As filed with the Securities and Exchange Commission

on November 22, 2023.

Registration No. 333–273881

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3/A

(Pre-Effective Amendment No. 2)

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

INTERNATIONAL TOWER HILL MINES LTD.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada |

98-0668474 |

(State or other jurisdiction of incorporation or

organization) |

(I.R.S. Employer Identification No.) |

2710-200 Granville Street,

Vancouver, British Columbia, Canada V6C 1S4

(604) 683-6332

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Karl L. Hanneman

Chief Executive Officer

506 Gaffney Road, Suite 200

Fairbanks, Alaska 99701

(907) 328-2800

(Name, address, including zip

code, and telephone number, including area code, of agent for service)

Copy to:

|

David R. Crandall

Brandon Kinnard

Hogan Lovells US LLP

1601 Wewatta Street, Suite 900

Denver, Colorado 80202

(303) 899-7300 |

Robin Mahood

McCarthy Tétrault LLP

745 Thurlow Street, Suite 2400

Vancouver, British Columbia, Canada V6E 0C5

(604) 643-7100 |

APPROXIMATE DATE

OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement as determined

by market and other conditions.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities

offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

| Non-accelerated filer |

|

x |

|

Smaller reporting company |

|

x |

| |

|

|

|

Emerging growth company |

|

¨ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may

determine.

The information in this prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

NOVEMBER 22, 2023

PROSPECTUS

$100,000,000

Common Shares

Debt Securities

Warrants

Rights

Subscription Receipts

Units

International Tower Hill Mines

Ltd. (the “Company,” “we,” “us,” or “our”) may offer and sell from time to time, in one

or more offerings, in amounts, at prices and on terms determined at the time of any such offering, up to an aggregate initial offering

price of $100,000,000 of any combination of the securities described in this prospectus (the foregoing, the “Securities”),

either individually or in units. We may also offer common shares of the Company, no par value (the “Common Shares”), upon

conversion of debt securities, upon the exercise of warrants or upon the exchange of subscription receipts.

We may sell the Securities

directly to you, through agents we select, or through underwriters and dealers we select, on a continuous or delayed basis. If we use

agents, underwriters or dealers to sell the Securities, we will name them and describe their compensation in a prospectus supplement.

The price to the public of such Securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus

supplement.

This prospectus describes

some of the general terms that may apply to the Securities and the general manner in which they may be offered. Each time we sell Securities

we will provide a prospectus supplement that will contain specific information about the terms of the Securities we are offering and the

specific manner in which we will offer the Securities. The prospectus supplement may add to, update or change the information in this

prospectus. You should read this prospectus and any prospectus supplement carefully before you invest in our Securities. This prospectus

may not be used to sell Securities unless accompanied by a prospectus supplement.

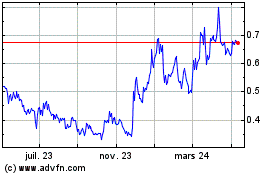

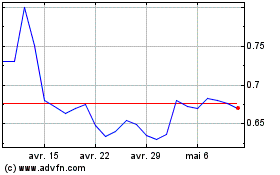

Our Common Shares are

traded on the Toronto Stock Exchange (“TSX”) under the symbol “ITH” and on the NYSE American (“NYSE American”)

under the symbol “THM.” On November 21, 2023, the last reported sale price of the Common Shares on the NYSE American was

$0.35 per Common Share and on the TSX was C$0.46 per Common Share.

Investing in our Securities

involves a high degree of risk. You should read “Risk Factors” beginning on page 1 of this prospectus and the reports we

file with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, incorporated by reference

in this prospectus, to read about factors to consider before purchasing our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2023.

TABLE OF CONTENTS

We have not authorized

anyone to provide you with information different from that contained or incorporated by reference in this prospectus or any accompanying

prospectus supplement or free writing prospectus, and we take no responsibility for any other information that others may give you. This

prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or

sale is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing

prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in

any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless

of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects

may have changed since those dates.

As permitted by the rules

and regulations of the United States Securities and Exchange Commission (the “SEC”), the registration statement of which this

prospectus forms a part includes additional information not contained in this prospectus. You may read the registration statement and

the other reports we file with the SEC at the SEC’s website described below under the heading “Where You Can Find More Information.”

Before investing in the Securities, you should read this prospectus and any accompanying prospectus supplement or free writing prospectus,

as well as the additional information described under “Where You Can Find More Information” and “Information Incorporated

by Reference.”

In this prospectus and in

any prospectus supplement, unless the context otherwise requires, references to “International Tower Hill Mines Ltd.,” “ITH,”

the “Company,” “we,” “us” and “our” refer to International Tower Hill Mines Ltd., either

alone or together with our subsidiaries as the context requires. When we refer to “shares” throughout this prospectus, we

include all rights attaching to our Common Shares under any shareholder rights plan then in effect.

References in this prospectus

to “$” are to United States dollars. Canadian dollars are indicated by the symbol “C$”.

ABOUT THIS PROSPECTUS

This prospectus is a part

of a registration statement that the Company filed with the SEC utilizing a “shelf” registration process. Under this shelf

registration process, the Company may sell the Securities described in this prospectus in one or more offerings up to a total dollar amount

of initial aggregate offering price of $100,000,000. This prospectus provides you with a general description of the Securities that we

may offer. The specific terms of the Securities in respect of which this prospectus is being delivered will be set forth in a prospectus

supplement and may include, where applicable, the number of Securities offered, the offering price and any other specific terms of the

offering. A prospectus supplement may include specific variable terms pertaining to the Securities that are not within the alternatives

and parameters set forth in this prospectus.

A prospectus supplement or

free writing prospectus may include a discussion of risks or other special considerations applicable to the Company or the Securities.

A prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus. If there is

any inconsistency between the information in this prospectus and any related prospectus supplement or free writing prospectus, you must

rely on the information in the prospectus supplement or free writing prospectus. Please carefully read both this prospectus and the related

prospectus supplement or free writing prospectus in their entirety together with additional information described under the heading “Where

You Can Find More Information” in this prospectus. This prospectus may not be used to offer or sell any Securities unless accompanied

by a prospectus supplement or free writing prospectus.

Owning securities may subject

you to tax consequences both in Canada and the United States. This prospectus or any applicable prospectus supplement may not describe

these tax consequences fully. You should read the tax discussion in any prospectus supplement with respect to a particular offering and

consult your own tax advisor with respect to your own particular circumstances.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus forms part

of a registration statement on Form S-3 filed by us with the SEC under the Securities Act. As permitted by the SEC, this prospectus does

not contain all the information set forth in the registration statement filed with the SEC. For a more complete understanding of this

offering, you should refer to the complete registration statement, including the exhibits thereto, on Form S-3 that may be obtained as

described below. Statements contained or incorporated by reference in this prospectus or any prospectus supplement about the contents

of any contract or other document are not necessarily complete. If we have filed any contract or other document as an exhibit to the registration

statement or any other document incorporated by reference in the registration statement of which this prospectus forms a part, you should

read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract or other document

is qualified in its entirety by reference to the actual document.

We file annual, quarterly

and special reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from commercial

retrieval services and at the website maintained by the SEC at www.sec.gov. The reports and other information filed by us with

the SEC are also available at our website. The address of the Company’s website is www.ithmines.com. Information contained

on our website or that can be accessed through our website is not incorporated by reference into this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to incorporate

information into this prospectus “by reference,” which means that we can disclose important information to you by referring

you to another document that we file separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus,

except for any information superseded by information contained directly in this prospectus. These documents contain important information

about the Company and its financial condition, business and results.

We are incorporating by

reference the Company’s filings listed below and any additional documents that we may file with the SEC pursuant to Section

13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) on or after the date

hereof and prior to the termination of any offering, including all such documents we may file with the SEC after the date of the

initial registration statement of which this prospectus forms a part and prior to the effectiveness of the registration statement,

except we are not incorporating by reference any information furnished (but not filed) under Item 2.02 or Item 7.01 of any Current

Report on Form 8-K and corresponding information furnished under Item 9.01 as an exhibit thereto:

| · | our

Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023

and September 30, 2023, filed with the SEC on May

5, 2023, August

7, 2023 and November

8, 2023, respectively; |

| · | our Current Reports on Form 8-K as filed with the SEC on May

25, 2023 and June

22, 2023, to the extent “filed” and not “furnished” pursuant to Section 13(a) of the Exchange Act;

and |

We will provide, without charge,

to each person, including any beneficial owner, to whom a copy of this prospectus has been delivered a copy of any and all of the documents

referred to herein that are summarized in this prospectus, if such person makes a written or oral request directed to:

International Tower Hill Mines Ltd.

Attention: Corporate Secretary

2710-200 Granville Street,

Vancouver, British Columbia, Canada V6C 1S4

(604) 683-6332

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, any accompanying

prospectus supplement or free writing prospectus, and the documents we have incorporated by reference contain forward-looking statements

within the meaning of the federal securities laws that involve risks and uncertainties that could cause actual results to differ materially

from projections or estimates contained herein. Forward-looking statements convey our current expectations or forecasts of future events.

We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995.

Forward-looking statements

are generally identifiable by use of the words “estimate,” “project,” “believe,” “intend,”

“plan,” “anticipate,” “expect” and similar expressions. Such forward-looking statements may include,

but are not limited to, statements concerning:

| · | the Company’s future cash requirements, the Company’s ability to meet its financial obligations

as they come due, and the Company’s ability to raise the necessary funds to continue operations on acceptable terms, if at all; |

| · | the Company’s ability to carry forward and incorporate into future engineering studies of the Livengood

Gold Project updated mine design, production schedule and recovery concepts identified during the optimization process; |

| · | the Company's potential to carry out an engineering phase that will evaluate and optimize the Livengood

Gold Project’s configuration and capital and operating expenses, including determining the optimum scale for the Livengood Gold

Project; |

| · | the Company’s strategies and objectives, both generally and specifically in respect of the Livengood

Gold Project; |

| · | the Company’s belief that there are no known environmental issues that are anticipated to materially

impact the Company’s ability to conduct mining operations at the Livengood Gold Project; |

| · | the potential for the expansion of the estimated mineral resources at the Livengood Gold Project; |

| · | the potential for a production decision concerning, and any production at, the Livengood Gold Project; |

| · | the sequence of decisions regarding the timing and costs of development programs with respect to, and

the issuance of the necessary permits and authorizations required for, the Livengood Gold Project; |

| · | the Company’s estimates of the quality and quantity of the mineral resources at the Livengood Gold

Project; |

| · | the timing and cost of any future exploration programs at the Livengood Gold Project, and the timing of

the receipt of results therefrom; |

| · | the expected levels of overhead expenses at the Livengood Gold Project; and |

| · | future general business and economic conditions, including changes in the price of gold and the overall

sentiment of the markets for public equity. |

Such

forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain known and

unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different

from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among

others:

| · | the demand for, and level and volatility of the price of, gold; |

| · | conditions in the financial markets generally, the overall sentiment of the markets for public equity,

interest rates, currency rates, and the rate of inflation; |

| · | general business and economic conditions; |

| · | government regulation and proposed legislation (and changes thereto or interpretations thereof); |

| · | defects in title to claims, or the ability to obtain surface rights, either of which could affect the

Company’s property rights and claims; |

| · | the Company’s ability to secure the necessary services and supplies on favorable terms in connection

with its programs at the Livengood Gold Project and other activities; |

| · | the Company’s ability to attract and retain key staff, particularly in connection with the permitting

and development of any mine at the Livengood Gold Project; |

| · | the accuracy of the Company’s resource estimates (including with respect to size and grade) and

the geological, operational and price assumptions on which these are based; |

| · | the timing of the Company's ability to commence and complete planned work programs at the Livengood Gold

Project; |

| · | the timing of the receipt of and the terms of the consents, permits and authorizations necessary to carry

out exploration and development programs at the Livengood Gold Project and the Company’s ability to comply with such terms on a

safe and cost-effective basis; |

| · | the ongoing relations of the Company with the lessors of its property interests and applicable regulatory

agencies; |

| · | the metallurgy and recovery characteristics of samples from certain of the Company’s mineral properties

and whether such characteristics are reflective of the deposit as a whole; |

| · | the continued development of and potential construction of any mine at the Livengood Gold Project property

not requiring consents, approvals, authorizations or permits that are materially different from those identified by the Company; and |

| · | the risks set forth under the caption “Risk Factors” herein and in our most recent Annual

Report on Form 10-K and our other filings with the SEC. |

Should one or more of these

risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described

herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking

statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events

or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and

other factors, including without limitation those discussed in Part I, Item 1A, Risk Factors of our most recent Annual Report on Form

10-K, which are incorporated herein by reference, as well as other factors described elsewhere in this prospectus and the Company’s

other reports filed with the SEC.

The Company’s forward-looking

statements contained in this prospectus are based on the beliefs, expectations and opinions of management as of the date of this prospectus.

The Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations

or opinions should change, except as required by law. For the reasons set forth above, investors should not attribute undue certainty

to or place undue reliance on forward-looking statements discussed in or incorporated by reference in this prospectus or any accompanying

prospectus supplement or free writing prospectus.

RISK FACTORS

An investment in our Securities

involves a high degree of risk. In addition to all of the other information contained or incorporated by reference into this prospectus

and the accompanying prospectus supplement, you should carefully consider the risk factors incorporated by reference from our Annual Report

on Form 10-K for the year ended December 31, 2022, as updated by our subsequent filings under the Exchange Act, including Forms 10-Q and

8-K, and the risk factors contained or incorporated by reference into the accompanying prospectus supplement before acquiring any of the

Securities. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may

be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects

on our future results. If any of these risks actually occur, our business, financial condition or results of operations could be harmed.

This could cause the trading price of our Securities to decline, resulting in a loss of all or part of your investment. Please also read

carefully the section above titled “Cautionary Statement Regarding Forward-Looking Statements.”

ABOUT INTERNATIONAL TOWER HILL MINES LTD.

International Tower Hill

Mines Ltd. is a mineral exploration company engaged in the acquisition and development of mineral properties. The Company currently holds

or has the right to acquire interests in a development stage project in Alaska referred to as the “Livengood Gold Project”

or the “Project”. The Company has not yet begun extraction of mineralization from the deposit or reached commercial

production. The Company has a 100% interest in the Livengood Gold Project. As reported in the Technical Report Summary (the “TRS”)

attached as Exhibit 96.1 to our most recent Annual Report on Form 10-K, as of December 31, 2022, the Project has a measured and indicated

mineral resource, exclusive of mineral reserves, of 274.51 million tonnes at an average grade of 0.52 g/tonne (4.62 million ounces) based

on a gold price of $1,650 per ounce, and proven and probable reserves of 430.1 million tonnes at an average grade of 0.65 g/tonne (9.0

million ounces) based on a gold price of $1,680 per ounce. A more complete description of the Livengood Gold Project, including detailed

presentation of resources and reserves, and the current activities is set forth in Part I, Item 2, Properties and Part II, Item 7, Management’s

Discussion and Analysis of Financial Condition and Results of Operations of our most recent Annual Report on Form 10-K, which is incorporated

herein by reference.

Since early 2008, the Company’s

primary focus has been the exploration and advancement of the Livengood Gold Project and the majority of its resources have been directed

to that end. In August 2010, the Company undertook a corporate spin-out arrangement transaction whereby all of its mineral property interests

other than the Project were spun out as an independent and separate company. Since the completion of that transaction, the sole mineral

property held by the Company has been the Livengood Gold Project and the Company has focused exclusively on the ongoing exploration and

potential development of the Livengood Gold Project.

The head office and principal

executive address of ITH is located at 200 Granville Street, Suite 2710, Vancouver, British Columbia, Canada V6C 1S4, and its registered

and records office is located at 745 Thurlow Street, Suite 2400, Vancouver, British Columbia, Canada V6E 0C5, and our telephone number

is (604) 683-6332. Our website is located at www.ithmines.com. Information contained on our website or that can be accessed through

our website is not incorporated by reference into this prospectus.

For additional information

as to our business, properties and financial condition, please refer to the documents cited in “Where You Can Find More Information.”

USE OF PROCEEDS

Unless otherwise specified

in a prospectus supplement, the net proceeds from the sale of the Securities will be used for general corporate purposes and working capital.

Each prospectus supplement will contain specific information concerning the use of proceeds from that sale of the Securities.

We will bear all of the expenses

of the offering of the Securities, and such expenses will be paid out of our general funds, unless otherwise stated in the applicable

prospectus supplement.

DILUTION

We will set forth in a prospectus

supplement and/or free writing prospectus the following information, as required, regarding any dilution of the equity interests of investors

purchasing Securities in an offering under this prospectus:

| · | the net tangible book value per share of our equity securities before and after the offering; |

| · | the amount of the change in such net tangible book value per share attributable to the cash payments made by purchasers in the offering;

and |

| · | the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers. |

DESCRIPTION OF SECURITIES

Common Shares

The following description

of our Common Shares is a summary and does not purport to be complete. It is subject to and qualified in its entirety by reference to

our Articles of the Company, as amended and restated (the “Articles”), which are an exhibit to the registration statement

of which this prospectus forms a part. We are incorporated in the Province of British Columbia, Canada and are subject to the Business

Corporations Act (British Columbia).

Authorized Capital Shares

The Company’s share

capital consists of an unlimited number of authorized Common Shares of which 195,885,531 are issued and outstanding as of November 15,

2023. The outstanding Common Shares are fully paid and nonassessable. No other classes of shares are currently authorized.

Voting Rights

Holders of Common Shares are

entitled to receive notice of and to attend any meetings of shareholders of the Company and at any meetings of shareholders to cast one

vote for each Common Share held. Holders of Common Shares do not have cumulative voting rights. A simple majority of votes cast on a resolution

is required to pass an ordinary resolution; however, if the resolution is a special resolution two-thirds of the votes cast on the special

resolution are required to pass it.

Dividend Rights and Liquidation Rights

Holders of Common Shares are

entitled to receive dividends as and when declared by the board of directors of the Company at its discretion from funds legally available

therefor and to receive a pro rata share of the assets of the Company available for distribution to the shareholders in the event of the

liquidation, dissolution or winding-up of the Company after payment of debts and other liabilities, in each case subject to the rights,

privileges, restrictions and conditions attached to any other series or class of shares ranking senior in priority to or on a pro-rata

basis with the holders of Common Shares with respect to dividends or liquidation.

Other Rights and Preferences

There are no pre-emptive,

subscription, conversion or redemption rights attached to the Common Shares nor do they contain any sinking or purchase fund provisions.

Debt Securities

The debt securities will be

our direct unsecured general obligations. The debt securities will be issued under an indenture which may be amended or supplemented from

time to time, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part.

The applicable prospectus

supplement and/or other offering materials will describe the material terms of the debt securities offered through that prospectus supplement

as well as any general terms described in this section that will not apply to those debt securities. To the extent the applicable prospectus

supplement or other offering materials relating to an offering of debt securities are inconsistent with this prospectus, the terms of

that prospectus supplement or other offering materials will supersede the information in this prospectus.

The prospectus supplement

relating to any series of debt securities that we may offer will contain the specific terms of the debt securities. These terms may include

the following:

| · | the title and principal aggregate amount of the debt securities; |

| · | whether the debt securities will be secured or unsecured; |

| · | whether the debt securities are convertible or exchangeable into other securities; |

| · | the percentage or percentages of principal amount at which such debt securities will be issued; |

| · | the interest rate(s) or the method for determining the interest rate(s); |

| · | the dates on which interest will accrue or the method for determining dates on which interest will accrue

and dates on which interest will be payable; |

| · | the person to whom any interest on the debt securities will be payable; |

| · | the places where payments on the debt securities will be payable; |

| · | redemption or early repayment provisions; |

| · | authorized denominations; |

| · | amount of discount or premium, if any, with which such debt securities will be issued; |

| · | whether such debt securities will be issued in whole or in part in the form of one or more global securities; |

| · | the identity of the depositary for global securities; |

| · | whether a temporary security is to be issued with respect to such series and whether any interest payable

prior to the issuance of definitive securities of the series will be credited to the account of the persons entitled thereto; |

| · | the terms upon which the beneficial interests in a temporary global security may be exchanged in whole

or in part for beneficial interests in a definitive global security or for individual definitive securities; |

| · | any covenants applicable to the particular debt securities being issued; |

| · | any defaults and events of default applicable to the particular debt securities being issued; |

| · | the guarantors of each series, if any, and the extent of the guarantees, if any; |

| · | any restriction or condition on the transferability of the debt securities; |

| · | the currency, currencies, or currency units in which the purchase price for, the principal of and any

premium and any interest on, such debt securities will be payable; |

| · | the time period within which, the manner in which and the terms and conditions upon which we or the purchaser

of the debt securities can select the payment currency; |

| · | the securities exchange(s) on which the securities will be listed, if any; |

| · | whether any underwriter(s) will act as market maker(s) for the securities; |

| · | the extent to which a secondary market for the securities is expected to develop; |

| · | our obligations or right to redeem, purchase or repay debt securities under a sinking fund, amortization

or analogous provision; |

| · | provisions relating to covenant defeasance and legal defeasance; |

| · | provisions relating to satisfaction and discharge of the indenture; |

| · | provisions relating to the modification of the indenture both with and without consent of holders of debt

securities issued under the indenture; |

| · | the law that will govern the indenture and debt securities; and |

| · | additional terms not inconsistent with the provisions of the indenture. |

General

We may sell the debt securities,

including original issue discount securities, at par or at a substantial discount below their stated principal amount. Unless we inform

you otherwise in a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the holders

of the debt securities of such series outstanding at the time of issuance. Any such additional debt securities, together with all other

outstanding debt securities of that series, will constitute a single series of securities under the applicable indenture. In addition,

we will describe in the applicable prospectus supplement material Canadian and U.S. federal income tax considerations and any other special

considerations for any debt securities we sell which are denominated in a currency or currency unit other than U.S. dollars. Unless we

inform you otherwise in the applicable prospectus supplement, the debt securities will not be listed on any securities exchange.

We expect most debt securities

to be issued in fully registered form without coupons and in denominations of $1,000 and integral multiples thereof. Subject to the limitations

provided in the indenture and in the prospectus supplement, debt securities that are issued in registered form may be transferred or exchanged

at the corporate office of the trustee or the principal corporate trust office of the trustee, without the payment of any service charge,

other than any tax or other governmental charge payable in connection therewith.

If specified in the applicable

prospectus supplement, certain of our subsidiaries will guarantee the debt securities. The particular terms of any guarantee will be described

in the related prospectus supplement.

Governing Law

We anticipate that any indenture

and supplemental indenture will be governed by and construed in accordance with the laws of the State of New York, except to the extent

that the Trust Indenture Act is applicable.

Warrants

We may issue warrants for

the purchase of Common Shares or debt securities in one or more series. We may issue warrants independently or together with other securities

registered hereunder, and the warrants may be attached to or separate from these securities. While the terms summarized below will apply

generally to any warrants that we may offer, we will describe the particular terms of any series of warrants in more detail in the applicable

prospectus supplement. The terms of any warrants offered under a prospectus supplement may differ from the terms described below.

We will file as exhibits to

the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC,

the form of warrant agreement, including a form of warrant certificate, that describes the terms of the particular series of warrants

we are offering before the issuance of the related series of warrants. The following summaries of material provisions of the warrants

and the warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the warrant agreement

and warrant certificate applicable to the particular series of warrants that we may offer under this prospectus. We urge you to read the

applicable prospectus supplements related to the particular series of warrants that we may offer under this prospectus, as well as any

related free writing prospectuses, and the complete warrant agreements and warrant certificates that contain the terms of the warrants.

General

We will describe in the applicable

prospectus supplement the terms of the series of warrants being offered, including:

| · | the offering price and aggregate number of warrants offered; |

| · | the currency for which the warrants may be purchased; |

| · | if applicable, the designation and terms of the securities with which the warrants are issued and the

number of warrants issued with each such security or each principal amount of such security; |

| · | if applicable, the date on and after which the warrants and the related securities will be separately

transferable; |

| · | the number of Common Shares or debt securities

purchasable upon the exercise of one warrant and the price at which these shares may be purchased upon such exercise; |

| · | the effect of any merger, consolidation, sale

or other disposition of our business on the warrant agreements and the warrants; |

| · | the terms of any rights to redeem or call the

warrants; |

| · | any provisions for changes to or adjustments

in the exercise price or number of securities issuable upon exercise of the warrants; |

| · | the dates on which the right to exercise the

warrants will commence and expire; |

| · | the manner in which the warrant agreements and

warrants may be modified; |

| · | a discussion of any material or special United

States federal income tax consequences of holding or exercising the warrants; |

| · | the terms of the securities issuable upon exercise

of the warrants; and |

| · | any other specific terms, preferences, rights

or limitations of or restrictions on the warrants. |

Before exercising their warrants,

holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise, including the right to

receive dividends, if any, or, payments upon our liquidation, dissolution or winding up or to exercise voting rights, if any.

Exercise of Warrants

Each warrant will entitle

the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price that we describe in

the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement, holders of the warrants may

exercise the warrants at any time up to the specified time on the expiration date that we set forth in the applicable prospectus supplement.

After the close of business on the expiration date, unexercised warrants will become void.

Holders of the warrants may

exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with specified information,

and paying the required amount to the warrant agent or the Company in immediately available funds, as provided in the applicable prospectus

supplement. We will set forth on the reverse side of the warrant certificate and in the applicable prospectus supplement the information

that the holder of the warrant will be required to deliver to the warrant agent.

Upon receipt of the required

payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent or any other

office indicated in the applicable prospectus supplement, we will issue and deliver the securities purchasable upon such exercise. If

fewer than all of the warrants represented by the warrant certificate are exercised, then we will issue a new warrant certificate for

the remaining amount of warrants. If we so indicate in the applicable prospectus supplement, holders of the warrants may surrender securities

as all or part of the exercise price for warrants.

Governing Law

Unless we provide otherwise

in the applicable prospectus supplement, the warrants and warrant agreements will be governed by and construed in accordance with the

laws of the State of New York.

Enforceability of Rights by Holders of Warrants

Each warrant agent will act

solely as our agent under the applicable warrant agreement and will not assume any obligation or relationship of agency or trust with

any holder of any warrant. A single bank or trust company may act as warrant agent for more than one issue of warrants. A warrant agent

will have no duty or responsibility in case of any default by us under the applicable warrant agreement or warrant, including any duty

or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a warrant may, without

the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate legal action its right to exercise,

and receive the securities purchasable upon exercise of, its warrants.

Rights

We may issue rights to

purchase our debt securities or Common Shares. These rights may be issued independently or together with any other

security offered hereby and may or may not be transferable by the shareholder receiving the rights in such offering. In connection with

any offering of such rights, we may enter into a standby arrangement with one or more underwriters or other purchasers pursuant to which

the underwriters or other purchasers may be required to purchase any securities remaining unsubscribed for after such offering.

Each series of rights will

be issued under a separate rights agreement which we will enter into with a bank or trust company, as rights agent, all which will be

set forth in the relevant prospectus supplement. The rights agent will act solely as our agent in connection with the certificates relating

to the rights and will not assume any obligation or relationship of agency or trust with any holders of rights certificates or beneficial

owners of rights.

The following

description is a summary of selected provisions relating to rights that we may offer. The summary is not complete. When rights are

offered in the future, a prospectus supplement, information incorporated by reference or related free writing prospectus, as

applicable, will explain the particular terms of those rights and the extent to which these general provisions may apply. The

specific terms of the rights as described in a prospectus supplement, information incorporated by reference, or related free writing

prospectus will supplement and, if applicable, may modify or replace the general terms described in this section.

This summary and any description

of rights in the applicable prospectus supplement, information incorporated by reference or related free writing prospectus is subject

to and is qualified in its entirety by reference to the rights agreement and the rights certificates. We will file each of these documents,

as applicable, with the SEC and incorporate them by reference as an exhibit to the registration statement of which this prospectus is

a part on or before the time we issue a series of rights. See “Where You Can Find More Information” and “Information

Incorporated By Reference” above for information on how to obtain a copy of a document when it is filed.

The applicable prospectus

supplement, information incorporated by reference or related free writing prospectus may describe:

| · | in the case of a distribution of rights to our shareholders, the date of determining the shareholders

entitled to the rights distribution; |

| · | in the case of a distribution of rights to our stockholders, the number of rights issued or to be issued

to each shareholder; |

| · | the exercise price payable for the underlying debt securities or Common Shares upon the exercise of the

rights; |

| · | the number and terms of the underlying debt securities or Common Shares which may be purchased per each

right; |

| · | the extent to which the rights are transferable; |

| · | the date on which the holder’s ability to exercise the rights shall commence, and the date on which

the rights shall expire; |

| · | the extent to which the rights may include an over-subscription privilege with respect to unsubscribed

securities; |

| · | if applicable, the material terms of any standby underwriting or purchase arrangement entered into by

us in connection with the offering of such rights; and |

| · | any other terms of the rights, including, but not limited to, the terms, procedures, conditions and limitations

relating to the exchange and exercise of the rights. |

The provisions described in

this section, as well as those described under “Common Shares” and “Debt Securities” above, will apply, as applicable,

to any rights we offer.

Subscription Receipts

The Company may issue

subscription receipts that may be exchanged for debt securities, Common Shares, or warrants, which may be offered separately or

together with any other securities offered by means of this prospectus, as the case may be, all as set forth in the prospectus

supplement relating to the particular issue of subscription receipts. Each series of subscription receipts will be issued under a

separate subscription receipts agreement or indenture to be entered into between the Company and a transfer agent, as subscription

receipts agent, all as set forth in the prospectus supplement relating to the particular issue of subscription receipts. The

subscription receipts agent will act solely as an agent of the Company in connection with the certificates relating to the

subscription receipts of such series and will not assume any obligation or relationship of agency or trust for or with any holders

of subscription receipts certificates or beneficial owners of subscription receipts. The subscription receipts agreement or

indenture and the subscription receipts certificates relating to each series of subscription receipts will be filed with the SEC and

incorporated by reference as an exhibit to the registration statement of which this prospectus is a part.

The applicable prospectus

supplement will describe the terms of the subscription receipts to be issued, including the following:

| · | the number of subscription receipts; |

| · | the price at which the subscription receipts will be offered; |

| · | the procedures for the exchange of the subscription receipts into debt securities, Common Shares or warrants; |

| · | the number of debt securities, Common Shares or warrants that may be exchanged upon exercise of each subscription

receipt; |

| · | the designation and terms of any other securities with which the subscription receipts will be offered,

if any, and the number of subscription receipts that will be offered with each security; |

| · | terms applicable to the gross proceeds from the sale of the subscription receipts plus any interest earned

thereon; |

| · | a discussion of material U.S. and Canadian federal income tax considerations; and |

| · | any other material terms of such subscription receipts, including terms, procedures and limitations relating

to the distribution, exchange and exercise of such subscription receipts. |

Units

The Company may issue units

consisting of any combination of the other types of securities offered under this prospectus in one or more series. The Company may evidence

each series of units by unit certificates that it will issue under a separate agreement. The Company may enter into unit agreements with

a unit agent. Each unit agent will be a bank or trust company that the Company selects. The Company will indicate the name and address

of the unit agent in the applicable prospectus supplement relating to a particular series of units.

The

following description, together with the additional information included in any applicable prospectus supplement, summarizes the general

features of the units that the Company may offer under this prospectus. You should read any prospectus supplement and any free writing

prospectus that the Company may authorize to be provided to you related to the series of units being offered, as well as the complete

unit agreements that contain the terms of the units. Specific unit agreements will contain additional important terms and provisions and

the Company will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference

from another report that the Company files with the SEC, the form of each unit agreement relating to units offered under this prospectus.

If

the Company offers any units, certain terms of that series of units will be described in the applicable prospectus supplement, including,

without limitation, the following, as applicable:

| · | the title of the series of units; |

| · | identification and description of the separate constituent securities comprising the units; |

| · | the price or prices at which the units will be issued; |

| · | the date, if any, on and after which the constituent securities comprising the units will be separately

transferable; |

| · | a discussion of certain U.S. and Canadian federal income tax considerations applicable to the units; and |

| · | any other terms of the units and their constituent securities. |

Limitations to Control due to Certain Provisions

of Canadian and British Columbian Law and our Articles

Unless such offer is exempt

from the take-over provisions under Canadian securities laws, an offer made by a person, or an offeror, to acquire outstanding shares

of a Canadian entity that, when aggregated with the offeror’s holdings (and those of persons or companies acting jointly with the

offeror), would constitute 20% or more of the outstanding shares (taking into account any securities owned by the offeror and its joint

actors that are convertible into or exchangeable for shares within 60 days), would be subject to the take-over provisions of Canadian

securities laws. The foregoing is a limited and general summary of certain aspects of applicable securities law in the provinces and territories

of Canada, all in effect as of the date hereof.

In addition to the take-over

bid requirements noted above, the acquisition of shares may trigger the application of additional statutory regimes including, amongst

others, the Investment Canada Act (Canada) and the Competition Act (Canada).

This summary is not a comprehensive

description of relevant or applicable considerations regarding such requirements and, accordingly, is not intended to be, and should not

be interpreted as, legal advice to any prospective purchaser and no representation with respect to such requirements to any prospective

purchaser is made. Prospective investors should consult their own Canadian legal advisors with respect to any questions regarding securities

law in the provinces and territories of Canada and other applicable statutory regimes.

As well, under the Business

Corporations Act (British Columbia), unless otherwise stated in the Articles, certain corporate actions require the approval of a

special majority of shareholders, meaning holders of shares representing 66 2∕3% of those votes cast in respect of a shareholder

vote addressing such matter. Those items requiring the approval of a special majority generally relate to fundamental changes with respect

to our business, and include amongst others, resolutions: (i) removing a director prior to the expiry of his or her term; (ii) altering

the Articles, (iii) approving an amalgamation; (iv) approving a plan of arrangement; and (v) providing for a sale of all or substantially

all of our assets.

Considerations for Non-Resident Holders

There are no limitations under

the laws of Canada or in the organizing documents of the Company on the right of foreigners to hold or vote securities of the Company

or affecting the remittance of dividends, interest and other payments to non-residents, except that the Investment Canada Act (Canada)

may require review and approval by the Minister of Industry (Canada) of certain acquisitions of “control” of the Company by

a “non-Canadian.” See “Certain Canadian Federal Income Tax Considerations for U.S. Holders” and “Certain

U.S. Federal Income Tax Considerations for U.S. Holders” in the Company’s Annual Report on Form 10-K for the year ended December

31, 2022 under Part II. Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities for additional information.

DENOMINATIONS, REGISTRATION AND TRANSFER

Other than in the case

of book-entry-only Securities, Securities may be presented for registration of transfer (with the form of transfer endorsed thereon

duly executed) in the city specified for such purpose at the office of the registrar or transfer agent designated by us for such

purpose with respect to any issue of Securities referred to in a prospectus supplement. No service charge will be made for any

transfer, conversion or exchange of the Securities but we may require payment of a sum to cover any transfer tax or other

governmental charge payable in connection therewith. Such transfer, conversion or exchange will be effected upon such registrar or

transfer agent being satisfied with the documents of title and the identity of the person making the request. If a prospectus

supplement refers to any registrar or transfer agent designated by us with respect to any issue of Securities, we may at any time

rescind the designation of any such registrar or transfer agent and appoint another in its place or approve any change in the

location through which such registrar or transfer agent acts.

In the case of book-entry-only

Securities, a global certificate or certificates representing the Securities will be held by a designated depository for its participants.

The Securities must be purchased or transferred through such participants, which includes securities brokers and dealers, banks and trust

companies. The depository will establish and maintain book-entry accounts for its participants acting on behalf of holders of the Securities.

The interests of such holders of Securities will be represented by entries in the records maintained by the participants. Holders of Securities

issued in book-entry-only form will not be entitled to receive a certificate or other instrument evidencing their ownership thereof, except

in limited circumstances. Each holder will receive a customer confirmation of purchase from the participants from which the Securities

are purchased in accordance with the practices and procedures of that participant.

CERTAIN INCOME TAX CONSIDERATIONS

The applicable prospectus

supplement will describe certain Canadian federal income tax consequences to investors described therein of acquiring Securities including,

in the case of investors who are not residents of Canada for purposes of the Income Tax Act (Canada), whether payment of any amount in

respect of a security will be subject to Canadian non-resident withholding tax.

The applicable prospectus

supplement will also describe certain U.S. federal income tax consequences of the acquisition, ownership and disposition of Securities

by an initial investor who is a U.S. person (within the meaning of the U.S. Internal Revenue Code), if applicable, including, to the extent

applicable, any such consequences relating to Securities payable in a currency other than the U.S. dollar, issued at an original issue

discount for U.S. federal income tax purposes or containing early redemption provisions or other special terms.

PLAN OF DISTRIBUTION

We are registering the Securities

with an aggregate offering price not to exceed $100,000,000, to be sold by the Company under a “shelf” registration process.

If we offer any of the Securities under this prospectus we will amend or supplement this prospectus by means of an accompanying prospectus

supplement setting forth the specific terms and conditions and other information about that offering as is required or necessary.

We may offer and sell all

or a portion of the Securities covered by this prospectus from time to time, in one or more or any combination of the following transactions:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and

resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | short sales effected after the date the registration statement of which this prospectus is a part is declared

effective by the SEC; |

| · | through the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| · | broker-dealers may agree to sell a specified number of such shares at a stipulated price per share; |

| · | sales “at the market” to or through a market maker or into an existing trading market, on

an exchange or otherwise; |

| · | a combination of any such methods of sale; and |

| · | any other method permitted by applicable law. |

We may sell the Securities

at prices then prevailing or related to the then current market price or at negotiated prices. The offering price of the Securities from

time to time will be determined by us, and, at the time of the determination, may be higher or lower than the market price of our Securities

on the TSX, NYSE American, or any other exchange or market.

In connection with the sale

of the Securities or interests therein, we may enter into hedging transactions with broker-dealers or other financial institutions, which

may in turn engage in short sales of the Securities in the course of hedging the positions they assume. We may also sell the Securities

short and deliver these Securities to close out their short positions, or loan or pledge the Securities to broker-dealers that in turn

may sell these Securities. We may also enter into option or other transactions with broker-dealers or other financial institutions or

the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares

offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as

supplemented or amended to reflect such transaction).

In connection with an underwritten

offering, underwriters or agents may receive compensation in the form of discounts, concessions or commissions from us or from purchasers

of the offered shares for whom they may act as agents. In addition, underwriters may sell the shares to or through dealers, and those

dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the

purchasers for whom they may act as agents. Any underwriters, broker-dealers or agents that participate in the sale of the Securities

or interests therein may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions,

concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. We

will bear all of the expenses of the offering of Securities.

We may agree to indemnify

an underwriter, broker-dealer or agent against certain liabilities related to the selling of the Securities, including liabilities arising

under the Securities Act.

We have not entered into any

agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of the Securities. Upon entering

into any material arrangement with an underwriter or broker-dealer for the sale of the Securities through a block trade, special offering,

exchange distribution, secondary distribution or a purchase by an underwriter or broker-dealer, we will file a prospectus supplement,

if required, pursuant to Rule 424(b) under the Securities Act, disclosing certain material information, including:

| · | the name of the applicable seller; |

| · | the Securities being offered; |

| · | the terms of the offering; |

| · | the names of the participating underwriters, broker-dealers or agents; |

| · | any discounts, commissions or other compensation paid to underwriters or broker-dealers and any discounts,

commissions or concessions allowed or reallowed or paid by any underwriters to dealers; |

| · | the purchase price of the Securities and the proceeds to be received from the sale; and |

| · | other material terms of the offering. |

We are subject to the applicable

provisions of the Exchange Act and the rules and regulations under the Exchange Act, including Regulation M. This regulation may limit

the timing of purchases and sales of any of the Securities offered in this prospectus. The anti-manipulation rules under the Exchange

Act may apply to sales of Securities in the market and to our activities.

To the extent required, this

prospectus may be amended and/or supplemented from time to time to describe a specific plan of distribution. Instead of selling the Securities

under this prospectus, we may sell the Securities in compliance with the provisions of Regulation D under the Securities Act, if available,

or pursuant to other available exemptions from the registration requirements of the Securities Act.

With respect to the sale of

any Securities under this prospectus, the maximum commission or discount to be received by any member of the Financial Industry Regulatory

Authority, Inc. (“FINRA”) or any independent broker or dealer will comply with the rules promulgated by FINRA.

LEGAL MATTERS

Certain legal matters in connection

with this offering will be passed upon for us by McCarthy Tétrault LLP, Vancouver, British Columbia, Canada, with respect to Canadian

law. Certain legal matters in connection with this offering will be passed upon for us by Hogan Lovells US LLP, Denver, Colorado, with

respect to U.S. law. Any underwriters will be advised about other issues relating to any offering by their own legal counsel.

EXPERTS

The

consolidated financial statements of the Company included in the Annual Report on Form 10-K incorporated by

reference in this prospectus have been so incorporated in reliance on the report of Davidson & Company LLP, Chartered Professional

Accountants, Vancouver, British Columbia, Canada, an independent registered public accounting firm, given on the authority of said firm

as experts in auditing and accounting.

Information relating to

the Company’s Livengood Gold Project contained herein and incorporated herein by reference is derived from the technical report

entitled “S-K 1300 Technical Report Summary Pre-feasibility Study of the Livengood Gold Project” with an effective date of

October 29, 2021 and an original signing date of February 23, 2022 and an amended signing date of October 13, 2023 prepared

by BBA USA Inc., NewFields Mining Design & Technical Services, LLC, JDS Energy & Mining Inc., and Resource Development Associates

Inc., each a qualified person under S-K 1300 (of the United States Securities and Exchange Commission) pursuant to the consent of such

author.

INTERNATIONAL TOWER HILL MINES LTD.

$100,000,000

Common Shares

Debt Securities

Warrants

Rights

Subscription Receipts

Units

PROSPECTUS

,

2023

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

| |

Item 14. |

Other Expenses of Issuance and Distribution |

The following sets forth the

expenses in connection with the issuance and distribution of the securities being registered hereby, other than underwriting discounts

and commissions. All amounts set forth below, other than the SEC registration fee are estimates.

| SEC Registration Fee | |

$ | 9,951.06 | |

| FINRA Fee | |

| * | |

| Legal Fees and Expenses | |

| * | |

| Accountants Fees and Expenses | |

| * | |

| Listing Fee | |

| * | |

| Transfer and Disbursement Agent Fees | |

| * | |

| Printing Costs | |

| * | |

| Miscellaneous | |

| * | |

| Total | |

| * | |

| * |

These fees and expenses will be determined based on the number of issuances and amount and type of securities issued. Accordingly, they cannot be estimated at this time. An estimate of the aggregate amount of these expenses will be reflected in the applicable prospectus supplement. |

| |

Item 15. |

Indemnification of Officers and Directors |

Under the Business

Corporations Act (British Columbia) (the “BCBCA”) the Company may indemnify a director or officer, a former director or officer,

or an individual who acts or acted as a director or officer of an affiliate of the Company, or at the Company’s request as a director

or officer (or in a similar capacity) of another corporation or other legal entity, against all judgments, penalties or fines awarded

or imposed in, or amounts paid in settlement of, any legal proceeding or investigative action, whether current, threatened, pending or

completed, in which such individual or any of his or her heirs and personal or other legal representatives is or may be joined as a party,

or is or may liable for in respect of a judgment, penalty or fine in, or expenses related to such legal proceeding or investigative action

because of serving in such capacity, on condition that (i) the individual acted honestly and in good faith with a view to the best interests

of the Company or such other corporation or legal entity, and (ii) in the case of such a proceeding or investigative action other than

a civil proceeding, the individual had reasonable grounds for believing that his or her conduct was lawful. The Company may also indemnify

a person described above in respect of all costs, charges and expenses, including legal and other fees, actually and reasonably incurred

by such person in respect of such a legal proceeding or investigative action, providing such person complies with (i) and (ii) above.

The Company may provide indemnification in respect of such costs, charges and expenses after the final disposition of such legal proceeding

or investigative action, and may pay such costs, charges and expenses as they are incurred in advance of such final disposition, provided

it obtains a written undertaking that such person will repay the amounts advanced if it is ultimately determined that the individual did

not comply with (i) and (ii) above. Under the BCBCA, an individual described above is entitled to indemnification from the Company in

respect of such costs, charges and expenses after the final disposition of such legal proceeding or investigative action as a matter of

right if the individual has not been reimbursed for such costs, charges and expenses and is wholly successful in the outcome of such legal

proceeding or investigative action, or is substantially successful on the merits thereof, providing such individual complies with (i)

and (ii) above. On application of the Company or an individual described above, the Supreme Court of British Columbia may order the Company

to indemnify a person described above in respect of any liability incurred by such person in respect of such a legal proceeding or investigative

action, and to pay some or all of the expenses incurred by such individual in respect of such legal proceeding or investigative action.

In

accordance with the BCBCA, the Articles of the Company provide that the Company must indemnify a director, former director or

alternate director of the Company and his or her heirs and legal personal representatives against all eligible penalties to which

such person is or may be liable, and the Company must, after the final disposition of an eligible proceeding, pay the expenses

actually and reasonably incurred by such person in respect of that proceeding. Subject to any restrictions in the BCBCA, the Company

may indemnify any other person. The Articles also provide that the Company may purchase and maintain insurance for the benefit of

any person (or his or her heirs or legal personal representatives) who: (i) is or was a director, alternate director, officer,

employee or agent of the Company; (ii) is or was a director, alternate director, officer, employee or agent of a corporation at a

time when the corporation is or was an affiliate of the Company; (iii) at the request of the Company, is or was a director,

alternate director, officer, employee or agent of a corporation or of a partnership, trust, joint venture or other unincorporated

entity; or (iv) at the request of the Company, holds or held a position equivalent to that of a director, alternate director or

officer of a partnership, trust, joint venture or other unincorporated entity; in each case against any liability incurred by him or

her as such director, alternate director, officer, employee or agent or person who holds or held such equivalent position.

A policy of directors’ and officers’ liability insurance is maintained by the Company which insures

directors and officers for losses as a result of claims against the directors and officers of the Company in their capacity as

directors and officers and also reimburses the Company for payments made pursuant to the indemnity provisions under the Articles of

the Company and the BCBCA.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to

the foregoing provisions, the Company has been informed that in the opinion of the Commission such indemnification is against public policy

as expressed in the Securities Act and is therefore unenforceable.

| |

Item 16. |

Exhibits and Financial Statement Schedules |

| * |

Filed herewith. |

| ** |

Previously filed. |

| (1) |

To be filed by amendment or as an exhibit to a report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, and incorporated herein by reference. |

| (2) |

To be filed in accordance with the Trust Indenture Act of 1939, as amended. |

(a) The

undersigned registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement;

provided, however, that

paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the registration statement is on Form S-3 and the information required

to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement,

or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(4) That,

for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B

relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section

10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such

form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described