AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION

ON DECEMBER 10, 2024

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section 14(d)(1) or

13(e)(1) of the

Securities Exchange Act of 1934

Eaton Vance Municipal Bond Fund

(Name of Subject Company (Issuer))

Eaton Vance Municipal Bond Fund

(Name of Filing Person (Issuer))

Common Shares of Beneficial Interest, $.01 par value

(Title of Class of Securities)

27827X101

(CUSIP Number of Class of Securities)

Deidre E. Walsh

Eaton Vance Management

One Post Office Square

Boston, Massachusetts 02109

(617) 672-8305

(Name, Address and Telephone Number of Person Authorized

to Receive Notices

and Communications on Behalf of the Person(s) Filing

Statement)

December 10, 2024

(Date Tender Offer First Published, Sent or Given to

Security Holders)

| |

[_] |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which

the statement relates:

| |

[_] |

third party tender offer subject to Rule 14d-1. |

| |

[X] |

issuer tender offer subject to Rule 13e-4. |

| |

[_] |

going-private transaction subject to Rule 13e-3. |

| |

[_] |

amendment to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer. [_]

This Issuer Tender Offer Statement on Schedule TO relates to an offer by

Eaton Vance Municipal Bond Fund, a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the “1940

Act”), as a closed-end management investment company (the “Fund”), to purchase for cash up to 5% or 2,846,127 shares

of its outstanding common shares of beneficial interest, with par value of $.01 (the “Shares”), upon the terms and subject

to the conditions set forth in the Fund’s Offer to Purchase dated December 10, 2024 (the “Offer to Purchase”) and the

related Letter of Transmittal (the “Letter of Transmittal” which, together with any amendments or supplements thereto, collectively

constitute the “Offer”), copies of which are attached hereto as Exhibits (a)(1)(i) and (a)(1)(ii), respectively. The price

to be paid for the Shares is an amount per Share, net to the seller in cash, equal to 98% of the net asset value per Share as of the Expiration

Date (as defined in the Offer) or such later date to which the Offer is extended. The information set forth in the Offer is incorporated

herein by reference with respect to Items 1 through 9 and Item 11 of this Schedule TO.

| |

Item 1. |

Summary Term Sheet. |

The information set forth under “Summary Term Sheet” in the

Offer to Purchase is incorporated herein by reference.

| |

Item 2. |

Subject Company Information. |

(a) The name of the issuer is Eaton Vance Municipal Bond Fund, a Massachusetts

business trust registered under the 1940 Act as a closed-end management investment company. The principal executive offices of the Fund

are located at One Post Office Square, Boston, Massachusetts 02109. The telephone number of the Fund is (617) 482-8260.

(b) The securities being sought in the Offer are the Shares. As of December

5, 2024, there were 56,922,547 Shares issued and outstanding.

(c) The principal market in which the Shares are traded is the NYSE American

LLC (the “NYSE American”). The Fund began trading on the NYSE American on August 30, 2002. For information on the high and

low closing market prices of the Shares in such principal market for each quarter for the past two fiscal years (as of the close of ordinary

trading on the NYSE American on the last day of each of the Fund’s fiscal quarters), see “Section 7. Price Range of Common

Shares; Dividends, of the Offer to Purchase,” which is incorporated herein by reference.

| |

Item 3. |

Identity and Background of Filing Person. |

(a) The Fund is the filing person. The information set forth in the Offer

to Purchase under “Section 10. Information about the Fund,” is incorporated herein by reference.

| |

Item 4. |

Terms of the Transaction. |

(a)(1) The following sections of the Offer to Purchase contain a description

of the material terms of the transaction and are incorporated herein by reference:

Summary Term Sheet

Section 1. Terms of the Offer; Expiration Date

Section 2. Extension of Tender Period, Termination; Amendment

Section 3. Procedures for Tendering Common Shares

Section 4. Withdrawal Rights

Section 5. Acceptance for Payment and Payment

Section 6. Certain Material U.S. Federal Income Tax Consequences

Section 8. Source and Amount of Funds; Effect of The Offer

Section 9. Purpose of the Offer

Section 10. Information Concerning the Fund

Section 11. Interests of the Trustees and Officers; Transactions and Arrangements

Concerning the Shares

Section 13. Conditions of the Offer

Section 14. Fees and Expenses

(a)(2) Not applicable.

(b) The information set forth in the Offer to Purchase under “Section

11. Interests of the Trustees and Officers; Transactions and Arrangements Concerning the Shares,” is incorporated herein by reference.

| |

Item 5. |

Past Contracts, Transactions, Negotiations and Agreements. |

(e) The information set forth in the Offer to Purchase under “Section

9. Purpose of the Offer,” and “Section 11. Interests of the Trustees and Officers; Transactions and Arrangements Concerning

the Shares,” are incorporated herein by reference.

| |

Item 6. |

Purposes of the Transaction and Plans or Proposals. |

(a) The information set forth in the Offer to Purchase under “Section

9. Purpose of the Offer,” is incorporated herein by reference.

(b) The information set forth in the Offer to Purchase under “Section

9. Purpose of the Offer,” is incorporated herein by reference.

(c) The information set forth in the Offer to Purchase under “Section

9. Purpose of the Offer,” is incorporated herein by reference.

| |

Item 7. |

Source and Amount of Funds or Other Considerations. |

(a) The information set forth in the Offer to Purchase under “Section

8. Source and Amount of Funds; Effect of the Offer,” is incorporated herein by reference.

(b) The information set forth in the Offer to Purchase under “Section

8. Source and Amount of Funds; Effect of the Offer,” is incorporated herein by reference.

(d) The information set forth in the Offer to Purchase under “Section

8. Source and Amount of Funds; Effect of the Offer,” is incorporated herein by reference.

| |

Item 8. |

Interests in Securities of the Subject Company. |

(a) The information set forth in the Offer to Purchase under “Section

11. Interests of the Trustees and Officers; Transactions and Arrangements Concerning the Shares,” is incorporated herein by reference.

(b) The information set forth in the Offer to Purchase under “Section

11. Interests of the Trustees and Officers; Transactions and Arrangements Concerning the Shares,” is incorporated herein by reference.

| |

Item 9. |

Persons/Assets Retained, Employed, Compensated or Used. |

(a) No persons have been directly or indirectly employed, retained, or are

to be compensated by or on behalf of the Fund to make solicitations or recommendations in connection with the Offer to Purchase.

| |

Item 10. |

Financial Statements. |

Not applicable.

| |

Item 11. |

Additional Information. |

(a)(1) The information set forth in the Offer to Purchase under “Section

11. Interests of the Trustees and Officers; Transactions and Arrangements Concerning the Shares,” is incorporated herein by reference.

(a)(2) None.

(a)(3) Not applicable.

(a)(4) Not applicable.

(a)(5) None.

(c) Not applicable.

| Exhibit No. |

Document |

| (a)(1)(i) |

Offer to Purchase dated December 10, 2024. |

| (a)(1)(ii) |

Letter of Transmittal. |

| (a)(1)(iii) |

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(iv) |

Letter to Clients for us by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(v) |

Form of Notice of Withdrawal. |

| (a)(2)-(4) |

Not applicable. |

| (a)(5)(i) |

Press Release issued on November 12, 2024.(1) |

| (a)(5)(ii) |

Press Release issued on December 10, 2024. |

| (d)(i) |

Standstill Agreement dated May 1, 2024.(2) |

| (g) |

Not applicable. |

| (h) |

Not applicable. |

| 107 |

Filing Fees – Calculation of Filing Fee Table. |

_____

(1) Incorporated

by reference to the Registrant’s Schedule TO-C, as filed with the Securities and Exchange Commission on November 12, 2024.

(2) Incorporated

by reference to the Registrant’s Schedule TO-I, as filed with the Securities and Exchange Commission on June 7, 2024.

| |

Item 13. |

Information Required by Schedule 13e-3. |

Not applicable.

Signature

After due inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this statement is true, complete and correct.

Eaton Vance Municipal Bond Fund

By: /s/ Kenneth

A. Topping

Name: Kenneth A. Topping

Title: President

Dated

as of December 10, 2024

Exhibit

Index

| Exhibit |

Description |

| (a)(1)(i) |

Offer to Purchase dated December 10, 2024. |

| (a)(1)(ii) |

Letter of Transmittal. |

| (a)(1)(iii) |

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(iv) |

Letter to Clients for us by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(v) |

Form of Notice of Withdrawal. |

| (a)(5)(ii) |

Press Release issued on December 10, 2024. |

| 107 |

Filing Fees – Calculation of Filing Fee Table. |

EXHIBIT (a)(1)(i)

OFFER TO PURCHASE

EATON VANCE MUNICIPAL BOND FUND

OFFER TO PURCHASE FOR CASH UP TO 5% OR 2,846,127

OF ITS OUTSTANDING COMMON SHARES OF

BENEFICIAL INTEREST AT 98%

OF NET ASSET VALUE PER SHARE

THE OFFER TO PURCHASE WILL EXPIRE ON JANUARY 9,

2025,

AT 5:00 P.M. EASTERN TIME, UNLESS THE OFFER IS EXTENDED

To the Common Shareholders of Eaton Vance Municipal Bond Fund:

Eaton Vance Municipal Bond Fund, a Massachusetts business trust

registered under the Investment Company Act of 1940, as amended, as a closed-end management investment company (the “Fund”),

is offering to purchase up to 5% or 2,846,127 (the “Offer Amount”) of its outstanding common shares of beneficial interest,

with par value of $.01 per share (the “Shares”), for cash at a price equal to 98% of the net asset value (“NAV”)

per Share as of the close of regular trading of the New York Stock Exchange (“NYSE”) on the Expiration Date (as defined below).

The offer is being made upon the terms and subject to the conditions set forth in the enclosed Offer to Purchase and the related Letter

of Transmittal (which, together with any amendments or supplements thereto, collectively constitute the “Offer”). The Offer

is designed to provide holders of the Shares (“Shareholders”) with the opportunity to redeem some or all of their Shares at

a price close to NAV should they wish to do so.

In order to participate in the Offer, the materials described in

the Offer must be transmitted to and received by Equiniti Trust Company, LLC, the depositary for the Offer, before 5:00 p.m. Eastern Time,

January 9, 2025, or such later date to which the Offer is extended. The later of January 9, 2025 and the latest time or date to which

the Offer is extended is hereinafter called the “Expiration Date.” Should the Offer be extended beyond January 9, 2025, Shares

will be purchased at 98% of the NAV of the Shares as of the close of regular trading of the NYSE on the date to which the Offer was extended.

The Shares are traded on the NYSE American LLC (the “NYSE

American”) under the ticker symbol “EIM.” As of December 5, 2024, the closing price as of the close of regular trading

of the NYSE American was $10.71 per Share. The Fund normally calculates the NAV of its Shares daily at the close of regular trading of

the NYSE. As of the close of regular trading of the NYSE on December 5, 2024, the NAV was $11.53 per Share. During the pendency of the

Offer, current NAV quotations can be obtained from EQ Fund Solutions, LLC, the information agent for the Offer (“Information Agent”)

at 1-877-732-3614.

The Offer is open to all Shareholders. None of the Fund, its

Board of Trustees (the “Board” or the “Trustees”), or Eaton Vance Management (“EVM”), the investment

adviser for the Fund, makes any recommendation to any Shareholder as to whether to tender any or all of such Shareholder’s Shares.

Shareholders are urged to evaluate carefully all information in the Offer, consult their own investment and tax advisors, and make their

own decisions whether to tender Shares and, if so, how many Shares to tender.

No person has been authorized to make any recommendation on behalf

of the Fund as to whether Shareholders should tender their Shares pursuant to the Offer. No person has been authorized to give any information

or to make any representations in connection with the Offer other than those contained in the Offer to Purchase and in the related Letter

of Transmittal. If given or made, such recommendation, information, or representations may not be relied upon as having been authorized

by the Board, the officers of the Fund, or EVM. The Fund has been advised that none of its Trustees, officers, or its investment adviser

intends to tender any Shares pursuant to the Offer.

The Offer is not conditioned upon the tender of any minimum number

of Shares. If the number of Shares properly tendered and not withdrawn prior to the Expiration Date is less than or equal to the Offer

Amount, the Fund will, upon the terms and subject to the conditions of the Offer, purchase all Shares tendered. If more Shares than the

Offer Amount are properly tendered and not withdrawn prior to the Expiration Date, the Fund will, upon the terms and subject to the conditions

of the Offer, purchase the Offer Amount on a pro rata basis (disregarding fractional shares).

You should be aware that, if you tender Shares pursuant to the Offer,

you will not be entitled to receive, with respect to tendered Shares that are accepted for repurchase by the Fund, any Fund dividend or

distribution with a record date occurring on or after the date on which the Fund accepts the Shares for repurchase.

Questions and requests for assistance should be directed to the

Information Agent at its address and telephone number set forth on page 6 of the Offer to Purchase. Shareholders may obtain additional

copies of the Offer to Purchase, the Letter of Transmittal, the Notice of Withdrawal or any other tender materials from the Information

Agent and may also contact their brokers, dealers, banks, trust companies or other nominees for copies of these documents. If you do not

wish to tender your Shares, you need not take any action.

If, after carefully evaluating all of the information set forth

in the Offer to Purchase, you wish to tender Shares pursuant to the Offer, please follow the instructions contained in the Offer to Purchase

and in the Letter of Transmittal or, if your Shares are held of record in the name of a broker, dealer, commercial bank, trust company

or other nominee, contact that firm to effect the tender for you. Shareholders are urged to consult their own investment and tax advisors

and make their own decisions whether to tender any Shares and, if so, how many Shares to tender.

THE OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL CONTAIN

IMPORTANT INFORMATION AND YOU SHOULD READ THEM CAREFULLY AND IN THEIR ENTIRETY BEFORE YOU MAKE ANY DECISION WITH RESPECT TO THE OFFER.

If you do not wish to tender your Shares,

you need not take any action.

December 10, 2024

Table of Contents

| SUMMARY TERM SHEET |

1 |

| THE OFFER |

6 |

| 1. TERMS OF THE OFFER; EXPIRATION DATE |

6 |

| 2. EXTENSION OF TENDER PERIOD, TERMINATION; AMENDMENT |

6 |

| 3. PROCEDURES FOR TENDERING SHARES |

7 |

| 4. WITHDRAWAL RIGHTS |

9 |

| 5. ACCEPTANCE FOR PAYMENT AND PAYMENT |

10 |

| 6. CERTAIN MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES |

11 |

| 7. PRICE RANGE OF SHARES; DIVIDENDS |

14 |

| 8. SOURCE AND AMOUNT OF FUNDS; EFFECT OF THE OFFER |

14 |

| 9. PURPOSE OF THE OFFER |

16 |

| 10. INFORMATION CONCERNING THE FUND |

17 |

| 11. INTERESTS OF THE TRUSTEES AND OFFICERS; TRANSACTIONS AND ARRANGEMENTS CONCERNING THE SHARES |

18 |

| 12. LEGAL MATTERS; REGULATORY APPROVALS |

19 |

| 13. CONDITIONS OF THE OFFER |

19 |

| 14. FEES AND EXPENSES |

20 |

| 15. MISCELLANEOUS |

20 |

OFFER TO PURCHASE

EATON VANCE MUNICIPAL BOND FUND

OFFER TO PURCHASE FOR CASH UP TO 5% OR 2,846,127

OUTSTANDING COMMON SHARES OF BENEFICIAL INTEREST

SUMMARY TERM SHEET

This Summary Term Sheet highlights certain information in this Offer to

Purchase. To understand the Offer (as defined herein) fully and for a more complete description of the terms of the Offer, please read

carefully this entire Offer to Purchase and the related Letter of Transmittal (which, together with any amendments or supplements thereto,

collectively constitute the “Offer”). We have included section references to direct you to a more complete description in

this Offer to Purchase of the topics in this Summary.

What and how many securities is Eaton Vance Municipal Bond Fund (the

“Fund”) offering to purchase?

The Board of Trustees of the Fund (the “Board” or the

“Trustees”) has authorized the Fund to conduct a cash tender offer to purchase up to 5% or 2,846,127 the “Offer Amount”)

of its issued and outstanding common shares of beneficial interest, with par value of $.01 per share (the “Shares”), at the

purchase price discussed below.

Are there conditions to the Offer?

The Offer is subject to certain customary conditions described in Section

13 of this Offer to Purchase.

How much and in what form will the Fund pay me for my Shares?

The Fund will pay cash for Shares purchased pursuant to the Offer,

less any applicable withholding taxes. The purchase price will equal 98% of the Fund’s net asset value (“NAV”) per Share

as of the close of regular trading on the New York Stock Exchange (the “NYSE”) on the date the Offer expires (or if the Offer

is extended, on the date to which the Offer is extended), upon the terms and subject to the conditions set forth in the Offer.

The Shares are traded on the NYSE American LLC (the “NYSE

American”) under the ticker symbol “EIM.” As of December 5, 2024, the closing price as of the close of regular trading

of the NYSE American was $10.71 per Share. The Fund normally calculates the NAV of its Shares daily at the close of regular trading of

the NYSE. As of the close of regular trading of the NYSE on December 5, 2024, the NAV was $11.53 per Share. During the pendency of the

Offer, current NAV quotations can be obtained from EQ Fund Solutions, LLC, the information agent for the Offer (“Information Agent”),

at 1-877-732-3614. For more information, see Section 1, “Terms of the Offer; Expiration Date” and Section 5, “Acceptance

for Payment and Payment.”

When does the Offer expire? Can the Fund extend the Offer,

and if so, when will the Fund announce the extension?

- The Offer expires on January 9, 2025 at 5:00 p.m. Eastern Time, unless the Fund extends the Offer.

The later of January 9, 2025 and the latest time or date to which the Offer is extended is hereinafter called the “Expiration Date.”

- The Fund may extend the Offer period at any time. If it does, the Fund will determine the purchase

price as of the close of regular trading on the NYSE as of the new Expiration Date.

- If the Offer period is extended, the Fund will make a public announcement of the extension no later

than 9:30 a.m. Eastern Time on the next business day following the previously scheduled Expiration Date.

If you hold your Shares directly, you have until the Expiration Date to

decide whether to tender your Shares in the Offer. If you want to tender your Shares, but you cannot comply with the procedure for book-entry

transfer by the Expiration Date, you will not be able to tender your Shares. This can occur, for example, if you purchased Shares at,

or within one or two days of, the Expiration Date, which would not allow sufficient time for such purchase transaction to settle. There

are no guaranteed delivery procedures available under the terms of the Offer as an alternative delivery mechanism. You should consult

your broker or other Nominee Holder (as defined below) to determine if there is an earlier deadline by which you must inform such Nominee

Holder of any decision to tender your Shares and provide to such Nominee Holder any other required materials.

For more information see Section 1, “Terms of the Offer; Expiration Date” and Section 2, “Extension of Tender

Period; Termination; Amendment.”

Must the Fund accept all Shares tendered?

If the number of Shares properly tendered and not withdrawn prior to the

Expiration Date is less than or equal to the Offer Amount, the Fund will, upon the terms and subject to the conditions of the Offer, purchase

all Shares tendered. If more Shares than the Offer Amount are properly tendered and not withdrawn prior to the Expiration Date, the Fund

will purchase the Offer Amount on a pro rata basis (disregarding fractional shares). Shareholders cannot be assured that all of their

tendered Shares will be repurchased. For more information, see Section 1, “Terms of the Offer; Expiration Date.”

Will I have to pay any fees or commissions on Shares I tender?

Shares will be purchased at 98% of the NAV of the Shares as of the

close of regular trading of the NYSE on the Expiration Date, which amount is expected to more than offset the costs of the tender, including

the processing of tender forms, effecting payment, postage and handling. The Fund will not charge a separate service fee in conjunction

with the Offer. If your Shares are held through a financial intermediary, the financial intermediary may charge you a service or other

fee for participation in the Offer. Tendering Shareholders will not be obligated to pay transfer taxes on the purchase of Shares by the

Fund, except under certain circumstances. For more information see Section 1, “Terms of the Offer; Expiration Date,”

Section 5, “Acceptance for Payment and Payment” and Section 14, “Fees and Expenses.”

Does the Fund have the financial resources to pay me for

my Shares?

Yes. If the Fund purchased 5% or 2,846,127 Shares at 98% of the December

5, 2024 NAV of $11.53 per Share, the Fund’s total cost, not including fees and expenses incurred in connection with the Offer would

be approximately $32,161,235.10. Available sources of funds for the purchase of tendered Shares include cash on hand and the liquidation

of portfolio instruments. Although permitted to do so, the Fund does not expect to increase its use of leverage to finance the purchase

of any tendered Shares. For more information see Section 8, “Source and Amount of Funds; Effect of the Offer.”

How do I tender my Shares?

If your Shares are registered in the name of a nominee holder, such

as a broker, dealer, commercial bank, trust company or other nominee (“Nominee Holder”), you should contact that firm if you

wish to tender your Shares.

All other Shareholders wishing to participate in the Offer must,

prior to the Expiration Date, complete and execute a Letter of Transmittal, together with any required signature guarantees, and any other

documents required by the Letter of Transmittal. You must send these materials to Equiniti Trust Company, LLC (the “Depositary”)

at the address provided below:

The Depositary for the Offer:

Equiniti Trust Company, LLC

By hand, mail, express mail, courier or any

other expedited service:

Equiniti Trust Company, LLC

55 Challenger Road

Suite #200

Ridgefield Park, New Jersey 07660

Attn: Reorganization Department

By facsimile transmission (for eligible institutions

only):

718-765-8758

You must comply with the book-entry delivery procedure set forth

in Section 3.C of this Offer to Purchase. The Depositary must receive these materials prior to the date and time the Offer expires.

For more information, see Section 3, “Procedures for Tendering Common Shares.”

Must I tender all of my Shares for purchase?

No. You may tender for purchase none, all or some of the Shares

you own. For more information, see Section 1, “Terms of the Offer; Expiration Date.”

Until what time can I withdraw tendered Shares?

You may withdraw your tendered Shares at any time prior to the Expiration

Date. In addition, after the Offer expires, you may withdraw your tendered Shares if the Fund has not yet accepted tendered Shares for

payment by February 7, 2025, the date that is 40 business days from commencement of the Offer.

Withdrawals of tendered Shares may not be rescinded, and any Shares

validly withdrawn will thereafter be deemed not validly tendered for purposes of the Offer. However, withdrawn Shares may be retendered

by following one of the procedures described in Section 3 of this Offer to Purchase at any time before the Expiration Date. For more

information, see Section 4, “Withdrawal Rights.”

How do I withdraw tendered Shares?

If you desire to withdraw tendered Shares, you should either:

- Give proper written notice to the Depositary; or

- If your Shares are held of record in the name of a Nominee Holder, contact that firm to withdraw

your tendered Shares.

For more information, see Section 4, “Withdrawal Rights.”

What are the tax consequences of tendering Shares?

The receipt of cash for Shares pursuant to the Offer by a U.S. shareholder

other than a Shareholder exempt from tax or investing through a tax-advantaged arrangement generally will be a taxable transaction for

U.S. federal income tax purposes and may also be a taxable transaction under applicable state, local, foreign and other tax laws. For

U.S. federal income tax purposes, the sale of your Shares for cash generally will be treated either as (1) a sale or exchange of

the Shares, or (2) a distribution with respect to the Shares that is treated in whole or in part as a taxable dividend. Each Shareholder

should consult its tax adviser as to the tax consequences of tendering its Shares in the Offer. For more information, see Section 6,

“Certain Material U.S. Federal Income Tax Consequences.”

What is the purpose of the Offer?

On July 12, 2024, the Fund announced that it had commenced a four-month

measurement period, beginning July 9, 2024 through November 8, 2024, whereby if, during such period, the Shares trade at an average discount

to NAV of more than 7.5% (based upon the average of the difference between its volume-weighted average market price and NAV each business

day during the period) (the “First Trigger Event”), the Fund would conduct a conditional tender offer (this Offer) within

20 business days of the date on which the First Trigger Event occurs. The Offer would be for up to 5% of the Fund’s then-outstanding

Shares at 98% of NAV per share as of the close of regular trading on the NYSE on the date the tender offer expires. The Fund has determined

that the conditions of the First Trigger Event have been met.

Please bear in mind that none of the Fund, the Board, nor EVM, has

made any recommendation as to whether you should tender any or all of your Shares in the Offer. No person has been authorized to give

any information or to make any representations in connection with the Offer other than as contained herein or in the Letter of Transmittal.

If given or made, such recommendation, information, or representations may not be relied upon as having been authorized by the Board,

the officers of the Fund, or EVM. Shareholders are urged to consult their own investment and tax advisors and make their own decisions

whether to tender any Shares and, if so, how many Shares to tender. For more information, see Section 9, “Purpose of the Offer.”

This Offer to Purchase and the Letter of Transmittal relate solely

to the Offer and do not relate to any subsequent conditional tender offer.

What are the most significant conditions of the Offer?

The Fund may not accept Shares tendered for payment under any one

of the following circumstances that, in the view of the Board, would make it inadvisable to proceed with the Offer, purchase or payment.

The following is not a complete list. For a complete list of the conditions of the Offer, please see Section 13, “Conditions

of the Offer.”

- The purchase of Shares in the Offer would result in the delisting of the Shares from the

NYSE American.

- The Offer could impair compliance with U.S. Securities and Exchange Commission (“SEC”)

or Internal Revenue Service (“IRS”) requirements.

- The purchase of Shares in the Offer would result in a failure to comply with the applicable

asset coverage requirements applicable to any senior securities of the Fund that are issued and outstanding.

- The Fund would be unable to sell portfolio instruments in connection with or as a result

of the Offer in an orderly manner or such sale would have an adverse effect on the NAV of the Fund to the detriment of those Shareholders

who do not tender their Shares.

- In the Board’s good faith and reasonable judgment, there is a material legal action

or proceeding instituted or threatened, challenging the Offer or otherwise potentially materially adversely affecting the Fund.

- The suspension of or limitation on prices for trading securities generally on the NYSE American

or other national securities exchange(s), or the National Association of Securities Dealers Automated Quotation System (“NASDAQ”)

National Market System.

- Any declaration of a banking moratorium or similar action materially adverse to the Fund

by U.S. federal or state authorities or any foreign jurisdiction, or any suspension of payment material to the Fund by banks in the United

States, Massachusetts or New York, or any other jurisdiction.

- Certain circumstances exist beyond the Fund’s control, including limitations imposed

by federal or state authorities on the extension of credit by lenders or where banks have suspended payment.

- Any limitation having a material adverse effect on the Fund that is imposed by U.S. federal

or state authorities, or by any governmental authority of any foreign jurisdiction, with respect to the extension of credit by lending

institutions or the convertibility of foreign currencies.

- In the Board’s judgment, the Fund or its Shareholders might be adversely affected if

Shares were purchased in the Offer.

- The Board determines in good faith that the purchase of Shares might constitute a breach

of its fiduciary duty.

If

I decide not to tender, how will the Offer affect my Shares?

If you do not tender your Shares (or if you own Shares following

completion of the Offer), your percentage ownership interest in the Fund will increase after the completion of the Offer and you will

be subject to any increased risks associated with the reduction in the Fund’s total assets due to the payment for the tendered Shares.

These risks may include greater volatility due to a decreased asset base and proportionately higher expenses, as well as the possibility

of receiving additional taxable capital gains on the distributions, and bearing greater brokerage and other transaction expenses, from

the sale of portfolio instruments to pay for tendered Shares. The reduced assets of the Fund as a result of the Offer may result in less

investment flexibility for the Fund, depending on the number of Shares repurchased, and may have an adverse effect on the Fund’s

investment performance. For more information, see Section 8, “Source and Amount of Funds; Effect of the Offer” and Section 14,

“Fees and Expenses.”

What action need I take if I decide not to tender my Shares?

No action is required if you decide not to tender your shares.

How do I obtain more information about the Offer?

Any questions or requests for assistance or additional copies of this Offer

to Purchase, the Letter of Transmittal, or other documents may be directed to the Information Agent at its telephone number below. If

you own Shares through a broker or other Nominee Holder, you may call your broker or other Nominee Holder for assistance.

The Information Agent for the Offer is:

EQ Fund Solutions, LLC

48 Wall Street, 22nd Floor

New York, New York 10005

1-877-732-3614

THE OFFER

1. TERMS OF THE OFFER; EXPIRATION DATE

Upon the terms and subject to the conditions set forth in this Offer

to Purchase, the Fund will accept for payment and purchase for cash for up to 5% or 2,846,127 of its issued and outstanding Shares at

a price equal to 98% of the NAV per Share as of the close of regular trading of the NYSE on the date the Offer expires, January 9, 2025,

or if the Offer is extended, as of the close of regular trading of the NYSE on the date to which the Offer is extended. As of the close

of regular trading of the NYSE on December 5, 2024, the Fund’s NAV was $11.53 per Share. During the pendency of the Offer, current

NAV quotations can be obtained from EQ Fund Solutions, LLC, the information agent for the Offer (“Information Agent”) at 1-877-732-3614.

The Fund reserves the right to extend the Offer at any time. The Offer period may be extended by the Fund issuing a press release or making

some other public announcement no later than 9:30 a.m. Eastern Time on the next business day after the Offer otherwise would have expired.

During any such extension, all Shares previously tendered and not withdrawn will remain subject to the Offer, subject to the right of

any such tendering Shareholder to withdraw his, her or its Shares.

If the Fund makes a material change in the terms of the Offer or

the information concerning the Offer, or if it waives a material condition of the Offer, the Fund will extend the Offer to the extent

required under the Securities Exchange Act of 1934, as amended, (the “Exchange Act”).

The Offer is being made to all Shareholders of the Fund and is not

conditioned upon any minimum number of Shares being tendered. If the number of Shares properly tendered and not withdrawn prior to the

Expiration Date is less than or equal to 5% of the Fund’s outstanding Shares, the Fund will, upon the terms and subject to the conditions

of the Offer, purchase all Shares so tendered. If more Shares than the Offer Amount are properly tendered and not withdrawn prior to the

Expiration Date, the Fund will purchase the Offer Amount on a pro rata basis (disregarding fractional shares). Shares acquired by the

Fund pursuant to the Offer will thereafter constitute authorized but unissued Shares of the Fund. Under no circumstances will interest

be paid on the Offer price for tendered Shares, regardless of any extension of or amendment to the Offer or any delay in paying for such

Shares.

When considering whether to tender Shares, Shareholders should be

aware that the payment received pursuant to the Offer will be less than the amount that the Shareholders would be entitled to receive

upon a liquidation of the Fund.

Shares will be purchased at 98% of the NAV of the Shares as of the

close of regular trading of the NYSE on the Expiration Date, which amount is expected to more than offset the costs of the tender, including

the processing of tender forms, effecting payment, postage and handling. The Fund will not charge a separate service fee in conjunction

with the Offer. If your Shares are held through a financial intermediary, the financial intermediary may charge you a service or other

fee for participation in the Offer. Tendering Shareholders will not be obligated to pay transfer taxes on the purchase of Shares by the

Fund, except in the circumstances set forth in Section 5, “Acceptance for Payment and Payment.”

Subject to the terms and conditions of the Offer, the Fund will

pay the consideration offered or return the tendered Shares promptly after the termination or withdrawal of the Offer. Specifically, shareholders

who choose to participate in the Offer can expect payment for Shares tendered and accepted to be mailed within approximately three business

days after the Expiration Date. If payment of the purchase price is to be made to, or Shares not tendered or not purchased are to be returned

in, the name of any person other than the registered holder(s), or if a transfer tax is imposed for any reason other than the sale or

transfer of Shares to the Fund pursuant to the Offer, then the amount of any share transfer taxes (whether imposed on the registered holder(s),

such other persons or otherwise) will be deducted from the purchase price unless satisfactory evidence of the payment of such taxes, or

exemption therefrom, is submitted.

As of December 5, 2024, there were 56,922,547 Shares outstanding,

and there were approximately 96 holders of record of these Shares. As of the date of this Offer to Purchase, the Fund has been advised

that none of its Trustees, officers nor investment adviser intend to tender any Shares pursuant to the Offer.

2. EXTENSION OF TENDER PERIOD, TERMINATION;

AMENDMENT

The Fund expressly reserves the right, in its sole discretion, at

any time or from time to time, to extend the period of time during which the Offer is open by giving notice of such extension to the Information

Agent and making a public announcement thereof. In the event that the Fund so elects to extend the tender period, the NAV for the Shares

tendered will be computed as of the close of regular trading of the NYSE on the newly designated Expiration Date. During any such extension,

all Shares previously tendered and not purchased or withdrawn will remain subject to the Offer. The Fund also reserves the right, at any

time and from time to time up to and including the Expiration Date, to (a) terminate the Offer and not purchase or pay for any Shares

or, subject to applicable law, postpone payment for Shares, in each case upon the occurrence of any of the conditions specified in Section 13,

“Conditions of the Offer;” and (b) amend the Offer in any respect by making a public announcement thereof. Such public

announcement will be issued no later than 9:30 a.m. Eastern Time on the next business day after the previously scheduled Expiration Date.

Without limiting the manner in which the Fund may choose to make a public announcement of extension, termination or amendment, except

as provided by applicable law (including Rule 13e-4(d)(2), Rule 13e-4(e)(3), and Rule 14e-l(d) under the Exchange Act), the Fund shall

have no obligation to publish, advertise or otherwise communicate any such public announcement in any particular manner.

If the Fund materially changes the terms of the Offer or the information

concerning the Offer, or if it waives a material condition of the Offer, the Fund will extend the Offer to the extent required by Rules

13e-4(d)(2) and 13e-4(e)(3) under the Exchange Act. These rules require that the minimum period during which the Offer must remain open

following material changes in the terms of the Offer or information concerning the Offer (other than a change in price or a change in

percentage of securities sought) will depend on the facts and circumstances, including the relative materiality of such terms or information.

If (i) the Fund increases or decreases the price to be paid for Shares, or the Fund unilaterally decreases the number of Shares being

sought and (ii) the Expiration Date is less than ten business days away, then the Expiration Date will be extended at least ten business

days from the date of the notice.

3. PROCEDURES FOR TENDERING SHARES

A. Proper Tender of Shares.

Shareholders that are registered in the name of a Nominee Holder

should contact such firm if they desire to tender their Shares.

For Shares to be properly tendered pursuant to the Offer, the following

must occur prior to 5:00 p.m. Eastern Time on the Expiration Date:

| (a) | A properly completed and duly executed Letter of Transmittal, together with any required signature guarantees

(or an “Agent’s Message” as described in Section 3.C, “Book Entry Delivery Procedures”), and any other documents

required by the Letter of Transmittal must be received by the Depositary at its address set forth on page 2 of this Offer to Purchase;

and |

| (b) | The tendering Shareholder must comply with the book-entry delivery procedure set forth in Section 3.C,

“Book Entry Delivery Procedures.” |

If you want to tender your Shares, but you cannot comply with the

procedure for book-entry transfer by the Expiration Date of the Offer, you will not be able to tender your Shares. This can occur, for

example, if you purchased Shares at, or within one or two days of, the Expiration Date, which would not allow sufficient time for such

purchase transaction to settle. There are no guaranteed delivery procedures available under the terms of the Offer as an alternative delivery

mechanism. If the Letter of Transmittal is signed by trustees, executors, administrators, guardians, agents, attorneys-in-fact, officers

of corporations or others acting in a fiduciary or representative capacity, such persons should so indicate when signing and must submit

proper evidence satisfactory to the Fund of their authority to so act. Letters of Transmittal should be sent to the Depositary; they should

not be sent or delivered to the Fund.

Section 14(e) of the Exchange Act, and Rule 14e-4 promulgated

thereunder make it unlawful for any person, acting alone or in concert with others, to tender shares in a partial tender offer for such

person’s own account unless at the time of tender, and at the time the shares are accepted for payment, the person tendering has

a net long position equal to or greater than the amount tendered in (i) shares,

and will deliver or cause to be delivered such shares for the purpose of tendering to the person making

the offer within the period specified in the offer, or (ii) an equivalent security and, upon acceptance of his or her tender, will

acquire shares by conversion, exchange, or exercise of such equivalent security to the extent required by the terms of the Offer, and

will deliver or cause to be delivered the shares so acquired for the purpose of tender to the offeror prior to or on the expiration date.

Section 14(e) and Rule 14e-4 provide a similar restriction applicable to the tender or guarantee of a tender on behalf of another

person.

The acceptance of Shares by the Fund for payment will constitute

a binding agreement between the tendering Shareholder and the Fund upon the terms and subject to the conditions of the Offer, including

the tendering Shareholder’s representation that (i) such Shareholder has a net long position in the Shares being tendered within

the meaning of Rule 14e-4 promulgated under the Exchange Act and (ii) the tender of such Shares complies with Rule 14e-4.

By submitting the Letter of Transmittal, a tendering Shareholder

shall, subject to and effective upon acceptance of payment for the Shares tendered, be deemed in consideration of such acceptance to sell,

assign and transfer to, or upon the order of, the Fund all right, title and interest in and to all the Shares that are being tendered

(and any and all dividends, distributions, other Shares or other securities or rights declared or issuable in respect of such Shares after

the Expiration Date) and irrevocably constitute and appoint the Depositary the true and lawful agent and attorney-in-fact of the tendering

Shareholder with respect to such Shares (and any such dividends, distributions, other Shares or securities or rights), with full power

of substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest) to (a) present such Shares

(and any such other dividends, distributions, other Shares or securities or rights) for transfer on the books of the Fund, and (b) receive

all benefits and otherwise exercise all rights of beneficial ownership of such Shares (and any such other dividends, distributions, other

Shares or securities or rights), all in accordance with the terms of the Offer. By submitting a Letter of Transmittal, and in accordance

with the terms and conditions of the Offer, a tendering Shareholder shall be deemed to represent and warrant that: (a) the tendering

Shareholder has full power and authority to tender, sell, assign and transfer the tendered Shares (and any and all dividends, distributions,

other Shares or other securities or rights declared or issuable in respect of such Shares after the Expiration Date); (b) when and to

the extent the Fund accepts the Shares for purchase, the Fund will acquire good, marketable and unencumbered title thereto, free and clear

of all liens, restrictions, charges, proxies, encumbrances or other obligations relating to their sale or transfer, and not subject to

any adverse claim; (c) on request, the tendering Shareholder will execute and deliver any additional documents deemed by the Depositary

or the Fund to be necessary or desirable to complete the sale, assignment and transfer of the tendered Shares (and any and all dividends,

distributions, other Shares or securities or rights declared or issuable in respect of such Shares after the Expiration Date); and (d) the

tendering Shareholder has read and agreed to all of the terms of the Offer, including this Offer to Purchase and the Letter of Transmittal.

B. Signature Guarantees and Method of Delivery.

Signatures on the Letter of Transmittal are required to be guaranteed

if a check for cash is to be issued in a name other than that of the registered owner of such Shares. In those instances, all signatures

on the Letter of Transmittal must be guaranteed by an eligible guarantor acceptable to the Depositary (an “Eligible Guarantor”).

An Eligible Guarantor includes a bank, broker, dealer, credit union, savings association or other entity that is a member in good standing

of the Securities Transfer Agents Medallion Program, or a bank, broker, dealer, credit union, savings association or other entity that

is an “Eligible Guarantor Institution” as such term is defined in Rule 17Ad-15 under the Exchange Act. If Shares are tendered

for the account of an institution that qualifies as an Eligible Guarantor, signatures on the Letter of Transmittal are not required to

be guaranteed. If the Letter of Transmittal is signed by a person or persons authorized to sign on behalf of the registered owner(s),

then the Letter of Transmittal must be accompanied by documents evidencing such authority to sign to the satisfaction of the Fund.

THE METHOD OF DELIVERY OF ANY DOCUMENTS IS AT THE ELECTION

AND RISK OF THE PARTY TENDERING SHARES. IF DOCUMENTS ARE SENT BY MAIL, IT IS RECOMMENDED THAT THEY BE SENT BY REGISTERED MAIL, PROPERLY

INSURED, WITH RETURN RECEIPT REQUESTED.

C. Book-Entry Delivery Procedure.

The Depositary will establish accounts with respect to the Shares

at The Depository Trust Company (“DTC”) for purposes of the Offer. Any financial institution that is a participant in any

of DTC’s systems may make delivery of tendered Shares by (i) causing DTC to transfer such Shares into the Depositary’s

account in accordance with DTC’s procedure for such transfer; and (ii) causing a confirmation of receipt of such delivery to

be received by the Depositary. DTC may charge the account of such financial institution for tendering Shares on behalf of Shareholders.

Notwithstanding that delivery of Shares may be properly effected in accordance with this book-entry delivery procedure, the Letter of

Transmittal, with signature guarantee, if required, or, in lieu of the Letter of Transmittal, an Agent’s Message (as defined below),

must be transmitted to and received by the Depositary at the appropriate address set forth on page 2 of this Offer to Purchase before

5:00 p.m. Eastern Time on the Expiration Date.

The term “Agent’s Message” means a message from

DTC transmitted to, and received by, the Depositary forming a part of a timely confirmation of a book-entry transfer (a “Book-Entry

Confirmation”), which states that DTC has received an express acknowledgment from the DTC participant (“DTC Participant”)

tendering the Shares that are the subject of the Book-Entry Confirmation that (i) the DTC Participant has received and agrees to

be bound by the terms of the Letter of Transmittal; and (ii) the Fund may enforce such agreement against the DTC Participant.

DELIVERY OF DOCUMENTS TO DTC IN ACCORDANCE WITH DTC’S

PROCEDURES DOES NOT CONSTITUTE DELIVERY TO THE DEPOSITARY FOR PURPOSES OF THE OFFER.

D. Determination of Validity.

All questions as to the validity, form, eligibility (including time of

receipt) and acceptance of tenders will be determined by the Fund, in its sole discretion, whose determination shall be final and binding.

The Fund reserves the absolute right to reject any or all tenders determined by it not to be in appropriate form or good order, or the

acceptance of or payment for which may, in the opinion of the Fund’s counsel, be unlawful. The Fund also reserves the absolute right

to waive any of the conditions of the Offer or any defect in any tender with respect to any particular Shares or any particular Shareholder,

and the Fund’s interpretations of the terms and conditions of the Offer will be final and binding. Unless waived, any defects or

irregularities in connection with tenders must be cured within such times as the Fund shall determine. Tendered Shares will not be accepted

for payment unless any defects or irregularities have been cured or waived within such time. Neither the Fund, EVM, the Depositary nor

any other person shall be obligated to give notice of any defects or irregularities in tenders, nor shall any of them incur any liability

for failure to give such notice.

E. U.S. Federal Income Tax Withholding.

Payments made to tendering Shareholders pursuant to the Offer may be subject

to withholding pursuant to the Internal Revenue Code of 1986, as amended, (the “Code”) and the regulations thereunder. For

an additional discussion of such withholding as well as a discussion of certain other U.S. federal income tax consequences to tendering

and non-tendering Shareholders, see Section 6, “Certain Material U.S. Federal Income Tax Consequences.”

4. WITHDRAWAL RIGHTS

Except as otherwise provided in this Section 4, tenders of Shares

made pursuant to the Offer will be irrevocable. You have the right to withdraw tendered Shares at any time prior to 5:00 p.m. Eastern

Time on the Expiration Date. If you desire to withdraw Shares tendered on your behalf by a Nominee Holder, you may withdraw by contacting

that firm and instructing them to withdraw such Shares. In addition, after the Offer expires, you may withdraw your tendered Shares if

the Fund has not yet accepted tendered Shares for payment by February 7, 2025, the date that is 40 business days from commencement of

the Offer. To be effective, a written or facsimile transmission notice of withdrawal must be timely received by the Depositary at the

address set forth on page 2 of this Offer to Purchase. Any notice of withdrawal must specify the name of the person who tendered the Shares

to be withdrawn, the number of Shares to be withdrawn, and the names in which the Shares to be withdrawn are registered. Shareholders

should contact the Information Agent for instructions if they wish to submit a notice of withdrawal.

Any notice of withdrawal must specify the name and number of the

account at the book-entry transfer facility to be credited with the withdrawn Shares (which must be the same name, number, and book-entry

transfer facility from which the Shares were tendered), and must comply with the procedures of DTC.

All questions as to the form and validity (including time of receipt)

of notices of withdrawal will be determined by the Fund in its sole discretion, whose determination shall be final and binding.

Neither the Fund, EVM, the Depositary nor any other person shall

be obligated to give notice of any defects or irregularities in tenders, nor shall any of them incur any liability for failure to give

such notice. Shares properly withdrawn shall not thereafter be deemed to be tendered for purposes of the Offer. However, withdrawn Shares

may be retendered by following the procedures described in Section 3, “Procedures for Tendering Shares,” prior to 5:00

p.m. Eastern Time on the Expiration Date.

The method of delivery of any documents related to a withdrawal

is at the risk of the withdrawing Shareholder. Any documents related to a withdrawal will be deemed delivered only when actually received

by the Depositary. If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended. In all cases,

sufficient time should be allowed to ensure timely delivery.

5. ACCEPTANCE FOR PAYMENT AND PAYMENT

Upon the terms and subject to the conditions of the Offer, the Fund

will accept for payment, and will pay cash for, Shares validly tendered on or before the Expiration Date, and not properly withdrawn in

accordance with Section 4, “Withdrawal Rights,” promptly after the Expiration Date of the Fund’s Offer. Specifically,

shareholders who choose to participate in the Offer can expect payments for Shares tendered and accepted to be mailed within approximately

three business days after the Expiration Date. The Fund expressly reserves the right, in its sole discretion, to delay the acceptance

for payment of, or payment for, Shares, in order to comply, in whole or in part, with any applicable law.

Payment for Shares accepted for payment pursuant to the Offer will

be made by the Depositary out of funds made available to it by the Fund. The Depositary will act as agent for the Fund for the purpose

of effecting payment to the tendering Shareholders. In all cases, payment for Shares tendered and accepted for payment pursuant to the

Offer will be made only after timely receipt by the Depositary of (i) a Book-Entry Confirmation of the delivery of such Shares, (ii) a

properly completed and duly executed Letter of Transmittal or, in the case of a book-entry transfer, an Agent’s Message in lieu

of the Letter of Transmittal, and (iii) any other documents required by the Letter of Transmittal. Accordingly, payment may not be

made to all tendering Shareholders at the same time and will depend upon when Book-Entry Confirmations of tendered Shares are received

in the Depositary’s account at DTC.

If any tendered Shares are not accepted for payment or are not paid

because of an invalid tender or if a Shareholder withdraws tendered Shares, (i) the Shares will be issued in book-entry form and

will be electronically held in your account for such unpurchased Shares, as soon as practicable following the expiration, termination

or withdrawal of the Offer, (ii) Shares delivered pursuant to the book-entry delivery procedures will be credited to the account

from which they were delivered, and (iii) Shares held by the Fund’s transfer agent pursuant to the Fund’s dividend reinvestment

and cash purchase plan will be returned to the dividend reinvestment and cash purchase plan account maintained by the transfer agent.

The Fund will pay all transfer taxes, if any, payable on the transfer

to it of Shares purchased pursuant to the Offer. If, however, payment of the purchase price is to be made to, or if unpurchased Shares

were registered in the name of, any person other than the tendering holder, the amount of any transfer taxes (whether imposed on the registered

holder or such other person) payable on account of such transfer will be deducted from the purchase price unless satisfactory evidence

of the payment of such taxes, or exemption therefrom, is submitted. In addition, if certain events occur, the Fund may not be obligated

to purchase Shares pursuant to the Offer. See Section 13, “Conditions of the Offer.”

A tendering U.S. Shareholder or other payee who fails to fully complete

and sign an IRS Form W-9 (or substitute form) may be subject to U.S. federal income backup withholding on the gross proceeds paid to such

Shareholder or other payee pursuant to the Offer. Non-U.S. Shareholders (as defined in Section 6, “Certain Material U.S. Federal

Income Tax Consequences” below) should provide the Depositary with an appropriate and properly completed IRS Form W-8BEN or W-8BEN-E

(or substitute form) in order to avoid backup withholding. A copy of IRS Form W-9, W-8BEN or W-8BEN-E will be provided upon request from

the Depositary. See Section 3, “Procedures for Tendering Shares” and Section 6, “Certain Material U.S. Federal

Income Tax Consequences.”

6. CERTAIN MATERIAL U.S. FEDERAL INCOME TAX

CONSEQUENCES

The following discussion is a general summary of the U.S. federal

income tax consequences of the purchase of Shares by the Fund from Shareholders pursuant to the Offer. This summary is based on U.S. federal

income tax law as of the date the Offer begins, including the Code, applicable Treasury regulations, IRS rulings, judicial authority and

current administrative rulings and practice, all of which are subject to change, possibly with retroactive effect. There can be no assurance

that the IRS would not assert, or that a court would not sustain, a position contrary to any of those set forth below, and the Fund has

not obtained, nor does the Fund intend to obtain, a ruling from the IRS or an opinion of counsel with respect to any of the consequences

described below. Shareholders should also consult their own tax advisors regarding their particular situation and the potential tax consequences

to them of a purchase of their Shares by the Fund pursuant to the Offer, including potential state, local and foreign taxation, as well

as any applicable transfer taxes.

As used herein, the term “U.S. Shareholder” refers to

a Shareholder who is (i) a citizen or resident of the United States, (ii) a corporation (other entity taxable as a corporation)

created or organized in or under the laws of the United States or any State thereof or the District of Columbia, (iii) an estate

the income of which is subject to U.S. federal income tax regardless of the source of such income, or (iv) a trust if (x) a

court within the United States is able to exercise primary supervision over the administration of the trust and one or more “U.S.

persons” (as defined in the Code) have the authority to control all substantial decisions of the trust or (y) the trust has

a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. If an entity or arrangement treated

as a partnership for U.S. federal income tax purposes holds our Shares, the tax treatment of an owner of such an entity or arrangement

generally will depend on the status of the owner and the activities of the entity or arrangement. The term “Non-U.S. Shareholder”

refers to a Shareholder who is not a U.S. Shareholder.

Sale or Exchange of Shares. A Shareholder whose Shares are

repurchased pursuant to the Offer generally will be treated as having sold the Shares and (other than tax-exempt Shareholders) will recognize

gain or loss for U.S. federal income tax purposes, so long as either (a) such Shareholder tenders, and the Fund repurchases, all

of such Shareholder’s Shares (i.e., the Shareholder reduces its percentage ownership of the Fund to 0%) or meets certain

numerical safe harbors with respect to percentage voting interest and reduction in ownership of the Fund following the completion of the

Offer, or (b) the tender otherwise is treated as being “not essentially equivalent to a dividend” under current U.S.

federal income tax law. For these purposes, a Shareholder’s ownership of the Fund is determined after applying the ownership attribution

rules under Section 318 of the Code. Under Section 318 of the Code, a Shareholder may constructively own Shares actually owned, and

in some cases constructively owned, by certain related individuals and certain entities in which the Shareholder or a related individual

or entity has an interest. The rules of constructive ownership are complex and must be applied to a particular Shareholder’s situation.

Such gain or loss will equal the difference between the price paid by the Fund for the Shares pursuant to the Offer and the Shareholder’s

adjusted tax basis in the Shares sold. A Shareholder’s holding period for Shares repurchased pursuant to the Offer will terminate

as of the Expiration Date. A tendering Shareholder’s gain or loss will generally be capital gain or loss if the Shares sold are

held by the Shareholder at the time of sale as capital assets and will be treated as long-term capital gain if the Shares have been held

for more than one year or as short-term if the Shares have been held for one year or less. It is expected that, if a Shareholder is treated

as having sold Shares pursuant to the Offer and realizes a gain upon such sale, and if one or more payments are received after the close

of the taxable year of the Shareholder in which the Expiration Date occurs, unless the Shareholder elects otherwise, the gain will be

accounted for under the installment sale rules for U.S. federal income tax purposes and the Shareholder will generally recognize any such

gain as and when proceeds are received, likely allocating tax basis according to the presumed percentage of the total payment received

in each installment. To the extent that a portion of any such gain is treated as interest, that portion will be taxed to the Shareholder

as ordinary income.

The maximum U.S. federal income tax rate applicable to short-term

capital gains recognized by a non-corporate Shareholder is currently the same as the applicable ordinary income rate. In addition, the

Code generally imposes a 3.8% Medicare contribution tax on the net investment income of certain individuals, estates and trusts to the

extent their income exceeds certain threshold amounts. For these purposes, “net investment income” generally includes, among

other things, (i) distributions paid by the Fund of net investment income and capital gains, and (ii) any net gain from the

sale, exchange or other taxable disposition of Shares of the Fund.

In the event that a tendering Shareholder’s ownership of the

Fund is not reduced to the extent required under the tests described above, such Shareholder will be deemed to receive a distribution

from the Fund under Section 301 of the Code with respect to the Shares held (or deemed held under Section 318 of the Code) by

the Shareholder after the tender (a “Section 301 distribution”). Such distribution, which will equal the price paid by

the Fund to such Shareholder for the Shares sold, will be taxable as a dividend to the extent of the Fund’s current and accumulated

earnings and profits allocable to such distribution. Any such dividend will constitute an ordinary income dividend, an exempt-interest

dividend or a capital gain dividend. An ordinary income dividend is generally taxable at ordinary income tax rates, and a dividend properly

reported as a capital gain dividend is generally taxable at long-term capital gain rates. The excess will be treated as a return of capital

reducing the Shareholder’s tax basis in the Shares held after the Offer (but not below zero), and thereafter as capital gain. In

the case of a tendering Shareholder that is a corporation treated as receiving a Section 301 distribution from the Fund in connection

with the transaction, special basis adjustments might also apply with respect to any Shares of such Shareholder not repurchased in connection

with the Offer.

Provided that no tendering Shareholder is treated as receiving a

Section 301 distribution as a result of the Offer, Shareholders whose percentage ownership of the Fund increases as a result of the

Offer will not be treated as realizing constructive distributions by virtue of that increase. In the event that any tendering Shareholder

is deemed to receive a Section 301 distribution as a result of the Offer, it is possible that Shareholders whose percentage ownership

of the Fund increases as a result of the Offer, including Shareholders who do not tender any Shares pursuant to the Offer, will be deemed

to receive a constructive distribution under Section 305(c) of the Code in an amount determined by the increase in their percentage

ownership of the Fund as a result of the Offer. Such constructive distribution will be treated as a dividend to the extent of current

or accumulated earnings and profits allocable to it, and treated as provided in the immediately preceding paragraph. Such dividend treatment

will not apply, however, if the tender is treated as an “isolated redemption” within the meaning of the Treasury regulations.

Under the “wash sale” rules under the Code, provided

the tender of Shares pursuant to the Offer is treated as a sale or exchange (and not a distribution as described above), loss recognized

on Shares sold pursuant to the Offer will ordinarily be disallowed to the extent the Shareholder acquires other Shares of the Fund (whether

through automatic reinvestment of dividends or otherwise) or substantially identical stock or securities within 30 days before or after

the date the tendered Shares are purchased pursuant to the Offer and, in that event, the basis and holding period of the Shares acquired

will be adjusted to reflect the disallowed loss. Any loss realized by a Shareholder on the sale of a Share held by the Shareholder for

six months or less will be treated for U.S. federal income tax purposes as a long-term capital loss to the extent of any distributions

or deemed distributions of long-term capital gains received by the Shareholder with respect to such Share. A Shareholder’s ability

to use capital losses may be limited under the Code.

Non-U.S. Shareholders. Provided the sale of Shares pursuant

to the Offer is respected as a sale or exchange for U.S. federal income tax purposes, any gain realized by a Non-U.S. Shareholder upon

the tender of Shares pursuant to the Offer will generally not be subject to any U.S. tax withholding and, provided such gain is not effectively

connected with a trade or business carried on in the United States by such Non-U.S. Shareholder, will not be subject to any U.S. federal

income tax. If, instead, all or a portion of the proceeds received by a tendering Non-U.S. Shareholder is treated for U.S. federal income

tax purposes as a Section 301 distribution by the Fund that is treated in whole or in part as a dividend, or if a Non-U.S. Shareholder

is otherwise treated as receiving a deemed distribution that is a dividend by reason of the Shareholder’s increase in its percentage

ownership of the Fund resulting from other Shareholders’ sale of Shares pursuant to the Offer, absent a statutory exemption, the

dividend received or deemed received by the Non-U.S. Shareholder would be subject to a U.S. withholding tax at the rate of 30% (or such

lower rate as may be applicable under a tax treaty).

If any gain or dividend income realized in connection with the tender

of Shares by a Non-U.S. Shareholder is effectively connected with a trade or business carried on in the United States by the Non-U.S.

Shareholder, such gain or dividend will be taxed at the graduated rates applicable to U.S. Shareholders. If a Non-U.S. Shareholder is

eligible for the benefits of a tax treaty, any gain or dividend income that is effectively connected with a U.S. trade or business will

generally be subject to U.S. federal income tax on a graduated basis only if it is also attributable to a permanent establishment maintained

by such Non-U.S. Shareholder in the United States. In addition, if the Non-U.S. Shareholder is a non-U.S. corporation, it may be subject

to a 30% (or such lower rate as may be applicable under a tax treaty) branch profits tax on such effectively connected income.

As the Fund may be unable to determine whether a payment made pursuant

to the Offer will properly be characterized as an “exchange” or a “dividend” for U.S. tax purposes at the time

of such payment, the Fund may withhold up to 30% of payments made to a Non-U.S. Shareholder or its agents. In that case, such Non-U.S.

Shareholder may be eligible to file for a refund of such tax or a portion of such tax if all or a portion of the tender of Shares pursuant

to the Offer is treated as a sale or exchange for U.S. federal income tax purposes or if such Non- U.S. Shareholder is entitled to a reduced

rate of withholding pursuant to a tax treaty and the Fund withheld at a higher rate.

In order to qualify for any exemptions from withholding described

above or for lower withholding tax rates under income tax treaties, or to establish an exemption from backup withholding, a Non-U.S. Shareholder

must comply with special certification and filing requirements relating to its non-U.S. status (including, in general, by furnishing an

IRS Form W-8BEN, W-8BEN-E or substitute form). Non-U.S. Shareholders are urged to consult their tax advisors regarding the application

of U.S. federal income tax rules, including withholding, to their tender of Shares.

Backup Withholding. The Fund generally is required to withhold

and remit to the U.S. Treasury a percentage of the taxable distributions and redemption proceeds paid to any individual Shareholder who

fails to properly furnish the Fund with a correct taxpayer identification number, who has under-reported dividend or interest income,

or who fails to certify to the Fund that he or she is not subject to such withholding.

Shareholders should provide the Fund with a completed IRS Form W-9,

W-8BEN, W-8BEN-E, as applicable, or other appropriate form in order to avoid backup withholding on the distributions they receive from

the Fund regardless of how they are taxed with respect to their tendered Shares. Backup withholding is not an additional tax and any amount

withheld may be credited against a Shareholder’s U.S. federal income tax liability, provided the appropriate information is timely

furnished to the IRS.

Other Tax Consequences. The Fund’s purchase of Shares

in the Offer may directly result in, or contribute to, a subsequent limitation on the Fund’s ability to use capital loss carryforwards

to offset future gains. Therefore, in certain circumstances, Shareholders who remain Shareholders following the completion of the Offer

may pay taxes sooner, or pay more taxes, than they would have had the Offer not occurred.

Any sales of securities by the Fund to raise cash to meet repurchase

requests could result in increased taxable distributions to Shareholders, including distributions taxable as ordinary income. See “Tax

Recognition of Capital Gains” in Section 8, “Source and Amount of Funds; Effect of the Offer” below.

Under Treasury regulations directed at tax shelter activity, if

a Shareholder recognizes a loss of $2 million or more in the case of an individual Shareholder or $10 million or more in the

case of a corporate Shareholder (or a greater loss over a combination of years), such Shareholder must file a disclosure statement with

the IRS on Form 8886. Direct holders of portfolio instruments are in many cases excepted from this reporting requirement, but under current

guidance, Shareholders of a regulated investment company (“RIC”) are not excepted. Future guidance may extend the current

exception from this reporting requirement to Shareholders of most or all RICs. The fact that a loss is reportable under these regulations

does not affect the legal determination of whether the taxpayer’s treatment of the loss is proper. Shareholders should consult their

own tax advisors concerning any possible disclosure obligation with respect to their investment in Shares.

FATCA Withholding. Sections 1471-1474 of the Code and the

U.S. Treasury and IRS guidance issued thereunder (collectively, “FATCA”) generally require the Fund to obtain information

sufficient to identify the status of each of its Shareholders under FATCA or under an applicable intergovernmental agreement (an “IGA”)

between the United States and a foreign government. If a Shareholder fails to provide the requested information or otherwise fails to

comply with FATCA or an IGA, the Fund may be required to withhold under FATCA with respect to that Shareholder at a rate of 30% on

ordinary dividends it pays. The IRS and the U.S. Department of Treasury have issued proposed regulations providing that these withholding

rules will not be applicable to the gross proceeds of share redemptions or capital gain dividends the Fund pays. If a payment by the Fund

is subject to FATCA withholding, the Fund is required to withhold without reference to any other withholding exemption.

In addition to the withholding described above under “Non-U.S.

Shareholders,” as the Fund may be unable to determine whether a payment made pursuant to the Offer will properly be characterized

as an “exchange” or a “dividend” for U.S. tax purposes at the time of such payment, the Fund may withhold under

FATCA up to 30% of any payment to a tendering Shareholder that is a foreign financial institution (“FFI”) or non-financial

foreign entity (“NFFE”) unless (a) in the case of an FFI, the FFI reports certain direct and indirect ownership of foreign

financial accounts held by U.S. persons with the FFI and (b) in the case of an NFFE, the NFFE (i) reports information relating

to its “substantial U.S. owners” (within the meaning of FATCA), if any, or (ii) certifies that it has no “substantial

U.S. owners.”

Certain Non-U.S. Shareholders may fall into certain exempt, excepted

or deemed-compliant categories as established by U.S. Treasury regulations, IGAs, and other guidance regarding FATCA. In order to qualify

for any such exception, a Non-U.S. Shareholder generally must provide the Fund with the applicable IRS Form W-8 (W-8BEN-E, W-8ECI, W-8EXP

or W-8IMY) properly certifying the Shareholder’s status under FATCA.

Shareholders are urged to consult their own tax advisors regarding

the application of U.S. federal income tax withholding, including eligibility for a withholding tax reduction or exemption, and the applicable

refund procedure, if any.

7. PRICE RANGE OF SHARES; DIVIDENDS

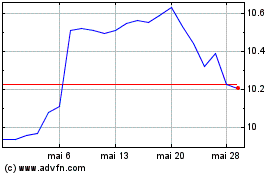

The Fund commenced investment operations on August 30, 2002 as an

NYSE American-listed company, and its Shares are traded on the NYSE American under the symbol “EIM.” The following table sets

forth for each of the periods indicated the highest and lowest closing market prices per Share on the NYSE American:

| |

Market Price on the NYSE American ($) |

NAV per Share on

Date of Market Price ($) |

| Fiscal Quarter Ended |

High |

Low |

High |

Low |

| September 30, 2024 |

10.93 |

10.21 |

11.56 |

11.45 |

| June 30, 2024 |

10.65 |

9.94 |

11.39 |

11.13 |

| March 31, 2024 |

10.42 |

9.81 |

11.52 |

11.46 |

| December 31, 2023 |

10.15 |

8.64 |

11.61 |

10.23 |

| September 30, 2023 |

10.12 |

8.95 |

11.57 |

10.49 |

| June 30, 2023 |

10.37 |

9.75 |

11.74 |