Alpha Pro Tech, Ltd. (NYSE American: APT), a

leading manufacturer of products designed to protect people,

products and environments, including disposable protective apparel

and building products, today announced financial

results

for the three month period and year

ended December 31, 2023.

Lloyd Hoffman, President and Chief Executive

Officer of Alpha Pro Tech, commented, “We have experienced the six

highest quarters on record for the Building Supply segment over the

past eight quarters: the second, third, and fourth quarters of 2023

and the first, second and third quarters of 2022. These

achievements come despite the continued softness in the housewrap

market, as housing starts in 2023 in the United States decreased by

8.8%, compared to the same period a year ago. Management is

encouraged by the full year 22.2% increase in housewrap and

accessories sales, as we continue to significantly outperform the

market through diversification and product development. Sales of

our REX Wrap® and REX Wrap Plus®, our entry-level housewrap

products, were up by 15.1% over the prior year, despite the

decrease in housing starts, as we continue to form relationships

with new dealers.

Management expects to see continued growth

opportunities with REX™ Wrap Fortis, our premium housewrap line, as

we continue to make inroads into the multi-family and commercial

construction sector, evidenced by a 33.9% increase in sales for

this product in 2023. We also experienced a 180% increase in sales

of our housewrap accessories, REXTREME Window and Door Flashing and

REX™ Premium Seam Tape, in 2023. Management expects that we will

continue to see positive trends relative to the industry for both

our entry level and premium housewrap and housewrap accessories

product lines.

The synthetic roof underlayment market has also

been affected by the continued decrease in new home starts,

economic uncertainty, more offshore competition and a push in the

market to reduce product selling prices. Despite these pressures,

our synthetic roof underlayment sales also outperformed the market

despite being down 3.0% in 2023 compared to 2022. We launched our

new line of self-adhered roofing products in late 2023, which

management expects will result in revenue growth within our current

customer base and allow for expansion into new markets and business

segments. We continue to work closely with our customers to develop

and expand our product lines. Other woven material sales increased

by 18.0% in 2023 compared to the same period of 2022, due to

increased sales to our major customer, but management does not

expect this to be a growth driver in the coming year.”

Mr. Hoffman continued, “Sales of disposable

protective garments in 2023 were up by 4.0% as our channel partners

and end customers are continuing to work through their excess

inventory, which had accumulated as a result of the pandemic. Our

sales have been positively affected as we can now meet face-to-face

with our distribution partners and end customers, something we have

not been able to do since 2020. Disposable protective garment sales

in 2023 were up by approximately 19% as compared to pre-pandemic

levels. We expect continued growth for disposable protective

garments in 2024.

Face mask and face shield sales are still

suffering from the COVID-19 residual excess inventories at the

distributor level, but sales in the fourth quarter of 2023 showed

improvement and approximately doubled as compared to the prior

quarter. The market continues to be saturated with products, but

management is cautiously optimistic that face mask and face shield

sales will show growth in the coming year.”

2023 Results

Consolidated sales for the three months ended December

31, 2023 increased to $15.3 million, from $12.2 million

for the three months ended December 31, 2022, representing an

increase of $3.0 million, or 24.9%. This increase consisted of

higher sales in the Building Supply segment of $3.5 million,

partially offset by decreased sales in the Disposable Protective

Apparel segment of $460,000.

Building Supply segment sales

for the three months ended December 31, 2023, increased by $3.5

million, or 55.7%, to $9.8 million, compared to $6.3 million for

the three months ended December 31, 2022. The Building Supply

segment increase during the three months ended December 31, 2023

was primarily due to a 61.9% increase in sales of housewrap, a

35.2% increase in sales of synthetic roof underlayment and a

$661,000 increase in sales of other woven material compared to

the same period of 2022.

The sales mix of the Building Supply segment for

the three months ended December 31, 2023 was approximately 42% for

synthetic roof underlayment, 52% for housewrap and 6% for other

woven material. This compared to approximately 49% for synthetic

roof underlayment, 51% for housewrap and 0% for other woven

material for the three months ended December 31, 2022.

Disposable Protective Apparel

segment sales for the three months ended December 31, 2023

decreased by $460,000, or 7.7%, to $5.5 million, compared to $5.9

million for the same period of 2022. This segment decrease was due

to a 5.6% decrease in sales of disposable protective garments, a

11.0% decrease in sales of face masks and a 33.9% decrease in sales

of face shields.

The sales mix of the Disposable Protective

Apparel segment for the three months ended December 31, 2023 was

approximately 85% for disposable protective garments, 11% for face

masks and 4% for face shields. This sales mix is compared to

approximately 83% for disposable protective garments, 12% for face

masks and 5% for face shields for the three months ended December

31, 2022.

Consolidated sales for the year ended

December 31, 2023, decreased to $61.2 million, from $62.0

for the year ended December 31, 2022, representing a decrease of

$749,000, or 1.2%. This decrease consisted of decreased sales in

the Disposable Protective Apparel segment of $4.2 million,

partially offset by increased sales in the Building Supply segment

of $3.5 million.

Building Supply segment sales

for the year ended December 31, 2023 increased by $3.5 million, or

9.4%, to a record sales year of $40.4 million, compared to $36.9

million for the year ended December 31, 2023. The Building Supply

segment increase during the year ended December 31, 2023 was

primarily due to a 22.2% increase in sales of housewrap and a 18.0%

increase in sales of other woven material, partially offset by a

3.0% decrease in sales of synthetic roof underlayment and an

increase in rebates compared to the same period of 2022.

The sales mix of the Building Supply segment for

the year ended December 31, 2023 was approximately 42% for

synthetic roof underlayment, 47% for housewrap and 11% for other

woven material. This compared to approximately 47% for synthetic

roof underlayment, 43% for housewrap and 10% for other woven

material for the year ended December 31, 2022.

Disposable Protective Apparel

segment sales for the year ended December 31, 2023

decreased by $4.2 million, or 16.8%, to $20.8 million, compared to

$25.0 million for 2022. This segment decrease was due to a 4.0%

increase in sales of disposable protective garments that was more

than offset by a 62.3% decrease in sales of face masks and a 75.5%

decrease in sales of face shields.

The sales mix of the Disposable Protective

Apparel segment for the year ended December 31, 2023 was

approximately 88% for disposable protective garments, 9% for face

masks and 3% for face shields. This sales mix is compared to

approximately 71% for disposable protective garments, 19% for face

masks and 10% for face shields for the year ended December 31,

2022.

Gross Profit

Gross profit decreased by $895,000, or 18.6%, to

$5.7 million for the three months ended December 31, 2023, from

$4.8 million for the three months ended December 31, 2022. The

gross profit margin was 37.4% for the three months ended December

31, 2023, compared to 39.4% for the three months ended December 31,

2022.

Gross profit increased by $1.1 million or 5.3%,

to $22.8 million for the year ended December 31, 2023, from $21.7

million for the year ended December 31, 2022. The gross profit

margin was 37.3% for the year ended December 31, 2023, compared to

35.0% for the year ended December 31, 2022.

The gross profit margin in 2023 was positively

affected by ocean freight rates that have come down since the

latter part of 2022. Management expects the gross profit margin to

be in a similar range in 2024, although gross margin could be

negatively affected by the ongoing wars in Ukraine and the middle

east, which have resulted in increased freight rates.

Selling, General and Administrative

Expenses

Selling, general and administrative expenses

increased by $619,000, or 16.0%, to $4.5 million for the three

months ended December 31, 2023, from $3.9 million for the three

months ended December 31, 2022. As a percentage of net sales,

selling, general and administrative expenses decreased to 29.5% for

the three months ended December 31, 2023, from 31.7% for the same

period of 2022.

The increase in selling, general and

administrative expenses for the quarter ended December 31, 2023 was

primarily due to an increase in Building Supply segment expenses

related to increased employee compensation, sales commission,

insurance expenses and general factory expenses. In addition,

corporate unallocated expenses increased due to increased employee

compensation, bonuses and stock option and restricted stock

expense.

Selling, general and administrative expenses

increased by $1.6 million, or 9.6%, to $17.8 million for the year

ended December 31, 2023, from $16.2 million for the year ended

December 31, 2022. As a percentage of net sales, selling, general

and administrative expenses increased to 29.0% for the year ended

December 31, 2023, from 26.2% for 2022.

The increase in selling, general and

administrative expenses of $1.6 million for the year ended December

31, 2023 was primarily due to an increase in Building Supply

segment expenses of $1.2 million, related to increased employee

compensation due to a larger sales team and increased factory

indirect staff, sales commission, sales travel and insurance

expenses and general factory expenses. Corporate unallocated

expenses increased due to increased employee compensation, accrued

bonuses, stock option and restricted stock expenses, professional

fees, and general office expenses, partially offset by decreased

insurance expenses.

Income from Operations

Income from operations increased by $211,000, or

27.8%, to $1.0 million for the three months ended December 31,

2023, compared to $760,000 for the three months ended December 31,

2022. The increase in income from operations was primarily due to

an increase in gross profit of $895,000, partially offset by an

increase in selling, general and administrative expenses of

$619,000 and an increase in depreciation and amortization expense

of $65,000. Income from operations as a percentage of net sales for

the three months ended December 31, 2023 was 6.4%, compared to 6.2%

for the same period of 2022.

Income from operations decreased by $518,000, or

11.1%, to $4.1 million for the year ended December 31, 2023,

compared to $4.6 million for the year ended December 31, 2022. The

decreased income from operations was primarily due to an increase

in selling, general and administrative expenses of $1.6 million and

an increase in depreciation and amortization expense of $111,000,

partially offset by an increase in gross profit of $1.1 million.

Income from operations as a percentage of net sales for the year

ended December 31, 2023 was 6.7%, compared to 7.5% for 2022.

Other Income

Other income increased by $243,000, or 222.9%,

to $352,000 for the three months ended December 31, 2023, from

$109,000 for the three months ended December 31, 2022. The increase

was due to an increase in interest income of $158,000 and an

increase in equity in income of unconsolidated affiliate of

$85,000.

Other income increased by $1.5 million to income

of $1.3 million for the year ended December 31, 2023, from a loss

of $255,000 for 2022. The increase was primarily due to an increase

in equity in income of unconsolidated affiliate of $390,000 and an

increase in interest income of $668,000. In addition, there was a

loss on fixed assets of $490,000 in 2022 due to equipment for the

Disposable Protective Apparel segment that was not delivered.

Net Income

Net income for the three months ended December

31, 2023 was $1.1 million, compared to net income of $564,000 for

the three months ended December 31, 2022, representing an increase

of $497,000, or 88.1%. Net income as a percentage of net sales for

the three months ended December 31, 2023 was 7.0%, and net income

as a percentage of net sales for the same period of 2022 was 4.6%.

Basic and diluted earnings per common share for the three months

ended December 31, 2023, and 2022 were $0.09 and $0.05,

respectively.

Net income for the year ended December 31, 2023

was $4.2 million compared to net income of $3.3 million for 2022,

representing an increase of $907,000, or 27.6%. The net income

increase between 2023 and 2022 was due to an increase in income

before provision for income taxes of $1.0 million, partially offset

by an increase in provision for income taxes of $123,000. Net

income as a percentage of net sales for the year ended December 31,

2023 was 6.8%, and net income as a percentage of net sales for 2022

was 5.3%. Basic and diluted earnings per common share for the years

ended December 31, 2023 and 2022 were $0.35 and $0.26,

respectively.

Balance Sheet

As of December 31, 2023, the Company had cash

and cash equivalents of $20.4 million compared to $16.3 million as

of December 31, 2022. Working capital totaled $50.5 million and the

Company’s current ratio was 21:1, compared to a current ratio of

22:1 as of December 31, 2022.

Inventory decreased by $4.3 million or 17.5%, to

$20.1 million as of December 31, 2023, from $24.4 million as of

December 31, 2022. The decrease was due to a decrease in inventory

for the Disposable Protective Apparel segment of $1.2 million, or

8.5%, to $13.2 million and a decrease in inventory for the Building

Supply segment of $3.0 million, or 30.4%, to $7.0 million.

Colleen McDonald, Chief Financial Officer,

commented, “As of December 31, 2023, we had $2.2 million available

for stock purchases under our stock repurchase program. During the

year ended December 31, 2023, we repurchased 951,010 shares of

common stock at a cost of $4.0 million. As of December 31, 2023, we

had repurchased a total of approximately 20.4 million shares of

common stock at a cost of approximately $50.3 million through our

repurchase program. We retire all stock upon repurchase and future

repurchases are expected to be funded from cash on hand and cash

flows from operating activities.”

About Alpha Pro Tech, Ltd.Alpha

Pro Tech, Ltd. is the parent company of Alpha Pro Tech, Inc. and

Alpha ProTech Engineered Products, Inc. Alpha Pro Tech, Inc.

develops, manufactures and markets innovative disposable and

limited-use protective apparel products for the industrial, clean

room, medical and dental markets. Alpha ProTech Engineered

Products, Inc. manufactures and markets a line of construction

weatherization products, including building wrap and roof

underlayment. The Company has manufacturing facilities in Salt Lake

City, Utah; Nogales, Arizona; Valdosta, Georgia; and a joint

venture in India. For more information and copies of all news

releases and financials, visit Alpha Pro Tech’s website at

http://www.alphaprotech.com.

Certain statements made in this press release

constitute “forward-looking statements” within the meaning of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include any statement that

may predict, forecast, indicate or imply future results,

performance or achievements instead of historical facts and may be

identified generally by the use of forward-looking terminology and

words such as “expects,” “anticipates,” “estimates,” “believes,”

“predicts,” “intends,” “plans,” “potentially,” “may,” “continue,”

“should,” “will” and words of similar meaning. Without limiting the

generality of the preceding statement, all statements in this press

release relating to estimated and projected

earnings, expectations regarding order volume, timing of

fulfillment of orders, production capacity and our plans to

ramp up production and expand capacity, product

demand, availability of raw materials and supply chain access,

margins, costs, expenditures, cash flows, sources of capital,

growth rates and future financial and operating results are

forward-looking statements. We caution investors that any such

forward-looking statements are only estimates based on current

information and involve risks and uncertainties that may cause

actual results to differ materially from the results contained in

the forward-looking statements. We cannot give assurances that any

such statements will prove to be correct. Factors that could cause

actual results to differ materially from those estimated by us

include the risks, uncertainties and assumptions described from

time to time in our public releases and reports filed with the

Securities and Exchange Commission, including, but not limited to,

our most recent Annual Report on Form 10-K and Quarterly Report on

Form 10-Q. Specifically, these factors include, but are not

limited to, changes in global economic conditions; the inability of

our suppliers and contractors to meet our requirements; potential

challenges related to international manufacturing; our partnership

with a joint venture partner; the inability to protect our

intellectual property; competition in our industry; customer

preferences; the timing and market acceptance of new product

offerings; security breaches or disruptions to the information

technology infrastructure; the impact of legal and regulatory

proceedings or compliance challenges; and volatility in our common

stock price and our investments. We also caution investors

that the forward-looking information described herein represents

our outlook only as of this date, and we undertake no obligation to

update or revise any forward-looking statements to reflect events

or developments after the date of this press release. Given these

uncertainties, investors should not place undue reliance on

forward-looking statements as a prediction of actual results.

-- Tables follow --

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

20,378,000 |

|

|

$ |

16,290,000 |

|

|

|

Accounts receivable, net |

|

|

5,503,000 |

|

|

|

5,382,000 |

|

|

|

Accounts receivable, related party |

|

1,042,000 |

|

|

|

1,591,000 |

|

|

|

Inventories, net |

|

20,131,000 |

|

|

|

24,397,000 |

|

|

|

Prepaid expenses |

|

6,010,000 |

|

|

|

4,902,000 |

|

|

|

|

|

Total current assets |

|

53,064,000 |

|

|

|

|

52,562,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

5,587,000 |

|

|

|

5,742,000 |

|

|

Goodwill |

|

|

55,000 |

|

|

|

55,000 |

|

|

Definite-lived intangible assets, net |

|

- |

|

|

|

1,000 |

|

|

Right-of-use assets |

|

4,810,000 |

|

|

|

1,725,000 |

|

|

Equity investment in unconsolidated affiliate |

|

5,247,000 |

|

|

|

4,718,000 |

|

|

|

|

|

Total assets |

$ |

68,763,000 |

|

|

|

$ |

64,803,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

$ |

802,000 |

|

|

$ |

674,000 |

|

|

|

Accrued liabilities |

|

1,103,000 |

|

|

|

833,000 |

|

|

|

Lease liabilities |

|

661,000 |

|

|

|

899,000 |

|

|

|

|

|

Total current liabilities |

|

2,566,000 |

|

|

|

|

2,406,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease liabilities, net of current portion |

|

4,187,000 |

|

|

|

875,000 |

|

|

Deferred income tax liabilities, net |

|

442,000 |

|

|

|

764,000 |

|

|

|

|

|

Total liabilities |

|

7,195,000 |

|

|

|

4,045,000 |

|

|

Commitments and contingencies |

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

Common stock, $.01 par value: 50,000,000 shares authorized; |

|

|

|

|

|

|

11,416,212 and 12,226,306 shares outstanding as of |

|

|

|

|

|

|

December 31, 2023 and December 31, 2022, respectively |

|

114,000 |

|

|

|

123,000 |

|

|

|

Additional paid-in capital |

|

16,339,000 |

|

|

|

17,099,000 |

|

|

|

Retained earnings |

|

46,552,000 |

|

|

|

45,025,000 |

|

|

|

Accumulated other comprehensive loss |

|

(1,437,000 |

) |

|

|

(1,489,000 |

) |

|

|

|

|

Total shareholders' equity |

|

61,568,000 |

|

|

|

60,758,000 |

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

68,763,000 |

|

|

$ |

64,803,000 |

|

|

|

Consolidated Statements of

Income

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

15,265,000 |

|

$ |

12,225,000 |

|

$ |

61,232,000 |

|

$ |

61,981,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold, excluding depreciation |

|

|

|

|

|

|

|

|

|

and amortization |

|

9,559,000 |

|

|

7,414,000 |

|

|

38,403,000 |

|

|

40,298,000 |

|

|

|

|

|

|

|

Gross profit |

|

5,706,000 |

|

|

4,811,000 |

|

|

22,829,000 |

|

|

21,683,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

4,497,000 |

|

|

3,878,000 |

|

|

17,772,000 |

|

|

16,219,000 |

|

|

|

Depreciation and amortization |

|

238,000 |

|

|

173,000 |

|

|

925,000 |

|

|

814,000 |

|

|

|

|

|

|

|

Total operating expenses |

|

4,735,000 |

|

|

4,051,000 |

|

|

18,697,000 |

|

|

17,033,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

971,000 |

|

|

760,000 |

|

|

4,132,000 |

|

|

4,650,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses): |

|

|

|

|

|

|

|

|

|

Equity in income of unconsolidated affiliate |

|

85,000 |

|

|

- |

|

|

477,000 |

|

|

87,000 |

|

|

|

Impairment on deposit |

|

- |

|

|

- |

|

|

- |

|

|

(490,000 |

) |

|

|

Interest income, net |

|

267,000 |

|

|

109,000 |

|

|

816,000 |

|

|

148,000 |

|

|

|

|

|

|

|

Total other income (loss), net |

|

352,000 |

|

|

109,000 |

|

|

1,293,000 |

|

|

(255,000 |

) |

|

Income before provision |

|

|

|

|

|

|

|

|

|

for income taxes |

|

1,323,000 |

|

|

869,000 |

|

|

5,425,000 |

|

|

4,395,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

262,000 |

|

|

305,000 |

|

|

1,236,000 |

|

|

1,113,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

1,061,000 |

|

$ |

564,000 |

|

$ |

4,189,000 |

|

$ |

3,282,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.09 |

|

$ |

0.05 |

|

$ |

0.35 |

|

$ |

0.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per common share |

$ |

0.09 |

|

$ |

0.05 |

|

$ |

0.35 |

|

$ |

0.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average common shares outstanding |

|

11,506,261 |

|

|

12,354,564 |

|

|

11,856,356 |

|

|

12,713,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average common shares outstanding |

|

11,578,557 |

|

|

12,403,455 |

|

|

11,856,356 |

|

|

12,781,004 |

|

|

|

XXX

| Company Contact: |

Investor Relations Contact: |

| Alpha Pro Tech,

Ltd. |

HIR Holdings |

| Donna Millar |

Cameron Donahue |

| 905-479-0654 |

651-707-3532 |

|

e-mail: ir@alphaprotech.com |

e-mail: cameron@hirholdings.com |

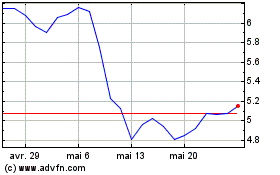

Alpha Pro Tech (AMEX:APT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Alpha Pro Tech (AMEX:APT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024