Cegedim achieves solid growth in first quarter 2024

Quarterly financial information as of March 31, 2024IFRS -

Regulated information - Not audited

Cegedim achieves solid growth in first quarter

2024

- Q1 2024 revenue up

6.9%

- Strong growth in

digitization, marketing, and international activities

Boulogne-Billancourt, France, April 25, 2024, after the

market close

Revenue

|

|

First quarter |

Change Q1 2024 / 2023 |

|

In millions of euros |

2024 |

2023 Reclassified(1) |

Reclassification(1) |

2023 Reported |

Reported vs. Reclassified(1) |

Like for like (2) (3) vs.Reclassified |

|

Software & Services |

74.3 |

74.4 |

-6.0 |

80.4 |

-0.1% |

-1.7% |

|

Flow |

25.3 |

24.0 |

-0.8 |

24.8 |

5.5% |

5.3% |

|

Data & Marketing |

27.0 |

24.6 |

0.0 |

24.6 |

9.8% |

9.9% |

|

BPO |

20.2 |

14.4 |

0.0 |

14.4 |

39.7% |

39.7% |

|

Cloud & Support |

9.0 |

8.4 |

6.8 |

1.6 |

7.0% |

7.0% |

|

Cegedim |

155.9 |

145.9 |

0.0 |

145.9 |

6.9% |

6.0% |

(1) The activities of Cegedim

Outsourcing, Audiprint, and BSV have been reclassified under the

“Cloud & Support” division due to operational

synergies.(2) At constant scope and exchange

rates. (3) The positive currency impact of 0.2%

was mainly due to the pound sterling. The positive scope effect of

0.7% was attributable to the first-time consolidation in Cegedim’s

accounts of Visiodent from March 1, 2024.Cegedim generated

consolidated Q1 2024 revenues of €155.9 million, an increase of

6.9% as reported and 6.0% like for like

(2) compared with 2023.

As a result of the operational synergies between

the cloud businesses and the integration of IT solutions, as of

January 1, 2024, the Cloud & Support division now

includes our Cegedim Outsourcing and Audiprint

subsidiaries—previously in the Software & Services division—and

BSV—previously in the Flow division.

Analysis of business trends by division

|

|

First quarter |

Change Q1 2024 / 2023 |

|

In millions of euros |

2024 |

2023 Reclassified(1) |

Reported vs. Reclassified(1) |

Like for like (2) vs.Reclassified(1) |

|

Cegedim Santé |

18.0 |

20.6 |

-12.6% |

-17.1% |

|

Insurance, HR, Pharmacies, and other services |

42.7 |

41.3 |

3.6% |

3.5% |

|

International businesses |

13.6 |

12.5 |

8.7% |

6.6% |

|

Software & Services |

74.3 |

74.4 |

-0.1% |

-1.7% |

Cegedim Santé’s Q1 revenue declined 12.6%,

principally because the Ségur subsidies received in 2023 made for

an unfavorable basis effect. Postponed delivery of tablets for

nurses also impacted Q1 revenue growth, although the shortfall

should be made up in the coming quarters. The favorable scope

effect is due to the integration of Visiodent from March 1,

2024.

Other French subsidiaries posted growth of 3.6%,

buoyed by continued expansion of HR activities, which is being

driven notably by their new partner networks. The insurance segment

made a smaller contribution to the division’s growth. The pharmacy

segment was impacted by an unfavorable comparison basis for its

equipment installation and updating activities, both of which

experienced strong growth in 2023 as clients prepared to integrate

functionalities related to the French health authorities’ Ségur

program.

International subsidiaries’ Q1 revenue grew 6.6%

like for like, spurred by both the UK pharmacy segment, which is

benefiting from the launch of the NHS’s Pharmacy First service, and

expansion of the hospital activity in Spain’s Murcia region. The

positive exchange rate effect is mostly linked to a stronger pound

sterling.

|

|

First quarter |

Change Q1 2024 / 2023 |

|

In millions of euros |

2024 |

2023 Reclassified(1) |

Reported vs. Reclassified(1) |

Like for like (2) vs.Reclassified(1) |

|

E-business |

15.4 |

14.2 |

8.9% |

8.6% |

|

Third-party payer |

9.9 |

9.8 |

0.5% |

0.5% |

|

Flow |

25.3 |

24.0 |

5.5% |

5.3% |

The e-business flows grew 8.9 % with its two

segments contributing to growth: the invoicing and procurement

segment continued to grow, while health data flow activity was

buoyed by the launch of new offerings designed to help hospitals to

safeguard their pharmaceutical supply chain.

Third-party payer revenue appeared stable

because the Allianz contract’s flows have been managed as a BPO

service since April 2023. Excluding this impact, the business has

grown, boosted by higher volumes and the development of the fraud

detection offering.

|

|

First quarter |

Change Q1 2024 / 2023 |

|

In millions of euros |

2024 |

2023 Reclassified1 |

Reported vs. Reclassified(1) |

Like for like (2) vs.Reclassified(1) |

|

Data |

13.0 |

13.1 |

-0.6% |

-0.6% |

|

Marketing |

14.0 |

11.5 |

21.7% |

21.7% |

|

Data & Marketing |

27.0 |

24.6 |

9.8% |

9.8% |

Data activities were stable in the first

quarter, with stronger sales in France than internationally.

Advertising in pharmacies continued to

experience robust growth, driven by the expansion of in-pharmacy

phygital media.

|

|

First quarter |

Change Q1 2024 / 2023 |

|

In millions of euros |

2024 |

2023 Reclassified(1) |

Reported vs. Reclassified(1) |

Like for like( 2) vsReclassified(1) |

|

Insurance BPO |

14.5 |

8.8 |

65.2% |

65.2% |

|

BPO Business Services* |

5.7 |

5.6 |

0.3% |

0.3% |

|

BPO |

20.2 |

14.4 |

39.7% |

39.7% |

* BPO of HR and digitization activities

BPO services for health and personal protection

insurers again benefited from a positive comparison effect related

to the Allianz contract, which started in Q2 2023, as well as from

dynamic sales in the overflow business.

BPO Business Services (HR and digitization

services) posted stable revenue in Q1.

Highlights

To the best of the company’s knowledge, apart

from the items cited below, there were no events or changes during

Q1 2024 that would materially alter the Group’s financial

situation.

On February 15, 2024, Cegedim Santé acquired

Visiodent, a leading provider of management solutions for dental

practices and health clinics in France. Visiodent launched the

market’s first 100% SaaS solution, Veasy, at a time when the number

of dental practices and health clinics in France was increasing

significantly. Its users now include the country’s largest

nation-wide networks of health clinics, both cooperative and

privately owned, as well as several thousand dental surgeons in

private practice. Visiodent generated revenue of c.€10 million in

2023 and began contributing to Cegedim Group’s consolidation scope

on March 1, 2024. Post the acquisition, Cegedim is in compliance

with all of its covenants and financing contracts.

Cegedim, jointly with IQVIA (formerly IMS

Health), is being sued by Euris for unfair competition. Cegedim

asked the court to dismiss the case against the Company. On

December 17, 2018, the Paris Commercial Court granted Cegedim’s

request, which IQVIA then appealed. On December 8, 2021, the Court

of Appeals upheld the judgement in favor of Cegedim. The case was

appealed to the Supreme Court, and in a ruling on March 20, 2024,

the court overturned the Court of Appeals judgement that had

exonerated Cegedim. As a result, the case has been sent back to the

Paris Court of Appeals, with a different set of judges.After

consulting its external legal counsel, the Group decided not to set

aside any provisions.

The Group does not do business in Russia or

Ukraine and has no assets exposed to those countries.

Significant transactions and events post March 31,

2024

To the best of the company’s knowledge, there

were no events or changes after March 31, 2024, that would

materially alter the Group’s financial situation.

Outlook

Based on the currently available information,

the Group expects 2024 like-for-like revenue(1) growth to be in the

range of 5-8% relative to 2023. Recurring operating income should

continue to improve, following a similar trajectory as in 2023.

These targets are not forecasts and may need to

be revised if there is a significant worsening of geopolitical,

macroeconomic, or currency risks.

---------

(1) At constant scope and exchange rates.

|

WEBCAST IN ENGLISH ON APRIL 25, 2024, AT 6:15 PM (PARIS

TIME) |

|

The webcast is available at:

www.cegedim.fr/webcast |

| |

|

The Q1 2024 revenue presentation is available on the website:

https://www.cegedim.fr/finance/documentation/Pages/presentations.aspx |

|

|

The Audit Committee met on April 25, 2024.

The Board of Directors, chaired by Jean-Claude

Labrune, met on April 25, 2024.

2024 financial calendar

|

2024 |

June 14 at 9:30 amJuly 25 after

the closeSeptember 26 after the

closeOctober 24 after the close |

Shareholders’ General MeetingH1 2024 revenuesH1 2024 resultsQ3 2024

revenues |

The financial calendar is available on the website:

https://www.cegedim.fr/finance/agenda/Pages/default.aspx

|

DisclaimerThis press release is available

in French and in English. In the event of any difference between

the two versions, the original French version takes precedence.

This press release may contain inside information. It was sent to

Cegedim’s authorized distributor on April 25, 2024, no earlier than

5:45 pm Paris time.The figures cited in this press

release include guidance on Cegedim's future financial performance

targets. This forward-looking information is based on the opinions

and assumptions of the Group’s senior management at the time this

press release is issued and naturally entails risks and

uncertainty. For more information on the risks facing Cegedim,

please refer to Chapter 7, “Risk management”, section 7.2, “Risk

factors and insurance”, and Chapter 3, “Overview of the financial

year”, section 3.6, “Outlook”, of the 2023 Universal Registration

Document filed with the AMF on April 3, 2024, under number

D.24-0233. |

|

About Cegedim:Founded in 1969, Cegedim is an innovative

technology and services group in the field of digital data flow

management for healthcare ecosystems and B2B, and a business

software publisher for healthcare and insurance professionals.

Cegedim employs more than 6,500 people in more than 10 countries

and generated revenue of €616 million in 2023. Cegedim SA is listed

in Paris (EURONEXT: CGM).To learn more please visit:

www.cegedim.frAnd follow Cegedim on X: @CegedimGroup, LinkedIn and

Facebook. |

| Aude

BalleydierCegedimMedia Relations

andCommunications ManagerTel.: +33 (0)1 49 09 68

81aude.balleydier@cegedim.fr |

Damien

BuffetCegedimHead of Financial

CommunicationTel.: +33 (0)7 64 63 55

73damien.buffet@cegedim.com |

Céline

Pardo BecomingMedia

Relations Tel.: +33

(0)6 52 08 13 66cegedim@becoming-group.com |

|

Annexes

Breakdown of revenue by division

|

In million euros |

|

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Software & Services |

|

74.3 |

|

|

|

74.3 |

|

| Flow |

|

25.3 |

|

|

|

25.3 |

|

| Data &

Marketing |

|

27.0 |

|

|

|

27.0 |

|

| BPO |

|

20.2 |

|

|

|

20.2 |

|

| Cloud &

Support |

|

9.0 |

|

|

|

9.0 |

|

|

Group revenue |

|

155.9 |

|

|

|

155.9 |

|

|

In million euros |

|

Q1 Reclassified |

Q1Reported |

Reclassification |

TotalReclassified |

TotalReported |

|

Software & Services |

|

74.4 |

80.4 |

-6.0 |

74.4 |

80.4 |

|

| Flow |

|

24.0 |

24.8 |

-0.8 |

24.0 |

24.8 |

|

| Data &

Marketing |

|

24.6 |

24.6 |

0.0 |

24.6 |

24.6 |

|

| BPO |

|

14.4 |

14.4 |

0.0 |

14.4 |

14.4 |

|

| Cloud &

Support |

|

8.4 |

1.6 |

6.8 |

8.4 |

1.6 |

|

|

Group revenue |

|

145.9 |

145.9 |

0.0 |

145.9 |

145.9 |

|

Breakdown of revenue by geographic zone, currency, and

division at March 31, 2024

|

As a % of consolidated revenues |

|

Geographic zone |

|

Currency |

| |

France |

EMEAexcl. France |

Americas |

|

Euro |

GBP |

Others |

|

Software & Services |

|

81.7% |

18.2% |

0.1% |

|

85.2% |

13.1% |

1.7% |

| Flow |

|

91.4% |

8.6% |

0.0% |

|

94.5% |

5.5% |

0.0% |

| Data &

Marketing |

|

97.6% |

2.4% |

0.0% |

|

97.9% |

0.0% |

2.1% |

| BPO |

|

100.0% |

0.0% |

0.0% |

|

100.0% |

0.0% |

0.0% |

| Cloud &

Support |

|

99.9% |

0.1% |

0.0% |

|

100.0% |

0.0% |

0.0% |

|

Cegedim |

|

89.5% |

10.5% |

0.1% |

|

91.7% |

7.1% |

1.2% |

(4) The activities of Cegedim

Outsourcing, Audiprint, and BSV have been reclassified under the

“Cloud & Support” division due to operational

synergies.(5) At constant scope and exchange

rates.

- Cegedim_Revenue_1Q2024_ENG

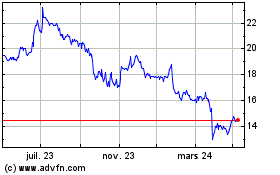

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

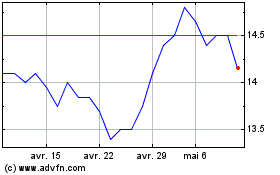

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025