IMCD N.V. LAUNCHES A CAPITAL RAISE OF EUR 300 MILLION TO INCREASE FINANCIAL FLEXIBILITY

12 Novembre 2024 - 5:46PM

UK Regulatory

IMCD N.V. LAUNCHES A CAPITAL RAISE OF EUR 300 MILLION TO INCREASE

FINANCIAL FLEXIBILITY

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, INTO OR IN THE UNITED STATES,

CANADA, AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN

WHICH OFFERS OR SALES WOULD BE PROHIBITED BY APPLICABLE LAW. THIS

ANNOUNCEMENT DOES NOT CONSTITUTE OR FORM AN OFFER OF SECURITIES IN

THE UNITED STATES, CANADA, AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY

OTHER JURISDICTION.

PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THIS

ANNOUNCEMENT.

ROTTERDAM, The Netherlands (12 November 2024, 17:45

CET) – IMCD N.V. (“IMCD” or “Company”) announces its

intention to raise approximately EUR 300 million of gross proceeds

through an accelerated bookbuilding offering of new ordinary shares

(the “New Shares”) in the share capital of the Company (the

“Capital Raise”). The EUR 300 million Capital Raise will result in

pro-forma leverage of 2.3. The pro-forma leverage is based on the

adjusted leverage ratio as of 30 September 2024, reported in the

Company's press release of 8 November 2024.

• The new shares to be issued represent c. 3.5% of IMCD N.V.’s

issued share capital and shall be issued under the existing

shareholder authorization granted at the Company’s 2024 AGM

• The Capital Raise will be a primary accelerated bookbuild

offering

• This Capital Raise will provide IMCD increased financial

flexibility as well as further strengthen its balance sheet

The Capital Raise will comprise: the issuance of New Shares for

approximately EUR 300 million, representing approximately 3.5% of

the total issued share capital, which will be offered through an

accelerated bookbuilding process to institutional investors (the

“Placing”). The New Shares will be issued on a non-pre-emptive

basis under the existing mandate by the Company’s shareholders

provided at the most recent AGM on 14 May 2024. The Placing is

being made outside the United States, exclusively to institutional

investors in the European Economic Area or the United Kingdom and

to certain institutional investors in other jurisdictions, and in

the United States in transactions pursuant to an exemption from, or

in transactions not subject to, the registration requirements of

the U.S. Securities Act of 1933, as amended (the “Securities Act”)

to qualified institutional buyers (as defined in Rule 144A under

the Securities Act).

No prospectus will be published in connection with the

Placing.

Attached, the full press release in PDF format.

- Press release_IMCD N.V. capital raise

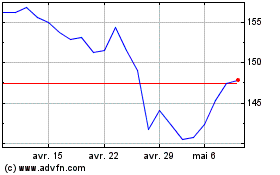

IMCD NV (EU:IMCD)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

IMCD NV (EU:IMCD)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025