TIDMFEVR

RNS Number : 0791M

Fevertree Drinks PLC

12 September 2023

Fevertree Drinks plc

FY23 Interim Results to 30 June 2023

This announcement contains inside information

FY23 Interim Highlights

-- Revenue growth of 9% year-on-year, with a standout

performance in the US of +40% growth (+32% constant currency) which

is now the Group's largest region by revenue contribution.

-- Strong market share performance globally, achieving our

highest ever market share by value in the UK.

-- 670 bps reduction in gross margin is in-line with our

expectations, driven by product cost headwinds, partially offset by

efficiency projects.

-- Adjusted EBITDA margin of 5.8% reflects the lower gross

margin and phasing of overheads, maintaining our strategy of

investing for growth. We therefore expect to drive an improvement

in the second half of the year.

-- GBP3.3m exceptional item relating to a production issue in

the US. The issue did not impact customer relationships or our

ability to supply the market.

-- Recommending an interim dividend of 5.74 pence per share, an increase of 2% year-on-year.

GBPm H1 FY23 H1 FY22 Change

---------------------------- -------- -------- ---------

Revenue

UK 53.8 53.5 1%

US 56.1 40.1 40%

Europe Fever-Tree brand

revenue 50.5 46.5 9%

Europe total* 56.1 52.3 7%

ROW 9.6 15.0 (36)%

Total* 175.6 160.9 9%

Gross profit 53.8 60.1 (11)%

Gross margin 30.7% 37.4% (670)bps

Adjusted EBITDA [1] 10.2 22.0 (54)%

Adjusted EBITDA margin 5.8% 13.6% (780)bps

Diluted EPS (pence per

share) 1.20 12.08 (90)%

Dividend (pence per share) 5.74 5.63 2%

Cash 75.8 100.0 (24)%

---------------------------- -------- -------- ---------

*includes GDP's portfolio brands

Strategic highlights

-- Very strong revenue growth in the US across all categories,

extending our leadership position in Tonic Water and Ginger Beer,

with continued positive contribution from our product

innovation.

-- Fever-Tree extended its clear market leadership in the UK

with its highest ever value share and encouraging initial

performance from our range of cocktail mixers and adult soft

drinks.

-- Many of the Group's European markets performed well against

strong comparators, growing our leadership position to two thirds

of the premium mixer category across the region.

-- First half revenue for ROW region reflects a one-off

inventory buy-back as part of the transition to our new subsidiary

set-up in Australia, positioning us to further drive the

opportunity ahead in that market.

-- Good progress on key operational initiatives and softening

inflationary headwinds underpins our confidence in significant

year-on-year margin recovery in 2024.

Outlook and guidance

Whilst we expect to deliver continued good growth in FY23, most

notably in the US, our sales performance since period-end has been

impacted by the unseasonably poor weather in the UK which has

subdued the wider category over the key summer trading period.

Therefore, alongside the impact of the inventory buyback in

Australia, we now expect to deliver FY23 revenue of between GBP380m

to GBP390m.

We are making good progress with the mitigation of inflationary

cost challenges and are reiterating our gross margin guidance of

31% to 33% for FY23. We remain committed to investing in the

substantial future opportunity for the brand across our regions and

expect overheads to be in the range GBP88m to GBP92m resulting in

FY23 EBITDA guidance range of c.GBP30m to GBP36m.

Looking ahead to 2024, due to a combination of softening

inflationary headwinds and the benefit of the actions we are taking

this year, we are confident of delivering significant margin

improvement, setting up the Group for strong, profitable growth

going forward. Reflecting the momentum in our key growth regions,

we are comfortable with current market revenue growth rate

expectations for 2024 and expect to deliver an improved FY24 EBITDA

margin of c.15%, which is ahead of current market expectations.

Tim Warrillow, CEO of Fever-Tree, commented:

"Fever-Tree delivered good revenue growth in the first half of

2023. We had a standout performance in the US where the brand

continues to go from strength to strength, extending our leadership

position in the Tonic and Ginger Beer categories. This reflects how

well established the brand is becoming in the world's largest

premium spirit market.

In the UK, despite the challenging macro-economic conditions, we

ended the first half with our highest ever value share of 45%,

which is over 50% higher than our nearest competitor. I have been

hugely encouraged by the response to our new innovation,

specifically our range of cocktail mixers and adult soft drinks, as

shown by the significant and growing listings across both channels.

Our European business is growing in depth and breadth and the

recent step changes we have made in our route to market across

Australia, Canada and Japan reflect the growing potential we see in

our Rest of World region.

Whilst the vagaries of the British summer weather have impacted

sales since period end, contributing to our revised guidance for

the full year, the Group still expects to deliver good growth in

the reminder of 2023. Looking ahead to 2024, with a stronger global

market position than ever before, a broader product portfolio and

our confidence in delivering significant margin improvement, the

Group is well set up for strong, profitable growth going

forward."

There will be live audio webcast on Tuesday 12(th) September

2023 at 10:00am BST. The webcast can be accessed via:

Fever-Tree FY23 Interim Results webcast

For more information please contact:

Investor queries

Ann Hyams, Director of Investor Relations I

ann.hyams@fever-tree.com I +44 (0)7435 828 138

Media queries

Oliver Winters, Director of Communications I

oliver.winters@fever-tree.com I +44 (0)770 332 9024

Nominated Advisor and Broker - Investec Bank plc

David Flin I Alex Wright I +44 (0)20 7597 5970

Corporate Broker - Morgan Stanley & Co, International

plc

Andrew Foster I Jessica Pauley I +44 (0)20 7425 8000

Financial PR advisers - FGS Global

Faeth Birch +44 (0)7768 943 171; Anjali Unnikrishnan +44 (0)

7826 534 233

This announcement contains inside information. The person

responsible for arranging the release of this announcement on

behalf of the Company is Andy Branchflower, CFO

Strategic update

GBPm H1 FY23 H1 FY22 change constant currency

change

-------- --------

Revenue

UK 53.8 53.5 1%

US 56.1 40.1 40% 32%

Europe Fever-Tree

brand revenue 50.5 46.5 9% 5%

Europe total* 56.1 52.3 7% 4%

ROW 9.6 15.0 (36)% (35)%

Total* 175.6 160.9 9% 6%

-------------------- -------- -------- ------- ------------------

Fever-Tree delivered revenue of GBP175.6m, an increase of 9%

year-on-year, with particularly strong growth in the US driven by

continued distribution gains and innovation. Whilst our UK sales

have been impacted since period end by the effects of the

unseasonably poor weather on the wider category, the first half saw

the brand continue to grow its market share and deliver very

encouraging early signs from the launch of our range of cocktail

mixers as well as increasing distribution of our adult soft drinks.

Good momentum continues in Europe, and whilst the Rest of World

revenue was impacted by the one-off inventory buyback as part of

the change in distribution model in Australia, this is not

reflective of underlying performance or the confidence we have in

the region moving forward.

As well as our focus on topline growth, we are continuing to

take proactive steps to mitigate cost headwinds and drive

efficiencies. As previously announced, whilst we are experiencing

significant margin dilution in the current year, most notably due

to materially elevated glass costs, we are confident that we will

see margin improvement in the second half and are reiterating our

gross margin guidance for the full year. Furthermore, the steps we

are taking this year, alongside softening inflationary headwinds,

will ensure that we drive material margin improvement in 2024.

We have recognised a GBP3.3 million exceptional cost in the

first half results which relates to issues during US production

which arose towards the end of the first half. This was ring-fenced

to specific production batches and has not impacted customer

relationships or our ability to supply the market. Going forward,

we are confident that our US supply chain strategy is robust with

appropriate flexibility and contingencies in place.

We are very pleased with our underlying strategic performance.

Innovation remains the cornerstone of the brand and is driving

growth across all our regions. Adult soft drinks are gaining

distribution and starting to contribute to total growth in the UK,

cocktail mixers are showing positive signs following their launch

in the UK and US earlier this year, and Blood Orange Ginger Beer

has been our fastest growing new product since its US launch in

Autumn 2022, extending the category into exciting new flavours. We

continue to evolve our route to market to capture current and

future growth markets. Over the past twelve months we have

announced the set-up of our own subsidiary operation in Australia

and new distribution partnerships in Japan and Canada.

The Group has continued to make good progress across its

sustainability initiatives in the first six months of 2023. We have

finalised our UK product carbon footprint for 2022 which has shown

a reduction in both absolute and per litre emissions, reflecting

our on-going focus on reducing the impact our products have on the

environment throughout our supply chain.

2023 also marks the tenth year of our partnership with Malaria

No More UK. The fight against malaria remains at the very heart of

the Fever-Tree brand given the role quinine plays in anti-malaria

medication and the fact many of the communities where Fever-Tree

sources its ingredients also experience the devastating effects of

malaria. We are proud to have supported the incredible work

undertaken by Malaria No More UK for a decade and are focused on

sponsoring initiatives that are making a difference to those

communities most impacted by the disease.

UK I Broadening the portfolio and extending our leadership of

the mixer category

Fever-Tree delivered UK revenue of GBP53.8m in the first half of

the year, an increase of 1% year-on-year, driven by a slight

increase in On-Trade revenue and flat Off-Trade revenue. Despite

the challenging macro-economic environment, crucially, we have

extended our clear leadership position of the UK mixer category,

with c.45% value share across the On- and Off-Trade combined, over

twenty times the nearest premium mixer brand, and over 50% higher

than Schweppes [2] .

Fever-Tree is outperforming the mixer market in the On-Trade,

growing value share by more than 5% since 2019 to over 53% [3] of

the total On-Trade mixer value, our highest ever share. As the

number one mixer brand in the UK, Fever-Tree is best placed to

capitalise on continued spirit category growth and premiumisation,

and we are increasingly engaging with spirits companies through

co-promotions across a greater number of spirit and mixer

occasions, with our broad, diversifying portfolio.

In the Off-Trade, Fever-Tree's sales were flat year-on-year as

we lapped tough comparators during the first quarter. The brand has

maintained its number one value share position, c.1% ahead of

Schweppes and significantly ahead of the next largest premium brand

[4] . In fact, Fever-Tree now accounts for over 90% of total

premium mixer sales in the Off-Trade(5) , highlighting our strong

position in this category.

Over the last year we have extended into two exciting adjacent

categories. Firstly, adult soft drinks, where we have established

over 9,000 points of distribution at UK retail, delivering value

growth of 55% in the first half of the year [5] as we outperform

established brands to grow our share within the category.

The first half of the year also saw the launch of our range of

cocktail mixers. The initial response has been highly encouraging

and we have already secured over 3,000 points of distribution

across Tesco, Sainsbury's, Waitrose, as well as a good presence on

Ocado, and a significant number of listings with some of our

largest On-Trade customers, including Mitchells & Butlers and

Young's.

US I Innovation and distribution gains driving growth

Fever-Tree's revenue for the first half of the year increased by

40% to GBP56.1m (+32% at constant currency). The brand's strong

growth has been driven by gains across all categories and we have

extended our number one position in the Tonic Water and Ginger Beer

categories in the first half of the year.

Fever-Tree is seeing strong growth in the On-Trade, which is now

back, post-COVID, to almost 20% of total US sales. The brand

continues to win new mandates and distribution across hotels,

dining, sports and nightlife venues, contributing to a 21% increase

in our number of On-Trade accounts as we extend our position as the

premium mixer of choice in this channel.

Fever-Tree also performed well in the Off-Trade during the first

half of the year. Our retail sales increased by 23% year-on-year

and by 200% over the last four years, compared to 2019 [6] . Value

growth is being driven by Tonic and Ginger Beer in absolute terms,

as we outpace these two categories, as well as being the fastest

growing Grapefruit and Club Soda brand. Consequently, we continue

to gain share of the total mixer category, extending our position

as the clear premium market leader and driving category growth.

Our multiple drinks strategy has driven our innovation agenda

and this remains a critical part of our US growth as we leverage

our consumer insights to ensure we are creating mixers to elevate

everyday drinking experiences with fast-growing, premiumising

spirits. The launches of both our Sparkling Sicilian Lemonade,

aimed at Bourbon and Vodka occasions, as well as our Blood Orange

Ginger Beer to extend this popular mixer category, have

demonstrated the power of our unique approach to innovation.

To further expand our drinks strategy, we have also extended our

range into the non-carbonated mixer category, launching Fever-Tree

Margarita and Bloody Mary in the first quarter of the year. We have

already seen the positive impacts of this, with very positive

sell-in of Margarita and Bloody Mary, leading to promising

conversations with retailers about further distribution

opportunities. The non-carbonated mixer category is a significant

long-term opportunity for the brand due to its size, level of

premiumisation, brand fragmentation, and similar consumer profile

to carbonated mixers.

Alongside innovation and distribution gains, the business is

focused on expanding our consumer brand awareness. In the On-Trade,

we have focused on making the brand more visible on menus, and

creating our own perfect serve menus, in addition to sponsoring

five Fever-Tree bars across the country. At retail, we have become

Category Captain at multiple national retail chains, enabling

enhanced displays, better activations and thus supporting our many

spirit partnerships.

Europe I Growing value share and diversifying the portfolio

The Fever-Tree brand delivered 9% revenue growth across our

European markets, slightly ahead of our total European growth of

7%, which includes GDP portfolio brands (4% at constant currency).

Italy and France continue to outperform, with good growth also

coming from the Nordics during the first half of the year as we

extend our distribution and increase our brand awareness.

Fever-Tree continues to drive premiumisation across Europe. In

the Off-Trade, Fever-Tree now has over two-thirds value share of

premium mixers and continues to gain share from other premium

brands [7] . We are also increasing our share of the total mixer

category, with a good performance in France, Norway and Italy,

where we have delivered absolute growth of over 20% and gained

between one and four percentage points of value share in these

markets(7) .

The On-Trade started the year well as the market annualised the

first quarter of 2022, which had some restrictions still in place.

Both channels have seen good growth compared to pre-Covid levels,

contributing to a total sales growth of over 50% since 2019.

Fever-Tree is growing its leadership of the Ginger Beer

category, which is popular as a mixer for the Mule serve, pairing

well with Vodka, as well as dark spirits. The brand now has more

than a third of the value share of Ginger Beer across European

retail, almost 10% more than the next largest brand(7) and we see

more opportunity to grow this in the coming years.

We also continue to invest across a range of marketing

activities, from traditional above-the-line campaigns to On-Trade

activations, social media campaigns, and television adverts, as

well as through partnerships and co-promotions at retail to drive

incremental distribution, visibility and sales. We have now

produced television campaigns in Italy, Spain, The Netherlands and

Switzerland and launched a prominent out-of-home campaign in Paris

which included promotions of our Ginger Beer and Mediterranean

Tonic across four thousand billboards around the city.

RoW I Upgrading our route-to-market

Despite making good progress in our Rest of the World Region,

revenue of GBP9.6m is a 36% decrease year-on-year (35% at constant

currency). Our reported sales were impacted by a one-off inventory

buy-back in Australia, as we established our own subsidiary and

transitioned to a new distribution partner in that market, a move

which sets us up strongly for the future.

In terms of the brand's trading performance, in Australia

Fever-Tree remains the number one premium mixer in this market by a

significant margin, with more than 80% value share of the premium

mixer category at Australian retail [8] . We continue to win new

shelf space, with four new products launched in Woolworths,

including 500ml Sparkling Pink Grapefruit, and four new SKUs

planned to go on-shelf in Coles following our double-digit growth

in the second quarter of the year, along with consistent share

gains.

Our new subsidiary set-up in Australia will allow us to take

greater control of our sales, marketing and distribution, working

alongside a new distribution partner with complimentary ambitions

and skillsets. We have already secured a local warehouse and aim to

start production with a local bottler during 2024, giving us even

more confidence in where we can take the brand in this market.

In Canada, we also made a significant step-change in our

route-to-market, transitioning to a new, larger, more experienced

distributor last year. Their sales team have already started to

support our significant growth ambitions and we look forward to

seeing how our partnership will drive further growth for the brand

in this market.

In Japan, we started to work with Asahi Breweries as our new

distributor and see real potential to expand in this large market

over the next few years in both the premium mixer and adult soft

drink category. Beyond Japan, we continue to grow our presence

across a number of Asian markets, supported by On-Trade

activations, prominent retail displays and new product

launches.

Operational review

Towards the end of the first half, the Group were made aware

that issues during production had potentially impacted certain US

inventory batches. Following completion of a programme of testing

we subsequently made the decision to permanently quarantine the

affected inventory, resulting in a GBP3.3m stock provision

recognised in the first half results. The issue was ring-fenced to

specific production batches and did not impact customer

relationships or our ability to supply the market.

The Group has made good progress with regards to 2024 glass

supply and is at the contracting phase of a UK/European glass

tender. Alongside this, we are well advanced in discussions with a

local Australian production partner and are also progressing well

with the implementation of our wide-ranging programme to embed

technology across our global operations.

All of these actions further improve supply chain resilience and

efficiency, and we look forward to combining continued revenue

growth with material margin improvement in 2024 and beyond.

Financial review

Revenue of GBP175.6m (H1 2022: GBP160.9m), with growth of 9% (6%

at constant currency) included particularly strong growth in the

US, where we grew by 40% year-on-year (32% on a constant currency

basis).

The Group generated an adjusted EBITDA of GBP10.2m (H1 2022:

GBP22.0m), a 53.5% decrease year-on-year. As anticipated, gross

margins have been impacted by inflationary cost pressures most

notably the effect of materially elevated glass pricing in 2023.

These headwinds were partially offset by mitigating actions,

including pricing actions across regions.

Continued investment behind the brand, our team and our

operations, alongside some phasing effects have increased operating

expenditure to 24.9% of Group revenue (H1 2022: 23.7%) and as a

result, the impacts on gross margin have translated to a reduction

in adjusted EBITDA margin to 5.8% (H1 2022: 13.6%).

We expect improving gross margin and overhead phasing to drive

an improvement in adjusted EBITDA margin in the second half of the

year and are confident of further recovery in 2024 due to a

combination of softening inflationary headwinds and the benefit of

the actions we are taking this year, setting up the Group for

strong, profitable growth going forward.

Working capital remains elevated due to inventory holdings,

which alongside the reduction in adjusted EBITDA margin drove

negative operating cash flow conversion in the first half and a

reduction in cash to GBP75.8m. We expect improving working capital

and adjusted EBITDA margins to combine to drive a return to

positive operating cash flow conversion as the year progresses. The

balance sheet remains strong and the Board is recommending an

interim of dividend of 5.74 pence per share, an increase of 2%

year-on-year.

GBPm H1 FY23 H1 FY22 Change

-------- --------

Revenue 175.6 160.9 9.1%

------------------- -------- -------- ---------

Gross profit 53.8 60.1 (11)%

------------------- -------- -------- ---------

Gross margin 30.7% 37.4% (670)bps

------------------- -------- -------- ---------

Adjusted EBITDA 10.2 22.0 (54%)

------------------- -------- -------- ---------

Adjusted EBITDA

margin 5.8% 13.6% (780)bps

------------------- -------- -------- ---------

Operating profit 0.6 17.4 (96%

------------------- -------- -------- ---------

Profit before tax 1.4 17.9 (92)%

------------------- -------- -------- ---------

Cash 75.8 100.0 (24)%

------------------- -------- -------- ---------

Gross margin

Gross margin of 30.7% represents a reduction from the 37.4%

gross margin reported in the first half of 2022. This was in line

with expectations, with s ignificant inflationary cost increases

across categories, most notably glass costs, impacting underlying

product costs across regions. The Group has taken mitigating

actions, including increased pricing across regions, delivering

logistics efficiencies and increased US local production, however,

this was not sufficient to offset the impact of the inflationary

headwinds in the first half.

We expect an improvement in gross margin in the second half of

the year, reflecting the full benefit of pricing actions across the

period and reducing Trans-Atlantic freight rates.

As outlined in the operational review, we are taking significant

steps in 2023 to underpin gross margin improvements in 2024 and

beyond, including:

-- Concluding a tender for UK and Europe glass requirements,

which, subject to contracting, will realise significant

year-on-year improvements in glass costs in 2024, greater

co-operation and transparency on energy cost hedging and will

underpin security of glass supply.

-- Trans-Atlantic freight rates have materially recalibrated

towards historic levels following several years of significantly

elevated rates. This will provide the flexibility to supply the US

from our UK production network as required, whilst still driving

margin improvement.

-- We are in the implementation phase of our wide-ranging

programme to embed technology across our global operations, setting

us up for 2024 with best-in-class ways of working, data and

insights to improve supply chain efficiency and underpin our future

growth.

Operating expenditure

Underlying operating expenses increased by 14.3% in the first

half of the year to GBP43.6m (H1 2022: GBP38.2m) increasing to

24.9% of Group revenue (H1 2022: 23.7%).

Our marketing spend in the first half of the year was 9.9% of

Fever-Tree brand revenue (H1 2022: 10.2%) as we continue to invest

behind the brand. Activities in the first half included a national

UK radio campaign, television advertising in European markets

including Italy, Switzerland and The Netherlands, alongside

continued execution of retail displays, On-Trade activations and

co-promotions with spirits brands across markets globally. Staff

costs and other overheads increased by 20.1%, largely driven by the

staff cost line as 2022 hires annualised alongside inflationary

wage increases, whilst we built head count in Australia ahead of

the transition to a subsidiary set-up in that market. As a result

of the investments we have made in our team and technology, we do

not anticipate having to increase headcount notably in 2024.

The dilution in gross margin, due to inflationary cost

pressures, coupled with increased levels of underlying operating

expenditure as a proportion of revenue, has resulted in a

retraction in adjusted EBITDA margin to 5.8% (H1 2022: 13.6%). As a

result, the Group generated an adjusted EBITDA of GBP10.2m, a 53.5%

decrease on the first half of 2022 (H1 2022: GBP22.0m).

Depreciation increased to GBP3.3m (H1 2021: GBP1.6m) due to the

impact of right-of-use assets capitalised under IFRS 16 in relation

to US warehousing. Amortisation remained flat at GBP0.8m (H1 2022:

GBP0.8m) alongside share-based payments of GBP2.2m (H1 2022:

GBP2.2m).

Exceptional items include a GBP3.3m provision made against

quarantined US inventory as set out in the Operational Review. The

Group considers this issue to be a one-off, non-recurring item and

is considering all recourse available relating to this issue.

As a result of these movements, adjusted EBITDA of GBP10.2m

translates to operating profit of GBP0.6m (H1 2022: GBP17.4m).

Tax

The effective tax rate in the first half of 2023 was 22.0% (H1

2022: 19.8%) and was in line with expectations.

Earnings per share

The basic earnings per share for the period are 1.20 pence (H1

2022: 12.10 pence) and the diluted earnings per share for the

period are 1.20 pence (H1 2022: 12.08 pence), a decrease of

90.1%.

In order to compare earnings per share period on period,

earnings have been adjusted to exclude amortisation, exceptional

items and the UK statutory tax rates have been applied

(disregarding other tax adjusting items). On this basis, normalised

basic earnings per share for the first half of 2023 are 3.52 pence

(H1 2022: 12.85 pence), a decrease of 74.2%.

Balance sheet and working capital

Working capital increased to GBP89.4m (H1 2022: GBP76.3m),

rising to 24.9% of last twelve months' revenue (H1 2022: 23.1%).

Whilst period end receivables reduced marginally year-on-year,

reflecting continued strong recoverability, the increase in working

capital was driven by a 41% uplift in inventory levels. This

reflects the higher levels of US inventory held at period end to

ensure we are well positioned to service the strong momentum in

that market, whilst lapping inventory pinch points in the US market

in June 2022. We expect inventory levels to recalibrate over the

remainder of the year, which will drive improvements in working

capital profile.

The increase in working capital, combined with the reduction in

adjusted EBITDA generated in the first half of the year has

temporarily resulted in negative cash generated from operations of

GBP5.6m, -54% of adjusted EBITDA (H1 2022: GBP1.5m, +6% of adjusted

EBITDA). An improving working capital profile, alongside an

improving adjusted EBITDA margin will drive a return to positive

operating cash flow conversion in the second half of the year.

Cash and Dividend

The Group's cash position reduced in the first half of the year

as a result of the retraction in operating cash flow conversion,

alongside the payment of the 2022 final dividend. The Group

continues to retain a strong cash position of GBP75.8m and this

allows us to continue to focus on making the correct strategic

choices for the long-term health of the Fever-Tree brand and

success of the business.

As a reflection of our continued confidence in the financial

strength of the Group the Directors are pleased to declare an

interim dividend of 5.74 pence per share, 2% ahead of the 2022

interim dividend. The dividend will be paid on 20 October 2023, to

shareholders on the register on 29 September 2023.

Consolidated statement of comprehensive income

For the six months ended 30 June 2023

Notes Unaudited 6 Unaudited 6 Audited

months to 30 months to 30 year to

June 2023 June 2022 31 December

GBPm GBPm 2022

GBPm

Revenue 2 175.6 160.9 344.3

Cost of sales (121.8) (100.8) (225.5)

============== ============== =============

Gross profit 53.8 60.1 118.8

Administrative expenses (49.9) (42.7) (88.2)

Adjusted EBITDA 1 10.2 22.0 39.7

Depreciation (3.3) (1.6) (4.3)

Amortisation (0.8) (0.8) (1.5)

Share based payment charges (2.2) (2.2) (3.3)

================================ ====== ============== ============== =============

Operating profit before

exceptional items 3.9 17.4 30.6

Exceptional

items 4 (3.3) - -

============== ============== =============

Operating profit after 0.6 - -

exceptional items

Finance costs

Finance income 1.1 0.3 0.8

Finance expense (0.3) (0.1) (0.4)

Profit before tax 1.4 17.6 31.0

Tax expense (0.3) (3.5) (6.1)

============== ============== =============

Profit for the period

/ year 1.1 14.1 24.9

Items that may be reclassified

to profit or loss

Foreign currency translation

difference of foreign

operations (1.2) (0.1) (0.1)

Effective portion of cash

flow hedges 1.1 (1.6) (0.3)

Related Tax - 0.3 -

============== ============== =============

(0.1) (1.4) (0.4)

Comprehensive income

attributable to equity

holders of the parent

company 1.0 12.7 24.5

Consolidated statement of comprehensive income (continued)

For the six months ended 30 June 2023

Earnings per share for

profit attributable to

the owners of the parent

during the year

Basic (pence) 5 1.20 12.10 21.36

Diluted (pence) 5 1.20 12.08 21.32

Consolidated statement of financial position

As at 30 June 2023

Unaudited Unaudited Audited

30 30 31

June June December

2023 2022 2022

GBPm GBPm GBPm

Non-current assets

Property, plant & equipment 24.0 9.2 25.6

Intangible assets 54.1 48.4 53.2

Deferred tax asset 1.6 3.0 1.9

Other financial assets - - 1.8

=========== =========== ==========

Total non-current assets 79.7 60.6 82.5

=========== =========== ==========

Current assets

Inventories 75.6 53.3 60.1

Trade and other receivables 75.7 77.5 72.4

Derivative financial instruments 1.4 - -

Corporation tax asset 0.8 3.1 1.3

Cash and cash equivalents 75.8 100.0 95.3

=========== =========== ==========

Total current assets 229.3 233.9 229.1

=========== =========== ==========

Total assets 309.0 294.5 311.6

=========== =========== ==========

Current liabilities

Trade and other payables (61.8) (54.4) (51.3)

Loans and other borrowing - (0.1) (1.8)

Derivative financial instruments - (1.1) -

Corporation tax liability - - (0.8)

Lease liabilities (3.4) (0.7) (3.4)

=========== =========== ==========

Total current liabilities (65.2) (56.3) (57.3)

=========== =========== ==========

Non-current liabilities

Deferred tax liability (1.5) (1.6) (1.6)

Lease liabilities (12.7) (1.9) (13.5)

=========== =========== ==========

Total non-current liabilities (14.2) (3.5) (15.1)

=========== =========== ==========

Total liabilities (79.4) (59.8) (72.4)

=========== =========== ==========

Net assets 229.6 234.7 239.2

=========== =========== ==========

Equity attributable to

equity holders of the

company

Share capital 0.3 0.3 0.3

Share premium 54.8 54.8 54.8

Capital Redemption Reserve 0.1 0.1 0.1

Cash Flow Hedge Reserve - (1.1) (0.5)

Translation Reserve (1.5) (0.3) (0.3)

Retained earnings 175.9 180.9 184.8

Total equity 229.6 234.7 239.2

=========== =========== ==========

Consolidated statement of cash flows

For the six months ended 30 June 2023

Unaudited 6 Unaudited Audited year

months to 30 6 months to to 31 December

June 2023 30 June 2022 2022

GBPm GBPm GBPm

Operating activities

Profit before tax 1.4 17.6 31.0

Finance expense 0.3 0.1 0.4

Finance income (1.1) (0.3) (0.8)

Depreciation of property,

plant & equipment 3.3 1.6 4.3

Amortisation of intangible

assets 0.8 0.8 1.5

Share

based

payments 2.2 2.2 3.3

Non-cash movements on working

capital 3.5 0.1 (3.1)

Gain - - -

on

disposal

of

fixed

asset

3.3 - -

Exceptional

items

============== ============== ================

13.7 22.1 36.6

(Increase)/

Decrease

in

trade

and

other

receivables (2.4) (10.2) (1.6)

(Increase)/ Decrease in inventories (25.9) (19.6) (23.5)

Increase/ (Decrease) in trade

and other payables 11.7 6.0 0.5

(Decrease)/ Increase in derivative

asset/liability (2.7) 3.2 2.4

(19.3) (20.6) (22.2)

Cash generated from operations (5.6) 1.5 14.4

============== ============== ================

Income tax paid (0.6) (5.5) (5.9)

Net cash flows from operating

activities (6.2) (4.0) 8.5

============== ============== ================

Investing activities

Purchase of property, plant

and equipment (1.1) (1.1) (4.6)

Interest received 1.1 0.3 0.8

Investment in intangible assets (1.8) (1.2) (2.5)

Acquisition of subsidiary,

net of cash acquired - - (3.7)

============== ============== ================

Net cash used in investing

activities (1.8) (2.0) (10.0)

============== ============== ================

Financing activities

Interest paid (0.1) (0.1) (0.1)

Dividends paid (12.4) (62.2) (68.8)

Repayment - - -

of

loan

Payment

of

lease

liabilities (1.7) (0.4) (1.8)

Net cash used in financing

activities (14.2) (62.7) (70.7)

============== ============== ================

Net increase/ (decrease) in

cash and cash equivalents (22.2) (68.7) (72.2)

Cash and cash equivalents

at beginning of period 95.3 166.2 166.2

Effect of movement in exchange

rates on cash held 2.7 2.5 1.3

============== ============== ================

Cash and cash equivalents

at end of period 75.8 100.0 95.3

============== ============== ================

Notes to the consolidated financial information

For the six months ended 30 June 2023

1. Basis of preparation and accounting policies

The principal accounting policies adopted in the preparation of

the interim financial information are unchanged from those applied

in the Group's financial statements for the year ended 31 December

2022 which had been prepared in accordance with International

Accounting Standards in conformity with the requirements of the

Companies Act 2006. The accounting policies applied herein are

consistent with those expected to be applied in the financial

statements for the year ended 31 December 2023.

This report is not prepared in accordance with IAS 34. The

financial information does not constitute statutory accounts within

the meaning of section 435 of the Companies Act 2006. Statutory

accounts for Fevertree Drinks plc for the year ended 31 December

2022 have been delivered to the Registrar of Companies. The

auditor's report on those accounts was unqualified, did not draw

attention to any matters by way of emphasis and did not contain a

statement under Section 498 (2) or (3) of the Companies Act

2006.

Adjusted EBITDA has been used throughout the interim financial

information. The Group believes adjusted EBITDA to be a key

indicator of underlying operational performance, adjusting

operating profit for several non-cash items. As a consequence of

these adjustments, the Group believes that adjusted EBITDA

represents normalised corporate profits. Adjusted EBITDA for the

period is operating profit before exceptional items of GBP3.9m

before depreciation of GBP3.3m, amortisation of GBP0.8m and share

based payment charges of GBP2.2m. Adjusted EBITDA is an appropriate

measure since it represents to users a normalised, comparable

operating profit, excluding the effects of the accounting estimates

and non-cash items mentioned above. The definition for adjusted

EBITDA as defined above is consistent with the definition applied

in previous years. This measure is not defined in the International

Financial Reporting Standards. Since this is an indicator specific

to the Group's operational structure, it may not be comparable to

adjusted metrics used by other companies. The determination of

exceptional items is also not defined in the International

Financial Reporting Standards, and has been used throughout this

financial information as it provides users with specific

information on a once-off event which will not recur in future

periods. As such it allows for improved comparability of results

across financial periods.

The impact of the ongoing conflict in Ukraine and the

inflationary macro-economic environment has been reflected in the

Directors' assessment of the going concern basis of preparation.

This has been considered by modelling the impact on the Group's

cashflow for the period to the end of June 2024. In completing this

exercise, the Directors established there were no plausible

scenarios that would result in the Group no longer continuing as a

going concern.

The Directors have therefore concluded that the Group has

adequate resources to continue in operational existence for at

least the 12 months following the publication of the interim

financial statements, that it is appropriate to continue to adopt

the going concern basis of preparation in the financial statements,

that there is not a material uncertainty in relation to going

concern and that there is no significant judgement involved in

making that assessment. This strong financial position has

underpinned the Directors' decision to pay an interim dividend of

5.74 pence per share.

Notes to the consolidated financial information (continued)

For the six months ended 30 June 2023

2. Revenue by region

Unaudited Unaudited Audited

6 months to 6 months to year to 31

30 June 2023 30 June 2022 December

GBPm GBPm 2022

GBPm

United Kingdom 53.7 53.5 116.2

United States of America 56.1 40.1 95.6

Europe 56.2 52.3 101.0

Rest of the World 9.6 15.0 31.5

============== ============== ============

Group 175.6 160.9 344.4

============== ============== ============

3. Dividend

The interim dividend of 5.74 pence per share will be paid on

20(th) October 2023 to shareholders on the register on 29(th)

September 2023.

4. Exceptional items

A provision of GBP3.3m has been recognised relating to a

quantity of stock on hand in the US at period end. This relates to

issues during production which arose towards the end of this

interim period. The issue has been investigated and linked to

specific production batches and subsequently the decision has been

made to not sell the affected inventory, therefore a full provision

has been made against this inventory. This cost has been recognised

as an exceptional item on account of its material quantum and

one-off nature.

5. Earnings per share

Unaudited 6 Unaudited 6 months Audited year

months to 30 to 30 June 2022 to 31 December

June 2023 GBPm 2022

GBPm GBPm

Profit

Profit used to calculate

basic and diluted EPS 1.4 14.1 24.9

============== =================== ================

Number of shares

Weighted average number

of shares for the purpose

of basic earnings per

share 116,605,028 116,551,449 116,556,818

Weighted average number

of employee share options

outstanding 192,288 214,120 222,486

Weighted average number

of shares for the purpose

of diluted earnings

per share 116,797,316 116,765,569 116,779,304

Basic earnings per

share (pence) 1.20 12.10 21.36

============== =================== ================

Diluted earnings per

share (pence) 1.20 12.08 21.32

============== =================== ================

Notes to the consolidated financial information

For the six months ended 30 June 2023

4. Earnings per share (continued)

Normalised EPS Unaudited Unaudited 6 Audited year

6 months to months to 30 to 31 December

30 June 2023 June 2022 2022

GBPm GBPm GBPm

Profit

Reported profit before tax 1.4 17.6 31.0

============== ============== ================

Add back:

Amortisation 0.8 0.8 1.5

3.3 - -

Exceptional

items

Adjusted profit before tax 5.5 18.4 32.5

Tax - assume standard rate

(25% (2022: 19%)) (1.4) (3.5) (6.2)

============== ============== ================

Normalised earnings 4.1 15.0 26.3

============== ============== ================

Number of shares 116,605,028 116,551,449 116,556,818

Normalised earnings per share

(pence) 3.52 12.87 22.59

============== ============== ================

Normalised EPS is an Alternative Performance Measure in which

earnings have been adjusted to exclude amortisation, exceptional

items and the UK statutory tax rates have been applied to these

adjusting items (disregarding other tax adjusting items).

[1] Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, share based payment charges,

exceptional items and finance costs

[2] IRI 52 Wks to 09/07/2023; CGA MAT to 17/06/2023

[3] CGA

[4] IRI 13 weeks to 09/07/2023

[5] IRI YTD to 09/07/2023

[6] Nielsen 26 weeks to 17 June 2023

[7] Nielsen H1 2023 top 12 European markets

[8] Woolworth & Coles scan data

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UAAWROUUKAAR

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

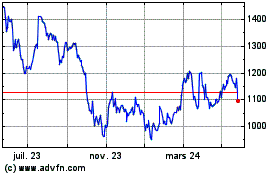

Fevertree Drinks (LSE:FEVR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

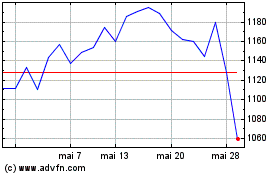

Fevertree Drinks (LSE:FEVR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025