FALSE000004993800000499382023-12-182023-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | |

Date of Report (Date of earliest event reported): | December 18, 2023 | |

IMPERIAL OIL LIMITED

___________________________________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Canada | | 0-12014 | | 98-0017682 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | | | | | | | | | | | | | | | | | |

| 505 Quarry Park Boulevard S.E., Calgary, Alberta | | T2C 5N1 | |

| (Address of principal executive offices) | | (Zip Code) | |

| | | | | | | | | | | | | | | | | | | | |

Registrant's telephone number, including area code: | 1-800-567-3776 | |

____________________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on

which registered |

| None |

| None |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

| | | | | | | | | | | | | | |

Item 7.01 | | Regulation FD Disclosure |

| | | | |

On December 18, 2023, Imperial Oil Limited (the “company”) by means of a press release provided an update on its corporate guidance outlook for 2024. A copy of the press release is attached as Exhibit 99.1 to this report. |

| | | | |

Item 9.01 | | Financial Statements and Exhibits. |

| | | | |

(d) | | Exhibits. |

| | | | |

| | The following exhibit is furnished as part of this report on Form 8-K: |

| | | | |

| | | | News release of the company on December 18, 2023 providing an update on its corporate guidance outlook for 2024. |

| | | | |

| | 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 18, 2023

| | | | | | | | | | | |

| By: | /s/ Ian Laing | |

| | | |

| Name: | Ian Laing | |

| Title: | Vice-president, general counsel and corporate secretary | |

| | | |

| By: | /s/ Elma Feratovic | |

| | | |

| Name: | Elma Feratovic | |

| Title: | Assistant corporate secretary | |

Imperial provides 2024 corporate guidance outlook

CALGARY, Alberta – December 18, 2023 – Imperial (TSE: IMO, NYSE American: IMO) today provided an update on its corporate guidance outlook for 2024. The company’s strategy remains focused on maximizing value of existing assets and progressing select high-value growth opportunities while continuing to reduce company emissions and delivering industry-leading returns to shareholders.

“Over the next year, Imperial is positioned to deliver key milestones on strategic goals as we continue to profitably grow volumes at Kearl, begin producing from industry’s first solvent-assisted SAGD project with Cold Lake Grand Rapids, and advance construction on Canada’s largest renewable diesel facility at our Strathcona refinery,” said Brad Corson, chairman, president and chief executive officer. “Our strategic investments and continued focus on cost efficiencies have positioned Imperial to generate robust free cash flow over a range of business conditions and we remain confident in our ability to deliver on our commitments to shareholders.”

Capital spending is forecast at $1.7 billion. In the Downstream, construction continues on the Strathcona Renewable Diesel facility with production expected to begin in early 2025. In the Upstream, key projects include the SAGD redevelopment of the Leming field and high-value drilling opportunities at Cold Lake, as well as further volume enhancement initiatives, including secondary bitumen recovery technology, and continued progression of work on the in-pit tailings project at Kearl.

In the Upstream, production is forecast to be between 420,000 and 442,000 gross oil equivalent barrels per day. This reflects the multi-year volume growth and cost optimization journey at Kearl to profitably deliver annual production of 280,000 total gross barrels per day, as well as the accelerated ramp-up of the first phase of the Grand Rapids (GRP1) project at Cold Lake. The GRP1 project is expected to deliver 15,000 gross barrels per day at full production and is designed to reduce greenhouse gas emissions intensity by up to 40% compared to current steam technology.

In the Downstream, throughput is forecast to be between 385,000 and 400,000 barrels per day with capacity utilization between 89% and 92%. The company is planning to complete turnarounds at all three of its refineries in 2024, which includes scope to enable the co-processing of vegetable oils alongside conventional feedstock at Strathcona refinery. The planned turnarounds are anticipated to have a modestly higher impact on throughput but at a lower cost in comparison to 2023 turnaround activity. Imperial continues to focus on further improving its advantaged Canadian downstream business by leveraging its coast-to-coast logistics network to efficiently move product to high-value markets, maximizing refinery crude and product slate flexibility to improve resiliency and further developing its lower-carbon product offering to meet the needs of customers across Canada.

Imperial remains committed to supplying secure, reliable and affordable energy to Canadians in an environmentally responsible manner, including reducing emissions through deployment of large-scale solutions such as carbon capture and storage through the Pathways Alliance, development of next-generation solvent recovery technologies at Cold Lake and investing in other attractive emissions abatement opportunities. “Imperial supports Canada’s vision for a lower-emission future and our plans reflect our aggressive pursuit of high-value opportunities that help reduce emissions and grow production and improve profitability for our shareholders,” said Corson.

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

| | | | | |

| 2024 Full-Year Guidance |

| Canadian dollars, unless noted |

| Total capital and exploration expenditures $M | 1,700 |

| |

| Upstream production boe/d | 420,000 - 442,000 |

| Kearl (gross) bbl/d | 275,000 - 285,000 |

| Cold Lake bbl/d | 140,000 - 150,000 |

| Syncrude bbl/d | 75,000 - 80,000 |

| |

| Refinery throughput kbd | 385,000 - 400,000 |

| Refinery utilization % | 89% - 92% |

Upstream production is Imperial share before royalties, except Kearl which is 100% gross basis

Kearl is jointly owned by Imperial (70.96%) and ExxonMobil Canada (29.04%)

| | |

| 2024 Planned Turnarounds |

| Production and throughput reflect annualized basis |

| Upstream: |

| 2Q: Kearl, 6 kbd, $65M operating cost (Imperial share) |

| 2Q: Syncrude Coker, 6 kbd, $85M operating cost |

| 3Q: Cold Lake, 3 kbd, $25M operating cost |

| 3Q/4Q: Syncrude Hydrotreater, 3 kbd, $30M operating cost |

|

| Downstream & Chemical: |

| 2Q: Sarnia refinery, 5 kbd, $55M operating cost |

| 3Q: Nanticoke refinery, 12 kbd, $80M operating cost |

| 2Q: Strathcona refinery, 5 kbd, $15M operating cost |

| 3Q: Strathcona refinery, 2 kbd, $10M operating cost |

Upstream production is Imperial share before royalties

| | | | | | | | |

For further information: |

| | |

Investor relations | | Media relations |

| (587) 962-4401 | | (587) 476-7010 |

| | |

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

Forward-looking statements

Statements of future events or conditions in this report, including projections, targets, expectations, estimates, and business plans are forward-looking statements. Forward-looking statements can be identified by words such as believe, anticipate, intend, propose, plan, goal, seek, project, predict, target, estimate, expect, strategy, outlook, forecast, schedule, future, continue, likely, may, should, will and similar references to future periods. Forward-looking statements in this report include, but are not limited to, references to Imperial’s corporate strategy remaining focused on maximizing existing assets, select growth initiatives, reducing company emissions and supplying energy in an environmentally responsible manner including through deployment of large-scale solutions such as carbon capture and storage and investing in other emissions abatement opportunities, and delivering returns to shareholders; anticipated capital and exploration expenditures of $1.7 billion for 2024; the company’s ability to generate free cash flow and deliver on commitments to shareholders, and focus on cost efficiencies; the accelerated ramp-up of and production from Cold Lake Grand Rapids Phase 1, its expected delivery of 15,000 gross barrels per day at full production, and its expected reduction of greenhouse gas emissions intensity by up to 40% compared to current steam technology; investments at Cold Lake in respect of the Leming field, high-value drilling opportunities and volume enhancement, and at Kearl in respect of the in-pit tailings project; construction and expected production in respect of the Strathcona Renewable Diesel project; total Upstream and asset production guidance for 2024, including profitable growth at Kearl and Kearl delivering 280,000 gross barrels per day; Downstream throughput and utilization guidance; improvements to the company’s downstream business, including through efficient product transportation, refinery slate flexibility and further development of its lower-carbon product offering; and the cost, scope and impact of 2024 planned turnarounds.

Forward-looking statements are based on the company's current expectations, estimates, projections and assumptions at the time the statements are made. Actual future financial and operating results, including expectations and assumptions concerning demand growth and energy source, supply and mix; commodity prices, foreign exchange rates and general market conditions; production rates, growth and mix across various assets; project plans, timing, costs, technical evaluations and capacities and the company’s ability to effectively execute on these plans and operate its assets, including Kearl’s in-pit tailings project, Cold Lake Grand Rapids and solvent technologies projects, and the Strathcona Renewable Diesel project, and any changes in the scope, terms, or costs of such projects; factors influencing construction in respect of the Strathcona Renewable Diesel project; the adoption and impact of new facilities or technologies such as the deployment of new solvent technologies at Cold Lake; receipt of regulatory approvals; maintenance and turnaround activity and cost; cash generation, financing sources and capital structure; capital and environmental expenditures; refinery utilization; and applicable laws and government policies could differ materially depending on a number of factors. These factors include global, regional or local changes in supply and demand for oil, natural gas, and petroleum and petrochemical products and resulting price, differential and margin impacts, including foreign government action with respect to supply levels and prices; environmental regulation, including climate change and greenhouse gas regulation and changes to such regulation; project management and schedules and timely completion of projects; availability and performance of third-party service providers; unanticipated technical or operational difficulties; operational hazards and risks; third-party opposition to company and service provider operations, projects and infrastructure; the results of research programs and new technologies, and ability to bring new technologies to commercial scale on a cost-competitive basis; lack of required support from governments and policymakers

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

for adoption of new technologies for emissions reductions; environmental risks inherent in oil and gas exploration and production activities; the receipt, in a timely manner, of regulatory and third-party approvals; transportation for accessing markets; political or regulatory events, including changes in law or government policy; management effectiveness and disaster response preparedness; cybersecurity incidents; availability and allocation of capital; currency exchange rates; general economic conditions; and other factors discussed in Item 1A risk factors and Item 7 management’s discussion and analysis of Imperial Oil Limited’s most recent annual report on Form 10-K and subsequent interim reports on Form 10-Q.

Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial. Imperial’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them. Imperial undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law.

In this release all dollar amounts are expressed in Canadian dollars unless otherwise stated. This release should be read in conjunction with Imperial’s most recent Form 10-K.

The term “project” as used in this release can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

Capital and exploration expenditures

Capital and exploration expenditures (or capital expenditures) represent the combined total of additions at cost to property, plant and equipment, additions to finance leases, additional investments and acquisitions; exploration expenses on a before-tax basis from the Consolidated statement of income; and the company’s share of similar costs for equity companies. Capital and exploration expenditures exclude the purchase of carbon emission credits.

Operating costs

Operating costs is a non-GAAP financial measure that are the costs during the period to produce, manufacture, and otherwise prepare the company’s products for sale – including energy costs, staffing and maintenance costs. It excludes the cost of raw materials, taxes and interest expense and are on a before-tax basis. The most directly comparable financial measure that is disclosed in the financial statements is total expenses within the company’s Consolidated statement of income. While the company is responsible for all revenue and expense elements of net income, operating costs represent the expenses most directly under the company’s control and therefore, are useful in evaluating the company’s performance. Reconciliation of historical annual operating costs is incorporated by reference and can be found in the company’s most recent annual report on Form 10-K under the heading “Frequently Used Terms”, available on EDGAR at www.sec.gov, SEDAR+ at www.sedarplus.ca, and the company’s website at www.imperialoil.ca.

After more than a century, Imperial continues to be an industry leader in applying technology and innovation to responsibly develop Canada’s energy resources. As Canada’s largest petroleum refiner, a major producer of crude oil, a key petrochemical producer and a leading fuels marketer from coast to coast, our company remains committed to high standards across all areas of our business.

imperialoil.ca ∙ youtube.com/ImperialOil ∙ twitter.com/ImperialOil ∙ linkedin.com/company/Imperial-Oil ∙ facebook.com/ImperialOilLimited

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

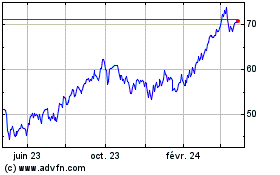

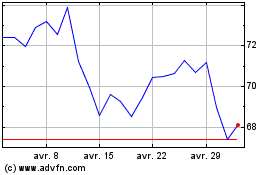

Imperial Oil (AMEX:IMO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Imperial Oil (AMEX:IMO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024