0001880343

false

true

true

0001880343

2025-03-11

2025-03-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March

11, 2025

FRESH

VINE WINE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41147 |

|

87-3905007 |

(State or Other

Jurisdiction

of Incorporation) |

(Commission File Number) |

|

(I.R.S.

Employer

Identification

No.) |

P.O.

Box 78984

Charlotte,

NC 28271

(Address

of Principal Executive Offices) (Zip Code)

(855)

766-9463

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on

which registered |

| Common stock, par value

$0.001 per share |

|

VINE |

|

NYSE American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☑

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

8.01 Other Events.

On

March 11, 2025, Fresh Vine Wine, Inc. issued a press release announcing that it has regained compliance with the NYSE American continued

listing standards relating to stockholders’ equity. The press release is attached as Exhibit 99.1 to this Current Report on Form

8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FRESH VINE WINE, INC. |

| |

|

|

| Date: March 11, 2025 |

By: |

/s/ Michael Pruitt |

| |

|

Michael Pruitt |

| |

|

Chairman and Chief Executive Officer |

Exhibit 99.1

Fresh Vine Wine Inc. Regains NYSE American Compliance Following

Successful Acquisition

Charlotte, NC and Newport

Beach, CA – March 11, 2025 – Fresh Vine Wine, Inc. (NYSE American: VINE) (“Fresh

Vine” or the “Company”)

is pleased to announce that it has regained compliance with the NYSE American continued listing requirements for stockholders’

equity. This milestone follows the completion of its acquisition of Amaze Software,

Inc. (“Amaze”), marking a significant step toward a stronger,

more dynamic future for the Company and its stockholders.

After giving effect to the transaction, Fresh Vine reports,

at March 6, 2025, preliminary stockholders’ equity of approximately $80 million, a significant increase from prior periods and above

the $4 million NYSE American stockholders’ equity compliance threshold.

Key Transactions Driving Fresh Vine’s Compliance:

- Strategic Acquisition of Amaze: The

business combination contributed approximately $98 million in goodwill and intangibles, which is expected to enhance Fresh Vine’s

position for future growth.

- Additional Paid-in Capital Increase: The

transaction resulted in an increase of approximately $78 million in additional paid-in capital, reflecting new capital contributions

and adjustments post-merger.

- Elimination of Intra-Company

Balances: A $4.473 million note receivable was eliminated as part of the consolidation.

- Fair Value Reassessments: The

fair value of warrants and other liabilities were reviewed and adjusted, resulting in an approximately $3.6 million preliminary

warrant valuation.

- This achievement not only strengthens

the Company’s financial foundation, but also reinforces its commitment to delivering value for both stockholders and customers

as it continues its journey of innovation and growth.

Financial Strength and Future

Growth Trajectory: With its enhanced capital structure and the strategic integration of Amaze’s digital commerce platform, Fresh

Vine is now in a stronger position to scale operations, drive sustainable revenue growth, and deliver long-term value for stockholders.

This transaction is more than a compliance milestone—it represents

a key step to accelerate the Company’s expansion into digital and e-commerce-driven markets. Primary advantages include:

- Cost savings through operational

efficiencies and back-office consolidation.

- Expanded market reach via digital

and e-commerce growth powered by Amaze’s technology platform.

- Stronger revenue potential through

new distribution channels and product innovation.

“Regaining NYSE compliance

marks a turning point for Fresh Vine as we look ahead to the next phase of our growth,” said

Michael Pruitt, Chief Executive Officer. “With approximately $80

million in stockholders’ equity and the powerful addition of Amaze’s technology, we are well-positioned to scale, innovate,

and create lasting value for both our stockholders and the communities we serve.”

If at any time in the future Fresh Vine falls out of compliance

with the stockholders’ equity requirements to meet NYSE American continued listing rules, Fresh Vine would be subject to immediate

reevaluation by NYSE American.

About Fresh Vine Wine, Inc.

Fresh Vine is a producer of lower-carb, lower-calorie premium

wines in the United States. Fresh Vine Wine positions its core brand lineup as an affordable luxury, retailing between $14.99 - $24.99

per bottle. Fresh Vine Wine’s varietals currently include Cabernet Sauvignon, Chardonnay, Pinot Noir, Rosé, Sauvignon Blanc,

Sparkling Rosé, and a limited Reserve Napa Cabernet Sauvignon. All varietals are produced and bottled in Napa, California.

About Amaze Software, Inc.

Amaze Software, Inc. is an end-to-end, creator-powered commerce

platform offering tools for seamless product creation, advanced e-commerce solutions, and scalable managed services. By empowering anyone

to “sell anything, anywhere,” Amaze enables creators to tell their stories, cultivate deeper audience connections, and generate

sustainable income through shoppable, authentic experiences.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning

of the federal securities laws. Such statements relate to future plans, developments, performance or financial condition. These forward-looking

statements are not historical facts, but rather are based on current plans, expectations, and estimates of management of Fresh Vine and

Amaze. Forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations,

hopes, beliefs, intentions or strategies regarding the future of the combined companies and the expected benefits of the acquisition.

In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including

any underlying assumptions, are forward-looking statements. In some cases, you can identify forward-looking statements by the following

words: “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” or the negative

of these terms or other similar expressions, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements are subject to a number of risks and

uncertainties (some of which are beyond our control) that may cause actual results or performance to be materially different from those

expressed or implied by such forward-looking statements. The following factors, among others, could cause actual results and the timing

of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (i) the

potential effect of the announcement of the acquisition on Amaze’s or Fresh Vine’s business relationships, performance and

business generally, including potential difficulties in employee retention; (ii) the outcome of any legal proceedings related to the merger

agreement or the acquisition (iii) the risk that Fresh Vine will be unable to maintain the listing of Fresh Vine’s securities on

NYSE American; (iv) the risk that the price of Fresh Vine’s securities may be volatile due to a variety of factors, including changes

in the competitive industries in which Fresh Vine or Amaze operates, variations in performance across competitors, changes in laws and

regulations affecting Fresh Vine’s or Amaze’s business and changes in the capital structure; (v) the risk that the anticipated

benefits of the acquisition or other commercial opportunities may otherwise not be fully realized or may take longer to realize than expected;

(vi) the impact of changes in applicable law, rules, regulations, regulatory guidance, or social conditions in the countries in which

customers and suppliers operate; (vii) the risk that integration of Amaze and Vine post-closing may not occur as anticipated or the combined

company may not be able to achieve the growth prospects and synergies expected from the transaction, as well as the risk of potential

delays, challenges and expenses associated with integrating the combined company’s existing businesses; (viii) the risk that Fresh

Vine and/or Amaze may not achieve or sustain profitability; (ix) the risk that Fresh Vine and/or Amaze will need to raise additional capital

to execute its business plan, which may not be available on acceptable terms or at all; and (x) the risk that Fresh Vine and/or Amaze

experiences difficulties in managing its growth and expanding operations. Additional factors that may affect the future results of Fresh

Vine are set forth in its filings with the United States Securities and Exchange Commission (the “SEC”), which are available

on the SEC’s website at www.sec.gov. The risks and uncertainties described above and in the SEC filings noted above are not exclusive

and further information concerning Fresh Vine and its business, including factors that potentially could materially affect its business,

financial conditions or operating results, may emerge from time to time. Readers are urged to consider these factors carefully in evaluating

these forward-looking statements, and not to place undue reliance on any forward-looking statements. Readers should also carefully review

the risk factors described in other documents that Fresh Vine files from time to time with the SEC. The forward-looking statements in

this release speak only as of the date of this release. Except as required by law, Fresh Vine assumes no obligation to update or revise

these forward-looking statements for any reason, even if new information becomes available in the future.

For more information, visit https://ir.freshvinewine.com/info/.

For press inquiries, please contact investorrelations@freshvinewine.com.

v3.25.0.1

Cover

|

Mar. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 11, 2025

|

| Entity File Number |

001-41147

|

| Entity Registrant Name |

FRESH

VINE WINE, INC.

|

| Entity Central Index Key |

0001880343

|

| Entity Tax Identification Number |

87-3905007

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

P.O.

Box 78984

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28271

|

| City Area Code |

(855)

|

| Local Phone Number |

766-9463

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value

$0.001 per share

|

| Trading Symbol |

VINE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

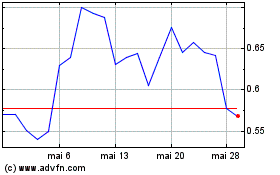

Fresh Vine Wine (AMEX:VINE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Fresh Vine Wine (AMEX:VINE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025