MAIN TRANSACTION TERMS

- Subscription price: EUR 0.0178 per new share

- Priority right for shareholders of record as at November

15th, 2023: from December 6th to December 12th, 2023

inclusive

- Subscription commitments from members of the Groupement

covering the entire capital increase

Not to be published, distributed or circulated

directly or indirectly in the United States, Canada, Australia or

Japan.

This press release is an advertisement and not

a prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and of the Council of June 14, 2017

Regulatory News:

ORPEA ANNOUNCES THE LAUNCH OF A SHARE CAPITAL INCREASE

WITHOUT PREFERENTIAL SUBSCRIPTION RIGHTS RESERVED TO CAISSE DES

DÉPÔTS ET CONSIGNATIONS, MAIF, CNP ASSURANCES AND MACSF EPARGNE

RETRAITE, WITH A PRIORITY RIGHT GRANTED TO EXISTING SHAREHOLDERS,

FOR AN AMOUNT OF APPROXIMATELY EUR 1.2 BILLION

ORPEA S.A (the “Company”) announces today the launch of a

share capital increase without preferential subscription rights

reserved for named persons, namely to Caisse des Dépôts et

Consignations, Mutuelle Assurance des Instituteurs de France

(MAIF), CNP Assurances and MACSF Epargne Retraite (the

“Groupement”), with a priority right granted to the Existing

Shareholders, (as defined below) allowing them to subscribe by

preference to the shares so issued, in an amount (including the

issue premium) of EUR 1,160,080,551.59, by way of issuance of

65,173,064,696 new shares (the “New Shares”) at an issue

price of EUR 0.0178 per New Share (the “Groupement Capital

Increase”).

IMPORTANT:

As previously indicated by the Company, it is reminded that only

shareholders whose shares are evidenced by book-entries (inscrit en

compte) at the end of the accounting day of November 15th, 2023

(the “Existing Shareholders”) will be able to subscribe on

an irreducible basis (à titre irréductible) based on the number of

shares they held as at November 15th, 2023, adding thereto, if

applicable, and provided that their shares were held in pure

registered form (au nominatif pur) from November 15th, 2023 at the

latest and are maintained in such form until the settlement and

delivery date of the Groupement Capital Increase expected to take

place on December 19th, 2023, the shares that they may have

subscribed as part of the Equitization Capital Increase.

In the absence of registration in pure registered form (au

nominatif pur) at the latest from November 15th, 2023, the new

shares subscribed by Existing Shareholders upon exercise of their

preferential subscription rights as part of the Equitization

Capital Increase will not be taken into account for the purposes of

calculating their entitlement under their priority right in the

Groupement Capital Increase.

It is specified that shareholders who have not registered their

shares in pure registered form (au nominatif pur) will nevertheless

be able to subscribe to the Groupement Capital Increase. However,

only the shares evidenced by book-entries (inscrit en compte) of

the Existing Shareholder on November 15th, 2023 will be taken into

account in this case, without taking into account the new shares

subscribed, as the case may be, as part of the Equitization Capital

Increase.

The Groupement Capital Increase follows the Equitization Capital

Increase and is carried out in the context of the accelerated

safeguard plan adopted by the Nanterre Specialised Commercial Court

on July 24th, 2023 (the “Accelerated Safeguard Plan”).

REMINDER ON THE ACCELERATED SAFEGUARD PLAN

The Accelerated Safeguard Plan, provides for the implementation

of three capital increases, namely (i) a capital increase with

shareholders' preferential subscription rights backstopped by the

unsecured creditors (the “Equitization Capital Increase”),

having been the subject of a prospectus approved by the AMF on

November 10th, 2023 under number 23-465, and whose

delivery-settlement occurred on December 4th, 2023, (ii) the

Groupement Capital Increase, as detailed in this press release and

(iii) a capital increase with shareholders' preferential

subscription rights in an amount (including the issue premium) of

EUR 390,019,672.62, by issuing 29,324,787,415 new shares at an

issue price of EUR 0.0133 per new share, to which the members of

the Groupement have committed to subscribe in the amount of

approximately EUR 196 million, the balance, i.e. EUR 194 million,

being backstopped by five institutions holding a significant

portion of the Company's unsecured debt (the “Rights Issue”

and together with the Equitization Capital Increase and the

Groupement Capital Increase, the “Capital Increases”, all

three Capital Increases forming an indivisible whole).

On November 30th, 2023, the Company published the results of the

EUR 3,884,212,344.65 Equitization Capital Increase, in which the

64,629,157,149 new shares issued at an issue price of EUR 0.0601

per new share (of which EUR 0.01 of nominal value and EUR 0.0501)

were subscribed as follows:

- 1,199,337,462 new shares were subscribed in cash on an

irreducible basis (“à titre irréductible”) by shareholders or

purchasers of preferential subscription rights, for an amount of

EUR 72.1 million, which have been allocated to the reimbursement of

the unsecured indebtedness at par, and pro rata;

- 63,429,819,687 new shares were subscribed by the unsecured

creditors pursuant to their backstop commitment, for EUR 3.8

billion, by way of set-off against their claims.

Following the Equitization Capital Increase, and prior to the

completion of the Groupement Capital Increase, the Company's share

capital stands at EUR 646,938,510, comprised of 64,693,851,000

shares with a par value of EUR 0.01 each, of which 98.05% held by

the unsecured creditors who hold 98.04% of its voting rights.

It is specified that among the 1,199,337,462 new shares

subscribed in cash by the shareholders or purchasers of

preferential subscription rights as part of the Equitization

Capital Increase, 4,321,674 new shares (i.e. a subscription amount

of EUR 259,732) were subscribed by shareholders whose shares were

registered in pure registered form on November 15th, 2023.

As a reminder, as described in this press release, and in

accordance with the terms of the Accelerated Safeguard Plan, the

priority right provided for in the context of the Groupement

Capital Increase will only benefit Existing Shareholders, according

to the number of shares they held on November 15th, 2023, adding

thereto, if applicable, and provided that their shares were held in

pure registered form (nominatif pur) at the latest from November

15th, 2023 and are maintained in such form until the settlement and

delivery of the Groupement Capital Increase expected to take place

on December 19th, 2023, the new shares that they may have

subscribed as part of the Equitization Capital Increase.

Consequently, in accordance with the terms of the Accelerated

Safeguard Plan, the total number of shares on the basis of which

the priority right provided for in the context of the Groupement

Capital Increase may be exercised amounts to 69,015,525 New Shares,

i.e. the number of shares comprised in the share capital before the

settlement and delivery of the Equitization Capital Increase

(64,693,851 shares), to which is added the number of shares

subscribed in the Equitization Capital Increase by Existing

Shareholders (i.e. 4,321,674 new shares).

On this basis, assuming that all Existing Shareholders exercise

their priority right in the Groupement Capital Increase, up to

their total entitlement, i.e. 69,015,525 New Shares, the Company's

share capital after completion of the Groupement Capital Increase

would breakdown as follows:

- Groupement: 50.13%

- Unsecured Creditors: 48.84%

- Free float: 1.03%

If no Existing Shareholder exercises his or her priority right

in the context of the Groupement Capital Increase, the Company's

share capital after completion of the Groupement Capital Increase

would breakdown as follows:

- Groupement: 50.18%

- Unsecured Creditors: 48.84%

- Free float: 0.97%

INDEPENDENT EXPERTISE

The Company appointed on a voluntary basis the firm Sorgem

Evaluation, located at 11 rue Leroux, 75116 Paris, and represented

by Mr. Maurice Nussenbaum, as independent expert, in accordance

with Article 261-3 of the Autorité des marchés financiers’

(“AMF”) General Regulations, in order to give an opinion on

the fairness of the terms and conditions of the Company’s

restructuring from the current shareholders’ standpoint.

This independent expert’s report, together with its addendum,

provided at the Company’s request, are incorporated by reference in

the Prospectus related to the Groupement Capital Increase, with the

consent of Sorgem Evaluation which has approved its content and

allowed the Company to report the conclusion of this expertise in

publicly available documents.

MAIN TERMS OF THE GROUPEMENT CAPITAL INCREASE

The Groupement Capital Increase will be carried out without

shareholders’ preferential subscription rights reserved for named

persons, and with a priority right granted to Existing Shareholders

(i.e. the shareholders whose shares are evidenced by book-entries

(inscrit en compte) on November 15th, 2023), pursuant to the 3rd

resolution attached to the Accelerated Safeguard Plan, and will

result in the issue of 65,173,064,696 new shares (the “New

Shares”), at a subscription price of EUR 0.0178 per New Share

(i.e. EUR 0.01 nominal value and EUR 0.0078 issue premium), to be

fully paid up upon subscription, representing gross proceeds,

including the issue premium, of EUR 1,160,080,551.59.

In the context of the priority right, the Existing Shareholders

will be able, under the conditions laid down in Article L.22-10-51

of the French Commercial Code, to subscribe on an irreducible basis

(à titre irréductible) on the basis of the number of shares they

held as at the end of the accounting day of November 15th, 2023,

adding thereto, if applicable, and provided that their shares were

held in pure registered form (au nominatif pur) at the latest from

November 15th, 2023 and are kept in this form until the

settlement-delivery of the Groupement Capital Increase scheduled

for December 19th, 2023, the shares that they were able to

subscribe on an irreducible basis (à titre irréductible) as part of

the Equitization Capital Increase.

Characteristics of the priority

right:

- such priority right, which is non-negotiable and

non-transferable, shall be exclusively reserved for the Existing

Shareholders (i.e., the shareholders whose shares are evidenced by

book-entries (inscrits en compte) prior to the Equitization Capital

Increase, on the Existing Shareholders Record Date); thus, a

shareholder whose shares are evidenced by book-entries (inscrit en

compte) at the end of the accounting day of November 15th, 2023 who

would sell his shares after this date would benefit from this

priority right, while the transferee of these shares will not

benefit from it, not being registered in the account on this date.

For the avoidance of doubt, the unsecured creditors whose unsecured

indebtedness would have been converted into shares at the time of

the Equitization Capital Increase shall not benefit from this

priority right in respect of the shares subscribed for in the

context of the Equitization Capital Increase;

- the Existing Shareholders shall benefit from this priority

right on the basis of the number of shares held by them as at

November 15th, 2023 adding to it, if applicable and provided that

the shares have been held in pure registered form (nominatif pur)

at the latest from November 15th, 2023 and are kept in this form

until the settlement-delivery of the Groupement Capital Increase

scheduled for December 19th, 2023, the shares that they were able

to subscribe on an irreducible basis (à titre irréductible) from

November 16th to November 27th, 2023 inclusive as part of the

subscription period of the Equitization Capital Increase by

exercising on an irreducible basis (à titre irréductible) the

preferential subscription rights detached from the shares they held

at the end of the accounting day of November 15th, 2023;

- will be disregarded for the calculation of the priority right

entitlement:

- the shares of the Company that were subscribed for by Existing

Shareholders, as part of the Equitization Capital Increase, beyond

the proportion of the share capital they held prior to the

implementation of the Equitization Capital Increase (for example,

in case of purchase and exercise of preferential subscription

rights),

- the shares of the Company that were subscribed for as part of

the Equitization Capital Increase by Existing Shareholders who

would be unsecured creditors, due to the conversion of their

unsecured indebtedness in the context of the completion of the

Equitization Capital Increase;

- in case of exercise of the priority right, the New Shares will

be subscribed for at the same price as those to be subscribed for

by the members of the Groupement in the context of the Groupement

Capital Increase;

- there will be no subscription on a reducible basis (à titre

réductible) under the priority right. Consequently, shareholders

will not be able to subscribe beyond the number of New Shares to

which they are entitled pursuant to the exercise of the priority

right as described above;

- if, for each Existing Shareholder, the exercise of priority

rights results in a number of New Shares other than a whole number,

then the maximum number of New Shares to which such Existing

Shareholder may subscribe shall be rounded down to the nearest

whole number, but shall not be less than one New Share;

- the amount of the subscriptions of the members of the

Groupement in respect of their subscription undertakings will be

reduced up to an amount equal to the amount of the subscriptions to

the Groupement Capital Increase made, if need be, by the Existing

Shareholders exercising their priority right according to the

methods described above, between the members of the Groupement in

proportion to their subscription undertakings;

- the New Shares not subscribed for within the priority period

by the Existing Shareholders will be subscribed for by the

Groupement.

Thus, each Existing Sharehoder may place a subscription order in

euros for a maximum amount corresponding to (i) EUR

1,160,080,551.59 multiplied by (ii) the number of shares he held as

at November 15th, 2023, increased, where applicable, by the shares

subscribed in cash as part of the Equitization Capital Increase

(excluding any shares subscribed upon exercise of additional

preferential subscription rights acquired by Existing

Shareholders), provided to held his shares in pure registered form

on November 15th, 2023 and kept them, as well as those eventually

subscribed as part of Equitization Capital Increase, in this form,

until the settlement-delivery of the Groupement Capital Increase

scheduled for December 19th, 2023, and divided by (iii)

64,693,851,000 (i.e., number of shares comprising the capital of

the Company).

As an example, a shareholder holding 75 shares at the end of the

accounting day of November 15th, 2023 and having subscribed on an

irreducible basis (à titre irréductible) by way of exercise in full

of his preferential subscription rights as part of the Equitization

Capital Increase (having led to the subscription of 74,925 shares

as part of the Equitization Capital Increase) may (provided that

his shares were held in pure registered form on this date and were

maintained, as well as those eventually subscribed as part of the

Equitization Capital Increase, in such form, at least until the

settlement and delivery date of the Groupement Capital Increase

expected to take place on December 19th, 2023) place a priority

subscription order for a maximum amount of: EUR 1 160,080,551.59 x

(75,000 / 64,693,851,000) = EUR 1,344.88.

Should an Existing Shareholder, having not participated in the

Equitization Capital Increase, wish not to be diluted following the

Groupement Capital Increase, he would have to exercise his priority

subscription right on an irreducible basis (à titre irréductible)

during the priority period and subscribe in the Groupement Capital

Increase up to his entire priority right. The number of shares

retained for the priority right would be equal to 75 shares. The

Existing Shareholder could therefore place a priority subscription

order on an irreducible basis (à titre irréductible) for a total

amount of EUR 1.35, corresponding to 75 New Shares issued as part

of the Groupement Capital Increase.

It is reminded that this Existing Shareholder, having not

subscribed to the Equitization Capital Increase, previously

suffered a dilution of approximately 99.9% of his initial

participation, due to the completion of the Equitization Capital

Increase.

The number of New Shares allocated will be equal to the amount

of each shareholder's priority subscription order under the

priority right divided by the subscription price, this number being

rounded down to the nearest integer. By way of derogation, any

Existing Shareholder who is granted by application of this rule the

right to subscribe for less than one New Share will have the right

to subscribe to one New Share.

The Groupement Capital Increase will be open to the public in

France only.

INDICATIVE TIMETABLE FOR THE GROUPEMENT CAPITAL

INCREASE

The subscription priority rights will be exercisable during a

period of five consecutive trading days, from December 6th, 2023 to

December 12th, 2023 (inclusive) at 5 p.m.

The issuance, settlement and delivery of the New Shares and

commencement of trading on Euronext Paris (“Euronext Paris")

are expected to take place on December 19th, 2023. The New Shares

will immediately entitle their holders to receive dividends

declared by the Company as from the date of issuance. They will be

immediately fungible with existing shares of the Company and will

be traded on the same trading line under the same ISIN code

FR0000184798.

USE OF PROCEEDS

The allocation of the estimated maximum gross proceeds of the

capital increase, which amount to approximately EUR 1,160 million

will be as follows:

(i) up to EUR 500 million, to the full reimbursement of the

amounts drawn under the additional new money financing (totaling

EUR 600 million), namely, (a) a line of revolving credit of EUR 100

million (Credit D2) maturing on December 31st, 2023, which must be

repaid in advance due to the completion of the Groupement Capital

Increase and (b) a revolving credit line of EUR 400 million (D1A

and D1B Credits), which can be voluntarily repaid in advance by the

Company. It is specified that the revolving credit line under

Credits D1A and D1B may, if necessary, notwithstanding its

repayment, be drawn again by the Company until its final maturity

date of June 30th, 2026, providing additional resources potential

for the Company in the amount of EUR 0.4 billion. Consequently, and

as long as this line is likely to be drawn or is actually drawn in

the future, the Company's commitments under the documentation of

the new money additional financing (and in particular compliance

with an N94/95 LTV Ratio not exceeding 55% as of December 31st,

2023 and 50% as of December 31st of each subsequent year), will

continue to apply. Furthermore, the revolving credit line under

Credit D3, in the amount of EUR 100 million and undrawn to date,

can no longer be drawn given the level of proceeds from sales

carried out since March 23rd, 2023 (which is greater than EUR 100

million to date and is deducted from the drawing capacity of D3

Credit);

(ii) up to approximately EUR 183 million, to the payment of

interest suspended under the existing credits agreement;

(iii) the balance will be, together with the future net proceeds

from the issue of future shares as part of Rights Issue (estimated

at approximately EUR 311 million, after deduction of EUR 79 million

in restructuring-related costs), allocated to financing general

corporate purposes, and in particular the financing of its

refoundation plan ORPEA is changing! With you and for you, in view

of restoring the Group’s EBITDAR margin and complete the

rebalancing of its balance sheet by 2026.

GUARANTEE / BACKSTOP COMMITMENT

The issue of the New Shares is neither guaranteed by a bank

syndicate nor underwritten.

Under the terms of the Lock-Up Agreement and those of the

Accelerated Safeguard Plan, the members of the Groupement have

undertaken (severally but not jointly) to subscribe to the

Groupement Capital Increase in the following proportions and

amounts:

- The Caisse des Dépôts et Consignations: 29,099,412,650 New

Shares representing a total subscription amount (including issue

premium) of EUR 517,969,545.17 (i.e. 44.6% of the amount of the

Groupement Capital Increase);

- Mutuelle Assurance des Instituteurs de France (MAIF):

19,239,281,091 New Shares representing a total subscription amount

(including issue premium) of EUR 342,459,203.42 (i.e. 29.5% of the

amount of the Groupement Capital Increase);

- CNP Assurances: 7,214,730,409 New Shares representing a total

subscription amount (including issue premium) of EUR 128,422,201.28

(i.e. 11.1% of the amount of the Groupement Capital Increase);

and

- MACSF Epargne Retraite: 9,619,640,546 New Shares representing a

total subscription amount (including issue premium) of EUR

171,229,601.72 (i.e. 14.8% of the amount of the Groupement Capital

Increase).

The subscription amounts of the members of the Groupement will

be, if applicable, reduced in due proportion of their respective

commitments, up to the Existing Shareholders subscription as part

of their priority right.

These commitments do not constitute a “garantie de bonne fin”

within the meaning of article L.225-145 of the French Code de

commerce

DILUTION

The implementation of the Capital Increases contemplated under

the Accelerated Safeguard Plan, will result in a massive dilution

for the Existing Shareholders.

For illustrative purposes only, an Existing Shareholder holding

1% of the share capital of the Company prior to the completion of

the Capital Increases (i.e. 646,938 shares, based on the number of

shares comprised in the Company’s share capital on November 30th,

i.e. before settlement and delivery of the Equitization Capital

Increase, which took place on December 4th, 2023) would see its

stake decrease (depending on whether or not he participated in the

Equitization Capital Increase), after the completion of the new

money capital increases provided for in the Accelerated Safeguard

Plan, to:

Share of capital (en%)

No exercise of his preferential

subscription rights and his priority right by the shareholder

Exercise of his preferential

subscription rights in the Equitization Capital Increase, no

exercise of its priority right in the Groupement Capital Increase

and no exercise of his preferential subscription rights in the

Rights Issue:

646,291,062 shares subscribed in

total for an aggregate subscription price of EUR 38,842,093

Exercise of his preferential

subscription rights in the Equitization Capital Increase, exercise

of its priority right in the Groupement Capital Increase and no

exercise of his preferential subscription rights in the Rights

Issue:

1,298,021,150 shares subscribed

in total for an aggregate subscription price of EUR 50,442,888

Exercise of his preferential

subscription rights in the Equitization Capital Increase, exercise

of its priority right in the Groupement Capital Increase and

exercise of his preferential subscription rights in the Rights

Issue:

1,591,268,776 shares subscribed

in total for an aggregate subscription price of EUR 54,343,082

Prior to the issue of the

159,127,009,260 shares as part of the Capital Increases

1.000%

1.000%

1.000%

1.000%

After the issue of the

64,629,157,149 shares issued as part of the Equitization Capital

Increase

0.0010%

1.000%

1.000%

1.000%

After the issue of the

64,629,157,149 shares issued as part of the Equitization Capital

Increase and the 65,173,064,696 New Shares issued as part of the

Groupement Capital Increase

0.0005%

0.4982%

1.000%

1.000%

After the issue of the

64,629,157,149 shares issued as part of the Equitization Capital

Increase and the 65,173,064,696 New Shares issued as part of the

Groupement Capital Increase and the 29,324,787,415 shares issued as

part of the Rights Issue

0.0004%

0.4064%

0.8158%

1.000%

GOVERNANCE OF THE COMPANY POST-RESTRUCTURING

The Company and the members of the Groupement have entered on 5

December 2023 into an investment agreement (the “Investment

Agreement”) in order to reflect the rules and principles of

governance which are set out in the Accelerated Safeguard Plan and

to specify them. The members of the Groupement have indicated on

this occasion that they intend to act in concert (within the

meaning of applicable French regulations) towards the Company.

The Investment Agreement includes, mostly, regarding governance,

provisions which are identical to those of the shareholders’

agreement relating to the Company entered into between the members

of the Groupement on 5 December 2023 (the “Shareholders’

Agreement”), constituting an action de concert. The

Shareholders’ Agreement’s purpose is to organize the relationships

between the members of the Groupement as shareholders of the

Company further to the completion of the Groupement Capital

Increase in the context of the financial restructuring of the

Company and to provide for certain principles relating to the

governance of the Company and transfers of shares (or other equity

securities) issued by it.

The main provisions of the Investment Agreement and the

Shareholders’ Agreement are described respectively in paragraph

4.1.4 and paragraph 4.1.5 of the Second Amendment to the URD (as

defined below).

AVAILABILITY OF THE PROSPECTUS

The prospectus (the « Prospectus ») in the French

language approved by the AMF under number 23-503 on December 5th ,

2023 and comprised of (i) ORPEA S.A. 2022 universal registration

document filed with the AMF on June 7, 2023 under number D. 23-0461

(the “Universal Registration Document” or “URD”),

(ii) a first amendment to the URD filed with the AMF on November

10, 2023 under number D.23-0461-A01 (the “First Amendment to the

URD”), (iii) a second amendment to the URD filed with the AMF

on December 5th, 2023 under number D.23-0461-A02 (the "Second

Amendment to the URD”) (iv) the securities note dated December

5th, 2023 (the “Securities Note”) and (iv) the summary of

the Prospectus (included in the Securities Note) is available on

the websites of the AMF (www.amf-france.org) and the Company

(www.orpea-group.com). Copies of the Prospectus are available free

of charge at the Company’s registered office (12, rue Jean Jaurès,

92813 Puteaux).

Potential investors are advised to read the Prospectus before

making an investment decision in order to fully understand the

potential risks and rewards associated with the decision to invest

in the New Shares. The approval of the Prospectus by the AMF should

not be understood as an endorsement of the offer or admission to

trading on Euronext Paris of the New Shares.

RISK FACTORS

Investors’ attention is drawn to the risk factors relating to

the Company included in chapter 2 « Internal Control and Risk

Factors » of the URD as updated in chapter 2 of the First Amendment

to the URD and in chapter 2 of the Second Amendment to the URD and

the risk factors relating to the transaction and the New Shares

mentioned in chapter 2 “Risk Factors” of the Securities Note, in

particular risk factor 2.1 related to the massive dilution implied

by the Capital Increases and the need for Existing Shareholders to

invest significant amounts if they want to maintain their stakes

unchanged.

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 20 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https://www.orpea-group.com/en/

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120 and CAC Mid 60 indices;

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

ordinary shares in any State or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

The distribution of this document may, in certain jurisdictions,

be restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

This press release is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (as amended, the

“Prospectus Regulation”). Potential investors are advised to

read the prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

the decision to invest in the securities. The approval of the

prospectus by the AMF should not be understood as an endorsement of

the securities offered or admitted to trading on a regulated

market.

With respect to the member states of the European Economic Area

(others than France) and the United Kingdom (each a “Relevant

State”), no action has been undertaken or will be undertaken to

make an offer to the public of the securities referred to herein

requiring a publication of a prospectus in any Relevant State. As a

result, the securities may and will be offered in any Relevant

State only (i) to qualified investors within the meaning of the

Prospectus Regulation, for any investor in a Member State of the

European Economic Area, or Regulation (EU) 2017/1129 as part of

national law under the European Union (Withdrawal) Act 2018 (the

“UK Prospectus Regulation”), for any investor in the United

Kingdom, (ii) to fewer than 150 individuals or legal entities

(other than qualified investors as defined in the Prospectus

Regulation or the UK Prospectus Regulation, as the case may be), or

(iii) in accordance with the exemptions set forth in Article 1 (4)

of the Prospectus Regulation or under any other circumstances which

do not require the publication by the Company of a prospectus

pursuant to Article 3 of the Prospectus Regulation, of the UK

Prospectus Regulation and/or to applicable regulations of that

Relevant State.

The distribution of this press release has not been made, and

has not been approved, by an “authorised person” within the meaning

of Article 21(1) of the Financial Services and Markets Act 2000. As

a consequence, this press release is only being distributed to, and

is only directed at, persons in the United Kingdom that (i) are

“investment professionals” falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended, the “Order”), (ii) are persons falling

within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the Order, or (iii) are

persons to whom an invitation or inducement to engage in investment

activity (within the meaning of Article 21 of the Financial

Services and Markets Act 2000) in connection with the issue or sale

of any securities may otherwise lawfully be communicated or caused

to be communicated (all such persons together being referred to as

“Relevant Persons”). Any investment or investment activity

to which this document relates is available only to Relevant

Persons and will be engaged in only with Relevant Persons. Any

person who is not a Relevant Person should not act or rely on this

document or any of its contents.

This press release may not be published, distributed or

transmitted in the United States (including its territories and

dependencies). This press release does not constitute or form part

of any offer of securities for sale or any solicitation to purchase

or to subscribe for securities or any solicitation of sale of

securities in the United States. The securities referred to herein

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended (the “Securities Act”) or the law of

any State or other jurisdiction of the United States, and may not

be offered or sold in the United States absent registration under

the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. The Company does not intend to register all or any

portion of the securities in the United States under the Securities

Act or to conduct a public offering of the securities in the United

States.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231205696541/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net Toll-free number for

shareholders : 0 805 480 480

Investor Relations NewCap Dusan Oresansky Tel. :

01 44 71 94 94 ORPEA@newcap.eu Press Relations ORPEA

Isabelle Herrier-Naufle Investor Relations Director Tel. : 07 70 29

53 74 i.herrier-naufle@orpea.net Image7 Charlotte Le Barbier

// Laurence Heilbronn 06 78 37 27 60 – 06 89 87 61 37

clebarbier@image7.fr lheilbronn@image7.fr

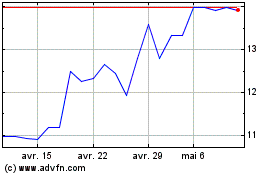

Orpea (EU:ORP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Orpea (EU:ORP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024