Indian Rupee Slides To Record Low Amid Speculations On RBI Intervention

11 Décembre 2024 - 4:56AM

RTTF2

The Indian rupee weakened against the U.S. dollar in the Asian

session on Wednesday, as traders speculate that the Reserve Bank of

India (RBI) is likely to intervene in the foreign exchange to limit

the significant weakening of the rupee.

Traders increased their bets on interest rate reduction after

career bureaucrat Sanjay Malhotra was named the RBI's next

governor.

Moreover, India's CPI inflation data will be released on

Thursday, along with Industrial and Manufacturing Output

report.

Investors await key U.S. consumer price inflation reports, due

later in the day.

The report is expected to show U.S. consumer prices rose by 0.2

percent for the fifth straight month in November. The annual rate

of consumer price growth is expected to tick up to 2.7 percent from

2.6 percent in October.

Core consumer prices, which exclude food and energy prices, are

expected to increase by 0.3 percent for the fourth straight month

while the annual rate of core consumer price growth is expected to

remain at 3.3 percent.

The CPI report along with the release of producer price

inflation figures on Thursday might impact the outlook for U.S.

interest rates.

According to CME Group's FedWatch Tool, markets currently price

in an 85 percent chance of a Fed rate cut next week.

Whatever the policy decision, there is much uncertainty

regarding what could happen to Fed interest rates next year.

Against the U.S. dollar, the rupee fell to a record low of

85.060 from an early high of 84.82. At yesterday's close, the rupee

was trading at 84.88 against the greenback.

The next possible support level for the rupee is seen around the

86.00 region.

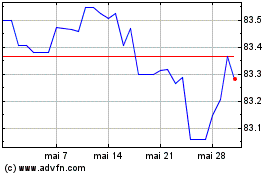

US Dollar vs INR (FX:USDINR)

Graphique Historique de la Devise

De Déc 2024 à Jan 2025

US Dollar vs INR (FX:USDINR)

Graphique Historique de la Devise

De Jan 2024 à Jan 2025