AMA launches a capital increase with cancellation of the

shareholders’ preferential subscription right of an amount of €7.99

million

AMA launches

a capital increase with cancellation of the

shareholders’ preferential subscription

right of an amount of

€7.99

million

-

Public offering of

€7.99

million

-

Offer price:

€0.26 per new

share at a discount of

10.3% to the closing price on

12 June 2023

-

Duration of the subscription

period: 13 June

2023 to 26

June 2023

(included)

-

Commitment to subscribe to 100% of the amount of the

operation by the Guillemot

family, through its holding

Guillemot Brothers SAS

-

The shareholder holding 1% of the share capital, not

participating in the offer, would hold

0.42% of the share capital at the end of

the offer.

AMA CORPORATION PLC

(“AMA”),

pioneer in assisted reality solutions, editor and integrator of B2B

software solutions for the smart workplace, announces today the

launch of a capital increase with cancellation of the subscription

right in the context of a public offering, of an amount of €7.99

million (the “Offer”).

Christian Guillemot, chief

executive officer and co-founder of AMA: « Many advances have

been made since the IPO to foster growth in the market for assisted

reality solutions for professionals in the field. Thanks to a

sustained pace of innovation, our proprietary software, XpertEye,

is increasingly easy to integrate into existing systems, and our

new Enterprise Model commercial offer is driving sales momentum and

wider deployment of our solutions. Today, we are carrying out this

capital increase to maintain our solid financial position, and the

confidence of our customers, mainly major international groups, in

our ability to support them long term. In 2023, with the support of

forthcoming innovations and a strengthened commercial strategy

combining direct sales and distribution partnerships, we aim to

confirm the inflection point in our order book recorded in recent

weeks.

For this transaction of around 7.99 million

euros, the process for maintaining preferential subscription

rights, or for setting up a priority subscription period, revealed

major technical complexities, which could have compromised the

smooth running of the operation. Nonetheless, we are keen to ensure

that this operation is open to all, and its placement period

reflects this. This is why the founding shareholders of the

Guillemot family have decided to subscribe for 50 to 100% of the

shares offered, thus guaranteeing its success ».

Rationale for the Offer

The Company plans to use the proceeds of the

Offering to continue its strong financial position with reinforced

shareholders’ equity while maintaining a high pace of innovation

and an international sales strategy. Following the Offer, the

Company would have a cash position in excess of 12 months,

excluding the activation of financing lines already granted,

amounting to €12 million at the date of this press release.

Terms and conditions of

the Offer

Structure of the

Offer

Pursuant to the authorisation granted by the

shareholders general meeting of 12 June 2023, the Offer concerns an

issuance of 30,769,230 new ordinary shares with a nominal value of

£0.125 (the “Offered Shares”) in the context of a

capital increase with cancellation of the preferential subscription

right of the shareholders, to be subscribed in cash in the context

of a public offering, at the price of €0.26 per share, implying

gross proceeds of € 7.99 million.

As AMA is a public limited company under English

law, a capital increase with preferential subscription rights, as

well as the implementation of a priority subscription period,

presented significant technical complexities, pertaining to (i) the

identification of shareholders, (ii) the management of preferential

subscription rights and (iii) the priority subscription period,

likely to compromise the completion of the transaction within an

efficient timeframe. For these reasons, the Company has opted for a

capital increase without shareholders' preferential subscription

rights.

The subscription period will begin on Tuesday 13

June 2023 and will be open until Monday 26 June 2023

(included).

Pursuant to Article 3 of the Regulation (EU)

2017/1129 of the European Parliament and Council of 14 June 2017

and article 211-2 of the General regulation of the French financial

markets authority (Autorité des marchés financiers,

“AMF”), the Offer will not be subject to the

preparation of a prospectus submitted to the approval of the

AMF.

Price of the Offer

The offering price, determined by the board of

directors, is €0.26 per new share, which represents a discount of

10.3% compared to the closing share price on 12th June 2023

(€0.29).

Amount of the Offer

The gross proceeds of the Offer amount to

€7,999,999.80 million. The net proceeds of the Offer will be in the

range of €7.6 million to €7.8 million.

The Offer will not be covered by an

over-allotment option.

Subscription commitment of Guillemot

Brothers

The Guillemot family holds, directly and

indirectly via Guillemot Brothers SAS, 79,71% of the share capital

and voting rights of the Company at the date of the present press

release. The Guillemot family intends to ensure the success of the

Offer and strongly hope that the Offer will be taken up as widely

as possible in order to strengthen its free float. Therefore,

Guillemot Brothers SAS, shareholder holding 34,38% of the share

capital and voting rights of the Company, has committed to

subscribe up to €7.99 million, representing 100% of the Offered

Shares.

The subscription orders placed by the other

subscribers will be served in priority and the subscription of

Guillemot Brothers will be consequently reduced, down to 50% of the

capital increase, i.e. €4 million.

The Company committed to TP ICAP Midcap not to

issue new shares of the Company, with the exception of the Offered

Shares, subject to certain customary exceptions, for 90 calendar

days following the settlement date of the Offered Shares.

Lock-up

agreements

Guillemot Brothers committed towards TP ICAP

Midcap to a lock-up of 180 calendar days following the settlement

date of the Offered Shares covering the entirety of the shares held

as well as the entirety of the Offered Shares that will be

subscribed in the context of the subscription commitment described

above.

Undertaking not to initiate a

squeeze-out

Should the free float be less than or equal to

10%, AMA will not be delisted. Accordingly, the Guillemot family

and Guillemot Brothers undertake not to initiate a squeeze-out

procedure during the twelve months following settlement of the

Offer.

The Guillemot family and the Company would like

the free float of the Company to remain as high as possible and to

be maintained within a range of 10% to 15%. In the event that the

free float falls below this range, they will use the means at their

disposal to increase the level of the free float.

Financial intermediaries

TP ICAP (Midcap) acts as Global Coordinator,

Lead Manager and Bookrunner of the Offer.

Characteristics of the new

shares

The new shares will be assimilated to the

existing shares and will be subject to an application for admission

to trading on Euronext Growth on the same trading line (ISIN code:

GB00BNKGZC51 – ticker: ALAMA). They will bear current dividend

rights and will carry full dividend rights paid out by the Company

starting from their issue date.

The new shares will be subject to the entirety

of the provisions of the articles of association of the Company and

of the Companies Act 2006 which applies to public limited companies

of English law.

As the Company is a public limited company

governed by English law, the rules governing taxation, corporate

governance, shareholder information and general meetings are those

applicable under English law.Indicative

timetable of the Offer

|

12/06/2023 |

- Shareholders general

meeting authorising the Offer

- Decision of the

board of directors on the characteristics of the Offer

- Euronext notice on

the launch of the Offer

|

|

13/06/2023 |

- Opening of the

subscription period

|

|

26/06/2023 |

- Closing of the

subscription period

|

|

28/06/2023 |

- Decision of the

board of directors setting the final characteristics of the

Offer

- Press release

announcing the outcome of the Offer

- Euronext notice

regarding the issuance of the Offered Shares

|

|

30/06/2023 |

- Settlement and

delivery of the Offered Shares

- Admission to trading

of the Offered Shares on Euronext Growth Paris

|

Terms and conditions of the

subscription

Placing of orders

Persons wishing to participate in the Offer must

submit their orders to an authorised financial intermediary in

France no later than 26 June 2023 at 5pm (Paris time) for counter

subscriptions and 8pm (Paris time) for online subscriptions, if

that option is provided by their financial intermediary, unless the

Offer is closed earlier or extended later than initially

scheduled.

Form and registration of the Offered Shares

The procedures for the subscription and

registration of the Offered Shares are governed by the laws of

England and Wales, which require that the shares be subscribed for

and registered in the Company's share register handled by Link

Group (Central Square, 10th Floor, 29 Wellington Street, Leeds,

England, LS1 4DL).

The Offered Shares will be delivered in

book-entry form only and will be credited to the relevant

securities accounts via Euroclear France, 66 rue de la Victoire

75009 Paris, France. The Offered Shares will be registered in the

name of Euroclear Nominees Limited, 33 Cannon Street, London EC4M

5SB, United Kingdom, in the register of the Company and their

beneficial ownership will be recorded, through Euroclear Bank

Brussels, 1 boulevard du Roi Albert II Saint-Josse-ten-Noode, 1210

Belgium, and Euroclear France, by other financial intermediaries

taking part in the holding chain.

The Company being a public limited company of

English law, it is reminded that rules relating to taxation,

corporate governance, information of the shareholders and general

meetings are those applying pursuant to English law.

It is specified that the shares of the Company

are not eligible to the French special regime of equity savings

plans (plan d’épargne en actions) nor to the tax reduction applying

to subscriptions in cash to small and medium-sized companies

(“IR-PME”).

Risk factors

Risks associated with the

business of the

Company

Detailed information concerning AMA,

particularly on its activity, its results and its risk factors are

available in its annual report and financial statements relating to

the year ended on 31 December 2022. They are available as well as

other regulated information and press releases, on the website of

the Company (www.amaxperteye.com/investors).

The materialisation of all or part of the risks

may have an adverse effect on the business, the financial position,

the results, or the prospective outlooks of the Company. The risk

factors exposed in the annual financial report remain unchanged at

the date of the present press release.

The Company reviewed its liquidity risk and

considers that it is not subject to any such risk.

Risks associated with the

Offer

In addition, investors are invited to consider

the following risks related to the issuance of new shares:

- the market price of

the shares could fluctuate and decrease below the subscription

price of the shares issued in the context of the Offer,

- the volatility and

liquidity of the shares of the Company could significantly

fluctuate,

- sales of shares of

the Company could take place on the market and have a negative

impact on the share price of the Company, and

- the shareholders of

the Company could be significantly diluted in case of future

capital increases.

Impact of the issuance of the shares on

the interest of the shareholders

The impact of the issuance of the Offered Shares

described above on the interest of the shareholders (calculations

based on 22,455,815 composing the share capital as of 31 December

2022 and 24,496,315 shares on a fully diluted basis at the same

date, including shares that may be issued on exercise of stock

options), would be as follows:

|

|

Shareholders’ interest

(in %) |

|

Non fully diluted basis |

Fully diluted basis |

|

Before issuance of the new shares |

1.00% |

0.92% |

|

After issuance of the 30,769,230 new shares |

0.42% |

0.41% |

Impact of the issuance of the equity

per share of the shareholders

The impact of the issuance of the Offered Shares

described above on the equity per share of the shareholders

(calculations based on 22,455,815 composing the share capital as of

31 December 2022 and 24,496,315 shares on a fully diluted basis at

the same date, including shares that may be issued on exercise of

stock options), would be as follows:

|

|

Equity per share as of 31

décembre 2022 |

|

Non fully diluted basis |

Fully diluted basis |

|

Before issuance of the new shares |

0.26€ |

0.25€ |

|

After issuance of the 30,769,230 new shares |

0.26€ |

0.26€ |

Ownership structure prior to

the transaction

|

|

Prior to the transaction |

|

Theoretical number of shares and voting

rights |

Theoretical % of share capital and voting

rights |

|

Guillemot Brothers SAS |

7 721 212 |

34,38% |

|

Guillemot family |

10 178 375 |

45,33% |

|

Free float |

4 556 228 |

20,29% |

|

Total |

22 455 815 |

100,00% |

Ownership structure after the

Transaction

If Guillemot Brothers subscribes up to

50% of its undertaking

|

|

After the transaction |

|

Theoretical number of shares and voting

rights |

Theoretical % of share capital and voting

rights |

|

Guillemot Brothers SAS |

23 046 882 |

43,40% |

|

Guillemot family |

10 178 375 |

19,17% |

|

Free float |

19 881 898 |

37,44% |

|

Total |

53 107 155 |

100,00% |

If Guillemot Brothers subscribes up to

100% of its undertaking

|

|

After the transaction |

|

Theoretical number of shares and voting

rights |

Theoretical % of share capital and voting

rights |

|

Guillemot Brothers SAS |

38 372 552 |

72,25% |

|

Guillemot family |

10 178 375 |

19,17% |

|

Free float |

4 556 228 |

8,58% |

|

Total |

53 107 155 |

100,00% |

Partners in the operation

|

|

|

|

|

Global Coordinator, Lead Manager and Bookrunner of the Offer

|

Legal advisors on the Offer |

Financial communication agency |

Next financial press

release2023 second-quarter revenues: 28 July 2023 (before

start of trading)

About AMASince 2015, AMA, a

software developer and integrator, is helping industry and service

providers of all sizes, as well as medical establishments, to

accelerate their digital transformation. AMA’s XpertEye suite of

applications addresses a wide range of use cases, from remote

diagnostics to inspection, planning, and workflow management. These

unequaled remote interactive collaboration solutions empower

customers to improve productivity, speed up resolution time, and

maximize uptime while reducing their carbon footprint. With offices

in France, Germany, Spain, the United States, China and Japan, AMA

has a global presence and works across all time zones to forge

close relationships with its clients wherever they are. AMA is

listed on Euronext Growth Paris (GB00BNKGZC51 – ALAMA). Learn more

at www.amaxperteye.com.

Contacts

| Investor Relations

& Financial Media Perrine Fromont, CFO -

+33 223 441 339 – investors@ama.bzh Marie

Calleux, Calyptus - +33 609 685 538 - ama@calyptus.net |

Corporate media:

Esther Duval+33 689 182 343 esther.duval@ama.bzh |

Disclaimer

This press release and the information it

contains does not constitute a sale offer or an offer to subscribe,

nor a solicitation to purchase or subscribe shares of AMA Corporate

PLC in any country.

This press release is an advertisement and not a

prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and the Council of 14 June 2017 (the

“Prospectus Regulation”).

With respect to the member States of the

European Economic Area, other than France (the “Member

States”), no action has been undertaken or will be

undertaken to make an offer to the public of the shares requiring a

publication of a prospectus in one of these Member States.

Consequently, the securities cannot be offered and will not be

offered in any Member State (other than France) except in

accordance with the exemptions set out in Article 1(4) of the

Prospectus Regulation, or in other cases which does not require the

publication by AMA Corporation PLC of a prospectus pursuant to the

Prospectus Regulation and/or applicable regulation in these Member

States.

This press release does not constitute or form a

part of any offer or solicitation to purchase or subscribe for

securities in the United States or any other jurisdiction (other

than France). Securities may not be offered or sold in the United

States unless they have been registered under the U.S. Securities

Act of 1933, as amended (the “U.S. Securities

Act”), or are exempt from registration. The shares of AMA

Corporation PLC have not been and will not be registered under the

U.S. Securities Act and AMA Corporation PLC does not intend to make

a public offer of its shares in the United States.

This press release does not constitute an offer

of the securities to the public in the United Kingdom. The

distribution of this press release is not made, and has not been

approved, by an authorised person within the meaning of Article

21(1) of the Financial Services and Markets Act 2000. Consequently,

this press release is directed only at persons who (i) are located

outside the United Kingdom, (ii) have professional experience in

matters relating to investments and fall within Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotions)

Order 2005, as amended and (iii) (iii) are persons falling within

Article 49(2)(a) to (d) (high net worth companies, unincorporated

associations, etc.) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (the persons mentioned under (i),

(ii) and (iii) referred together as “Relevant

Persons”). The securities of AMA Corporation PLC are

directed only at Relevant Persons and no invitation, offer or

agreements to subscribe, purchase or otherwise acquire the

securities of AMA Corporation PLC may be proposed or made other

than with Relevant Persons. Any person other than a Relevant Person

may not act or rely on this document or any provision thereof. This

press release is not a prospectus which has been approved by the

Financial Conduct Authority or any other United Kingdom regulatory

authority for the purposes of Section 85 of the Financial Services

and Markets Act 2000.

This press release contains indications on the

targets of AMA Corporation PLC as well as forward-looking

statements. This information is not historical data and shall not

be interpreted as a guarantee that the facts and data announced

will occur. Such information is based on data, hypothesis and

assumptions considered to be reasonable by AMA Corporation PLC. The

Company operates in a constantly changing competitive environment.

Therefore, it cannot anticipate all risks, uncertainties or other

factors that may have an impact on its business, nor the extent to

which the occurrence of a risk or combination of risks may have

materially different outcomes to those referred to in any

forward-looking information. Such information is valid only at the

date of the present press release. AMA Corporation PLC does not

commit, in any way, to publish updates on the information nor on

the hypothesis on which they are based except in cases where it has

a legal or regulatory requirement to do so.

The distribution of this press release in

certain countries may be subject to a specific regulation.

Consequently, persons present in such countries and in which the

press release is disseminated, published, or distributed shall

comply to such laws and regulations.

The information contained in this document does

not constitute an offer of securities for sale in the United States

of America, Canada, Australia or Japan. This press release may not

be published, forwarded, or distributed, directly or indirectly, in

the United States, Canada, Australia or Japan.

Finally, this press release may be drafted both

in French and in English. The French version of this press release

shall prevail over the English version in the event of a

discrepancy.

- AMA_CP_Lancement-augmentation-de-capital_EN_20230612_DEF

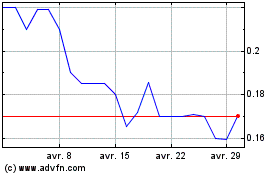

AMA (EU:ALAMA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

AMA (EU:ALAMA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025