UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2025.

Commission File Number: 001-40673

Cybin Inc.

(Exact Name of Registrant as Specified in Charter)

100 King Street West, Suite 5600, Toronto, Ontario, M5X 1C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F □ Form 40-F ⊠

INCORPORATION BY REFERENCE

Exhibit 99.1 of this Form 6-K of Cybin Inc. (the "Company") is hereby incorporated by reference into the Registration Statement on Form F-10 (File No. 333-284173) of the Company, as amended or supplemented.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

CYBIN INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date:

|

February 14, 2025

|

By:

|

/s/ Doug Drysdale

|

|

|

|

Name:

|

Doug Drysdale

|

|

|

|

Title:

|

Chief Executive Officer

|

EXHIBIT INDEX

FORM 51-102F3

MATERIAL CHANGE REPORT

Item 1. Name and Address of Company

Cybin Inc. (the "Company")

100 King Street West, Suite 5600

Toronto, Ontario

M5X 1C9

Item 2. Date of Material Change

February 10, 2025

Item 3. News Release

A news release disclosing the material change was disseminated by the Company on February 10, 2025 through BusinessWire.

Item 4. Summary of Material Change

On February 10, 2025, the Company announced that it had established a new at-the-market equity program (the "New ATM Program") to allow the Company to issue and sell up to US$100,000,000 of common shares in the capital of the Company (the "Shares") from treasury to the public, from time to time.

Item 5. Full Description of Material Change

The New ATM Program will allow the Company to issue and sell up to US$100,000,000 of Shares from treasury to the public, from time to time, through Cantor Fitzgerald Canada Corporation and Cantor Fitzgerald & Co. (together, the "Agents"). All Shares sold under the New ATM Program will be sold in transactions that are deemed to be "at-the-market" distributions as defined in National Instrument 44-102 - Shelf Distributions, directly through Cboe Canada, the NYSE American LLC (the "NYSE American") or any other "marketplace" (as defined in National Instrument 21-101 - Marketplace Operation) upon which the Shares are listed, quoted or otherwise traded, at the prevailing market price at the time of sale. The Company intends to use the net proceeds from sales of Shares under the New ATM Program, if any, for growth opportunities and working capital initiatives.

Distributions of Shares under the New ATM Program, if any, will be made pursuant to the terms and conditions of an "at-the-market equity" distribution agreement (the "New Distribution Agreement") dated February 10, 2025 that the Company entered into with the Agents.

The New ATM Program will be effective until the earlier of the issuance and sale of all of the Shares issuable pursuant to the New ATM Program and September 17, 2025, unless earlier terminated in accordance with the terms of the New Distribution Agreement. The Company is not obligated to make any sales of Shares under the New ATM Program and there can be no assurance as to when such sales will be completed, if ever. The volume and timing of distributions under the New ATM Program, if any, will be determined in the Company's sole discretion and in accordance with the New Distribution Agreement. As any Shares distributed under the New ATM Program will be issued and sold at the prevailing market price at the time of the applicable sale, prices may vary among purchasers through the duration of the New ATM Program. The completion of sales of Shares under the New ATM Program will be subject to customary closing conditions, including the listing of such Shares on Cboe Canada and the NYSE American, and any required approvals of each exchange.

The ATM Program is being established, and the sale of the Shares through the ATM Program will be made pursuant to, and qualified by way of a prospectus supplement dated February 10, 2025 (the "Prospectus Supplement") to the Company's short form base shelf prospectus dated August 17, 2023, as amended on December 22, 2023, April 8, 2024 and January 6, 2025 (the "Base Shelf Prospectus") filed with the securities commissions in each of the provinces and territories of Canada. The Base Shelf Prospectus allows the Company to qualify offerings of Shares, warrants, subscription receipts, units or debt securities, or a combination thereof, up to an aggregate total of C$650,000,000 during the 25-month period, ending on September 17, 2025, that the Base Shelf Prospectus remains effective. The Prospectus Supplement was filed with the United States Securities and Exchange Commission as a supplement to the Company's registration statement on Form F-10 (File No. 333-284173), which was declared effective on January 14, 2025, in accordance with the Multijurisdictional Disclosure System established between Canada and the United States.

The Prospectus Supplement and accompanying Base Shelf Prospectus contain important detailed information about the New ATM Program. The Prospectus Supplement and accompanying Base Shelf Prospectus can be found under the Company's profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov/edgar. Copies of the Prospectus Supplement and accompanying Base Shelf Prospectus may also be obtained from Cantor Fitzgerald Canada Corporation, Attn: Equity Capital Markets, 181 University Avenue, Suite 1500, Toronto, ON, M5H 3M7, Email: ecmcanada@cantor.com, Cantor Fitzgerald & Co., Attn: Capital Markets, 110 East 59th Street, 6th floor, New York, New York 10022, Email: prospectus@cantor.com. Prospective investors should read the Prospectus Supplement and accompanying Base Shelf Prospectus and the other documents the Company has filed before making an investment decision.

In connection with the launch of the New ATM Program, the Company and the Agents have terminated the Company's existing "at-the market" equity program (the "2023 ATM Program"), which allowed the Company to issue and sell up to US$35,000,000 of Shares from treasury to the public pursuant to a distribution agreement, dated August 23, 2023, among the Company and the Agents.

The Company sold a total of 1,653,320 Shares under the 2023 ATM Program at an average price of US$11.05 per Share for gross proceeds of approximately US$18,264,982. The 2023 ATM Program was qualified by way of a prospectus supplement dated August 23, 2023 (the "2023 ATM Supplement") to the Base Shelf Prospectus. The 2023 ATM Supplement was also filed with the SEC as part of a registration statement on Form F-10 (File No. 333-272706), as amended, which became effective on August 17, 2023 upon filing with the SEC.

Item 6. Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7. Omitted Information

Not applicable.

Item 8. Executive Officer

Further information regarding the matters described in this report may be obtained from Gabriel Fahel, Chief Legal Officer of the Company, who is knowledgeable about the details of the material change and may be contacted at 1-866-292-4601.

Item 9. Date of Report

February 14, 2025.

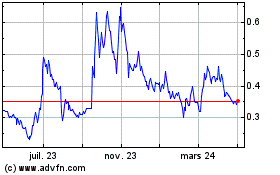

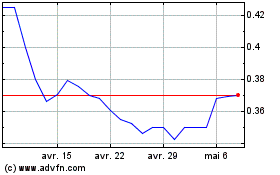

Cybin (AMEX:CYBN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Cybin (AMEX:CYBN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025