false

0001174940

0001174940

2024-12-11

2024-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934.

Date

of Report: December 11, 2024

(Date

of earliest event reported)

Oragenics,

Inc.

(Exact

name of registrant as specified in its charter)

| FL |

|

001-32188 |

|

59-3410522 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

Number) |

1990

Main Street

Suite

750

Sarasota,

|

|

34236 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

813-286-7900

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

OGEN |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

5.02 |

DEPARTURE

OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS. |

(b)

and (c) Termination of Interim Principal Executive Officer and President; Appointment of New Interim Principal Executive Officer and

President

As

previously disclosed, the Company has elected not to renew J. Michael Redmond’s Employment Agreement dated December 28, 2023. Effective

December 16, 2024, the Company terminated the employment of J. Michael Redmond, the Company’s Interim Principal Executive Officer

and President, and appointed the Company’s Chief Financial Officer, Janet Huffman, to serve as the Company’s new Interim

Principal Executive Officer and President until such time as the Company retains a new Chief Executive Officer and President. Ms. Huffman

has served as the Company’s Chief Financial Officer since March 6, 2023.

(e)

Compensatory Arrangements of Certain Officers.

As

reported below under Item 5.07 of this Current Report, Oragenics, Inc. (the “Company”) held its annual meeting of

shareholders on December 11, 2024 (the “Annual Meeting”), at which meeting the Company’s shareholders approved

an amendment (the “Plan Amendment”) to the Company’s 2021 Plan (the “2021 Plan”) to increase

the aggregate number of shares available for the grant of awards by 2,000,000 shares to a total of 3,166,667 shares. The foregoing description

of the Plan Amendment does not purport to be complete and is qualified in its entirety by reference to the complete text of the 2021

Plan and Plan Amendment, copies of which are filed as Exhibit 4.1 and 4.3, respectively to this Current Report and are incorporated by

reference herein.

| Item

5.07 | SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

(a)

The Annual Meeting was held on December 11, 2024.

(b)

At the Annual Meeting the following proposals were voted on by our shareholders:

PROPOSAL

I: Election of Directors.

Mr.

Charles Pope, Dr. Frederick Telling, Mr. Robert Koski, Dr. Alan Dunton, Mr. John Gandolfo and Mr. Bruce Cassidy were each re-elected

as Directors, to serve until our next annual meeting of shareholders or until their respective successors are elected and qualified or

until their earlier resignation, removal from office or death. The votes were as follows:

| |

|

For |

|

Withheld |

|

Broker

Non-Votes |

| Charles

Pope |

|

2,204,841 |

|

177,780 |

|

2,183,106 |

| Dr.

Frederick Telling |

|

2,143,305 |

|

237,028 |

|

2,183,106 |

| Dr.

Alan Dunton |

|

2,202,081 |

|

180,540 |

|

2,183,106 |

| Robert

Koski |

|

2,197,291 |

|

185,330 |

|

2,183,106 |

| John

Gandolfo |

|

2,209,360 |

|

173,261 |

|

2,183,106 |

| Bruce

Cassidy |

|

2,083,887 |

|

296,446 |

|

2,183,106 |

PROPOSAL

II: To conduct a non-binding advisory vote on executive compensation. The votes were as follows:

| FOR |

|

1,931,906 |

| AGAINST |

|

365,871 |

| ABSTAIN |

|

84,844 |

| BROKER

NON-VOTES |

|

2,183,106 |

PROPOSAL

III: To approve an amendment to the Company’s 2021 Equity Incentive Plan to increase the number of common shares available

for issuance under the 2021 Equity Incentive Plan from 1,166,667 shares of Common Stock to 3,166,667 shares of Common Stock. The votes

were as follows:

| FOR |

|

1,470,156 |

| AGAINST |

|

861,173 |

| ABSTAIN |

|

51,292 |

| BROKER

NON-VOTES |

|

2,183,106 |

PROPOSAL

IV: Ratification of the selection of Cherry Bekaert LLP as the Company’s independent auditors for the year ending December

31, 2024. The votes were as follows:

| FOR |

|

4,254,641 |

| AGAINST |

|

269,101 |

| ABSTAIN |

|

41,985 |

| ITEM

8.01. |

OTHER

INFORMATION. |

On

December 16, 2024, Oragenics, Inc. (the “Company”) issued a press release announcing the conversion of its Series A Preferred

Stock and Series B Preferred Stock into Common Stock. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated

by reference herein.

| Item

9.01. |

FINANCIAL

STATEMENTS AND EXHIBITS. |

(d)

Exhibits

SIGNATURES

In

accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized on this 16th day of December, 2024.

| |

ORAGENICS,

INC.

(Registrant)

|

| |

|

|

| |

BY: |

/s/Janet

Huffman |

| |

|

Janet

Huffman

Chief

Financial Officer |

Exhibit

4.3

SECOND

AMENDMENT TO

ORAGENICS,

INC.

2021

EQUITY INCENTIVE PLAN

This

Second Amendment to the 2021 Equity Incentive Plan (the “Second Amendment”) is made pursuant to Section 13 of the

2021 Incentive Plan (the “2021 Plan”).

Recitals:

WHEREAS,

the 2021 Plan was adopted by the Company and approved by the shareholders on February 25, 2022; and

WHEREAS,

10,000,000 shares were originally authorized to be issued under the 2021 Incentive Plan;

WHEREAS,

the Company effected a 1-for-60 reverse split of the Company’s authorized shares of common stock and issued and outstanding shares

of common stock, including shares under the 2021 Plan, with an effective date of January 20, 2023 (the “Reverse Stock Split”);

WHEREAS,

after the Reverse Stock Split, the shares available for issuance under the 2021 Plan was 166,667 shares of common stock;

WHEREAS,

on December 14, 2023, the Company’s shareholders approved an amendment (the “First Amendment”) to increase the

shares available under the 2021 Plan by 1,000,000 shares; and

WHEREAS,

the Board of Directors believes it would be in the best interest of the Company and its shareholders to increase the authorized shares

available under the 2021 Plan by an additional 2,000,000 shares.

NOW

THEREFORE, Section 2(a) titled “Share reserve” is hereby amended and restated as follows:

| (a) | Share

Reserve. Subject to adjustment in accordance with Section 2(d) and any adjustments as

necessary to implement any Capitalization Adjustments, the aggregate number of shares of

Common Stock that may be issued pursuant to Awards will not exceed the sum of (i) 3,166,667

new shares, plus (ii) the Prior Plan’s Available Reserve; plus, (iii) the number of

Returning Shares, if any, as such shares become available from time to time. |

All

other terms and conditions of the 2021 Plan not otherwise modified hereby shall remain in full force and effect. The Second Amendment

was approved by the Board of Directors on October 8, 2024 and approved by the Company’s shareholders on December 11, 2024.

Exhibit 99.1

Oragenics,

Inc. Announces Conversion of Preferred Shares and Elimination of Liquidation Preference

Sarasota,

FL – December 16, 2024 – Oragenics, Inc. (NYSE: OGEN), a biotechnology company advancing innovative treatments for brain-related

health conditions, today announced the conversion of its remaining outstanding convertible Series A and Series B Preferred Shares into

common stock. The conversion helps simplify the company’s capital structure and eliminates approximately $2.35 million in liquidation

preference, effectively removing a significant overhang on the company’s stock.

Holders

of the Company’s remaining 5,417,000 Series A Preferred Shares and 4,050,000 Series B Preferred Shares exercised their right to

convert their shares into a total of approximately 22,000 common shares. The Series A and B Preferred Shares, which carried no voting

rights, have now been fully retired.

“This

conversion is a pivotal step for Oragenics as we simplify our financial structure and strengthen our foundation for future growth,”

said Janet Huffman, Chief Financial Officer of Oragenics. “Eliminating the liquidation preference removes a significant overhang

on our stock, aligning with our commitment to creating long-term value for shareholders and positioning us to focus on advancing our

innovative pipeline of treatments for neurological and rare diseases.”

About

Oragenics:

Oragenics

is a development-stage biotechnology company focused on nasal delivery of pharmaceutical medications in neurology and fighting infectious

diseases, including drug candidates for treating mild traumatic brain injury (mTBI), also known as concussion, and for treating Niemann

Pick Disease Type C (NPC), as well as proprietary powder formulation and an intranasal delivery device. For more information, please

visit www.oragenics.com.

Forward-Looking

Statements

This

communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s beliefs and assumptions and

information currently available. The words “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “project” and similar expressions that do not relate solely to historical matters identify forward-looking

statements. Investors should be cautious in relying on forward-looking statements because they are subject to a variety of risks, uncertainties,

and other factors that could cause actual results to differ materially from those expressed in any such forward-looking statements. These

factors include, but are not limited to, those described in our Form 10-K and other filings with the U.S. Securities and Exchange Commission.

All information set forth in this press release is as of the date hereof. You should consider these factors in evaluating the forward-looking

statements included in this press release and not place undue reliance on such statements. We do not assume any obligation to publicly

provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise,

should circumstances change, except as otherwise required by law.

Investor

Contact

Rich

Cockrell

Investor

Relations

404.736.3838

OGEN@CG.CAPITAL

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

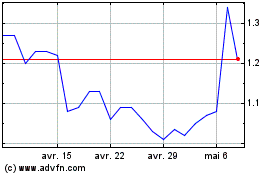

Oragenics (AMEX:OGEN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Oragenics (AMEX:OGEN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024