ASM International N.V. reports second quarter 2023

Almere, The Netherlands July 25, 2023, 6 p.m. CETASM

International N.V. (Euronext Amsterdam: ASM) today reports its

second quarter 2023 operating results (unaudited).

Continued revenue growth and lower orders in Q2

reflecting softer market conditions; outlook for revenue growth for

the year maintained

Financial highlights

|

€ million |

Q2 2022 |

Q1 2023 |

Q2 2023 |

|

New orders |

942.7 |

647.4 |

485.8 |

|

YoY change % at constant currencies |

73% |

(6%) |

(48%) |

|

Revenue |

559.5 |

710.0 |

669.1 |

|

YoY change % at constant currencies |

30% |

40% |

21% |

|

Normalized gross profit margin 1) |

47.5% |

51.1% |

49.0% |

|

Normalized operating result 1) |

148.0 |

221.2 |

180.1 |

|

Normalized operating result margin 1) |

26.5% |

31.2% |

26.9% |

|

Share in income of investments in associates (excluding

amortization intangible assets resulting from the sale of ASMPT

stake 2013) |

26.9 |

9.4 |

9.2 |

|

Amortization intangible assets (resulting from the sale of ASMPT

stake in 2013) |

(3.4) |

(3.4) |

(0.2) |

|

Reversal of impairment of investments in associates |

0.0 |

215.4 |

0.0 |

|

Net earnings |

160.4 |

380.4 |

151.2 |

|

Normalized net earnings 2) |

164.1 |

183.0 |

160.7 |

1 Excluding amortization of fair value adjustments from purchase

price allocations (before tax)2 Excluding amortization of fair

value adjustments from purchase price allocations (net of tax),

change in fair value of the contingent consideration (LPE earn-out)

and impairment reversal of ASMPT

- New orders of €486 million for the second quarter 2023

decreased by 48% compared to the same period last year, both at

constant currencies and as reported. The decrease reflected

softening market conditions, and push-outs in logic/foundry as

earlier indicated with the Q1 2023 report.

- Year-on-year revenue growth for the second quarter 2023 was 21%

at constant currencies (20% as reported).

- Normalized gross profit margin of 49.0%, excluding PPA expenses

in the second quarter 2023, improved compared to 47.5% in the same

quarter last year, mainly explained by mix.

- Normalized operating result for the second quarter 2023,

excluding PPA expenses, improved from €148 million last year to

€180 million this year due to strong revenue growth and higher

gross margin.

- Net earnings included a negative impact of €9 million (net of

tax) relating to PPA expenses. Normalized net earnings for the

second quarter 2023 were €161 million, down from €164 million in Q2

last year, and included a translation gain of €8 million compared

to a translation gain of €26 million in Q2 2022 and a translation

loss of €7 million in Q1 2023.

- Details of (estimated) amortization and earn-out expenses (PPA

expenses) relating to the 2022 acquisitions of LPE and Reno are

found in Annex 2.

Comment

“Against a backdrop of slowing market conditions, ASM delivered

a resilient performance in the second quarter,” said Benjamin Loh,

President and CEO of ASM. “Revenue increased 21% at constant

currencies compared to prior year to €669 million, in line with our

previous guidance of €650-690 million. The gross margin improved

year on year but decreased compared to the exceptionally high level

in Q1 and amounted to a solid level of 49% in Q2, with a positive

mix, and including again a relatively increased contribution from

the Chinese market. Despite higher investments in R&D, and

supported by the increased revenue, the operating result increased

23% at constant currencies to €180 million. As communicated

previously, we still expect operating margin for the full year of

2023 to be 26% or slightly lower, explained by the expected lower

sales level in the second half. We generated €86 million in free

cash flow in Q2. We used €123 million in cash for the dividend

payment, and €50 million for share repurchases.

Orders dropped by 48% to €486 million in Q2. The lower order

intake in Q2 was impacted by softening demand, and, as indicated

with our Q1 results, by push-outs in leading-edge logic/foundry,

reflecting softer end-market conditions and some delays in new

customer fab readiness. In addition, the decrease in order intake

also reflected some further normalization of the backlog compared

to the relatively elevated level in 2022, following improved supply

chain conditions.

Demand in the memory market continued to be weak in Q2 and is

not expected to recover in the remainder of the year. Logic/foundry

orders dropped in Q2. Despite the near-term market softening, ASM

remains well positioned for the next nodes. As our logic/foundry

customers are preparing for the transition to gate-all-around (GAA)

device technology we are confident that this transition will drive

a meaningful double-digit increase in served available markets,

with continued ALD leadership for ASM and opportunities for share

gains in silicon Epi. We continue to expect a first meaningful

contribution from GAA pilot-line orders in Q4 2023.

Demand in the mature node markets remained solid in Q2. For our

company, these markets are a smaller part of revenue and mainly a

selective play in the power, analog and wafer manufacturer

segments. Combined with solid momentum of new product

introductions, such as our Sonora vertical furnace, we expect solid

growth in this part of our business this year.

Our silicon carbide Epi business increased substantially in Q2

and remains on track to achieve more than €130 million in sales in

2023. Since we acquired LPE last year, customer engagements have

increased significantly. After winning a new leading North American

customer earlier this year, we have received a first order from a

major European SiC player.”

Outlook

On a currency-comparable level, we project revenue of €580-620

million for Q3. As already communicated with our Q1 results, we

expect Q3 orders will also show a drop compared to the level in Q1,

albeit not as pronounced as in Q2. Our forecast for the second half

is unchanged, we still expect a decrease in revenue of 10% or more

compared to the first half of the year, based on the current

visibility and at constant currencies. For FY 2023, we still expect

revenue to show year-on-year a single-digit percentage increase, at

constant currencies and including the consolidation of LPE.

Wafer fab equipment (WFE) is now expected to drop by a

mid-to-high-teens percentage in 2023. Memory WFE is expected to

show the sharpest drop and leading-edge logic/foundry is impacted

by push-outs and weaker market conditions, while the trend in

mature node spending remains more positive. We expect to again

outperform the WFE market this year.

Share buyback program

On April 25, 2023, ASM announced the start of the €100 million

share buyback program. As of June 30, 2023, 50.1% of the share

buyback program was completed at an average share price of

€361.26.

Investor Day

We will host our 2023 Investor Day on September 26. Speakers

will include our CEO, CFO and CTO, and other members of ASM’s

senior management team. Further details will be announced

later.

Interim financial report

ASM today also publishes its Interim Financial Report for the

six month period ended June 30, 2023.

This report includes an Interim Management Board Report and

condensed consolidated interim financial statements prepared in

accordance with IAS 34 (Interim Financial Reporting). The Interim

Financial Report comprises regulated information within the meaning

of the Dutch Financial Markets Supervision Act (“Wet op het

Financieel Toezicht”) and is available in full on our website

www.asm.com.

About ASM International

ASM International N.V., headquartered in Almere, the

Netherlands, and its subsidiaries design and manufacture equipment

and process solutions to produce semiconductor devices for wafer

processing, and have facilities in the United States, Europe, and

Asia. ASM International's common stock trades on the Euronext

Amsterdam Stock Exchange (symbol: ASM). For more information, visit

ASM's website at www.asm.com.

Cautionary Note Regarding Forward-Looking Statements: All

matters discussed in this press release, except for any historical

data, are forward-looking statements. Forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those in the forward-looking statements.

These include, but are not limited to, economic conditions and

trends in the semiconductor industry generally and the timing of

the industry cycles specifically, currency fluctuations, corporate

transactions, financing and liquidity matters, the success of

restructurings, the timing of significant orders, market acceptance

of new products, competitive factors, litigation involving

intellectual property, shareholders or other issues, commercial and

economic disruption due to natural disasters, terrorist activity,

armed conflict or political instability, changes in import/export

regulations, epidemics and other risks indicated in the company's

reports and financial statements. The company assumes no obligation

nor intends to update or revise any forward-looking statements to

reflect future developments or circumstances.

This press release contains inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

ASM will host the quarterly earnings conference call and webcast

on Wednesday, July 26, 2023, at 3:00 p.m. CET.

Conference call participants should pre-register using this link

to receive the dial-in numbers, passcode and a personal PIN, which

are required to access the conference call.

A simultaneous audio webcast, and replay will be accessible at

this link.

Contact

Investor and media relations

Victor BareñoT: +31 88 100 8500 E:

investor.relations@asm.com

- 20230725 ASM reports Q2 2023 results

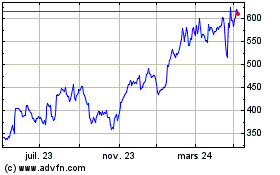

ASM International NV (EU:ASM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

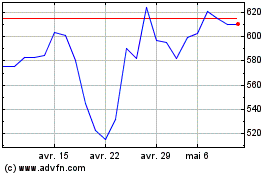

ASM International NV (EU:ASM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025