UCB Convening Notice to the General Meeting of theShareholders 2023

|

CONVENING NOTICE TO THE GENERAL MEETING OF

SHAREHOLDERS |

The Board of Directors invites the shareholders

for the general meeting of shareholders (the “General

Meeting”) which will be held on

Thursday,

27 April

2023,

at

11:00

am

CEST, at

the registered office of UCB SA/NV, Allée

de la Recherche 60 - 1070

Brussels, for the purpose of considering and voting on the

items shown on the agenda set out below.

|

Applicable participation formalities are detailed at the end of

this convening notice. Shareholders may, to the extent indicated,

also use the Lumi Connect platform (www.lumiconnect.com) to

complete all participation formalities and to vote by proxy at the

General Meeting. The Lumi Connect platform is free of charge for

the shareholders. |

ORDINARY PART

1. Report of the Board

of Directors on the annual accounts for the financial year ended 31

December 2022

2. Report of the

statutory auditor on the annual accounts for the financial year

ended 31 December 2022

3. Communication of the

consolidated annual accounts of the UCB Group relating to the

financial year ended 31 December 2022

4. Approval of the

annual accounts of UCB SA/NV for the financial

year ended 31 December 2022 and

appropriation of the results

Proposed resolution: The General Meeting

approves the annual accounts of UCB SA/NV for the financial

year ended 31 December 2022 and the appropriation of the results

reflected therein, including the approval of a gross dividend of

€ 1.33 per share (*).

(*) The UCB shares held by UCB SA/NV

(own shares) are not entitled to a dividend. Therefore, the

aggregate amount to be distributed to the shareholders may

fluctuate depending on the number of UCB shares held by

UCB SA/NV (own shares) on the dividend approval date.

5. Approval of the

remuneration report for the financial year ended 31 December

2022

The Belgian Code of Companies and

Associations (BCCA) requires the General Meeting to approve the

remuneration report each year by separate vote.

This report includes a description of the remuneration

policy that was applicable in 2022

and information on remuneration of the members of the Board

of Directors and of the Executive Committee.

Proposed resolution: The General Meeting

approves the remuneration report for the financial year ended 31

December 2022.

6. Discharge in favour

of the directors

Pursuant to the BCCA, the General

Meeting must, after approval of the annual accounts, vote on the

discharge of liability of the directors for the financial year

ended on 31 December

2022.

Proposed resolution: The General Meeting grants

discharge to the directors for the performance of their duties

during the financial year ended 31 December 2022.

7. Discharge in favour

of the statutory auditor

Pursuant to the BCCA, the General

Meeting must, after approval of the annual accounts, vote on the

discharge of liability of the statutory auditor

(Mazars).

Proposed resolution: The General Meeting grants

discharge to the statutory auditor for the performance of its

duties during the financial year ended 31 December 2022.

8. Directors:

appointment and renewal of

mandates of (independent) directors

The mandates of

Mrs. Jan Berger

and Mr. Cyril

Janssen shall expire at this General

Meeting. Also, Mrs. Viviane

Monges will step down from the Board of

Directors and Audit Committee on 27 April 2023.

She accepted a mandate as chair of the board of another

listed company and decided to end her mandate with UCB to avoid a

situation where she could not ensure to dedicate the time needed

for a full engagement as director of UCB. Upon

recommendation of the Governance, Nomination and Compensation

Committee (“GNCC”), the Board of Directors proposes:

(i) the renewal of the mandate of

Mrs. Jan Berger as independent

director for a term of 4 years

and (ii) the renewal of the mandate of Mr. Cyril

Janssen as director for a

term of 4 years.

The Board of Directors also

proposes to the General Meeting the appointment of

Mrs. Maëlys

Castella as new

independent director, for a term of four years, in

replacement of Mrs. Viviane

Monges. Upon appointment, Mrs.

Maëlys Castella will also replace Mrs.

Viviane Monges as member of the

Audit Committee. Both

Mrs. Jan Berger and

Mrs.

Maëlys Castella

meet the independence criteria stipulated by article 7:87

of the BCCA, by provision 3.5 of the 2020 Code and by the

Board. Subject to the abovementioned

appointment and renewals by the General

Meeting, the Board of Directors

will continue to be composed of a majority

of independent directors. The

curriculum vitae, information on other

board mandates and skills of these

directors are available on the internet site of UCB

(https://www.ucb.com/investors/UCB-Governance).

Proposed resolutions:8.1

A) The General Meeting renews the appointment of

Mrs. Jan Berger (*) as director

for a term of four years until the close of the annual General

Meeting of 2027.

B) The General Meeting

acknowledges that, from the information made available to the

Company, Mrs. Jan Berger

qualifies as an independent director according to the independence

criteria provided for by article 7:87 of the Belgian Code of

Companies and Associations, by provision 3.5 of the 2020 Belgian

Corporate Governance Code and by the Board of Directors and

appoints her as independent director.

8.2 The General Meeting renews

the appointment of Mr. Cyril

Janssen (*) as director for a term of four years until the

close of the annual General Meeting of 2027.

8.3 A) The

General Meeting appoints

Mrs.

Maëlys Castella (*) as director

for a term of four years until the close of the annual General

Meeting of 2027.

B) The General Meeting

acknowledges that, from the information made available to the

Company, Mrs. Maëlys

Castella qualifies as an independent director

according to the independence criteria provided for by article 7:87

of the Belgian Code of Companies and Associations, by provision 3.5

of the 2020 Belgian Corporate Governance Code and by the Board of

Directors and appoints her as independent director.

(*) Curriculum vitae and details are available at

https://www.ucb.com/investors/UCB

shareholders/Shareholders-meeting-2023

SPECIAL PART

9. Long-Term Incentive

Plans - Program of free allocation of shares

This approval requested from the General

Meeting is not as such a hard requirement

under Belgian law but is sought

in order to ensure transparency and, as

the case may be, compliance with foreign law for certain

jurisdictions where our Long-Term Incentive Plans (LTI plans) are

offered to our employees. For more information on UCB’s LTI plans,

please refer to the 2022

remuneration report. For the avoidance of doubt,

UCB SA/NV confirms that it covers

all its obligations under the LTI Plans with existing

shares, i.e. through share

buybacks, so there is no dilution for existing shareholders of UCB

SA/NV.

Proposed resolution:The General Meeting approves

the decision of the Board of Directors to allocate an estimated

number of 1 435 000 free shares:a) of which an estimated number of

1 220 000 shares to eligible employees under the Long-Term

Inventive policy (LTI policy), namely to approximately 2 900

individuals, according to the applicable allocation criteria. These

free shares will only vest if and when the eligible employees are

still employed within the UCB Group three years after the grant of

the awards;b) of which an estimated number of 215 000 shares

to eligible employees under the Performance Share Plan, namely to

approximately 150 individuals, according to the applicable

allocation criteria. These free shares will be delivered after a

three-year vesting period and the number of shares actually

allocated will vary from 0% to 150% of the number of shares

initially granted depending on the level of achievement of the

performance conditions set by the Board of Directors of UCB SA/NV

at the moment of grant.

The estimated figures under a) and b) do not

take into account employees hired or promoted to eligible levels

between 1 January 2023 and 1 April 2023.

10.

Change of control provisions in

contracts or funding agreements - art.

7:151 of the Belgian Code of Companies and

Associations

Pursuant to article 7:151 of the BCCA,

the General Meeting is solely competent to approve so-called

‘change of control’ clauses, i.e., provisions whereby third parties

are granted rights having a substantial influence on the assets of

the Company or causing a substantial debt or liability for the

Company, if the exercise of such rights depends on the launch of a

public takeover bid on the shares of the Company or a change of

control thereof. These clauses are standard requests from our

creditors and/or in the legal documentation of our financing

arrangements.

10.1

EMTN Program – renewal

UCB SA/NV has

entered into a Euro Medium Term Note

Program dated 6 March 2013 for an amount of

EUR 5

000 000 000, with last update of the Base Prospectus

on 18 October 2022,

as this program may be further amended, extended or updated

from time to time (the “EMTN

Program”). The terms of the EMTN

Program provide for a change of control clause - condition 5 (e)

(i) - under which, for any of the

Notes issued under the EMTN Program where a change of control put

is included in the relevant final terms, any and all of the holders

of such notes can, in certain circumstances, require UCB SA/NV to

redeem that Note, following a change of control at the level of UCB

SA/NV, upon exercise of the change of control put, for a value

equal to the put redemption amount increased with, if appropriate,

interest accrued until the date of exercise of the change of

control put (all as more particularly described in the Base

Prospectus of the EMTN Program). In accordance with said article

7:151 of the BCCA, this clause must be approved by the

General Meeting and it is

hereby proposed to renew this approval for any series of notes

issued under the EMTN Program including such clause during the next

12 months.

Proposed resolution:Pursuant to article 7:151 of

the Belgian Code of Companies and Associations, the General Meeting

renews its approval: (i) of condition 5 (e) (i) of the

Terms and Conditions of the EMTN Program (Redemption at the Option

of Noteholders – Upon a Change of Control (Change of Control Put)),

in respect of any series of notes to which such condition is made

applicable being issued under the Program from 27 April 2023 until

26 April 2024, under which any and all of the holders of the

relevant notes can, in certain circumstances when a change of

control at the level of UCB SA/NV occurs, require UCB SA/NV to

redeem that note on the change of control put date at the put

redemption amount together, if appropriate, with interest accrued

to such change of control put date, following a change of control

of UCB SA/NV; and (ii) of any other provision of the EMTN Program

or notes issued under the EMTN Program granting rights to third

parties which could affect an obligation on UCB SA/NV where in each

case the exercise of these rights is dependent on the occurrence of

a change of control.

10.2

Schuldschein Loan Agreements

entered on 2

November 2022

UCB SA/NV has entered

into the following

Schuldschein Loan agreements

between, amongst others, UCB SA/NV as borrower,

and ING Bank, a branch of ING-DIBA AG

as original

lender, dated 2

November 2022,

each of them including

a clause

(Article 5

b) under which any and all of the

lenders can, in certain circumstances, cancel their commitments and

require repayment of their participations in the loans, together

with accrued interests and all other amounts accrued and

outstanding thereunder, following a change of control of UCB

SA/NV:

-

A Schuldschein loan

agreement in the amount of EUR 108.5

million;

-

A Schuldschein loan

agreement in the amount of EUR 20.5

million;

-

A Schuldschein loan

agreement in the amount of EUR 15

million;

-

A Schuldschein loan

agreement in the amount of USD 20

million.

Proposed resolution:Pursuant to article 7:151 of

the Belgian Code of the Companies and Associations, the General

Meeting approves Article 5 b) of the four Schuldschein loan

agreements in the amounts of EUR 108.5 million, EUR 20.5 million,

EUR 15.0 million and USD 20.0 million respectively, entered into

between, amongst others, UCB SA/NV as borrower, and ING Bank, a

branch of ING-DIBA AG as Original Lender, dated 2 November 2022,

under which each of these four Schuldschein loan agreements,

together with accrued interests and all other amounts accrued and

outstanding thereunder, could in certain circumstances become

immediately due and payable, at the discretion of any and all of

the lenders following a change of control of UCB SA/NV.

10.3 Revolving credit

facility agreement to replace the existing EUR 1

000 000 000 revolving

credit facility agreement as amended, restated and/or refinanced

from time to time, including on 5 December 2019 and 3 December

2021

UCB SA/NV may enter into a revolving

credit facility agreement of up to an amount of EUR 1

000 000 000 on any date

between the date of this convening notice and 25 April 2024 (the

“New RCF”), to replace the existing EUR 1

000 000 000 revolving

credit facility agreement as amended, restated and/or refinanced

from time to time, including on 5 December 2019 and 3 December 2021

(the “Existing RCF”) of which the change of control clause was last

approved by the shareholders meeting of 30 April

2020. The terms of the New RCF would include a change of control

clause on substantially the same terms as in the Existing RCF under

which any and all of the lenders

can, in certain circumstances, cancel their commitments and require

repayment of their participations in the loans, together with

accrued interest and all other amounts accrued and outstanding

thereunder, following a change of control of UCB SA/NV. It is now

proposed to the General Meeting

to approve the change of control clause to be included in

the New RCF on substantially the same terms as those of the

Existing RCF and as further described above.

Proposed resolution: Pursuant to article 7:151

of the Belgian Code of Companies and Associations, the General

Meeting approves the change of control clause as provided for in a

revolving credit facility agreement of up to an amount of EUR 1 000

000 000 which has been entered into prior to the date of this

General Meeting or, if this is not the case, may be entered into by

UCB SA/NV on any date prior to 25 April 2024 (the “New

RCF”), replacing the existing EUR 1 000 000 000 revolving

credit facility agreement as amended, restated and/or refinanced

from time to time, including on 5 December 2019 and 3 December 2021

(the “Existing RCF”), under which any and all of

the lenders can, in certain circumstances, cancel their commitments

and require repayment of their participations in the loans,

together with accrued interest and all other amounts accrued and

outstanding thereunder, following a change of control of UCB SA/NV.

The General Meeting approves, such change of control clause of the

New RCF, substantially the same terms as in the Existing RCF or any

other ancillary document that would be referred to in the New RCF

and would confer certain rights on third parties which have a

substantial impact on the assets and liabilities of UCB SA/NV or

result in a substantial debt or obligation for UCB SA/NV where the

exercise of such rights depends on the launch of a public takeover

bid on UCB SA/NV or a change of control over UCB SA/NV.

***

PARTICIPATION FORMALITIES

In order to participate in the General Meeting,

shareholders must comply with the following formalities:

1. Kindly note that all due dates and times

mentioned herein are the final deadlines and that these will not be

extended due to a weekend, holiday or for any other reason.

2. Registration

Date: the registration date is

13 April

2023, at 24:00 CEST.

a) Owners of registered shares

must be registered as a shareholder in UCB SA/NV’s share register,

held by Euroclear, on 13 April 2023, at 24:00 CEST.b) Owners of

dematerialized shares must be registered as a

shareholder on an account with a recognized account holder or

settlement institution on 13 April 2023, at 24:00 CEST.

3. Voting in

person: the shareholder who intends to

participate in the General Meeting in person must declare his/her

intent to participate, in the General Meeting, as follows:

a) Owners of registered shares

must declare their intention to participate in person to the

General Meeting, at the latest by

21 April

2023, 15:00 CEST, to UCB

SA/NV’s registered office (c/o Mrs. Muriel Le Grelle) or via e-mail

to shareholders.meeting@ucb.com. The Company will verify if the

owners of registered shares who declared their intention to

participate in person to the General Meeting are effectively listed

in the share register.

|

For owners of registered shares who choose to use the Lumi Connect

electronic platform, this platform enables them to directly declare

their intention to participate in person in the General

Meeting. |

b) Owners of dematerialized

shares must declare their intention to participate in

person at the General Meeting, at the latest by

21 April

2023, 15:00 CEST, to UCB

SA/NV’s registered office (c/o Mrs. Muriel Le Grelle) or via e-mail

to shareholders.meeting@ucb.com. Owners of dematerialized shares

must always include a certificate issued by a recognized account

holder or settlement institution evidencing their holding of

dematerialized shares on the registration date.

|

For owners of dematerialized shares who choose to use the Lumi

Connect electronic platform, this platform (i) enables them to

directly declare their intention to participate in person in the

General Meeting and (ii) allows the above-mentioned certificate of

dematerialized shares to be issued directly. |

Only persons having notified their

intent to participate in person

at the General Meeting at the latest by

21 APRIL

2023, 15:00 CEST

and in accordance with the aforementioned formalities will

be allowed to attend and

vote at the General

Meeting.

4. Voting by proxy: the

shareholders are allowed to be represented by a proxy holder at the

General Meeting. In the case of voting by proxy, the proxy form

will serve as declaration of the intention to participate in the

General Meeting, but owners of dematerialized shares must still

provide a certificate issued by a recognized account holder or

settlement institution evidencing their holding of dematerialized

shares on the registration date to UCB SA/NV (c/o Mrs. Muriel Le

Grelle) or via e-mail to shareholders.meeting@ucb.com.

For owners of dematerialized

shares who choose to use the

Lumi Connect platform,

this platform allows the above-mentioned certificate of

dematerialized shares to be issued directly.

a) Original proxy: the proxy form approved by

UCB SA/NV, which must be used to be represented at the General

Meeting, can be downloaded and printed from

https://www.ucb.com/investors/UCB-shareholders/Shareholders-meeting-2023.

Shareholders must deposit or send these proxies,

duly filled out and signed, to UCB SA/NV’s registered office (c/o

Mrs. Muriel Le Grelle) or send them via e-mail to

shareholders.meeting@ucb.com, in such a way that they arrive at UCB

at the very latest by 21

April 2023, 15:00

CEST. Scans by e-mail are allowed and recommended,

provided that the proxy holder produces the original proxy at the

latest prior to the General Meeting. Failure to comply with these

requirements may result in UCB SA/NV not acknowledging the powers

of the proxy holder.

b) Electronic proxy: for shareholders who choose

to use the Lumi Connect platform, this platform enables them to

electronically complete and submit proxies. In that case, no

original must be provided.

Only persons having notified their

intention to participate by proxy in the General Meeting at the

latest by 21 April

2023, 15:00 CEST and in

accordance with the aforementioned

formalities will be allowed to vote by proxy at the General

Meeting.

5. New agenda items and new

resolutions: in accordance with article 7:130 of the BCCA

and under certain conditions, one or more shareholder(s) holding

(together) at least 3% of the share capital of the Company may

request to add items to the agenda and may file resolution

proposals relating to the items on the agenda or to be added to the

agenda.

Such request will only be valid if it is duly

notified to UCB SA/NV’s registered office in writing (c/o Mrs.

Muriel Le Grelle) and received or via shareholders.meeting@ucb.com

at the latest by 5 April

2023, 15:00

CEST. An updated agenda will, if applicable, be

published on 12 April 2023. In such case, the Company will make an

updated proxy form available on UCB website in order to allow

shareholders to give specific voting instructions thereon. The

additional items on the agenda and the proposed resolutions will

only be discussed at the General Meeting if this/these

shareholder(s) holding (together) at least 3% of the share capital

of the Company has/have fulfilled the admission formalities as

detailed under points 3 and 4 above.

6. Questions: in accordance

with article 7:139 of the BCCA and under certain conditions,

shareholders are entitled to submit questions (i) in writing prior

to the General Meeting or (ii) orally during the General Meeting,

to the Board of Directors or the statutory auditor regarding their

reports or items on the agenda. The questions will be answered

during the General Meeting provided (i) the shareholders concerned

have complied with all required admission formalities and (ii) any

communication of information or fact in response to such question

does not prejudice the Company’s business interests or the

confidentiality undertaking of UCB SA/NV, its directors and

statutory auditor.

Questions asked prior to the General Meeting

must be sent in writing to UCB SA/NV’s registered office (c/o Mrs.

Muriel Le Grelle) or by e-mail to shareholders.meeting@ucb.com in a

way that they arrive at UCB by 21

April 2023, 15:00

CEST at the latest.

|

For shareholders who choose to use the Lumi Connect platform, this

platform enables them to submit questions in writing in advance,

subject to the above-mentioned deadline. |

7. Available documentation: as

of the date of publication of this notice, the documents to be

presented at the General Meeting, the (amended) agenda, and the

(amended) proxy form are available on

https://www.ucb.com/investors/UCB-shareholders/Shareholders-meeting-2023.

The shareholders shall be able to access and consult the documents

during working hours on business days at UCB NV/SA’s registered

office, and/or preferably can receive a free hard copy of these

documents.

|

The documents can also be accessed via the Lumi Connect

platform. |

8. Arrival time and facilities:

Shareholders attending the General Meeting are requested to arrive

at least 45 minutes before the time set for the General Meeting in

order to complete the participation formalities at the registered

office of UCB SA/NV, Allée de la Recherche 60 - 1070 Brussels.

Outside parking facilities will be available. Once the General

Meeting has started, shareholders are kindly requested to stay in

the room until the end of the General Meeting.

9. Privacy notice: the Company

is responsible for the processing of the personal data it receives

from shareholders, holders of other securities issued by the

Company (if any) and proxy holders in the context of the General

Meeting of the shareholders in accordance with the applicable data

protection legislation. The processing of such personal data will

in particular take place for the analysis and management of the

participation and voting procedure in relation to the General

Meeting of the shareholders, in accordance with the applicable

legislation and the Company’s Privacy Policy. These personal data

will be transferred to third parties for the purpose of providing

assistance in the management of participation and voting

procedures, and for analyzing the composition of the shareholder

base of the Company. The personal data will not be stored any

longer than necessary in light of the aforementioned objectives.

Shareholders, holders of other securities issued by the Company and

proxy holders can find the Company’s Privacy Policy on the

Company’s website. This Privacy Policy contains detailed

information regarding the processing of the personal data of, among

others, shareholders, holders of other securities issued by the

Company and proxy holders, including the rights that they can

assert towards the Company in accordance with the applicable data

protection legislation. The aforementioned can exercise their

rights with regard to their personal data provided to the Company

by contacting the Company’s Data Protection Officer via

dataprivacy@ucb.com.

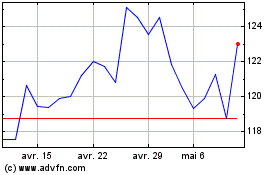

UCB (EU:UCB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

UCB (EU:UCB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024