New Star Investment Trust PLC (NSI) New Star Investment Trust

PLC: Annual Results for the year ended 30th June 2022 11-Oct-2022 /

10:10 GMT/BST Dissemination of a Regulatory Announcement,

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

NEW STAR INVESTMENT TRUST PLC

This announcement constitutes regulated information.

UNAUDITED RESULTS

FOR THE YEARED 30TH JUNE 2022

New Star Investment Trust plc (the 'Company'), whose objective

is to achieve long-term capital growth, announces its consolidated

results for the year ended 30th June 2022.

FINANCIAL HIGHLIGHTS

30th June 30th June %

2022 2021 Change

PERFORMANCE

Net assets (GBP '000) 123,978 138,132 (10.3)

Net asset value per Ordinary share 174.56p 194.49p (10.3)

Mid-market price per Ordinary share 125.00p 134.00p (6.7)

Discount of price to net asset value 28.4% 31.1% n/a

Total Return* (9.53)% 22.16% n/a

IA Mixed Investment 40% - 85% Shares (total return) (7.12)% 17.48% n/a

MSCI AC World Index (total return, sterling adjusted) (3.73)% 25.10% n/a

MSCI UK Index (total return) 3.16% 17.46% n/a

1st July 2021 to 1st July 2020 to

30th June 2022 30th June 2021

Revenue return per Ordinary share 0.98p 0.61p

Capital return per share (19.51)p 34.93p

Return per Ordinary share (18.53)p 35.54p

TOTAL RETURN* (9.53)% 22.16%

PROPOSED DIVID PER ORDINARY SHARE 1.40p 1.40p

* The total return figure for the Group represents the revenue

and capital return shown in the Consolidated Statement of

Comprehensive Income divided by the net asset value at the

beginning of the period.

CHAIRMAN'S STATEMENT

PERFORMANCE

Your Company had a negative total return of 9.53% over the year

to 30th June 2022, leaving the net asset value (NAV) per ordinary

share at 174.56p. By comparison, the Investment Association's Mixed

Investment 40-85% Shares Index fell 7.12%. The MSCI AC World Total

Return Index fell 3.73% in sterling while the MSCI UK Total Return

Index rose 3.16%. Over the year, UK government bonds declined

14.27%. Further information is provided in the investment manager's

report.

Your Company made a revenue profit for the year of GBP700,000

(2021: GBP429,000).

GEARINGS AND DIVID

Your Company has no borrowings. It ended the year under review

with cash representing 19.79% of its NAV and is likely to maintain

a significant cash position. In respect of the financial year to

30th June 2022, your Directors recommend the payment of a dividend

of 1.4p per share (2021: 1.4p).

DISCOUNT

During the year under review, your Company's shares continued to

trade at a significant discount to their NAV. The Board keeps this

issue under review.

OUTLOOK

Investors may have to contend with challenging economic

conditions over the remainder of 2022 and early 2023. Weakening

monetary trends within the Group of Seven major industrial nations,

intensifying housing market weakness and falling long-term bond

yields relative to short-term interest rates suggest a period of

weak or no economic growth extending into the spring of 2023.

Inflationary trends, however, were showing signs of moderating over

the early autumn, suggesting that a return to 1970s-style price

rises was unlikely.

NET ASSET VALUE

Your Company's unaudited NAV at 30th September 2022 was

174.35p.

INVESTMENT MANAGER'S REPORT

MARKET REVIEW

Global equities and bonds fell 3.73% and 3.60% in sterling

respectively over the year to 30th June 2022 as rising inflation

and interest rates hurt economic growth. Global equities rose 7.86%

in sterling in the first half of the year under review as economies

emerged from Covid-19 lockdowns and rising inflation was largely

dismissed as transitory. Central banks, including the Federal

Reserve, turned more hawkish around the New Year, however, as

inflation became entrenched. Global equities and bonds fell 10.74%

and 3.99% in sterling respectively over the second half of the year

under review.

Russia's invasion of Ukraine in February 2022 exacerbated the

rise in energy and materials prices caused by the synchronised

recovery in global demand following the end of Covid-19 lockdowns.

The US is close to self-sufficient in energy because it has

exploited its shale gas reserves whereas European governments have

closed coal-fired and nuclear power stations, leaving the region

dependent on Russian gas. In the short term, liquid natural gas can

be purchased from the US but it will take time to reduce dependence

on Russia by accelerating the transfer to renewable energy and by

classifying some gas and nuclear developments as "green

investments".

In July 2022, headline inflation rates in US, eurozone and UK

were 8.5%, 8.9% and 10.1%, far above the central banks' 2% targets.

US inflation fell from a 9.1% high in June and may have reached its

cyclical peak but inflation is likely to rise in Europe because of

higher energy costs as a result of Russian gas supply restrictions.

Before the recent announcement of energy subsidies, the Bank of

England said UK inflation might exceed 13% in the fourth quarter of

2022 because of the planned Ofgem energy price increase and other

factors. Monetary policy tightened and in September 2022, US and UK

official interest rates were 3.00-3.25% and 2.25% respectively. In

the eurozone, key policy interest rates rose by half a percentage

point in July as the European Central Bank abandoned negative

interest rates and by a further 0.75 points in September. UK

government bonds, sterling corporate bonds and sterling high-yield

bonds fell 14.27%, 14.54% and 11.78% respectively over the year as

the widening differential between shorter-dated US and UK interest

rates led to sterling weakness and UK economic prospects

deteriorated. The pound fell 12.09% against the dollar over the

year. PORTFOLIO REVIEW

Your Company had a negative total return of 9.53% over the year

under review. By comparison, the Investment Association Mixed

Investment 40-85% Shares sector, a peer group of funds with a

multi-asset approach to investing and a typical investment in

global equities in the 40-85% range, fell 7.12%. The MSCI AC World

Total Return Index fell 3.73% in sterling over the year while the

MSCI UK All Cap Total Return Index rose 3.16%. In falling markets,

your company benefited from a high allocation to sterling cash and

dollars. Investment in technology stocks and a relatively low

allocation to US equities and large-cap UK equities, however, hurt

performance.

In January 2022, following a shift towards tighter monetary

policies by some central banks, your Company increased cash by

approximately GBP8 million through partial sales of Fundsmith, Crux

European Special Situations and Trojan Income and the outright

disposal of Aberdeen Standard European Income and Chelsea Managed

Monthly Income.

Your Company also received a net GBP14.8 million from the sale

of a private-equity investment, Embark Group, to Lloyds Banking

Group. As a result of this disposal, your Company's private-equity

investments fell from 12% of assets to 2% over the course of the

year. Approximately GBP1 million was invested in Vietnam Enterprise

Investments. In March, after falls by US stocks in January and

February, USD5 million was invested in the iShares Core S&P 500

exchange-traded fund (ETF).

Tighter monetary policy contributed to a rotation in market

leadership in favour of global value stocks, which gained 5.25% in

sterling over the year whereas growth stocks fell 12.77%. Growth

stocks had made gains during the initial phases of the Covid-19

pandemic because their future cash flows were discounted less

aggressively in an environment of near-zero interest rates.

Technology stocks had been particularly strong because Covid

lockdowns accelerated the adoption of new technologies, fuelling

demand for electronic goods and online services. US technology

stocks, however, retreated 7.45% in sterling over the year and

Polar Capital Technology did worse, falling 21.75% because its

holdings in smaller stocks tended to underperform larger peers.

The underperformance of growth stocks and technology companies

in particular also contributed to an 11.13% fall for Fundsmith

Equity, whose concentrated portfolio included Meta, the owner of

Facebook, as well as Intuit and Paypal. By contrast, Baillie

Gifford Global Income Growth fell 2.75% as greater diversification

and an income mandate proved defensive.

Equities in Europe excluding the UK lagged, falling 9.78% in

sterling as energy prices, particularly gas prices, rose after

Russia's invasion of Ukraine. European policymakers are being

forced to confront the consequences of energy policies that have

left the region dependent on Russian gas. BlackRock Continental

European Income fell 10.56% while Crux European Special Situations,

which has a growth bias and typically has significant holdings in

smaller companies, fell 15.27%.

UK equities rose against the trend because of the UK

stockmarket's bias towards cyclical value sectors such as energy

and mining. UK smaller companies, however, underperformed because

of their higher sensitivity to domestic trends, falling 17.18%.

Within your Company's portfolio, Man GLG Income, which has a value

investment style, did best, rising 0.83%. By contrast, Trojan

Income, which typically invests in companies where the earnings

sensitivity is lower than the market, fell 6.94%. Chelverton UK

Equity Income and Aberforth Split Level Income, two small-company

specialists, fell 11.51% and 23.19% respectively. The weakness

among UK small companies was magnified in Aberforth Split Level

Income's fall because of portfolio leverage resulting from the

trust's zero dividend preference shares.

Equities in emerging markets and Asia excluding Japan fell

14.68% and 14.44% respectively in sterling over the year, with

Chinese equities, which account for the largest proportion of both

indices, down 22.30%. Chinese stocks fell because of weak growth

resulting from the country's "zero-Covid" policy, which led to

lockdowns in cities such as Shanghai, an over-indebted property

sector and increased political risk stemming from state

intervention in quoted companies in accordance with Beijing's

"common prosperity" policy. Matthews Asia ex-Japan Dividend and

Liontrust Asia Income fell 9.93% and 8.65% respectively. The JP

Morgan investments, Emerging Markets Income Trust and Emerging

Markets Income Fund, fell 13.86% and 5.48% respectively. The bias

towards regional funds managed in accordance with an income mandate

proved defensive as low-yielding big Chinese technology companies

such as Tencent and Alibaba fell sharply while higher-yielding

stocks such as Taiwan Semiconductor Manufacturing Company fell

less.

Amongst single-country emerging market income investments,

Stewart Investors India Sustainability, which aims to buy companies

with strong business models and balance sheets, did best, up 9.31%

while Indian equities gained 8.70% in sterling. Vietnam Enterprise

Investments fell 3.16%. Vietnamese equities are benefiting from

monetary discipline, high public sector spending and an expanding

middle class. Some global manufacturers have moved capacity from

China to benefit from lower costs and avoid Sino-US sanctions.

Following Russia's Ukraine invasion, the HSBC Russia Capped

exchange-traded fund suspended trading. Your Company has taken a

conservative approach and valued the investment at zero.

Your Company predominantly invests in equity funds and achieves

diversification through holding other assets including cash and

currencies, low-risk multi-asset funds, alternative funds and gold

equity funds. It has minimal exposure to bonds and no direct

investment to UK government bonds which have fallen sharply since

your Company's year-end, forcing the Bank of England to intervene

and buy UK government bonds to stabilise the market. Your Company

benefited from holding dollars, which represented 12.5% of NAV at

the year end, with sterling falling 12.09% against the dollar over

the year. Amongst its low-risk multi-asset holdings, Trojan rose

1.47% while EF Brompton Global Conservative fell 6.54%. Aquilus

Inflection, an alternative investment, fell 3.11%. Gold rose 15.25%

in sterling but gold equities fell 9.87% as margins came under

pressure from rising costs. BlackRock Gold & General, which

invests in gold producers, fell 10.36%.

OUTLOOK

In the early autumn of 2022, US inflation remained far above the

Federal Reserve 2% target but appeared to be close to its cyclical

high, with tighter monetary policies reducing demand and economic

activity. In Europe, inflation may rise further because of Russian

gas supply restrictions. The US economy was technically in

recession following two quarters of economic decline and some

leading indicators implied that a further contraction was likely.

US 10-year government bond yields close to 3% may present a buying

opportunity.

Equity valuations have fallen but earnings forecasts may be too

high as margins come under pressure from higher costs and the

impact of rising living costs on consumer spending. The longer-term

prospects for equities look positive overall, however, because some

companies have the ability to pass on higher inflation through

higher prices and reward investors through higher dividends. Equity

income investments may outperform because higher yields may support

valuations. Your Company's equity income holdings also contribute

to the ability to pay a dividend although investment income has yet

to regain pre-Covid-19 levels.

At the year-end, your Company held 19.79% of its NAV in sterling

and dollar cash. Your Company was cautiously positioned prior to

Russia's Ukraine invasion and has taken advantage of weak markets

to increase its overall allocation to equities modestly. Further

falls in equity markets may present buying opportunities for

longer-term investors.

SCHEDULE OF LARGEST HOLDINGS AT 30TH JUNE 2022

Purchases/ Market

Market value 30 June (Sales) movement Market value 30 June

2021 2022 % of net

assets

GBP'000 GBP'000

GBP'000

GBP'000

Fundsmith Equity Fund 10,653 (1,000) (1,091) 8,562 6.91

Polar Capital Global Technology 9,299 - (2,022) 7,277 5.87

Matthews Asia Ex Japan Fund 5,839 - (681) 5,158 4.16

MI Chelverton UK Equity Income 5,387 - (806) 4,581 3.69

Fund

EF Brompton Global Conservative 4,766 - (312) 4,454 3.59

Fund

Aquilus Inflection Fund 4,378 - (136) 4,242 3.42

First State Indian Subcontinent 3,608 - 335 3,943 3.18

Fund

BlackRock Continental European 4,431 - (515) 3,916 3.16

Income Fund

Baillie Gifford Global Income 4,075 - (199) 3,876 3.13

Growth

iShares Core S&P 500 UCITS ETF - 3,969 (141) 3,828 3.09

BlackRock Gold & General 4,195 - (485) 3,710 2.99

EF Brompton Global Equity Fund 3,726 - (365) 3,361 2.71

EF Brompton Global Opportunities 3,545 - (347) 3,198 2.58

Fund

Aberforth Split Level Income Trust 4,212 - (1,068) 3,144 2.54

EF Brompton Global Growth Fund 3,309 - (265) 3,044 2.45

Vietnam Enterprise Investments 2,109 992 (157) 2,944 2.37

Liontrust Asia Income Fund 3,233 - (384) 2,849 2.30

MI Brompton UK Recovery Unit Trust 3,020 - (222) 2,798 2.26

Lindsell Train Japanese Equity 3,199 - (549) 2,650 2.14

Fund

Man GLG UK Income Fund 2,584 - (116) 2,468 1.99

TM Crux European Special 5,903 (3,000) (443) 2,460 1.98

Situations Fund

EF Brompton Global Balanced Fund 2,669 - (218) 2,451 1.98

Trojan Accumulation Fund 2,337 - 35 2,372 1.91

EF Brompton Global Income Fund 2,354 - (210) 2,144 1.73

Embark Group 14,842 (14,764) ____- _ _78 __0.06

113,673 (13,803) (6,362) 89,528 72.19

Balance not held in investments 16,054 (1,286) (4,826) 9,942 8.02

above

Total investments (excluding cash) 129,727 (15,089) (15,188) 99,450 80.21

The investment portfolio, excluding cash, can be further analysed as follows:

GBP '000

Investment funds 82,496

Investment companies and exchange traded funds 12,890

Unquoted investments, including loans of GBP1.6m 2,613

Other quoted investments 1,451

99,450

STRATEGIC REVIEW

The Strategic Review is designed to provide information

primarily about the Company's business and results for the year

ended 30th June 2022. The Strategic Review should be read in

conjunction with the Chairman's Statement and the Investment

Manager's Report, which provide a review of the year's investment

activities of the Company and the outlook for the future.

STATUS

The Company is an investment company under section 833 of the

Companies Act 2006. It is an Approved Company under the Investment

Trust (Approved Company) (Tax) Regulations 2011 (the 'Regulations')

and conducts its affairs in accordance with those Regulations so as

to retain its status as an investment trust and maintain exemption

from liability to United Kingdom capital gains tax.

The Company is a small registered Alternative Investment Fund

Manager.

PURPOSE CULTURE AND VALUES

The Directors acknowledge the expectation under the UK Code on

Corporate Governance issued by the Financial Reporting Council in

July 2018 (the 'Code') that they formally define a purpose for the

Company. The Directors have reviewed this requirement and consider

that the Company's purpose is to deliver the Company's stated

investment objective to achieve long-term capital growth for the

benefit of its investors.

Similarly, the Directors have also considered the Company's

culture and values in line with the Code requirements. The Board

has formed the view that as the Company has no direct employees,

and with operational management outsourced to the Investment

Manager, the Administrator and the Company Secretary, the Company's

culture and values have to be those of the Board. Having a stable

composition and established working practices, the Board is defined

by experienced membership, trust and robust investment challenge.

These are therefore the key characteristics of the Company's

culture and values.

STAKEHOLDER RESPONSIBILITIES (S.172 STATEMENT UNDER COMPANIES

ACT 2006)

The Directors are aware of their responsibilities to

stakeholders under both the Code and legislation through regular

governance updates from the Company Secretary. As a UK listed

investment trust, the Directors outsource operational management of

the Company, including day-to-day management of the investment

portfolio, to third parties. As a consequence, the Directors

consider their key stakeholder groups to be limited to the

Company's shareholders, its third party advisers and service

providers, and individual Board members.

The Company's Articles of Association, the Board's commitment to

follow the principles of the Code and the involvement of the

independent Company Secretary in Board matters enable the Directors

to meet their responsibilities towards individual shareholder

groups and Board members. Governance procedures are in place which

allow both investors and Directors to ask questions or raise

concerns appropriately. The Board is satisfied that those

governance procedures mean the Company can act fairly between

individual shareholders and takes account of Mr Duffield's

significant shareholding. In considering the payment of the minimum

dividend required to maintain investment trust tax status, the

recommendations to vote in favour of the resolutions at the AGM and

the asset allocation within the investment portfolio, the Board

assessed the potential benefits to shareholders and the manager of

the investment portfolio.

The Board also regularly considers the performance of its

independent third party service providers. Those third party

service providers in turn have regular opportunities to report on

matters meriting the attention of the Board, including in relation

to their own performance. The Board is therefore confident that its

responsibilities to each of its key stakeholder groups are being

discharged effectively.

As the Company does not have any employees, the Board does not

consider it necessary to establish means for employee engagement

with the Board as required by the latest version of the Code.

INVESTMENT OBJECTIVE AND POLICY

Investment Objective

The Company's investment objective is to achieve long-term

capital growth.

Investment Policy

The Company's investment policy is to allocate assets to global

investment opportunities through investment in equity, bond,

commodity, real estate, currency and other markets. The Company's

assets may have significant weightings to any one asset class or

market, including cash.

The Company will invest in pooled investment vehicles, exchange

traded funds, futures, options, limited partnerships and direct

investments in relevant markets. The Company may invest up to 15%

of its net assets in direct investments in relevant markets.

The Company will not follow any index with reference to asset

classes, countries, sectors or stocks. Aggregate asset class

exposure to any one of the United States, the United Kingdom,

Europe ex UK, Asia ex Japan, Japan or Emerging Markets and to any

individual industry sector will be limited to 50% of the Company's

net assets, such values being assessed at the time of investment

and for funds by reference to their published investment policy or,

where appropriate, the underlying investment exposure.

The Company may invest up to 20% of its net assets in unlisted

securities (excluding unquoted pooled investment vehicles), such

values being assessed at the time of investment.

The Company will not invest more than 15% of its net assets in

any single investment, such values being assessed at the time of

investment.

Derivative instruments and forward foreign exchange contracts

may be used for the purposes of efficient portfolio management and

currency hedging. Derivatives may also be used outside of efficient

portfolio management to meet the Company's investment objective.

The Company may take outright short positions in relation to up to

30% of its net assets, with a limit on short sales of individual

stocks of up to 5% of its net assets, such values being assessed at

the time of investment.

The Company may borrow up to 30% of net assets for short-term

funding or long-term investment purposes.

No more than 10%, in aggregate, of the value of the Company's

total assets may be invested in other closed-ended investment funds

except where such funds have themselves published investment

policies to invest no more than 15% of their total assets in other

listed closed-ended investment funds.

Information on the Company's portfolio of assets with a view to

spreading investment risk in accordance with its investment policy

is set out above.

FINANCIAL REVIEW

Net assets at 30th June 2022 amounted to GBP123,978,000 compared

with GBP138,132,000 at 30th June 2021. In the year under review,

the NAV per Ordinary share decreased by 10.25% from 194.49p to

174.56p, after paying a dividend of 1.40p per share.

The Group's gross revenue rose to GBP1,857,000 (2021:

GBP1,522,000), recovering from the worst impact of the Covid-19

pandemic. After deducting expenses and taxation, the revenue profit

for the year was GBP700,000 (2021: GBP429,000).

Total expenses for the year rose to GBP1,157,000 after an

increased management fee (2021: GBP1,093,000). In the year under

review the investment management fee increased to GBP837,000 (2021:

GBP774,000), reflecting the Company's increased average NAV over

the period. Further details on the Company's expenses may be found

in notes 3 and 4.

Historically, dividends have not formed a central part of the

Company's investment objective. The increased investment in income

focused funds over the last few years has enabled the Directors to

declare an increased dividend in recent years. The pandemic's

adverse impact on dividends received is seen as temporary, and the

Directors have decided to utilise retained earnings to maintain the

dividend. The Directors propose a final dividend of 1.40p per

Ordinary share in respect of the year ended 30th June 2022 (2021:

1.40p). If approved at the Annual General Meeting, the dividend

will be paid on 30th November 2022 to shareholders on the register

at the close of business on 4th November 2022 (ex-dividend 3rd

November 2022).

The primary source of the Company's funding is shareholder

funds.

While the future performance of the Company is dependent, to a

large degree, on the performance of international financial

markets, which in turn are subject to many external factors, the

Board's intention is that the Company will continue to pursue its

stated investment objective in accordance with the strategy

outlined above. Further comments on the short-term outlook for the

Company are set out in the Chairman's Statement and the Investment

Manager's report.

PERFORMANCE MEASUREMENT AND KEY PERFORMANCE INDICATORS

Throughout the year the Group's investments included seven funds

managed by the Investment Manager (2021: seven). No investment

management fees were payable directly by the Company in respect of

these investments.

In order to measure the success of the Company in meeting its

objectives, and to evaluate the performance of the Investment

Manager, the Directors review at each meeting: net asset value,

income and expenditure, asset allocation and attribution, share

price of the Company and the discount. The Directors take into

account a number of different indicators as the Company does not

have a formal benchmark, and performance against these is shown in

the Financial Highlights.

Performance is discussed in the Chairman's Statement and

Investment Manager's Report.

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks identified by the Board, and the steps the

Board takes to mitigate them, are discussed below. The audit

committee reviews existing and emerging risks on a six monthly

basis. The Board has closely monitored the societal, economic and

market focused implications of the events in 2021 and 2022.

Investment strategy

Inappropriate long-term strategy, asset allocation and fund

selection could lead to underperformance. The Board discusses

investment performance at each of its meetings and the Directors

receive reports detailing asset allocation, investment selection

and performance.

Business conditions and general economy

The Company's future performance is heavily dependent on the

performance of different equity and currency markets. The Board

cannot mitigate the risks arising from adverse market movements.

However, diversification within the portfolio will reduce the

impact. Further information is given in portfolio risks below.

Macro-economic event risk

The Covid pandemic was felt globally in 2021 and 2022 although

economies and markets have recovered. The scale and potential

adverse impact of a macro-economic event, such as the Covid

pandemic, has highlighted the possibility of a number of identified

risks such as market risk, currency risk, investment liquidity risk

and operational risk having an adverse impact at the same time. The

risk may impact on: the value of the Company's investment

portfolio, its liquidity, meaning investments cannot be realised

quickly, or the Company's ability to operate if the Company's

suppliers face financial or operational difficulties. The Directors

closely monitor these areas and currently maintain a significant

cash balance.

Portfolio risks - market price, foreign currency and interest

rate risks

The largest investments are listed above. Investment returns

will be influenced by interest rates, inflation, investor

sentiment, availability/cost of credit and general economic and

market conditions in the UK and globally. A significant proportion

of the portfolio is in investments denominated in foreign

currencies and movements in exchange rates could significantly

affect their sterling value. The Investment Manager takes all these

factors into account when making investment decisions but the

Company does not normally hedge against foreign currency movements.

The Board's policy is to hold a spread of investments in order to

reduce the impact of the risks arising from the above factors by

investing in a spread of asset classes and geographic regions.

Net asset value discount

The discount in the price at which the Company's shares trade to

net asset value means that shareholders cannot realise the real

underlying value of their investment. Over the last few years the

Company's share price has been at a significant discount to the

Company's net asset value. The Directors regularly review the level

of discount, however given the investor base of the Company, the

Board is very restricted in its ability to influence the discount

to net asset value.

Investment Manager

The quality of the team employed by the Investment Manager is an

important factor in delivering good performance and the loss of key

staff could adversely affect returns. A representative of the

Investment Manager attends each Board meeting and the Board is

informed if any major changes to the investment team employed by

the Investment Manager are proposed. The Investment Manager

regularly informs the Board of developments and any key

implications for either the investment strategy or the investment

portfolio.

Tax and regulatory risks

A breach of The Investment Trust (Approved Company) (Tax)

Regulations 2011 (the 'Regulations') could lead to capital gains

realised within the portfolio becoming subject to UK capital gains

tax. A breach of the FCA Listing Rules could result in suspension

of the Company's shares, while a breach of company law could lead

to criminal proceedings, financial and/or reputational damage. The

Board employs Brompton Asset Management Limited as Investment

Manager, and Maitland Administration Services Limited as Secretary

and Administrator, to help manage the Company's legal and

regulatory obligations.

Operational

Disruption to, or failure of, the Investment Manager's or

Administrator's accounting, dealing or payment systems, or the

Custodian's records, could prevent the accurate reporting and

monitoring of the Company's financial position. The Company is also

exposed to the operational risk that one or more of its suppliers

may not provide the required level of service. How the Board

monitors its service providers, with an emphasis on their business

interruption procedures, is set out in the Corporate Governance

Statement.

The Directors confirm that they have carried out a robust

assessment of the risks and emerging risks facing the Company,

including those that would threaten its business model, future

performance, solvency and liquidity.

VIABILITY STATEMENT

The assets of the Company consist mainly of securities that are

readily realisable or cash and it has no significant liabilities

and no financial commitments. Investment income has exceeded annual

expenditure and current liquid net assets cover current annual

expenses for many years. Accordingly, the Company is of the opinion

that it has adequate financial resources to continue in operational

existence for the long term which is considered to be in excess of

five years. Five years is considered a reasonable period for

investors when making their investment decisions. In reaching this

view the Directors reviewed the anticipated level of annual

expenditure against the cash and liquid assets within the

portfolio. The Directors have also considered the risks the Company

faces in making this viability statement.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ISSUES

The Company has no employees, with day-to-day operational and

administration of the Company being delegated by the Board to the

Independent Investment Manager and the Administrator. The Company's

portfolio is managed in accordance with the investment objective

and policy approved by shareholders. The Company is primarily

invested in investment funds and exchange traded funds, where it

has no direct dialogue with the underlying investments.

Environmental, social and governance considerations of underlying

investee companies are not a key driver when evaluating existing

and potential investments.

GREENHOUSE GAS EMISSIONS

As the Company has no premises, properties or equipment of its

own, the Directors deem the Company to be exempt from making any

disclosures under the Companies Act 2006 (Strategic Reports and

Directors' Reports) Regulations 2013.

STREAMLINED ENERGY AND CARBON REPORTING

The Company is categorised as a lower energy user under the HMRC

Environmental Reporting Guidelines March 2019 and is therefore not

required to make the detailed disclosures of energy and carbon

information set out within the guidelines. The Company's energy and

carbon information is not therefore disclosed in this report.

MODERN SLAVERY ACT

The Directors rely on undertakings given by its independent

third party advisers that those companies continue to have no

instances of modern slavery either within their businesses or

supply chains. Given the financial services focus and geographical

location of all third party suppliers to the Company, the Directors

perceive the risks of a contravention of the legislation to be very

low.

GER DIVERSITY

The Board of Directors comprises three male directors, and

currently no female board members. Composition of the Board has not

changed since 2017, and the Board has benefited from stable

membership and strong working relationships between individual

directors in that time. For this reason, the Board does not

currently anticipate making future changes.

The Board is committed to the benefits of diversity, including

gender, ethnicity and background when considering new appointments

to the Board, whilst always seeking to base any decision on merit,

measured by knowledge, experience and ability to make a positive

contribution to the Board's decision making.

CLIMATE RELATED REPORTING

As a closed-end investment fund, the Group is exempt from any

climate related reporting. The Group mainly invests in funds. Those

funds are responsible for determining the impact of climate change

when making their investment decisions. The Group does not

influence the investment decisions of the funds it invests in.

LISTING RULE 9.8.4

Listing rule 9.8.4 requires the Company to include certain

information in a single identifiable section of the Annual Report

or a cross-reference table indicating where the information is set

out. The Directors confirm that there were no disclosures to be

made in this regard.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME AT 30TH JUNE

2022

Year ended Year ended

30th June 2022 30th June 2021

Revenue Revenue

Return Capital Return Capital

Return Total Return Total

GBP '000 GBP '000 GBP '000 GBP '000 GBP '000 GBP '000

Notes

INVESTMENT INCOME 2 1,837 - 1,837 1,519 - 1,519

Other operating income 2 20 - 20 3 - 3

1,857 - 1,857 1,522 - 1,522

GAINS AND LOSSES ON INVESTMENTS

(Losses)/gains on investments at fair value

through profit or loss

9 - (15,188) (15,188) - 25,927 25,927

Legal and professional costs - (60) (60) - - -

Other exchange gains/(losses) - 1,382 1,382 - (1,119) (1,119)

Trail rebates - 6 6 - 4 4

1,857 (13,860) 1,522 24,812 26,334

(12,003)

EXPENSES

Management fees 3 (837) - (837) (774) - (774)

Other expenses 4 (320) - (320) (319) - (319)

(1,157) - (1,157) (1,093) - (1,093)

(LOSS)/PROFIT BEFORE TAX 700 (13,860) (13,160) 429 24,812 25,241

Tax 5 - - - - - -

(LOSS)/PROFIT FOR THE YEAR 700 (13,860) (13,160) 429 24,812 25,241

EARNINGS PER SHARE

Ordinary shares (pence) 7 0.98p (19.51)p (18.53) 0.61p 34.93p 35.54p

p

The total column of this statement represents the Group's profit

and loss account, prepared in accordance with UK adopted

international accounting standards. The supplementary Revenue

Return and Capital Return columns are both prepared under guidance

published by the Association of Investment Companies. All revenue

and capital items in the above statement derive from continuing

operations.

The Company did not have any income or expense that was not

included in '(Loss)/Profit for the year'. Accordingly, the

'(Loss)/Profit for the year' is also the 'Total comprehensive

income for the year', as defined in IAS 1(revised) and no separate

Statement of Comprehensive Income has been presented.

No operations were acquired or discontinued during the year.

All income is attributable to the equity holders of the parent

company. There are no minority interests.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30TH

JUNE 2022

Share

Share premium Special reserve Retained earnings

Note capital Total

GBP '000 GBP '000 GBP '000

GBP '000 GBP '000

AT 30th JUNE 2021 710 21,573 56,908 58,941 138,132

Total comprehensive loss for the year - - - (13,160) (13,160)

Dividend paid 8 - - - (994) (994)

AT 30th JUNE 2022 710 21,573 56,908 44,787 123,978

Included within Retained earnings were GBP1,666,000 of Company

reserves available for distribution.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30TH

JUNE 2021

Share

Share premium Special reserve Retained earnings

Note capital Total

GBP '000 GBP '000 GBP '000

GBP '000 GBP '000

AT 30th JUNE 2020 710 21,573 56,908 34,694 113,885

Total comprehensive income for the year - - - 25,241 25,241

Dividend paid 8 - - - (994) (994)

AT 30th JUNE 2021 710 21,573 56,908 58,941 138,132

Included within Retained earnings were GBP1,960,000 of Company

reserves available for distribution.

CONSOLIDATED BALANCE SHEET AT 30TH JUNE 2022

30th June 30th June

Notes 2022 2021

GBP '000 GBP '000

NON-CURRENT ASSETS

Investments at fair value through profit or loss 9 99,450 129,727

CURRENT ASSETS

Other receivables 11 258 235

Cash and cash equivalents 12 24,530 8,440

24,788 8,675

TOTAL ASSETS 124,238 138,402

CURRENT LIABILITIES

Other payables 13 (260) (270)

TOTAL ASSETS LESS CURRENT LIABILITIES 123,978 138,132

NET ASSETS 123,978 138,132

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS

Called-up share capital 14 710 710

Share premium 15 21,573 21,573

Special reserve 15 56,908 56,908

Retained earnings 15 44,787 58,941

TOTAL EQUITY 123,978 138,132

NET ASSET VALUE PER ORDINARY SHARE 16 174.56p 194.49p

CONSOLIDATED CASH FLOW STATEMENTS AT 30TH JUNE 2022

Year ended Year ended Year ended Year ended

30th June 30th June 30th June 30th June

2022 2022 2021 2021

Group Company Group Company

Notes GBP '000 GBP '000 GBP '000 GBP '000

NET CASH INFLOW FROM OPERATING ACTIVITIES

673 673 376 376

INVESTING ACTIVITIES

Purchase of investments (11,861) (11,861) (9,717) (9,717)

Sale of investments 26,950 26,950 8,932 8,932

Legal and professional costs (60) (60) - -

NET CASH INFLOW/(OUTFLOW) FROM INVESTING ACTIVITIES

15,029 15,029 (785) (785)

FINANCING

Equity dividends paid 8 (994) (994) (994) (994)

NET CASH OUTFLOW FROM FINANCING

(994) (994) (994) (994)

INCREASE/(DECREASE) IN CASH 14,708 14,708 (1,403) (1,403)

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN CASH & CASH

EQUIVALENTS

Increase/(decrease) in cash resulting from cash flows 14,708 14,708 (1,403) (1,403)

Exchange movements 1,382 1,382 (1,119) (1,119)

Movement in net funds 16,090 16,090 (2,522) (2,522)

Net funds at start of the year 8,440 8,440 10,962 10,962

CASH & CASH EQUIVALENTS AT OF YEAR 17 24,530 24,530 8,440 8,440

RECONCILIATION OF PROFIT BEFORE

FINANCE COSTS AND TAXATION TO NET CASH FLOW FROM OPERATING

ACTIVITIES

(Loss)/profit before finance costs and taxation* (13,160) (13,160) 25,241 25,241

(Losses)/gains on investments 15,188 15,188 (25,927) (25,241)

Legal and professional costs 60 60 - -

Exchange differences (1,382) (1,382) 1,119 1,119

Capital trail rebates (6) (6) (4) (4)

Net revenue gains before taxation 700 700 429 935

Decrease/(Increase) in debtors (30) (30) (90) (90)

(Decrease)/Increase in creditors (10) (10) 41 (465)

Taxation 7 7 (8) (8)

Capital trail rebates 6 6 4 4

NET CASH INFLOW FROM OPERATING ACTIVITIES 673 673 376 376

*Includes dividends received in cash of GBP1,653,000 (2021:

GBP1,273,000), accumulation income of GBP149,000 (2021: GBP187,000)

and interest received of GBP20,000 (2021: GBP3,000).

NOTES TO THE ACCOUNTS FOR THE YEARED 30TH JUNE 2022

1. ACCOUNTING POLICIES

The financial statements have been prepared in accordance with

UK adopted international accounting standards.

These financial statements are presented in pounds sterling, the

Group's functional currency, being the currency of the primary

economic environment in which the Group operates, rounded to the

nearest thousand.

(a) Basis of preparation: The financial statements have been

prepared on a going concern basis (see 1(p)). The principal

accounting policies adopted are set out below.

Where presentational guidance set out in the Statement of

Recommended Practice 'Financial Statements of Investment Trust

Companies and Venture Capital Trusts' ('SORP') issued by the

Association of Investment Companies ('AIC') in November 2014 and

updated in February 2018 and October 2019 with consequential

amendments is consistent with the requirements of UK adopted

International Accounting Standards, the Directors have sought to

prepare the financial statements on a basis compliant with the

recommendations of the SORP.

(b) Basis of consolidation: The consolidated financial

statements include the accounts of the Company and its subsidiary

made up to 30th June 2022. No statement of comprehensive income is

presented for the parent company as permitted by Section 408 of the

Companies Act 2006.

The Company is an investment entity as defined by UK adopted

International Accounting Standards and assets are held at their

fair value reflecting the impact, if any, of climate change (see 1

(g)). The consolidated accounts include subsidiaries which are an

integral part of the Group and not investee companies.

Subsidiaries are consolidated from the date of their

acquisition, being the date on which the Company obtains control,

and continue to be consolidated until the date that such control

ceases. The financial statements of the subsidiary used in the

preparation of the consolidated financial statements are based on

consistent accounting policies. All intra-group balances and

transactions, including unrealised profits arising therefrom, are

eliminated. Subsidiaries are valued at fair value, which is

considered to be their NAV, in the accounts of the Company.

(c) Presentation of Statement of Comprehensive Income: In order

to better reflect the activities of an investment trust company and

in accordance with guidance issued by the AIC, supplementary

information which analyses the consolidated statement of

comprehensive income between items of a revenue and capital nature

has been presented alongside the consolidated statement of

comprehensive income.

In accordance with the Company's Articles of Association, net

capital returns may not be distributed by way of a dividend.

Additionally, the net revenue profit is the measure the Directors

believe is appropriate in assessing the Group's compliance with

certain requirements set out in the Investment Trust (Approved

Company) (Tax) Regulations 2011.

(d) Use of estimates: The preparation of financial statements

requires the Group to make estimates and assumptions that affect

items reported in the consolidated and parent company balance

sheets and consolidated statement of comprehensive income and the

disclosure of contingent assets and liabilities at the date of the

financial statements. Although these estimates are based on the

Directors' best knowledge of current facts, circumstances and, to

some extent, future events and actions, the Group's actual results

may ultimately differ from those estimates, possibly significantly.

The most significant estimate relates to the valuation of unquoted

investments.

(e) Revenue: Dividends and other such revenue distributions from

investments are credited to the revenue column of the consolidated

statement of comprehensive income on the day in which they are

quoted ex-dividend. Where the Company has elected to receive its

dividends in the form of additional shares rather than in cash and

the amount of the cash dividend is recognised as income, any excess

in the value of the shares received over the amount recognised is

credited to the capital reserve. Deemed revenue from offshore funds

is credited to the revenue account. Interest on fixed interest

securities and deposits is accounted for on an accruals basis.

(f) Expenses: Expenses are accounted for on an accruals basis.

Management fees, administration and other expenses, with the

exception of transaction charges, are charged to the revenue column

of the consolidated statement of comprehensive income. Performance

fees and transaction charges are charged to the capital column of

the consolidated statement of comprehensive income.

(g) Investments held at fair value: Purchases and sales of

investments are recognised and derecognised on the trade date where

a purchase or sale is under a contract whose terms require delivery

within the timeframe established by the market concerned, and are

initially measured at fair value.

All investments are classified as held at fair value through

profit or loss on initial recognition and are measured at

subsequent reporting dates at fair value, which is either the

quoted bid price or the last traded price, depending on the

convention of the exchange on which the investment is quoted.

Investments in units of unit trusts or shares in OEICs are valued

at the bid price for dual priced funds, or single price for

non-dual priced funds, released by the relevant investment manager.

Unquoted investments are valued by the Directors at the balance

sheet date based on recognised valuation methodologies, in

accordance with International Private Equity and Venture Capital

('IPEVC') Valuation Guidelines such as dealing prices or third

party valuations where available, net asset values and other

information as appropriate.

As the quoted investments hold listed companies, the fair value

prices should reflect the impact, if any, of climate change.

(h) Taxation: The charge for taxation is based on taxable income

for the year. Withholding tax deducted from income received is

treated as part of the taxation charge against income. Taxation

deferred or accelerated can arise due to temporary differences

between the treatment of certain items for accounting and taxation

purposes. Full provision is made for deferred taxation under the

liability method on all temporary differences not reversed by the

Balance Sheet date. No deferred tax provision is made against

deemed reporting offshore funds. Deferred tax assets are only

recognised when there is more likelihood than not that there will

be suitable profits against which they can be applied.

(i) Foreign currency: Assets and liabilities denominated in

foreign currencies are translated at the rates of exchange ruling

at the balance sheet date. Foreign currency transactions are

translated at the rates of exchange applicable at the transaction

date. Exchange gains and losses are taken to the revenue or capital

column of the consolidated statement of comprehensive income

depending on the nature of the underlying item.

(j) Capital reserve: The following are accounted for in this

reserve:

- gains and losses on the realisation of investments together

with the related taxation effect;

- foreign exchange gains and losses on capital transactions,

including those on settlement, together with the related taxation

effect;

- revaluation gains and losses on investments;

- legal expenses in assessing potential investments or incurred

in disposing of investments; and

- trail rebates received from the investment managers of the

Company's investments.

The capital reserve is not available for the payment of

dividends.

(k) Revenue reserve: This reserve includes net revenue

recognised in the revenue column of the Statement of Comprehensive

Income.

(l) Special reserve: The special reserve can be used to finance

the redemption and/or purchase of shares in issue.

(m) Cash and cash equivalents: Cash and cash equivalents

comprise current deposits and balances with banks. Cash and cash

equivalents may be held for the purpose of either asset allocation

or managing liquidity.

(n)Dividends payable: Dividends are recognised from the date on

which they are irrevocably committed to payment.

(o) Segmental Reporting: The Directors consider that the Group

is engaged in a single segment of business with the primary

objective of investing in securities to generate long term capital

growth for its shareholders. Consequently no business segmental

analysis is provided.

(p) Going concern basis of preparation: The financial statements

are prepared on a going concern basis under the historical cost

convention, and on the assumption that approval as an investment

trust under section 1158 of the Corporation Tax Act 2010 and the

Investment Trust (Approved Company) (Tax) Regulations 2011 will be

retained.

(q) New standards, interpretations and amendments effective for

the periods beginning on or after 1st July 2021: There are no new

standards, amendments to standards and interpretations that have

impacted the Group and should be disclosed.

(r) New standards, interpretations and amendments issued which

are not yet effective and applicable for the periods beginning on

or after 1st July 2022: There are no new standards, amendments to

standards and interpretations that will impact the Group and should

be disclosed. 2. INVESTMENT INCOME

Year ended Year ended

30th June 30th June

2022 2021

GBP '000 GBP '000

INCOME FROM INVESTMENTS

UK net dividend income 1,581 1,278

Unfranked investment income 219 238

UK fixed interest 37 3

1,837 1,519

OTHER OPERATING INCOME

Bank interest receivable 20 3

20 3

TOTAL INCOME COMPRISES

Dividends 1,800 1,516

Other income 57 6

1,857 1,522

The above dividend and interest income has been included in the

profit before finance costs and taxation included in the cash flow

statements.

3. MANAGEMENT AND PERFORMANCE FEES

Year ended Year ended

30th June 2022 30th June 2021

Revenue Capital Total Revenue Capital Total

GBP '000 GBP '000

GBP '000 GBP '000 GBP '000 GBP '000

Investment management fee 837 - 837 774 - 774

837 - 837 774 - 774

At 30th June 2022 there were amounts accrued of GBP193,000

(2021: GBP214,000) for investment management fees.

4. OTHER EXPENSES

Year ended Year ended

30th June 30th June

2022 2021

GBP '000 GBP '000

Directors' remuneration 65 65

Administrative and secretarial fee 95 95

Auditors' remuneration

- Audit 55 41

- Interim review - 8

Other 105 110

320 319

Allocated to:

- Revenue 320 319

- Capital - -

320 319

5. TAXATION

(a) Analysis of tax charge for the year:

Year ended Year ended

30th June 2022 30th June 2021

Revenue Return

Capital Return Revenue Return Capital Return

GBP '000 GBP '000 Total GBP '000 Total

GBP '000 GBP '000 GBP '000

Overseas tax 2 - 2 9 - 9

Recoverable income tax (2) - (2) (9) - (9)

Total current tax for the year - - - - - -

Deferred tax - - - - - -

Total tax for the year (note 5b) - - - - - -

(b) Factors affecting tax charge for the year:

The charge for the year of GBPnil (2021: GBPnil) can be

reconciled to the profit per the consolidated statement of

comprehensive income as follows:

Year ended Year ended

30th June 30th June

2022 2021

GBP '000 GBP '000

Total (loss)/profit before tax (13,160) 25,241

Theoretical tax at the UK corporation tax rate of 19.00% (2021: 19.00%) (2,500) 4,796

Effects of:

Non-taxable UK dividend income (300) (243)

Gains and losses on investments that are not taxable 2,623 (4,714)

Excess expenses not utilised 197 188

Overseas dividends which are not taxable (20) (27)

Overseas tax 2 9

Recoverable income tax (2) (9)

Total tax for the year - -

Due to the Company's tax status as an investment trust and the

intention to continue meeting the conditions required to maintain

approval of such status in the foreseeable future, the Company has

not provided tax on any capital gains arising on the revaluation or

disposal of investments.

There is no deferred tax (2021: GBPnil) in the capital account

of the Company. There is no deferred tax charge in the revenue

account (2021: GBPnil).

At the year-end there is an unrecognised deferred tax asset of

GBP884,000 (2021: GBP669,000) based on the enacted tax rates of 19%

for financial years beginning 1st April 2022, as a result of excess

expenses.

6. COMPANY RETURN FOR THE YEAR

The Company's total loss for the year was GBP13,160,000 (2021:

profit GBP25,241,000).

7. RETURN PER ORDINARY SHARE

Total return per Ordinary share is based on the Group total loss

on ordinary activities after taxation of GBP13,160,000 (2021:

profit GBP25,241,000) and on 71,023,695 (2021: 71,023,695) Ordinary

shares, being the weighted average number of Ordinary shares in

issue during the year.

Revenue return per Ordinary share is based on the Group revenue

profit on ordinary activities after taxation of GBP700,000 (2021:

GBP429,000) and on 71,023,695 (2021: 71,023,695) Ordinary shares,

being the weighted average number of Ordinary shares in issue

during the year.

Capital return per Ordinary share is based on net capital loss

for the year of GBP13,860,000 (2021: profit GBP24,812,000) and on

71,023,695 (2021: 71,023,695) Ordinary shares, being the weighted

average number of Ordinary shares in issue during the year.

8. DIVIDS ON EQUITY SHARES

Amounts recognised as distributions in the year:

Year ended Year ended

30th June 30th June

2022 2021

GBP '000 GBP '000

Dividends paid during the year 994 994

Dividends payable in respect of the year ended:

30th June 2022: 1.4p (2021: 1.4p) per share 994 994

It is proposed that a dividend of 1.4p per share will be paid in

respect of the current financial year.

9. INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS

Year ended Year ended

30th June 30th June

2022 2022

GBP '000 GBP '000

GROUP AND COMPANY 99,450 129,727

ANALYSIS OF INVESTMENT

PORTFOLIO - GROUP AND COMPANY

Quoted* Unquoted Total

GBP '000 GBP '000 GBP '000

Opening book cost 68,281 9,428 77,709

Opening investment holding gains 44,200 7,818 52,018

Opening valuation 112,481 17,246 129,727

Movement in period

Purchases at cost 7,819 4,042 11,861

Sales

- Proceeds (8,738) (18,212) (26,950)

- Realised gains/(losses) on sales 3,534 14,841 18,375

Movement in investment holding gains for the year (18,259) (15,304) (33,563)

Closing valuation 96,837 2,613 99,450

Closing book cost 70,896 10,099 80,995

Closing investment holding gains 25,941 (7,486) 18,455

Closing valuation 96,837 2,613 99,450

* Quoted investments include unit trust and OEIC funds and one

monthly priced fund.

Year ended Year ended

30th June 30th June

2022 2021

GBP '000 GBP '000

ANALYSIS OF CAPITAL GAINS AND LOSSES

Realised gains on sales of investments 18,375 745

Investment holding (losses)/gains (33,563) 25,182

Net (losses)/gains on investments attributable to ordinary shareholders (15,188) 25,927

Transaction costs

The purchase and sale proceeds figures above include transaction

costs on purchases of GBP1,984 (2021: GBP680) and on sales of

GBPnil (2021: GBPnil).

10. INVESTMENT IN SUBSIDIARY UNDERTAKING

The Company owns the whole of the issued share capital (GBP1) of

JIT Securities Limited, a company registered in England and

Wales.

The financial position of the subsidiary is summarised as

follows:

Year ended Year ended

30th June 30th June

2022 2021

GBP '000 GBP '000

Net assets brought forward - 506

Dividend paid to parent - (506)

Net assets carried forward - -

11. OTHER RECEIVABLES

30th June 30th June

2022 2021

Group Group

GBP '000 GBP '000

Prepayments and accrued income 253 223

Taxation 5 12

258 235

12. CASH AND CASH EQUIVALENTS

30th June 30th June

2022 2021

Group Group

GBP '000 GBP '000

Cash at bank and on deposit 24,530 8,440

13. OTHER PAYABLES

30th June 30th June

2022 2021

Group Group

GBP '000 GBP '000

Accruals 260 270

260 270

14. CALLED UP SHARE CAPITAL

30th June 30th June

2022 2021

GBP '000 GBP '000

Authorised

305,000,000 (2021: 305,000,000) Ordinary shares of GBP0.01 each 3,050 3,050

Issued and fully paid

71,023,695 (2021: 71,023,695) Ordinary shares of GBP0.01 each 710 710

15. RESERVES

Share Special Retained

Premium Reserve earnings

account

GBP '000 GBP '000 GBP '000

GROUP

At 30th June 2021 21,573 56,908 58,941

Decrease in investment holding gains - - (33,563)

Net gains on realisation of investments - - 18,375

Gains on foreign currency - - 1,382

Trail rebates - - 6

Legal fees allocated to capital - - (60)

Retained revenue profit for year - - 700

Dividend paid - - (994)

At 30th June 2022 21,573 56,908 44,787

The components of retained earnings are set out below:

30th June 30th June

2022 2021

GBP '000 GBP '000

GROUP

Capital reserve - realised 24,666 5,316

Capital reserve - revaluation 18,455 52,018

Revenue reserve 1,666 1,607

44,787 58,941

16. NET ASSET VALUE PER ORDINARY SHARE

The net asset value per Ordinary share is calculated on net

assets of GBP123,978,000 (2021: GBP138,132,000) and 71,023,695

(2021: 71,023,695) Ordinary shares in issue at the year end.

17. ANALYSIS OF CASH AND CASH EQUIVALENTS AT THE END OF THE

YEAR

At 1st July 2021 At 30th June 2022

Cash flow Exchange movement

GBP '000 GBP '000

GROUP

Cash at bank and on deposit 8,440 14,708 1,382 24,530

18. FINANCIAL INFORMATION

2022 Financial information

The figures and financial information for 2022 are unaudited and

do not constitute the statutory accounts for the year. The

preliminary statement has been agreed with the Company's auditors

and the Company is not aware of any likely modification to the

auditor's report required to be included with the annual report and

accounts for the year ended 30th June 2022.

2021 Financial information

The figures and financial information for 2021 are extracted

from the published Annual Report and Accounts for the year ended

30th June 2021 and do not constitute the statutory accounts for the

year. The Annual Report and Accounts for the year-end 30th June

2021 (available on the Company's website www.nsitplc.com) has been

delivered to the registrar of Companies and includes the

Independent Auditors report which was unqualified and did not

contain a statement under either section 498 (2) or section 498 (3)

of the Companies Act 2006.

Annual Report and Accounts

The accounts for the year ended 30th June 2022 will be sent to

shareholders in October 2022 and will be available on the Company's

website or in hard copy format at the Company's registered office,

1 Knightsbridge Green, London SW1X 7QA and will be available for

inspection. A copy will also be submitted to the FCA's National

Storage Mechanism.

The Annual General Meeting of the Company will be held on 17th

November 2022 at 11.00am at 1 Knightsbridge Green, London SW1X

7QA.

11th October 2022

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB0002631041

Category Code: ACS

TIDM: NSI

Sequence No.: 193677

EQS News ID: 1460837

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1460837&application_name=news

(END) Dow Jones Newswires

October 11, 2022 05:10 ET (09:10 GMT)

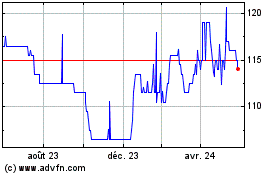

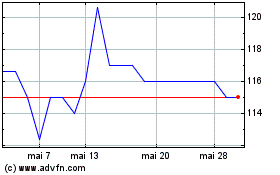

New Star Investment (AQSE:NSI.GB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

New Star Investment (AQSE:NSI.GB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024