Palladium ETFs to Rally in 2013? - ETF News And Commentary

11 Janvier 2013 - 1:31PM

Zacks

Palladium is one of the most popular niche commodities and can

be considered an extremely lucrative investment avenue. In 2012,

the metal experienced a huge fall in its price attributable to weak

demand in the auto industry and sluggish jewelry demand (Platinum

ETF Investing 101).

But heading into 2013, the price of the metal is expected to

appreciate. The reason is that the metal is going through a supply

deficit attributable to the labor dispute in South Africa and

production cuts made in the country due to higher labor and other

factors which make their palladium mines unprofitable.

On the other hand, stockpiles from the biggest producer of the

metal, Russia, are diminishing leading to a further deficit of the

metal. Palladium production outages may result in highest supply

deficit since 2000 (Why you don’t need both palladium and platinum

ETFs).

Conversely, with a rebound in the auto industry, the demand for

the metal remains steady. Palladium is used in auto catalytic

agents, which scrub emissions from automobiles.

A major portion of the production of palladium is utilized in

such catalytic converter fabrication, which is a key input in

automobile manufacturing. Increase in vehicle demand has therefore

stimulated palladium demand significantly (Precious Metal ETFs:

Beyond Gold).

Palladium use by the automotive industry has consequently gained

from higher demand for vehicles in the U.S. and the emerging world.

Also consumption of palladium in cell phones and computers and

jewelry should further provide a boost to the demand for the

metal.

With demand for palladium rising in the auto industry and supply

at an all-time low, price of the metal may be primed to shoot up

going forward. Amid expectation of higher price for the

metal, this could be the right time to invest in the metal and

investing through ETFs makes it even more lucrative thanks to low

bid ask spreads and minimal expense ratios (Top Three Precious

Metal Mining ETFs).

With the auto industry expected to remain robust globally going

further and demand for the metal and consequently its price on the

rise, investors may be able to take advantage. For those who are

willing to go long in palladium, the following ETF option is

available:

ETF Securities Physical Palladium Shares

(PALL)

For a bullion-backed approach to palladium ETF investing,

investors can look to ETFs Physical Palladium Shares or PALL. PALL

is the ETF which is backed by physical metal and holds the metal in

the form of bullion, or ingots. The metal is securely stored in

London and Zürich on behalf of the custodian, JP Morgan Chase

Bank.

Investing through PALL in palladium represents a cost-effective

and suitable mode for investors. The transaction costs for buying

and selling the shares will be much lower than purchasing, storing

and insuring physical palladium for most investors (Has The Junior

Gold Mining ETF Lost Its Luster?).

This ETF is designed to track the spot price of Palladium

bullion. PALL is the most liquid option available in palladium ETF

space, trading with volumes of 56,200 shares a day and it has $500

million in assets under management.

The expense ratio of 60 basis points also appears to be at par

with other ETFs in the precious metals space, although it is

obviously higher than what we see in the much more popular gold

market. Still, we give the product a Zacks ETF Rank of 2 or ‘Buy’

meaning that we are rather bullish on the metal overall in

2013.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ETFS-PALLADIUM (PALL): ETF Research Reports

ETFS-PLATINUM (PPLT): ETF Research Reports

ETFS-WHITE METL (WITE): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

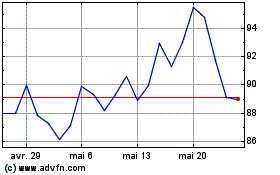

Abrdn Palladium ETF (AMEX:PALL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Abrdn Palladium ETF (AMEX:PALL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024