Current Report Filing (8-k)

03 Mars 2023 - 11:27PM

Edgar (US Regulatory)

0001682220

false

0001682220

2023-02-28

2023-02-28

0001682220

us-gaap:CommonStockMember

2023-02-28

2023-02-28

0001682220

sach:Notes7.125PercentDue2024Member

2023-02-28

2023-02-28

0001682220

sach:Notes6.875PercentDue2024Member

2023-02-28

2023-02-28

0001682220

sach:Notes7.75percentDue2025Member

2023-02-28

2023-02-28

0001682220

sach:Notes6.00percentDue2026Member

2023-02-28

2023-02-28

0001682220

sach:Notes6.00percentDue2027Member

2023-02-28

2023-02-28

0001682220

sach:Notes7.125PercentDue2027Member

2023-02-28

2023-02-28

0001682220

sach:Notes8.00percentDue2027Member

2023-02-28

2023-02-28

0001682220

us-gaap:SeriesAPreferredStockMember

2023-02-28

2023-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 28, 2023

SACHEM

CAPITAL CORP.

(Exact name of Registrant as specified in its

charter)

| New

York |

|

001-37997 |

|

81-3467779 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 698

Main Street, Branford,

Connecticut |

|

06405 |

| (Address

of Principal Executive Office) |

|

(Zip

Code) |

Registrant's

telephone number, including area code (203)

433-4736

| (Former

Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Ticker

symbol(s) |

Name

of each exchange on which registered |

| Common

Shares, par value $.001 per share |

SACH |

NYSE American LLC |

| 7.125%

Notes due 2024 |

SCCB |

NYSE American LLC |

| 6.875%

Notes due 2024 |

SACC |

NYSE American LLC |

| 7.75%

notes due 2025 |

SCCC |

NYSE American LLC |

| 6.00%

notes due 2026 |

SCCD |

NYSE American LLC |

| 6.00%

notes due 2027 |

SCCE |

NYSE American LLC |

| 7.125%

notes due 2027 |

SCCF |

NYSE American LLC |

| 8.00%

notes due 2027 |

SCCG |

NYSE American LLC |

| 7.75%

Series A Cumulative Redeemable Preferred Stock, Liquidation Preference $25.00 per share |

SACHPRA |

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company

x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On March 2, 2023, Sachem Capital Corp. (the “Company”)

entered into Credit and Security Agreement (the “Credit Agreement”), with Needham Bank, a Massachusetts co-operative

bank, as the administrative agent (the “Administrative Agent”) for the lenders party thereto (the “Lenders”)

with respect to a $45 million revolving credit facility (the “Credit Facility”). Under the Credit Agreement, the Company

also has the right to request an increase in the size of the Credit Facility up to $75 million, subject to certain conditions, including

the approval of the Lenders. Loans under the Credit Facility accrue interest at the greater of (i) the annual rate of interest equal to

the “prime rate,” as published in the “Money Rates” column of The Wall Street Journal minus one-quarter

of one percent (0.25%), and (ii) four and one-half percent (4.50%). All amounts borrowed under the Credit Facility are secured by a first

priority lien on virtually all Company’s assets. Assets excluded from the lien include real estate owned by the Company (other than

real estate acquired pursuant to foreclosure) and mortgages sold under the Company’s Master Repurchase Agreement with Churchill

MRA Funding I LLC, entered into in July 2021. The Credit Facility expires March 2, 2026 but the Company has a right to extend the term

for one year upon the consent of the Administrative Agent and the Lenders, which consent cannot be unreasonably withheld, and so long

as it is not in default and satisfies certain other conditions. All outstanding revolving loans and accrued but unpaid interest are due

and payable on the expiration date. The Company may terminate the Credit Facility at any time without premium or penalty by delivering

written notice to the Administrative Agent at least ten (10) days prior to the proposed date of termination.

The foregoing descriptions of the Credit Agreement

and the terms of the Credit Facility do not purport to be complete and are qualified in their entirety by reference to the full text of

such documents, including the exhibits thereto, copies of which are attached to this Current Report on Form 8-K as Exhibits 10.1 and 4.1,

respectively, and incorporated herein by reference.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information regarding the Credit Facility and

the Credit Agreement set forth in Item 1.01 above, is incorporated herein by reference.

On February 28, 2023, the Company refinanced its

then existing $1.4 million adjustable-rate mortgage loan, obtained in November 2021 from New Haven Bank with a new $1.66 million adjustable-rate

mortgage loan from New Haven Bank. The new loan accrues interest at an initial rate of 5.75% per annum for the first 60 months. The interest

rate will be adjusted on each of March 1, 2028 and March 1, 2033 to the then published 5-year Federal Home Loan Bank of Boston Classic

Advance Rate, plus 1.75%. Beginning on April 1, 2023 and through March 1, 2038, principal and interest will be due and payable on a monthly

basis. All payments under the new loan are amortized based on a 20-year amortization schedule. The unpaid principal amount of the loan

and all accrued and unpaid interest are due and payable in full on March 1, 2038. The new loan is a non-recourse obligation, secured primarily

by a first mortgage lien on the properties located 698 Main Street, Branford, Connecticut and 568 East Main Street, Branford, Connecticut,

which are owned by the Company.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

No. |

Description |

| 4.1 |

Revolving Credit Note, dated March 2, 2023,in the principal amount of $45 million in favor of Needham Bank, as lender. |

| |

|

| 10.1 |

Credit and Security Agreement, dated as of March 2, 2023, among the Company, the lenders party thereto and Needham Bank, as administrative agent. |

| |

|

| 99.1 |

Open-End Mortgage, Security Agreement and Assignment of Leases and Rents, dated February 28, 2023, by Sachem Capital Corp. |

| |

|

| 99.2 |

Commercial Term Note made by Sachem Capital Corp to New Haven Bank, dated February 28, 2023, in the principal amount of $1,660,000 (attached as Exhibit B to Exhibit 99.1 above). |

| |

|

| 99.3 |

Loan Agreement between Sachem Capital Corp. and New Haven Bank, dated as of February 28, 2023. |

| |

|

| 99.4 |

Mortgage Release releasing Sachem Capital Corp. from the $1.4 million mortgage loan. |

| |

|

| 99.5 |

Press Release dated March 2, 2023. |

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* * * * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Sachem Capital Corp. |

| |

|

| Dated: March 3, 2023 |

By: |

/s/ John L. Villano |

| |

|

John L. Villano, CPA |

| |

|

Chief Executive Officer |

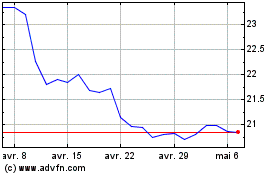

Sachem Capital (AMEX:SACH-A)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Sachem Capital (AMEX:SACH-A)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025