Indian Rupee Falls To Record Low Against U.S. Dollar

04 Novembre 2024 - 4:21AM

RTTF2

The Indian rupee weakened against the U.S. dollar in the Asian

session on Monday, due to pressure from the local stock market

outflows and a muted trend in domestic stocks as investors remain

cautious amidst the U.S. presidential elections and the Fed

interest rate decision later this week.

The benchmark S&P/BSE Sensex was down 850 points, or 1.1

percent, at 78,875 in early trade while the broader NSE Nifty index

was down 265 points, or 1.1 percent, at 24,038.

Among other factors that influenced investor sentiment in the

Indian markets include the speculation over an economic stimulus

package from China this week as well as the weaker than expected

earnings and sales figures from the consumer goods companies and

automakers.

In economic news, data compiled by S&P Global showed that

India's manufacturing sector growth accelerated in October as

rising new orders lifted production and confidence. The HSBC final

manufacturing Purchasing Managers' Index rose to 57.5 in October

from an eight-month low of 56.5 in September. The flash reading was

57.4.

Against the U.S. dollar, the rupee fell to a record low of

84.183 from last week's closing value of 84.061.

If the rupee extends its downtrend, it is likely to find support

around against the 85.00 region.

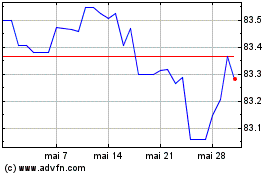

US Dollar vs INR (FX:USDINR)

Graphique Historique de la Devise

De Fév 2025 à Mar 2025

US Dollar vs INR (FX:USDINR)

Graphique Historique de la Devise

De Mar 2024 à Mar 2025