business is as follows: |

| |

Nine

Months Ended September 30, |

Three

Months Ended September 30, |

| |

2023 |

2022 |

2023 |

2022 |

|

Sale of Voice Services |

$ 55,850,292 |

$ 59,992,356 |

$ 17,250,618 |

$ 19,185,991 |

| Sales of SMS Services |

3,852,016 |

774,319 |

1,947,752 |

388,388 |

| Total |

$ 59,702,308 |

$ 60,766,675 |

$ 19,198,370 |

$ 19,574,379 |

Analysis

of revenue by country of destination:

| |

Nine

Months Ended September 30, |

Three

Months Ended September 30, |

| |

2023 |

2022 |

2023 |

2022 |

|

United Kingdom |

$ 18,792,944 |

$ 12,077,706 |

$ 5,794,865 |

$ 3,839,775 |

| United States of America |

17,120,702 |

23,783,470 |

5,547,774 |

6,917,573 |

| Rest of the world |

23,788,662 |

24,905,499 |

7,855,731 |

8,817,031 |

| Total |

$ 59,702,308 |

$ 60,766,675 |

$ 19,198,370 |

$ 19,574,379 |

| 4. Income Taxes |

| |

| The Company provides for income taxes under ASC 740, “Income Taxes.”

Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recorded based on the differences between the

financial statement and tax basis of assets and liabilities and the tax rates in effect when these differences are expected to reverse.

There were no material differences between the financial statement and tax basis of assets and liabilities for the three and nine month

periods ended September 30, 2023 and 2022.. |

| |

| The income tax provision attributable to the net income before income taxes

for the three and nine month periods ended September 30, 2023 and 2022 differed from the amounts computed by applying the standard 19%

corporate tax rate in the UK primarily due to differences in the method of calculating depreciation and certain expenses that are reflected

in the accompanying financial statements that are not deductible for tax purposes. Such differences are not material to the financial

statements taken as a whole. |

| |

| Finance Act 2021 includes legislation to increase the UK corporate tax from 19%

to 25%, effective April 1, 2023. |

| |

Qxtel Limited

Notes to

Financial Statements

For

the Three and Nine Month Periods

Ended September 30, 2023 and 2022

(unaudited)

| 5. Share

Capital |

| |

| Share

capital consistent of the following: |

| December

31, | | |

September

30, 2023 | | |

December

31, 2022 |

| | | |

| | |

|

Ordinary

A shares | | |

$ | 27 | | |

$ | 27 |

| Ordinary B shares | | |

| 125 | | |

| 125 |

| | | |

| | | |

| |

| Total | | |

$ | 152 | | |

$ | 152 |

There are no differences in rights between Ordinary A and Ordinary B shares.

There were 100 shares authorized and 18 and 82 shares of Ordinary A and Ordinary B shares, respectively, issued and outstanding at September

30, 2023 and December 31, 2022. The par value of the shares is $1.00.

| 6. Related

Party Transactions |

| |

During

the nine months ended September 30, 2023 and 2022, the Company entered

into transactions totaling $270,000 with Topax Consulting Corp (“Topax”), an entity in which one of the directors of the Company

is also a director. During the three months ended September 30, 2023 and 2022, the Company entered into transactions totaling $90,000

with Topax. Such amounts are included in Selling, general, and administrative expenses in the accompanying Statements of Income. No amounts

are payable to Topax Cosulting Corp. as of September 30, 2023 or 2022.

During

the nine months ended September 30, 2023 and 2022 the Company entered into transactions totaling $55,632 and $0 with Valorex

Holdings Inc. (“Valorex”), an entity with a majority interest in the Company. During the three months ended September

30, 2023 and 2022, the Company entered into transactions totaling $5,465 and $0 with Valorex. Such amounts are included in Selling,

general, and administrative expenses in the accompanying Statements of Income. Payables of $31,249 and $0 are included in accounts

payable in the accompany balance sheets as of September 30, 2023 and 2022.

|

| |

| 7. Major

Customer and Supplier |

| |

The

Company had two major customers representing approximately 26% of revenues

for the nine months ended September 30, 2023. There were no major customers for the nine months ended September 30, 2022. The Company

had two and one major customers representing approximately 24% and 12% of revenues for the three months ended September 30, 2023 and 2022,

respectively. There were no net receivables from the customers at September 30, 2023 and 2022.

The

Company had one major supplier who accounted for 14% and 10% of purchases

during the nine months ended September 30, 2023 and 2022, respectively. The Company had one and two major suppliers who accounted for

13% and 23% of purchases during the three months ended September 30, 2023 and 2022.

Accounts payable to the suppliers totaled $522,155 and $504,068 at September 30, 2023 and 2022, respectively. The

products and services provided by the suppliers are available from other sources. |

| |

| 8. Subsequent

Events |

| |

Management

has evaluated events and transactions subsequent to the balance sheet date through the date these financial statements were available

to be issued for potential recognition or disclosure in the financial statements. On January 19, 2024, iQSTEL, Inc. entered into a share

purchase agreement with Yukon River Holdings, Ltd. (“Seller”) concerning the contemplated sale by Seller and the purchase

by iQSTEL, Inc. of 51% of the ordinary shares Seller holds in the Company. The accompanying financial statements have not been adjusted

to reflect the transaction.

Management

has not identified any other items requiring recognition or disclosure. |

iQSTEL INC.

UNAUDITED PRO FORMA COMBINED

FINANCIAL STATEMENTS

The

following unaudited pro forma combined financial statements give effect to the probable acquisition of QXTEL Limited:

| |

Page |

| Unaudited Pro Forma Consolidated Balance Sheet as of September 30, 2023 |

2 |

| Unaudited Pro Forma Consolidated Statement of Operations for the Nine Months Ended September 30, 2023 |

3 |

| Unaudited Pro Forma Consolidated Statement of Operations for the Year Ended December 31, 2022 |

4 |

iQSTEL Inc.

Unaudited Pro Forma Condensed Combined Balance Sheet

At September 30, 2023

| |

|

|

|

|

|

|

Transaction |

|

|

|

Pro Forma |

| |

|

iQSTEL Inc. |

|

Qxtel Limited |

|

Adjustments |

|

Notes |

|

As Adjusted |

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash |

|

$ |

2,001,320 |

|

$ |

1,238,633 |

|

$ |

452,500 |

|

A, B, C |

|

$ |

3,692,453 |

| Accounts receivable, net |

|

|

7,635,615 |

|

|

6,434,280 |

|

|

- |

|

|

|

|

14,069,895 |

| Inventory |

|

|

27,121 |

|

|

- |

|

|

- |

|

|

|

|

27,121 |

| Due from related parties |

|

|

427,194 |

|

|

120,000 |

|

|

- |

|

|

|

|

547,194 |

| Prepaid and other current assets |

|

|

1,696,944 |

|

|

- |

|

|

- |

|

|

|

|

1,696,944 |

| Total Current assets |

|

|

11,788,194 |

|

|

7,792,913 |

|

|

452,500 |

|

|

|

|

20,033,607 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

463,036 |

|

|

29,306 |

|

|

- |

|

|

|

|

492,342 |

| Intangible asset |

|

|

99,592 |

|

|

147,430 |

|

|

- |

|

|

|

|

247,022 |

| Goodwill |

|

|

5,172,146 |

|

|

- |

|

|

3,664,751 |

|

D |

|

|

8,836,897 |

| Deferred tax assets |

|

|

444,504 |

|

|

- |

|

|

- |

|

|

|

|

444,504 |

| Other asset |

|

|

156,388 |

|

|

150,000 |

|

|

- |

|

|

|

|

306,388 |

| TOTAL ASSETS |

|

$ |

18,123,860 |

|

$ |

8,119,649 |

|

$ |

4,117,251 |

|

|

|

$ |

30,360,760 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

4,014,529 |

|

$ |

4,827,775 |

|

$ |

- |

|

|

|

$ |

8,842,304 |

| Accrued and other current liabilities |

|

|

5,204,219 |

|

|

673,739 |

|

|

- |

|

|

|

|

5,877,958 |

| Payable for acquisition of QXTEL |

|

|

- |

|

|

- |

|

|

2,000,000 |

|

B |

|

|

2,000,000 |

| Due to related parties |

|

|

26,613 |

|

|

- |

|

|

- |

|

|

|

|

26,613 |

| Loan payable |

|

|

252,779 |

|

|

- |

|

|

- |

|

|

|

|

252,779 |

| Loan payable - related parties |

|

|

238,291 |

|

|

- |

|

|

- |

|

|

|

|

238,291 |

| Convertible note |

|

|

177,666 |

|

|

- |

|

|

3,477,500 |

|

A |

|

|

3,655,166 |

| Total Current Liabilities |

|

|

9,914,097 |

|

|

5,501,514 |

|

|

5,477,500 |

|

|

|

|

20,893,111 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans payable, non-current |

|

|

91,018 |

|

|

- |

|

|

- |

|

|

|

|

91,018 |

| Employees benefits, non-current |

|

|

155,909 |

|

|

- |

|

|

- |

|

|

|

|

155,909 |

| TOTAL LIABILITIES |

|

|

10,161,024 |

|

|

5,501,514 |

|

|

5,477,500 |

|

|

|

|

21,140,038 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

- |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock: 1,200,000 authorized; $0.001 par value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A Preferred stock: 10,000 designated; $0.001 par value,

10,000 shares issued and outstanding |

|

|

10 |

|

|

- |

|

|

- |

|

|

|

|

10 |

| Series B Preferred stock: 200,000 designated; $0.001 par value, 31,080 shares issued and outstanding |

|

|

31 |

|

|

- |

|

|

- |

|

|

|

|

31 |

| Series C Preferred stock: 200,000 designated; $0.001 par value, No shares issued and outstanding |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

- |

| Common stock: 300,000,000 authorized; $0.001 par value, 170,231,395 shares issued and outstanding |

|

|

170,232 |

|

|

- |

|

|

- |

|

|

|

|

170,232 |

| Share capital |

|

|

- |

|

|

152 |

|

|

(152) |

|

D |

|

|

- |

| Additional paid-in capital |

|

|

34,350,837 |

|

|

- |

|

|

- |

|

|

|

|

34,350,837 |

| Accumulated deficit |

|

|

(25,960,018) |

|

|

2,617,983 |

|

|

(2,642,983) |

|

C, D |

|

|

(25,985,018) |

| Accumulated other comprehensive loss |

|

|

(33,485) |

|

|

- |

|

|

- |

|

|

|

|

(33,485) |

| Equity attributed to stockholders of iQSTEL Inc. |

|

|

8,527,607 |

|

|

2,618,135 |

|

|

(2,643,135) |

|

|

|

|

8,502,607 |

| Equity (Deficit) attributable to noncontrolling interests |

|

|

(564,771) |

|

|

- |

|

|

1,282,886 |

|

|

|

|

718,115 |

| TOTAL STOCKHOLDERS' EQUITY |

|

|

7,962,836 |

|

|

2,618,135 |

|

|

(1,360,249) |

|

|

|

|

9,220,722 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

18,123,860 |

|

$ |

8,119,649 |

|

$ |

4,117,251 |

|

|

|

$ |

30,360,760 |

See accompanying notes to the Unaudited Pro Forma

Condensed Combined Financial Statements

iQSTEL Inc.

Unaudited Pro Forma Condensed Combined Statement

of Operations

Period Ended September 30, 2023

| |

|

iQSTEL Inc. |

|

Qxtel Limited |

|

|

|

|

|

|

|

|

| |

|

Nine months ended |

|

Nine months ended |

|

Proforma |

|

|

|

Proforma |

| |

|

September 30, 2023 |

|

September 30, 2023 |

|

Adjustments |

|

Notes |

|

As Adjusted |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

$ |

97,248,561 |

|

$ |

59,702,308 |

|

$ |

- |

|

|

|

$ |

156,950,869 |

| Cost of revenues |

|

|

94,218,838 |

|

|

56,533,224 |

|

|

- |

|

|

|

|

150,752,062 |

| Gross profit |

|

|

3,029,723 |

|

|

3,169,084 |

|

|

- |

|

|

|

|

6,198,807 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

|

3,529,218 |

|

|

2,184,222 |

|

|

25,000 |

|

C |

|

|

5,738,440 |

| Total operating expenses |

|

|

3,529,218 |

|

|

2,184,222 |

|

|

25,000 |

|

|

|

|

5,738,440 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

(499,495) |

|

|

984,862 |

|

|

(25,000) |

|

|

|

|

460,367 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income |

|

|

3,126 |

|

|

- |

|

|

- |

|

|

|

|

3,126 |

| Other expense |

|

|

(105,714) |

|

|

- |

|

|

- |

|

|

|

|

(105,714) |

| Interest expense |

|

|

(54,322) |

|

|

- |

|

|

- |

|

|

|

|

(54,322) |

| Change in fair value of derivative liabilities |

|

|

381,848 |

|

|

- |

|

|

- |

|

|

|

|

381,848 |

| Total other income |

|

|

224,938 |

|

|

- |

|

|

- |

|

|

|

|

224,938 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income before provision for income taxes |

|

|

(274,557) |

|

|

984,862 |

|

|

(25,000) |

|

|

|

|

685,305 |

| Income taxes |

|

|

- |

|

|

(203,975) |

|

|

- |

|

|

|

|

(203,975) |

| Net (loss) income |

|

$ |

(274,557) |

|

$ |

780,887 |

|

$ |

(25,000) |

|

|

|

$ |

481,330 |

| Less: Net income attributable to noncontrolling interests |

|

|

364,586 |

|

|

- |

|

|

- |

|

|

|

|

364,586 |

| Net (loss) income attributed to iQSTEL Inc. |

|

$ |

(639,143) |

|

$ |

780,887 |

|

$ |

(25,000) |

|

|

|

$ |

116,744 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend on Series B Preferred Stock |

|

|

(816,480) |

|

|

- |

|

|

- |

|

|

|

|

- |

| Net loss attributed to stockholders of iQSTEL Inc. |

|

$ |

177,337 |

|

$ |

780,887 |

|

$ |

(25,000) |

|

|

|

$ |

116,744 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(274,557) |

|

$ |

780,887 |

|

$ |

(25,000) |

|

|

|

$ |

481,330 |

| Foreign currency translation adjustment |

|

|

142 |

|

|

- |

|

|

- |

|

|

|

|

142 |

| Total comprehensive (loss) income |

|

$ |

(274,415) |

|

$ |

780,887 |

|

$ |

(25,000) |

|

|

|

$ |

481,472 |

| Less: Comprehensive income attributable to noncontrolling interests |

|

|

364,656 |

|

|

- |

|

|

- |

|

|

|

|

364,656 |

| Total comprehensive (loss) income |

|

$ |

(639,071) |

|

$ |

780,887 |

|

$ |

(25,000) |

|

|

|

$ |

116,816 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted income (loss) per common share |

|

$ |

(0.00) |

|

$ |

7,808.87 |

|

|

|

|

|

|

$ |

0.00 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted weighted average number of common shares outstanding |

|

|

165,640,341 |

|

|

100 |

|

|

(100) |

|

D |

|

|

165,640,341 |