BlackRock Energy and Resources Income Trust Plc Portfolio Update

29 Décembre 2023 - 2:31PM

UK Regulatory

TIDMBERI

BLACKROCK ENERGY AND

RESOURCES INCOME TRUST plc

(LEI:54930040ALEAVPMMDC31)

All information is at 30

November 2023 and

unaudited.

Performance at month end

with net income reinvested

One Three Six One Three Five

Month Months Months Year Years Years

Net asset value 2.1% -3.2% 2.3% -11.8% 71.3% 103.7%

Share price 1.7% -3.4% 0.8% -15.2% 73.9% 99.2%

Sources: Datastream,

BlackRock

At month end

Net asset value - capital 122.51p

only:

Net asset value cum 123.62p

income1:

Share price: 110.40p

Discount to NAV (cum 10.7%

income):

Net yield: 4.0%

Gearing - cum income: 7.5%

Total assets: £162.4m

Ordinary shares in issue2: 131,386,194

Gearing range (as a % of 0-20%

net assets):

Ongoing charges3: 1.13%

1 Includes net revenue of

1.11p.

2 Excluding 4,200,000

ordinary shares held in

treasury.

3 The Company's ongoing

charges are calculated as

a percentage of average

daily net assets and using

the management fee and all

other operating expenses

excluding finance costs,

direct transaction costs,

custody transaction

charges, VAT recovered,

taxation and certain other

non-recurring items for

the year ended 30 November

2022. In addition, the

Company's Manager has also

agreed to cap ongoing

charges by rebating a

portion of the management

fee to the extent that the

Company's ongoing charges

exceed 1.25% of average

net assets.

Sector Overview

Mining 44.5%

Traditional Energy 31.0%

Energy 25.0%

Transition

Net Current Liabilities -0.5%

-----

100.0%

=====

Sector Analysis % Total Country % Total

Assets^ Analysis Assets^

Mining:

Diversified 23.8 Global 58.1

Copper 6.8 USA 15.9

Gold 3.2 Canada 9.2

Industrial Minerals 2.9 Latin 8.0

America

Steel 2.6 Germany 3.2

Aluminium 2.1 France 2.6

Uranium 1.7 Australia 1.3

Nickel 1.5 Africa 1.0

Platinum Group Metals 0.3 United 0.7

Kingdom

Tin -0.4 Ireland 0.5

Subtotal Mining: 44.5

Net -0.5

Current

Assets

-----

Traditional Energy: 100.0

E&P 13.3 =====

Integrated 12.8

Distribution 2.4

Oil Services 2.0

Refining & Marketing 0.5

Subtotal Traditional 31.0

Energy:

Energy Transition:

Energy Efficiency 9.2

Electrification 8.1

Renewables 4.3

Transport 3.4

Subtotal Energy 25.0

Transition:

Net Current Liabilities -0.5

----

100.0

=====

^ Total Assets for the

purposes of these

calculations exclude bank

overdrafts, and the net

current liabilities figure

shown in the tables above

therefore exclude bank

overdrafts equivalent to

7.0% of the Company's net

asset value.

Ten Largest Investments

Company Region % Total

of Risk Assets

Glencore Global 4.8

BHP Global 4.7

Vale Latin

America

Equity 3.3

Bond 1.3

Rio Tinto Global 4.4

Shell Global 3.8

Exxon Mobil Global 3.8

NextEra Energy United 2.7

States

Canadian Natural Resources Canada 2.7

RWE Germany 2.5

Hess Global 2.4

Commenting on the markets,

Tom Holl and Mark Hume,

representing the

Investment Manager noted:

The Company's NAV returned

by 2.1% during the month

of November (in GBP

terms).

Global equity markets

performed well in

November, on the back of

signs of economic

moderation in the US and

falling inflation across

developed markets. Central

banks also indicated that

they had reached the peak

of the rate hiking cycle.

The Bank of England,

Federal Reserve, and

European Central Bank left

their policy rates

unchanged. Markets

anticipated rate cuts in

the first half of next

year on the release of

softer inflation data

across developed markets.

Lower bond yields and

healthy corporate earnings

also contributed to

returns. Given this

macroeconomic backdrop,

the MSCI All Country World

Index returned 9.2%.

The mining sector

performed well but

modestly lagged broader

equity markets. China's

manufacturing PMI reached

a three-month high, rising

to 50.7 from 49.5 in

October. Mined commodities

were up across the board,

with the copper and iron

ore prices (62% fe) rising

by 4.5% and 7.8%

respectively. The copper

price was buoyed by the

shock to supply caused by

the closing of the Cobre

de Panama asset in Panama,

which accounts for 1.5% of

global copper supply.

Iron ore prices appeared

to be up on China's

seasonal restocking ahead

of Chinese New Year.

Elsewhere, the precious

metals also performed well

on geopolitical risk in

the Middle East, an

uncertain macroeconomic

outlook, a fall in real

rates and weakness in the

US dollar. For references,

gold and silver prices

rose by 2.1% and 9.2%

respectively.

Within energy markets,

OPEC announced a rollover

of existing production

targets and greater

production cuts. However,

the impact on oil prices

proved temporary with

apparent uncertainty over

the cohesion and support

within OPEC. Year to

date, global oil demand

has been resilient rising

1.6mbpd to 101.6mbps

according to US Energy

Information Administration

(EIA). However, oil supply

has also exceeded

expectations with some

additional supply from

Iran and Brazil, whilst

there remains modest

production growth from US

shale. Brent and WTI oil

prices fell -5.9% and

-7.4%, ending the month at

$82/bbl and $76/bbl

respectively. The US

Henry Hub natural gas

price fell -21.6% during

the month to end at

$2.80/mmbtu, given back

last month's price

increase.

Within the energy

transition theme, ahead of

COP28, US and China

released a joint statement

announcing support for the

G20 leaders to triple

global renewable energy

capacity by 2030 and to

accelerate renewable

energy deployment in their

respective economies. It

has been estimated that

this would require a 21%

per annum growth in

renewable energy capacity

additions between 2023 and

2030. The statement also

included that each would

advance at least five

large scale carbon capture

and storage projects.

Elsewhere, the UK

Government released

revised parameters for the

pricing cap on AR6

offshore wind bidding, an

estimated 8GW of offshore

capacity and increased the

price cap by 66% compared

to a recent auction, where

there were no bidders due

to the price cap for the

power being set too low to

attract bids.

All data points in US

dollar terms unless

otherwise specified.

Commodity price moves

sourced from Thomson

Reuters Datastream.

ENDS

Latest information is

available by typing

www.blackrock.com/uk/beri

on the internet,

"BLRKINDEX" on Reuters,

"BLRK" on Bloomberg or

"8800" on Topic 3 (ICV

terminal). Neither the

contents of the Manager's

website nor the contents

of any website accessible

from hyperlinks on the

Manager's website (or any

other website) is

incorporated into, or

forms part of, this

announcement.

29 December 2023

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 29, 2023 08:31 ET (13:31 GMT)

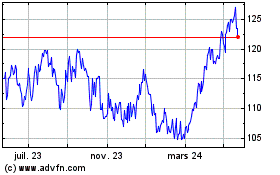

Blackrock Energy And Res... (LSE:BERI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

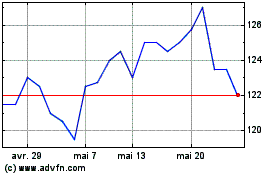

Blackrock Energy And Res... (LSE:BERI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024