Why You Don't Need Both the Palladium and Platinum ETFs - ETF News And Commentary

29 Novembre 2012 - 11:11AM

Zacks

Precious metal investing has become increasingly popular as of

late, as more investors grow worried over the long term impact of

the Fed’s policies on the strength of the dollar. This fear has

pushed many into the hedges of the four metals of gold, silver,

platinum, and palladium as a result.

While gold, and to a lesser extent silver, have always been

popular with investors, palladium and platinum have really begun to

shine as possible investments thanks to the development of the

exchange traded fund industry. These physically backed ETFs,

PALL for palladium and PPLT for

platinum, both come to us from ETF Securities and were the first

exchange-traded way for investors to establish a position in the

physical metal in the U.S.

Both have seen decent interest from investors as the two metals

have very different drivers than what we see in the gold and silver

markets. Gold is almost entirely dependent on investment demand,

while silver has more of a split between investing and industrial

uses. Meanwhile, platinum and palladium are, at least at this time,

used primarily in industry, making them far more correlated to

economic growth than silver and especially gold (see Zacks #1

Ranked Precious Metal ETF: PALL).

It should also be noted that both are driven by car demand and

catalytic converters in particular. This usage comprises the bulk

of platinum and palladium demand while jewelry and then other

industrial uses account for much of the rest. In fact, in

both cases, investment demand makes up less than 10% of the total

usage, suggesting an extremely high correlation with economic

activity for both of the metals.

Given this reality, investors shouldn’t be surprised to note

that the charts for PPLT and PALL are quite similar, as they are

both driven by the same things. Over the past two years, the two

metals have put up nearly identical performances with both losing

about 3.2% in the time frame in question.

That doesn’t mean that the two always move in lockstep though,

as shorter time periods have shown significant outperformance for

one metal when compared to the other. In the YTD period, for

example, PPLT is up about 12.3% while PALL is just barely above

break-even, while in a one-year look, PALL has outperformed

platinum by about 1,000 basis points (read Protect Against QE with

these Precious Metal ETFs).

Clearly, the metals don’t always move in a perfect one-to-one

correlation with each other but they do often revert back to

similar performance levels over longer-time periods. The only

difference seems to be that palladium is far more volatile and

prone to bigger swings than its platinum counterpart, suggesting

that those with a lower risk tolerance should consider PPLT over

PALL.

So while both metals offer up great exposure to their respective

metal, it is questionable if investors really need both in their

portfolio. PALL and PPLT both are influenced by the same

macroeconomic factors, and for long-term investors, they seem

likely to move in similar patterns (see Precious Metal ETFs: Beyond

Gold).

While it is never advisable to base decisions off of past

events, both PALL and PPLT look to have the same drivers going

forward, so it is doubtful that their relationship will not hold in

the near future as well. For this reason, if investors are bent on

obtaining some precious metal exposure in their portfolio beyond

gold and silver, platinum and palladium could make for interesting

choices, but obtaining both is probably overkill for most.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

ETFS-PALLADIUM (PALL): ETF Research Reports

ETFS-PLATINUM (PPLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

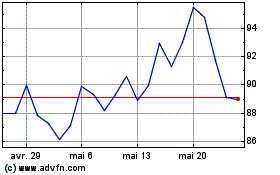

Abrdn Palladium ETF (AMEX:PALL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Abrdn Palladium ETF (AMEX:PALL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024