Genius Group announces $33 Million Rights Offering to increase Bitcoin Treasury

14 Janvier 2025 - 3:18PM

Genius Group Limited (NYSE American: GNS) (“Genius Group” or the

“Company”), a leading AI-powered, Bitcoin-first education group,

announced today that its Board of Directors (the “Board”) has

approved a plan to proceed with a $33 million rights offering for

the Company’s ordinary shares (the “Rights Offering”), with 100% of

net proceeds to be used to purchase Bitcoin for the Company’s

Bitcoin Treasury. The Rights Offering will be made only by means of

a prospectus supplement, and this announcement does not constitute

an offer to sell, or a solicitation of an offer to buy, any of

securities.

SUMMARY OF THE TERMS OF THE RIGHTS

OFFERING

| |

● |

Each shareholder will receive one transferable right (the “Right”)

for each ordinary share held on January 24, 2025 (the “Record

Date”). The number of Rights to be issued to a shareholder as of

the close of business on the Record Date will be rounded up to the

nearest number of Rights. The Company’s ordinary shares are

expected to trade “Ex-Rights” on the NYSE American beginning on

January 24, 2025. |

|

|

● |

Each Right entitles the holder to purchase one ordinary share of

the Company (the “Basic Subscription Right”) at the subscription

price of $0.50 per whole ordinary share (the “Subscription

Price). |

|

|

● |

Rights holders who fully exercise their Basic Subscription Rights

will be entitled to subscribe for additional ordinary shares of the

Company that remain unsubscribed as a result of any unexercised

Basic Subscription Rights (the “Over-subscription Right”). The

Over-subscription Right allows a rights holder to subscribe for

additional ordinary shares of the Company at the subscription price

on a pro rata basis. Any record date shareholder who sells any

Rights will not be eligible to participate in the over-subscription

privilege. |

|

|

● |

Rights holders who choose not to exercise their Rights may sell

their Rights. Trading in the Rights on the NYSE American is

expected to begin on a “when-issued” basis on January 23, 2025

under the symbol “GNS RTWI” and trade on a “regular way” basis on

January 27, 2025 under the symbol “GNS RT” and continue until the

close of trading on the NYSE American on February 13, 2025 (or if

the offer is extended, on the business day immediately prior to the

extended expiration date). |

|

|

● |

The Rights Offering expires at 4.30 p.m., Eastern Time, on February

14, 2025 (the “expiration date”) unless extended by the

Company. |

| |

|

|

SUMMARY OF THE USE OF FUNDS: BITCOIN

TREASURY

| |

● |

The Company plans to use 100% of the net proceeds of the Rights

Offering to purchase Bitcoin for its Bitcoin Treasury. The Company

anticipates that, in the event that the Rights Offering is fully

subscribed, the proceeds will be up to $33 million. |

|

|

● |

The Company also plans to pursue one or more additional loan

financings of up to, in the aggregate, $20 million. If the Company

is successful in raising the maximum amount in the Rights Offering

and through additional loans, the Company’s Bitcoin Treasury will

increase from approximately $35 million in Bitcoin to $86 million

in Bitcoin. |

| |

|

|

FOUNDER & MANAGEMENT

PARTICIPATION

| |

● |

The Founder and CEO of the Company, Roger Hamilton, intends to

submit an application to acquire 500,000 additional newly issued

shares of the Company, as approved by the Board on August 9, 2024.

The Board approved a plan in which Mr. Hamilton would have the

right to purchase one million shares (adjusted from ten million

shares after the Company’s reverse stock split) at a per share

price equal to 105% of the closing price on the prior trading day

to the date of purchase. On October 8, 2024, Mr. Hamilton acquired

500,000 shares, and has notified the Company that he would purchase

the remaining 500,000 shares on January 15, 2025 in accordance with

the terms of the plan. |

|

|

● |

Following the acquisition of these additional newly issued shares,

subject to the closing share price on January 14, 2025, Mr.

Hamilton will own an estimated 6.8 million shares of the Company,

representing approximately 10.3% of the 66 million issued shares in

the Company. Mr. Hamilton has notified the Company that he would

fully subscribe to his rights under this Rights Offering, which

will amount to rights to an additional 6.8 million shares on the

same terms as all shareholders on the Record Date as detailed

above. |

| |

|

|

The subscription agent for the Rights Offering

will send a rights certificate to each registered holder of the

Company’s ordinary shares as of the close of business on the record

date, based on the Company’s stockholder registry maintained at the

transfer agent for its ordinary shares. Holders of ordinary shares

in “street name” through a brokerage account, bank, or other

nominee will not receive a physical rights certificate, and

instead, such holders must instruct their broker, bank, or nominee

whether or not to exercise subscription rights on their behalf. For

any questions or further information about the Rights Offering,

please call Campaign Management LLC, the proposed information agent

for the Rights Offering, at +1 (855) 264-1527.

The Rights Offering will be made pursuant to the

Company’s effective shelf registration statement on Form S-3 (Reg.

No.333-280600) on file with the Securities and Exchange Commission

(the “SEC”) and a prospectus supplement to be filed with the SEC

prior to the commencement of the Rights Offering.

The information herein is not complete and is

subject to change. This press release does not constitute an offer

to sell or the solicitation of an offer to buy any of the rights,

ordinary shares or any other securities, nor will there be any sale

of the rights, ordinary shares or any other securities in any state

or other jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction. This

document is not an offering, which can only be made by a

prospectus. The base prospectus contains this and additional

information about the Company and the prospectus supplement will

contain this and additional information about the Rights Offering,

and should be read carefully before investing. For any questions or

further information about the Rights Offering, or to obtain a

prospectus supplement and the accompanying prospectus, when

available, please call Campaign Management LLC, the proposed

information agent for the Rights Offering, at +1 (855)

264-1527.

RIGHTS OFFERING INVESTOR

CALL

The Company will hold a live webcast and

investor call to discuss the Rights Offering on Wednesday, January

15, 2025 at 5.00 pm., Eastern Time. Certain financial information

relating to the Company’s 2025 outlook and Bitcoin Treasury

strategy will be discussed on the webcast and is included in the

prospectus supplement to be filed related to the Rights Offering.

Investors can attend the Investor call live by visiting

https://www.geniusgroup.ai

About Genius Group

Genius Group (NYSE: GNS) is a Bitcoin-first

business delivering AI powered, education and acceleration

solutions for the future of work. Genius Group serves 5.4 million

users in over 100 countries through its Genius City model and

online digital marketplace of AI training, AI tools and AI talent.

It provides personalized, entrepreneurial AI pathways combining

human talent with AI skills and AI solutions at the individual,

enterprise and government level. To learn more, please visit

www.geniusgroup.net.

For more information, please visit

https://www.geniusgroup.net/

Forward-Looking Statements

Statements made in this press release include

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements can be

identified by the use of words such as “may,” “will”, “plan,”

“should,” “expect,” “anticipate,” “estimate,” “continue,” or

comparable terminology. Such forward-looking statements are

inherently subject to certain risks, trends and uncertainties, many

of which the Company cannot predict with accuracy and some of which

the Company might not even anticipate and involve factors that may

cause actual results to differ materially from those projected or

suggested. Readers are cautioned not to place undue reliance on

these forward-looking statements and are advised to consider the

factors listed above together with the additional factors under the

heading “Risk Factors” in the Company’s Annual Reports on Form

20-F, as may be supplemented or amended by the Company’s Reports of

a Foreign Private Issuer on Form 6-K and prospectus supplement to

Form F-3 to be filed with respect thereto. The Company assumes no

obligation to update or supplement forward-looking statements that

become untrue because of subsequent events, new information or

otherwise. No information in this press release should be construed

as any indication whatsoever of the Company’s future revenues,

results of operations, or stock price.

Contacts

MZ Group - MZ North America(949)

259-4987GNS@mzgroup.uswww.mzgroup.us

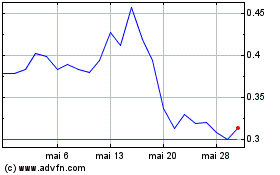

Genius (AMEX:GNS)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Genius (AMEX:GNS)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025