Bitcoin Indicator Signals Short-Term Holders Have Been Taking Profits – Is The Next Rally Near?

09 Février 2025 - 12:30PM

NEWSBTC

Bitcoin is trading below the $100K mark after enduring a volatile

and turbulent week. The cryptocurrency faced extreme selling

pressure last Sunday, dropping over 9% in less than 24 hours.

Although Bitcoin managed a slight recovery on Monday, the selling

pressure has persisted, leaving the market in a state of

uncertainty. Related Reading: Whales Accumulate 100 Million

Dogecoin In 24 Hours – Demand Signals Growing Confidence Key

metrics shared by Axel Adler on X shed light on the current state

of Bitcoin’s price action. According to Adler, the Bitcoin

Short-Term Holder (STH) MVRV indicator has declined from $98K and a

value of 1.35 to average levels. This drop suggests that short-term

holders have been actively taking profits during this period of

heightened volatility. The STH MVRV is a critical indicator for

assessing market sentiment among short-term participants.

Historically, values above 1.30–1.35 signal an overheated market,

often leading to sell-offs. The recent decline in the indicator

indicates that some short-term holders have exited their positions,

potentially marking the end of a local overheated phase. As Bitcoin

consolidates below $100K, market participants are keeping a close

eye on key support and resistance levels, hoping to identify the

next big move in this unpredictable market environment. For now,

profit-taking and volatility dominate the narrative. Bitcoin Faces

Persistent Selling Pressure As Short-Term Holders Exit Positions

Bitcoin has been grappling with heightened volatility and selling

pressure since the start of February, a trend that has negatively

impacted altcoins and meme coins, leading to bearish price action

across the market. Analysts are increasingly calling for a

correction as bulls show signs of fatigue and price movements

suggest further declines could be on the horizon. Key insights from

CryptoQuant, shared by Axel Adler on X, reveal an important shift

in market dynamics. The Bitcoin Short-Term Holder (STH) MVRV

indicator, a critical tool for gauging short-term holder behavior,

has declined from $98K and 1.35 to average levels. This drop

indicates that short-term holders have been taking profits amid the

recent market volatility. Historically, an STH MVRV above 1.30–1.35

signals an overheated market, often preceding significant

sell-offs. The current decline in the indicator suggests that a

portion of short-term holders have exited their positions,

relieving some pressure on the market. A return to average levels

typically marks the end of a local overheated phase. Related

Reading: Solana Holds Support Above Key Indicator – Expert Sees

Push To ATH If Momentum Returns If demand remains strong, Bitcoin

is likely to enter a consolidation or sideways trading phase

following this period of profit-taking. However, a drop in the STH

MVRV below 1.0 would signal the formation of a local bottom,

potentially setting the stage for a future rally. As the market

navigates this period of uncertainty, monitoring these key metrics

will be crucial in anticipating Bitcoin’s next move. Price

Struggles to Find Direction Below $100K Bitcoin is trading at

$96,700 after several days of sideways movement within a tight

range between $100,000 and $95,600. The price has been unable to

establish a clear direction, with bulls losing control after

failing to hold the $100K mark last Tuesday. This lack of momentum

has created an atmosphere of uncertainty in the market, leaving

traders on edge as Bitcoin hovers near key support levels. The

short-term outlook for Bitcoin remains unclear, as neither bulls

nor bears have managed to take decisive control. If Bitcoin fails

to hold above the critical $95K support level, a deeper decline

into the $90K demand zone could follow. Such a move would signal

increased selling pressure, potentially dampening sentiment further

and extending the current consolidation phase. Related Reading:

Ethereum Is Consolidating After The Flush Last Weekend – The Calm

Before A Big Move? On the other hand, reclaiming the $100K level is

crucial for bulls to regain control and push the price higher.

However, without a strong push above this psychological resistance,

Bitcoin’s price action is likely to remain choppy and uncertain.

Market participants are watching closely for any signs of a

breakout or breakdown, as the next move could define Bitcoin’s

trajectory in the coming weeks. For now, caution remains the

prevailing sentiment. Featured image from Dall-E, chart from

TradingView

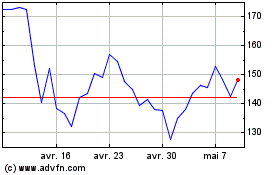

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025