0001270436

false

0001270436

2023-08-02

2023-08-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

| Registrant Name |

Cohen

& Co Inc. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 2, 2023

Cohen & Company

Inc.

(Exact name of registrant as specified in its

charter)

| Maryland |

|

1-32026 |

|

16-1685692 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Cira Centre

2929 Arch Street, Suite 1703

Philadelphia,

Pennsylvania |

|

19104 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (215) 701-9555

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

COHN |

|

The NYSE

American Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item

2.02 |

Results of Operations and Financial Condition. |

On August 2, 2023, Cohen & Company Inc., a Maryland

corporation (the “Company”), issued a press release announcing the Company’s financial results for the second quarter

ended June 30, 2023. A copy of the earnings release is attached to this report as Exhibit 99.1.

The information hereunder shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities

of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Filed electronically herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

COHEN & COMPANY INC. |

| |

|

|

| Date: August 2, 2023 |

By: |

/s/ Joseph

W. Pooler, Jr. |

| |

|

Name: |

Joseph W. Pooler, Jr. |

| |

|

Title: |

Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

COHEN &

COMPANY REPORTS SECOND QUARTER 2023 FINANCIAL RESULTS

Board Declares

Quarterly Dividend of $0.25 per Share

Philadelphia

and New York, August 2, 2023 – Cohen & Company Inc. (NYSE American: COHN), a financial services firm specializing

in an expanding range of capital markets and asset management services, today reported financial results for its second quarter ended

June 30, 2023.

Summary Operating Results

| | |

Three Months Ended | | |

Six Months Ended | |

| ($ in thousands) | |

6/30/23 | | |

3/31/23 | | |

6/30/22 | | |

6/30/23 | | |

6/30/22 | |

| Net trading | |

$ | 7,416 | | |

$ | 8,210 | | |

$ | 10,377 | | |

$ | 15,626 | | |

$ | 22,399 | |

| Asset management | |

| 1,605 | | |

| 2,025 | | |

| 1,898 | | |

| 3,630 | | |

| 3,787 | |

| New issue and advisory | |

| 1,395 | | |

| 900 | | |

| 3,481 | | |

| 2,295 | | |

| 7,251 | |

| Principal transactions and other revenue | |

| 12,156 | | |

| (2,311 | ) | |

| (6,602 | ) | |

| 9,845 | | |

| (24,965 | ) |

| Total revenues | |

| 22,572 | | |

| 8,824 | | |

| 9,154 | | |

| 31,396 | | |

| 8,472 | |

| Compensation and benefits | |

| 10,001 | | |

| 10,537 | | |

| 12,214 | | |

| 20,538 | | |

| 26,093 | |

| Non-compensation operating expenses | |

| 5,572 | | |

| 5,770 | | |

| 5,102 | | |

| 11,342 | | |

| 10,419 | |

| Operating income | |

| 6,999 | | |

| (7,483 | ) | |

| (8,162 | ) | |

| (484 | ) | |

| (28,040 | ) |

| Interest expense, net | |

| (1,630 | ) | |

| (1,592 | ) | |

| (1,106 | ) | |

| (3,222 | ) | |

| (2,457 | ) |

| Income (loss) from equity method affiliates | |

| (511 | ) | |

| (395 | ) | |

| (3,044 | ) | |

| (906 | ) | |

| (15,148 | ) |

| Income (loss) before income tax expense (benefit) | |

| 4,858 | | |

| (9,470 | ) | |

| (12,312 | ) | |

| (4,612 | ) | |

| (45,645 | ) |

| Income tax expense (benefit) | |

| 5,550 | | |

| 584 | | |

| (60 | ) | |

| 6,134 | | |

| 1,773 | |

| Net income (loss) | |

| (692 | ) | |

| (10,054 | ) | |

| (12,252 | ) | |

| (10,746 | ) | |

| (47,418 | ) |

| Less: Net income (loss) attributable to the non-convertible non-controlling interest | |

| 6,503 | | |

| 97 | | |

| (4,167 | ) | |

| 6,600 | | |

| (18,871 | ) |

| Enterprise net income (loss) | |

| (7,195 | ) | |

| (10,151 | ) | |

| (8,085 | ) | |

| (17,346 | ) | |

| (28,547 | ) |

| Less: Net income (loss) attributable to the convertible non-controlling interest | |

| (594 | ) | |

| (7,514 | ) | |

| (6,228 | ) | |

| (8,108 | ) | |

| (19,078 | ) |

| Net income (loss) attributable to Cohen & Company Inc. | |

$ | (6,601 | ) | |

$ | (2,637 | ) | |

$ | (1,857 | ) | |

$ | (9,238 | ) | |

$ | (9,469 | ) |

| Fully diluted net income (loss) per share | |

$ | (4.34 | ) | |

$ | (1.77 | ) | |

$ | (1.53 | ) | |

$ | (6.14 | ) | |

$ | (6.71 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted pre-tax income (loss) | |

$ | (1,645 | ) | |

$ | (9,567 | ) | |

$ | (8,145 | ) | |

$ | (11,212 | ) | |

$ | (26,774 | ) |

| Fully diluted adjusted pre-tax income (loss) per share | |

$ | (0.30 | ) | |

$ | (1.74 | ) | |

$ | (1.51 | ) | |

$ | (2.03 | ) | |

$ | (4.91 | ) |

Adjusted pre-tax

income (loss) is not a measure recognized under U.S. generally accepted accounting principles (“GAAP”). See Note 1 below.

Lester Brafman,

Chief Executive Officer of Cohen & Company, said, “Our principal investing segment recovered, while net trading and new

issue and advisory revenue remained relatively stagnant during the second quarter. Our team of bankers and originators continue to build

our pipeline, which we expect will drive higher revenue in the near term. As we continue to make progress on our pipeline, we are pleased

to have already closed approximately $5 million of new issue and advisory revenue to-date in the third quarter. As always, we remain

focused on enhancing stockholder value, and are optimistic about the future as evidenced by our continued payment of our quarterly dividend.”

Financial Highlights

| · | Net

loss attributable to Cohen & Company Inc. was $6.6 million, or $4.34 per diluted

share, for the three months ended June 30, 2023, compared to net loss of $2.6 million,

or $1.77 per diluted share, for the three months ended March 31, 2023, and net loss

of $1.9 million, or $1.53 per diluted share, for the three months ended June 30, 2022.

Adjusted pre-tax loss was $1.6 million, or $0.30 per diluted share, for the three months

ended June 30, 2023, compared to adjusted pre-tax loss of $9.6 million, or $1.74 per

diluted share, for the three months ended March 31, 2023, and adjusted pre-tax loss

of $8.1 million, or $1.51 per diluted share, for the three months ended June 30, 2022.

Adjusted pre-tax income (loss) and adjusted pre-tax income (loss) per diluted share are not

measures recognized under GAAP. See Note 1 below. |

| · | Revenues

were $22.6 million for the three months ended June 30, 2023, compared to $8.8 million

for the prior quarter and $9.2 million for the prior year quarter. |

| o | Net

trading revenue was $7.4 million for the three months ended June 30, 2023, down $0.8

million from the prior quarter and $3.0 million from the prior year quarter. The decrease

from the prior quarter was due primarily to lower trading revenue by our corporate, agency,

municipal, and treasury groups, and the decrease from the prior year quarter was due primarily

to lower trading revenue by our mortgage group. |

| o | Asset

management revenue was $1.6 million for the three months ended June 30, 2023, down $0.4

million from the prior quarter and $0.3 million from the prior year quarter. The decrease

from both prior quarters was due primarily to no revenue being earned by the manager of the

Company’s SPAC fund in the current quarter, as a result of SPAC fund investors redeeming

all of their interests in the SPAC fund at the end of the first quarter of 2023. |

| o | New

issue and advisory revenue was $1.4 million for the three months ended June 30, 2023,

up $0.5 million from the prior quarter and down $2.1 million from the prior year quarter.

In the current quarter, the Cohen & Company Capital Markets investment banking team

generated $0.9 million and the U.S. insurance origination team generated $0.5 million of

the new issue and advisory revenue. |

| o | Principal

transactions and other revenue was $12.2 million for the three months ended June 30,

2023, compared to negative $2.3 million in the prior quarter and negative $6.6 million in

the prior year quarter. |

| · | Compensation

and benefits expense during the three months ended June 30, 2023 decreased $0.5 million

from the prior quarter and $2.2 million from the prior year quarter. The number of Company

employees was 117 as of June 30, 2023, compared to 121 as of March 31, 2023, and

121 as of June 30, 2022. |

| · | Interest

expense during the three months ended June 30, 2023 was comparable to the prior quarter

and increased $0.5 million from the prior year quarter. The increase from the prior year

quarter was primarily due to higher interest on our trust preferred securities. |

| · | Loss

from equity method affiliates for the three months ended June 30, 2023 was $0.5 million,

compared to loss from equity method affiliates of $0.4 million for the prior quarter and

loss from equity method affiliates of $3.0 million for the prior year quarter. |

| · | Income

tax expense for the three months ended June 30, 2023 was $5.6 million, compared to $0.6

million in the prior quarter, and income tax benefit of $0.1 million in the prior year quarter.

The current quarter expense was the result of an increase to the valuation allowance applied

against the Company's net operating loss and net capital loss tax assets. The Company will

continue to evaluate its operations on a quarterly basis and may adjust the valuation allowance

applied against the Company's net operating loss and net capital loss tax assets. Future

adjustments could be material and may result in additional tax benefit or tax expense. |

Total Equity and Dividend Declaration

| · | As

of June 30, 2023, total equity was $81.3 million, compared to $94.0 million as of December 31,

2022; the non-convertible non-controlling interest component of total equity was $6.7 million

as of June 30, 2023 and $17 thousand as of December 31, 2022. Thus, the total equity

excluding the non-convertible non-controlling interest component was $74.7 million as of

June 30, 2023, a $19.4 million decrease from $94.0 million as of December 31, 2022. |

| · | The

Company’s Board of Directors has declared a quarterly dividend of $0.25 per share,

payable on September 1, 2023, to stockholders of record as of August 18, 2023.

The Board of Directors will continue to evaluate the dividend policy each quarter, and future

decisions regarding dividends may be impacted by quarterly operating results and the Company’s

capital needs. |

Update on Quarterly Conference Calls

Cohen &

Company will not conduct quarterly conference calls for the foreseeable future. The Company intends to continue its practice of issuing

earnings releases in connection with the filing of its quarterly and annual reports. Investors can find contact information at the bottom

of this release should they have any questions about the second quarter results or the Company.

About Cohen & Company

Cohen &

Company is a financial services company specializing in an expanding range of capital markets and asset management services. Cohen &

Company’s operating segments are Capital Markets, Asset Management, and Principal Investing. The Capital Markets segment consists

of fixed income sales, trading, and gestation repo financing as well as new issue placements in corporate and securitized products, and

advisory services, operating primarily through Cohen & Company’s subsidiaries, J.V.B. Financial Group, LLC in the United

States and Cohen & Company Financial (Europe) S.A. in Europe. A division of JVB, Cohen & Company Capital Markets is

the Company’s full-service boutique investment bank with a focus on mergers and acquisitions, capital markets, and SPAC advisory

services. The Asset Management segment manages assets through collateralized debt obligations, managed accounts, and investment funds.

As of June 30, 2023, the Company managed approximately $2.1 billion in primarily fixed income assets in a variety of asset classes

including US and European trust preferred securities, subordinated debt, and corporate loans. The Principal Investing segment is comprised

primarily of investments the Company holds related to its SPAC franchise and other investments the Company has made for the purpose of

earning an investment return rather than investments made to support its trading or other capital markets business activity. For more

information, please visit www.cohenandcompany.com.

Note 1: Adjusted

pre-tax income (loss) and adjusted pre-tax income (loss) per share are non-GAAP measures of performance. Please see the discussion under

“Non-GAAP Measures” below. Also see the tables below for the reconciliations of non-GAAP measures of performance to their

corresponding GAAP measures of performance.

Forward-looking Statements

This communication

contains certain statements, estimates, and forecasts with respect to future performance and events. These statements, estimates, and

forecasts are “forward-looking statements.” In some cases, forward-looking statements can be identified by the use of forward-looking

terminology such as “may,” “might,” “will,” “should,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,” “seek,”

or “continue” or the negatives thereof or variations thereon or similar terminology. All statements other than statements

of historical fact included in this communication are forward-looking statements and are based on various underlying assumptions and

expectations and are subject to known and unknown risks, uncertainties, and assumptions, and may include projections of our future financial

performance based on our growth strategies and anticipated trends in our business. These statements are based on our current expectations

and projections about future events. There are important factors that could cause our actual results, level of activity, performance,

or achievements to differ materially from the results, level of activity, performance, or achievements expressed or implied in the forward-looking

statements including, but not limited to, those discussed under the heading “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition” in our filings with the Securities and Exchange Commission (“SEC”),

which are available at the SEC’s website at www.sec.gov and our website at www.cohenandcompany.com/investor-relations/sec-filings.

Such risk factors include the following: (a) a decline in general economic conditions or the global financial markets, including

those caused by inflation, raising interest rates, and the Russian/Ukrainian war, (b) losses caused by financial or other problems

experienced by third parties, (c) losses due to unidentified or unanticipated risks, (d) a lack of liquidity, i.e., ready access

to funds for use in our businesses, (e) the ability to attract and retain personnel, (f) litigation and regulatory issues,

(g) competitive pressure, (h) an inability to generate incremental income from new or expanded businesses, (i) unanticipated

market closures or effects due to inclement weather or other disasters, (j) losses (whether realized or unrealized) on our principal

investments, (k) the possibility that payments to the Company of subordinated management fees from its CDOs will continue to be

deferred or will be discontinued, (l) the possibility that the stockholder rights plan may fail to preserve the value of the Company’s

deferred tax assets, whether as a result of the acquisition by a person of 5% of the Company’s common stock or otherwise, (m) the

Company’s reduction in the volume of its investments into SPACs, (n) the difficulty in identifying potential business combinations

as a result of increased competition in the SPAC market, (o) the value of our holdings of founders shares in post-business combination

companies is volatile and may decline and the possibility that significant portions of the founder shares may remain restricted for a

long period of time, (p) the possibility that the Company will stop paying quarterly dividends to its stockholders, (q) the

possibility that the Company will incur additional losses liquidating collateral related to a reverse repo with now bankrupt First Guaranty

Mortgage Corporation, (r) the impacts of rising interest rates and inflation, and (s) the impacts of the COVID-19 pandemic.

As a result, there can be no assurance that the forward-looking statements included in this communication will prove to be accurate or

correct. In light of these risks, uncertainties, and assumptions, the future performance or events described in the forward-looking statements

in this communication might not occur. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results

and we do not undertake any obligation to update any forward-looking statements, whether as a result of new information, future events,

or otherwise.

Cautionary Note Regarding Quarterly

Financial Results

Due to the nature

of our business, our revenue and operating results may fluctuate materially from quarter to quarter. Accordingly, revenue and net income

in any particular quarter may not be indicative of future results. Further, our employee compensation arrangements are in large part

incentive-based and, therefore, will fluctuate with revenue. The amount of compensation expense recognized in any one quarter may not

be indicative of such expense in future periods. As a result, we suggest that annual results may be the most meaningful gauge for investors

in evaluating our business performance.

COHEN & COMPANY INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

(in thousands, except per share data)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

| 6/30/23 | | |

| 3/31/23 | | |

| 6/30/22 | | |

| 6/30/23 | | |

| 6/30/22 | |

| Revenues | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net trading | |

$ | 7,416 | | |

$ | 8,210 | | |

$ | 10,377 | | |

$ | 15,626 | | |

$ | 22,399 | |

| Asset management | |

| 1,605 | | |

| 2,025 | | |

| 1,898 | | |

| 3,630 | | |

| 3,787 | |

| New issue and advisory | |

| 1,395 | | |

| 900 | | |

| 3,481 | | |

| 2,295 | | |

| 7,251 | |

| Principal transactions and other revenue | |

| 12,156 | | |

| (2,311 | ) | |

| (6,602 | ) | |

| 9,845 | | |

| (24,965 | ) |

| Total revenues | |

| 22,572 | | |

| 8,824 | | |

| 9,154 | | |

| 31,396 | | |

| 8,472 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| Compensation and benefits | |

| 10,001 | | |

| 10,537 | | |

| 12,214 | | |

| 20,538 | | |

| 26,093 | |

| Business development, occupancy, equipment | |

| 1,318 | | |

| 1,301 | | |

| 1,295 | | |

| 2,619 | | |

| 2,543 | |

| Subscriptions, clearing, and execution | |

| 2,343 | | |

| 2,125 | | |

| 1,972 | | |

| 4,468 | | |

| 3,913 | |

| Professional services and other operating | |

| 1,762 | | |

| 2,200 | | |

| 1,692 | | |

| 3,962 | | |

| 3,688 | |

| Depreciation and amortization | |

| 149 | | |

| 144 | | |

| 143 | | |

| 293 | | |

| 275 | |

| Total operating expenses | |

| 15,573 | | |

| 16,307 | | |

| 17,316 | | |

| 31,880 | | |

| 36,512 | |

| Operating income (loss) | |

| 6,999 | | |

| (7,483 | ) | |

| (8,162 | ) | |

| (484 | ) | |

| (28,040 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-operating income (expense) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (1,630 | ) | |

| (1,592 | ) | |

| (1,106 | ) | |

| (3,222 | ) | |

| (2,457 | ) |

| Income (loss) from equity method affiliates | |

| (511 | ) | |

| (395 | ) | |

| (3,044 | ) | |

| (906 | ) | |

| (15,148 | ) |

| Income (loss) before income tax expense (benefit) | |

| 4,858 | | |

| (9,470 | ) | |

| (12,312 | ) | |

| (4,612 | ) | |

| (45,645 | ) |

| Income tax expense (benefit) | |

| 5,550 | | |

| 584 | | |

| (60 | ) | |

| 6,134 | | |

| 1,773 | |

| Net income (loss) | |

| (692 | ) | |

| (10,054 | ) | |

| (12,252 | ) | |

| (10,746 | ) | |

| (47,418 | ) |

| Less: Net income (loss) attributable to the non-convertible non-controlling interest | |

| 6,503 | | |

| 97 | | |

| (4,167 | ) | |

| 6,600 | | |

| (18,871 | ) |

| Enterprise net income (loss) | |

| (7,195 | ) | |

| (10,151 | ) | |

| (8,085 | ) | |

| (17,346 | ) | |

| (28,547 | ) |

| Less: Net income (loss) attributable to the convertible non-controlling interest | |

| (594 | ) | |

| (7,514 | ) | |

| (6,228 | ) | |

| (8,108 | ) | |

| (19,078 | ) |

| Net income (loss) attributable to Cohen & Company Inc. | |

$ | (6,601 | ) | |

$ | (2,637 | ) | |

$ | (1,857 | ) | |

$ | (9,238 | ) | |

$ | (9,469 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings per share | |

| Basic | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to Cohen & Company Inc. | |

$ | (6,601 | ) | |

$ | (2,637 | ) | |

$ | (1,857 | ) | |

$ | (9,238 | ) | |

$ | (9,469 | ) |

| Basic shares outstanding | |

| 1,520 | | |

| 1,489 | | |

| 1,428 | | |

| 1,505 | | |

| 1,412 | |

| Net income (loss) attributable to Cohen & Company Inc. per share | |

$ | (4.34 | ) | |

$ | (1.77 | ) | |

$ | (1.30 | ) | |

$ | (6.14 | ) | |

$ | (6.71 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fully Diluted | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to Cohen & Company Inc. | |

$ | (6,601 | ) | |

$ | (2,637 | ) | |

$ | (1,857 | ) | |

$ | (9,238 | ) | |

$ | (9,469 | ) |

| Net income (loss) attributable to the convertible non-controlling interest | |

| - | | |

| (7,514 | ) | |

| (6,228 | ) | |

| - | | |

| - | |

| Income tax and conversion adjustment | |

| - | | |

| 435 | | |

| (172 | ) | |

| - | | |

| - | |

| Net income (loss) attributable to Cohen & Company Inc. for fully diluted net income (loss) per share calculation | |

$ | (6,601 | ) | |

$ | (9,716 | ) | |

$ | (8,257 | ) | |

$ | (9,238 | ) | |

$ | (9,469 | ) |

| Basic shares outstanding | |

| 1,520 | | |

| 1,489 | | |

| 1,428 | | |

| 1,505 | | |

| 1,412 | |

| Unrestricted Operating LLC membership units exchangeable into COHN shares | |

| - | | |

| 3,998 | | |

| 3,966 | | |

| - | | |

| - | |

| Fully diluted shares outstanding (1) | |

| 1,520 | | |

| 5,487 | | |

| 5,394 | | |

| 1,505 | | |

| 1,412 | |

| Fully diluted net income (loss) per share | |

$ | (4.34 | ) | |

$ | (1.77 | ) | |

$ | (1.53 | ) | |

$ | (6.14 | ) | |

$ | (6.71 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of adjusted pre-tax income

(loss) to net income (loss) attributable to Cohen & Company Inc. and calculations of per share amounts | |

| Net income (loss) attributable to Cohen & Company Inc. | |

$ | (6,601 | ) | |

$ | (2,637 | ) | |

$ | (1,857 | ) | |

$ | (9,238 | ) | |

$ | (9,469 | ) |

| Addback (deduct): Income tax expense (benefit) | |

| 5,550 | | |

| 584 | | |

| (60 | ) | |

| 6,134 | | |

| 1,773 | |

| Addback (deduct): Net income (loss) attributable to the convertible non-controlling interest | |

| (594 | ) | |

| (7,514 | ) | |

| (6,228 | ) | |

| (8,108 | ) | |

| (19,078 | ) |

| Adjusted pre-tax income (loss) | |

| (1,645 | ) | |

| (9,567 | ) | |

| (8,145 | ) | |

| (11,212 | ) | |

| (26,774 | ) |

| Net interest attributable to convertible debt | |

| - | | |

| - | | |

| - | | |

| - | | |

| 327 | |

| Enterprise pre-tax income (loss) for fully diluted adjusted pre-tax income (loss) per share calculation | |

$ | (1,645 | ) | |

$ | (9,567 | ) | |

$ | (8,145 | ) | |

$ | (11,212 | ) | |

$ | (26,447 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted fully diluted shares outstanding (2) | |

| 5,535 | | |

| 5,505 | | |

| 5,401 | | |

| 5,520 | | |

| 5,382 | |

| Fully diluted adjusted pre-tax income (loss) per share | |

$ | (0.30 | ) | |

$ | (1.74 | ) | |

$ | (1.51 | ) | |

$ | (2.03 | ) | |

$ | (4.91 | ) |

(1) When the fully diluted net income (loss) per share is anti-dilutive, the basic shares outstanding are presented on this line item.

(2) Adjusted fully diluted shares outstanding includes (a) Operating LLC units exchangeable into COHN shares at all times, including weighted restricted units, and (b) weighted restricted shares, even during periods when the corresponding GAAP calculation of fully diluted shares outstanding above does not include them. The Operating LLC units are always included because the non-GAAP measure of performance, adjusted pre-tax income (loss), always includes net income (loss) attributable to the corresponding convertible interest.

COHEN & COMPANY INC.

CONSOLIDATED BALANCE SHEETS

(in thousands)

| | |

June 30. 2023 | | |

| |

| | |

(unaudited) | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 12,166 | | |

$ | 29,101 | |

| Receivables from brokers, dealers, and clearing agencies | |

| 108,020 | | |

| 140,933 | |

| Due from related parties | |

| 719 | | |

| 787 | |

| Other receivables | |

| 5,734 | | |

| 9,527 | |

| Investments - trading | |

| 192,805 | | |

| 211,828 | |

| Other investments, at fair value | |

| 56,868 | | |

| 28,022 | |

| Receivables under resale agreements | |

| 457,528 | | |

| 437,692 | |

| Investment in equity method affiliates | |

| 8,782 | | |

| 8,929 | |

| Deferred income taxes | |

| 331 | | |

| 6,934 | |

| Goodwill | |

| 109 | | |

| 109 | |

| Right-of-use asset - operating leases | |

| 8,612 | | |

| 9,647 | |

| Other assets | |

| 4,452 | | |

| 3,546 | |

| Total assets | |

$ | 856,126 | | |

$ | 887,055 | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Payables to brokers, dealers, and clearing agencies | |

$ | 127,627 | | |

$ | 134,985 | |

| Accounts payable and other liabilities | |

| 8,513 | | |

| 11,439 | |

| Accrued compensation | |

| 8,044 | | |

| 12,434 | |

| Trading securities sold, not yet purchased | |

| 98,117 | | |

| 133,957 | |

| Other investments sold, not yet purchased, at fair value | |

| 28,606 | | |

| 78 | |

| Securities sold under agreements to repurchase | |

| 457,351 | | |

| 452,797 | |

| Operating lease liability | |

| 9,365 | | |

| 10,447 | |

| Redeemable financial instruments | |

| 7,868 | | |

| 7,868 | |

| Debt | |

| 29,324 | | |

| 29,024 | |

| Total liabilities | |

| 774,815 | | |

| 793,029 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Voting non-convertible preferred stock | |

| 27 | | |

| 27 | |

| Common stock | |

| 18 | | |

| 17 | |

| Additional paid-in capital | |

| 73,967 | | |

| 72,801 | |

| Accumulated other comprehensive loss | |

| (955 | ) | |

| (955 | ) |

| Accumulated deficit | |

| (35,373 | ) | |

| (25,151 | ) |

| Total stockholders' equity | |

| 37,684 | | |

| 46,739 | |

| Non-controlling interest | |

| 43,627 | | |

| 47,287 | |

| Total equity | |

| 81,311 | | |

| 94,026 | |

| Total liabilities and equity | |

$ | 856,126 | | |

$ | 887,055 | |

Non-GAAP Measures

Adjusted pre-tax

income (loss) and adjusted pre-tax income (loss) per diluted share

Adjusted pre-tax

income (loss) is not a financial measure recognized by GAAP. Adjusted pre-tax income (loss) represents net income (loss) attributable

to Cohen & Company Inc., computed in accordance with GAAP, excluding income tax expense (benefit), plus the net income (loss)

attributable to the convertible non-controlling interest. Income tax expense (benefit) has been excluded because a pre-tax measurement

of enterprise earnings that includes net income (loss) attributable to the convertible non-controlling interest is a useful and appropriate

measure of performance. Furthermore, our income tax expense (benefit) has been, and we expect it will continue to be, a substantially

non-cash item for the foreseeable future, generated from adjustments in our valuation allowance applied to the Company’s gross

deferred tax assets. Convertible non-controlling interest is added back to adjusted pre-tax income because the underlying Cohen &

Company, LLC equity units are convertible into Cohen & Company Inc. shares. Adjusted pre-tax income (loss) per diluted share

is calculated, by dividing adjusted pre-tax income (loss) by diluted shares outstanding, both of which include adjustments used in the

corresponding calculation in accordance with GAAP.

We present adjusted

pre-tax income (loss) and related per diluted share amounts in this release because we consider them to be useful and appropriate supplemental

measures of our performance. Adjusted pre-tax income (loss) and related per diluted share amounts help us to evaluate our performance

without the effects of certain GAAP calculations that may not have a direct cash or recurring impact on our current operating performance.

In addition, our management uses adjusted pre-tax income (loss) and related per diluted share amounts to evaluate the performance of

our enterprise operations. Adjusted pre-tax income (loss) and related per diluted share amounts, as we define them, are not necessarily

comparable to similarly named measures of other companies and may not be appropriate measures for performance relative to other companies.

Adjusted pre-tax income (loss) should not be assessed in isolation from or construed as a substitute for net income (loss) attributable

to Cohen & Company Inc. prepared in accordance with GAAP. Adjusted pre-tax income (loss) is not intended to represent and should

not be considered to be a more meaningful measure than, or an alternative to, measures of operating performance as determined in accordance

with GAAP.

Contact:

| Investors - |

Media - |

| Cohen & Company Inc. |

Joele Frank, Wilkinson Brimmer Katcher |

| Joseph W. Pooler, Jr. |

Nick Jannuzzi |

| Executive Vice President and |

212-351-8957 |

| Chief Financial Officer |

njannuzzi@joelefrank.com |

| 215-701-8952 |

|

| investorrelations@cohenandcompany.com |

|

v3.23.2

Cover

|

Aug. 02, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 02, 2023

|

| Entity File Number |

1-32026

|

| Entity Registrant Name |

Cohen

& Co Inc.

|

| Entity Central Index Key |

0001270436

|

| Entity Tax Identification Number |

16-1685692

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

Cira Centre

|

| Entity Address, Address Line Two |

2929 Arch Street, Suite 1703

|

| Entity Address, City or Town |

Philadelphia

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19104

|

| City Area Code |

215

|

| Local Phone Number |

701-9555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

COHN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

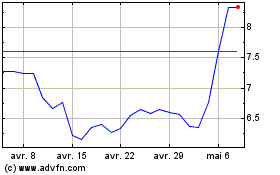

Cohen & (AMEX:COHN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Cohen & (AMEX:COHN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024