- Annual revenue: €496m, largely stable at an all-time

high

- EBITDA1: up 41% to €46m (9.3% of revenue)

- Strong growth in net cash flow from operating activities to

€40m, compared with €9m last year (x4.3)

- Net loss: €12m, including expenses linked to the OCEANE bond

redemption

- Group gross debt reduced by €40m (-22%)

This press release presents Group consolidated

figures prepared on the basis of IFRS. The Board of Directors met

on October 29, 2024 to approve the financial statements for FY

2023-2024. The audit of the consolidated financial statements has

been completed and the certification report is in the process of

being issued.

Regulatory News:

While Claranova’s (Euronext Paris: FR0013426004 - CLA) annual

revenue for FY 2023-2024 remained largely stable at €496m,

reflecting the Group's decision to give priority to profitability,

EBITDA rose 41% to €46m, up from €33m the previous year, despite

myDevices' underperformance. This strong growth resulted in an

increase in the EBITDA margin2 of nearly 3 points, from 6.4% to

9.3% at June 30, 2024. Restated for the myDevices division

(whose sale is being considered), EBITDA amounted to €47m,

representing 9.7% of revenue, highlighting the profitability of the

Group's core businesses.

Over the period, profitability of Claranova's strategic

divisions (excluding myDevices) improved significantly with EBITDA

for PlanetArt up 28% to €20m, and Avanquest up 60% to €28m. Efforts

to spread out PlanetArt's marketing investments and reduce the

seasonality effect on its business, optimize structure costs,

improve returns on customer acquisition investments, and above all

ramp up the SaaS business model for software publishing activities,

contributed to EBITDA of €18m for H2 2023-2024 (9.4% of revenue),

compared with €15m for the same period last year (7.8% of revenue).

These figures perfectly illustrate the effectiveness of the Group's

strategy focused on profitability, which should accelerate over the

next few years with the implementation of its new "One Claranova”

roadmap.

During the year, Claranova was successful in refinancing and

extending the maturity of its debt by 4 years, giving a new impetus

to its financial development. These measures, which were essential

to putting the Group back on a sound financial footing for the long

term, had a negative impact on net financial expense for the year,

which ended the period at €34m, including a charge of €23.3m3 for

the early redemption of the OCEANE bonds. This in turn mechanically

resulted in a net loss for the period of €12m. At the same time,

these bond redemptions (ORNANE, EuroPP, OCEANE) and debt

refinancing will reduce the Group's financial expenses and improve

financial income next year.

Reflecting the Group's increased capacity for cash flow

generation, most of these repayments were made from its own funds.

Net cash flow from operating activities increased more than

fourfold to €40m, compared with €9m the previous year. Similarly,

operating cash flow (before working capital changes, tax and

financial charges) rose to €42m, compared with €28m at the end of

FY 2022-2023. Following the repayments made during the year, by

June 30, 2024, Group financial debt was reduced by €40m to

€139m, compared with €179m one year earlier. The closing cash

position remains strong at €37m, bringing net debt (pre-IFRS 16) to

€102m, compared with €112m last year.

In €m

FY23-24

FY22-23

Reported basis

Revenue

496

507

EBITDA

46

33

EBITDA margin (% of Revenue)

9.3%

6.4%

Recurring operating income

39

25

Net financial income (expense)

(34)

(28)

Net Income

(12)

(11)

Net income attributable to owners of the

Company

(11)

(11)

Net cash flow from (used in) operating

activities

40

9

Of which Cash flow from operations before

working capital changes, tax and financial charges

42

28

Closing cash position

37

67

Financial liabilities

139

179

Of which current financial liabilities

25

94

Of which non-current financial

liabilities

114

85

Net debt

102

112

Net debt / EBITDA

2.2x

3.4x

Eric Gareau, CEO of Claranova commented: "The past year has

demonstrated our resilience and ability to improve our

fundamentals. We recorded annual revenue of nearly €500m, and above

all, in line with our strategy focused on profitability, our EBITDA

rose 41%, to €46m for the year. This result reflects the combined

effects of rigorous cost controls, improved margins and excellent

results from our core businesses.

These performances were accompanied by a fourfold increase in

net cash flow from operating activities which gave us the resources

to pay down our debt. This enabled us to reinforce our financial

structure in the period by reducing the level of the Group's

indebtedness and successfully refinancing our debt. This new

dynamic, also driven by new governance, marks a turning point for

Claranova, paving the way for a more profitable, transparent

management approach focused on long-term value creation under the

new “One Claranova” strategic plan we are unveiling today.

PlanetArt: EBITDA up 28% to €20m

PlanetArt, the e-commerce division for personalized objects,

reflecting a focus on profitability, demonstrated more measured

growth in FY 2023-2024. On that basis, the division reported annual

revenue of €365m, representing a marginal decline of 3%

like-for-like4 (-5% at actual exchange rates).

Optimizing customer acquisition costs, rationalizing expenses

and marketing higher-margin products, contributed to a significant

improvement in EBITDA which rose to €20m for the year, representing

a margin5 of 5% (versus 4% last year). Synergies generated by the

"One Claranova” plan will contribute to further improvements in the

EBITDA margin.

In €m

FY23-24

FY22-23

Reported basis

Change

FY23-24 vs. FY22-23

Revenue

365

383

- 5%

EBITDA

20

15

+ 28%

EBITDA %

5%

4%

+ 1pt

Avanquest: profitability6 accelerates in H2

Avanquest, the Group's digital software publishing business,

posted annual revenue of €122m, up 14% like-for-like (5% at actual

exchange rates). This was driven by record sales of €111m by core

businesses, representing 91% of the division's sales compared with

83% last year. Sales of proprietary SaaS software solutions rose

18% like-for-like compared with FY 2022‑2023 (14% at actual

exchange rates). Non-core activities accounted for less than 10% of

annual sales at €11m, down 39% like-for-like compared with last

year (-41% at actual exchange rates).

Bolstered by the strength of SaaS sales and the now marginal

share of non-strategic activities, the division's EBITDA margin

improved significantly in H2 to 28% (versus 19% in FY 2022-2023).

This positive momentum contributed to an 8-point increase in the

EBITDA margin to 23% for FY 2023-2024. As a result, the division’s

EBITDA grew 60% to €28 million.

In €m

FY23-24

FY22-23

Reported basis

Change

FY23-24 vs. FY22-23

Revenue

122

116

5%

EBITDA

28

17

+ 60%

EBITDA %

23%

15%

+ 8 pts

myDevices: H2 weighs on Group results

myDevices, the IoT division, reported €9m in annual revenue, up

8% on last year like-for-like (5% at actual exchange rates).

Following the strong growth momentum in recent quarters, the pace

of growth eased off in Q4 in response to delayed rollouts of

certain projects with partners. The downturn in business adversely

affected EBITDA which represented a loss of €1.2m for the year

versus a breakeven one year earlier.

By the end of the FY 2023-2024, myDevices' IoT offering will

continue to be supported by nearly 220 channel partners. Annual

recurring revenue (ARR) totaled €3.4m, stable on a like-for-like

basis (down 3% at actual exchange rates) compared with FY

2022-2023. This business is no longer strategic for the Group, and

is destined for sale in the coming months.

In €m

FY23-24

FY22-23

Reported basis

Change

FY23-24 vs. FY22-23

Revenue

9

8

5%

EBITDA

(1.2)

0.1

N/A

EBITDA %

(14%)

1%

N/A

Group capital resources and cash flow highlights

In €m

FY23-24

FY22-23

Reported basis

Cash flow from operations

before working capital changes, tax and financial charges

42

28

Change in working capital

requirements 7

8

(13)

Taxes and net interest paid

(10)

(6)

Net cash flow from (used in) operating

activities

40

9

Net cash flow from (used in) investing

activities

(5)

(32)

Net cash flow from (used in) financing

activities

(65)

(10)

Increase (decrease) in cash8

(30)

(33)

Opening cash position on July 1

67

100

Effects of exchange rate fluctuations on

cash and cash equivalents

0

(1)

Closing cash position on June

30

37

67

During the year, Claranova's cash flow (before working capital

changes, tax and financial charges) rose by €14m to €42m at the end

of June 2024, up from €28m the previous financial year. Bolstered

by this significant improvement, net cash flow from operating

activities increased by a factor of four to €40m in FY

2023-2024, compared with €9m in the previous financial year. This

growth in cash flow was accompanied by an €8m increase in working

capital as PlanetArt's trade payables returned to more normal

levels, and inventory management improved. As a reminder, the Group

benefits from structurally negative working capital based on a

business model largely focused on BtoC9 distribution (where

customer receipts are received before suppliers are paid).

Net cash flow used in investing activities represented an

outflow of €5m at June 30, 2024 which included mainly

capitalized R&D investments.10.

Net cash flow used in financing activities represented an

outflow of €65m at the end of June 2024, and concerned

mainly:

- Cash repayments of:

- €28.5m for ORNANE bonds and €19.7m for Euro PP

- €45m for OCEANE bonds11

- €10m for tranche B of the SaarLB loan10

- €15m for other financial liabilities (including IFRS 16)

- €8m in interest payments

- partly offset by (i) the new €51m loan net

of costs10 to refinance the OCEANE bond issue and (ii) other cash

flows for a net amount of €5m (capital increase, revolving credit

facility and the buyout of minority interests)

The net impact of the above changes in cash flow resulted in a

closing cash position of €37m for Claranova in FY 2023-2024.

Financial position, borrowing conditions and financing

structure

Net financial debt (excluding the impact of IFRS 16 on lease

accounting) amounted to €102m, compared with €112m at June 30,

2023.

The reduction in the Group's financial debt reflects mainly the

cash repayment of bonds (ORNANE, Euro PP)12 partially offset by the

OCEANE bond refinancing.

In €m

FY23-24

FY22-23

Reported basis

Bank debt

135

41

Bonds

-

119

Other financial liabilities13

-

14

Accrued interest

4

4

Total financial liabilities

139

179

Available unpledged cash

37

67

Net debt

102

112

The annual results will be presented today at 6:30 p.m. on site

and by videoconference.

Claranova's FY 2023-2024 results presentation is available on

the Company's website: https://www.claranova.com/publications

Lawsuits filed against the Group by Mr. Cesarini

Claranova confirms for the record that since the departure of

Mr. Pierre Cesarini, the former CEO of Claranova, no financial

transaction has been concluded between Claranova (or its

subsidiaries) and Pierre Cesarini. As announced in the press

release of August 1, 2024, Mr. Pierre Cesarini was removed from all

his offices held in Claranova SE and its subsidiaries.

As a reminder, Mr. Pierre Cesarini filed a claim against the

Group companies contesting his revocations for €15m:

- In France, Mr. Pierre Cesarini filed a suit

against Claranova before the Nanterre Court on June 26, 2024,

claiming an award in damages of €1m, including €100,000 for

wrongful dismissal as director and €900,000 for wrongful dismissal

without just cause as Chief Executive Officer.

- In Luxembourg, Mr. Pierre Cesarini filed a

claim with the Luxembourg Labor Court against Claranova Development

SARL, seeking compensation totaling approximately €14m. This amount

includes, in particular, €5m for alleged moral and material

prejudice, €4m as a contractual termination indemnity, €3m for the

insurance policy, €1.2m for fixed and variable compensation that

was not approved by the General Meeting for FY 2022-2023 and FY

2023-2024, and approximately €350,000 for the legal termination

indemnity based on the provisions of the Luxembourg Labor Code.

Mr. Pierre Cesarini also filed a garnishment order for €0.3m

with BIL, the bank of Claranova Development, for part of the claims

lodged by him with the Luxembourg Labor Court. A request for its

release is currently pending before the District Court (Tribunal

d'Arrondissement) of Luxembourg;

The Group has duly noted these claims, which it rejects both in

principle and in substance, and remains confident about the outcome

of these legal proceedings. These proceedings which are currently

in progress have no impact on the FY 2023-2024 financial

statements, and no provision has been recorded to that effect.

Financial calendar: November 13, 2024:

Q1 2024-2025 revenue: December 04, 2024: Annual General Meeting

About Claranova:

Claranova is a global leader in e-commerce for personalized

objects (photo prints, photo books, children's books, etc.),

software publishing (PDF, Photo and Security) and the Internet of

Things (IoT). As a truly international group, in 2024 it reported

revenue of nearly a half a billion euros, with 95% of this amount

originating from outside France.

Through its products and solutions sold in over 160 countries,

the Group's mission is to "Transform technological innovation into

user-centric solutions". By leveraging its digital marketing

expertise, AI and data from over 100 million active customers

worldwide, Claranova develops technological solutions, available

online, on mobile devices and tablets, for a wide range of private

and professional customers.

Operating in high-potential markets, the Group will pursue a

growth strategy focused on profitability and operational

excellence, in line with its "One Claranova" strategic roadmap.

Claranova is eligible for French “PEA-PME” tax-advantaged

savings accounts

For more information on Claranova Group:

https://www.claranova.com or

https://twitter.com/claranova_group

Disclaimer: All statements other than statements of

historical fact included in this press release about future events

are subject to (i) change without notice and (ii) factors beyond

the Company’s control. Forward-looking statements are subject to

inherent risks and uncertainties beyond the Company’s control that

could cause the Company’s actual results or performance to be

materially different from the expected results or performance

expressed or implied by such forward-looking statements.

Appendices

Appendix 1: Consolidated Income Statement

In €m

FY23-24

FY22-23

Reported basis

Revenue

496

507

Raw materials and purchases of goods

(136)

(152)

Other purchases and external expenses

(219)

(231)

Taxes, duties and similar payments

(1)

2

Employee expenses

(72)

(73)

Depreciation, amortization and provisions

(net of reversals)

(12)

(12)

Other recurring operating income and

expenses

(19)

(18)

Recurring operating income

39

25

Other operating income and expenses

(8)

(5)

Operating Profit

31

19

Net financial income (expense)

(34)

(28)

Tax expense

(8)

(2)

Net Income

(12)

(11)

Net income attributable to owners of

the Company

(11)

(11)

Appendix 2: Calculation of EBITDA and Adjusted net

income

EBITDA and Adjusted net income are non-GAAP measures and should

be viewed as additional information. They do not replace Group IFRS

aggregates. Claranova’s Management considers these aggregates to be

relevant indicators of the Group’s operating and financial

performance. It presents them for information purposes, as they

enable most non-operating and non-recurring items to be excluded

from the measurement of business performance.

The transition from Recurring Operating Income to EBITDA is as

follows:

In €m

FY23-24

FY22-23

Reported basis

Recurring operating income

39

25

Impact of IFRS 16 on leases expenses

(1)

(1)

Share-based payments, including social

security expenses

1

1

Depreciation, amortization and provisions

(net of reversals)14

7

8

EBITDA

46

33

Appendix 3: Simplified Statement of Financial

Position

Claranova's assets are comprised mainly of available cash and

goodwill, reflecting the Group's external growth strategy. Total

assets accordingly decreased from 264m to €228m between the end of

June 2023 and the end of June 2024.

Group balance sheet highlights:

In €m

FY23-24

FY22-23

Reported basis

Goodwill

96

97

Other non-current assets

37

42

Right-of-use lease assets

12

13

Current assets (excl. cash)

46

44

Cash and cash equivalents

37

67

Assets held for sale

-

2

Total assets

228

264

Equity

(8)

(16)

Financial liabilities

139

179

Lease liabilities

13

13

Non-current liabilities

4

11

Current liabilities

81

76

Liabilities held for sale

-

2

Total equity and liabilities

228

264

1EBITDA (earnings before interest, taxes, depreciation and

amortization) is a non-GAAP aggregate used to measure the operating

performance of the businesses. It equals Recurring Operating Income

before the impact of IFRS 2 (share-based payment expenses),

depreciation and amortization, and the IFRS 16 impact on the

recognition of leases. Details on the calculation of EBITDA are

provided in the Appendix.

2 EBITDA as a percentage of revenue

3 The remaining amortization of €93m, including expenses of

€19.6m, to be amortized, i.e. costs of €2.5m, and interest expense

of €1.2m.

4 Like-for-like defined as at constant structure and exchange

rates

5 EBITDA as a percentage of revenue

6 EBITDA as a percentage of revenue.

7 Change in working capital requirements in relation to the

opening cash position for the fiscal period.

8 Change in cash in relation to the opening cash position for

the fiscal period.

9 Business-to-Consumer.

10IAS 38

11 Press release April 02, 2024

12 €28.5m for ORNANE and €19.7m for Euro PP.

13 Excluding lease liabilities resulting from the adoption of

IFRS 16.

14 Pre-IFRS 16

CODES

Ticker: CLA ISIN: FR0013426004

www.claranova.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030121997/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 68

ir@claranova.com

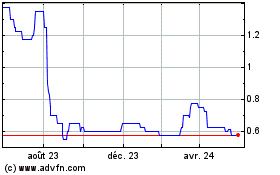

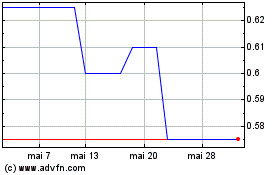

Celsius Resources (LSE:CLA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Celsius Resources (LSE:CLA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024