Bitcoin’s Market at a Crossroads: Are Long-Term Holders Signalling a Correction or a Rally?

07 Décembre 2024 - 6:00AM

NEWSBTC

The role of Bitcoin long-term holders (LTHs) has again come under

the microscope of analysts as the asset currently faces a 4.5%

correction from its all-time high (ATH) above $100,000 created on

Thursday. These holders, defined as those who retain their Bitcoin

for over 155 days, are known to influence market movements through

their accumulation and distribution behaviors significantly. A

recent analysis by CryptoQuant analyst Datascope has highlighted

key trends in LTH activity that could signal the next phase for

Bitcoin. Related Reading: Hut 8 Unveils $750 Million Initiative To

Establish Strategic Bitcoin Reserve Key Trends And Historical

Context Datascope’s insights highlight the importance of the LTH

accumulation/distribution ratio as an on-chain metric. This ratio

reflects whether LTHs are amassing Bitcoin, indicative of market

bottoms, or liquidating holdings during price peaks, often

signaling corrections. Historical patterns from 2013 and 2017 saw

LTHs engaging in substantial selling at market highs, while periods

like 2019 and 2020 were marked by intense accumulation, paving the

way for bull markets. According to datascope’s analysis, the peaks

of 2013 and 2017, which were characterized by heightened selling

activity from LTHs, correlated with significant price corrections.

These corrections, fueled by profit-taking, marked the culmination

of bullish cycles. Conversely, during the lows of 2019 and 2020,

LTHs exhibited strong accumulation tendencies, which signalled

confidence in Bitcoin’s long-term potential and laying the

groundwork for subsequent price surges. Now in 2024, datascope

pointed out that the LTH metric is once again providing critical

insights into market conditions. Recent data reveals increased

selling activity among LTHs, a behaviour observed during periods of

market overheating or resistance at current price levels. While

this trend could hint at an impending correction, it also raises

the possibility of the market transitioning into a new accumulation

phase. Echoing this, a recent report from CryptoQuant reveals there

has been sustained buying pressure from US investors. Bitcoin

passes $100k as institutional demand drives the market. The

Coinbase Premium Index highlights sustained buying pressure from

U.S. investors. pic.twitter.com/eZvKFCmVxs — CryptoQuant.com

(@cryptoquant_com) December 5, 2024 Current Outlook On Bitcoin

Bitcoin has continued to see decline in its price following the

$103,679 ATH recorded yesterday. At the time of writing, BTC has

dropped 2.2% in the past 24 hours with a current trading price of

$99,208. Regardless of this, the asset appears to still be in an

uptrend. over the past month, Bitcoin is still up by roughly 33.6%

with a current market capitalisation of $1.965 trillion. Related

Reading: Is Bitcoin’s $100K Just the Beginning? Key Insights from

Supply Distribution Data datascope commenting on Bitcoin’s current

market outlook wrote: The market is at a crossroads, potentially

entering a new upward cycle or consolidating before a deeper

correction. With Bitcoin in an “overheated” zone, investors should

exercise caution and evaluate profit-taking opportunities. Featured

image created with DALL-E, Chart from TradingView

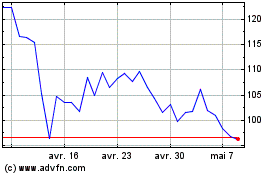

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024